Preview text:

lOMoAR cPSD| 58562220

1. Discount Incremental Cash Flows

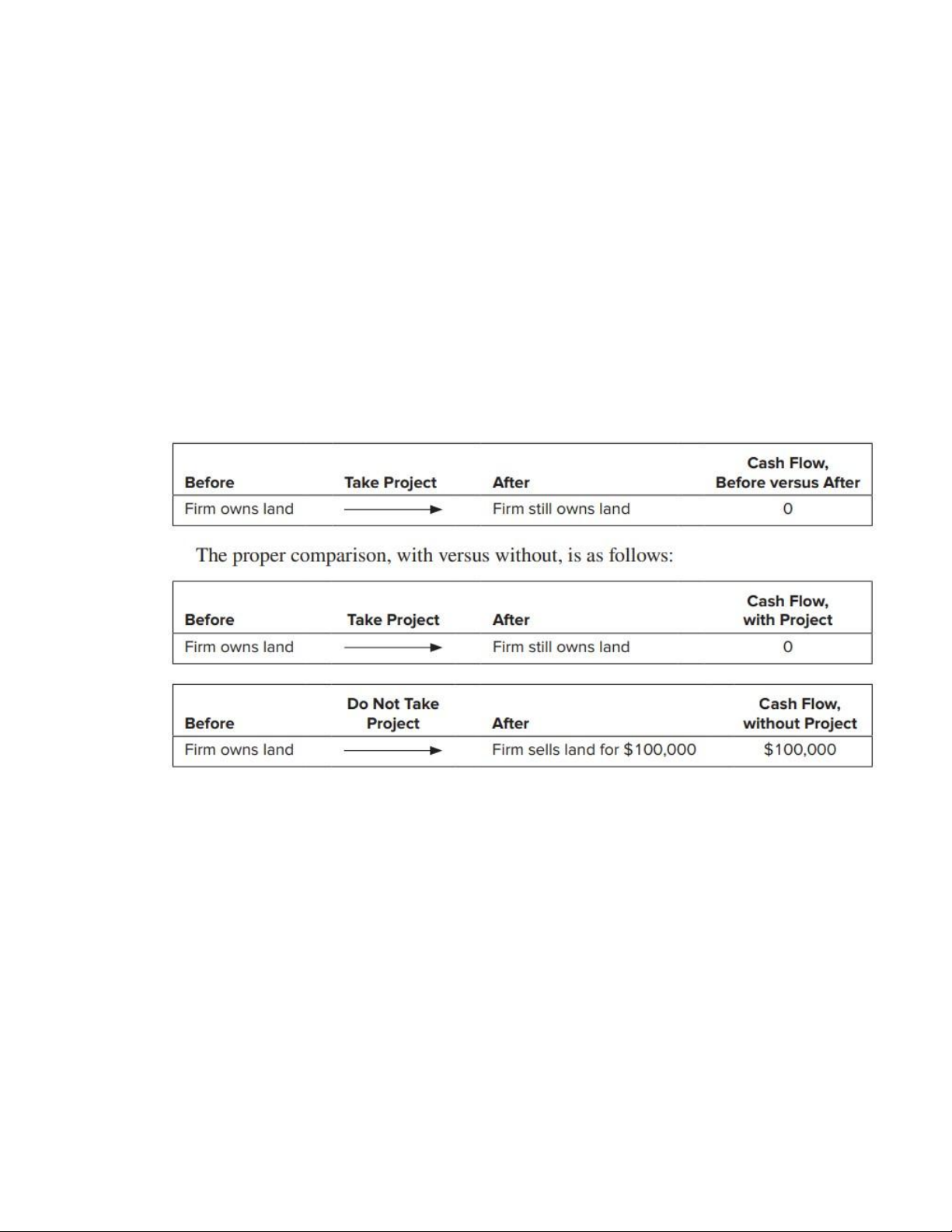

A project’s present value depends on the extra cash flows that it produces. So you need to

forecast first the firm’s cash flows if you go ahead with the project. Then forecast the cash flows

if you don’t accept the project. Take the difference and you have the extra (or incremental)

cash flows produced by the project:

Incremental cash flow = cash flow with project − cash flow without project 2. Forget Sunk Costs

They are past and irreversible outflows. Sunk costs remain the same whether or not you accept

the project. Therefore, they do not affect project NPV. 3. Include Opportunity Costs

