Preview text:

Chapter1: Conceptualframework

1

1

Content of Course

- Chapter 1: Conceptual framework

- Chapter 2: IAS 02- INVENTORIES

- Chapter 3:IAS 16 -PROPERTY, PLANT AND

EQUIPMENT

- CHAPTER 4: Intangible Assets

- Chapter 5: CURRENT LIABILITIES, PROVISIONS

AND CONTINGENCIES (IAS 37)

- Chapter 6: IFRS 15: REVENUE from contracts with customers

- Chapter 7: Income taxes

2

2

Learning outcomes

CLO1: Apply IASs and IFRSs for measurement of

inventory, tangible assets, intangible assets, liabilities,

reserves and contingent liabilities, revenue, corporate

income tax by using English.

3

3

OBJECTIVE OF CHAPTER

Explain basic knowledge about the international

accounting standard board and the process of IFRSs

setting.

Interpret about the purpose, role and content of the

conceptual framework.

4

4

Content

- Overview about IASB and IFRS.

- Conceptual framework

5

5

1

. Overview about IASB

and IFRS

1.1

Why adopt IFRS standards?

1.2

The international accounting standards board

(

IASB

)

1.3

Process of IFRSs setting

6

6

1.1 WHY ADOPT IFRS STANDARDS?

- Today, the world’s financial markets are borderless

- To assess the risks and returns of their various investment opportunities, investors and lenders need financial information that is relevant, reliable and comparable across borders.

IFRS Standards have improved efficiency of capital market operations and promoted cross-border investment.

7

7

1.2 THE INTERNATIONAL ACCOUNTING STANDARDS BOARD (IASB)

IFRS Standards are developed by the IASB (the Board), which:

- is an independent standard-setting board, overseen by a geographically and professionally diverse body of Trustees of the IFRS Foundation,

- which is publicly accountable to a Monitoring Board of public capital market authorities.

- has (at 1 April 2016) 14 full-time members drawn from 11 countries and a variety of professional backgrounds.

- has a staff of approximately 150 people from 30 countries.

