Preview text:

Chapter 7: Finance Start up

Profit and loss account (UK) / Income statement (US): statement showing sales, costs, expenses

and profit for an accounting period, e.g. a year.

Balance sheet: statement of the assets owned by a business and how they are financed from

liabilities and shareholders’ funds; a snapshot of the assets at a particular moment.

The articles in the unit focus on recent financial scandals involving well-known companies. The

companies mentioned are Enron, Royal Ahold, WorldCom and Parmalat. Enron

Enron, a Houston-based energy firm founded by Kenneth Lay, transformed itself over a 16-year

period from an obscure gas-pipeline business to the world’s largest - energy trading company.

Encouraged by deregulation, the company turned to electricity to supplement its natural-gas

business. It also tried to buy into the water business. Enron was successful for a long time but

then ran into difficulties. It attempted entry into California’s retail electricity market was problematic. The company’s -

10 year involvement in Dabhol, an Indian power-plant project,

also went badly wrong. In October 2001 Enron’s shares and credit rating plunged. The company

was forced to agree to a merger with Dynegy, a rival firm. But Dynegy backed out in November

because of concerns about Enron’s debt. (It also feared legal action over irregularities in Enron’s

accounting). Enron then filed for bankruptcy. Royal Ahold

Royal Ahold of the Netherlands, the world’s third-biggest food retailer, overstated its profits for

2001-02 by as much as $500m. Its chief executive and chief financial officer both quit. Ahold’s

accounting irregularities mainly involved American subsidiaries that it had bought over a 10-

year period. (Ahold had also bought businesses in other countries, from Argentina to

Scandinavia). But the company’s Amsterdam-based auditors, Deloitte & Touche, failed to pick

the problems up in 2001, even though worries about Ahold’s accounts were widely expressed in

the markets. Ahold’s board, instead of asking questions, extended the term of the chief

executive for up to seven years. The Dutch market regulator admitted that it had no powers of

discipline over faulty auditing. 59 WorldCom

The US telecoms company WorldCom, founded in 1983 by Bernie Ebbers, followed a strategy

of buying up other firms including MCI. WorldCom’s high share price helped it to outbid

competitors attempting to buy MCI and to secure a 37$ billion merger in 1998. Two years later

Mr Ebbers tried to buy Sprint, another American rival, but was blocked by antitrust regulators

on both sides of the Atlantic. With WorldCom’s share price falling, and an investigation by

regulators imminent, Mr Ebbers resigned as chief executive in April 2002. Shortly after, the

discovery of massive fraud in WorldCom’s account shook stockmarkets around the world and

prompted the company to file for bankruptcy protection. Two of its most senior finance officers

were charged with fraud. In May 2003 the company, renamed MCI, settled an investigation into

its accounting for $1.51 billion. The company emerged from bankruptcy in 2003 but its troubles

were not yet over: it faced legal action alleging that the company had unfairly exploited

telecoms regulations against competitors. Parmalat

In December 2003 Parmalat, an Italian food and milk-products company panicked investors by

almost defaulting on a small bond issue. Days later Parmalat’s bankers forced out Calisto Tanzi,

the group’s chairman and chief executive, leaving Enrico Bondi, a hired troubleshooter, in

charge. Mr Bondi quickly discovered a huge and long-running deception that became the

subject of a full-scale legal investigation. Two main allegations have emerged: that the family-

owned group falsified its accounts to conceal losses; and that up to €800m was embezzled,

chiefly by Mr Tanzi. The Italian government passed an emergency law on December 23rd

introducing American-style bankruptcy protection. Although this saved Parmalat, Italy’s image has been damaged. Reading Corporate governance

1. Read the text about corporate governance. What accounting irregularities are mentioned? Who was responsible? Europe’s Enron

The Ahold financial scandal should shock Europe into accounting and corporate governance

reform, just as the Enron scandal did in the USA. 60

It may seem an exaggeration to describe the scandal overwhelming Royal Ahold as Enron= – but in many ways it is true enough. Certainly, the world’s third-biggest food retailer,

after Wal-Mart and Carrefour, presents none of the financial risks of Enron, which was both

deeply in debt and the world’s largest electricity giant. That apart, the similarities between the

former Texan powerhouse and the Dutch retailer are striking, from the very bad corporate

governance, aggressive earnings management and accounting role must be called into question.

Now, at least, Europeans should stop believing that corporate wrong-doing is a US problem that

cannot occur in the old continent. Instead, they should fix their own corporate governance and accounting problems.

