Preview text:

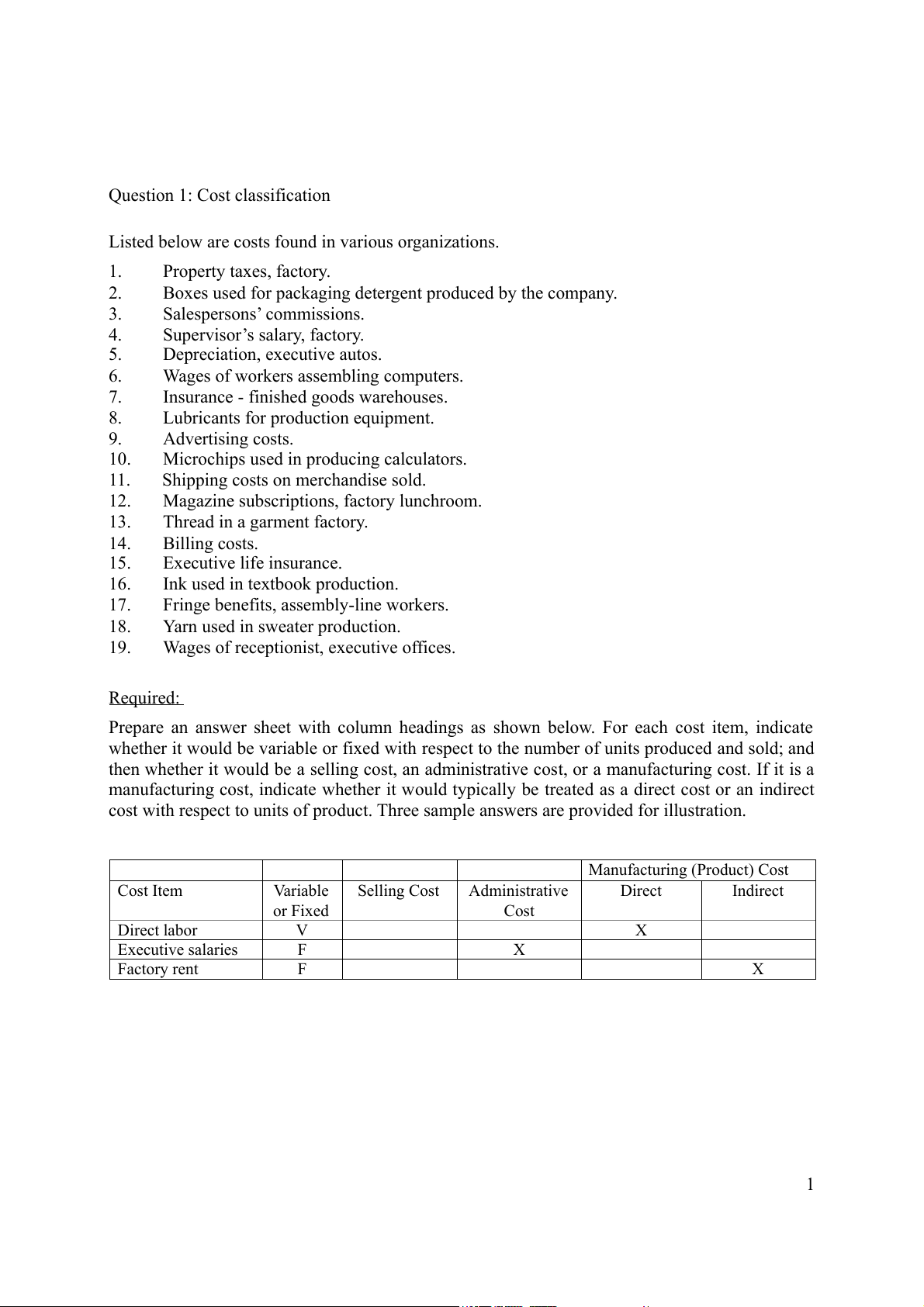

Question 1: Cost classification

Listed below are costs found in various organizations. 1. Property taxes, factory. 2.

Boxes used for packaging detergent produced by the company. 3. Salespersons’ commissions. 4.

Supervisor’s salary, factory. 5. Depreciation, executive autos. 6.

Wages of workers assembling computers. 7.

Insurance - finished goods warehouses. 8.

Lubricants for production equipment. 9. Advertising costs. 10.

Microchips used in producing calculators. 11.

Shipping costs on merchandise sold. 12.

Magazine subscriptions, factory lunchroom. 13. Thread in a garment factory. 14. Billing costs. 15. Executive life insurance. 16.

Ink used in textbook production. 17.

Fringe benefits, assembly-line workers. 18.

Yarn used in sweater production. 19.