8

8

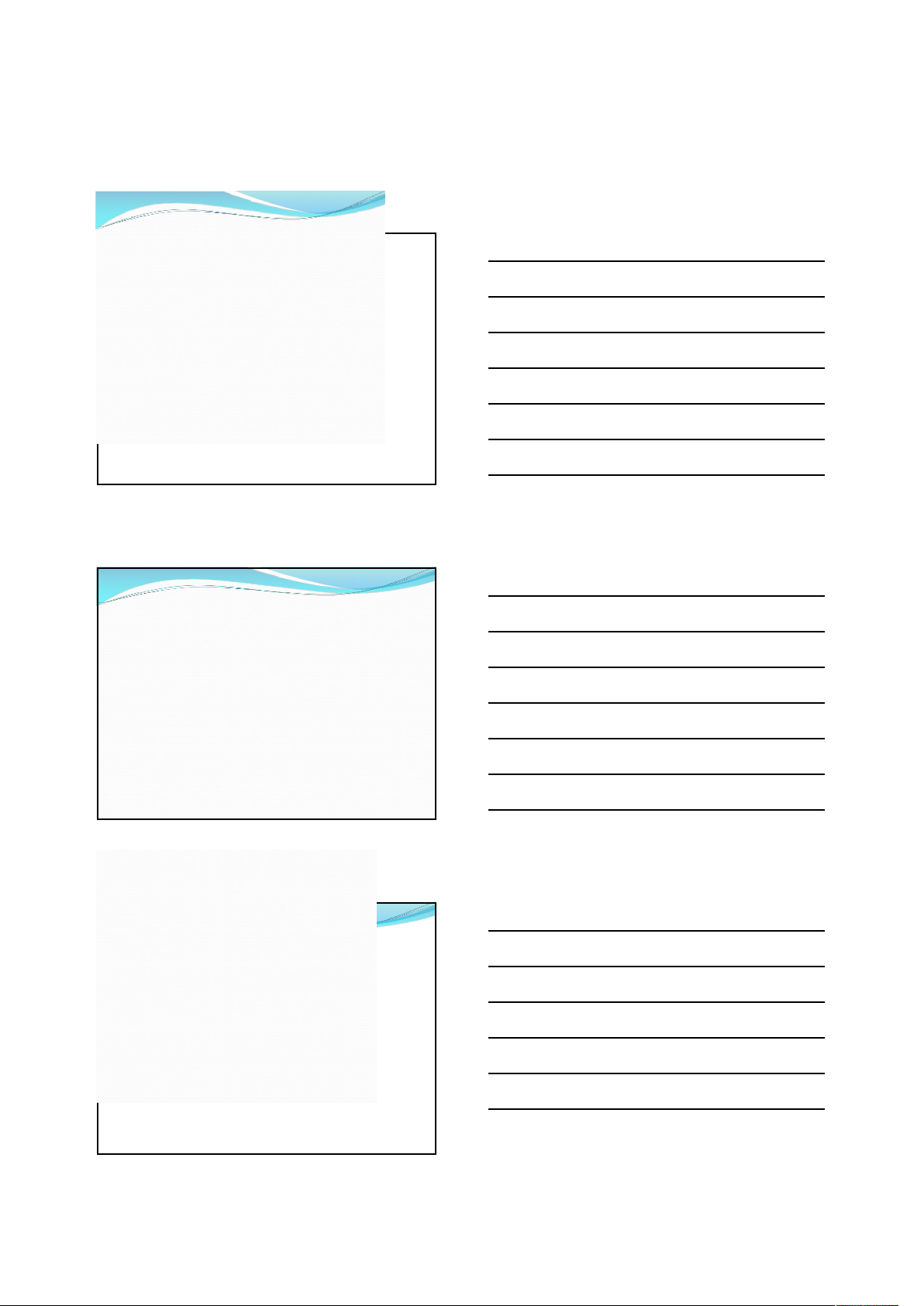

CURRENT STRUCTURE

9

Monitoring Board

Capital market authorities

)

(

IFRSFoundation(Governance)

IFRS Advisory Council

Standard setting

International Accounting

Standards Board (IASB)

(

)

IFRS/IFRS for SMEs

IFRS Interpretation Committee

SME Implementation Group

THE INTERNATIONAL ACCOUNTING

1.2

STANDARDS BOARD (IASB)

