Preview text:

NATIONAL ECONOMICS UNIVERSITY NEU BUSINESS SCHOOL ---o0o--- MICROECONOMICS FINAL GROUP PROJECT Topic

THE BOTTLED WATER INDUSTRY IN VIETNAM

Lecturer: Dr. Tran Thi Hong Viet Group: 7 Class: E-BBA 15.1 Members: Name Student CODE Than Thuy Duong 11230042 Le Manh Hung 11230072 Phan Cat Vu 11230169 Tran Ngoc An Duyen 11230041 Dinh Xuan Duc Anh 11230006 Ha Noi – 5/2024

Table of Contents

INTRODUCTION............................................................................................................ 3 I.

Bottled water industry overview:.............................................................................4 1.

History:................................................................................................................... 4 2.

Roles and challenges:.............................................................................................4 3.

Overview of bottled water industry in Vietnam:.................................................4

II. Bottled water’ market............................................................................................... 5 1.

Type of market: Oligopoly competition................................................................5 2.

Market structure:...................................................................................................5 2.1.

Numbers of firms:...........................................................................................5 2.2.

Nature of products:......................................................................................... 6 2.3.

Barriers of entry:............................................................................................. 7 2.4.

Market power:................................................................................................. 8 2.5.

Non – price competition (advertising):..........................................................9

III. Supply and demand................................................................................................... 9 1.

Supply..................................................................................................................... 9 1.1.

Supply in Vietnam:..........................................................................................9 1.2.

Factors that have affected the supply of bottled water:..............................11 2.

Demand................................................................................................................. 13 2.1.

Demand in Vietnam:......................................................................................13 2.2.

Factors that have affected the demand of bottled water:...........................14

IV. Problems and Government Intervention...............................................................15 1.

Lack of Regulation:.............................................................................................. 16 2.

Environmental Impact:........................................................................................16 3.

Market Competition:...........................................................................................16

CONCLUSION............................................................................................................... 17

REFERENCE RESOURCE.......................................................................................... 17 INTRODUCTION

Bottled water is packaged drinking water that is usually sold in plastic or glass

bottles. The Vietnam bottled water market is segmented on the basis of product type,

which includes still water and carbonated water. On the basis of distribution channel, the

market is segmented into supermarkets/hypermarkets, convenience stores, home and

office delivery, trade, and others.

Rapid urbanization in Vietnam has led to changing lifestyles and consumption

patterns. As urban areas grow, people are adopting busier routines and seeking convenient

hydration options. Bottled water's portability and availability cater to the on-the-go needs

of urban dwellers. Moreover, Vietnam's booming tourism industry plays a pivotal role in

driving the bottled water market. Tourists, both domestic and international, prioritize safe

and reliable drinking water. Bottled water offers a trustworthy option for staying hydrated

while exploring the country's attractions.

The country's economic progress has translated into higher disposable incomes for a

significant portion of the population. As a result, more consumers can afford bottled

water, which was once considered a luxury. This economic growth has expanded the

market's consumer base. Furthermore, the convenience factor cannot be overstated in the

bottled water market's growth. In a fast-paced world, bottled water offers an easily

accessible solution for staying hydrated without the need for preparation or refrigeration.

It's an ideal choice for various settings, from workplaces to gyms and beyond. I.

Bottled water industry overview: 1. History:

The roots of the bottled water industry in the US trace back to 1976 when Perrier, a

French brand, made its debut. Back then, the concept of bottled water was relatively

novel, with larger bottles mainly found in office settings or cafes. However, Perrier

revolutionized the scene by introducing smaller glass bottles, thus pioneering the

individual drink category. This move coincided with a time when soft drinks, beer, wine,

and fruit juices dominated the beverage landscape. Perrier swiftly emerged as the

healthier alternative, capturing consumer attention and preference.

