Preview text:

lOMoAR cPSD| 58797173 LEARNING OBJECTIVES

■ Identify the key components of e-commerce business models.

■ Describe the major B2C business models.

■ Describe the major B2B business models.

■ Understand key business concepts and strategies applicable to e-commerce. T w e e t T w e e t :

Tw i t t e r ’s B u s i n e s s M o d e l lOMoAR cPSD| 58797173

witter, the social network based

on 140-character text messages, Tc ontinues in the

long tradition of Internet developments

that appeared to spring out of nowhere and

take the world by storm. Twitter began as

a Web-based version of text messaging

services provided by cell phone carriers.

The basic idea was to marry short text

messaging on cell phones with the Web

and its ability to create social groups.

Since then, Twitter has expanded

beyond simple text messages to article

previews, photographs, videos, and even

animated images, and today has over 315

million active users worldwide (as of

September 2015). The 5,000 tweets a day

that it began with in 2006 has turned into a deluge of around 500 million daily tweets

worldwide. Special events, such as the Super Bowl, tend to generate an explosion of

tweets, with a total of 28.4 million tweets during the course of the game in 2015. Some

celebrities, such as the pop star Katy Perry, have millions of followers (in Perry’s case, over 75 million as of 2015).

Like many social network firms, Twitter began operating without any revenue

stream. However, it quickly developed some important assets, such as user attention and

audience size (unique visitors). Another important asset is its database of tweets, which

contain the real-time comments, observations, and opinions of its audience, and a search

engine that can mine those tweets for patterns. In addition, Twitter has become a

powerful alternative media platform for the distribution of news, videos, and pictures.

Twitter has sought to monetize its platform via three primary advertising options,

Promoted Tweets, Promoted Trends, and Promoted Accounts, although it is rolling out

more and more variations on these products every day.

Promoted Tweets are Twitter’s version of Google’s text ads. In response to a query

to Twitter’s search function for tablet computers, for example, a Best Buy tweet about

tablets will be displayed. Promoted Tweets look the same as regular tweets and are

available on a cost-per-engagement basis (advertisers only pay when users interact with

the tweet by clicking, replying, or retweeting it) or on an objective-based campaign basis

that focuses on a specific goal such as a click-through to the advertiser’s Web site, lead generation, or 53 Tweets Per Day,” by Alexei

Oreskovic, Businessinsider.com,

June 15, 2015; “Twitter Is Now Letting Apps Advertise With Video,” by Garett Sloane, Adweek.com, July 8, 2015; “Twitter To Pay

SOURCES: “Twitter Adds a New About

‘Buy’ Button,” by Emily Price,

$533 Million For TellApart, Largest

Blog.sfgate.com, September 16,

Acquisition To Date,” by Zach

2015; “Here’s Another Area

Rodgers, Adexchanger.com, April Where Twitter Appears to Have 30, 2015; “Where Did Dick Stalled: lOMoAR cPSD| 58797173 54

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s Costolo Go Wrong?” by Erin

they have interacted. Twitter’s research indicates that users are much more likely to

Griffith, Fortune, June 12, 2015;

engage with such Promoted Tweets, and that Promoted Tweets produce greater

“Twitter’s Evolving Pans to Make

Money From its Data,” by Vindu

engagement with viewers than do traditional Web advertisements.

Goel, New York Times, April 11,

Promoted Trends is the second major Twitter advertising product. “Trends” is a

2015; “Twitter Launches New Ad Product, Promoted Video, into

section of the Twitter home page that identifies what people are talking about. A company Beta,” by Sarah Perez,

can place a Promoted Trends banner at the top of the Trends section, and when users Techcrunch.com, August 12, 2014;

click on the banner, they are taken to the follower page for that company or product. A

“Twitter Changes Pricing Model

Promoted Trend must be purchased for an entire market for a day (for example, the for

Advertisers,” by Mark Bergan,

United States) for a flat fee. In the United States, the fee is now $200,000, up from $80,000 Adage.com, August 7, 2014;

when Promoted Trends were first introduced in 2010. Promoted Trends are available for “Twitter Hopes Its New Marketing

purchase in 50 different countries. Partnership Will Translate to

Twitter’s third primary advertising product is Promoted Accounts, which are Mobile

Ad Growth,” by Richard Byrne

suggestions to follow various advertiser accounts based on the list of accounts that the

Reilly, Venturebeat.com, July 5,

user already follows. Like Promoted Tweets, Promoted Accounts can be geo-targeted at

2014; “Twitter ‘Buy Now’ Button

both the country level and the Nielsen DMA (Designated Marketing Area, roughly

Appears for First Time,” by Kurt Wagner, Mashable.com, June

equivalent to a city and its suburb) level. Promoted Accounts are priced on a cost-per- 30, 2014; “Twitter Buys

follower basis, with advertisers only paying for new followers gained. Prices range from TapCommerce, a Mobile

Advertising Start-up,” by Mike

$.50 to $2.50. Twitter also offers Enhanced Profile Pages for brands. For a reported

Isaac, New York Times, June

$15,000 to $25,000, companies get their own banner to display images, and the ability to 30, 2014; “Twitter Now Supports

pin a tweet to the top of the company’s Twitter stream. Animated GIFs Online and On

In 2013, Twitter began a natural progression into the video ad market. Video clips Mobile,” by Sarah Perez,

Techcrunch.com, June 18, 2014;

that include video ads can now be embedded within tweets. Known as the Twitter Amplify “In a Single Tweet, as Many

program, the program now includes more than 80 media partners such as CBS, ESPN, Pieces of Metadata as There

Are Characters,” by Elizabeth

Condé Nast, MLB.com, Warner Music, and others in 10 countries. Twitter also launched Dwoskin, Wall Street

a television ad targeting product in 2013 that allows marketers to show Promoted Tweets the installation of an

to people who have been tweeting about a television show. The product leverages “video app. Promoted

fingerprinting” technology created by Bluefin Labs, which Twitter acquired in 2013 for Tweets typically cost

$90 million. In 2014, building on the Amplify program, Twitter announced a beta test of between 20 cents and

Promoted Video, which allows advertisers to distribute videos on the Twitter platform $4. Twitter also offers

and in 2015, it began allowing advertisers to use Promoted Video to link directly to app geo-targeted and

installations, as well as an ad purchasing feature for videos called “optimized action keyword targeting

bidding.” This allows marketers to customize ad purchases to improve their return on functionality, which investment. enables advertisers to

But it is mobile that is proving to be the primary driver of Twitter’s business and the send Promoted

source of most of its revenue. Twitter began testing Promoted Tweets and Promoted Tweets to specific

Accounts on mobile devices in March 2012, and by June 2012, reported that it was users in specific

generating the majority of its revenues from ads on mobile devices rather than on its Web locations or based on

site. Twitter has acquired companies like MoPub and TapCommerce to bolster its mobile keywords in their

capabilities, and in 2015 made its largest acquisition yet, spending $533 million to acquire recent tweets or

digital ad platform TellApart. Twitter hopes that TellApart’s technology will help tweets with which improve its mobile ad targeting. Currently, Twitter derives over 80% of its advertising revenue from mobile. lOMoAR cPSD| 58797173

Twitter went public in November 2013 with a valuation of about $14 billion, raising

Goel, New York Times, May 27,

$1.8 billion on top of the $1.2 billion it had previously raised from private investors and 2014; “Tweet to Buy: How Amazon and Twitter’s Social

venture capital firms. The public offering was viewed as a rousing success, with the stock Shopping Cart Works,” by

price jumping almost 75% on its opening day, despite the fact that at the time, Twitter Nathan Oliyarez-Giles,”

Wall Street Journal, May 5,

had not generated a profit. However, its share price has declined significantly from its high 2014;

of over $74 in December 2013 down to approximately $27 as of Fall 2015, threatening to

“Twitter’s New Profile Pages: A Guide to the New Settings and

dip below its IPO price of $26. Analysts have reiterated concerns that Twitter’s growth Styles,” by Nathan Olivarez-

rate in the United States is slowing. Only 25% of Americans with an Internet connection Giles,

Wall Street Journal, April 22,

use Twitter, compared to the over 60% that use Facebook. The vast majority of its users 2014;

(over 75%) are located outside the United States, although the United States is the source

“Twitter Pushes Further Into Mobile Ads with MoPub of 75% of its ad revenues.

