Preview text:

1

National Economics University …...0O0…… NEU BUSINESS SCHOOL Final Assignment Microeconomics December 3th , 2024

OVERVIEW OF THE ELECTRONIC COMMERCE MARKET

AND ROLES OF THE GOVERNMENT IN REGULATION AND ANTITRUST POLICY WORK

● COMPLETED BY TEAM 7:

- Phùng Hà Diệp Anh - 11245337

- Phạm Ngọc Quỳnh Anh - 11245336 - Hoàng Hà Vi - 11245491 - Tô Thành Long - 11245422

- Trương Gia Phúc Lâm - 11245396 CATALOGUE

INTRODUCTION................................…………………………………………… 4

Reasons.................................................. 4

………………………………………

Overview.............................…………………………………………………….4

MARKET CLASSIFICATION.................. 5

……………………………………

Number of firms..................................………………………………………… 6

Nature of products...............................…………………………………………7

Barriers to Entry……………………………………………………………….7

Advertising and Differentiation..........................................................................9

Information Asymmetry......................................................................................9

Conclusion.............................................................................................................9

FACTORS AFFECTING DEMAND AND SUPPLY OF THE

TECHNOLOGICAL RIDE-HAILING MARKET IN VIETNAM.......................10

Overview...............................................................................................................10

Factors affecting the demand for e-commerce market in Viet Nam...............10

Consumer's income.....................................................................................10

Price of related goods..................................................................................11

Consumer tastes...........................................................................................11

Expectations................................... ……………………………………….12

Factors affecting the supply of market in Viet Nam......................................13

Technology..................................... ………………………………………..13

Input price......................................................................................................13

Expectations...................................................................................................14

Number of firms.............................................................................................15 2

Conclusion......................................................................................................16

GOVERNMENT ROLES IN REGULATION AND ANTI-MONOPOLY

WORK……………………………………………………………………………..18

MARKET EFFICIENCY....................................................................................18

Externalities...................................................................................................18

Positive externalities.......................................................................................19

Monopoly power............................................................................................19

THE GOVERNMENT'S SOLUTION............................................................20

Negative externalities..................................................................................20

Monopoly power.......................................................................................... 21

PREDICTIONS OF THE TECHNOLOGICAL E-COMMERCE

MARKET...................................................................................................................21

EPILOGUE................................................................................................................25

REFERENCES...........................................................................................................26 INTRODUCTION 3 Reasons

Vietnam's economic landscape is undergoing a rapid transformation, with digital

technologies reshaping various sectors. Among these, the e-commerce industry stands

out as a cornerstone of the digital economy, fueled by rising Internet penetration,

widespread smartphone adoption, and an increasingly tech-savvy population. As of

2023, Vietnam boasts over 77 million Internet users, with more than 70% of the

population actively engaging in online shopping. Platforms like Shopee, Lazada,

Tiki, and Sendo have become household names, offering a diverse range of goods

from groceries to high-end electronics.

The remarkable growth of these platforms reflects a broader shift in consumer

behavior, as convenience, competitive pricing, and seamless digital transactions

become essential. E-commerce platforms have not only bridged the gap between

urban and rural consumers but also enabled small and medium-sized enterprises

(SMEs) to access broader markets without significant infrastructure investments. This

transformation has positioned e-commerce as a vital driver of Vietnam's economic modernization.

Given the industry's central role in Vietnam's economy, understanding its market

structure provides valuable insights into competition dynamics, efficiency, and growth

potential. This essay explores whether Vietnam's e-commerce industry operates closer

to a pure competition model, characterized by numerous small sellers and

consumers, or leans toward monopoly-like dominance, often associated with a few

powerful players controlling significant market share. By doing so, we aim to shed

light on the competitive dynamics of the sector and its implications for consumers, sellers, and policymakers. Overview

E-commerce involves the buying and selling of goods and services through digital

platforms, typically facilitated by Internet-based transactions. In Vietnam, this sector

has flourished in tandem with the country's rapid digitization. Platforms such as

Shopee, Lazada Tiki ,

, and Sendo lead the market, each offering unique features to

attract both sellers and buyers. For instance, Shopee emphasizes flash sales and

gamification, Lazada invests in logistics and livestream shopping, Tiki prioritizes fast

delivery through its TikiNow service, and Sendo appeals to rural users with localized

strategies and affordable pricing.

The rise of e-commerce in Vietnam can be attributed to several key factors:

1. Technological Advancement: Improved Internet infrastructure and

widespread smartphone use have made online shopping accessible to the masses.

2. Government Support: Policies encouraging digital transformation, such as the

"National Digital Transformation Program by 2025," have created a favorable

environment for e-commerce growth. 4

3. Consumer Behavior: A young, urbanized population prefers the convenience

of online shopping, especially during the COVID-19 pandemic, which accelerated digital adoption.

4. Competitive Strategies: E-commerce platforms invest heavily in logistics,

technology, and marketing to capture market share, leading to innovation and improved user experiences.

Despite these advancements, challenges persist, such as high logistics costs,

counterfeit goods, and intense competition among platforms. These factors influence

the industry's supply and demand dynamics, shaping its current and future trajectory.

This assignment will analyze how these elements interact to define the market

structure of Vietnam's e-commerce sector and explore the main factors that have

influenced supply and demand in recent years. By doing so, we aim to provide a

comprehensive understanding of the industry's growth, competitive landscape, and broader economic impact. MARKET CLASSIFICATION

The Vietnamese e-commerce market has undergone a remarkable transformation over

the past two decades, evolving from a nascent industry with limited players to a highly

competitive and concentrated sector. To determine the market classification, we will

evaluate the following criteria: number of firms, nature of products, barriers to 5

entry, market power, advertising and differentiation, and information asymmetry. Number of Firms

