Preview text:

Kế toán quản trị Chap 2: Job-order costing

Process costing: Xac dinh chi phi theo qua trinh

Job-order costing: Xac dinh chi phi theo don dat hang

Pohr (Predetermined Overhead Rate): Ti le phan bo uoc tinh – Ve nha tim cach tinh

Accumulate: Direct Material, Direct Labor, Manufacturing Overhead Assign

Trace (Direct Material and Direct Labor to each Job)

Allocate (Manufacturing Overhead) 1 bread = 20k 1 drink = 10k Shipping fee = 15k Total 45k Cost object: bread Direct cost: 20k

Indirect cost: 7.5k / 10k (ca hai truong hop deu dung’)

Actual costs: La chi phi da phat sinh va chi co the xac dinh vao cuoi ky`

Budgeted (Estimated) costs: Chua thuc te xay ra va chi mang tinh du doan, xac dinh vao dau` ky` How to allocate MOH

Using POHR (ti le phan bo uoc tinh) ( da nhac o tren)

Cost driver: the factor causes the cost (yeu to phat sinh chi phi)

E.g.: Shipping fee tinh theo quang duong, cost driver chinh la distance Allocation base: Co so phan bo Total estimated MOH

Cong thuc phan bo: POHR = Totalestimated allocationbase

Over-applied: applied > actual

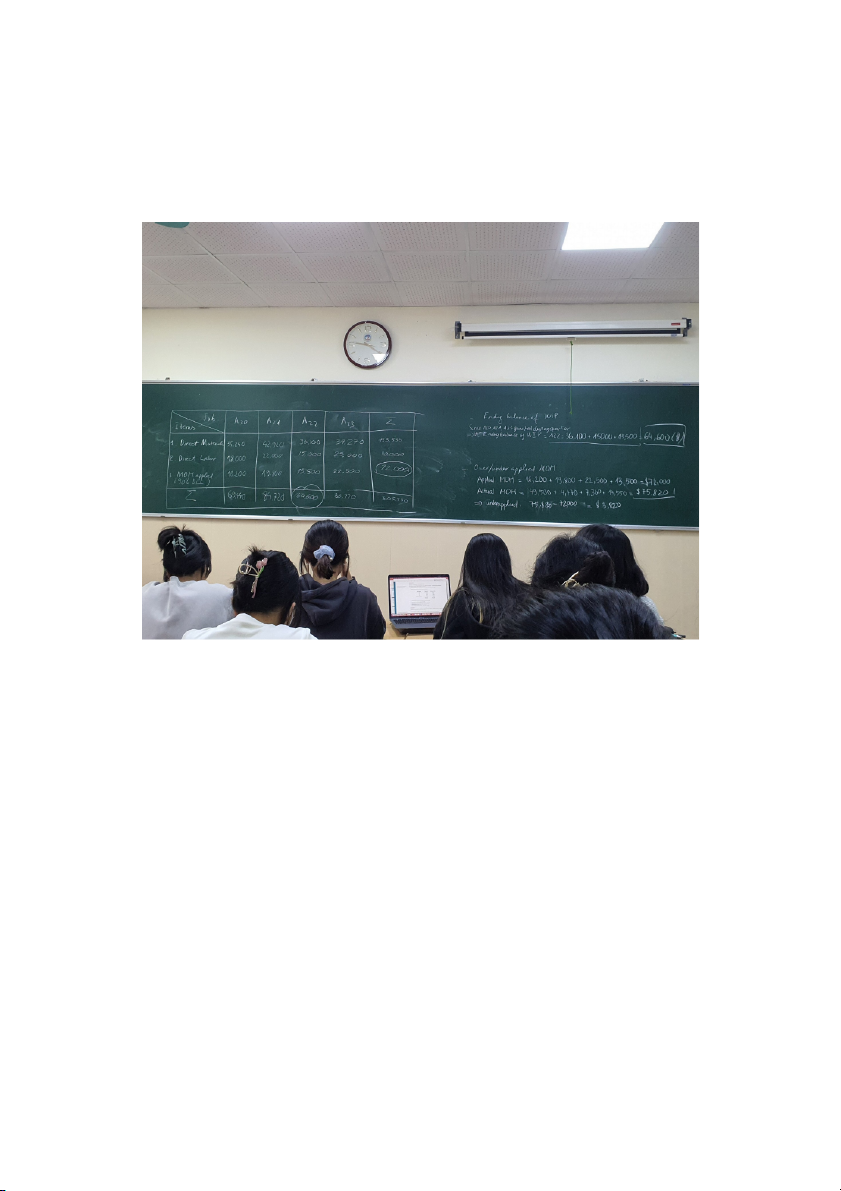

Under-applied: applied < actual BE 2.6 (tr89)

Overhead rate per direct labor cost = $900000 / $500000 = 180%

Overhead rate per direct labor hour = $900000 / 50000 = $18/h

Overhead rate per machine hour = $900000 / 100000 = $9/h

MOH applied = Actual Direct Labor cost * POHR E2.3

Balance = DL + DM + MOH = 5000+6000+4200 = 15200 a.1. WIP 5000+6000+4200 8000 44800 12000 9600 0 2. MOH 4,200 POHR nam ngoai: = =0.7 DL 6,000 MOH 6,400+3,200 POHR nam nay: = =0.8 DL 8,000+4,000 E2.5 a. 300,000

the manufacturing overhead rate for the year: POHR = =2.4 125,000 b.

applied MOH = 2.4 * 130,000 = 312,000

Underapplied 322,000 – 312,000 = 10,000