Integration,” by Yoree Koh, Wall

Another issue is user engagement. Research indicates that the vast majority of tweets

Street Journal, April 17, 2014;

“Twitter Goes After a Facebook

are generated by a small percentage of users: one study found that the top 15% of users

Cash Cow,” by Vindu Goel, New

account for 85% of all tweets. This is problematic because Twitter only makes money

York Times, April 17, 2014; “Twitter Acquires

when a user engages with an ad. User retention is another problem. One study found that

Gnip, Bringing a Valuable Data

Twitter had only a 40% retention rate: 60% of users failed to return the following month.

Service In-House,” by Ashwin

Only about 11% of the accounts created in 2012 are still tweeting. And while Twitter

Seshagiri, New York Times, April 15, 2014; “Only 11% of New

boasted that its users generated 500 million tweets per day in 2013, the company still

Twitter Users in 2012 Are Still

hasn’t announced that it has reached the 600 million daily tweet threshold, further

Tweeting,” by Yoree Koh, Wall

Street Journal, March 21,

suggesting that its growth has stalled. Acknowledging a need for a change in direction,

2014; “Twitter’s Big Battle is

CEO Dick Costolo stepped down in 2015, replaced by co-founder Jack Dorsey.

Indifference,” by Yoree Koh,

Wall Street Journal, February

Twitter recognizes that one of its problems is that it is perceived to be more confusing 10, 2014; “A

to use than Facebook. In 2014, it rolled out a new profile page design, and it has been Sneak Peek at Twitter’s E-commerce Plans,” by Yoree

experimenting with a variety of ways to make its service easier to use. Twitter continues

Koh, Wall Street Journal,

to refine its data mining capability, recognizing that its most valuable resource may be January 31, 2014; “#Wow!

Twitter Soars 73% in IPO,” by

customer sentiment about products, services, and marketing efforts. In 2013,Twitter Julianne Pepitone,

purchased Big Data start-up Lucky Sort and since then has acquired a number of Money.cnn.com, November 7, 2013; “Twitter Amplify

companies such as Topsy Labs and Gnip that will help it improve its ability to provide Partnerships: Great Content,

information about its users’ behavior. In 2015, Twitter stopped allowing third-party Great Brands, Great Engagement,” by Glenn

resellers to buy access to the full stream of daily messages on the site, hoping that direct Brown, Blog.twitter.com, May

relationships with companies interested in that data will prove more lucrative. 23, 2013; “TV Ad Targeting Uses

Twitter has also been working on a social e-commerce strategy that will allow its

‘Video Fingerprinting’,” by

users to purchase products without having to leave the site to help diversify its revenue Christopher Heine, Adweek.com,

stream. It partnered with Amazon in 2014 to allow users to add products directly to their

May 23, 2013; “Twitter’s Latest

Amazon shopping cart by responding to a tweet with a hashtag and began a beta test of a Buy: Big Data Startup Lucky

Buy Now button within tweets. In 2015, it rolled out the Buy Now button to all users on Sort,” by Daniel Terdiman, News.cnet.com, May 13, 2013;

all platforms, and made it available globally to any company that wants to use it,

“Twitter’s New Video Plan: Ads,

partnering with payments company Stripe. Brands such as Burberry, Home Depot, Saks

Brought to You by Ads,” by Peter

Kafka, Allthingsd.com, April 16,

Fifth Avenue, Warby Parker, and many others have already begun to implement the 2013; “Report: Twitter Now

button into their tweets, and Twitter hopes it will become a significant revenue generator Charges $200,000 for Promoted Trends,” by Seth Fiegerman, in the future. Mashable.com, February 11,

Journal, June 6, 2014; “Making Twitter Easier to Use,” by Vindu 2013;

Goel, New York Times, May 28,

“How Twitter Makes Money,” by

2014; “Twitter’s Growth Shifts to

Harry Gold, Clickz.com, April 26,

Developing Countries,” by Vindu 2011,“Twitter to Launch Geotargeted Promoted Tweets lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 57

and Data for Marketers,” by Sarah Shearman, Brandrepublic.com, April 7, 2011. model, the other business model elements are equally

a set of planned activities designed to result in a profit in a marketplace important when evaluating business

business plan a document that describes a firm’s business model models and plans, or when attempting to

e-commerce business model understand why a

a business model that aims to use and leverage the unique qualities of the particular company has Internet and the World succeeded or failed Wide Web (Kim and Mauborgne,

he story of Twitter illustrates the difficulties of turning a good business idea with a 2000). In the following

Thuge audience into a successful business model that produces revenues and even sections, we describe p rofits. each of the key

Thousands of firms have discovered that they can spend other people’s invested business model

capital much faster than they can get customers to pay for their products or services. In most elements more fully.

instances of failure, the business model of the firm is faulty from the beginning. In contrast,

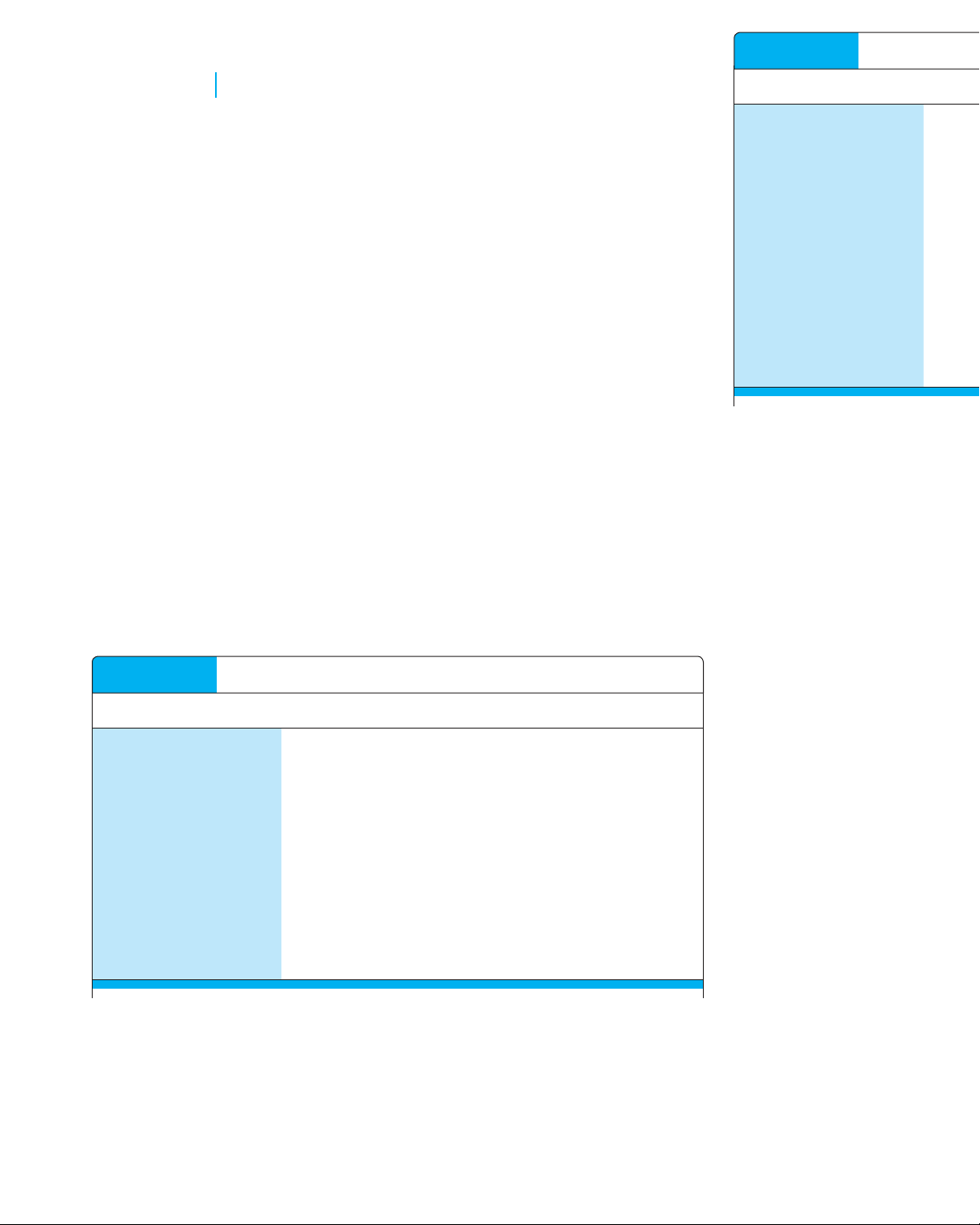

successful e-commerce firms have business models that are able to leverage the unique FIGURE 2.1

THE EIGHT KEY ELEMENTS OF A BUSINESS MODEL

qualities of the Internet, the Web, and the mobile platform, provide customers real value,

develop highly effective and efficient operations, avoid legal and social entanglements that can

harm the firm, and produce profitable business results. In addition, successful business models

must scale. The business must be able to achieve efficiencies as it grows in volume. But what is

a business model, and how can you tell if a firm’s business model is going to produce a profit?