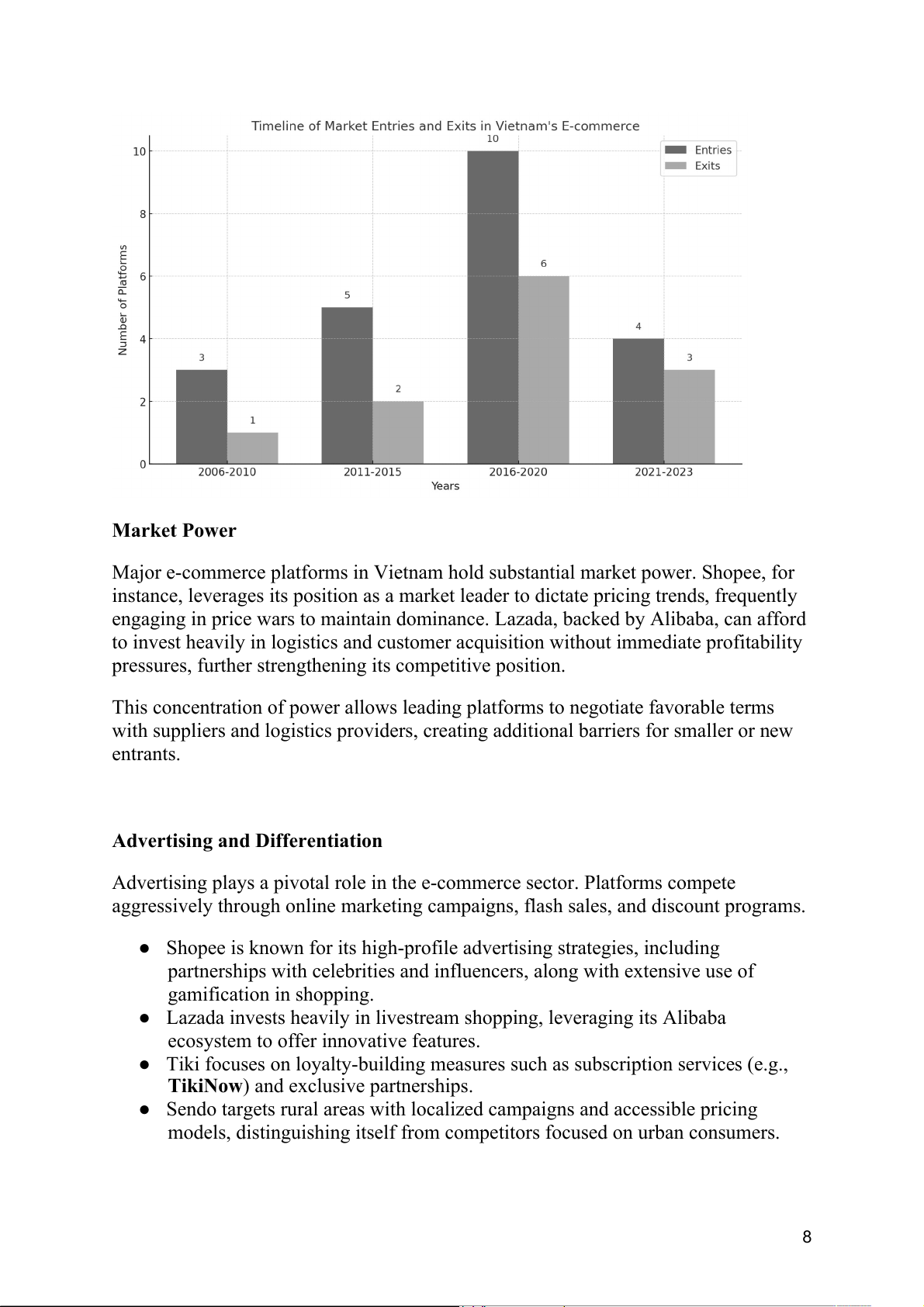

The e-commerce market in Vietnam began to take shape in the early 2000s with

platforms like Chodientu (2006), the country’s first C2C (consumer-to-consumer)

marketplace, inspired by eBay’s model. Over time, other players entered, including

Vatgia (2007) and 123Mua (2009), but many of these early platforms struggled with

low Internet penetration and limited digital payment options.

The real boom came in the 2010s with the arrival of global and regional giants like

Lazada (2012) and Tiki (2010, initially focused on books). By 2015, the market

welcomed Shopee, backed by Sea Group, which quickly became a dominant force

thanks to its aggressive promotional strategies. Local competitors such as Sendo

(founded in 2012 under FPT Corporation) also emerged to cater to specific Vietnamese market needs.

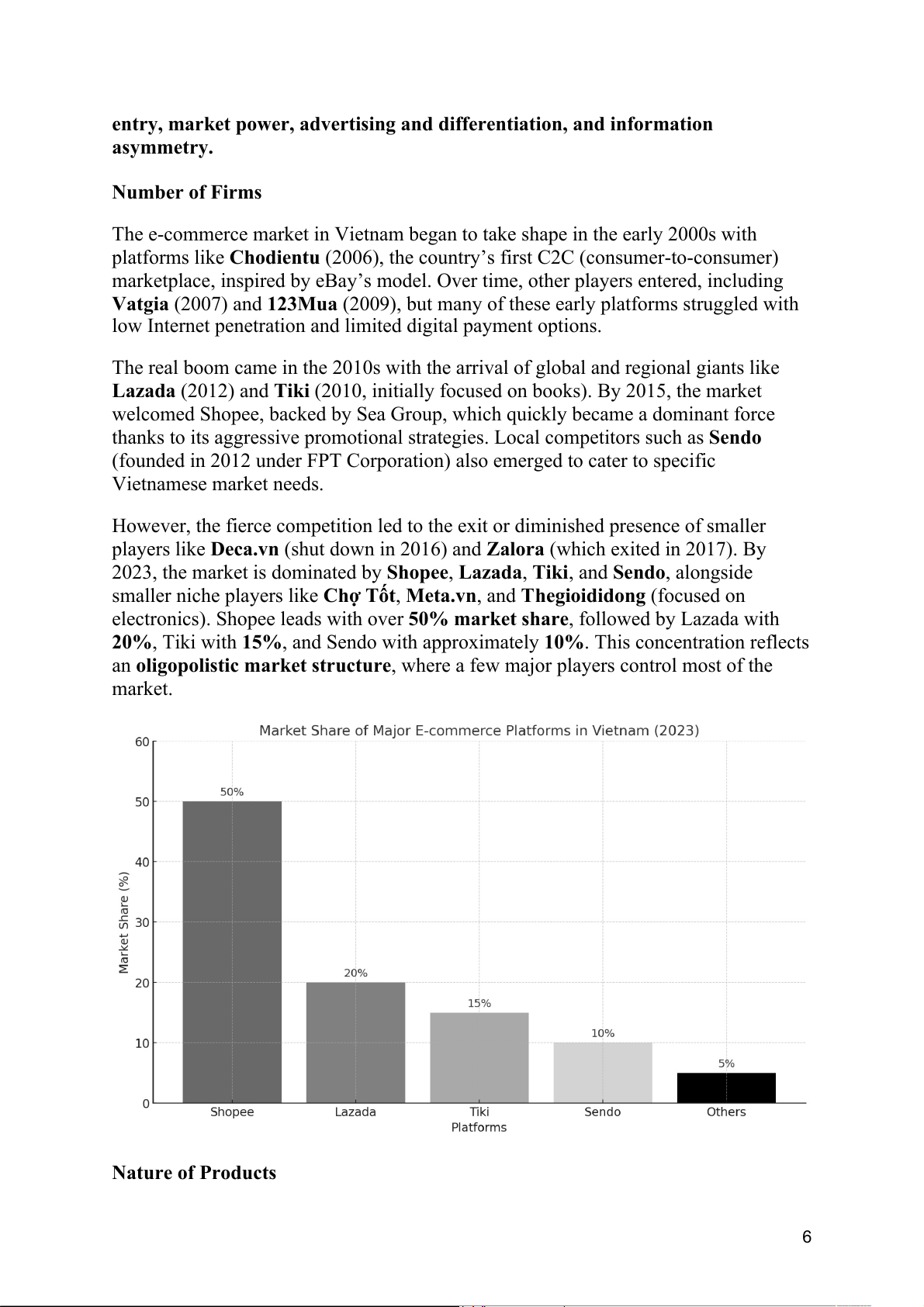

However, the fierce competition led to the exit or diminished presence of smaller

players like Deca.vn (shut down in 2016) and Zalora (which exited in 2017). By

2023, the market is dominated by Shopee, Lazada, Tiki, and Sendo, alongside

smaller niche players like Chợ Tốt, Meta.vn, and Thegioididong (focused on

electronics). Shopee leads with over 50% market share, followed by Lazada with

20%, Tiki with 15%, and Sendo with approximately 10%. This concentration reflects

an oligopolistic market structure, where a few major players control most of the market. Nature of Products 6

E-commerce platforms in Vietnam offer diverse product categories, including

electronics, fashion, groceries, and home appliances. Despite this variety, there is

considerable overlap in the types of products available across platforms.