On 24 February 2003 Ahold announced the resignation of its chief executive and finance

director after finding that it had overstated its profits by more than 463m ($500m). Its market

value plunged by 63 percent that day, to 3.3bn. in late 2001, it exceeded 30bn. Ahold is now

under investigation by various authorities, including the Securities and Exchange Commission (SEC) in the USA.

Rather like Kenneth Lay at Enron, and Dennis Kozlowski at Tyco, another scandal-hit US firm,

Ahold’s now-departing boss, Cees can de Hoeven, won a huge reputation from turning a dull

company into a growth machine. Investors applauded long after they should have started asking

hard questions. When eventually they did ask them, his anger and pride became quickly

apparent and he refused to answer.

The 463m overstatement is due primarily to Ahold’s US Foodservice unit, which supplies food

to schools, hospitals and restaurants, although there are also issues over its Disco subsidiary in

Argentina and several other units. This has led some observers to say that this is less a European

problem than yet another US accounting failure. Such a claim absolves Ahold’s bosses of

responsibility for their acquisitions and dishonesty and ignores the persistent, firm-wide

tendency to test the limits of acceptable accounting.

Most firms that buy in bulk – including such admired retailers as Wal-Mart and Tesco – get

discounts from suppliers if they meet sales targets. The issue if how those rebates are accounted

for. The accepted practice is to wait until the target are met. Failing firms, such as now-bankrupt

Kmart, food distributor Fleming, and now Ahold parments before they were earned. 61

What of Ahold’s auditor? Although the problems were uncovered, it should have done so much

earlier, says Lynn Turner, a former chief accountant at the SEC.

2. Read the text again and answer the following questions:

a. What are the similarities between Enron and Ahold?

b. What should European companies do?

c. Why did the shareholders admire Cees van der Hoeven?

d. Which of Ahold’s acquisitions is mentioned in the text?

e. What did Europeans believe about corporate wrong-doing in the past?

f. How did Foodservice overstate its sales? Speaking

Do you think CEOs who falsify accounts are criminals and should go to jail or is it an

acceptable risk to falsify accounts if it helps to safeguard the company’s future and jobs? Vocabulary

Choose the best word to fill each gap in the sentences below. 1. Sales are a good way for to get rid of surplus stock. a. retailers b. sellers c. dealers d. wholesalers

2. The company was in fact seriously

even though they claimed to be making a profit. a. at a loss b. in debt c. in the black d. broken 3. Some companies

their earnings to drive up share prices. a. overdo b. overflow c. overstate d. oversee

4. The Financial Services Authority was set up in the UK to deal with such as fraud and insider trading. a. issues b. ideas c. reasons d. purposes

5. When the CEO should have been cost cutting, he has spending huge sums on

that turned out to be unprofitable. a. increases b. investors c. growth d. acquisitions

6. When you buy in bulk you can obtain or rebates. a. discounts b. sales c. decreases d. interest

7. Shareholders lost money when the company declared itself . a. redundant b. sold out c. broken down d. bankrupt 62

8. When they heard about our financial difficulties our asked to be paid in advance. a. service b. deliveries c. suppliers d. orders

9. They did not lie – they simply tried to the truth. a. conceal b. prevent c. reduce d. warn Speaking Business know-how

1. Work in pairs. Discuss the questions.

Do you sometimes have trouble starting your work?

Do you get distracted easily from your work?

Do you often feel tired when you are working?

How to concentrate?

• Trouble getting started? Do a routine task at your desk for five minutes. You’ve started!

• Not sure what to do first? Make a daily and a weekly schedule.

• Stopped concentrating? After 50 minutes on one task, change task.

• Nervous? Avoid too much coffee and tea.

• Tired and weak? Have healthy snacks – they help maintain your blood sugar.

• Interruptions? Turn off your phone. Don’t answer emails every five minutes.

• Lost inspiration? Oxygenate your brain by doing some exercise.