In this chapter, we focus on business models and basic business concepts that you must

be familiar with in order to understand e-commerce. 2.1

E-COMMERCE BUSINESS MODELS INTRODUCTION

A business model is a set of planned activities (sometimes referred to as business processes)

designed to result in a profit in a marketplace. A business model is not always the same as a

business strategy, although in some cases they are very close insofar as the business model

explicitly takes into account the competitive environment (Magretta, 2002). The business

model is at the center of the business plan. A business plan is a document that describes a

firm’s business model. A business plan always takes into account the competitive environment.

An e-commerce business model aims to use and leverage the unique qualities of the Internet,

the Web, and the mobile platform.

EIGHT KEY ELEMENTS OF A BUSINESS MODEL

If you hope to develop a successful business model in any arena, not just e-commerce, you

must make sure that the model effectively addresses the eight elements listed in Figure 2.1.

These elements are value proposition, revenue model, market opportunity, competitive

environment, competitive advantage, market strategy, organizational development, and

management team. Many writers focus on a firm’s value proposition and revenue model. While

these may be the most important and most easily identifiable aspects of a company’s business lOMoAR cPSD| 58797173 58

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

A business model has eight key elements. Each element must be addressed if you hope to be Revenue Model successful.

A firm’s revenue model describes how the firm will earn revenue, generate profits, and Value Proposition produce a superior

A company’s value proposition is at the very heart of its business model. A value proposition return on invested

defines how a company’s product or service fulfills the needs of customers (Kambil, Ginsberg, capital. We use the

and Bloch, 1998). To develop and/or analyze a firm’s value proposition, you need to understand terms revenue model

why customers will choose to do business with the firm instead of another company and what and financial model

the firm provides that other firms do not and cannot. From the consumer point of view, interchangeably. The

successful e-commerce value propositions include personalization and customization of function of business

product offerings, reduction of product search costs, reduction of price discovery costs, and organizations is both to

facilitation of transactions by managing product delivery. generate profits and to

value proposition defines how a company’s produce returns on

product or service fulfills the needs of customers revenue model invested capital that

describes how the firm will earn revenue, produce profits, and produce a superior return on exceed alternative invested capital investments. Profits alone are not sufficient to make a company “successful” (Porter, 1985). In order to be considered successful,

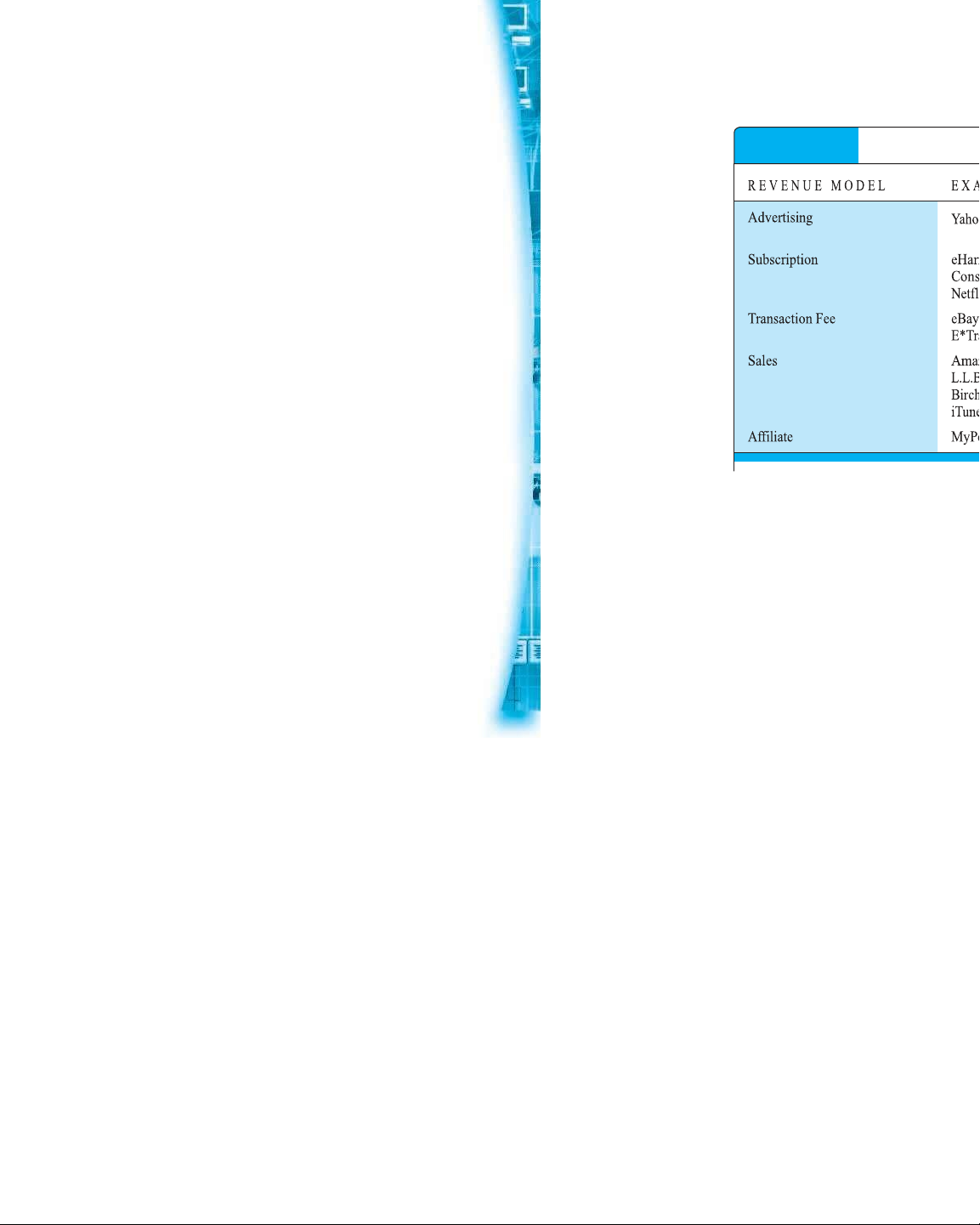

advertising revenue model a firm must produce

a company provides a forum for advertisements and receives fees from advertisers returns greater than

subscription revenue model alternative

a company offers its users content or services and charges a subscription fee for access to some or investments. Firms that all of its offerings fail this test go out of existence. Although there are many different e- commerce revenue models that have been

freemium strategy companies give away a certain level of product or services for free, but then developed, most

charge a subscription fee for premium levels of the product or service companies rely on one,

For instance, before Amazon existed, most customers personally traveled to book retailers or some combination,

to place an order. In some cases, the desired book might not be available, and the customer of the following major

would have to wait several days or weeks, and then return to the bookstore to pick it up. revenue models:

Amazon makes it possible for book lovers to shop for virtually any book in print from the advertising,

comfort of their home or office, 24 hours a day, and to know immediately whether a book is in subscription,

stock. Amazon’s Kindle takes this one step further by making e-books instantly available with transaction fee, sales,

no shipping wait. Amazon’s primary value propositions are unparalleled selection and and affiliate. convenience. In the advertising revenue model, a company that offers content, services, and/or products also lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 59

provides a forum for advertisements and receives fees from advertisers. Companies that are In the transaction

able to attract the greatest viewership or that have a highly specialized, differentiated fee revenue model, a

viewership and are able to retain user attention (“stickiness”) are able to charge higher company receives a fee

advertising rates. Yahoo, for instance, derives a significant amount of revenue from display and for enabling or video advertising. executing a

In the subscription revenue model, a company that offers content or services charges a transaction. For

subscription fee for access to some or all of its offerings. For instance, the digital version of example, eBay provides

Consumer Reports provides online and mobile access to premium content, such as detailed an auction marketplace

ratings, reviews, and recommendations, only to subscribers, who have a choice of paying a and receives a small