● Shopee dominates in low-cost goods and frequently offers flash sales and

gamified shopping experiences to attract price-sensitive consumers.

● Lazada excels in high-ticket items such as electronics, thanks to its strong

logistics and trust as part of the Alibaba ecosystem.

● Tiki, which began as a bookseller, differentiates itself with a focus on fast

delivery, especially through TikiNow, catering to urban, time-sensitive customers.

● Sendo, backed by domestic investors, caters more to rural and lower-tier city

markets with affordable products and localized promotions.

While these platforms largely offer substitutable products, differentiation arises

through features such as delivery speed, pricing, and promotional campaigns. Barriers to Entry

Entering the e-commerce market in Vietnam involves significant challenges:

1. High Initial Investment: Building an e-commerce platform requires

substantial investment in technology, marketing, and logistics infrastructure.

New entrants often struggle to compete with established players’ economies of scale.

2. Logistics and Delivery Network: Effective e-commerce operations depend on

an efficient delivery network. Companies like Shopee and Lazada have

invested heavily in warehousing and last-mile delivery, raising the entry threshold for competitors.

3. Consumer Trust and Brand Recognition: Platforms with established

reputations and high visibility (e.g., Shopee and Tiki) dominate due to strong

brand loyalty and trust, leaving new players at a disadvantage.

4. Network Effects: Large platforms benefit from network effects where more

buyers attract more sellers and vice versa, creating a self-reinforcing cycle.

The exit of numerous smaller platforms, such as Deca.vn and Vingroup's Adayroi

(shut down in 2019), highlights the challenges of surviving in this competitive market. 7 Market Power

Major e-commerce platforms in Vietnam hold substantial market power. Shopee, for

instance, leverages its position as a market leader to dictate pricing trends, frequently

engaging in price wars to maintain dominance. Lazada, backed by Alibaba, can afford

to invest heavily in logistics and customer acquisition without immediate profitability

pressures, further strengthening its competitive position.

This concentration of power allows leading platforms to negotiate favorable terms

with suppliers and logistics providers, creating additional barriers for smaller or new entrants.

Advertising and Differentiation

Advertising plays a pivotal role in the e-commerce sector. Platforms compete

aggressively through online marketing campaigns, flash sales, and discount programs.

● Shopee is known for its high-profile advertising strategies, including

partnerships with celebrities and influencers, along with extensive use of gamification in shopping.

● Lazada invests heavily in livestream shopping, leveraging its Alibaba

ecosystem to offer innovative features.

● Tiki focuses on loyalty-building measures such as subscription services (e.g.,

TikiNow) and exclusive partnerships.

● Sendo targets rural areas with localized campaigns and accessible pricing

models, distinguishing itself from competitors focused on urban consumers. 8

These strategies ensure that each platform carves out a distinct identity, despite

offering largely similar products. Information Asymmetry

E-commerce platforms hold a significant advantage in terms of data. Platforms like

Shopee and Lazada collect vast amounts of user data, allowing them to tailor

marketing efforts and optimize user experience. This access to proprietary data creates

a significant entry barrier, as new entrants lack the same level of consumer insights.

Furthermore, there is limited transparency regarding product quality and seller

credibility on some platforms, which can create trust issues for consumers. However,

established players have worked to address this through improved review systems and

guarantees, further strengthening their market positions. Conclusion

The Vietnamese e-commerce market is best classified as an oligopoly. A small

number of dominant players—Shopee, Lazada, Tiki, and Sendo—control the majority

of the market share, with significant barriers preventing new entrants from challenging

their dominance. While competition remains fierce, the market is characterized by

high levels of concentration, aggressive advertising, and powerful network effects.

The government plays an increasingly important role in regulating this sector,

ensuring fair competition and preventing monopolistic practices. As Vietnam’s digital

economy continues to grow, the e-commerce market is expected to remain a dynamic

and vital part of the country’s economic landscape. 9

FACTORS AFFECTING DEMAND AND SUPPLY OF THE E-

COMMERCE MARKET IN VIETNAM Overview

E-commerce platforms have revolutionized the way people shop. From humble

beginnings as simple online storefronts, they have evolved into sophisticated digital

marketplaces. Today's platforms offer a wide range of features, including personalized

recommendations, secure payment gateways, and seamless checkout processes. As

technology continues to advance, e-commerce platforms are becoming even more

integrated with social media and mobile devices, creating a truly omnichannel shopping experience.

Factors affecting the demand of the e-commerce market in Vietnam

Consumer’s income

According to data from the International Labor Organization (ILO) in Vietnam during

the Covid 19 pandemic, the average monthly income of workers is 5.2 million VND,

down 5% compared to the same period last year. Informal workers' income decreased

more than formal workers with a decrease of 8.4% (down 4.7% over the same period

the previous year). This makes consumers prioritize cheaper and proper options like e- commerce shopping platforms. 10

Therefore, online shopping with a variety of goods and prices may be an optimal

choice for every consumer with every level of income.

Price of related goods

Before online shopping appeared, when technology was not yet modern and Internet

coverage was not yet too popular, consumers chose traditional ways to buy goods as

going to offline stores. Consumers who lived far from that store had to spend more

money on traveling than the nearer one. Moreover, some stores may have a higher

price than others since they have to rent premises, this may lead to unstable prices.