2. Roles and challenges: Roles:

Bottled water plays several crucial roles in modern society. Firstly, it offers convenience

and safety, especially in areas where tap water quality is questionable. Moreover, it aligns

with the burgeoning trend of healthy living, positioning itself as a staple in the pursuit of

a wholesome lifestyle. In regions plagued by water quality issues, bottled water serves as

a reliable source of clean drinking water. Additionally, bottled water brands contribute to

tourism, as visitors often seek to sample local specialty waters, thus becoming integral to cultural experiences. Challenges:

However, the industry faces its fair share of challenges. Fierce competition, both

domestically and internationally, presents a constant hurdle for bottled water brands in

Vietnam. Quality management remains paramount, demanding stringent control measures

to ensure product safety and hygiene standards. Environmental concerns loom large,

stemming from the proliferation of plastic bottles and the subsequent challenges in waste

management. Moreover, the cost of production poses a significant challenge, potentially

impacting pricing strategies and consumer accessibility.

3. Overview of bottled water industry in Vietnam: Industry Development:

The bottled water sector in Vietnam is undergoing rapid expansion, mirroring shifts in

consumer preferences. This growth is underscored by a diverse array of products, ranging

from mineral water to carbonated drinks and fruit juices, catering to varied tastes and preferences. Market and Competition:

Competition within the Vietnamese bottled water market has intensified, driven by the

emergence of numerous local and international brands. The influx of international players

has injected diversity into the market, offering consumers a wide selection of options. Challenges:

However, amidst the growth, challenges persist. Quality management remains a primary

concern, necessitating continuous efforts to uphold food safety standards and water

quality. Environmental sustainability also looms large, with the escalating use of plastic

bottles exacerbating pollution and waste management issues.

Trends and Opportunities:

Despite challenges, opportunities abound in the bottled water industry. Heightened health

consciousness among consumers presents an avenue for products with enhanced

nutritional value. Moreover, there's scope for innovation through the development of new

bottled water variants, catering to evolving consumer preferences and driving industry growth. II. Bottled water’ market

1. Type of market: Oligopoly competition 1.1. What is Oligopoly?

An oligopoly refers to a market structure characterized by the dominance of a small

number of large firms. This dominance is often measured using concentration ratios,

which gauge the percentage of total industry sales attributed to a select number of the

largest companies within the sector. These firms operate in an environment of

interdependence, meaning that they closely consider the potential responses of rivals

when making business decisions. Significant barriers to entry, such as economies of scale,

collusion strategies, and mergers, hinder new competitors from entering the market.

Products within an oligopoly may be either differentiated or undifferentiated, and

imperfect information among consumers and firms further complicates market dynamics.

1.2. Why bottled water industry is an oligopoly market?

The bottled water industry is commonly characterized as an oligopoly due to the

dominance of a few major companies like Nestlé, PepsiCo, and Coca-Cola, whose brands

such as La Vie, Aquafina, and Dasani hold significant market share. These firms operate

in an interdependent environment, where decisions made by one company influence

others, and product differentiation through factors like water source, package... and

marketing strategies contribute to the competitive landscape within the market. Below is

a more detailed explanation of “ Why the bottled water industry is an oligopoly market?” through Market Structure 2. Market structure: 2.1. Numbers of firms:

Several major companies control the bottled purified water market:

- Pepsi Co: PepsiCo Corporation is currently leading the bottled beverage market in

Vietnam, particularly with its Aquafina brand

- Nestlé: Nestle is known for food and nutrition products, and it operates in the

Vietnamese market with many various products. Especially La Vie

- Coca-Cola: Coca-Cola is a renowned beverage conglomerate worldwide, with

numerous different beverage brands under its umbrella. In Vietnam, the well-known Dasani

