Preview text:

NATIONAL ECONOMICS UNIVERSITY NEU BUSINESS SCHOOL .....0O0..... Final Group Project MICROECONOMICS

Topic: Steel Market Research & Analysis Presented by: Group 7 1. Nguyễn Công Hưng 2. Nguyễn Trung Kiên 3. Lưu Thế Mạnh

4. Nguyễn Thị Kiều Trang Class: EBBA 16.2 Ha Noi – 2024 FINAL GROUP ASSIGNMENT Market Research TABLE OF CONTENTS INTRODUCTION I. Market Classification

1. Characteristics of market structure

2. Market structure analysis of the Vietnam steel industry

3. Comparison to other market II.

Factors Affecting Supply and Demand 1. Factors Affecting Supply 2. Factors Affecting Demand

3. Trends in Supply and Demand Over Recent Years and the Government’s Role III.

Conclusion and Evaluation 1. Summary of Key Points

2. Future outlook for the Commodity References GROUP 7 1 FINAL GROUP ASSIGNMENT Market Research INTRODUCTION

Steel is one of the most important construction and industrial materials, serving as a

cornerstone of Vietnam's economic and social development. The choice of steel as the

research subject is motivated not only by the strategic importance of this sector but also by

the urgent need to better understand the market structure and factors influencing supply and

demand. In the context of deep economic integration and intensifying competition, a study on

the steel market will provide valuable insights for policymakers, support businesses, and

promote the sustainable development of the industry

Vietnam's steel industry began to take shape in the 1960s, with initial reliance on imports to

meet domestic demand. By the 1990s, the establishment of the Vietnam Steel Corporation led

to significant progress, attracting both foreign and domestic investments. Over the next few

decades, the industry rapidly expanded, with key segments like construction steel, steel pipes,

and galvanized steel seeing growth of up to 69% in production between 2015 and 2018.

Vietnam became a leader in Southeast Asia, ranking 14th globally for steel production in

2019 and accounting for over 30% of the region's output. The country also experienced a

substantial increase in steel exports, rising from 1 million tons in 2010 to 6 million tons by 2018.

However, in 2019, the industry faced challenges due to global protectionism and a slowdown

in the domestic real estate sector, leading to a slight dip in production. The COVID-19

pandemic in 2020 further disrupted the steel supply chain, with trade activities severely

affected and many companies experiencing significant profit losses.

By 2024, the industry continues to struggle with external challenges, including ongoing

protectionism and the slow recovery of the construction sector. Despite these difficulties,

Vietnam remains a key player in the global steel market, but the outlook remains uncertain

due to these persistent hurdles.

Overview of the Industry and the Commodity GROUP 7 2 FINAL GROUP ASSIGNMENT Market Research

I. Market classification

1. Vietnam steel market classification

In order to gain a deeper and more comprehensive understanding of the characteristics and

operational mechanisms of the Vietnamese steel market, market classification is an essential step.

According to microeconomic theory, the classification of market structures is based on the analysis

and evaluation of the following factors: Market Number of Nature of Market power Barriers Non-price structure firms product of entry Competition Perfect Many small Homogenous No No No Competition firms “price taker” Monopolisti

Many relatively Differentiation Low Low Advertising c small firms Competition Oligopoly Some relatively Identical High High Advertising big firms Differentiation Monopoly Only one Unique Very high Very high No big firms (“price maker”)

By analyzing and evaluating the aforementioned factors, we can easily identify and classify

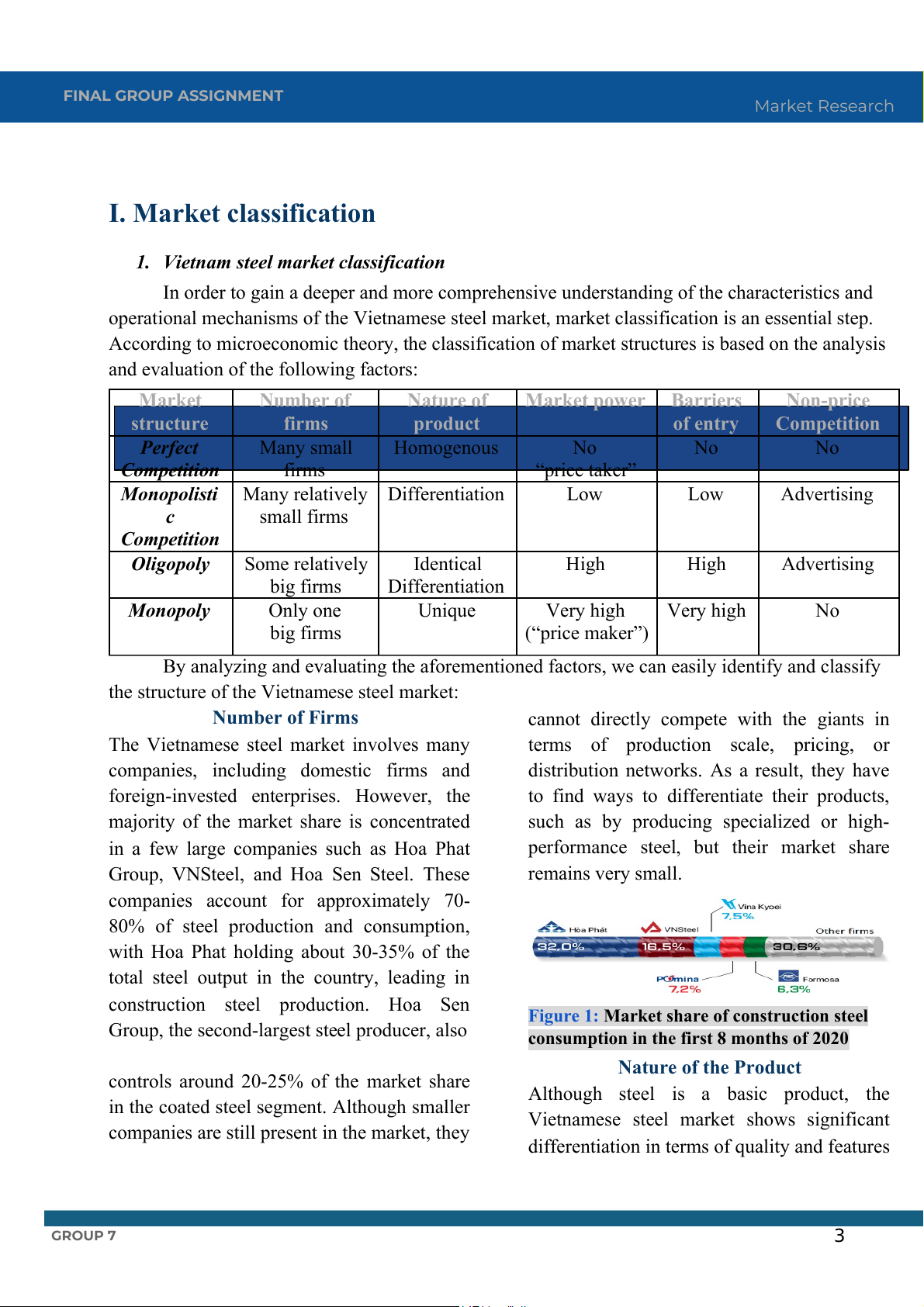

the structure of the Vietnamese steel market: Number of Firms

cannot directly compete with the giants in

The Vietnamese steel market involves many

terms of production scale, pricing, or

companies, including domestic firms and

distribution networks. As a result, they have

foreign-invested enterprises. However, the

to find ways to differentiate their products,

majority of the market share is concentrated

such as by producing specialized or high-

in a few large companies such as Hoa Phat

performance steel, but their market share

Group, VNSteel, and Hoa Sen Steel. These remains very small.

companies account for approximately 70-

80% of steel production and consumption,

with Hoa Phat holding about 30-35% of the

total steel output in the country, leading in

construction steel production. Hoa Sen

Figure 1: Market share of construction steel

Group, the second-largest steel producer, also

consumption in the first 8 months of 2020 Nature of the Product

controls around 20-25% of the market share

Although steel is a basic product, the

in the coated steel segment. Although smaller

Vietnamese steel market shows significant

companies are still present in the market, they

differentiation in terms of quality and features GROUP 7 3 FINAL GROUP ASSIGNMENT Market Research

among products from different companies.