Therefore, with e-commerce platforms with convenience such as national shipping,

express shipping, and various types of goods in one online app, prices are also more

reasonable because stores do not need to rent premises to sell their goods and many

vouchers are sponsored for customers such as freeship voucher, voucher discount 50%

with code. This led to a rapid increase in demand for online shopping. Consumer tastes

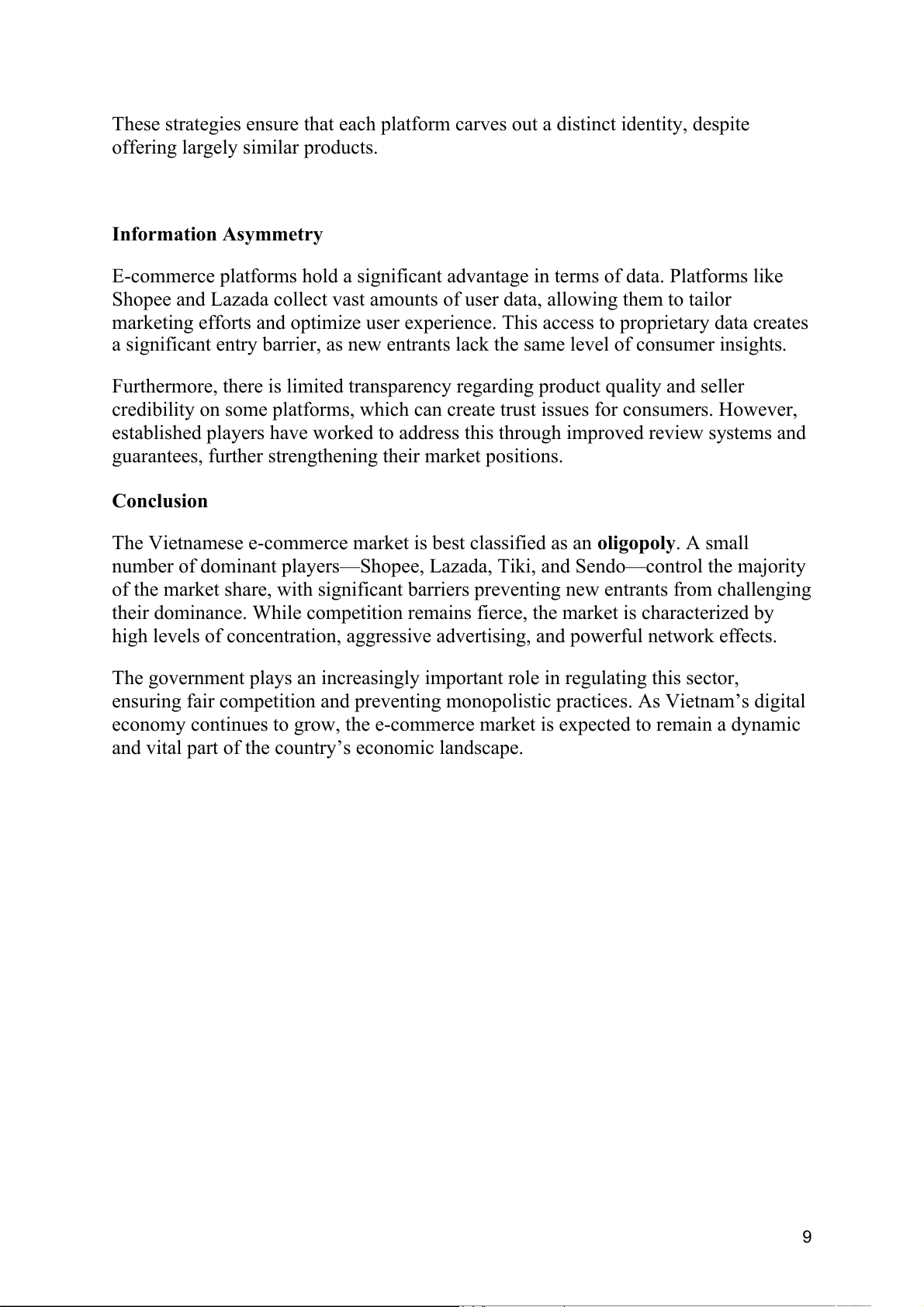

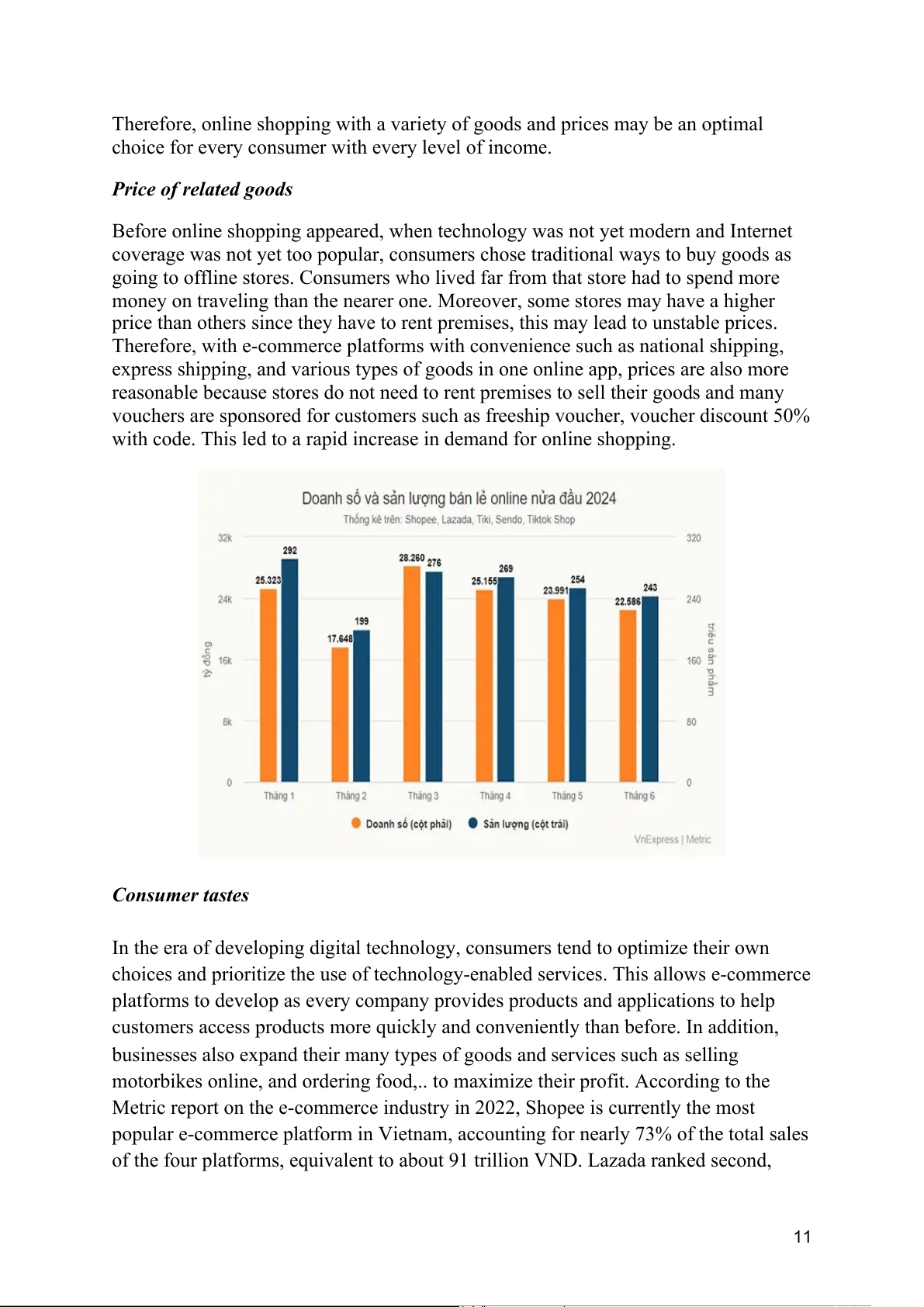

In the era of developing digital technology, consumers tend to optimize their own

choices and prioritize the use of technology-enabled services. This allows e-commerce

platforms to develop as every company provides products and applications to help

customers access products more quickly and conveniently than before. In addition,

businesses also expand their many types of goods and services such as selling

motorbikes online, and ordering food,.. to maximize their profit. According to the

