Preview text:

INTERNSHIP REPORT NAME: LÊ ĐỨC HIẾU STUDENT ID: BABAIU21396 COMPANY:

JSC BANK FOR FOREIGN TRADE OF VIETNAM PHU NHUAN BRANCH TYPE OF INTERNSHIP: PART-TIME INTERNSHIP DURATION:

1ST MARCH 23 – 31ST MAY 23 (40 WORKING DAYS) DEPARTMENT : CORPORATE BANKING SUPERVISOR: MR. NGUYEN HUY QUYEN MENTOR: MR. NGUYEN NGOC KHANH TEACHING INSTRUCTOR: DR. BUI QUANG THONG TABLE OF CONTENTS

TABLE OF CONTENTS ............................................................................................................................ 1

ACKNOWLEDGEMENT ............................................................................................................................ 2

EXECUTIVE SUMMARY .......................................................................................................................... 3

I. DESCRIPTION OF THE ORGANIZATION & PLACE OF INTERNSHIP ................................... 4 Internship report Le Duc Hieu

VNU – International University BABAIU21396

1.1 Description of place of Internship ................................................................................................... 4

Description of JSC Bank for Foreign Trade of Viet Nam ................................................................ 4

Description of Vietcombank - Phu Nhuan Branch .......................................................................... 5

1.2 A State-Owned Enterprise ............................................................................................................... 6

1.3 Organizational Structure ................................................................................................................. 6

1.4 Performance ...................................................................................................................................... 8

Performance of Joint Stock Commercial Bank for Foreign Trade of Vietnam ............................. 8

Performance of Vietcombank - Phu Nhuan Branch ........................................................................ 9

1.5 Awards and achievements ................................................................................................................ 9

II. INTERNSHIP DESCRIPTION .......................................................................................................... 10

2.1 Internship Activities ....................................................................................................................... 10

2.2 About Corporate Banking Department ........................................................................................ 10

2.3 Credit Point Analysis and Giving Process at Vietcombank – Phu Nhuan Branch ................... 11

2.4 Performance Evaluation of the Departments ............................................................................... 12

2.5 Problems and Suggested Measures to Improve the Situation ..................................................... 13

III. INTERNSHIP ASSESSMENT .......................................................................................................... 14

3.1 Skills and Qualifications Gained from the Internship................................................................. 14

3.2 Influences on Future Career Plans ................................................................................................ 15

3.3 Correlation Between Internship Activities and Classroom Knowledge ..................................... 15

3.4 Subjects/Topics Could Have Been Offered for a Sucessful Internship ...................................... 15

3.5 Lessons Learned from the Internship ........................................................................................... 15

CONCLUSION ......................................................................................................................................... 16

REFERENCES ......................................................................................................................................... 17

ACKNOWLEDGEMENT

This internship is an outstanding opportunity for me to gain experience and witness how my knowledge

and skill applies in the office environment. I’m grateful to Vietcombank Phu Nhuan for accepting my

application, assisting me in joining as a member of the organization, and providing guidance to me

throughout the internship period. Through their support, I have been able to broaden my understanding

and vision of how the organization functions in the cross-border flow of products and services. Furthermore,

with the assistance of the organization, my mentors, and coworkers, I am capable of accomplishing my

targeted goals throughout the internship program.

It is a great pleasure for me to be guided by Mr. Nguyen Ngoc Khanh, Mr. Nguyen Dinh Dien Credit

Appraisal Officer, Mr. Do Thanh Loi, Customer Relationship Management Officer. Their lead, patience and Internship report Le Duc Hieu

VNU – International University BABAIU21396

expertise have stimulated my skills, assisted me in joining the collective, to be a member of the team and

awakened my underlying ability and skills.

I'd like to express my deepest gratitude to the Corporate Banking Department, Debt and Risk Management

Department, and Customer Services Department at Vietcombank Phu Nhuan. Also, I want to thank my

supervisor and my mentors, Mr. Quyen, Mr. Khanh, Mr. Dien, Mr. Loi and Ms Dung for their insightful

advice and patience in helping me acquire more about the banking and financial field, company's outdoor

activities, and the company as a whole. Despite their tight and hectic schedule, they nevertheless take the

time and effort to share the company's operating procedure, standards, and other office environment skills

to me. Without their assistance and encouragement, my internship and this report would not have been as successful.

My appreciation goes to everyone at Vietcombank Phu Nhuan for their cooperation and assistance in

helping me adapt to the environment, grow, and sharpen my skills and knowledge. Thanks to this

improvement, I would be more stable as a full-time employee in the short term and a position with

responsibilities in the long run.

Furthermore, I'd want to express my heartfelt gratitude to Dr. Bui Quang Thong, my course teaching

instructor. His valuable revisions and feedback on the draft version of this report aided me much in the final phases.

Lastly, special thanks to my parents, loved ones, and friends for assisting me in overcoming the nervousness

of joining the industrial and professional environment for the first time. Thanks to their mental as well as

material provision during the internship allowing me achieved job satisfaction and succeed.

EXECUTIVE SUMMARY

The esteemed organization that I have a chance to have an internship at is Vietcombank Phu Nhuan – a

branch of JSC Bank for Foreign Trade of Viet Nam. This is a tremendous prestige of me as Vietcombank

Phu Nhuan is the branch with the lowest bad debt ratio in 2022 and one of the fledgling branches with the

strongest growth rate in the Vietcombank banking system in particular. Furthermore, Vietcombank is the

company with the largest market capitalization listed on the stock exchange and is the leading bank in

making profit from credit and investment products.

In the period of internship, I concentrated on credit and collateral appraisal. I spent a lot of time learning

about the credit evaluation and giving credit process to both individual and corporate clients. My major

task is to engage in the credit granting process by assisting with financial data input, financial health

analysis, industry, market conditions updates, participate in the process of disbursing money to customers,

debt collection and other such tasks. With listed tasks, my position is a credit appraisal intern at Corporate Banking Department.

The internship report will include 3 main parts as follows:

- First: consists of into two parts, the initial part of which details JSC Bank for Foreign Trade of

Vietnam in depth, covering its establishment history, system of governance, operations,

achievements, and business performance for the last two years.