$6.95 monthly subscription fee or a $30.00 annual fee. Experience with the subscription transaction fee from a

revenue model indicates that to successfully overcome the disinclination of users to pay for seller if the seller is

content, the content offered must be perceived as a high-value-added, premium offering that successful in selling the

is not readily available elsewhere nor easily replicated. Companies successfully offering content item. E*Trade, a

or services online on a subscription basis include eHarmony (dating services), Ancestry financial services

(genealogy research), Microsoft’s Xbox Live (video games), Pandora, Spotify, and Rhapsody provider, receives

(music), Scribd, and Amazon’s Kindle Unlimited program (e-books), and Netflix and Hulu transaction fees each

(television and movies). See Table 2.1 for examples of various subscription services. time it executes a stock

Recently, a number of companies have been combining a subscription revenue model with transaction on behalf

a freemium strategy. In a freemium strategy, the companies give away a certain level of of a customer.

product or services for free, but then charge a subscription fee for premium levels of the In the sales

product or service. See the case study, Freemium Takes Pandora Public, at the end of the revenue model,

chapter, for a further look at the freemium strategy. companies derive TABLE 2.1

EXAMPLES OF SUBSCRIPTION SERVICES revenue by selling goods, content, or N A M E D E S C R I P T I O N services to customers. eHarmony (dating)

• Free: Create profile and view profiles of matches Companies such as Amazon (which sells

• Basic (see photos, send and receive messages): $165–

$170 for 6 months; $225–$230 for 1 year books, music, and

• Total Connect (Basic plus additional services such as other products),

identification validation): $180 for 6 months; $288 for 1 L.L.Bean, and Gap all year have sales revenue

• Premier (Basic/Total Connect plus additional services models. A number of

such as if you do not find match within a year, get another companies are also year for free) : $500/year using a subscription-

Ancestry (genealogical research)

• All U.S. records: $19.99/month or $99 for 6 months based sales revenue

• All U.S. and international records: $34.99/monthly or model. Birchbox, which $149 for 6 months offers home delivery of

• All records on Ancestry and also Fold3 and beauty products for a Newspapers.com: $10 monthly or $100

$44.99/month or $199 for 6 months annual subscription Scribd (e-books)

• Unlimited books for $8.99/month (over 1 million e- price, is one example.

books, audio books, and comic books from which to choose) In the affiliate revenue model, Spotify (music)

• Many different permutations, depending on device (mobile, companies that steer

tablet, or desktop) and plan chosen (Free, Unlimited or Premium) business to an “affiliate” receive a referral fee or lOMoAR cPSD| 58797173 60

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

percentage of the revenue from any resulting sales. For example, MyPoints makes money by sen

connecting companies with potential customers by offering special deals to its members. When d

they take advantage of an offer and make a purchase, members earn “points” they can redeem you

for freebies, and MyPoints receives a fee. Community feedback companies typically receive adv

some of their revenue from steering potential customers to Web sites where they make a erti purchase. sem

Table 2.2 on page 62 summarizes these major revenue models. The Insight on Society ents

case, Foursquare: Check Your Privacy at the Door, examines some of the issues associated with ,

Foursquare's business and revenue model. cou

transaction fee revenue model pon

a company receives a fee for enabling or executing a transaction s,

sales revenue model a company derives revenue by selling goods, information, or services and flas h bar gain

affiliate revenue model s,

a company steers business to an affiliate and receives a referral fee or percentage of the revenue base from any resulting sales d on INSIGHT ON SOCIETY

FOURSQUARE: CHECK YOUR PRIVACY AT THE DOOR

Foursquare is one of a host of companies that combine a social whe

network business model with location-based technology. re

Foursquare offers mobile social applications that know where you you

are located and can provide you with informa- are

tion about popular spots nearby, as well as reviews from other Foursquare loca

users. These apps also allow you to check in to a restaurant or other ted.

location, and automatically let friends on Facebook and other social J networks learn where you are. ust

Founded in 2008 by Dennis Crowley and Naveen Selvadurai, as

Foursquare has over 60 million registered users and more than 50 million Fac

monthly active users worldwide, split fairly evenly between the United ebo

States and the rest of the world, who have checked in over 7.5 billion times. ok

Foursquare shares many similarities with other social networks like and

Facebook and Twitter that began operating without a revenue model in Twi

place. Like those companies, Foursquare has been able to command high tter

valuations from venture capital investors, despite unimpressive revenue and are

profits. How is this possible? The answer lies in the coupling of its social mo

network business model with smartphone-based technology that can neti

identify where you are located within a few yards. There’s potentially a zin

great deal of money to be made from knowing where you are. Location- g

based data has extraordinary commercial value because advertisers can then thei r lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 61

user bases with advertising and social commerce, so too is Foursquare. In As a case in point,

one of its first efforts, Foursquare partnered with American Express to offer in April 2012,

discounts to cardholders when they check in on their cell phone to certain Foursquare was hit by

shops and restaurants. Foursquare has continued to develop new location- a privacy landmine

based features, including Local Updates, which allow retailers to deliver when an app called

locationbased updates to customers, Foursquare Ads, which are paid Girls Around Me

advertisements targeted by location and by prior behavior, Check-In surfaced that used

Retargeting, which uses location and behavioral data to retarget ads to Foursquare’s

users on third-party Web sites, and Post Check-In Units, which serve application

advertisements to users after checking in with the Foursquare app. In 2015, programming interface

Foursquare launched Pinpoint, an advertising product that allows to show Facebook

marketers unprecedented ability to target users based on its accumulated photos of women

historical location data. Pinpoint has the ability to filter out inaccurate data currently checked in

and can even reach mobile users without the Foursquare app. Brands around a particular

interested in Pinpoint include Coors, FedEx, Jaguar Land Rover, Olive neighborhood. Garden, and Samsung. Foursquare quickly

In 2015, Foursquare’s main focus is to continue on a path to profitability by expanding shut down the app and

and monetizing its trove of location data. Analysts estimated that Foursquare earned $15 to shortly thereafter

$20 million in 2013, a significant increase over the $2 million it earned in 2012, and in 2014 made changes to its

and 2015, Foursquare’s revenue has continued to double on a year-to-year basis. In 2014, API to eliminate the

Foursquare struck a multiyear data licensing agreement with Microsoft, which may use the ability of users to see

data to customize Bing on a user-by-user basis with specific search results and advertisements strangers checked into

based on their location data. In 2015, Foursquare has continued these efforts, partnering with a venue without being

Twitter to provide location-based tagging features on tweets, which enables users to tag checked into the same

tweets with their precise location. Foursquare has also partnered with Google, Yahoo, and place themselves.

Pinterest to provide location-based functions and to share location data, increasing the Illustrating the

richness and accuracy of its own data in the process. continuing issues

In 2014, Foursquare made a major change to its business model, splitting its app into two Foursquare faces on

separate apps with different focuses. Its redesigned Foursquare app became a recommender the privacy front, the

system using passive location tracking to offer suggestions to users for where to eat or visit. version of its mobile

A separate app, Swarm, absorbed Foursquare’s check-in feature. CEO Crowley envisions the app introduced in June

new Foursquare app as a service that lets you know what places you might enjoy when you 2012 allowed users to

travel somewhere new. The redesigned app asks the user to identify things he or she likes, see all of their friends’

known as “tastes,” from over 10,000 possibilities (ranging from barbecue to museums to board check-ins from the

games), and then provides recommendations. Rather than earn badges, users are encouraged prior two weeks. Many

to add tips to work toward becoming an expert. Many loyal Foursquare users were driven users may not truly

away by the change, particularly Swarm users, who missed many of the old app’s lighthearted, understand how much

collectible elements. In 2015, the company added many of those old features back to Swarm, of their location

such as status levels, mayorships, and leaderboards, awards offered to users with the most history is available to

check-ins at a particular location. their friends. One

As the popularity of location-based services like Foursquare has grown, so too have advantage Foursquare

concerns about privacy. Privacy advocates point out that many apps have no privacy policy, does have, though, is

that most of the popular apps transmit location data to their developers, after which the that many of its users

information is not well controlled, and that these services are creating a situation where are actually interested

government, marketers, creditors, and telecommunications firms will end up knowing nearly in having their location

everything about citizens, including their whereabouts. tracked and their data lOMoAR cPSD| 58797173 62

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

collected – users are less likely to revolt when they find that Foursquare is collecting and sharing their data. TABLE 2.2