Metric report on the e-commerce industry in 2022, Shopee is currently the most

popular e-commerce platform in Vietnam, accounting for nearly 73% of the total sales

of the four platforms, equivalent to about 91 trillion VND. Lazada ranked second, 11

accounting for 20% with revenue of 26.5 trillion VND," the Reputa report emphasized. Expectations

Consumers' expectations towards manufacturers are also one of the important factors

when considering changes in demand for each firm. Supposedly, customers can expect

to receive more incentives if they use the service enough, leading to the phenomenon

of "consumption accumulation" Many young people now know how to use their

vouchers to minimize the price that they have to pay reality, thereby increasing

demand, or predicting benefits when using the program. Discounts and incentives

from brands to choose the most beneficial products for yourself.

In general, expectations are the least sustainable factor when it comes to changes in

demand. However, in certain periods, such as during epidemics or armed conflicts,

expectations are the primary factor influencing consumer choices and strategic decision producers.

Factors affecting the supply of e-commerce market in Viet Nam Technology

People are increasingly moving towards a more modern and convenient lifestyle in the

future. For this reason, technology has been created and continuously upgraded to

improve and bring many benefits that help Vietnamese consumers purchase goods and 12

access a wide range of products more easily.

In addition to the social benefits, we cannot deny the important role technology has

played in Vietnam's e-commerce industry, contributing to enormous economic profits

for the country. Thanks to technology, logistics, and issues related to transportation

and packaging, the process has become easier and faster, providing a better shopping

experience where customers don't have to wait too long for delivery. The applications

of artificial intelligence in the supply chain have helped businesses process orders and

shipments without paperwork using electronic bills of lading, reduce unnecessary

costs, ensure product quality, and predict demand. As a result, this has created a strong

foundation for the development of the e-commerce industry, boosting the supply of

products in both the present and future. Input Price

With the impact of exchange rate fluctuations, Vietnam will have to pay more

Vietnamese Dong to purchase the same amount of goods compared to other countries,

which means businesses will face significant losses if the fluctuations are high,

leading to a decrease in purchasing power from suppliers. Importing goods into

Vietnam also involves transportation and logistics costs, which are currently high for

the country. In July 2024, the increase in sea freight rates, according to Ms. Truong

Thi My Huong, Sales Manager at Goods Link JSC (specializing in agricultural

exports), has become excessively high, making Vietnamese goods less competitive

compared to other countries. With high transportation costs and other expenses

driving up the cost of Vietnamese goods, international buyers may choose to purchase

products from countries with more competitive costs. In this case, high shipping costs

reduce supply, diversify products, and increase prices on e-commerce platforms. Expectation

With the continuous advancement of technology, expectations for Vietnam's e-

commerce industry are witnessing remarkable breakthroughs. Based on the current

situation with constant transitions and innovations, e-commerce is rapidly becoming a 13

primary shopping channel. It not only boosts sales for sellers but also provides

numerous opportunities for market expansion and growth.

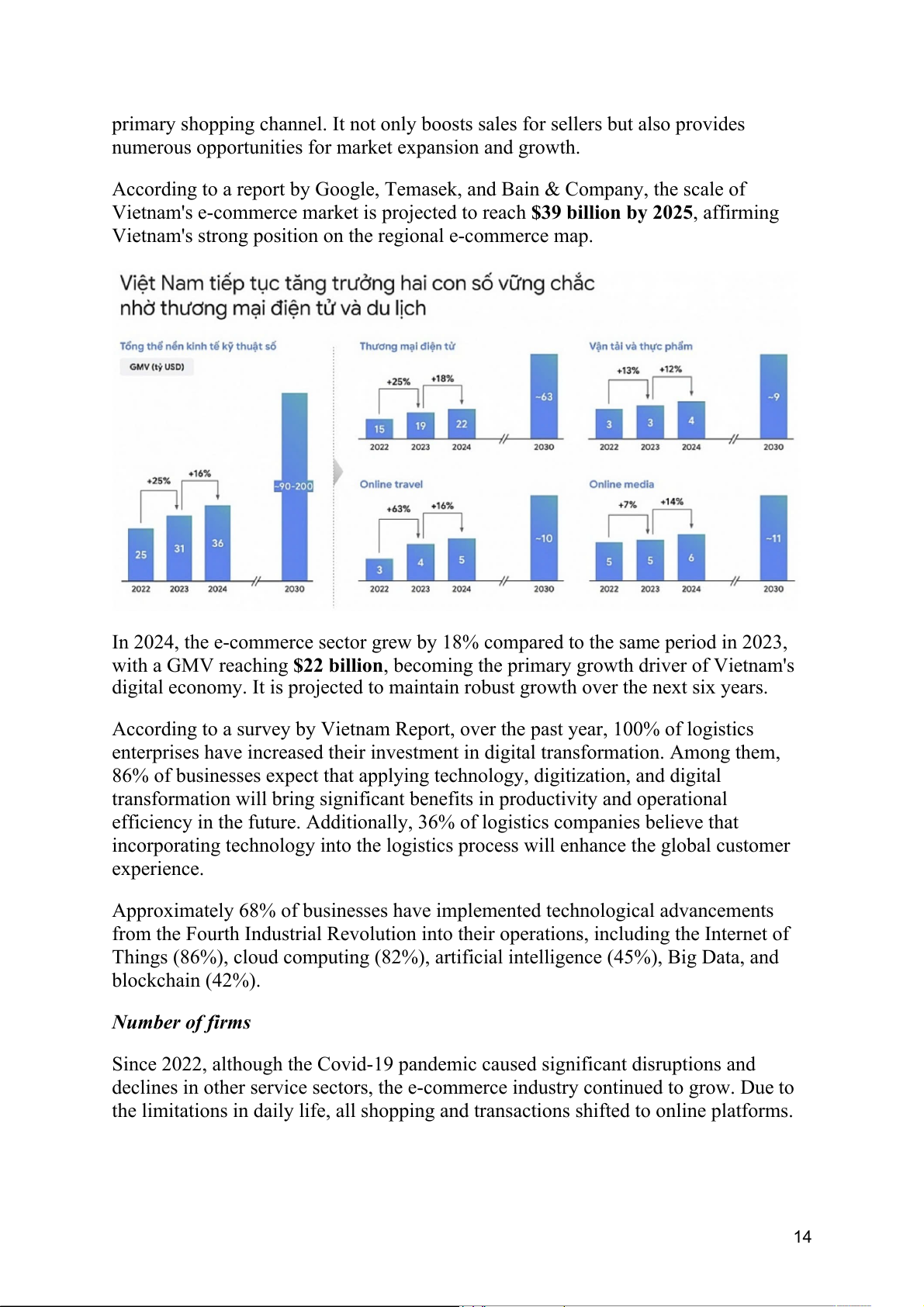

According to a report by Google, Temasek, and Bain & Company, the scale of

Vietnam's e-commerce market is projected to reach $39 billion by 2025, affirming

Vietnam's strong position on the regional e-commerce map.