9

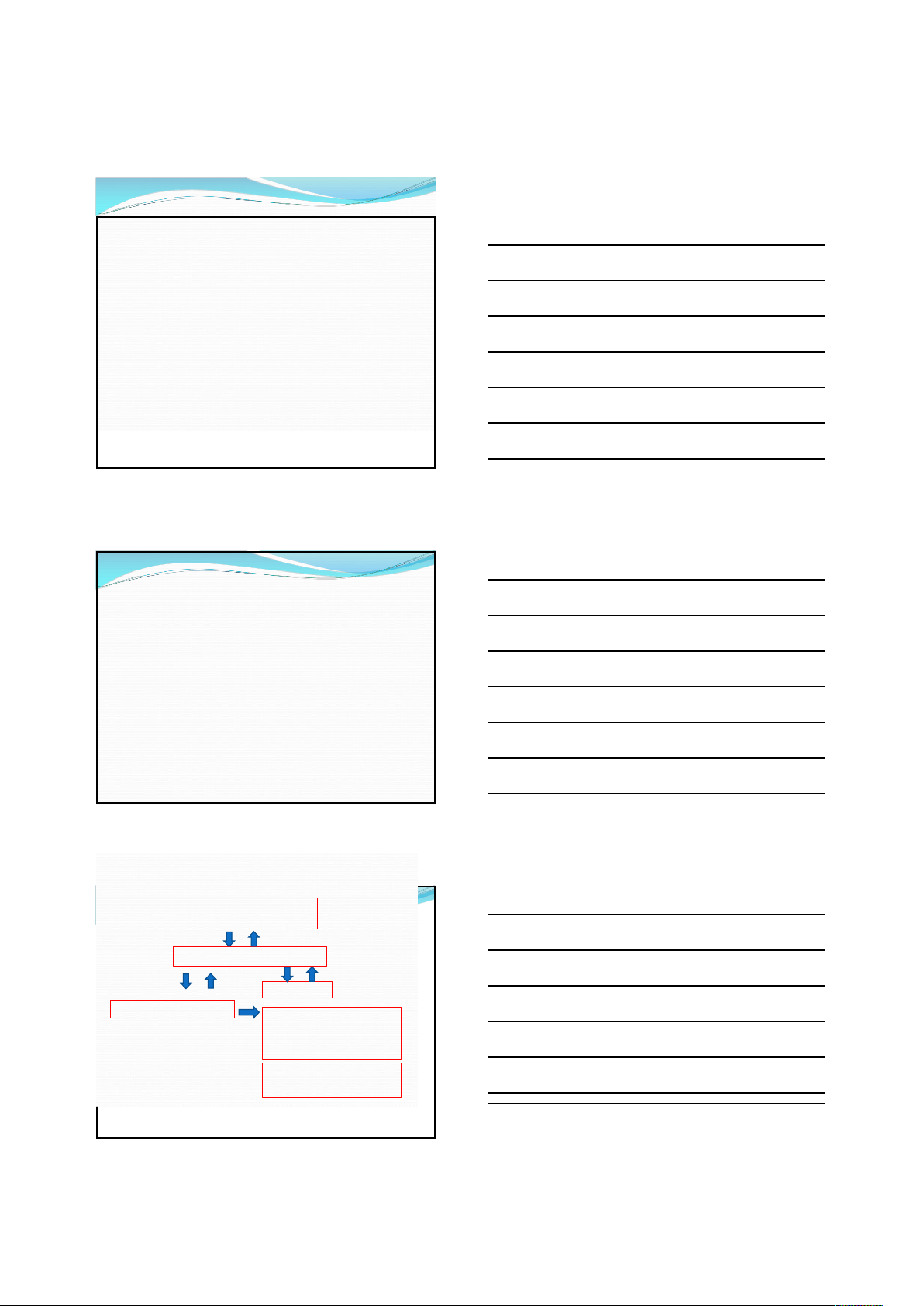

1.3

PROCESS OF IFRSs SETTING

•Request for information

•3-5 year plan

Agenda

consultation

•Research

•Discussion paper

•Agenda proposal

Research

programme

•Exposure draft

•Final IFRS standard

Standards

development

•Interpretation or narrow -scope

amended

•Post –implementation Review

Implementation

10

10

2. Conceptual framework

2.1 What is the conceptual framework?

2.2 The purpose of Conceptual Framework

2.3 Application of the conceptual framework

2.4 The objective of general-purpose financial statements

2.5 Qualitative characteristics of useful financial information

2.6 Underlying assumption

2.7 The elements of financial statements

2.8 Recognition criteria of elements

2.9 Measurement of elements

11

11

2.1 WHAT IS THE CONCEPTUAL FRAMEWORK?

Conceptual Framework sets out agreed concepts that underlie the preparation and presentation of financial statements, include:

Conceptual Framework sets out agreed concepts that underlie the preparation and presentation of financial statements, include:

- Objective of financial reporting

- Qualitative characteristics

- Underlying assumption of financial statement

- Element definitions Recognition criteria

- Measurement

12

12

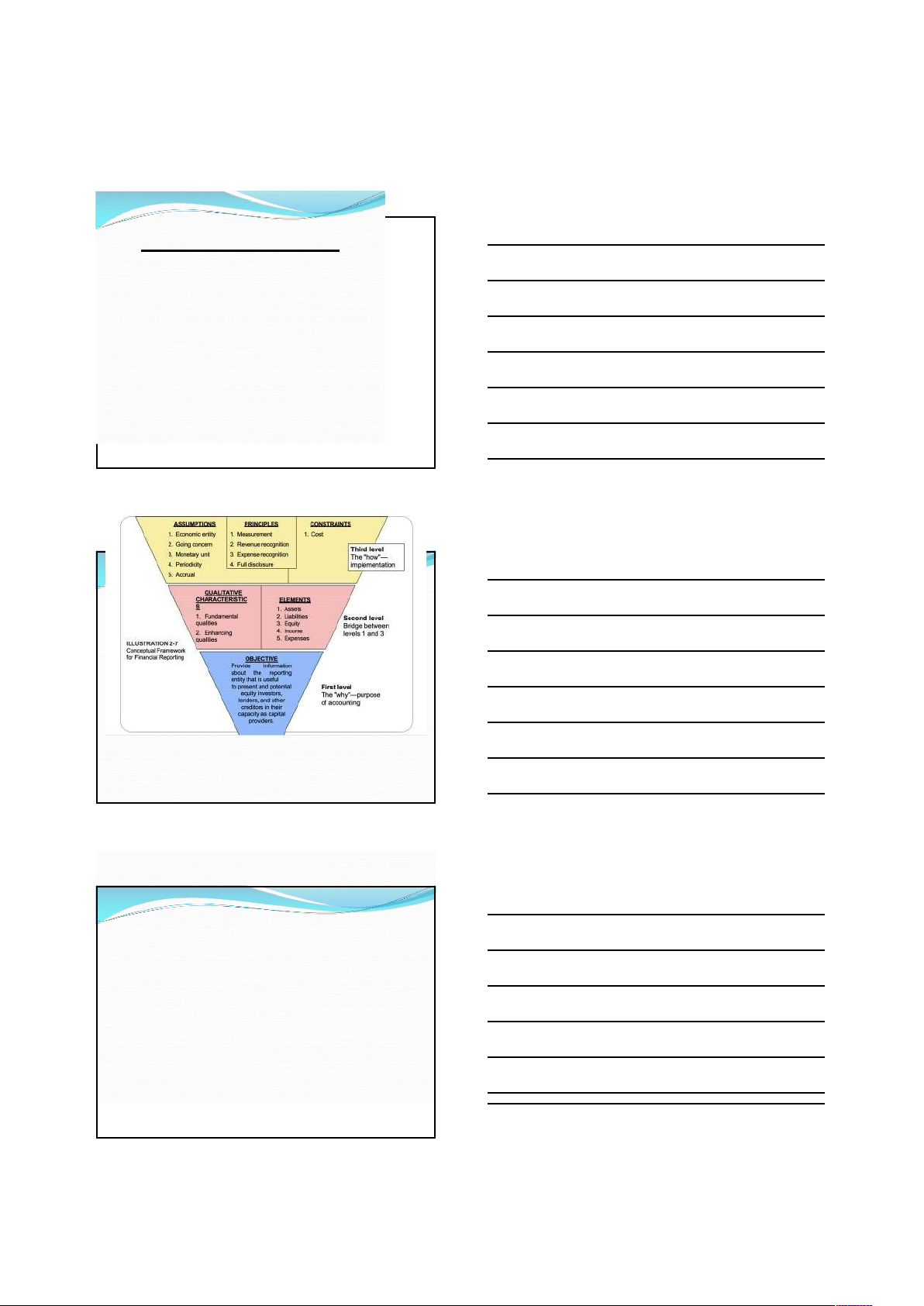

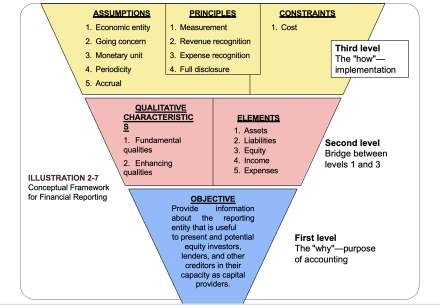

CONCEPTUAL

FRAMEWORK

Overview of the Conceptual Framework

Three levels:

u

First Level

=

Objectives of Financial Reporting

u

Second Level

=

Qualitative Characteristics and Elements of Financial

Statements

u

Third Level

=

Recognition, Measurement, and Disclosure Concepts.

1

3

13

14

14

2.2 PURPOSE OF THE CONCEPTUAL

FRAMEWORK

- Assit IASB:

Assist IASB in the development of future IFRSs; promoting harmonization of regulations, standards and procedures by providing a basis for reducing the number of alternative accounting treatments

Assist IASB in the development of future IFRSs; promoting harmonization of regulations, standards and procedures by providing a basis for reducing the number of alternative accounting treatments

- Assist national standard-setting bodies:

Assist national standard-setting bodies in developing national standards

15

15

2.2 PURPOSE OF THE CONCEPTUAL

FRAMEWORK

- Assist preparers and users of financial statements:

Assist preparers of financial statements in applying and interpreting IFRSs and in dealing with topics that have yet to form the subject of an IFRS

- Assist auditors and regulatory supervisors

Assist auditors and regulatory supervisors in forming an opinion on whether financial statements comply with IFRSs. 16

16

2.3 APPLICATION OF THE CONCEPTUAL

FRAMEWORK

Remember that:

- Conceptual framework is not an IFRS standard.

- Some circumstances there may be a conflict between the Conceptual framework and an

IFRS IFRS always prevail over the Conceptual Framework.

17

17

2.3 APPLICATION OF THE CONCEPTUAL

FRAMEWORK

Quiz:

When there is a conflict between the Conceptual framework and an IFRS, the person preparing the financial statements has the discretion to decide whether the Conceptual Framework or the lFRS prevails.