FIVE PRIMARY REVENUE MODELS

The redesigned Foursquare and Swarm apps also continue to raise

privacy concerns. The Foursquare app tracks a user’s location even when

the app is closed. Instead, by default, the app automatically provides

Foursquare with the phone’s GPS coordinates any time the phone is turned

on, unless the user specifically opts out of such tracking. In contrast,

Facebook’s Nearby Friends feature requires users to opt in. Persistent

location tracking of this sort further enhances the value of Foursquare’s

location data. Foursquare claims that the services it provides are a fair trade

for the data it collects; privacy experts are concerned that tracking is always

on by default, and that users cannot delete archived location data from Foursquare’s servers. market opportunity

refers to the company’s intended marketspace and the overall potential financial opportunities

available to the firm in that marketspace marketspace

SOURCES: “Swarm Gets Back into the Game with Leaderboards,” by Jordan Crook, Techcrunch.com, August 20, 2015; “Foursquare by

the Numbers: 60M Registered Users, 50M MAUs, and 75M Tips to Date,” by Harrison Weber and Jordan Novet, Venturebeat.com, August 18,

2015; “Foursquare Returns to Its Roots in Bid to Win Back Users,” by Jason Cipriani, Fortune, May 13, 2015; “Foursquare Brings Back Check-

in Badges with Swarm Update,” by Karissa Bell, Mashable.com, May 4, 2015; “Foursquare Unveils Pinpoint for Location-Based Ad Targeting,”

by Melanie White, Clickz.com, April 14, 2015; “Foursquare Unveils Pinpoint to Show You Ads Based on Where You’ve Been,” by Harrison

Weber, Venturebeat.com, April 14, 2015; “Foursquare Knows Where You’ve Been, Wants to Offer You a Sick Deal at Olive Garden,” by John

Paul Titlow, Fast Company, April 14, 2015; “Why Twitter and Foursquare Just Struck a Deal,” by Erin Griffith, Fortune, March 23, 2015; “Twitter

Teaming with Foursquare for Location Tagging in Tweets,” by Darrell Etherington, Techcrunch.com, March 23, 2015; “Foursquare Now Tracks

Your Every Move,” by Ryan Tate and Kristin Burnham, Information Week, August 7, 2014; “Radical New Foursquare App Thinks You Want Even

Less Privacy,” by Jason Cipriani, Wired.com, August 6, 2014; “Foursquare Launches Its Redesigned Mobile App Focused on Locationbased

Recommendations,” by Nick Summers, Thenextweb.com, August 6, 2014; “Foursquare Now Tracks Users Even When the App is Closed,” by

Douglas Macmillan, Wall Street Journal, August 6, 2014; “Foursquare Updates Swarm to Soothe Check-in Blues,” by Caitlin McGarry,

Techhive.com, July 8, 2014; “How Foursquare Uses Location Data to Target Ads on PCs, Phones,” by Cotton Delo, Adage.com, February 27,

2014; “With Foursquare Deal, Microsoft Aims for Supremacy in Hyper-Local Search,” by Ryan Tate, Wired.com, February 5, 2014; “Foursquare

Goes Beyond the Check-in with Passive Tracking,” by John McDermott, Digiday.com, December 18, 2013; “A Start-Up Matures, Working With

AmEx,” by Jenna Wortham, New York Times, June 22, 2011; “Telling Friends Where You Are (or Not),” by Jenna Wortham, New York Times, March 14, 2010.

the area of actual or potential commercial value in which a company intends to operate Market Opportunity The term market opportunity refers to the company’s intended marketspace (i.e., an area of actual or potential commercial value) and the overall potential

competitive environment financial opportunities

refers to the other companies operating in the same marketspace selling similar products available to the firm in that marketspace. The market opportunity is usually divided into smaller market niches. The realistic market lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 63

opportunity is defined by the revenue potential in each of the market niches where you hope competitors because to compete. both companies sell

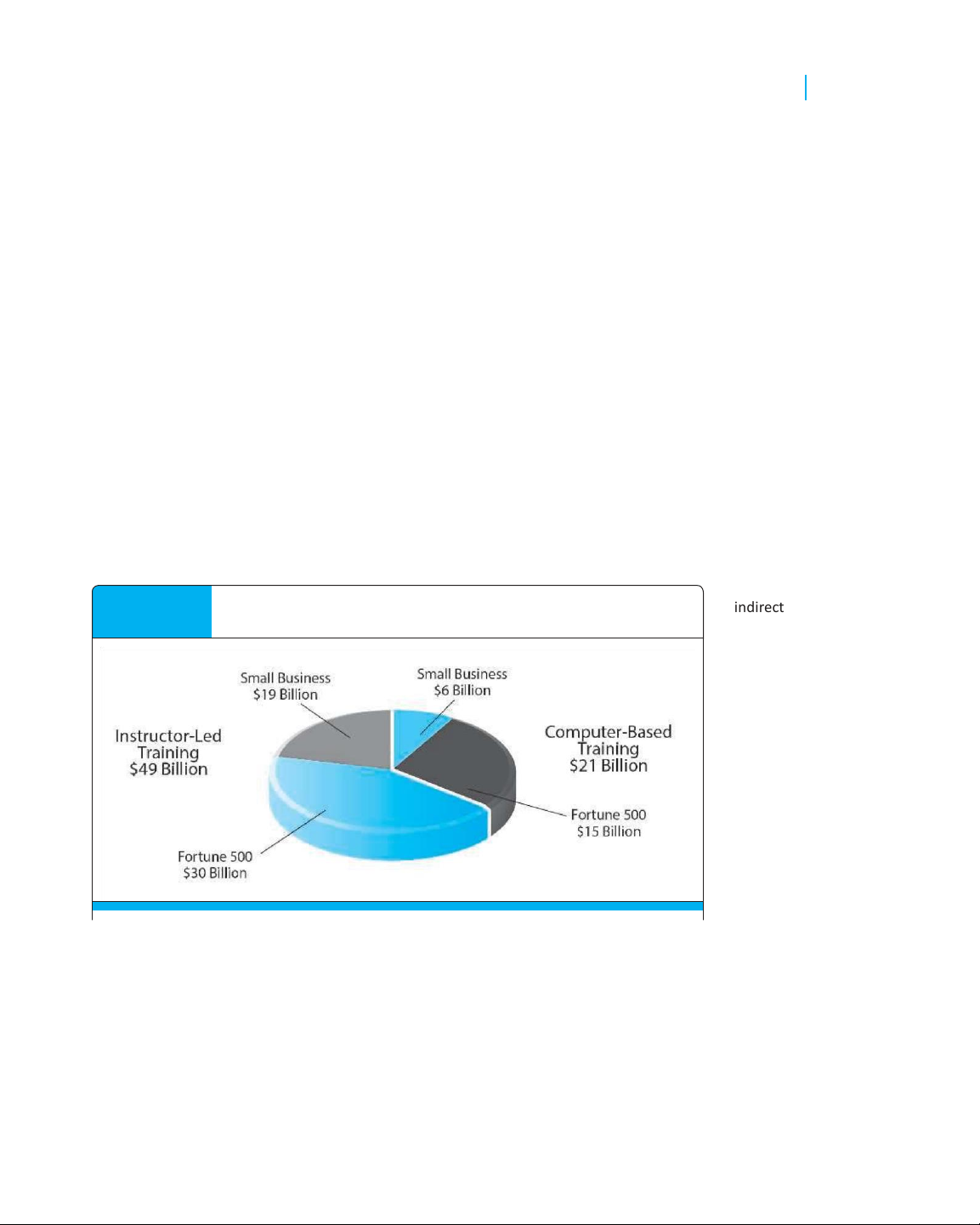

For instance, let’s assume you are analyzing a software training company that creates identical products—

online software-learning systems for sale to businesses. The overall size of the software training cheap tickets. Indirect

market for all market segments is approximately $70 billion. The overall market can be broken competitors are

down, however, into two major market segments: instructor-led training products, which companies that may be

comprise about 70% of the market ($49 billion in revenue), and computer-based training, which in different industries

accounts for 30% ($21 billion). There are further market niches within each of those major but still compete

market segments, such as the Fortune 500 computer-based training market and the small indirectly because their

business computer-based training market. Because the firm is a start-up firm, it cannot products can substitute

compete effectively in the large business, computer-based training market (about $15 billion). for one another. For