In 2024, the e-commerce sector grew by 18% compared to the same period in 2023,

with a GMV reaching $22 billion, becoming the primary growth driver of Vietnam's

digital economy. It is projected to maintain robust growth over the next six years.

According to a survey by Vietnam Report, over the past year, 100% of logistics

enterprises have increased their investment in digital transformation. Among them,

86% of businesses expect that applying technology, digitization, and digital

transformation will bring significant benefits in productivity and operational

efficiency in the future. Additionally, 36% of logistics companies believe that

incorporating technology into the logistics process will enhance the global customer experience.

Approximately 68% of businesses have implemented technological advancements

from the Fourth Industrial Revolution into their operations, including the Internet of

Things (86%), cloud computing (82%), artificial intelligence (45%), Big Data, and blockchain (42%). Number of firms

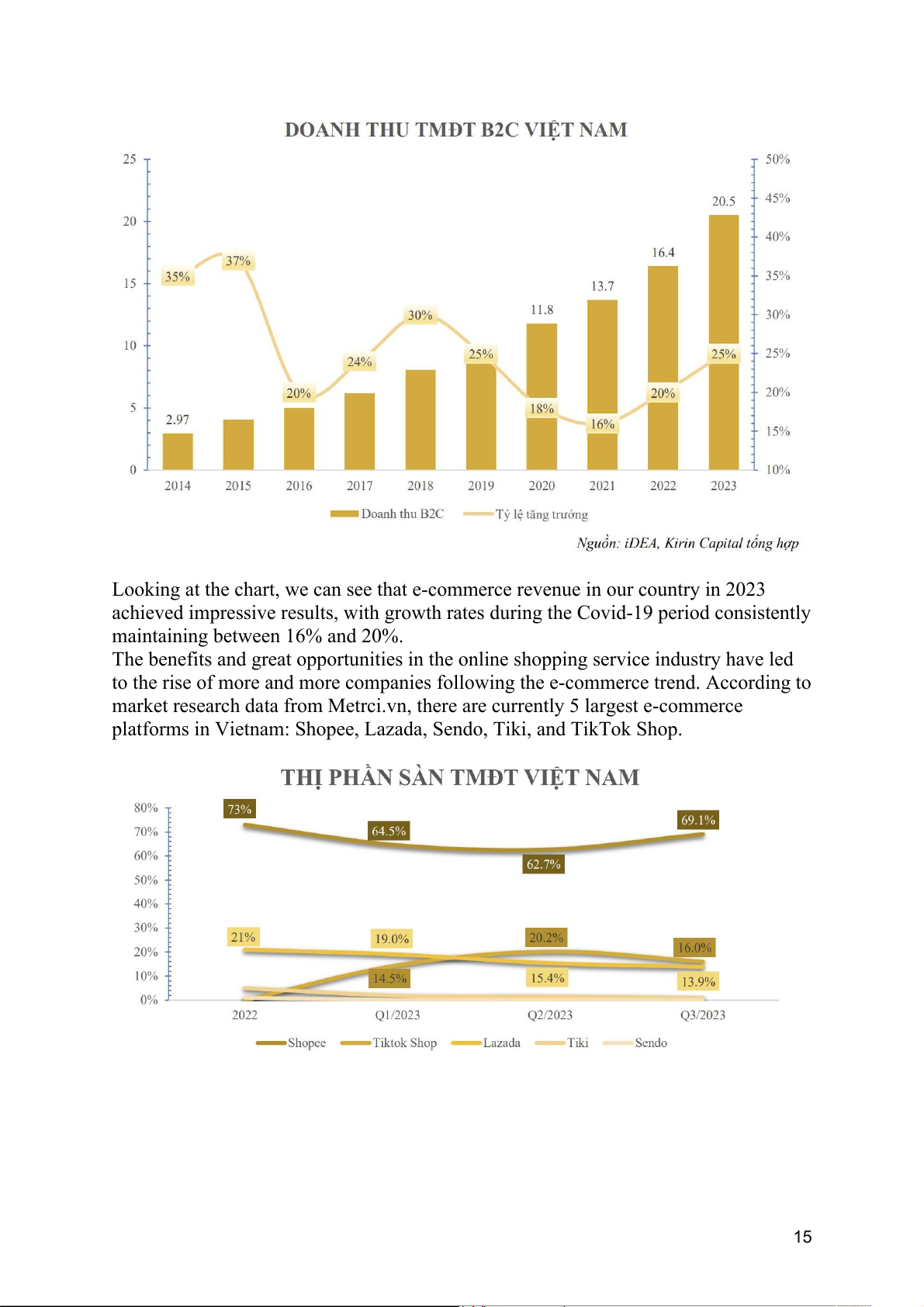

Since 2022, although the Covid-19 pandemic caused significant disruptions and

declines in other service sectors, the e-commerce industry continued to grow. Due to

the limitations in daily life, all shopping and transactions shifted to online platforms. 14

Looking at the chart, we can see that e-commerce revenue in our country in 2023

achieved impressive results, with growth rates during the Covid-19 period consistently

maintaining between 16% and 20%.

The benefits and great opportunities in the online shopping service industry have led