The following part covers the Vietcombank Phu Nhuan branch, its history, governance system,

achievements, and business performance over the last two years. Internship report Le Duc Hieu

VNU – International University BABAIU21396

- Second: is a description of my activities and work in the Corporate Banking department during

my internship. This section will go over the process of issuing credits from appraising to debt

recovery process in detail.

- Third: is a self-evaluation of the internship, including what I accomplished, insights experiences

learned, mistakes committed, and how I overcome them. At the end of this section, I will discuss

how my internship impacted my future professional path.

I. DESCRIPTION OF THE ORGANIZATION & PLACE OF INTERNSHIP

1.1 Description of place of Internship

Description of JSC Bank for Foreign Trade of Viet Nam

On April 1, 1963, the Joint Stock Commercial Bank for Foreign Trade of Vietnam was established

as the Bank for Foreign Trade of Vietnam. It was separated from the State Bank of Vietnam's international

Exchange Bureau to become an exclusive bank for international commerce.

Two years later, on the Party's directives, the State Bank of Vietnam formed a special payment professional

group at Vietcombank with the identity B29 functioning as a financial help receiver.

During the prolonged war against the US from 1963 to 1975, Vietcombank successfully took on the great

historical mission of being the only foreign commercial bank in Vietnam, contributing to the construction

and development of the Vietnamese economy in the North while also supporting the battlefield in the South.

Vietcombank changed its services from being solely focused on foreign commerce to being a general market

commercial bank in 1990. The official name of the bank was altered to Joint Stock Commercial Bank for

Foreign Trade of Vietnam in 1996. Internship report Le Duc Hieu

VNU – International University BABAIU21396 Name in Vietnamese

Ngân hàng thương mại cổ phần Ngoại thương Việt Nam Name in English

Joint Stock Commercial Bank for Foreign Trade of Vietnam

Trading & Abbreviated name Vietcombank Head office address

No. 198 Tran Quang Khai, Hoan Kiem District, Ha Noi, Vietnam Type of industry Banking, Finance Taxcode 100112437 Hotline 1900545413

The government chose Vietcombank as the pilot for privatization of state-owned enterprises in 2008.

Following a successful IPO that raised $652 million, the bank was listed on the Ho Chi Minh Stock

Exchange on June 30, 2009, making it the largest Vietnamese corporation to execute an initial public offering. - SIC code: VCB

- Owner’s Equity: 47,325.17 billion VND - IPO price: 60,000 VND

Description of Vietcombank - Phu Nhuan Branch

Ngân hàng thương mại cổ phần Ngoại thương Việt Nam – Name in Vietnamese chi nhánh Phú Nhuận Name in English

Joint Stock Commercial Bank for Foreign Trade of Vietnam

Trading & Abbreviated name Vietcombank Phu Nhuan Head office address

No. 285 Nguyen Van Troi, Ward 10, Phu Nhuan District, HCMC Type of industry Banking, Finance, Insurance Phone number 028 3847 6226 Fax 028 3847 6226 Branch Director Tran Van Minh

Vietcombank Phu Nhuan branch was established on December 10, 2015 - formerly known as Vietcombank district 8.

Culture: After more than 7 years of establishment and development, constantly developing, constantly

innovating, Vietcombank has gradually created its own cultural values - based on the standard set of 5

cultural values, and 10 corresponding cultural behaviors. Internship report Le Duc Hieu

VNU – International University BABAIU21396

These basic values are: faith, standard, innovation, sustainability, and humanity.

- Faith: maintain credibility and skill; in other words, leaders trust employees, employees believe in

the direction of leaders, Vietcombank trusts customers, customers trust Vietcombank, establish

customer trust based on a professional working attitude.

- Standard: Building customer's trust based on professional working attitude. standards in work,

image and behavior towards customers

- Innovation: willingness to innovate, always turning to the new, modern and civilized, putting new information into practice

- Suistainablity: sustainable development, looking ahead, not only establishing circumstances for the

development of Vietnamcombank, but also chances for customers and partners to succeed.

- Humanity: humanity and virtue are upheld, as is problem solving based on humanity and cultural behavior.

1.2 A State-Owned Enterprise

“ Together for the future”

- Vietcombank’s communication message -

Communication message of Vietcombank acts as well as a commitment to clients about comprehensive

innovation in both image and operation in order to be able to collaborate with customers, accompany

customers on their journey towards the future.

Mr. Nguyen Hoa Binh, Chairman of the Board of Directors of Vietcombank, stated at the ceremony, "With

the new brand image, Vietcombank continues to affirm its development orientation, always placing safety

and efficiency first, with green and sustainable development for the community as a cross-cutting goal."

Vietcombank will grow based on modern technology, exceptional human resources, and worldstandard

management, into a multi-functional banking and financial organization with a leading position in Vietnam,

regional and international impact, and scope. striving to become one of 300 major financial groups in the world by 2020.