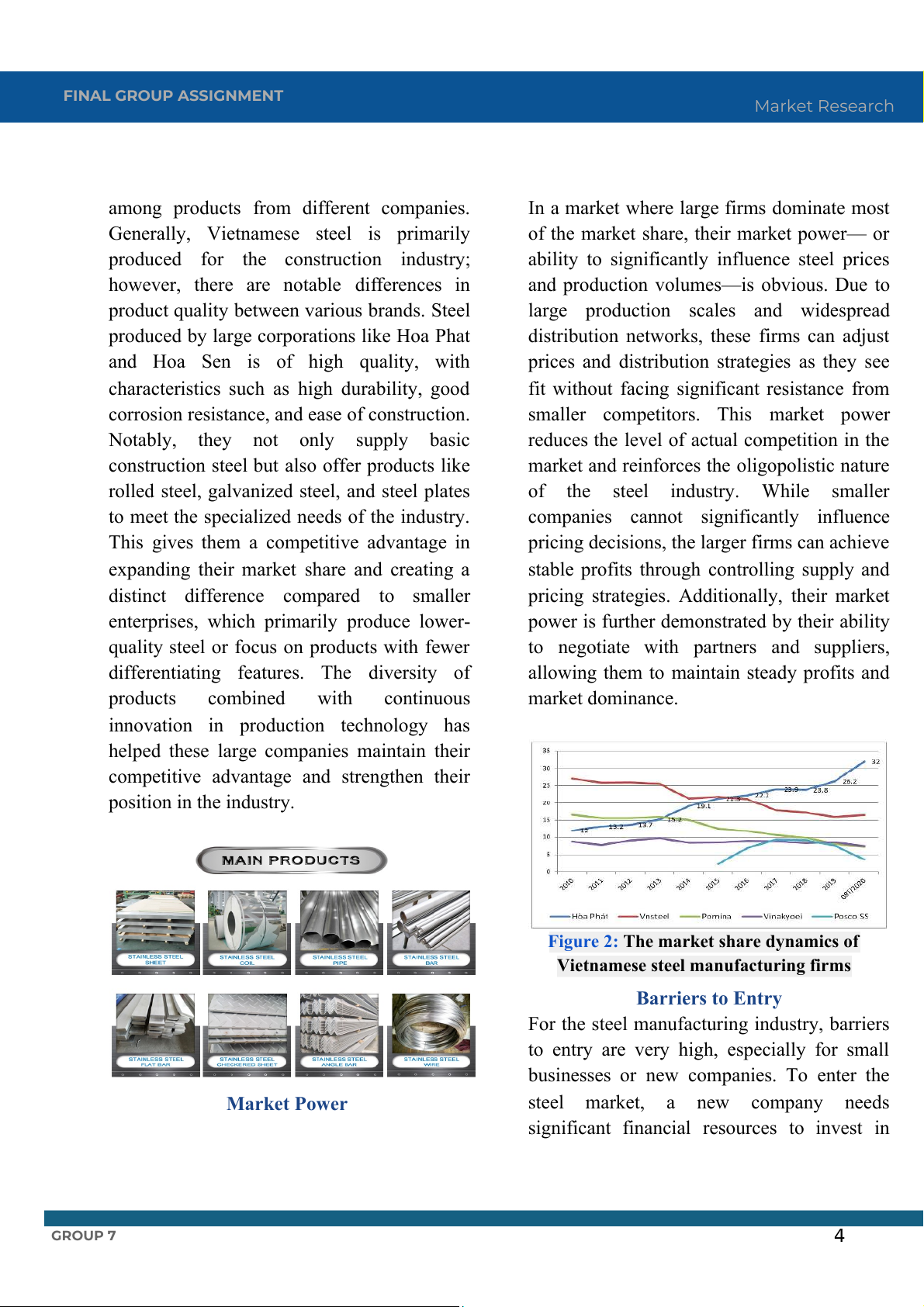

In a market where large firms dominate most

Generally, Vietnamese steel is primarily

of the market share, their market power— or

produced for the construction industry;

ability to significantly influence steel prices

however, there are notable differences in

and production volumes—is obvious. Due to

product quality between various brands. Steel

large production scales and widespread

produced by large corporations like Hoa Phat

distribution networks, these firms can adjust

and Hoa Sen is of high quality, with

prices and distribution strategies as they see

characteristics such as high durability, good

fit without facing significant resistance from

corrosion resistance, and ease of construction.

smaller competitors. This market power

Notably, they not only supply basic

reduces the level of actual competition in the

construction steel but also offer products like

market and reinforces the oligopolistic nature

rolled steel, galvanized steel, and steel plates

of the steel industry. While smaller

to meet the specialized needs of the industry.

companies cannot significantly influence

This gives them a competitive advantage in

pricing decisions, the larger firms can achieve

expanding their market share and creating a

stable profits through controlling supply and

distinct difference compared to smaller

pricing strategies. Additionally, their market

enterprises, which primarily produce lower-

power is further demonstrated by their ability

quality steel or focus on products with fewer

to negotiate with partners and suppliers,

differentiating features. The diversity of

allowing them to maintain steady profits and

products combined with continuous market dominance.

innovation in production technology has

helped these large companies maintain their

competitive advantage and strengthen their position in the industry.

Figure 2: The market share dynamics of

Vietnamese steel manufacturing firms Barriers to Entry

For the steel manufacturing industry, barriers

to entry are very high, especially for small

businesses or new companies. To enter the Market Power

steel market, a new company needs

significant financial resources to invest in GROUP 7 4 FINAL GROUP ASSIGNMENT Market Research

production plants, technology lines, and

customer service, and product innovation. For

distribution networks. Furthermore, large

the steel market, large corporations like Hoa

enterprises already control access to key

Phat and Hoa Sen have been investing

resources such as iron ore, scrap steel, and

heavily in brand building, image promotion,

other input materials, making it even more

and product quality improvements to attract

challenging for newcomers to enter the

customers. For instance, strong marketing

market. Legal regulations and licensing

strategies, long-term product warranties, and

requirements within the steel industry also

efficient customer service have helped these

add to the entry barriers. It is evident that

companies retain customers and create

such high entry barriers create a market

differentiation in consumers' minds. This

where large firms can easily maintain their

non-price competition is a significant factor dominant positions.

where companies not only rely on price

adjustments but also develop other strategies

to maintain and expand their market share.

Focusing on non-price factors helps large

firms reduce price competition pressure and maintain stable profits.

(Obstacles hindering a business’s efforts to enter a new market)

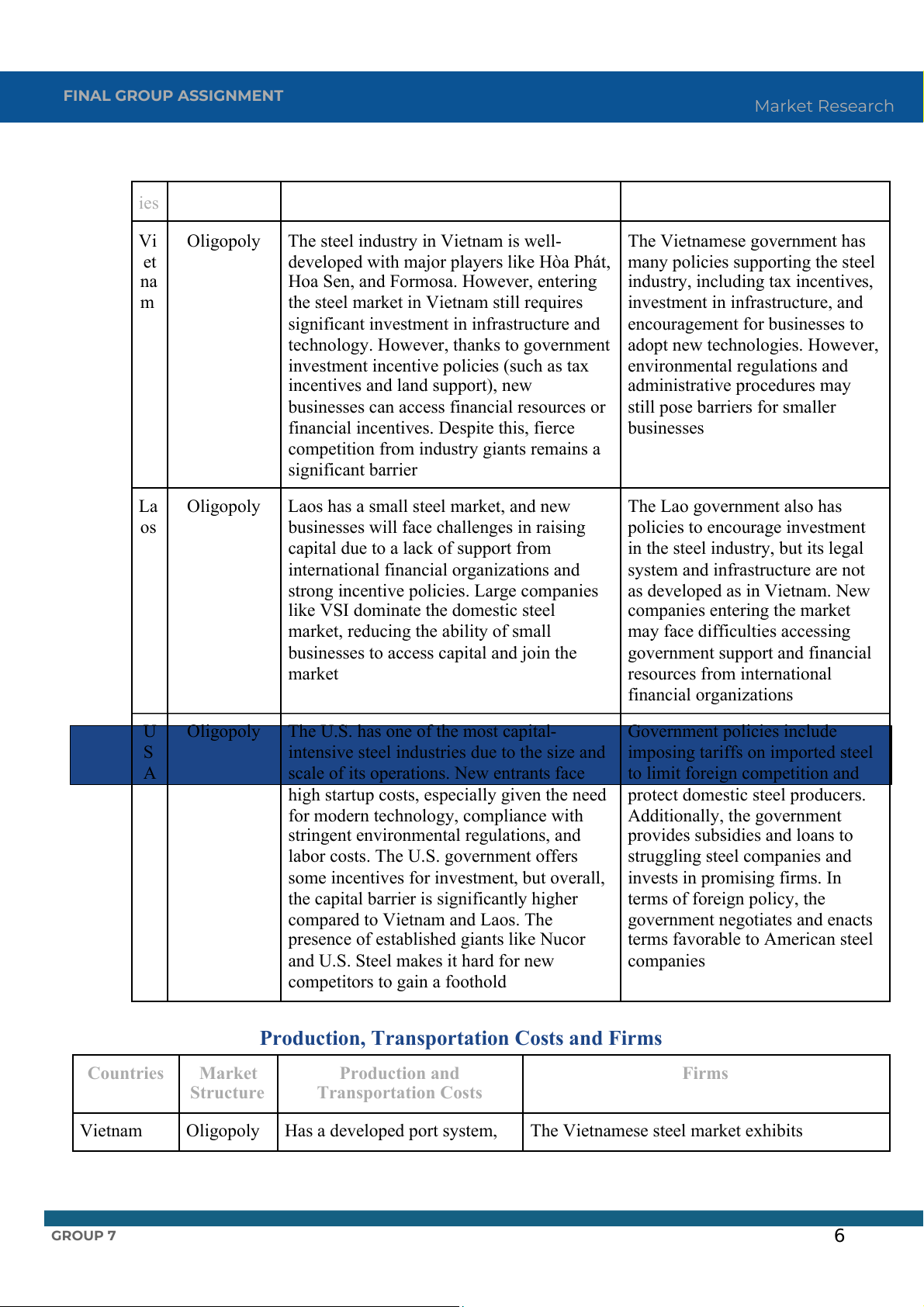

Non-price Competition

Not only in the Vietnamese steel market but

in many other markets as well, competition

occurs not just through pricing but also

through non-price factors such as advertising,

Figure 3: The ratio of advertising costs to

gross profit from sales of Hoa Phat, Hoa Sen

In conclusion, through the analysis of various market structure classification factors, such as