Benefit or cash flow forgone as a result of an action

Add (100,000) in the Incremental CF -

Incremental cash flow = cash flow with project − cash flow without project

The opportunity cost equals the cash that could be realized from selling the land now; you lose

that cash if you take the project

4. Recognize the Investment in Working Capital Net working capital (often referred to simply as working capital) -

Current assets minus current liabilities. Often called working capital

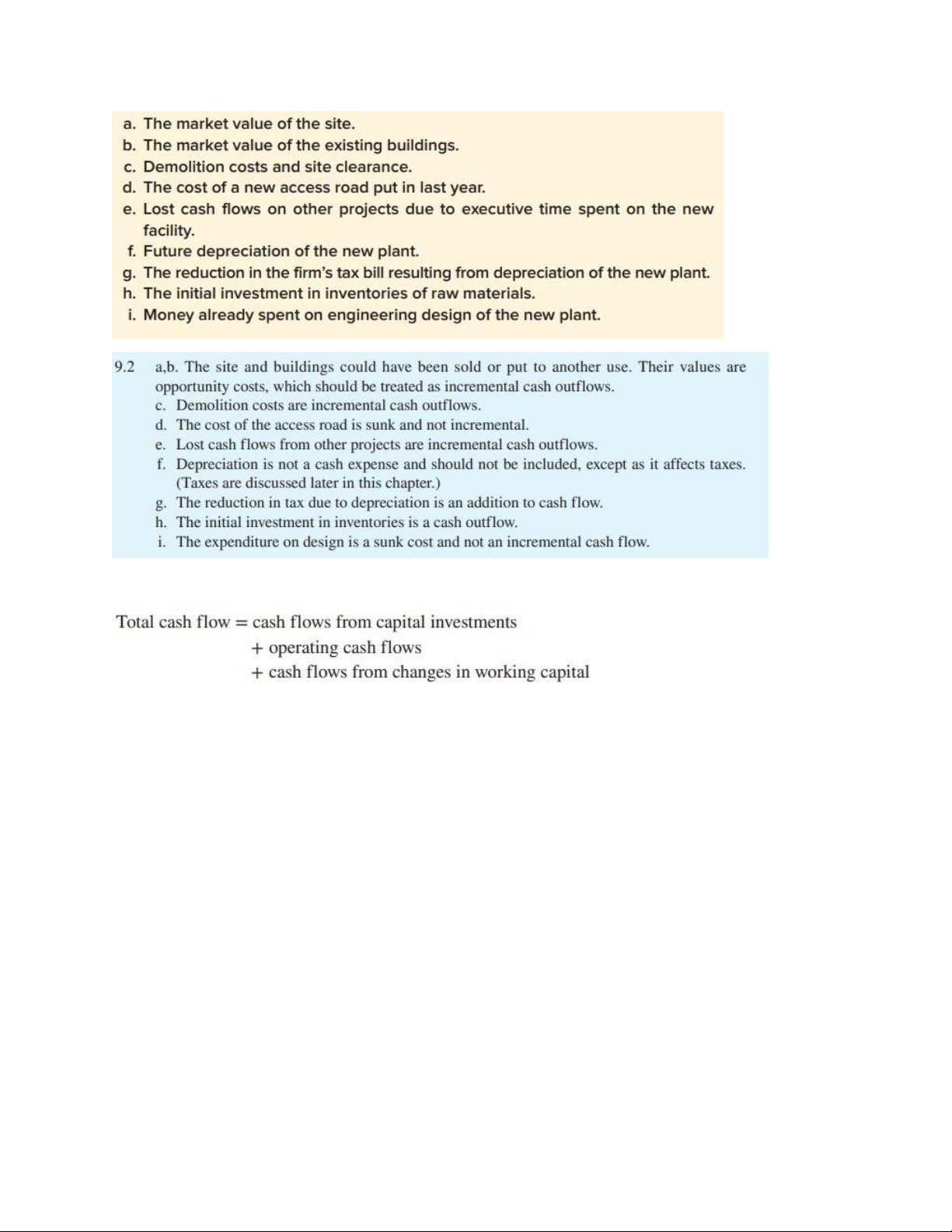

5. Beware of Allocated Overhead Costs -

A project may generate extra overhead costs, but then again it may not. We should be cautious

about assuming that the accountant’s allocation of overhead costs represents the incremental

cash flow that would be incurred by accepting the project lOMoAR cPSD| 58562220

The net increase in cash flow equals the after-tax cost savings: (1 − .35) × $30,000 = $19,500