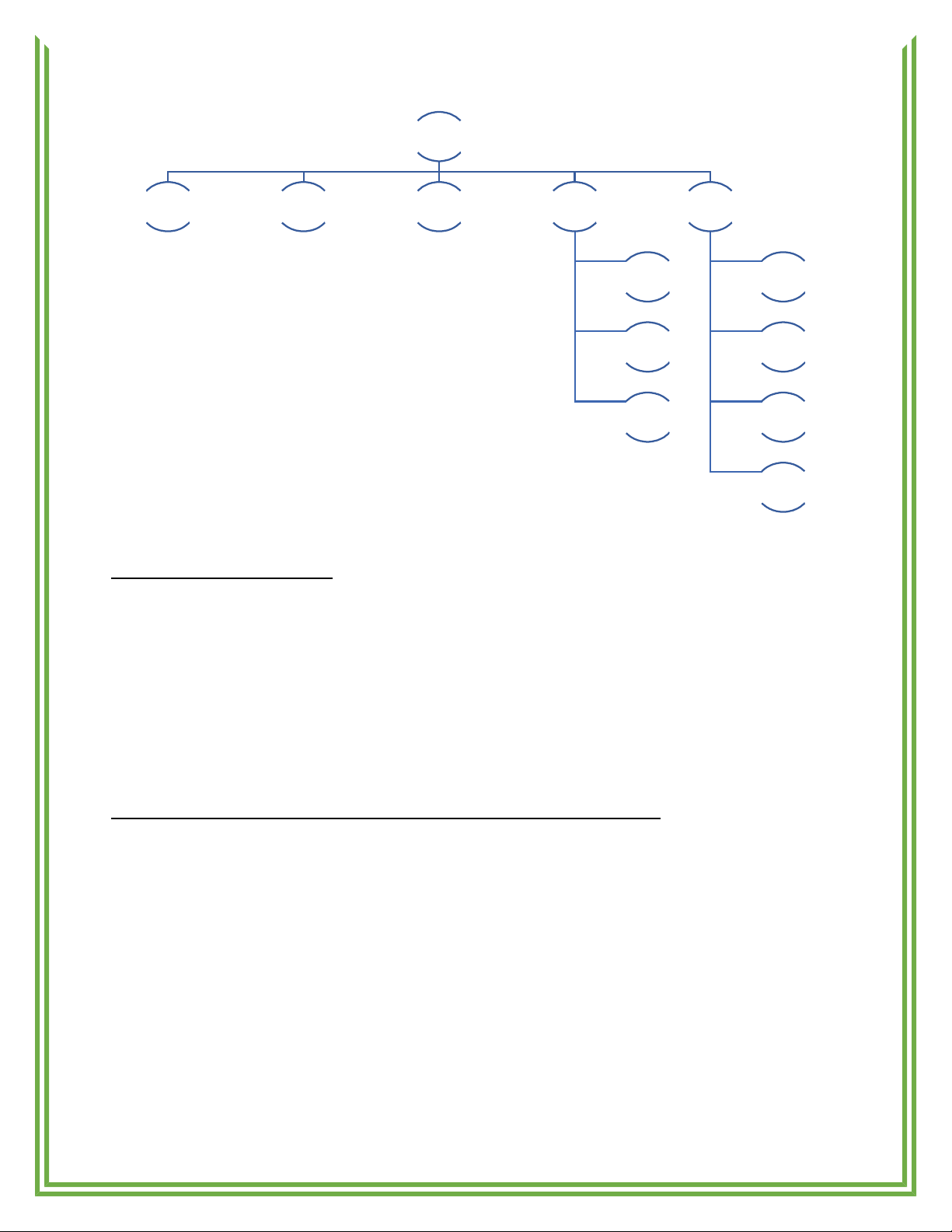

1.3 Organizational Structure

The structure of the branch is quite simple and is a vertical structure, with the branch director at the top, in

charge of several key departments including the Accounting Department, the Administration and Human

Resources Department, the Corporate Banking Department. Under the branch director, there are 2 deputy

directors, managing 4 main departments including: Debt and Risk Management Department, Capital

Management Department, Customer Service department, and 4 transaction offices located in Phu Nhuan district. Internship report Le Duc Hieu

VNU – International University BABAIU21396 Branch Director Corporate Banking ( Sector: Corporate A & HR department Accounting department Deputy Director Deputy Director clients) Customer Service Corporate Banking department ( Sector: Individual clients) Corporate Banking department (Function: Debt and Risk CRM) management Bank transaction offices Capital department Bank transaction offices

- Draw based on the information provided -

Customer Service Department

- Provide and answer information, advice, and instructions on using products and services of VCB.

- Receive and handle customer inquiries, complaints, and reflections on customer transactions and VCB's products and services.

- Receive and process requests for tracing transactions related to VCB's products and services

according to VCB's product supply instructions/processes/regulations.

- Carry out operational handling at the request of customers and branches within the assigned/specified authority.

- Cross-selling VCB's products and services to customers.

Corporate Banking Department (Both corporate & individual client sector)

- Increase the outstanding balance to ensure safe output for the Bank. Ensure lending in accordance

with the policies of the State Bank and Vietcombank, not contrary to current regulations on lending.

- Mobilizing term and demand deposits from organizations, enterprises, and individuals; Ensure

sales of services and products of the above subjects.

- Regularly check and monitor corporate and individual customers to minimize risks after lending

and at the same time build up the branch's reputation and credit quality.

- Valuation of collateral assets (function of forest management).

- Operations related to loan account management and disbursement, monitoring of loans,

implementation of credit approval conditions, credit contracts, etc. Internship report Le Duc Hieu

VNU – International University BABAIU21396

Risk and Debt Management Department

- Create an information system about signal-limited credit contracts, collateral assets, and credit

ratings to ensure accuracy and completeness compared to the original documents and in accordance

with regulations of law. the rule of VCB.

- Update and change information on the application system according to the right authorization.

- Perform operations related to capital withdrawal, manage and monitor the schedule of

principal/interest collection of loans, according to the signed credit contract.

- Set up only disbursement, debt collection, import and export of collateral and transfer the teller to carry out the plague.

- Operate domestic guarantee products, signal products and other products according to VCB's regulations.

- Signal profile: perform the work of receiving and storing signal granting, loan withdrawal,

collateral assets, credit socialization records... in a scientific and correct manner.

Bank Transaction Offices

- Carrying out money transfer transactions, cash collection and payment at the counter.

- Calculation and collection of service fees, collection of loan interest, foreign currency exchange,

bond exchange, unqualified money for circulation, debt collection, disbursement, etc.

- Perform the service of receiving and transferring collection orders to partners; post-checking

documents related to transactions.

- Responsible for assets in cash, foreign currency, precious assets, ... valuable papers, important

stamps within the scope of collection, payment, counting, selection, packaging. 1.4 Performance