When there is a conflict between the Conceptual framework and an IFRS, the person preparing the financial statements has the discretion to decide whether the Conceptual Framework or the lFRS prevails.

- True

- False

18

18

2.4 THE OBJECTIVE OF GENERAL-PURPOSE FINANCIAL STATEMENTS

To provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity.

19

19

2.4 THE OBJECTIVE OF GENERAL-PURPOSE FINANCIAL STATEMENTS

The users ’s concern:

- Investors: the risk and returns associated with their investment.

- Lenders: repayment capacity

- Employees: the stability and profitability; its ability to pay remuneration.

- Government: information to regulate the activities of the entity Suppliers and customer: repayment capacity The public: financial position of an entity.

20

20

2.5 QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL INFORMATION

2.5 QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL INFORMATION

Fundamental qualitative characteristic

- Relevance: capable of making a difference in users’ decisions

- predictive value

- confirmatory value

- materiality (entity-specific)

- Faithful representation: faithfully represents the phenomena it purports to represent

- completeness (depiction including numbers and words)

- neutrality (unbiased)

- free from error (ideally)

Note: faithful representation replaces reliability 21

21

2.5 QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL INFORMATION

Enhancing qualitative characteristics

- Comparability: like things look alike; different things look different

- Verifiability: knowledgeable and independent observers could reach consensus, but not necessarily complete agreement, that a depiction is a faithful representation

- Timeliness: having information available to decisionmakers in time to be capable of influencing their decisions

- Understandability: Classify, characterize, and present information clearly and concisely

22

22

- Qualitative characteristic:

+ Fundamental qualitative characteristic:

- Relevance

- Faithful representation + Enhancing qualitative characteristics:

- Comparability

- Verifiability

- Timliness

- Understandability

23

23

2.5 QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL INFORMATION

Pervasive constraint

Reporting financial information imposes costs, and it is important that those costs are justified by the benefits of reporting that information.

- Benefits include more efficient functioning of capital markets and a lower cost of capital for the economy.

Costs include collecting, processing, verifying and disseminating financial information and the costs of analysing and interpreting the information provided.

Costs include collecting, processing, verifying and disseminating financial information and the costs of analysing and interpreting the information provided.

24

24

2.5 QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL INFORMATION

Applying the enhancing qualitative characteristics

Is an iterative process that does not follow a prescribed order. Sometimes, one enhancing qualitative characteristic may have to be diminished to maximise another qualitative characteristic.

25

25

2.5 QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL INFORMATION

Quiz: Which of the followings are the fundamental qualitative characteristics of financial statements? a. Relevance

b. Understandability c Comparability

d.Faithful representation

e.Timeliness

f. Verifiability

26

26

2.5

QUALITATIVE CHARACTERISTICS OF USEFUL

FINANCIAL INFORMATION

27

Answer:

a. Relevance

d.Faithfulrepresentation

27

2.6 UNDERLYING ASSUMPTION

Going concern principle Assumes that:

- the entity will continue to operate for the foreseeable future.

- The entity has never the intention nor the need to liquidate or curtail materially the scale of its operations.

- If such an intention or need exists, the financial statements may have to be prepared on different basis, and the basis must be disclosed.

28

28

2.7 THE ELEMENTS OF FINANCIAL STATEMENTS

- Asset: Resource controlled as a result of past events and from which future economic benefits are expected to flow

- Liability: Present obligation arising from past events, the settlement of which is expected to result in outflow of resources embodying economic benefits

- Equity: Assets minus liabilities

- Income (expense): Increases (decreases) in economic benefits during period from inflows or enhancements

(outflows or depletions) of assets (liabilities) or decreases (incurrences) of liabilities from in increases

(decreases) in equity, other than contributions from

(distributions to) equity

29

29

Aresourcecontrolledbytheentityasa

resultofpasteventsandfromwhichfuture

economicbenefitsareexpectedto

flowto

theentity.(ConceptualFramework2010)

Elements of FinancialStatements

Asset

Liability

Equity

Income

Expenses

Apresenteconomicresourcecontrolledby

theentityasaresultofpastevents

Aneconomicresourceisarightthathas

thepotentialtoproduceeconomicbenefits

(

ConceptualFramework2018,4.3–page

29)

30

from

Apresentobligationoftheentityarising

of

events,

past

is

which

settlement

the

expectedtoresultinanoutflowfromtheentity

benefits.

ofresourcesembodyingeconomic

2010)

ConceptualFramework

(

Elements of FinancialStatements

Asset

Liability

Equity

Income

Expenses

Apresentobligationoftheentitytotransfer

aneconomicresourceasaresultofpast

events

Anobligationisadutyorresponsibilitythat

theentityhasnopracticalabilitytoavoid

(

Conceptual Framework 2018, 4.26 –page

33)

31

Theresidualinterestintheassetsofthe

entityafterdeductingallitsliabilities.