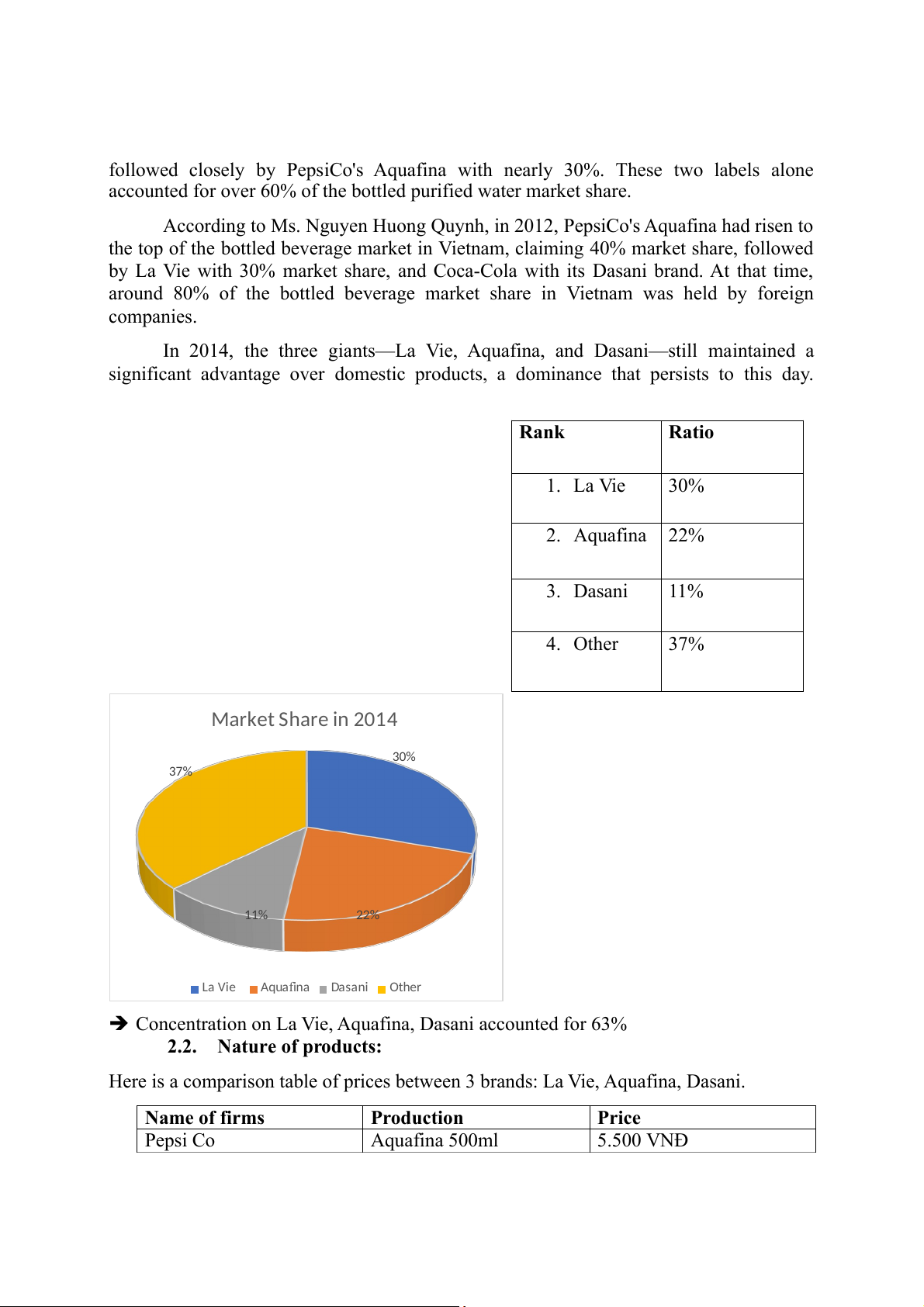

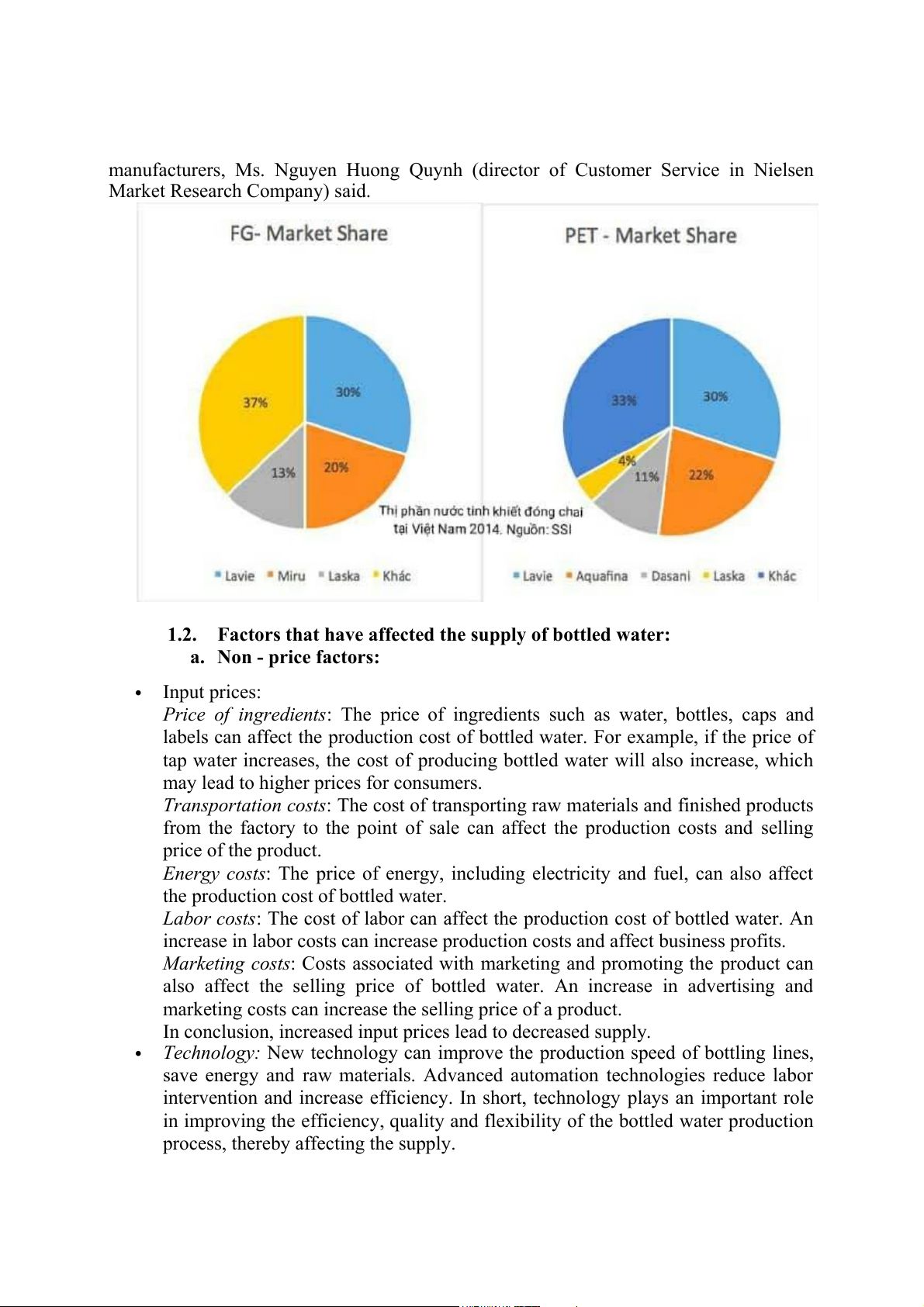

In 2009, Nielsen Vietnam released a market survey report on bottled purified water

that drew significant attention, with the Lavie brand capturing 31% market share,

followed closely by PepsiCo's Aquafina with nearly 30%. These two labels alone

accounted for over 60% of the bottled purified water market share.

According to Ms. Nguyen Huong Quynh, in 2012, PepsiCo's Aquafina had risen to

the top of the bottled beverage market in Vietnam, claiming 40% market share, followed

by La Vie with 30% market share, and Coca-Cola with its Dasani brand. At that time,

around 80% of the bottled beverage market share in Vietnam was held by foreign companies.