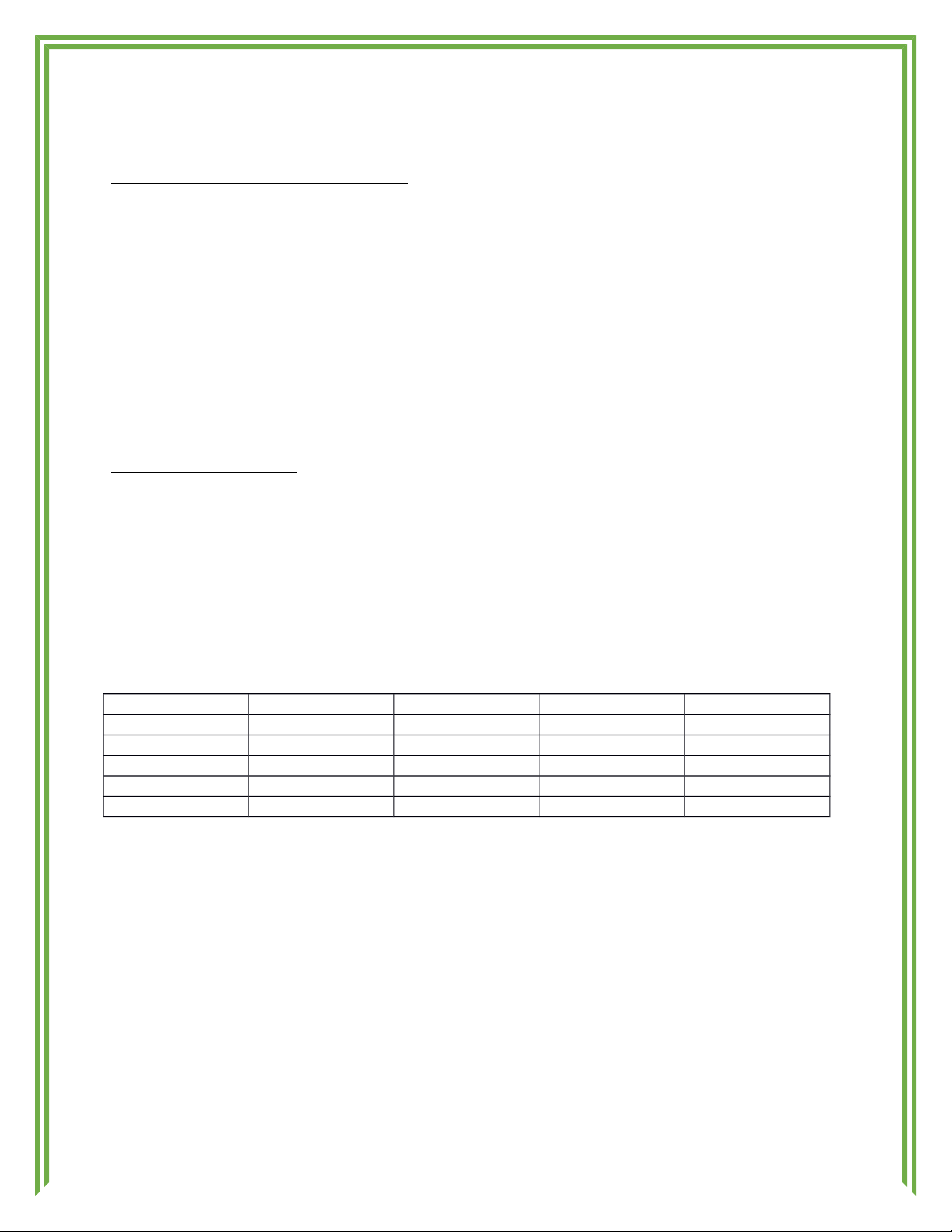

Performance of Joint Stock Commercial Bank for Foreign Trade of Vietnam 2019 2020 2021 2022 REVENUE 34,577,350 36,285,475 42,399,617 53,246,478 PROFIT 18,525,988 18,472,518 21,939,045 29,919,054 ASSET 1,222,718,858 1,326,230,092 1,414,672,587 1,813,815,170 NPL 0.8% 0.6% 0.6% 0.7% NIM 2.80% 2.70% 2.80% 3.00%

- Vietcombank's consolidated financial figures - numbers presented by millions VND

Revenue: The major source of revenue for vietcombank is interest income from loans. These amounts vary

depending on the overall economic environment; if the economy is not doing well, loans will not be made

and the bank's revenue will fall; normally, when business growth slows, Vietcombank's revenue will fall

(up 4% year on year). However, after the pandemic was under control and monetary measures were relaxed,

the bank's revenue resumed its upward trend, with rises ranging from 15% to 20%.

Profit/Asset: Bank earnings and assets are also clearly slowing. This is most likely due to the Fed's

restrictive monetary policy, which has caused the dollar to gain. The Vietnam State Bank must therefore

cope with this issue by drastically raising operating and deposit interest rates, which leads to a rise in lending

rates, generating a liquidity imbalance for banks that will endure until the end of the year 2022.

NPL: NPL index fluctuates slightly over the years, but this figure is still the lowest in the industry (0.7%)

compared to the industry average (0.9%) in 2022. Internship report Le Duc Hieu

VNU – International University BABAIU21396

NIM: Despite the banking industry's difficult picture throughout the years, Vietcombank retains the

inherent performance of Vietnam's No. 1 bank. One of the factors that helped create the success in

maintaining sustainability for Vietcombank in difficult years is the NIM index (an indicator that reflects the

ratio difference between the bank's interest income and interest expenses.

Accordingly, NIM has increased from 3.27% in 2021 to 3.51% in 2022. NIM has improved in part due to

banks, in addition to excellent capital management and capital utilization. Retaining a high proportion of

demand capital (CASA), Vietcombank stands at the fourth in the market in terms of proportion (behind

Techcombank, MB, and MSB) but first in absolute value.

In the background of other banks reducing their CASA proportions, Vietcombank's CASA percentage

stayed unchanged at 34%. Furthermore, continuing to change the credit portfolio's structure toward

increasing the amount of retail is a factor that can assist increase NIM. At the end of 2022, Vietcombank's

retail credit share was 55.1%.

Performance of Vietcombank - Phu Nhuan Branch

In 2022, Phu Nhuan branch mobilized more than VND 6,000,000 million:

Of which credit accounted for the largest proportion with 78% reaching more than VND 4,700,000

million. Also in 2022, sales from international payments and commercial payments increased by 15%

compared to 2022, reaching US$446 million. The bad debt ratio of 0.8% is much lower than that of the

whole Vietcombank system in particular and the Vietnamese banking system men in general.

The above figures have partly shown the efforts of the officers and employees at Phu Nhuan branch

in successfully completing the targets and plans set out by the head office.

In 2023, Vietcombank Phu Nhuan set a target of increasing mobilized capital by 12% compared to number achieved in 2022.