Large brandname training firms dominate this niche. The start-up firm’s real market instance, automobile

opportunity is to sell to the thousands of small business firms that spend about $6 billion on manufacturers and

computer-based software training. This is the size of the firm’s realistic market opportunity (see airline companies Figure 2.2). operate in different industries, but they still

Competitive Environment compete indirectly because they offer

A firm’s competitive environment refers to the other companies selling similar products and consumers alternative

operating in the same marketspace. It also refers to the presence of substitute products and means of

potential new entrants to the market, as well as the power of customers and suppliers over transportation. CNN, a

your business. We discuss the firm’s environment news outlet, is an FIGURE 2.2

MARKETSPACE AND MARKET OPPORTUNITY IN THE indirect competitor of

SOFTWARE TRAINING MARKET ESPN, not because they sell identical products, but because they both compete for consumers’ time online. The existence of a large number of competitors in any one segment may be a sign that the market is saturated and that it may be difficult to become profitable. On

Marketspaces are composed of many market segments. Your realistic market opportunity will the other hand, a lack

typically focus on one or a few market segments. of competitors could signal either an untapped market niche

later in the chapter. The competitive environment for a company is influenced by several ripe for the picking, or a

factors: how many competitors are active, how large their operations are, what the market market that has already

share of each competitor is, how profitable these firms are, and how they price their products. been tried without

Firms typically have both direct and indirect competitors. Direct competitors are success because there

companies that sell very similar products and services into the same market segment. For is no money to be

example, Priceline and Travelocity, both of whom sell discount airline tickets online, are direct made. Analysis of the lOMoAR cPSD| 58797173 64

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

competitive environment can help you decide which it is. (Rigdon, 2000; Teece, 1986). Indeed, many of Competitive Advantage the success stories we

Firms achieve a competitive advantage when they can produce a superior product and/or discuss in this book are

bring the product to market at a lower price than most, or all, of their those of companies

competitive advantage achieved by a firm when it can produce a superior product and/or bring that were slow

the product to market at a lower price than most, or all, of its competitors asymmetry followers—businesses

exists whenever one participant in a market has more resources than other participants that gained knowledge from failure of

first-mover advantage a competitive market advantage for a firm that results from being the first pioneering firms and

into a marketplace with a serviceable product or service entered into the

complementary resources market late.

resources and assets not directly involved in the production of the product but required for Some competitive

success, such as marketing, management, financial assets, and reputation advantages are called

unfair competitive advantage “unfair.” An unfair

occurs when one firm develops an advantage based on a factor that other firms cannot purchase competitive advantage occurs perfect market when one firm

a market in which there are no competitive advantages or asymmetries because all firms have develops an advantage

equal access to all the factors of production based on a factor that

competitors (Porter, 1985). Firms also compete on scope. Some firms can develop global other firms cannot

markets, while other firms can develop only a national or regional market. Firms that can purchase (Barney,

provide superior products at the lowest cost on a global basis are truly advantaged. 1991). For instance, a

Firms achieve competitive advantages because they have somehow been able to obtain brand name cannot be

differential access to the factors of production that are denied to their competitors—at least in purchased and is in that

the short term (Barney, 1991). Perhaps the firm has been able to obtain very favorable terms sense an “unfair”

from suppliers, shippers, or sources of labor. Or perhaps the firm has more experienced, advantage. Brands are

knowledgeable, and loyal employees than any competitors. Maybe the firm has a patent on a built upon loyalty, trust,

product that others cannot imitate, or access to investment capital through a network of former reliability, and quality.

business colleagues or a brand name and popular image that other firms cannot duplicate. An Once obtained, they

asymmetry exists whenever one participant in a market has more resources—financial are difficult to copy or

backing, knowledge, information, and/or power—than other participants. Asymmetries lead to imitate, and they

some firms having an edge over others, permitting them to come to market with better permit firms to charge

products, faster than competitors, and sometimes at lower cost. premium prices for

For instance, when Apple announced iTunes, a service offering legal, downloadable their products.

individual song tracks for 99 cents a track that would be playable on any digital device with In perfect

iTunes software, the company had better-than-average odds of success simply because of markets, there are no

Apple’s prior success with innovative hardware designs, and the large stable of music firms that competitive

Apple had meticulously lined up to support its online music catalog. Few competitors could advantages or

match the combination of cheap, legal songs and powerful hardware to play them on. asymmetries because

One rather unique competitive advantage derives from being a first mover. A first-mover all firms have access to

advantage is a competitive market advantage for a firm that results from being the first into a all the factors of

marketplace with a serviceable product or service. If first movers develop a loyal following or a production (including

unique interface that is difficult to imitate, they can sustain their first-mover advantage for long information and

periods (Arthur, 1996). Amazon provides a good example. However, in the history of knowledge) equally.

technology-driven business innovation, most first movers often lack the complementary However, real markets

resources needed to sustain their advantages, and often follower firms reap the largest rewards are imperfect, and lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 65

asymmetries leading to competitive advantages do exist, at least in the short term. Most market strategy

competitive advantages are short term, although some can be sustained for very long periods. the plan you put

But not forever. In fact, many respected brands fail every year.

Companies are said to leverage their competitive assets when they use their competitive

advantages to achieve more advantage in surrounding markets. For instance, Amazon’s move together that details

into the online grocery business leverages the company’s huge customer database and years of e-commerce experience. exactly how you intend Market Strategy

No matter how tremendous a firm’s qualities, its marketing strategy and execution are often to enter a new market

just as important. The best business concept, or idea, will fail if it is not properly marketed to potential customers.

Everything you do to promote your company’s products and services to potential and attract new

customers is known as marketing. Market strategy is the plan you put together that details

exactly how you intend to enter a new market and attract new customers.

For instance, Twitter, YouTube, and Pinterest have a social network marketing strategy that customers

encourages users to post their content on the sites for free, build personal profile pages,

contact their friends, and build a community. In these cases, the customer becomes part of the marketing staff! organizational

Organizational Development

Although many entrepreneurial ventures are started by one visionary individual, it is rare that development

one person alone can grow an idea into a multi-million dollar company. In most cases, fast-

growth companies—especially e-commerce businesses—need employees and a set of business plan that describes how

procedures. In short, all firms—new ones in particular—need an organization to efficiently the company will

implement their business plans and strategies. Many e-commerce firms and many traditional organize the work that

firms that attempt an e-commerce strategy have failed because they lacked the organizational needs to be

structures and supportive cultural values required to support new forms of commerce (Kanter, accomplished 2001). management team

Companies that hope to grow and thrive need to have a plan for organizational employees of the

development that describes how the company will organize the work that needs to be company responsible for

accomplished. Typically, work is divided into functional departments, such as production, making the business

shipping, marketing, customer support, and finance. Jobs within these functional areas are model work Management Team

defined, and then recruitment begins for specific job titles and responsibilities. Typically, in the

beginning, generalists who can perform multiple tasks are hired. As the company grows, Arguably, the single

recruiting becomes more specialized. For instance, at the outset, a business may have one most important

marketing manager. But after two or three years of steady growth, that one marketing position element of a business

may be broken down into seven separate jobs done by seven individuals. model is the

For instance, eBay founder Pierre Omidyar started an online auction site, according to management team

some sources, to help his girlfriend trade Pez dispensers with other collectors, but within a few responsible for making

months the volume of business had far exceeded what he alone could handle. So he began the model work. A

hiring people with more business experience to help out. Soon the company had many strong management

employees, departments, and managers who were responsible for overseeing the various team gives a model aspects of the organization. instant credibility to

leverage when a company uses its competitive advantages to achieve more advantage in outside investors, surrounding markets immediate market- lOMoAR cPSD| 58797173 66

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

specific knowledge, and experience in implementing business plans. A strong management w

team may not be able to salvage a weak business model, but the team should be able to change h i

the model and redefine the business as it becomes necessary. c

Eventually, most companies get to the point of having several senior executives or h

managers. How skilled managers are, however, can be a source of competitive advantage or y

disadvantage. The challenge is to find people who have both the experience and the ability to o

apply that experience to new situations. u

To be able to identify good managers for a business start-up, first consider the kinds of c o

experiences that would be helpful to a manager joining your company. What kind of technical m

background is desirable? What kind of supervisory experience is necessary? How many years p

in a particular function should be required? What job functions should be fulfilled first: a

marketing, production, finance, or operations? Especially in situations where financing will be r

needed to get a company off the ground, do prospective senior managers have experience and e

contacts for raising financing from outside investors? w h

Table 2.3 summarizes the eight key elements of a business model and the key questions a

that must be answered in order to successfully develop each element. t y RAISING CAPITAL o u