the number of firms, product characteristics, market power, barriers to entry, and non-price

competition, it can be firmly asserted that the structure of the Vietnamese steel market is an Oligopoly.

2. Comparison to other steel markets

Investment Capital And Government Policies and Regulations C Market Investment Capital Government Policies and ou Structure Regulations ntr GROUP 7 5 FINAL GROUP ASSIGNMENT Market Research ies Vi Oligopoly

The steel industry in Vietnam is well- The Vietnamese government has et

developed with major players like Hòa Phát, many policies supporting the steel na

Hoa Sen, and Formosa. However, entering

industry, including tax incentives, m

the steel market in Vietnam still requires

investment in infrastructure, and

significant investment in infrastructure and

encouragement for businesses to

technology. However, thanks to government adopt new technologies. However,

investment incentive policies (such as tax environmental regulations and

incentives and land support), new administrative procedures may

businesses can access financial resources or still pose barriers for smaller

financial incentives. Despite this, fierce businesses

competition from industry giants remains a significant barrier La Oligopoly

Laos has a small steel market, and new The Lao government also has os

businesses will face challenges in raising

policies to encourage investment

capital due to a lack of support from

in the steel industry, but its legal

international financial organizations and

system and infrastructure are not

strong incentive policies. Large companies

as developed as in Vietnam. New

like VSI dominate the domestic steel companies entering the market

market, reducing the ability of small

may face difficulties accessing

businesses to access capital and join the

government support and financial market resources from international financial organizations U Oligopoly

The U.S. has one of the most capital- Government policies include S

intensive steel industries due to the size and imposing tariffs on imported steel A

scale of its operations. New entrants face

to limit foreign competition and

high startup costs, especially given the need protect domestic steel producers.

for modern technology, compliance with Additionally, the government

stringent environmental regulations, and

provides subsidies and loans to

labor costs. The U.S. government offers

struggling steel companies and

some incentives for investment, but overall, invests in promising firms. In

the capital barrier is significantly higher terms of foreign policy, the

compared to Vietnam and Laos. The

government negotiates and enacts

presence of established giants like Nucor

terms favorable to American steel

and U.S. Steel makes it hard for new companies competitors to gain a foothold

Production, Transportation Costs and Firms Countries Market Production and Firms Structure Transportation Costs Vietnam Oligopoly Has a developed port system,

The Vietnamese steel market exhibits GROUP 7 6 FINAL GROUP ASSIGNMENT Market Research which helps reduce

characteristics of an oligopoly due to its high transportation costs for raw

concentration of a few dominant players and materials and finished steel.

significant barriers to entry. Major companies Easy access to raw materials

like Hoa Phat Group (HPG), Nam Kim Steel from neighboring countries

(NKG), and Hoa Sen Group (HSG). Especially, helps steel companies in

Hoa Phat Group accounted for up to 37.31% of Vietnam reduce production

the construction steel market and 24.59% of the

costs and easily scale up their

steel pipe market in 2024, (according to WTO) operations Laos Oligopoly Lacking seaports, they must

Key players in the market, like the Vientiane rely on transport through

Steel Industry (VSI), which began as a joint neighboring countries,

venture, now contribute significantly to

resulting in significantly higher domestic production, meeting approximately transportation costs. This 60% of local steel demand increases the cost of steel

Moreover, foreign investments from companies production in Laos, impacting

like Kunpeng and Jingye have further the ability of domestic

contributed to the development of steelworks in companies to compete against

Laos, indicating an interest in both the local and regional competitors export markets USA Oligopoly

As a vast country, the US faces As of 2023, Nucor led the market with a

significant transportation costs dominant share of 20.7%, followed by U.S. due to long distances and

Steel at 13.7%, and Steel Dynamics at 10.7%.

transit times for raw materials. These companies have a substantial presence in

However, advancements in rail, the market, and their positions are strengthened road, and maritime

by factors like fixed contracts with customers, infrastructure have

growing demand from sectors like automotive significantly reduced

and construction, and government investments transportation times.

in infrastructure( according to Fastmarkets) Additionally, the adoption of advanced technologies has streamlined production processes and lowered costs

II. Factors affecting Demand and Supply

Understanding the factors influencing the supply and demand of steel in Vietnam is crucial to

grasp the industry's dynamics and market behavior. Various internal and external forces, ranging

from economic policies to global trends, have significantly impacted the availability and

consumption of steel. This section delves into the key elements that have shaped supply and

demand in recent years, providing a detailed analysis of their roles and interconnections.

1. Factors Affecting Demand GROUP 7 7 FINAL GROUP ASSIGNMENT Market Research

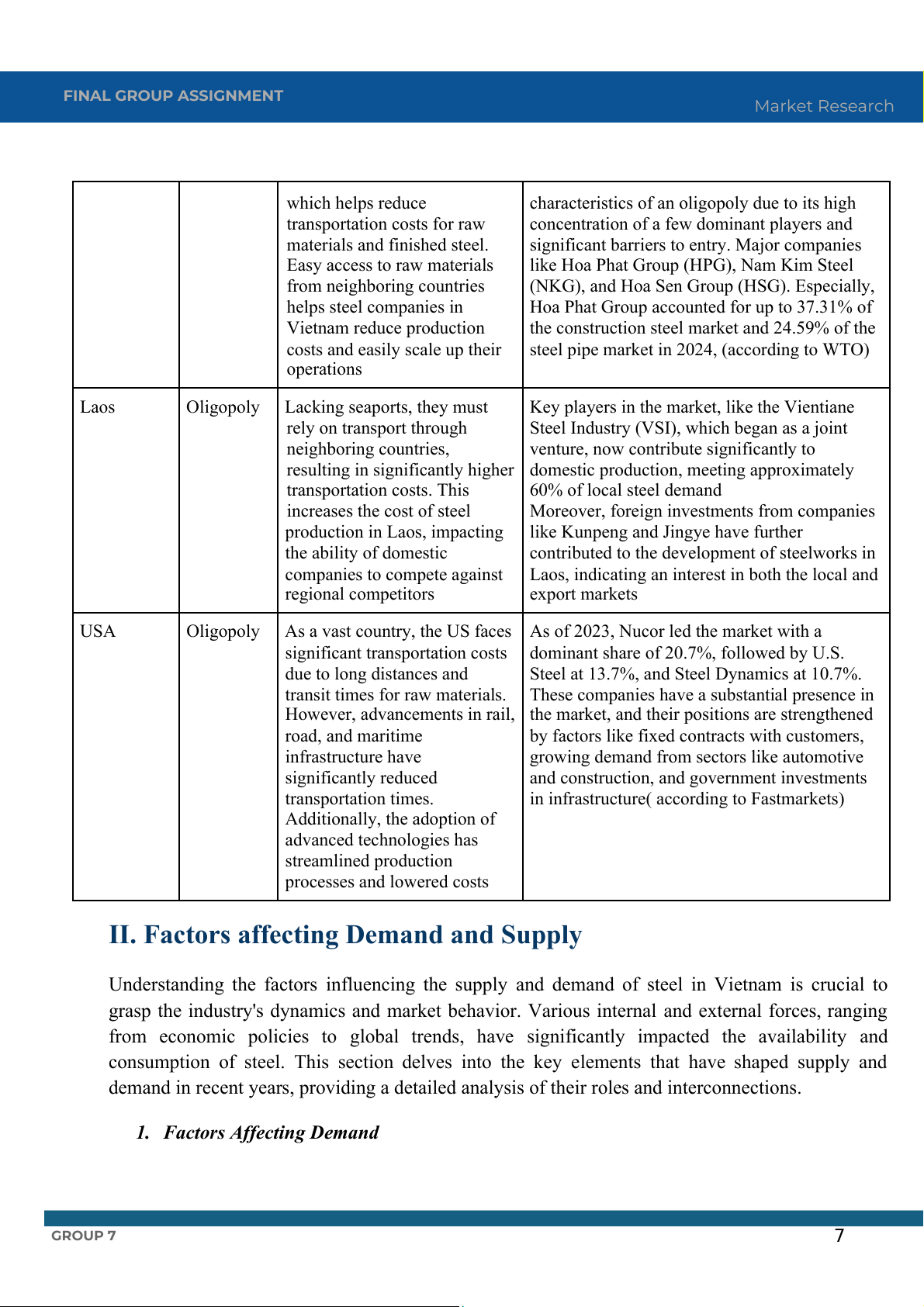

1.1. Economic Growth (GDP)

Economic growth directly impacts steel demand because it fuels construction, manufacturing, and

infrastructure development. In Vietnam, steady GDP growth has boosted steel consumption,

particularly in urbanization and industrial expansion projects.