In 2014, the three giants—La Vie, Aquafina, and Dasani—still maintained a

significant advantage over domestic products, a dominance that persists to this day. Rank Ratio 1. La Vie 30% 2. Aquafina 22% 3. Dasani 11% 4. Other 37% Market Share in 2014 30% 37% 11% 22% La Vie Aquafina Dasani Other

Concentration on La Vie, Aquafina, Dasani accounted for 63% 2.2. Nature of products:

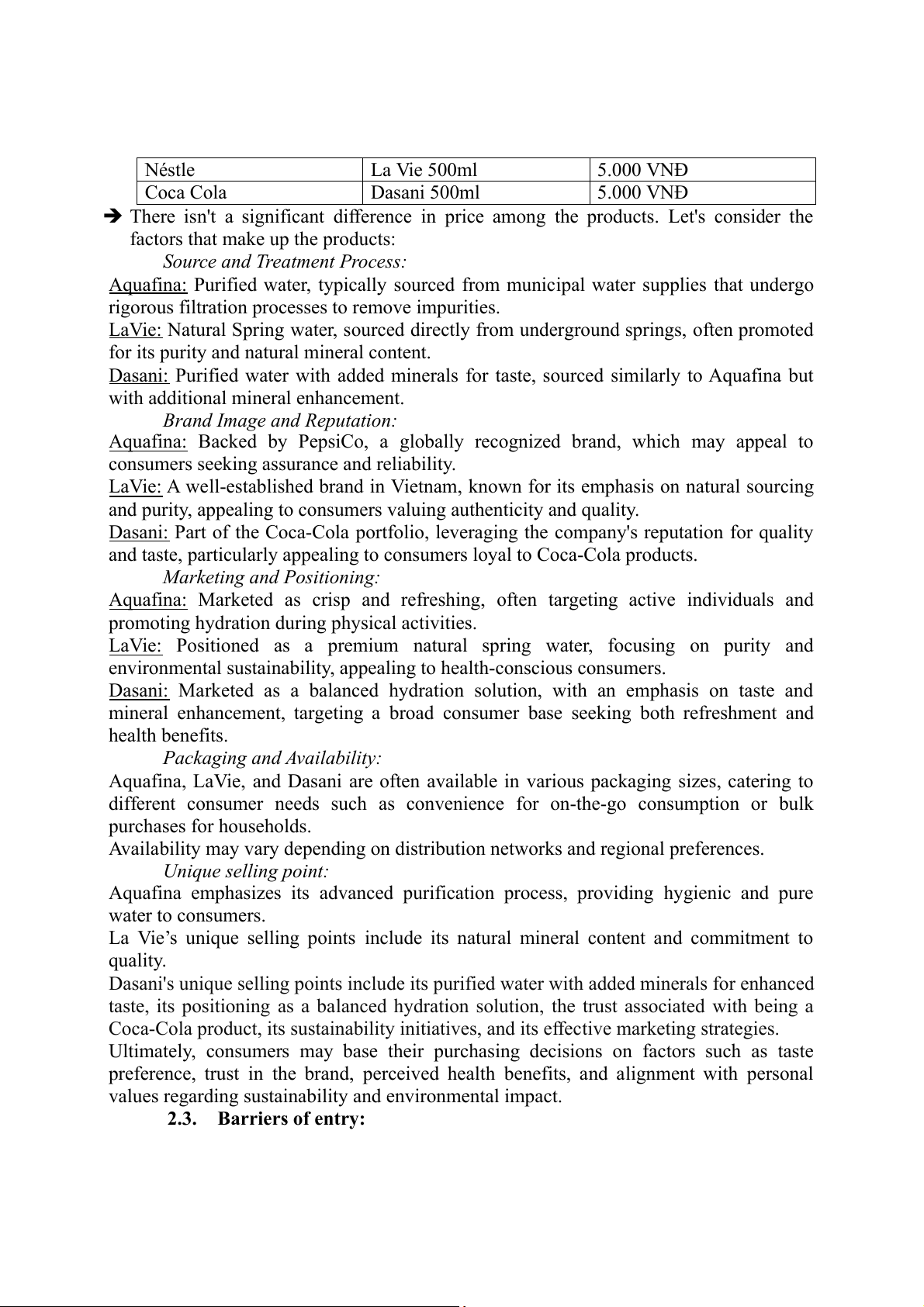

Here is a comparison table of prices between 3 brands: La Vie, Aquafina, Dasani. Name of firms Production Price Pepsi Co Aquafina 500ml 5.500 VNĐ Néstle La Vie 500ml 5.000 VNĐ Coca Cola Dasani 500ml 5.000 VNĐ

There isn't a significant difference in price among the products. Let's consider the

factors that make up the products:

Source and Treatment Process:

Aquafina: Purified water, typically sourced from municipal water supplies that undergo

rigorous filtration processes to remove impurities.