2. Read the tips with your partner. Which ones are useful? Add two more tips.

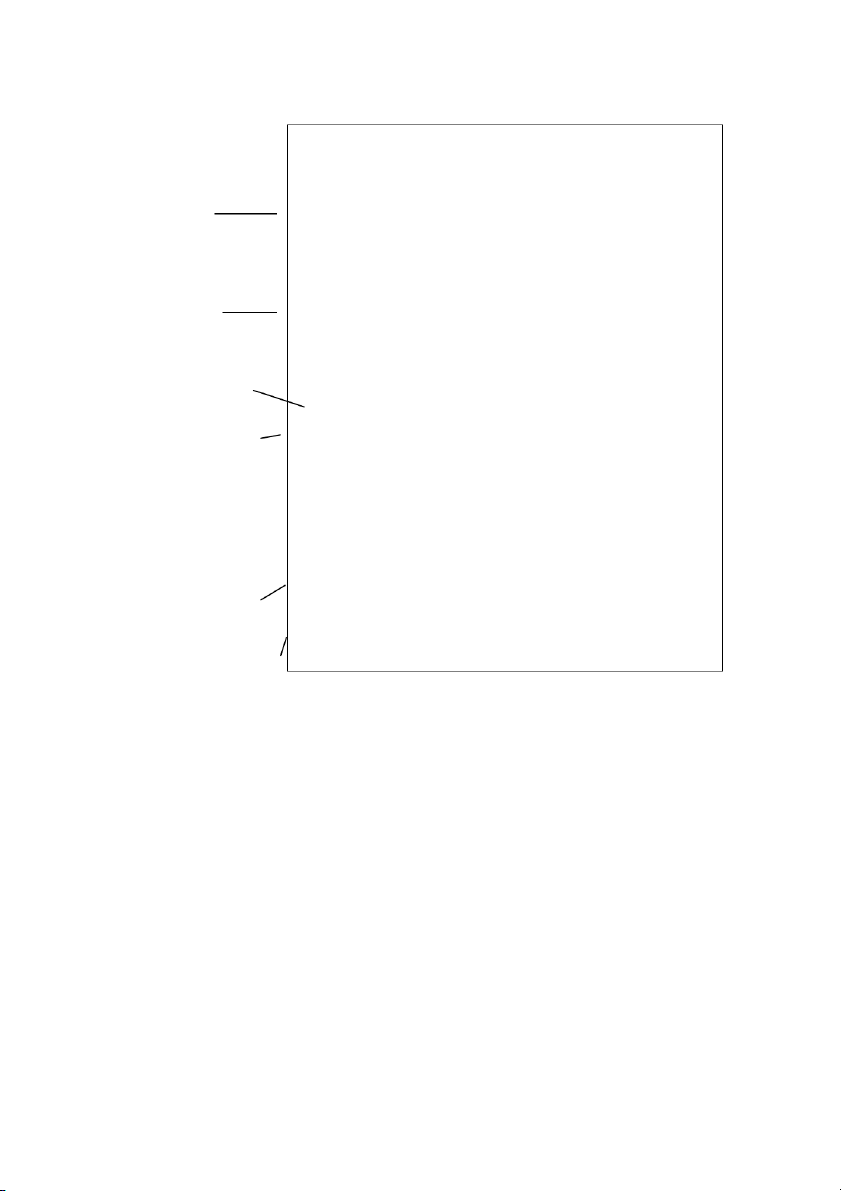

The Profit and Loss Account (P&L)

Study the incomplete P&L below. Complete the document with the following headings. Use a

dictionary to help you.

Research and development costs Cost of materials Gross profit Interest receivable Turnover Dividend 63

Consolidated Profit and Loss

For the year ended Dec 31 in $m Forecast Actual Money in

1 ............................. (sales revenue) 700 704 Other earnings

Gains on fixed assets and operations 250 244

2 .............................. on investments 175 162 Money out Costs of making goods

3 ....................................... and all (100) a......... manufacturing expenses Money in minus cost b of making goods

Salaries and personnel costs (200) .........

4 ................................. 825 c......... Other money out

Other costs and expenses

Indirect costs or overheads (25) (22) 5 d

......................................... (50) .........

Loss on fixed assets (25) (25)

Loss on foreign operations (100) (88)

Marketing and distribution costs (100) e......... Gross profit minus

Trading/Operating Profit 525 f......... other money out

Profit for shareholders (6..........................) 95 g.......... f Money left when

Retained profit 430 .......... shareholders have been paid

1. Read a presentation of the actual results and complete the missing figures for gaps a-h.

We are very happy to announce that we achieved our sales forecasts of $700m last year. What’s

more, the cheaper costs of outsourcing to Indonesia for many of our parts was even more cost-

effective than we’d hoped – reducing our manufacturing expenses by $30m – down to $70m.

Outsourcing in Indonesia also generated significant savings of $10m in salaries. Therefore,

gross profit is up at $840m. This is a trend we hope will continue into the next quarter and many more to come. 64

On the other hand, trading or operating profit fell slightly – but there are clear reasons for this

and we are confident that the next quarter will show a considerable upturn. Once again, research

and development costs were higher than expected – up from $50m to $75m. We have now

stabilised that budget and don’t expect any increases over the next quarters.