For example, Vietnam's GDP grew by 8.02% in 2022, one of the highest rates in Southeast Asia.

This growth has driven the need for more roads, bridges, and factories, all requiring large amounts

of steel. According to the Vietnam Steel Association (VSA), domestic steel consumption reached

23 million tons in 2022, up from 18 million tons in 2018, reflecting the economy's expansion.

Figure 1. Vietnam’s GDP per capita (2018-2022) Source: VOV

1.2. Government Spending and Fiscal Policies

The government’s investments in

infrastructure significantly drive steel

demand. Large-scale projects, like highways,

ports, and industrial zones, are major steel

consumers. In recent years, the Vietnamese

government has prioritized infrastructure

development, such as the North-South

Expressway and Long Thanh International

expenditure reached 507.4 trillion dong, Airport.

accounting for 46.6% of the central budget’s

medium-term investment capital allocation

In 2023, the Government promotes plan.

investment in infrastructure projects with the

goal of ensuring economic growth that can

Therefore, construction steel manufacturers

support domestic steel demand, especially

can benefit (Hoa Phat, Formosa, Pomina…) construction steel.

and disbursement of public investment has

accelerated gradually in the fourth quarter of

According to the medium-term public 2022.

investment plan for the 2021-2025 period, the

total planned public investment capital for the

1.3. Real estate and Construction boom

2021-2025 period will reach VND 2.87

million billion, up 43.5% compared to the

Vietnam's rapid urbanization and growing

2016-2020 plan. Traffic projects accounted

real estate sector are critical drivers of steel

demand. The construction industry accounts

for a large proportion when the total GROUP 7 8 FINAL GROUP ASSIGNMENT Market Research

for more than half of the total steel

volumes. Despite these challenges, exports

consumption. Between 2019 and 2021,

increased from 1 million tons in 2010 to

residential and commercial construction grew

around 10 million tons in 2021. When global

significantly, with major projects in Hanoi,

demand is strong, it boosts domestic

Ho Chi Minh City, and Da Nang. In 2021, the

production, but external constraints can

real estate sector's growth rate reached 5.71%,

reduce overall steel consumption in Vietnam.

contributing to increased demand for (Figure 2)

construction steel. The expansion of housing,

high-rise buildings, and industrial parks keeps

1.5. Substitute Materials

the need for steel consistently high.

The availability and cost of alternative

materials like aluminum, wood, and plastic

1.4. Global Market Trends and Exports

influence steel demand. When these

Vietnam’s steel demand is also influenced by

substitutes become expensive or scarce,

global trends. The country has become a

industries may rely more on steel. For

significant steel exporter, particularly within

instance, in 2021, global supply chain

Southeast Asia. However, external factors

disruptions increased the price of construction

such as trade tariffs and protectionist policies

timber, leading to a higher demand for steel affect this market.

as a substitute. This trend is particularly

evident in construction and manufacturing,

For example, in 2019, Vietnam faced anti-

where the versatility and durability of steel

dumping duties from the United States and make it a preferred choice.

the European Union, impacting export

Figure 2. Vietnam's steel export volume and price developments in 2021 GROUP 7 9 FINAL GROUP ASSIGNMENT Market Research

To visualize these complex interactions, supply and demand graphs offer a clear depiction of

market shifts. Each factor—whether related to production constraints or rising infrastructure needs

—has contributed to noticeable shifts in the supply and demand curves over time. The following

graphs illustrate these shifts, showing how external forces and strategic responses have reshaped the Vietnamese steel market.

2. Factors Affecting Supply 2.1. Price

Price is a key determinant of supply in the

affect how price changes translate into supply

steel industry, with direct effects on decisions.

profitability, production decisions, and

overall market supply. Manufacturers adjust

their output based on price changes, the cost

of inputs, and market expectations. In the

Vietnamese steel industry, external factors

like global commodity prices, trade policies,

and local economic conditions significantly GROUP 7 FINAL GROUP ASSIGNMENT Market Research

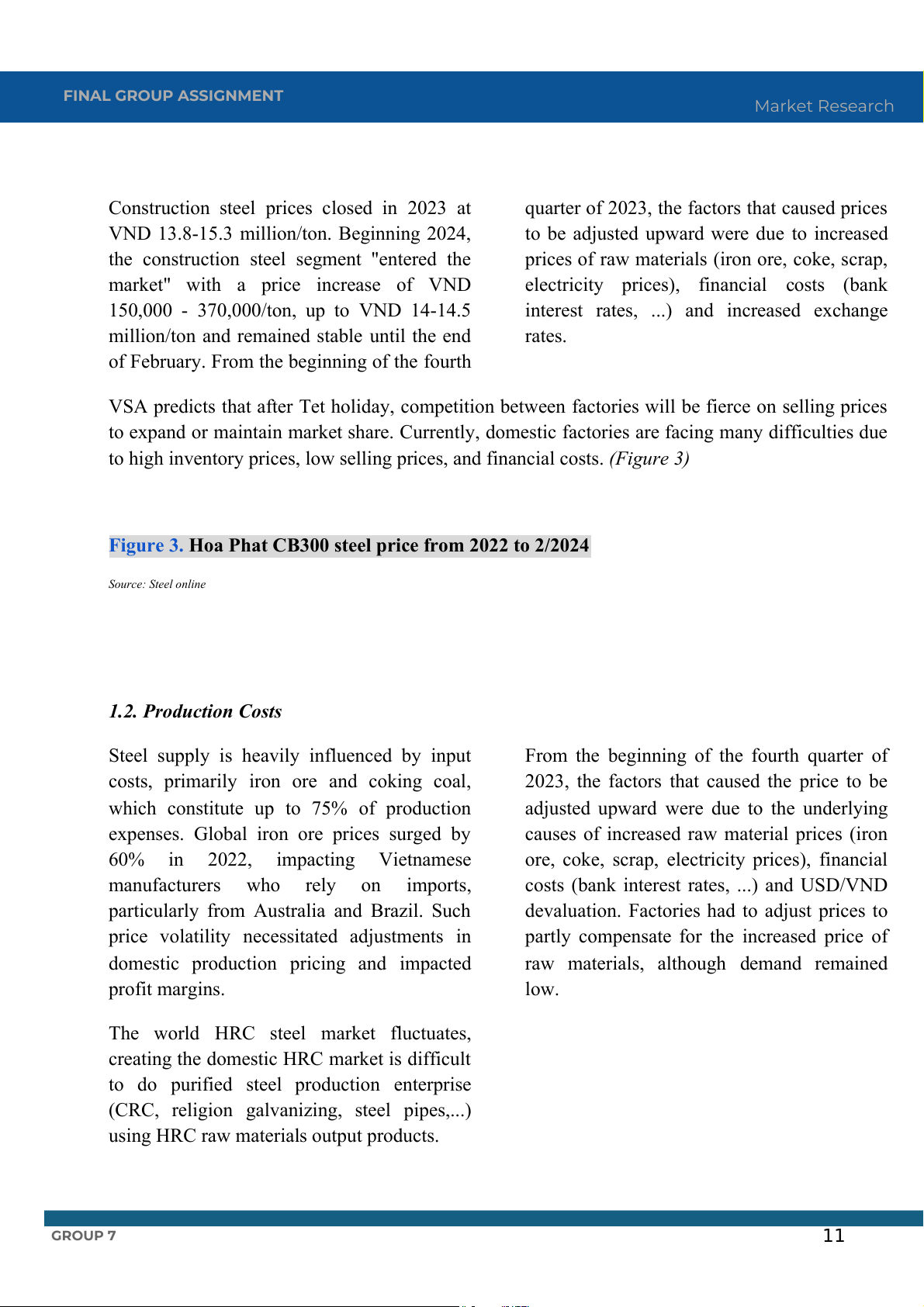

Construction steel prices closed in 2023 at

quarter of 2023, the factors that caused prices

VND 13.8-15.3 million/ton. Beginning 2024,

to be adjusted upward were due to increased

the construction steel segment "entered the

prices of raw materials (iron ore, coke, scrap,

market" with a price increase of VND

electricity prices), financial costs (bank

150,000 - 370,000/ton, up to VND 14-14.5

interest rates, ...) and increased exchange

million/ton and remained stable until the end rates.

