Preview text:

lOMoARcPSD|364 906 32 CORPORATE FINANCE

Chapter 11: RETURN AND RISK: THE CAPITAL ASSET PRICING MODEL (CAPM) I.

Individual Securities: -

The characteristics of individual securities that are of interest are the: ● Expected Return

● Variance and Standard Deviation

● Covariance and Correlation (to another security or index)

II. Expected return, variance and covariance: -

Expected return: E(R) = ∑(pi x Ri) -

Variance: V ar(δ )2 = ∑pi(Ri − E(Ri))2 -

Standard deviation: SD(δ) = √δ2 -

Covariance: Covar(a, )b = ∑pi[RiA − E(RA)] [RiB − E(RB)] -

Correlation: p = covδa (x δa,bb) (− 1≤p≤1) III. The Return and Risk for Portfolios:

E(RP ) = ∑[W xi E(Ri)] (W i : % investment in a certain asset) -

Standard Deviation of a portfolio of 2 assets: √ 2 2 2

δ 2 = √W σ W σ A A + 2 B B +2 δ = W WA B Aρ ,B

Where: pi : probability of state of economy (recession, normal, boom)

Ri : rate of return at each stage of economy (recession, normal, boom)

E(R) : expected return of an assets -

W A : % investment in asset A -

W B : % investment in asset B - ρA,B

: return correlation between A and B lOMoARcPSD|364 906 32 -

By creating a portfolio, risk is much reduced. To minimize risk, should choose

asssets with negative correlation. IV.

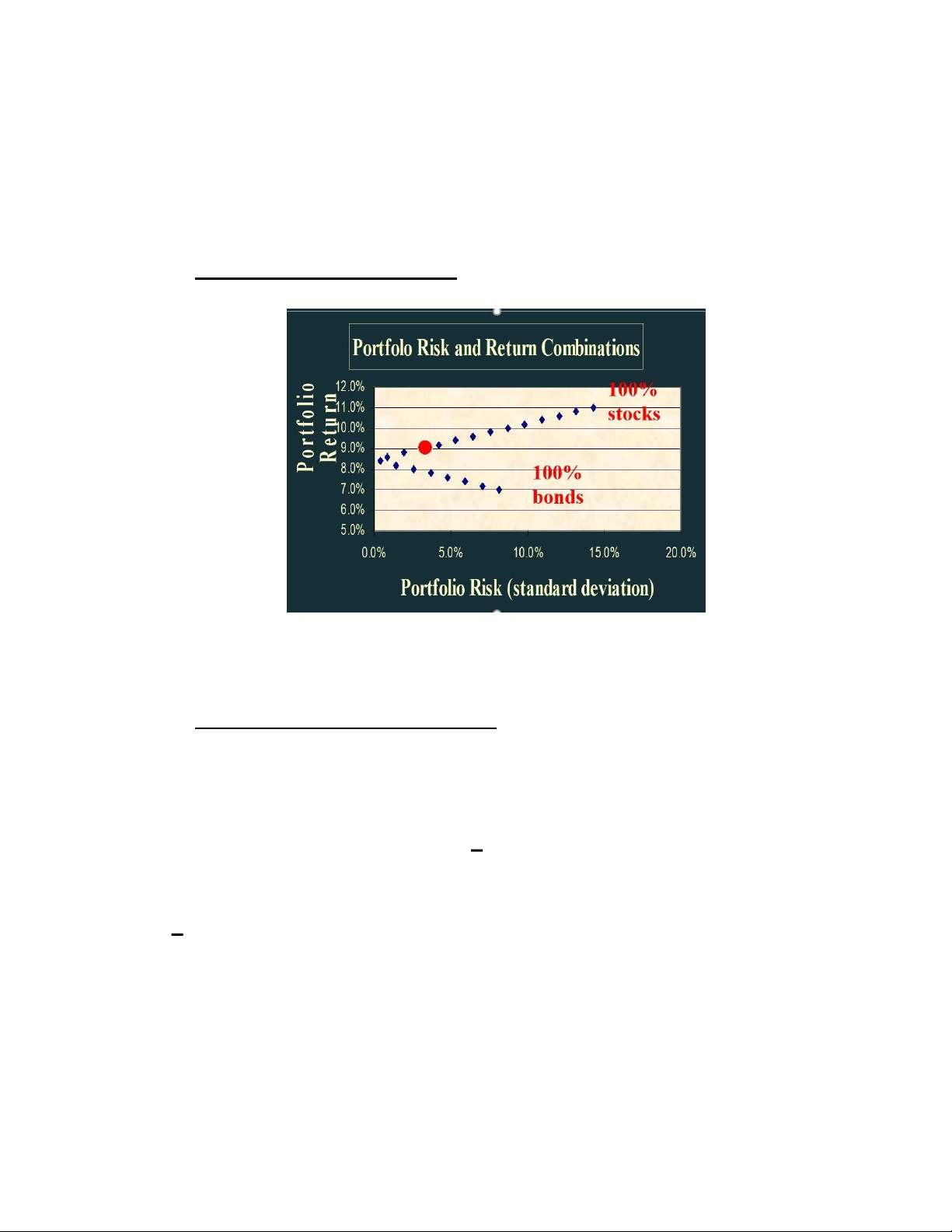

The Efficient Set for Two Assets:

- The same return → lower risk. - The same risk → higher return. V.