(

ConceptualFramework2018,4.63–page

39)

Elements of FinancialStatements

Asset

Liability

Equity

Income

Expenses

32

in

increases

is

Income

or

assets,

decreasesinliabilities,thatresultin

increasesinequity,otherthanthose

relatingtocontributionsfromholders

ofequityclaims.

ConceptualFramework2018,4.68–

(

page40)

Elements of FinancialStatements

Asset

Liability

Equity

Income

Expenses

33

are

Expenses

or

assets,

in

decreases

in

increases

that

in

result

liabilities,

decreases

those

than

other

in

equity,

relatingtodistributionstoholdersof

equityclaims.

2018

,

4.69

–

Conceptual

(

Framework

page40)

Elements of FinancialStatements

Asset

Liability

Equity

Income

Expenses

34

2.8 RECOGNITION CRITERIA OF ELEMENTS

- Accrual basis of accounting

- Recognise item that meets element definition

(asset, liability, income or expense) when

- probable that benefits will flow to/from the entity

- has cost or value that can measured reliably

35

35

2.9 MEASUREMENT OF ELEMENTS

Measurement is the process of determining monetary amounts at which elements are recognised and carried.

To a large extent, financial reports are based on estimates, judgements and models rather than exact depictions. The Framework establishes the concepts that underlie those estimates, judgements and models.

To a large extent, financial reports are based on estimates, judgements and models rather than exact depictions. The Framework establishes the concepts that underlie those estimates, judgements and models.

36

36

2.9

MEASUREMENT OF ELEMENTS

37

Types of measurement:

Historical cost

Current cost

Realizable (settlement) value

Present value

Fair value

37

2.9 MEASUREMENT OF ELEMENTS

Types of measurement:

Historical cost:

Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of their acquisition.

Liabilities are recorded at the amount of proceeds received in exchange for the obligation, or in some circumstances (for example, income taxes), at the amounts of cash or cash equivalents expected to be paid to satisfy the liability in the normal course of business.

38

38

2.9 MEASUREMENT OF ELEMENTS

Types of measurement:

Current cost:

Assets are carried at the amount of cash or cash equivalents that would have to be paid if the same or an equivalent asset was acquired currently.

Assets are carried at the amount of cash or cash equivalents that would have to be paid if the same or an equivalent asset was acquired currently.

Liabilities are carried at the undiscounted amount of cash or cash equivalents that would be required to settle the obligation currently

39

39

2.9 MEASUREMENT OF ELEMENTS

Types of measurement:

Realizable (settlement) value:

Assets are carried at the amount of cash or cash equivalents that could currently be obtained by selling the asset in an orderly disposal.

Liabilities are carried at their settlement values; that is, the undiscounted amounts of cash or cash equivalents expected to be paid to satisfy the liabilities in the normal course of business. 40

40

2.9 MEASUREMENT OF ELEMENTS

Types of measurement: Present value:

Assets are carried at the present discounted value of the future net cash flows that the item is expected to generate in the normal course of business.

Liabilities are carried at the present discounted value of the future net cash flows that are expected to be required to settle the liabilities in the normal course of business.

41

41

2.9

MEASUREMENT OF ELEMENTS

42

Quiz: Which of the following measurement

bases is not specificanydefined in the

Conceptual Framework?

a. Historical cost

b. Current cost

c. Fair value

d. Realizable (settlement) value

e. Present value

42

SUMMARY

43

Conceptual framework is included:

Objective of financial reporting

Qualitative characteristics

Underlying assumption of financial statement

Element definitions

Recognition criteria

Measurement

43

SELF STUDY

- Review all the knowledge in this chapter.

- Do all the related exercises in e-learning system

- Continue to learn next chapter

44

44

Try your best –No pain No gain

45

45