Specifically, growth targets include credit growth in 2023 (18.7%), a 25% increase in the number

of customers opening new cards, increasing the number of customers using digiBiz (built and

developed by Vietcombank) reflected in the process of promoting digital transformation.

Regarding the targets to be reduced in 2023: Vietcombank Phu Nhuan branch aims to reduce the

bad debt ratio to 0.5%. Reduce the allowance of bad debt from 0.4% to 0.12% in 2023.

1.5 Awards and achievements

On October 30, 1962, the Bank for Foreign Trade of Vietnam (Vietcombank) was created, with the

antecedent being the Foreign Exchange Office of the National Bank of Vietnam.

On April 1, 1963, Vietcombank formally began operations.

1990: Vietcombank transitioned from a bank specializing solely in overseas trade-economic

activity to a basic commercial bank.

2007: Vietcombank and SeaBank struck an agreement with Cardif to form Vietcombank - Cardif Life Insurance Company Ltd.

December 26, 2007: Vietcombank went public, became a joint stock commercial bank.

In 2009: VCB was listed on the HCM Stock Exchange.

On September 30, 2011: Mizuho Bank officially became a strategic investor in Vietcombank,

holding 15% of its charter capital. Internship report Le Duc Hieu

VNU – International University BABAIU21396

On January 16, 2019 : increased charter capital to VND 37,088,774 million.

On March 10, 2022: increased charter capital to VND 47,325,165 million. II. INTERNSHIP DESCRIPTION 2.1 Internship Activities

The first few weeks of my internship were spent getting to know the organization and the mentors who will

be assisting me during this time. Mr. Nguyen Ngoc Khanh – Credit Appraisal Officer - introduced me to

Vietcombank's history, laws and regulations, and the company's appraisal method.

Furthermore, Mr. Do Thanh Loi - Priority Customer Relationship Management Officer personnel informed

me about scenarios, challenges, and difficulties in the credit giving procedure, as well as relationship

building with consumers, based on previous experiences or situations.

During the internship, I preferred to participate in many positions in the loan giving process for clients

because I integrated well and built strong connections with everyone in the room. In particular, I had the

opportunity to participate in a field trip to H.B.C commercial and service limited company to discuss about

the company's situation, the progress of current and future projects that were about to be implemented, and

the way superiors conduct exchanges with customers, and agreeing on the terms of the loan contract.

About the topic of my internship report "The process of evaluating financial ratios and preparing reports

for credit approval".This procedure at my organization will take place at all departments in the bank.

However, my internship at the bank is at Corporate Banking department.

2.2 About Corporate Banking Department

Corporate Banking Department (Corporate client sector)

- Increase the outstanding balance to ensure safe output for the Bank. Ensure lending in accordance

with the policies of the State Bank and Vietcombank, not contrary to current regulations on lending.

- Mobilizing term and demand deposits from organizations, enterprises, and individuals; Ensure

sales of services and products of the above subjects.

- Regularly check and monitor corporate and individual customers to minimize risks after lending

and at the same time build up the branch's reputation and credit quality.

- Valuation of collateral assets (function of forest management).

- Operations related to loan account management and disbursement, monitoring of loans,

implementation of credit approval conditions, credit contracts, etc.

My role at Corporate Banking Department:

- Participate in the process of evaluating the company's financial standing by helping to complete

paperwork and dossiers and by offering disbursement proposal ideas.

- Participate in registration procedure with the appropriate authorities for property value and mortgage.

- Participate in the enterprise's production, business operations, and direct fixed asset appraisal process.

- Drafting and completing credit documents.

- Consulting, supporting documents, products Unsecured loans and credit cards of Vietcombank. Internship report Le Duc Hieu