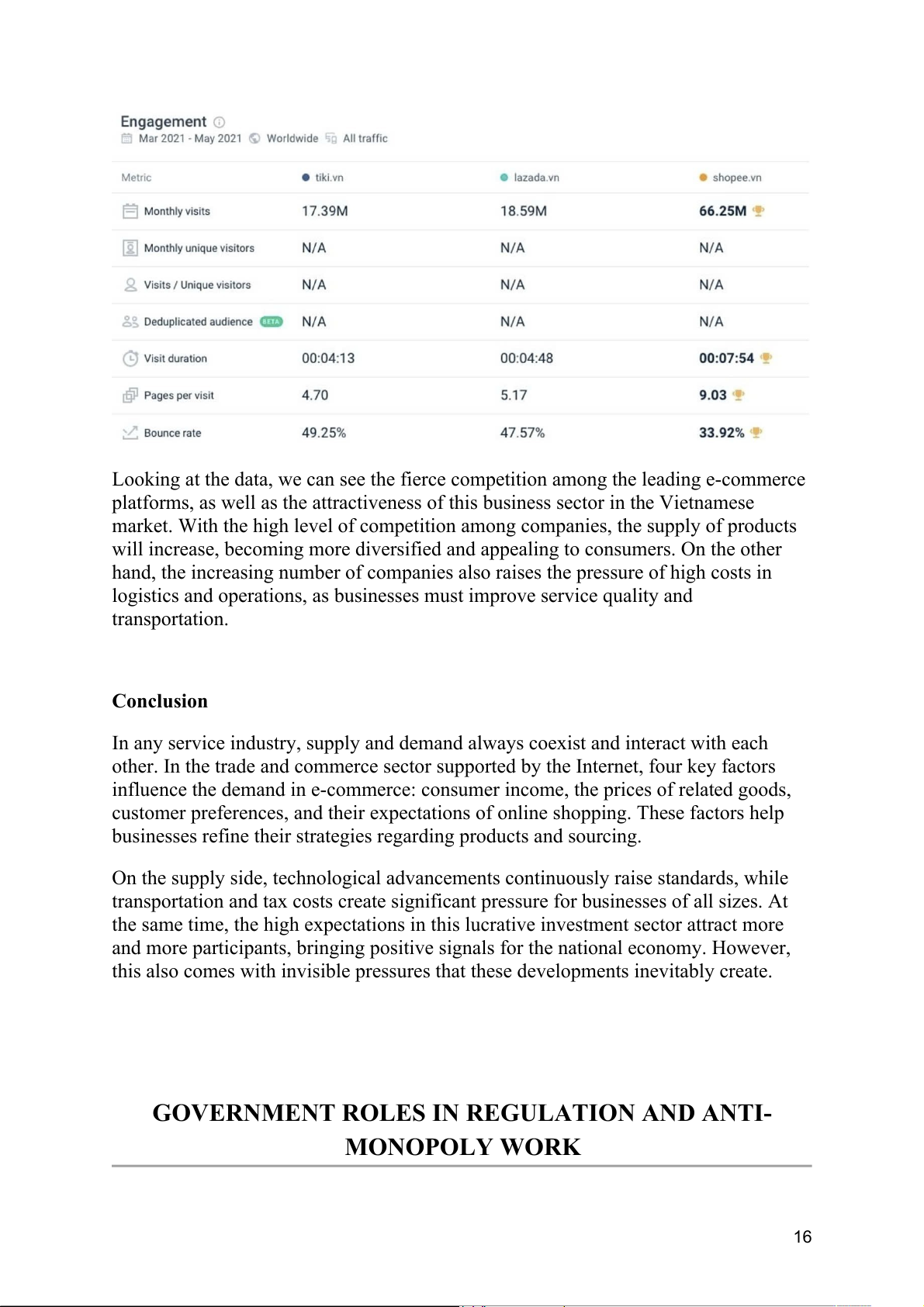

to the rise of more and more companies following the e-commerce trend. According to

market research data from Metrci.vn, there are currently 5 largest e-commerce

platforms in Vietnam: Shopee, Lazada, Sendo, Tiki, and TikTok Shop. 15

Looking at the data, we can see the fierce competition among the leading e-commerce

platforms, as well as the attractiveness of this business sector in the Vietnamese

market. With the high level of competition among companies, the supply of products

will increase, becoming more diversified and appealing to consumers. On the other

hand, the increasing number of companies also raises the pressure of high costs in

logistics and operations, as businesses must improve service quality and transportation. Conclusion

In any service industry, supply and demand always coexist and interact with each

other. In the trade and commerce sector supported by the Internet, four key factors

influence the demand in e-commerce: consumer income, the prices of related goods,

customer preferences, and their expectations of online shopping. These factors help

businesses refine their strategies regarding products and sourcing.

On the supply side, technological advancements continuously raise standards, while

transportation and tax costs create significant pressure for businesses of all sizes. At

the same time, the high expectations in this lucrative investment sector attract more

and more participants, bringing positive signals for the national economy. However,

this also comes with invisible pressures that these developments inevitably create.

GOVERNMENT ROLES IN REGULATION AND ANTI- MONOPOLY WORK 16 MARKET EFFICIENCY

The e-commerce market efficiency could be analyzed into two main criteria:

externalities and monopoly power. This type of market operation (especially with

dominant platforms like Shopee, Lazada, and Tiki) is not entirely efficient. Externalities:

Negative externalities:

The first problem of rapid expansion of online shopping in Vietnam would be the

increase in packaging waste, particularly plastic packaging, which resulted in

environmental pollution. In 2023, it was estimated that e-commerce in Vietnam

generated approximately 332,000 tons of packaging waste, with plastic packaging

accounting for 171,000 tons of this total. This high volume of plastic packaging

materials highlights the considerable environmental impact of the sector. Furthermore,

with the e-commerce industry continuing to grow at an annual rate of over 25%,

projections indicate that by 2030, plastic waste from e-commerce in Vietnam could reach as much as 800,000 tons.

Another issue is that the development of Vietnam's e-commerce was powered by e-

logistics, this combination has brought economic growth for the country. However it

also comes with the escalating greenhouse gas emissions, leading to air pollution.

According to McKinsey, predictions indicate that Vietnam's total GHG emissions

might approach 1.5 billion tons of CO2 equivalent by 2050, highlighting the urgent

need for sustainable interventions. A substantial portion of these emissions,

approximately 19.3%, according to Vietnam Briefing, is attributed to transportation

activities and work integral to e-commerce — from parcel transit between customer

homes and warehouses to shipments destined for airports.

Due to the negative effects of pollution

and increasing external costs, the social

marginal cost (MSC), which includes

the cost of pollution, is greater than the

individual marginal cost, as shown in

Fig represented by the supply curve S'

being higher than the supply curve S.