The marketing costs of our global campaigns for three major new products also exceeded the

budget and we did in fact need $123m. But we are very pleased with projected sales figures for

the products in question and marketing costs will fall drastically over the next quarters, where

we will see a very healthy return on that investment. However, the immediate impact is a slight

dip in trading profit to $517m.

We are, however, paying the dividend we promised to shareholders of $95m – which works out

at 50 cents a share. This leaves us with a retained profit of $422m. This figure will increase

considerably over the next quarters.

2. Read the presentation again and answer the following questions:

a. Why was gross profit higher than expected?

b. Where did the company decide to have parts made?

c. Which budgets went over the forecast limits?

d. What is expected to happen to the marketing budget in future?

e. How much will shareholders receive per share?

f. What prediction does the speaker make about retained profit? Speaking

If you were a potential shareholder, would you feel confident in investing in this company? Why? Why not? Sales results

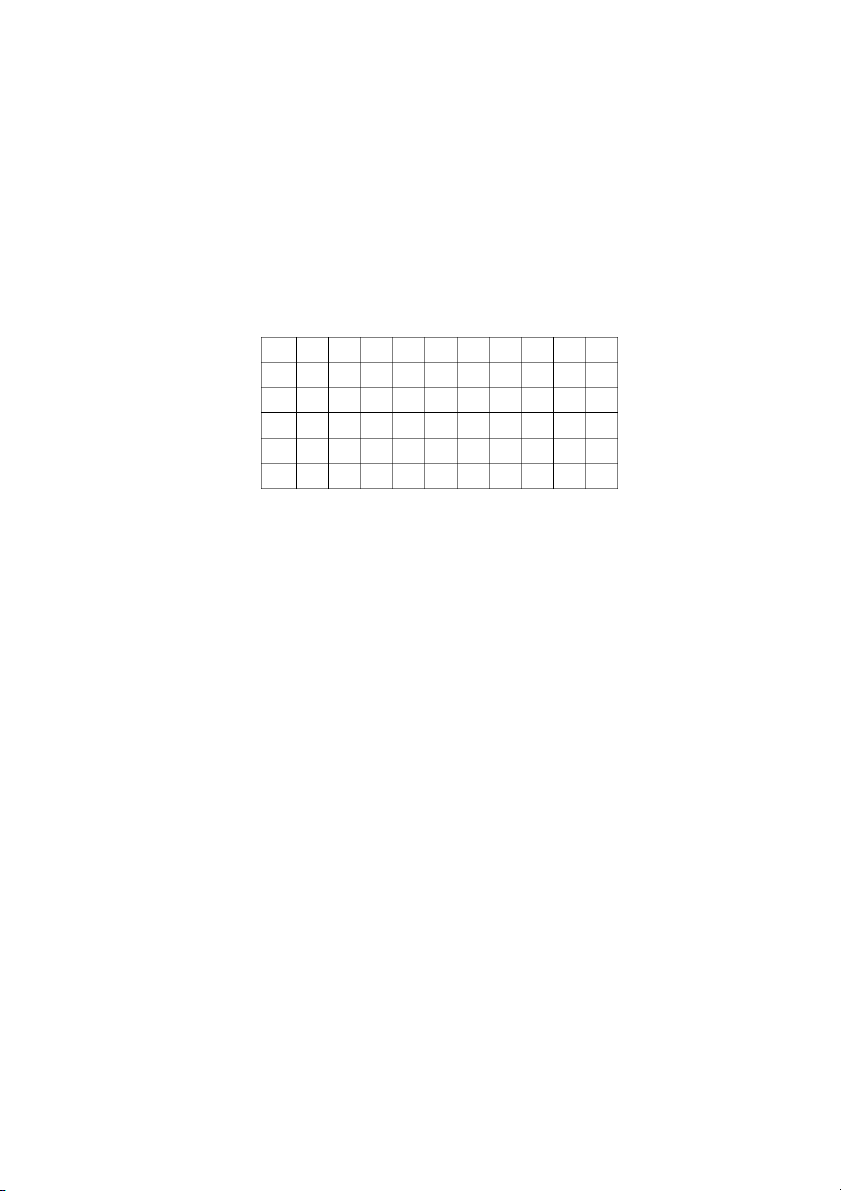

1. Choose the correct words in italics to complete this report. Sales analysis

Sales began the year at 30,000 units in January and increased 1slight / slightly to 32,000 units in

February. There was a 2sharp / sharply rise 3to / by 38,000 in March 4due / led to the

introduction of a new price discounting program. This was followed by a 5slight / slightly fall in

April when sales dropped to 36,000 units. 65

Our competitors launched a rival product in the spring and this resulted 6in / from a 7dramatic /

dramatically fall to 25,000 in May. But we ran a summer advertising campaign and sales

increased 8steady / steadily 9to / by 2,000 units a month throughout June, July, and August until

they stood 10in / at 38,000 in September.