The Efficient Set for Many Securities: -

The return on any security consists of two

parts. ● First, the expected returns

● Second, the unexpected or risky returns -

A way to write the return on a stock in the coming month is:

R = R + U Where

R: the expected part of the return

U : the unexpected part of the return

- Any announcement can be broken down into two parts, the anticipated (or

expected) part and the surprise (or innovation):

Announcement = Expected part + Surprise.

- The expected part of any announcement is the part of the information the market

uses to form the expectation, R, of the return on the stock. lOMoARcPSD|364 906 32

- The surprise is the news that influences the unanticipated return on the stock, U. VI.

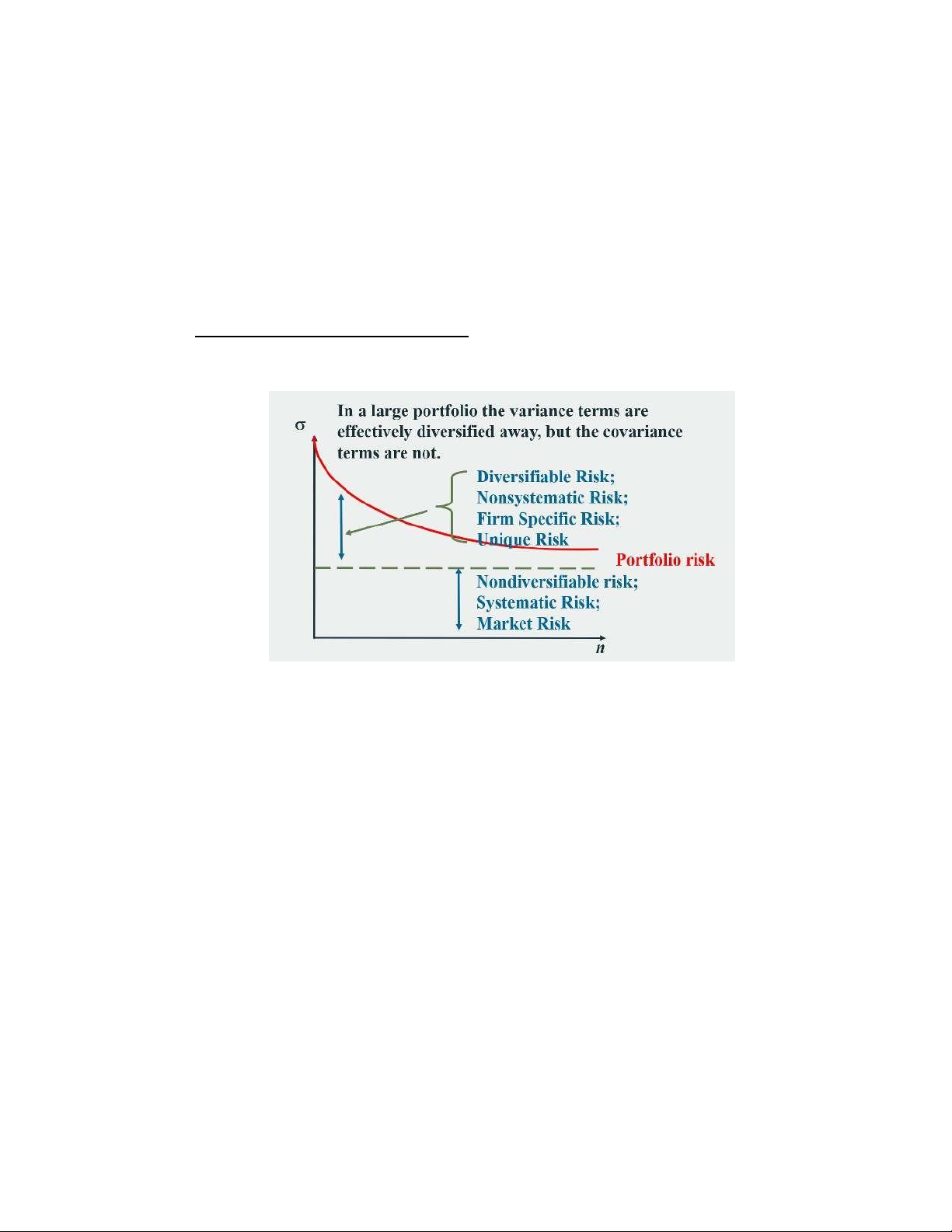

Diversification and Portfolio Risk:

- Portfolio Risk and Number of Stocks: Where: n: number of shares

- Total risk = systematic risk + unsystematic risk - A systematic risk

is any risk that affects a large number of assets, each to a greater or lesser degree.

- An unsystematic risk is a risk that specifically affects a single asset or small group of assets.

- Unsystematic risk can be diversified away.