The firm's demand curve D reflects the social marginal benefit. 17

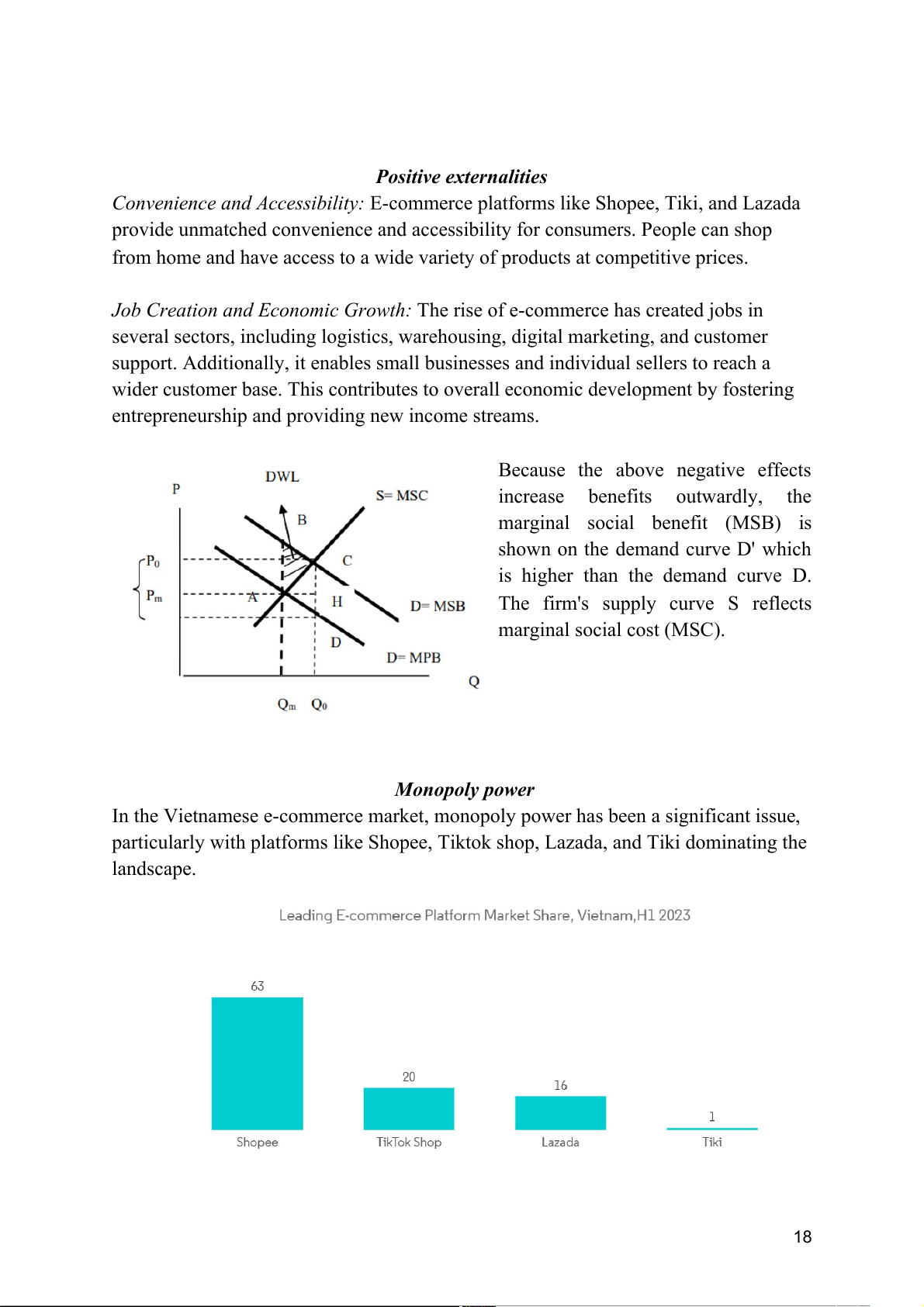

Positive externalities

Convenience and Accessibility: E-commerce platforms like Shopee, Tiki, and Lazada

provide unmatched convenience and accessibility for consumers. People can shop

from home and have access to a wide variety of products at competitive prices.

Job Creation and Economic Growth: The rise of e-commerce has created jobs in

several sectors, including logistics, warehousing, digital marketing, and customer

support. Additionally, it enables small businesses and individual sellers to reach a

wider customer base. This contributes to overall economic development by fostering

entrepreneurship and providing new income streams.

Because the above negative effects

increase benefits outwardly, the

marginal social benefit (MSB) is

shown on the demand curve D' which

is higher than the demand curve D.

The firm's supply curve S reflects marginal social cost (MSC). Monopoly power

In the Vietnamese e-commerce market, monopoly power has been a significant issue,

particularly with platforms like Shopee, Tiktok shop, Lazada, and Tiki dominating the landscape. 18

Shopee, in particular, has seen rapid growth and a commanding share of the market,

often leading to concerns about its pricing power and the competitive dynamics within the sector.

The dominance of these large platforms creates a situation where smaller competitors

struggle to set prices or attract consumers, as these giants leverage their scale,

technology, and customer base to offer deep discounts and extensive services. This

market concentration can lead to anti-competitive practices, such as predatory

pricing, which may temporarily reduce prices for consumers but ultimately harm

long-term competition. Additionally, the dominance of a few large platforms can limit

consumer choice and innovation, as smaller players are unable to compete effectively.

This monopolistic tendency could potentially lead to higher prices in the future, once

competition is reduced, and can also stifle the entry of new players into the market. As

the e-commerce sector continues to grow in Vietnam, the question of regulating

monopoly power remains crucial to maintaining a fair and competitive marketplace.

THE GOVERNMENT’S SOLUTION

Negative externalities

The Vietnamese Ministry of Industry and Trade’s Department of E-commerce and

Digital Economy has introduced a strategic policy direction to promote sustainable e-

commerce development while protecting the environment until 2030. The policy

focuses on six key stakeholders: government bodies, consumers, e-commerce

businesses, logistics companies, media, industry associations, and relevant

organizations. Key measures include supporting solutions to reduce plastic waste in e-

commerce, creating a set of criteria to identify "green e-commerce" businesses, and

encouraging the use of recyclable or biodegradable packaging materials. The

government aims to incentivize e-commerce companies to adopt environmentally

friendly practices, prioritize the use of sustainable packaging, and encourage eco-

friendly transportation solutions. Annual awards will also be given to businesses that

demonstrate significant environmental initiatives in e-commerce. These measures are

designed to foster a greener and more sustainable e-commerce ecosystem in Vietnam.

As of now, the Vietnamese government has not yet established specific policies

regarding the use of delivery vehicles to mitigate the environmental impact of rising

emissions. However, some e-commerce firms, such as Lazada, have taken proactive

steps by experimenting with the use of electric vehicles for goods transportation. This

initiative reflects the growing awareness within the private sector about the need to 19

reduce carbon emissions and improve environmental sustainability in the e-commerce delivery process. Monopoly power

Currently, the Vietnamese government does not have specific and clear policies aimed

at directly reducing monopoly power in the e-commerce sector. However, it has begun

to focus on promoting competition and creating conditions for new businesses to

enter the market, thereby limiting the dominance of large players such as Shopee, Lazada, and Tiki.

The Vietnamese government has implemented stricter tax regulations for large e-

commerce platforms, requiring foreign companies like Shopee and Lazada to pay

taxes fully within Vietnam. This measure aims to ensure a level playing field between

foreign and domestic businesses, fostering fair competition. Additionally, the

government has made efforts to reform its legal framework, particularly with the

Competition Law 2018, to maintain a fair business environment and encourage

healthy competition among e-commerce enterprises.

Anti-monopoly regulations and controls on mergers and acquisitions have been

introduced to prevent market dominance and market distortion caused by large

platforms. These measures reflect the government’s commitment to promoting a more

competitive and diverse e-commerce ecosystem in Vietnam.

PREDICTIONS OF THE E-COMMERCE MARKET IN VIETNAM ● Overview:

With the rapid advancement of modern technology and the increasing consumer

demand in society, e-commerce platforms and online shopping applications have

become some of the fastest-growing markets. This growth is particularly notable with

the emergence of many livestream-supporting applications, which aim to stimulate

consumer demand and cater to the growing preference for online shopping among various customer segments. 20