The 11dramatic / dramatically rise to 45,000 in October resulted 12in / from the launch of our

new autumn range. But then we experienced problems meeting demand and sales fell 13sharp /

sharply in November and remained 14steady / steadily at / by 39,000 in December.

2. Use the information in the report to complete this graph. 50,000 45,000 40,000 35,000 30,000 25,000 20,000 J F M A M J J A S O N D Business know-how

1. Work in pairs. Discuss these questions.

How does your behaviour change when you are angry?

What are the advantages and disadvantages of showing you are angry or hiding your anger?

2. Read these strategies for managing anger. Which are new to you? Which seem most useful?

Dealing with your anger

• Breathe deeply – it helps you stay calm.

• Delay talking until your anger is under control. Say • Keep your voice quiet and calm.

• Take time to think before you speak.

• Listen and say • Avoid making personal comments or using bad language. 66 Writing Memos 1. First decide who you are.

2. Every time you start to write, you need to ask yourself two questions:

a. What is the purpose of this piece of writing? b. Who am I writing to? 3. Structure of a memo: Date / To / From / Subject Introduction Main points Conclusion and recommendation Initials of the writer

4. What style should the memo be written in?

5. What phrases might be appropriate in your memo?

6. Now go ahead and write the memo.

7. When you have finished, check your writing for: logical structure, clarity of ideas,

accuracy of language, appropriateness of style. Example of a memo. Date: 01 February 2014 To: Elvis Presley

From: Michael Xavier, Advisory Team

Subject: Recommendations on strategic direction

The Advisory Team have been asked to summarise our proposals regarding a change of

strategic direction for Harley Davidson (HD).

It is clear that HD’s traditional market is declining as its customers grow older (average age of

customer: 46) and that action needs to be taken to attract additional buyers. It is also clear that

HD’s profit are over-reliant on the US market. However, any fundamental change of direction

risks offending HD’s traditional client base. We therefore believe that HD needs to launch a

product aimed at a slightly broader target market, offering significant new benefits while

remaining true to its core values. Any fundamental shifts of direction must be under a different

brand name; Buell is the obvious choice. 67

Discussion has also covered areas such as acquisition, distribution and merchandising. We feel,

however, that we first need to focus on product development. When we are confident that we

have identified the right products to sell to the right people, we can shift our attention to

complementary areas. Nevertheless, it would be wise to identify one market outside the US as a target for high volume sales.

We consider the following to be priority actions:

1. Launch a new Harley Davidson motorcycle to appeal to customers aged 30+. The

motorcycle should attract existing customers and slightly younger customers who

appreciate HD’s traditional values. The key feature of this new product will be increased speed.

2. Launch a new Buell motorcycle aimed at customers aged 20+. The motorcycle’s key

features will be speed, flexibility and style. Buell motorcycle should continue to retain a

completely separate identity from HD. However, increased marketing effort needs to be

devoted to Buell to increase sales significantly.

3. Focus on one market outside the USA as a location for high sales of HD / Buell

products. The most appropriate market needs to be determined as a matter of urgency. Dilemma Counting the costs Brief

MultiBrands is a globally successful consumer products company, which has built up a

reputation based on it has launched at least two new, high-quality products in different markets every year.

However, managers are currently reviewing company policy because of a recent dramatic fall in

profits and share price performance. Shareholders believe that this is due to over-diversification,

rising costs and failing consumer confidence as a result of complaints that product quality is

declining. Shareholder recommendations are:

1. Freeze current policy of developing new products.

2. Concentrate on consolidating current successful brands.

3. Improve quality or reduce prices.

4. Freeze recruitment but avoid layoffs.

5. Reduce current budget by 15 percent. 68 Task

Work in groups. Study the information below and discuss where budget cuts and reallocations

could be made in order to achieve a 15 percent reduction in total operating costs. Consider all

the above shareholder recommendations before making a final decision. 1. Human resources costs

• External recruitment fees: €400,000

• Performance-related bonuses: €400,000 • Salaries: €3.2m 2. Production operating costs Costs Previous year (€m) Last year (€m) High-quality local materials 1.7 1.2

Low-quality imported materials 0.6 0.9 Running costs 0.6 0.9 3. Sales and marketing costs

• Advertising for new products: €600,000

• Advertising for existing products: €150,000

• Independent market research: €250,000 69