of February. From the beginning of the fourth

VSA predicts that after Tet holiday, competition between factories will be fierce on selling prices

to expand or maintain market share. Currently, domestic factories are facing many difficulties due

to high inventory prices, low selling prices, and financial costs. (Figure 3)

Figure 3. Hoa Phat CB300 steel price from 2022 to 2/2024 Source: Steel online

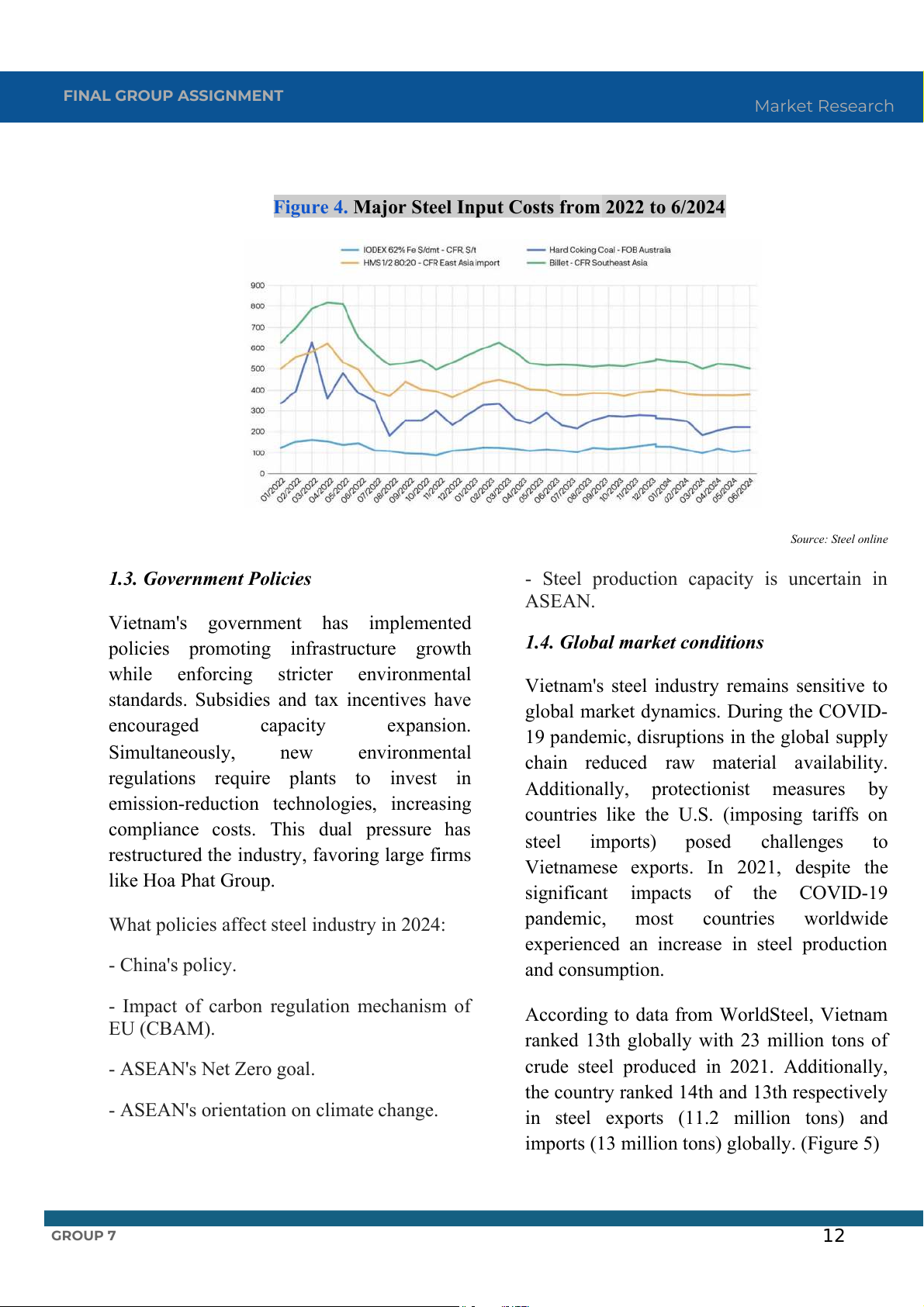

1.2. Production Costs

Steel supply is heavily influenced by input

From the beginning of the fourth quarter of

costs, primarily iron ore and coking coal,

2023, the factors that caused the price to be

which constitute up to 75% of production

adjusted upward were due to the underlying

expenses. Global iron ore prices surged by

causes of increased raw material prices (iron

60% in 2022, impacting Vietnamese

ore, coke, scrap, electricity prices), financial

manufacturers who rely on imports,

costs (bank interest rates, ...) and USD/VND

particularly from Australia and Brazil. Such

devaluation. Factories had to adjust prices to

price volatility necessitated adjustments in

partly compensate for the increased price of

domestic production pricing and impacted

raw materials, although demand remained profit margins. low.

The world HRC steel market fluctuates,

creating the domestic HRC market is difficult

to do purified steel production enterprise

(CRC, religion galvanizing, steel pipes,...)

using HRC raw materials output products. GROUP 7 11 FINAL GROUP ASSIGNMENT Market Research

Figure 4. Major Steel Input Costs from 2022 to 6/2024 Source: Steel online

1.3. Government Policies

- Steel production capacity is uncertain in ASEAN.

Vietnam's government has implemented

policies promoting infrastructure growth

1.4. Global market conditions

while enforcing stricter environmental

Vietnam's steel industry remains sensitive to

standards. Subsidies and tax incentives have

global market dynamics. During the COVID- encouraged capacity expansion.

19 pandemic, disruptions in the global supply

Simultaneously, new environmental

chain reduced raw material availability.

regulations require plants to invest in

Additionally, protectionist measures by

emission-reduction technologies, increasing

countries like the U.S. (imposing tariffs on

compliance costs. This dual pressure has

steel imports) posed challenges to

restructured the industry, favoring large firms

Vietnamese exports. In 2021, despite the like Hoa Phat Group.

significant impacts of the COVID-19

What policies affect steel industry in 2024:

pandemic, most countries worldwide

experienced an increase in steel production - China's policy. and consumption.