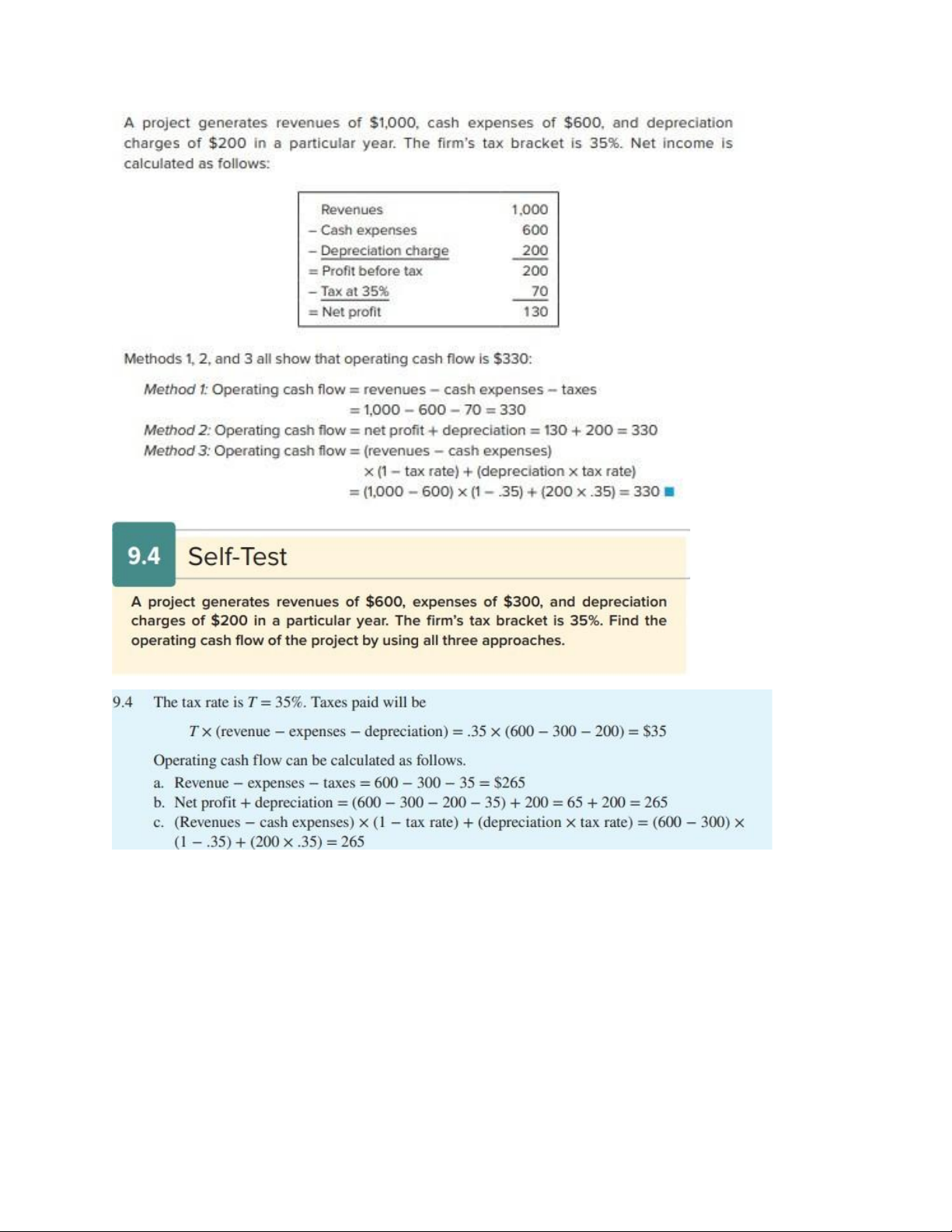

Operating cash flow = revenues − cash expenses – taxes

Operating cash flow = after-tax profit + depreciation

Depreciation tax shield = tax rate × depreciation

Operating cash flow = (revenues − cash expenses) × (1 − tax rate) + (tax rate × depreciation) lOMoAR cPSD| 58562220

Tax PAID = EBDIT*TAX RATE

= (Sale-Cost-Depreciation)*tax rate

Depreciation = (initial cost – salvage value)/year

If depreciation to straight-line = initial cost/year Tax shield on depreciation = depreciation*tax lOMoAR cPSD| 58562220 Definition:

interest tax shield Tax savings resulting from deductibility of interest payments. internal rate of return

(IRR) Discount rate at which project NPV = 0.

depreciation tax shield Reduction in taxes attributable to depreciation.

discounted cash flow (DCF) Method of calculating present value by discounting future cash flows

net working capital Current assets minus current liabilities. Often called working capital