- Examples of systematic risk include uncertainty about general economic

conditions, such as GNP, interest rates or inflation.

- On the other hand, announcements specific to a single company are examples of unsystematic risk.

- The standard deviation of returns is a measure of total risk.

- For well-diversified portfolios, unsystematic risk is very small. lOMoARcPSD|364 906 32

- Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk.

- Risk free assets (T-bill): Rf; Standard deviation = 0 - Risky assets (Bond Fund / Stock Fund) VII.

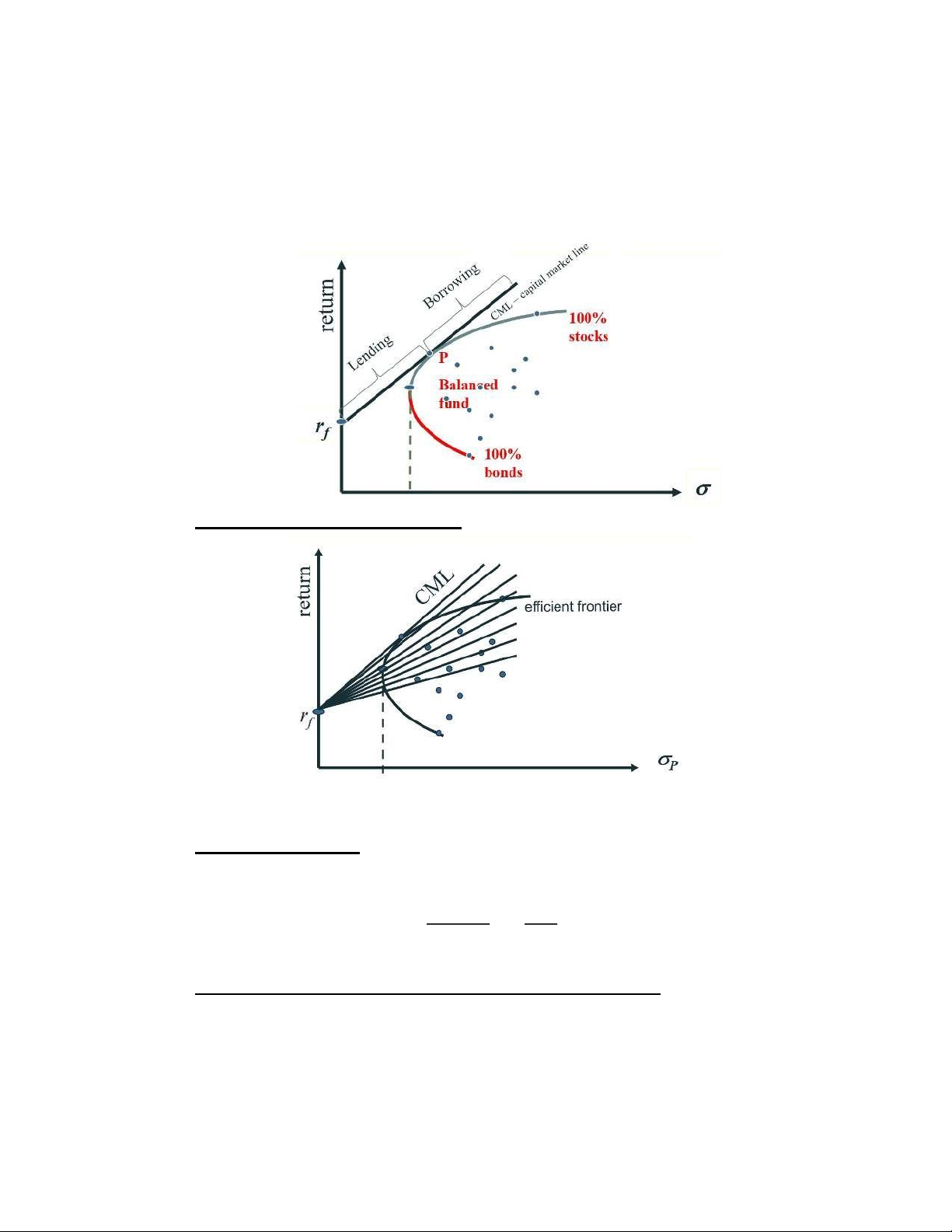

Riskless Borrowing and Lending:

- With a risk-free asset available and the efficient frontier identified, we choose the

capital allocation line with the steepest slope.

VIII. Market equilibrium:

- Beta measures the responsiveness of a security to movements in the market

portfolio (i.e., systematic risk).

βi = covδ ( (2 RRiM,R)M) = p δ(δ(RRMi)) IX.

Relationship between Risk and Expected Return (CAPM):

- Expected Return on the Market: RM = Rf + Market risk premium (MRP) -

Expected return on an individual security (CAPM):

Ri = Rf + βi x (RM – Rf ) lOMoARcPSD|364 906 32

RM - Rf is market risk premium.

- Assume β i = 0, then the expected return is R F. - Assume β i = 1, then R i = R M

Document Outline

- CORPORATE FINANCE