VNU – International University BABAIU21396

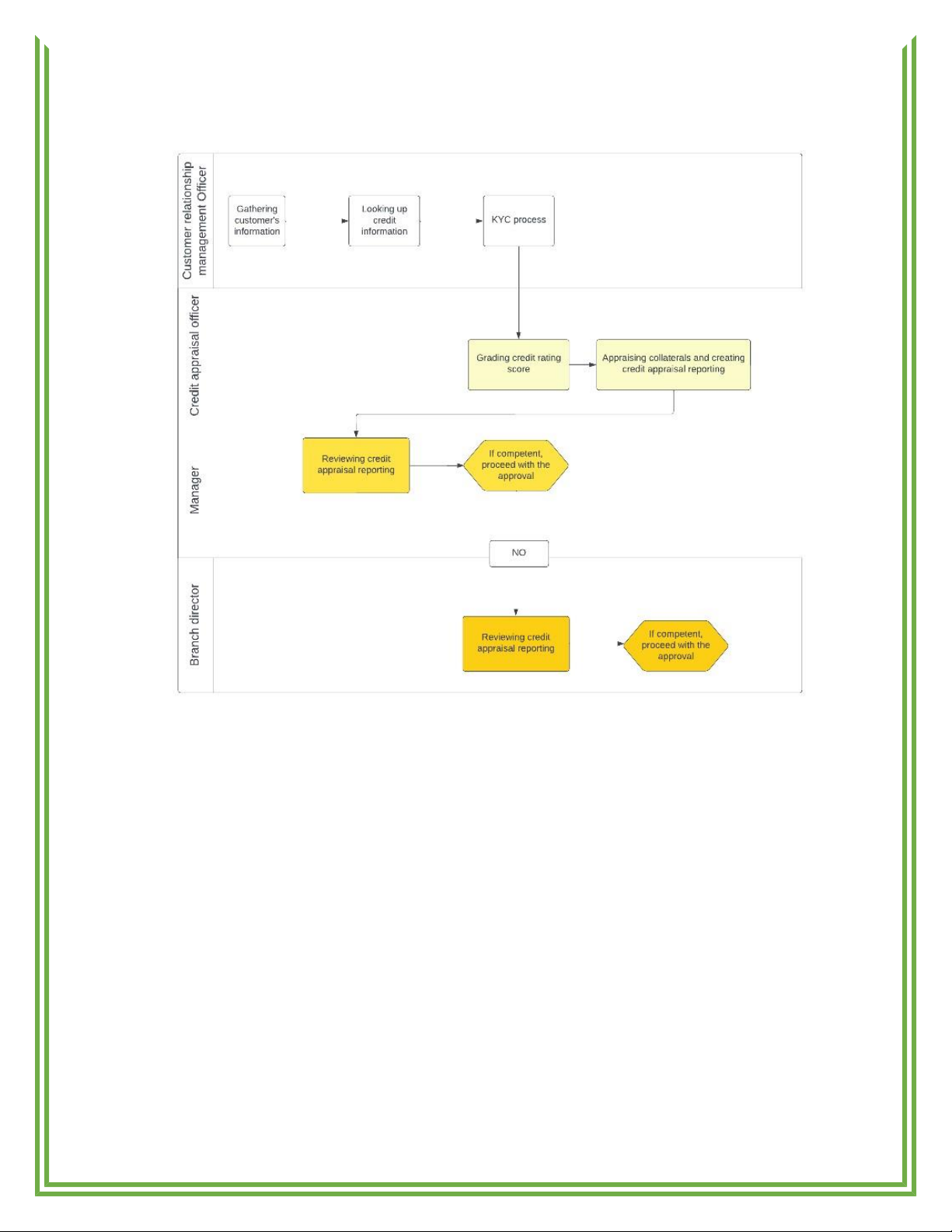

2.3 Credit Point Analysis and Giving Process at Vietcombank – Phu Nhuan Branch

- Draw based on the information provided -

This procedure consists of six main steps that are carried out by three to four officers and managers. This

procedure begins when Vietcombank staff meets with the client and discusses the customer's loan needs at

and ends when a loan disbursement license is granted.

Step 1: It begins when the customer relationship management officer collects all the information

about the borrower. The types of information collected usually include: financial statements, information

about collateral, invoices and documents in production and business activities, regulatory documents and

contracts of the borrowing company. The customer relationship management officer will check the validity

and completeness of the credit file provided by the customer in accordance with the bank's regulations. If

the application is full of and legitimate, the officer will go forward to the next step; otherwise, the customer

will be asked to give more information.

Step 2: With the provided information, the customer relationship management officer will conduct

a lookup of customer information on vietcombank's internal system, which is clearly shown in the KYC

process - which stands for Knowing Your Customer.

The term KYC, which stands for "Know Your Customer. When creating online banking accounts or periodically, this is

the procedure used to confirm a bank customer's identification.

KYC is used to mitigate and prevent customer-related hazards, whether they are irrational or predictable. Internship report Le Duc Hieu

VNU – International University BABAIU21396

Two key steps are part of KYC: o

Gathering personal data (PII - Personally Identifiable Information) from government-issued identity cards

given to citizens:Customers often fill out a form at this phase to declare essential information such their

complete name, phone number, birthdate, ID number, and if they are currently residing permanently or

temporarily. The documents must be authentic and complete. help ease the process of application evaluation. o

Verify clients by flagging those with a criminal past and those who are politically exposed: Vietcombank will

request additional ID cards or passports from clients in order to verify the correctness of the information reported.

Once Vietcombank has client verification data, it may compare it to internal and external databases to score

credit, evaluate risk, and more thoroughly verify the information that consumers have disclosed. then decide

whether or not to approve the transaction with the consumer.

Step 3: At this step, the Corporate Banking officer will review and grade the customer's credit

ranking. Success in the KYC review process only occurs when the information provided by the customer

is accurate and appropriate, the bank clearly identifies the identity, address, and ability to pay for services.

Then, officers check the CIC credit score; if it is acceptable, move on to the next stage; if not, submit a

request to the customer department instructing them to send a declining document of issuing credit to customers. o

CIC acts as a book, recording individuals and businesses about loan information with the bank, and is a

database that the bank may consult to make decisions about a person or company. or not a loan. The CIC

system will split the loan data of consumers who have borrowed into 5 groups. o

The CIC system can detect bad debt groups and people with a history of substandard loans thanks to the

classification of debt groups, which allows the State Banks and unit banks come up with ideas for how to deal with them.

Step 4: The Corporate Banking officer continued to prepare loan documents, collect other

documents including: company's contract, audited financial statements, important documents of the

business, identification papers. documents of collateral... this process takes place on the CLOS system, the

results will be output and submitted to the department manager, board of directors to sign for approval for funding.

Step 5: The department manager will perform a review, verify the accuracy of the records, and

make any required modifications. The department manager will then sign for disbursement if the loan has

a limit within the decision-making power. If not, the branch's board of directors or senior management will be consulted.

Step 6: However, if the loan still exceeds the branch's authority, officer will proceed to transfer the

file to the department manager and branch leader for review, if agreed, transfer a copy of the file to the

appraisal officer at the head office to perform the appraisal step and make an appraisal credit report.

2.4 Performance Evaluation of the Departments

Managing customer relationship: Contract signing requires strong negotiating abilities.

Vietcombank has grown and maintained connections with significant clients. Because the parties

have a long-standing commercial connection and mutual confidence in each other, the contract

discussion and signing process moves quickly.

Experience committed labor force: The staff at the Phu Nhuan branch is continually striving to

meet the objectives and plans that have been established. The proof is that outstanding titles were

gained in 2022 and 2023: Superstar (title for individuals on June 7, 8, 10, 11, 2022 and 3/2023 of

persons in the credit department) and branch with the lowest level of bad debt in the South. Internship report Le Duc Hieu

VNU – International University BABAIU21396

2.5 Problems and Suggested Measures to Improve the Situation

Inadequacies and errors in credit-granting decisions: Currently, the decision to grant credit to a

person or an organisation is still subjective. This is the result of bias due to emotive factors (such as

the fact that only old customers, relatives, come back to lend money from the bank) or pressure from

senior management (who is an old customer, or a friend, relatives of the brand executives) or

individuals are prepared to spend a substantial sum of money on other crossing-selling credit products

with the loan contract (these credit products are typically insurance). In addition, the fact that some

loans at the branch are small and only require evaluation and approval by one or two individuals

contributes to the occurrence of errors or inaccurate assessments. Consequently, certain loans will have

high risk ratios, poor debt ratios, or even be unlawful.