Wages of receptionist, executive offices. Required:

Prepare an answer sheet with column headings as shown below. For each cost item, indicate

whether it would be variable or fixed with respect to the number of units produced and sold; and

then whether it would be a selling cost, an administrative cost, or a manufacturing cost. If it is a

manufacturing cost, indicate whether it would typically be treated as a direct cost or an indirect

cost with respect to units of product. Three sample answers are provided for illustration. Manufacturing (Product) Cost Cost Item Variable Selling Cost Administrative Direct Indirect or Fixed Cost Direct labor V X Executive salaries F X Factory rent F X 1

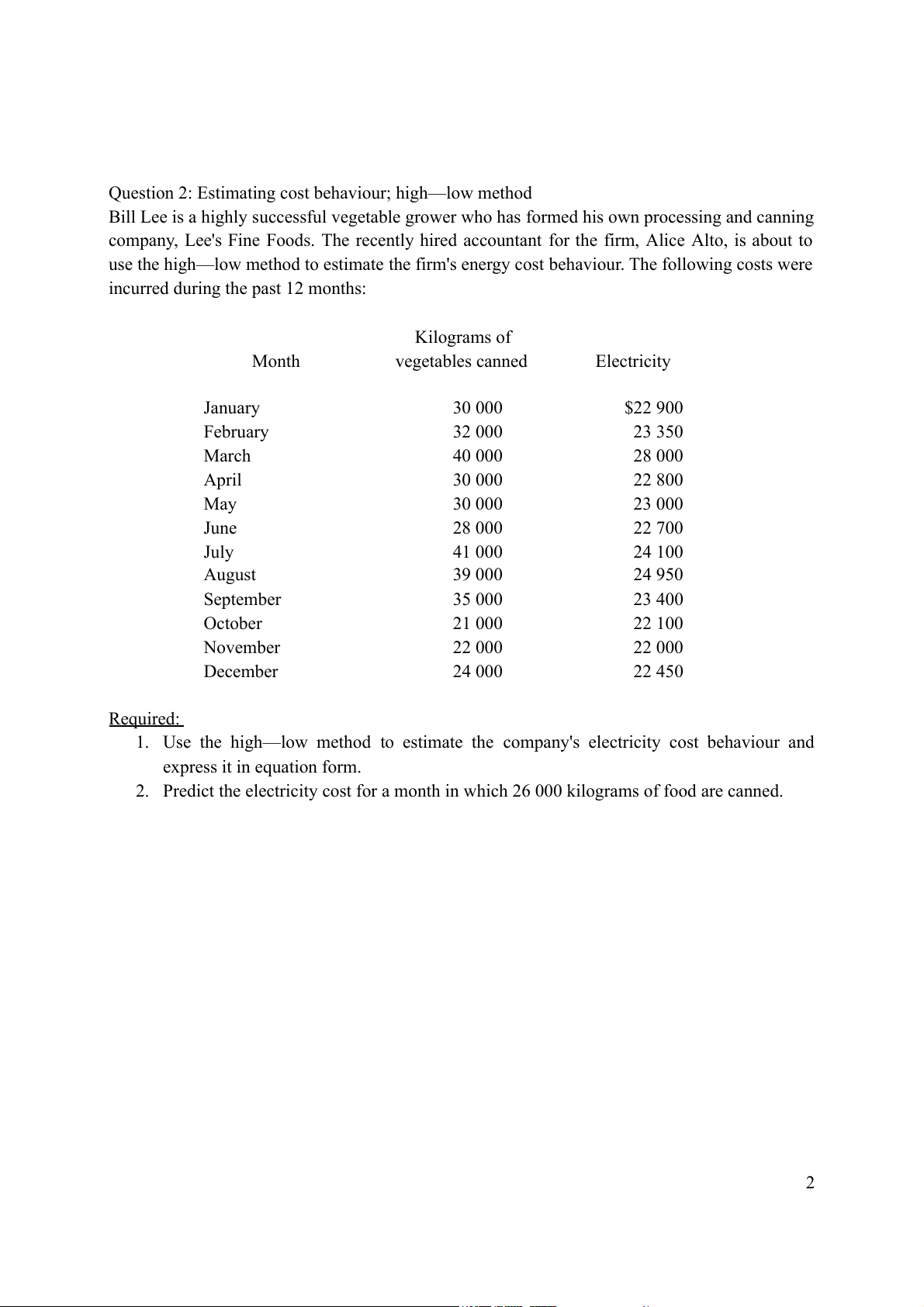

Question 2: Estimating cost behaviour; high—low method

Bill Lee is a highly successful vegetable grower who has formed his own processing and canning

company, Lee's Fine Foods. The recently hired accountant for the firm, Alice Alto, is about to

use the high—low method to estimate the firm's energy cost behaviour. The following costs were

incurred during the past 12 months: Kilograms of Month vegetables canned Electricity January 30 000 $22 900 February 32 000 23 350 March 40 000 28 000 April 30 000 22 800 May 30 000 23 000 June 28 000 22 700 July 41 000 24 100 August 39 000 24 950 September 35 000 23 400 October 21 000 22 100 November 22 000 22 000 December 24 000 22 450 Required:

1. Use the high—low method to estimate the company's electricity cost behaviour and express it in equation form.

2. Predict the electricity cost for a month in which 26 000 kilograms of food are canned. 2

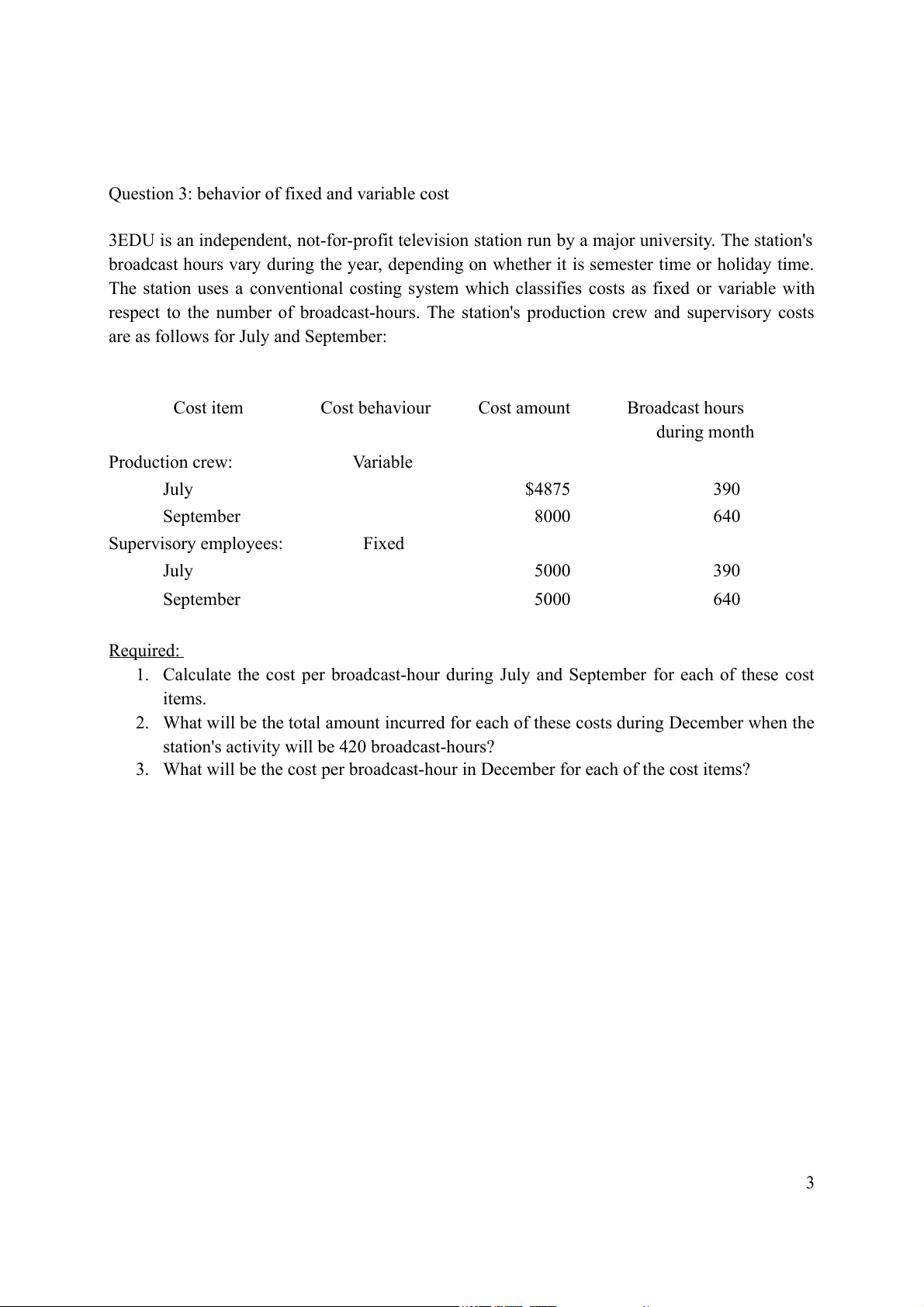

Question 3: behavior of fixed and variable cost

3EDU is an independent, not-for-profit television station run by a major university. The station's

broadcast hours vary during the year, depending on whether it is semester time or holiday time.

The station uses a conventional costing system which classifies costs as fixed or variable with

respect to the number of broadcast-hours. The station's production crew and supervisory costs

are as follows for July and September: Cost item Cost behaviour Cost amount Broadcast hours during month Production crew: Variable July $4875 390 September 8000 640 Supervisory employees: Fixed July 5000 390 September 5000 640 Required:

1. Calculate the cost per broadcast-hour during July and September for each of these cost items.

2. What will be the total amount incurred for each of these costs during December when the

station's activity will be 420 broadcast-hours?

3. What will be the cost per broadcast-hour in December for each of the cost items? 3