- Impact of carbon regulation mechanism of

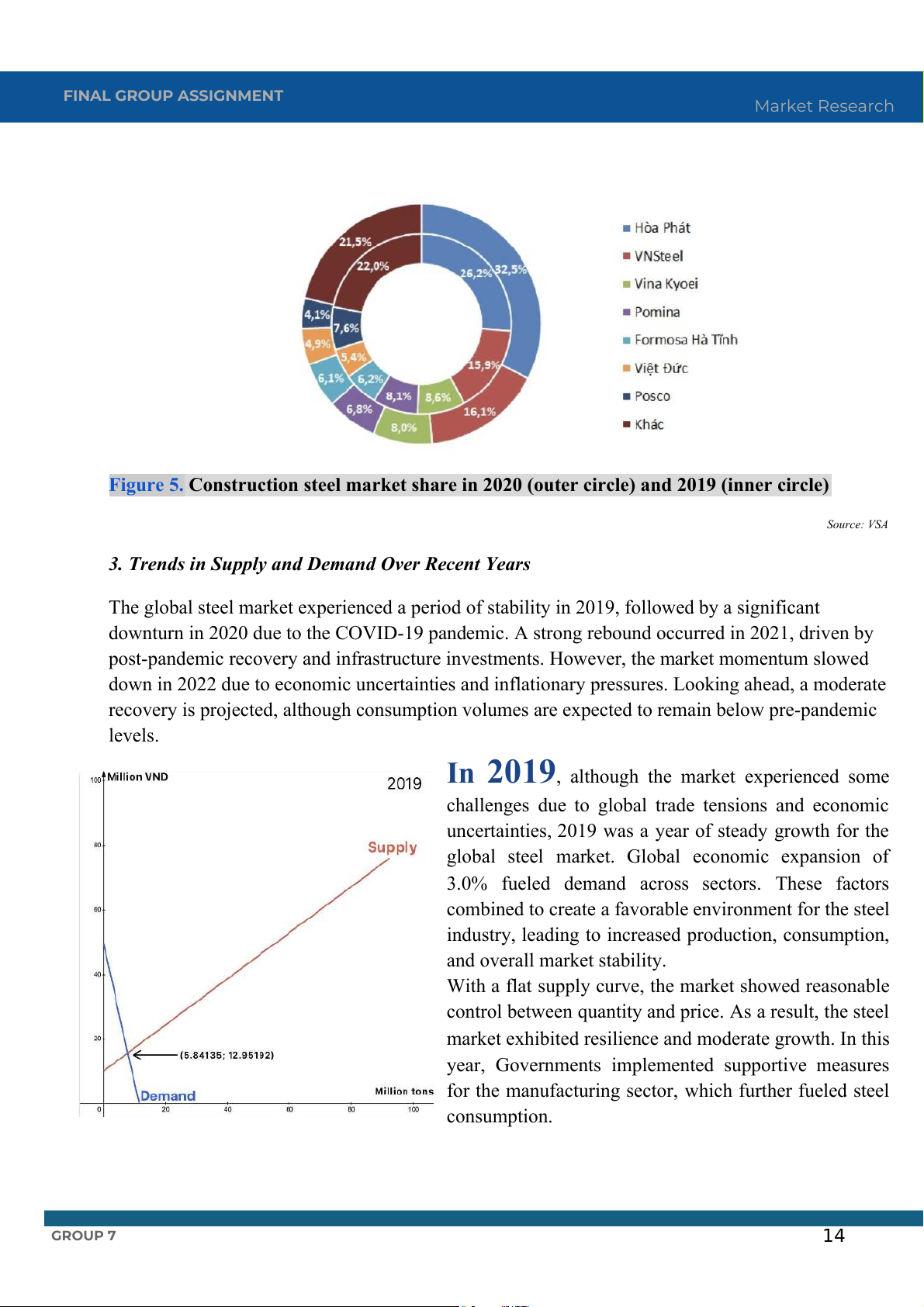

According to data from WorldSteel, Vietnam EU (CBAM).

ranked 13th globally with 23 million tons of - ASEAN's Net Zero goal.

crude steel produced in 2021. Additionally,

the country ranked 14th and 13th respectively

- ASEAN's orientation on climate change.

in steel exports (11.2 million tons) and

imports (13 million tons) globally. (Figure 5) GROUP 7 12 FINAL GROUP ASSIGNMENT Market Research

Figure 5. Top 20 steel-producing countries 2021 (million tones) Source: Internet

1.5. Number of producers

When there are more producers, the overall

entry of too many producers can also lead to

market supply increases because each

overcapacity, where supply exceeds demand,

company contributes to the total steel output.

causing prices to drop and reducing

In Vietnam, the growth of private and

profitability for manufacturers.

foreign-invested steel enterprises has

expanded production capacity. Major players

Conversely, a decrease in the number of

such as Hoa Phat Group, Formosa Ha Tinh

producers—due to business closures,

Steel, and Vietnam Steel Corporation have

mergers, or government regulations—can

continuously invested in new facilities,

limit the overall supply. For example, smaller

modern technologies, and infrastructure,

steel companies might struggle with rising

leading to higher output levels.

production costs or stringent environmental

policies, forcing them to shut down or reduce

This expansion creates a competitive

output. This can lead to supply shortages and

environment that encourages efficiency and

higher prices, especially during periods of

innovation, potentially lowering costs and high demand.

improving product quality. However, the GROUP 7 13 FINAL GROUP ASSIGNMENT Market Research

Figure 5. Construction steel market share in 2020 (outer circle) and 2019 (inner circle) Source: VSA