Raising capital is one of the most important functions for a founder of a start-up business and r

its management team. Not having enough capital to operate effectively is a primary reason why c

so many start-up businesses fail. Many entrepreneurs initially “bootstrap” to get a business off o

the ground, using personal funds derived from savings, m p a n TABLE 2.3

KEY ELEMENTS OF A BUSINESS MODEL y d C O M P O N E N T S K E Y Q U E S T I O N S o e Value proposition

Why should the customer buy from you? s Revenue model How will you earn money? t o Market opportunity

What marketspace do you intend to serve, and what is its size? a Competitive environment

Who else occupies your intended marketspace? w Competitive advantage

What special advantages does your firm bring to the marketspace? e l Market strategy

How do you plan to promote your products or services to attract l your target audience? -

Organizational What types of organizational structures within the firm are development k

necessary to carry out the business plan? n o Management team

What kinds of experiences and background are important for the w company’s leaders to have? n c TABLE 2.4

KEY ELEMENTS OF AN ELEVATOR PITCH o m E L E M E N T D E S C R I P T I O N p a Introduction

Your name and position; your company’s name, and a tagline in n y . lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 67

Example: “My name is X, I am the founder of Y, and we are the angel investors Uber/Amazon of Z.” typically wealthy individuals or a group of Background

The origin of your idea and the problem you are trying to solve. individuals who invest Industry size/market

Brief facts about the (hopefully very large) size of the market. their own money in opportunity exchange for an equity share in the stock of a

Revenue model/numbers/ Insight into your company’s revenue model and results thus far, business; often are the

growth metrics how fast it is growing, and early adopters, if there are any. first outside investors in Funding

The amount of funds you are seeking and what it will help you a start-up venture achieve. capital investors Exit strategy

How your investors will achieve a return on their investment. typically invest funds they manage for other investors; usually later- stage investors

credit card advances, home equity loans, or from family and friends. Funds of this type are

often referred to as seed capital. Once such funds are exhausted, if the company is not

generating enough revenue to cover operating costs, additional capital will be needed.

Traditional sources of capital include incubators, commercial banks, angel investors, venture

capital firms, and strategic partners. One of the most important aspects of raising capital is the crowdfunding

ability to boil down the elements of the company’s business plan into an elevator pitch, a short involves using the

two-to-three minute (about the length of an elevator ride, giving rise to its name) presentation Internet to enable

aimed at convincing investors to invest. Table 2.4 lists the key elements of an elevator pitch. individuals to

Incubators (sometimes also referred to as accelerators) such as Y Combinator (profiled in collectively contribute money to support a

Chapter 1’s Insight on Business case) typically provide a small amount of funding, but more project

importantly, also provide an array of services to start-up companies that they select to Venture capital

participate in their programs, such as business, technical, and marketing assistance, as well as investors typically

introductions to other sources of capital. Well-known incubator programs include TechStars, become more DreamIt, and Capital Factory. interested in a start-up

Obtaining a loan from a commercial bank is often difficult for a start-up company without company once it has

much revenue, but it may be worthwhile to investigate programs offered by the U.S. Small begun attracting a large

Business Administration, and its state or local equivalents. The advantage of obtaining capital audience and

in the form of a loan (debt) is that, although it must be repaid, it does not require an generating some

entrepreneur to give up any ownership of the company. revenue, even if it is not

Angel investors are typically wealthy individuals (or a group of individuals) who invest profitable. Venture

their own money in an exchange for an equity share in the stock in the business. In general,

capital investors invest

angel investors make smaller investments (typically $1 million or less) than venture capital funds they manage for

firms, are interested in helping a company grow and succeed, and invest on relatively favorable other investors such as

terms compared to later stage investors. The first round of external investment in a company is investment banks,

sometimes referred to as Series A financing. pension funds, seed capital insurance companies,

typically, an entrepreneur’s personal funds derived from savings, credit card advances, home or other businesses,

equity loans, or from family and friends and usually want to

elevator pitch short two-to-three minute presentation aimed at convincing investors to invest obtain a larger stake in incubators the business and

typically provide a small amount of funding and also an array of services to start-up companies exercise more control over the operation of lOMoAR cPSD| 58797173 68

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

the business. Venture capital investors also typically want a well-defined “exit strategy,” such the

as a plan for an initial public offering or acquisition of the company by a more established idea

business within a relatively short period of time (typically 3 to 7 years), that will enable them l

to obtain an adequate return on their investment. Venture capital investment often ultimately med

means that the founder(s) and initial investors will no longer control the company at some point ium in the future. for

Crowdfunding involves using the Internet to enable individuals to collectively contribute cro

money to support a project. The concepts behind crowdfunding have been popularized by wdf

Kickstarter and Indiegogo (see the Insight on Business case, Crowdfunding Takes Off), but they und

were not able to be used for equity investments in for-profit companies in the United States ing

due to securities regulations. However, the passage of the Jumpstart Our Business Startups bec

(JOBS) Act in 2012 and issuance of regulations by the Securities and Exchange Commission in ause

July 2013 has enabled companies to use the Internet to solicit wealthy (“accredited”) investors it

to invest in small and early-stage start-ups in exchange for stock. Regulation A+, which enables allo

equity crowdfunding investments by non-accredited investors (people with a net worth of less ws

than $1 million and who earned less than $200,000 a year in the previous two years), took indi

effect in June 2015. Regulations implementing even broaderbased equity crowdfunding vid

authorized by the JOBS Act, which would allow investments by people with annual income or uals

net worth of less than $100,000, remain a work in progress. and org

CATEGORIZING E-COMMERCE BUSINESS MODELS: SOME DIFFICULTIES aniz

There are many e-commerce business models, and more are being invented every day. The atio

number of such models is limited only by the human imagination, and our list of different ns

business models is certainly not exhaustive. However, despite the abundance of potential in

models, it is possible to identify the major generic types (and subtle variations) of business nee

models that have been developed for the e-commerce arena and describe their key features. d of

It is important to realize, however, that there is no one correct way to categorize these business fun models. ds

Our approach is to categorize business models according to the different major e- and

commerce sectors—B2C and B2B—in which they are utilized. You will note, however, that pote

fundamentally similar business models may appear in more than one sector. For example, the ntia

business models of online retailers (often called e-tailers) and e-distributors are quite similar. l

However, they are distinguished by the market focus of the sector in which they are used. In bac

the case of e-tailers in the B2C sector, the business model focuses on sales to the individual kers

consumer, while in the case of the e-distributor, the business model focuses on sales to another to

business. Many companies use a variety of Think you have the next big idea but lack the find one INSIGHT ON BUSINESS CROWDFUNDING TAKES OFF

resources to make it happen? Crowdfunding sites might ano

be your best shot. Sites such as Kick- ther

starter, Indiegogo, RocketHub, and aro

Crowdtilt have led the growth of crowdfunding from $530 million in und

2009 to over $34 billion in 2015. A World Bank study predicts that capital the

raised via crowdfunding will exceed $93 billion by 2025. The Internet is lOMoAR cPSD| 58797173

E - c o m m e r c e B u s i n e s s M o d e l s 69 globe. asso

How do sites like Kickstarter and Indiegogo work? The idea is ciat

simple—an inventor, artist, or activist looking to raise money for a project ed

uses the site to create a page for that project. People can pledge to support wit

the project, but at Kickstarter, money actually only changes hands once the h

project fully reaches its funding goal (other sites, such as Indiegogo and thei

RocketHub, allow project creators to keep the money they raise even if they r

do not achieve their goal). The sites take a small commission, usually about proj

5%, on completed projects. Backers do not receive any ownership interest ect,

in the project, but typically receive some type of reward, often and

corresponding to the size of their contribution to the project. for

Crowdfunding projects are diverse, ranging from inventions to art inve

installations, movies, video games, and political action projects. All you ntio

need is an idea that captures the attention of the crowd and for which people ns,

are willing to contribute funds. Crowdfunding is quickly becoming a now

mainstay in nearly all of these fields. For instance, among the most funded req

Kickstarter invention projects to date are Pebble, a customizable e-paper uire

watch that connects to a smartphone (over $20 million) and the Micro, a s

consumer 3-D printer ($3.4 million). Kickstarter has financed more pho

installation art projects than the National Endowment for the Arts, and tos

several of the biggest Kickstarter projects have been movie projects that of

have struggled to gain traction at Hollywood studios, like the Veronica prot

Mars movie project ($5.7 million) and Zach Braff’s film “Wish I Was Here” oty

($3.1 million), as well as a project to reboot the popular educational TV pe

show Reading Rainbow, which garnered over $5 million in financing in pro

2015. In 2014, a man from Ohio solicited $10 in donations to make a batch duc

of potato salad as a joke, but after his campaign went viral, he raised over ts

$55,000, much of which he used to support local charities. The applications inst

for crowdfunding are limited only by the imagination. ead

Successful crowdfunding projects typically share some common elements. One of the most of

important is a clear and concise presentation of the idea, especially through the use of video. sim