To overcome this issue, I offer a solution. Vietcombank -Phu Nhuan in particular and the

Vietcombank system as a whole should develop and implement artificial intelligence-based

machine learning and data analysis systems to support analysis and lending decisions. Specifically,

the machine learning algorithm will evaluate all of the loan applicants. The model can be used to

analyse and learn from historical loan application data, thereby assessing whether a new applicant

is trustworthy enough to receive a loan based on applicant characteristics such as income, marital

status, age, credit history (e.g., ever had bad debt), etc. The algorithm can be trained to make a

prediction by utilising historical data on consumers who have completed the entire loan process.

Guess whether the loan has a high likelihood of default; make new adjustment decisions based on

the obtained information. Applying data science and machine learning to decision support will help

the process of loan granting more intuitive, accurate, and minimize errors and errors.

Abusing cross-selling products: Individuals who come to Vietcombank to borrow money are

encouraged to use additional credit product models offered by the bank, such as insurance. In addition,

under government regulations, insurance contracts should only be promoted and presented to clients

who have needs. However, there are some clients, though, who do not need an insurance contract but

still require having an insurance plan with the minimum value required under the loan contract.

Borrowers are often “encouraged” to have an insurance plan to enjoy benefits such as: preferential

interest rates, higher loan limits, early disbursement time, etc.

Due to the short internship period, plus the lack of understanding and direct participation in the

process of communicating directly with customers about loans. So, I have not been able to come

up with a solution to the outstanding problem

Inconsistency in uniform : There is an issue with the Vietcombank Phu Nhuan officers' uniforms. The

problem incons described as follows: presently, Vietcombank Phu Nhuan personnel are permitted to

wear two kinds of upper clothing, one of which consists of a white formal shirt and a green polo shirt

of Vietcombank. The staff of Vietcombank Phu Nhuan alternates between these two shirts for the

duration of the workweek, which, in my opinion, does not convey uniformity, solemnity, and a high

standard image to the customers.

The proposed solution will eliminate uniform inconsistency and unprofessionalism while

preserving the distinctive culture of Vietcombank Phu Nhuan. Wear will mandate that all officers

wear formal white shirts from Monday till Thursday, and only green Vietcombank polo shirts on

Fridays. This will preserve the professional image of Vietcombank Phu Nhuan’s employees during

the week while preserving the distinctive collective culture of Vietcombank Phu Nhuan.

2.6 Working Environment and Company’s Corporate Culture

One of the things for which I am grateful during my apprenticeship is the opportunity to work in a pleasant

and professional atmosphere. I am fortunate to have the Deputy Manager introduce me to the company, its Internship report Le Duc Hieu

VNU – International University BABAIU21396

regulations, and its culture, which makes me feel valued for joining the organisation. Within Vietcombank

Phu Nhuan, courtesy and discipline must be observed, including salutations to all ranks, punctuality, and

decency, despite the company's military-inspired management style. My mentors and supervisors, who are

all professional yet welcoming, supportive, approachable, motivating, and willing to devote time to

answering my inquiries and addressing my concerns about the company, are another source of gratitude. In

addition, their knowledge and resources provided me with valuable future-applicable experiences.

Furthermore, I was encouraged to participate in organisational activities such as the running to celebrate

the 60th anniversary of Vietcombank during my internship. This opportunity has connected me with

numerous Vietcombank employees and provided me with a joyous and thrilling celebration.

This internship also provided me with the opportunity to meet and collaborate with interns from diverse

HCMC universities. I am fortunate to have a team that is friendly, mutually supportive, and collaborative

when working on initiatives. When a problem arises, we can get along well and assist each other without

difficulty. This experience provides me with new contacts, knowledge, and skills that I previously lacked

and therefore obtained from my new coworkers. III. INTERNSHIP ASSESSMENT

3.1 Skills and Qualifications Gained from the Internship a) Skills

Firstly, I had the fantastic chance to do an internship at Vietcombank Phu Nhuan, a location of one of the

biggest banks in Vietnam, and I was able to learn fresh information and practical experience outside of the

classroom. Prior to this worthwhile effort, the concept I found a lot about the area to be rather unfamiliar,

particularly the new facts and concepts that I found difficult to grasp and adjust to. Due to the opportunity

to work for Vietcombank, my knowledge of this industry has significantly increased. For example, I now

have a deeper understanding of the concepts and operations of various loan types, debt groups, and

regulatory interest rates, such as deposit interest, loan interest, interbank offer rate, and simple interest.

Secondly, my soft skills were also honed during the internship, particularly my interpersonal skills.

Recognised as the most energetic, enthusiastic, and excellent intern during the internship, I was able to

build excellent relationships with coworkers and am motivated to participate in the agency's extracurricular

activities, which distinguish me from my job title. is an intern to a member Vietcombank Phu Nhuan. Time

management is another of my accomplishments, which I adapted to organise the duties assigned by my

supervisor. Tasks may usually be due in two days; consequently, I must manage their schedule, reconcile

work and study, guarantee on-time task delivery while ensuring project quality. Also, with the opportunity

to work in a professional environment, I have enhanced my communication skills. When posing a query or

expressing an opinion on a subject, I am able to organise my thoughts and present them in a logical manner

without causing discomfort or confusion to the listener, I also practise listening and taking notes on what

others say, determining what they wish to present, and effectively contributing to the dialogue. b) Qualifications

My time as an intern at Corporate Banking Department has helped me learn more about credit trading and

lending, as well as credit solutions for companies who are experiencing bad financial health. This enables

me to widen my view on many facets of the industry. In particular, I discovered how to use the advantages

and disadvantages of leveraged loans at banks in doing business. I have also gained knowledge from Internship report Le Duc Hieu

VNU – International University BABAIU21396

companies who were unable to manage their finances in order to pay the present high interest rates.

Additionally, I learn how the business offers services to its clients and about its dedication to quality and

client satisfaction by working with my colleagues and mentors.

3.2 Influences on Future Career Plans

This internship has had a significant impact on my future career objectives. With this opportunity, I can

assess my abilities, including my knowledge and skills, and look to develop and hone them. By heeding the

counsel of my mentors and evaluating my value, I was able to examine myself, determine what I had

accomplished and what I lacked, what aspects of myself I need to change and develop, and what skills I

must acquire to become a better version of myself in my future career so as to avoid making the same error.

Vietcombank taught me what a professional environment is, how team members interact with one another,

and how to build an image of professional in working, taking care of customers partners Consequently, it

strengthens my foundational knowledge of these issues as I witness and recall them while working on future projects.