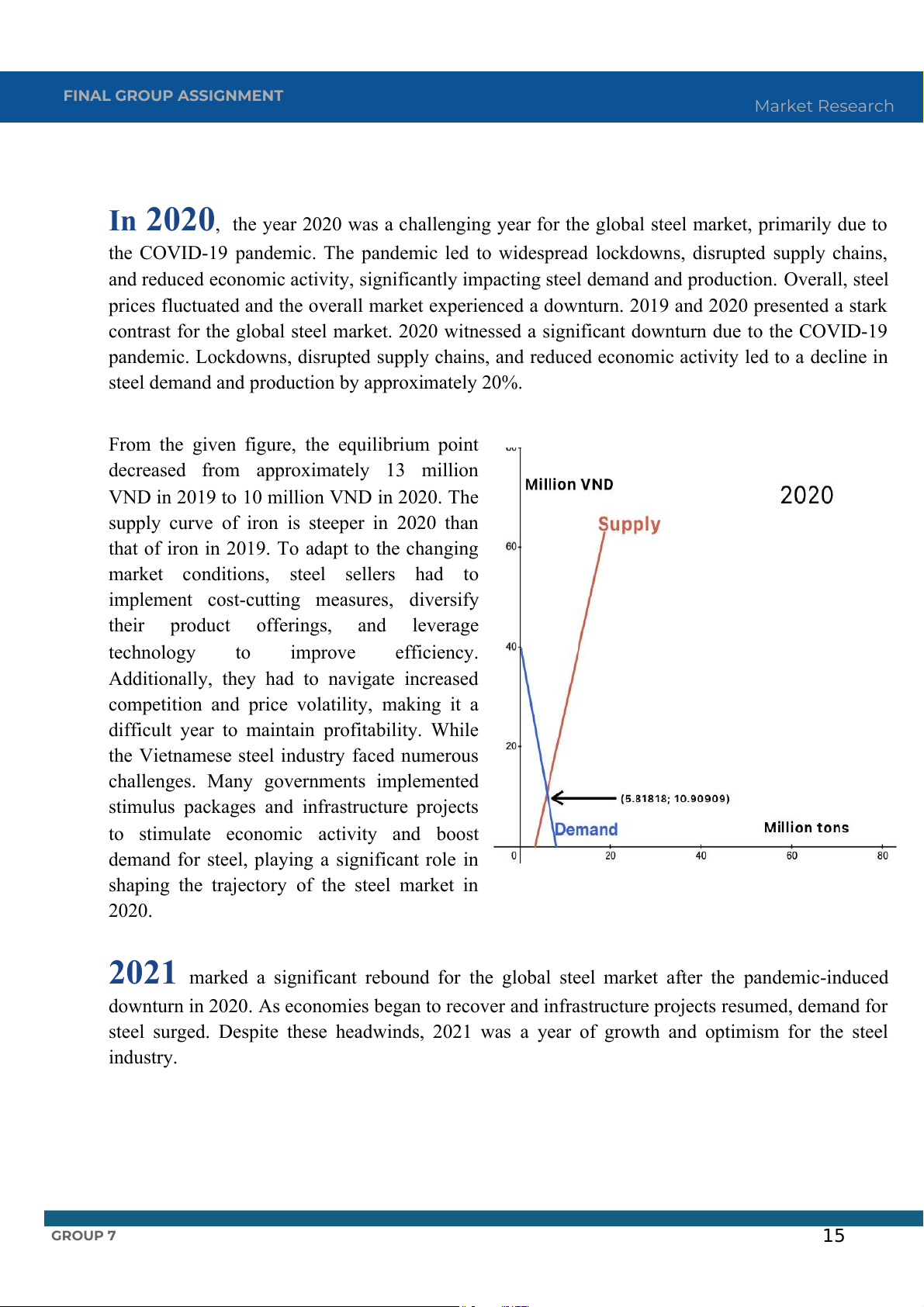

3. Trends in Supply and Demand Over Recent Years

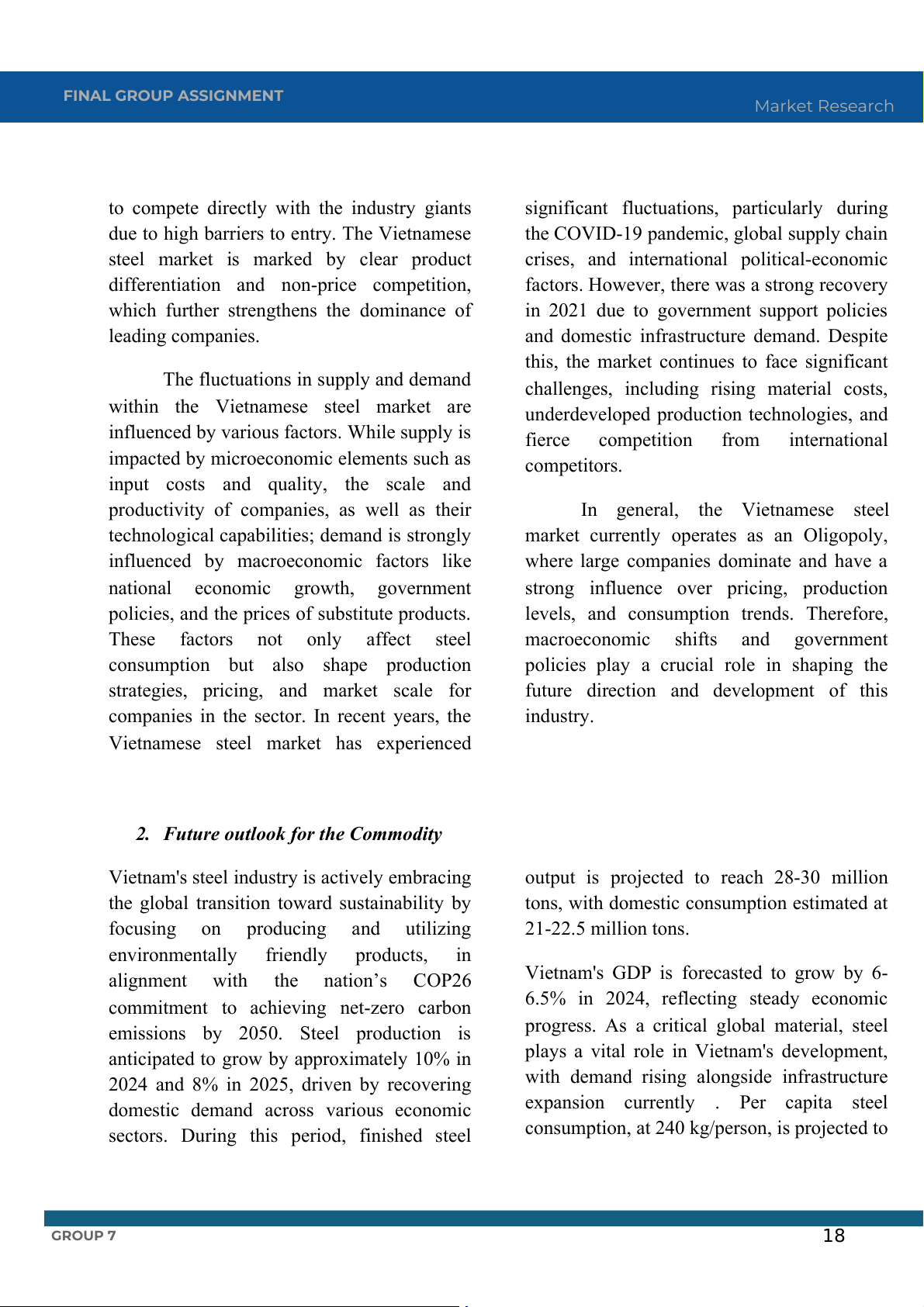

The global steel market experienced a period of stability in 2019, followed by a significant

downturn in 2020 due to the COVID-19 pandemic. A strong rebound occurred in 2021, driven by

post-pandemic recovery and infrastructure investments. However, the market momentum slowed

down in 2022 due to economic uncertainties and inflationary pressures. Looking ahead, a moderate

recovery is projected, although consumption volumes are expected to remain below pre-pandemic levels.

In 2019, although the market experienced some

challenges due to global trade tensions and economic

uncertainties, 2019 was a year of steady growth for the

global steel market. Global economic expansion of

3.0% fueled demand across sectors. These factors

combined to create a favorable environment for the steel

industry, leading to increased production, consumption, and overall market stability.

With a flat supply curve, the market showed reasonable

control between quantity and price. As a result, the steel

market exhibited resilience and moderate growth. In this

year, Governments implemented supportive measures

for the manufacturing sector, which further fueled steel consumption. GROUP 7 14 FINAL GROUP ASSIGNMENT Market Research

In 2020, the year 2020 was a challenging year for the global steel market, primarily due to

the COVID-19 pandemic. The pandemic led to widespread lockdowns, disrupted supply chains,

and reduced economic activity, significantly impacting steel demand and production. Overall, steel

prices fluctuated and the overall market experienced a downturn. 2019 and 2020 presented a stark

contrast for the global steel market. 2020 witnessed a significant downturn due to the COVID-19

pandemic. Lockdowns, disrupted supply chains, and reduced economic activity led to a decline in

steel demand and production by approximately 20%.

From the given figure, the equilibrium point

decreased from approximately 13 million

VND in 2019 to 10 million VND in 2020. The

supply curve of iron is steeper in 2020 than

that of iron in 2019. To adapt to the changing

market conditions, steel sellers had to

implement cost-cutting measures, diversify

their product offerings, and leverage

technology to improve efficiency.

Additionally, they had to navigate increased

competition and price volatility, making it a

difficult year to maintain profitability. While

the Vietnamese steel industry faced numerous

challenges. Many governments implemented

stimulus packages and infrastructure projects

to stimulate economic activity and boost

demand for steel, playing a significant role in

shaping the trajectory of the steel market in 2020.

2021 marked a significant rebound for the global steel market after the pandemic-induced

downturn in 2020. As economies began to recover and infrastructure projects resumed, demand for

steel surged. Despite these headwinds, 2021 was a year of growth and optimism for the steel industry. GROUP 7 15 FINAL GROUP ASSIGNMENT Market Research

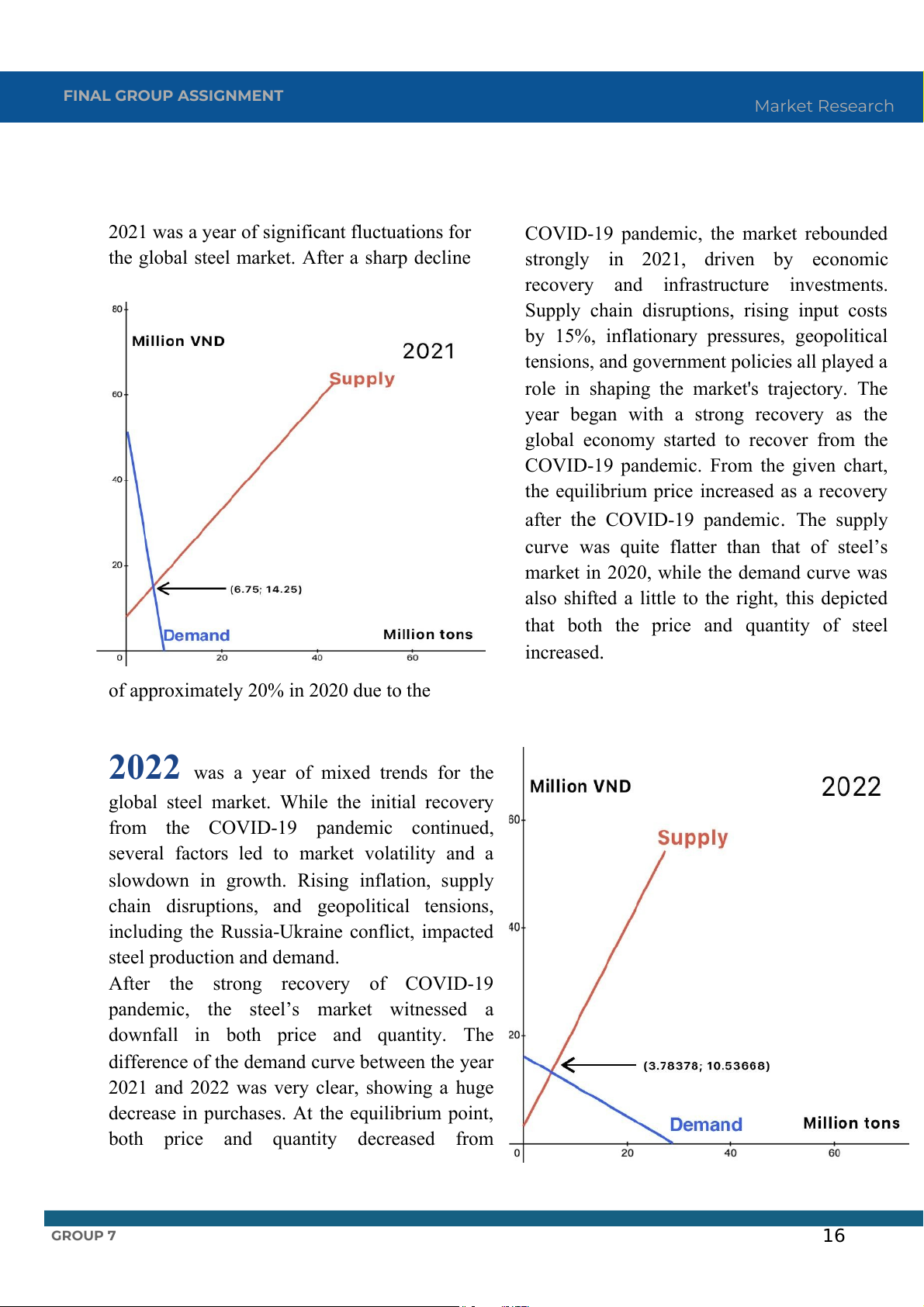

2021 was a year of significant fluctuations for

COVID-19 pandemic, the market rebounded

the global steel market. After a sharp decline

strongly in 2021, driven by economic

recovery and infrastructure investments.