One major crowdfunding site reports that campaigns with great videos get significantly more ply

investment than those without. The crowdfunding campaign is in many ways similar to dra

presenting a business plan, and should touch on the same eight elements of a business model, win

such as the project’s value proposition, its target market, and so on. A whole ecosystem of gs,

video producers, editors, and other services has sprung up to support crowdfunding projects. sim

Not every crowdfunding project gets off the ground—Kickstarter reports that only about 40% ulat

of its approximately 207,000 projects thus far have reached their funding goals. Sometimes ions

projects that do get off the ground simply flame out, disappointing their backers. Although , or

this is no different than investing in stocks, Kickstarter has sought to ease concerns by ren improving deri ngs. (continued) T

communication with respect to the risk inherent in the projects posted here

on its site. For instance, it now requires fundraisers to disclose the risks also is lOMoAR cPSD| 58797173 70

C H A P T E R 2 E - c o m m e r c e B u s i n e s s M o d e l s a n d C o n c e p t s

some worry that the lack of privacy involved with donating to are also springing up,

crowdfunding sites has a negative effect on the process. In the art world, with varying degrees

many artists are concerned that they will make enemies within their of success. For

industry if they ignore requests for crowdfunding donations, not to mention instance, SeedInvest is

the possibility of the focus on fundraising corrupting the artistic process. a company that caters

Another common criticism is that those who need Kickstarter the least, to investors who may

such as projects launched by established Hollywood actors and producers, have concerns about

are the ones benefitting the most. Kickstarter counters that a high-profile crowdfunding privacy

project draws attention to the site and helps lesser-known artists in their by offering better own fundraising efforts. privacy controls.

A new use of crowdfunding is to provide seed capital for startup CircleUp is focused on

companies. Under the JOBS Act passed by Congress in 2012, a company consumer products.

will be able to crowdfund up to $1 million over a 12-month period. More AlumniFinder is aimed

than twenty states have also enacted their own rules allowing local at bringing alumni

businesses to raise money via crowdfunding, and more are following suit. together to back

Many expect the use of crowdfunding for this purpose to skyrocket once college entrepreneurs.

federal regulations allowing it are fully implemented. However, some critics Many of these

worry that there will be a steep learning curve and that a period of chaos is fledgling services have

likely to ensue, until all participants (entrepreneurs, investors, failed to gain traction

crowdfunding platforms, and regulators) become familiar with all the as the more prominent

potential benefits and risks of equity crowdfunding. For example, in 2012, sites continue to grow,

a project for a virtual reality video gaming headset known as the Oculus but as crowdfunding

Rift raised nearly $2.5 million. In 2014, Facebook paid $2 billion to acquire becomes more widely

the start-up company that developed the headset. The thousands of backers recognized by the

who supported the project did not benefit from the Facebook purchase in general public, more

any way. In the future, sites that are registered as “funding portals” with specialty sites are

the Securities and Exchange Commission will allow crowdfunding equity likely to find success.

backers who support projects like Oculus Rift to profit when those companies are acquired.

Kickstarter currently has no plans to allow creators to offer equity in Kickstarter projects,

but in the meantime, many companies, such as Indiegogo, Crowdfunder, AngelList, and

StartEngine are laying the groundwork for an expected explosion of activity. Niche companies

SOURCES: “Indiegogo Is Getting Ready for Equity Crowdfunding,” by Harry McCracken, Fast Company, October 2015; “Kickstarter

Basics,” Kickstarter.com, accessed September 15, 2015; “Tired of Waiting for U.S. to Act, States Pass Crowdfunding Laws and Rules,” by Stacy

Cowley, New York Times, June 3, 2015;“Keeping Up With Kickstarter,” by Stephen Heyman, New York Times, January 15, 2015; “Leverage

Video to Cut Through the Crowdfunding Clutter,” by Ben Chodor, Entrepeneur.com, August 13, 2014; “Why Investors are Pouring Millions

into Crowdfunding,” by Katherine Noyes, Fortune, April 17,

2014; “Invest in Next Facebook…For a Few Bucks,” by Patrick M. Sheridan, CNNMoney.com, April 14, 2014; “How You’ll Fund – And Wildly

Profit From – The Next Oculus Rift,” by Ryan Tate, Wired.com, April 4, 2014; “If You Back a Kickstarter Project That Sells for $2 Billion, Do

You Deserve to Get Rich?,” by Adrianne Jeffries, Theverge.com, March 28, 2014; “Crowdfunding Tips for Turning Inspiration into Reality,”

by Kate Murphy, New York Times, January 22, 2014; “World Bank: Crowdfunding Investment Market to Hit $93 Billion by 2025,” by Richard

Swart, PBS.org, December 10, 2013; “SEC Finally Moves on Equity Crowdfunding, Phase 1,” by Chance Barnett, Forbes.com, July 19, 2013;

“SeedInvest Raises $1M to Help Angels Invest Online – Privately,” by Lora Kolodny, Wall Street Journal, June 28, 2013; “The Trouble with

Kickstarter,” by Ellen Gamerman, Wall Street Journal, June 21, 2013; “AngelList Commits to Crowdfunding,” by Lora Kolodny, Wall Street Journal, April 24, 2013. lOMoAR cPSD| 58797173

M a j o r B u s i n e s s - t o - C o n s u m e r ( B 2 C ) B u s i n e s s M o d e l s 71

different business models as they attempt to extend into as many areas of e-commerce as

possible. We look at B2C business models in Section 2.2 and B2B business models in Section 2.3.

A business’s technology platform is sometimes confused with its business model. For

instance, “mobile e-commerce” refers to the use of mobile devices and cellular and wide area

networks to support a variety of business models. Commentators sometimes confuse matters

by referring to mobile e-commerce as a distinct business model, which it is not. All of the basic

business models we discuss below can be implemented on both the traditional Internet/Web

and mobile platforms. Likewise, although they are sometimes referred to as such, social e-

commerce and local e-commerce are not business models in and of themselves, but rather

subsectors of B2C and B2B e-commerce in which different business models can operate.

You will also note that some companies use multiple business models. For instance,

Amazon has multiple business models: it is an e-retailer, content provider, market creator, e-

commerce infrastructure provider, and more. eBay is a market creator in the B2C and C2C e-

commerce sectors, using both the traditional Internet/Web and mobile platforms, as well as

an e-commerce infrastructure provider. Firms often seek out multiple business models as a

way to leverage their brands, infrastructure investments, and assets developed with one

business model into new business models.

Finally, no discussion of e-commerce business models would be complete without

mention of a group of companies whose business model is focused on providing the

infrastructure necessary for e-commerce companies to exist, grow, and prosper. These are the

e-commerce enablers. They provide the hardware, operating system software, networks and

communications technology, applications software, Web design, consulting services, and other

tools required for e-commerce (see Table 2.5 on page 72). While these firms may not be

conducting e-commerce per se (although in many instances, e-commerce in its traditional

sense is in fact one of their sales channels), as a group they have perhaps profited the most

from the development of e-commerce. We discuss many of these players in the following chapters.

2.2 MAJOR BUSINESS-TO-CONSUMER (B2C) BUSINESS MODELS

Business-to-consumer (B2C) e-commerce, in which online businesses seek to reach individual consumers,

is the most well-known and familiar type of e-commerce. Table

2.6 on page 73 illustrates the major business models utilized in the B2C arena. E-TAILER

Online retail stores, often called e-tailers, come in all sizes, from giant Amazon to tiny e-tailer local stores that

have Web sites. E-tailers are similar to the typical bricks-and-mortar online retail store

storefront, except that customers only have to connect to the Internet or use their TABLE 2.5 E-COMMERCE ENABLERS

I N F R A S T R U C T U R EP L AY E R S