3.3 Correlation Between Internship Activities and Classroom Knowledge

My background with subjects from IU contributed to the success of my internship. These courses have

given me fundamental knowledge in the fields of finance and economics as well as communication, critical

thinking, reverse-thinking and also computer skills.

Regarding my fundamental knowledge of finance and economics, I am able to state that Corporate Finance,

Financial Accounting, Fundamentals of Financial Management, and Macroeconomics have all helped to

support and advance my knowledge in these areas.

When it comes to thinking, communication, and behavior skills, classes in Business Ethics, Critical

Thinking, and Business Computing Skills have been very beneficial to me in my integration and

collaborative activities efforts at Vietcombank Phu Nhuan.

3.4 Subjects/Topics Could Have Been Offered for a Sucessful Internship

Business management is my specialization, so I have extensive background knowledge in most professions

thanks to my specialization's broad scope, including computer skills (Business Computing Skills), financial

knowledge (Fundamentals of Financial Management, Corporate Finance, Macroeconomics), accounting

knowledge (Financial Accounting), and knowledge of business ethics and management (Business Ethics,

Principles of Management, respectively).As a sophomore, I believe that learning about managing an

organization's credit, important papers like real estate documents, receipts, invoices, documents required

by the state on business and production, all types of business registration licenses, and how to use excel

(advanced functions, shortcut keys, pivot table, chart, validation) in data processing have all been beneficial.

Therefore, I believe that developing an extensive office computer course that covers Microsoft excel,

Microsoft word, and Microsoft powerpoint will be very beneficial to students as they become familiar with

and integrate into internship environments. I suggest doing this since it won't take students much time to

integrate into the business world and get employment once these courses have been organized into place and beneficial for students.

3.5 Lessons Learned from the Internship

In addition to the acquired skills, my internship at Vietcombank - Phu Nhuan Branch provided me with

invaluable lessons to remember and apply to future challenges and experiences:

The Value of Enthusiasm and Modesty: As an intern, it's important to demonstrate my openness to new

things, experiences, and challenges; therefore, I always strive to demonstrate my eagerness to learn more,

even if the information is unrelated to what I want to concentrate on and assist others with. Moreover, I Internship report Le Duc Hieu

VNU – International University BABAIU21396

believe that the more people I assist, the more positive things I will learn, so I would like to contribute

regardless of the size of the task. This demonstrated not only my value to my colleagues and mentors, but

also my enthusiasm and sincerity as an intern to others.

Benefits of relationship establishment: The first few weeks of my internship were a time for me to make

new contacts. In the short term, building relationships in the workplace is important because these

relationships can assist me in dealing with my concerns comfortably and give me advice for my future path

which can effectively help me avoid mistakes. In the long run, building such relationships will make your

career path much less thorny thanks to letters of recommendation for trust in the future if you're a client of each other's.

Why effective time management is crucial: Timely completion of projects and duties demonstrates my

professionalism and dedication to my responsibilities. I attempt to accomplish this by organising my daily

to-do list and prioritising tasks by importance.

Interpersonal skills: Effective communication is frequently correlated with good people skills, also

referred to as "people relations" or "people skills". It's crucial to interact with coworkers, managers,

suppliers, and consumers in the banking sector. You should develop the practice of forming and sustaining

connections and acting in a way that makes your team members want to work with you every day. Currently,

banks in Vietnam are not particularly autocratic in their operations; nonetheless, there are still departments,

and if you want to complete a task, you will need to work with everyone in those departments. This will

require you to be a person who has a good relationship with colleagues if you want to work really smoothly.

To prevent students from becoming overwhelmed during their internship, I believe the Faculty of Business

should provide them with guidance on how to communicate with coworkers and supervisors, how to set

goals for the internship, and how to determine what they wish to accomplish. In addition, organising

research workplace situations and cases will give students an advantage for observing and learning, which

they can then bring to their company.

Regarding my own shortcomings, I wish I had known more about myself. instructor at the organisation. I

can attend to them and inquire about their experience in the field, why they chose this career path and their

level of interest, as well as seek their advice on what to expect. Based on their consciousness and history, I

can learn, act, and make the correct decisions. CONCLUSION

Internships are essential for all students, regardless of their intended major, because this period will serve

as preparation for their future careers or, in my case, as a means to determine their preferred career field.

As an intern, I have the opportunity to connect classroom knowledge with real-world experience, and

nothing compares to my opportunity to enjoy and witness real business scenarios, the positives, and

negatives of a financial institution operation (such as employee relations, client company culture, and

procedures), which cannot be taught at university or heard only from guest speakers or read in textbooks.

It reveals both the positive and negative aspects of my desired field and is a reliable source of information

for identifying trends and planning my career in the near future.

This opportunity also expands my network, allowing me to develop relationships with others who share my

interests and objectives. Ultimately, I can learn from them, receive feedback from my superiors, and

determine what I need to do to develop in the future. I am extremely grateful to be an intern at Joint Stock Internship report Le Duc Hieu

VNU – International University BABAIU21396

Bank for Foreign Trade of Vietnam - Phu Nhuan Branch, one of the largest financial and banking institutions

in Vietnam. This experience has allowed me to gain a deeper understanding of corporate culture and the

financial industries, banking, lending, raising capital, and other forms of credit products, which will be

beneficial to students in the years to come. Internships have also afforded me valuable connections with my

brilliant and execellent coworkers. My mentor taught me so much that I could not have learned it elsewhere.

As an intern, I develop and enhance my skills, particularly my communication and time management

abilities, and I will apply this enthusiasm to future career opportunities and learning environments. REFERENCES

- VCB - Audited Consolidated Financial Statements 2022

- Consulted by Lawyer Nguyen Thuy Han, Legal expert Le Truong Quoc Dat, 15/08/2022, CIC là

gì? Cách thức kiểm tra CIC cá nhân,

- Swati Tyagi, Institute of Financial Service Analytics, Alfred Lerner College of Business and

Economics, University Of Delaware, ISSN- 2379-106X, www.aijbm.com Volume 5, Issue 01 (January-2022), PP 05-19,

(Analyzing Machine Learning Models for Credit Scoring with Explainable AI and Optimizing Investment Decision)