Supply chain disruptions, rising input costs

by 15%, inflationary pressures, geopolitical

tensions, and government policies all played a

role in shaping the market's trajectory. The

year began with a strong recovery as the

global economy started to recover from the

COVID-19 pandemic. From the given chart,

the equilibrium price increased as a recovery after the COVID-19 pandemic. The supply

curve was quite flatter than that of steel’s

market in 2020, while the demand curve was

also shifted a little to the right, this depicted

that both the price and quantity of steel increased.

of approximately 20% in 2020 due to the

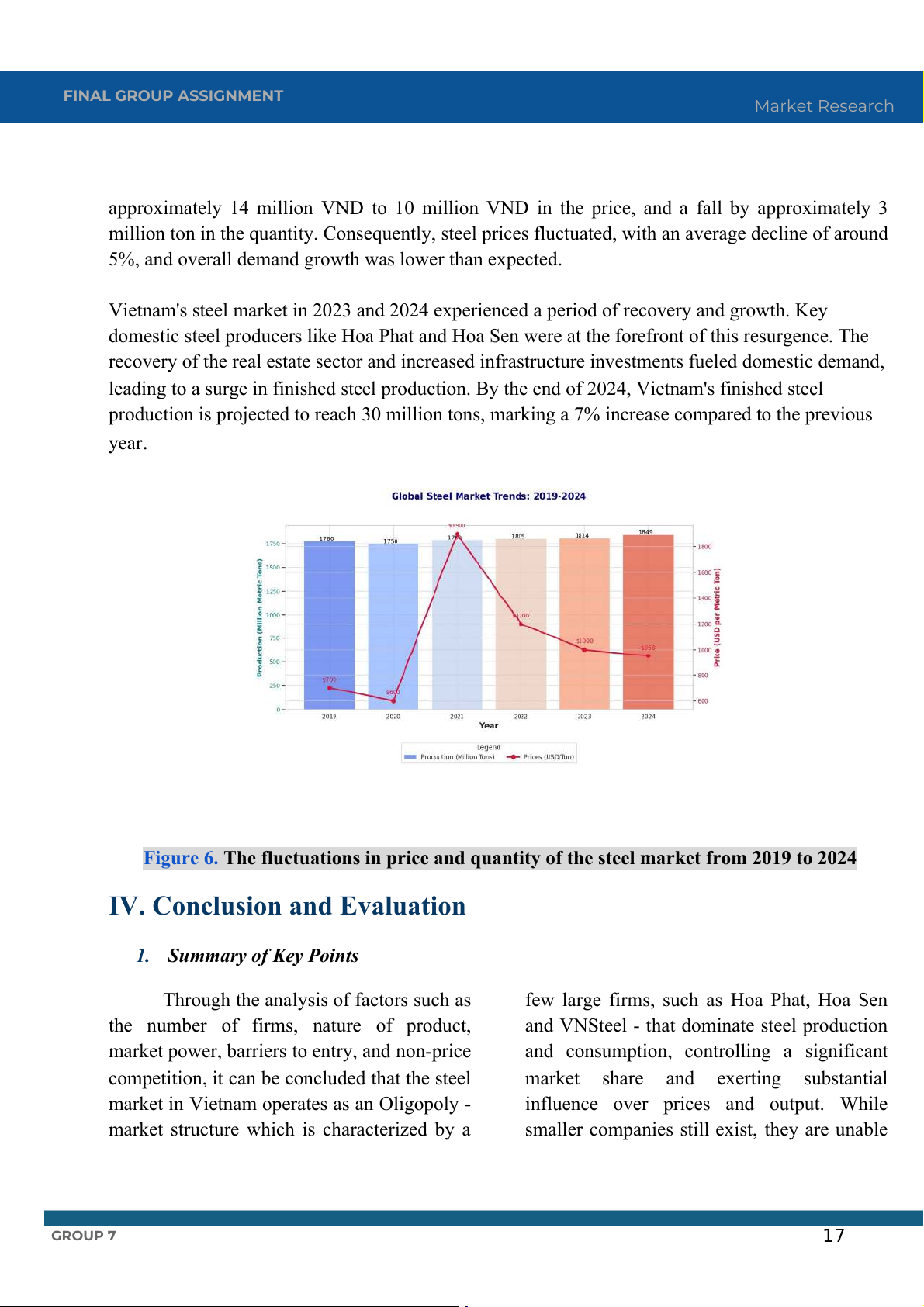

2022 was a year of mixed trends for the

global steel market. While the initial recovery

from the COVID-19 pandemic continued,

several factors led to market volatility and a

slowdown in growth. Rising inflation, supply

chain disruptions, and geopolitical tensions,

including the Russia-Ukraine conflict, impacted steel production and demand.

After the strong recovery of COVID-19

pandemic, the steel’s market witnessed a

downfall in both price and quantity. The

difference of the demand curve between the year

2021 and 2022 was very clear, showing a huge

decrease in purchases. At the equilibrium point,

both price and quantity decreased from GROUP 7 16 FINAL GROUP ASSIGNMENT Market Research

approximately 14 million VND to 10 million VND in the price, and a fall by approximately 3

million ton in the quantity. Consequently, steel prices fluctuated, with an average decline of around

5%, and overall demand growth was lower than expected.

Vietnam's steel market in 2023 and 2024 experienced a period of recovery and growth. Key

domestic steel producers like Hoa Phat and Hoa Sen were at the forefront of this resurgence. The

recovery of the real estate sector and increased infrastructure investments fueled domestic demand,

leading to a surge in finished steel production. By the end of 2024, Vietnam's finished steel

production is projected to reach 30 million tons, marking a 7% increase compared to the previous year.

Figure 6. The fluctuations in price and quantity of the steel market from 2019 to 2024

IV. Conclusion and Evaluation

1. Summary of Key Points

Through the analysis of factors such as

few large firms, such as Hoa Phat, Hoa Sen

the number of firms, nature of product,

and VNSteel - that dominate steel production

market power, barriers to entry, and non-price

and consumption, controlling a significant

competition, it can be concluded that the steel

market share and exerting substantial

market in Vietnam operates as an Oligopoly -

influence over prices and output. While

market structure which is characterized by a

smaller companies still exist, they are unable GROUP 7 17 FINAL GROUP ASSIGNMENT Market Research

to compete directly with the industry giants

significant fluctuations, particularly during

due to high barriers to entry. The Vietnamese

the COVID-19 pandemic, global supply chain

steel market is marked by clear product

crises, and international political-economic

differentiation and non-price competition,

factors. However, there was a strong recovery

which further strengthens the dominance of

in 2021 due to government support policies leading companies.

and domestic infrastructure demand. Despite

this, the market continues to face significant

The fluctuations in supply and demand

challenges, including rising material costs,

within the Vietnamese steel market are

underdeveloped production technologies, and

influenced by various factors. While supply is

fierce competition from international

impacted by microeconomic elements such as competitors.

input costs and quality, the scale and

productivity of companies, as well as their

In general, the Vietnamese steel

technological capabilities; demand is strongly

market currently operates as an Oligopoly,

influenced by macroeconomic factors like

where large companies dominate and have a

national economic growth, government

strong influence over pricing, production

policies, and the prices of substitute products.

levels, and consumption trends. Therefore,

These factors not only affect steel

macroeconomic shifts and government

consumption but also shape production

policies play a crucial role in shaping the

strategies, pricing, and market scale for

future direction and development of this

companies in the sector. In recent years, the industry.

Vietnamese steel market has experienced

2. Future outlook for the Commodity

Vietnam's steel industry is actively embracing

output is projected to reach 28-30 million

the global transition toward sustainability by

tons, with domestic consumption estimated at

focusing on producing and utilizing 21-22.5 million tons.

environmentally friendly products, in

alignment with the nation’s COP26

Vietnam's GDP is forecasted to grow by 6-

commitment to achieving net-zero carbon

6.5% in 2024, reflecting steady economic

emissions by 2050. Steel production is

progress. As a critical global material, steel

anticipated to grow by approximately 10% in

plays a vital role in Vietnam's development,

2024 and 8% in 2025, driven by recovering

with demand rising alongside infrastructure

domestic demand across various economic

expansion currently . Per capita steel

sectors. During this period, finished steel

consumption, at 240 kg/person, is projected to GROUP 7 18 FINAL GROUP ASSIGNMENT Market Research

reach 290-300 kg/person by 2030. The

enterprises is reducing production costs and

country’s steel production not only satisfies

enhancing competitiveness in global markets.

domestic needs but also supports exports to

Simultaneously, the global steel industry is

over 100 countries. Additionally, the adoption

striving to meet climate goals, including

of modern, efficient technologies by

limiting global temperature increases to 1.5°C

According to SSI Research, Vietnam's steel

projected to remain strong, supported by

industry, despite facing a significant decline

favorable global demand, widened price

in domestic consumption in 2023 due to

advantages, and stricter European import

macroeconomic and real estate challenges, is

controls on Russian steel. Vietnam's

expected to recover in 2024 with a 6%

competitiveness in steel exports has remained

increase in sales and nearly 7% growth in

robust, even amid a sharp rise in Chinese

domestic demand. Export volumes are exports. GROUP 7 19