LaVie: Natural Spring water, sourced directly from underground springs, often promoted

for its purity and natural mineral content.

Dasani: Purified water with added minerals for taste, sourced similarly to Aquafina but

with additional mineral enhancement.

Brand Image and Reputation:

Aquafina: Backed by PepsiCo, a globally recognized brand, which may appeal to

consumers seeking assurance and reliability.

LaVie: A well-established brand in Vietnam, known for its emphasis on natural sourcing

and purity, appealing to consumers valuing authenticity and quality.

Dasani: Part of the Coca-Cola portfolio, leveraging the company's reputation for quality

and taste, particularly appealing to consumers loyal to Coca-Cola products.

Marketing and Positioning:

Aquafina: Marketed as crisp and refreshing, often targeting active individuals and

promoting hydration during physical activities.

LaVie: Positioned as a premium natural spring water, focusing on purity and

environmental sustainability, appealing to health-conscious consumers.

Dasani: Marketed as a balanced hydration solution, with an emphasis on taste and

mineral enhancement, targeting a broad consumer base seeking both refreshment and health benefits.

Packaging and Availability:

Aquafina, LaVie, and Dasani are often available in various packaging sizes, catering to

different consumer needs such as convenience for on-the-go consumption or bulk purchases for households.

Availability may vary depending on distribution networks and regional preferences. Unique selling point:

Aquafina emphasizes its advanced purification process, providing hygienic and pure water to consumers.

La Vie’s unique selling points include its natural mineral content and commitment to quality.

Dasani's unique selling points include its purified water with added minerals for enhanced

taste, its positioning as a balanced hydration solution, the trust associated with being a

Coca-Cola product, its sustainability initiatives, and its effective marketing strategies.

Ultimately, consumers may base their purchasing decisions on factors such as taste

preference, trust in the brand, perceived health benefits, and alignment with personal

values regarding sustainability and environmental impact. 2.3. Barriers of entry:

Barriers to entry for Aquafina, La Vie, Dasani in Vietnam: - Capital barriers:

High initial investment: Requires significant costs for building factories, production lines,

warehouses, distribution systems, advertising, etc.

Research and development (R&D) costs: Developing water treatment technologies,

quality control, packaging, etc.

Marketing costs: Building brand awareness, product advertising, promotions, etc. - Raw material barriers:

High-quality mineral water sources: Finding and exploiting high-quality mineral water

sources that meet food safety standards is not easy.

Mineral water exploitation permits: The process of obtaining permits to exploit and use

mineral water sources is often complex and time-consuming.

- Distribution channel barriers:

Extensive distribution network: To get products to consumers, businesses need to build an

effective distribution network that includes distributors, retail stores, supermarkets, etc.

Reputation and relationships with distributors: To convince distributors to put their

products on shelves, businesses need to have a strong brand and good relationships with them. - Brand barriers:

Strong brands of competitors: Aquafina, La Vie, Dasani have established themselves in

the market with strong brands that are trusted by consumers.

Customer loyalty: Difficulty in attracting customers from established and well-loved brands. - Legal barriers:

Food safety approvals: Businesses must meet food safety standards set by regulatory agencies.

Environmental regulations: Businesses must comply with environmental protection

regulations during production and business operations.

In addition to the above barriers, new entrants to the bottled water market also face fierce

competition in terms of price, product quality, customer service, and more.

In addition, about Dasani also has some challenges:

- Perceived Quality: Dasani’s initial launch faced criticism because it was sourced from

local tap water and underwent purification. Consumers questioned its value compared to regular tap water.

- Additives: Dasani added minerals (such as magnesium sulfate, potassium chloride, and

salt) to enhance taste. However, this led to negative perceptions.

- Competition: Competing with established brands like Aquafina and La Vie posed a significant challenge. 2.4. Market power:

Market dominance in the bottled water industry is often concentrated among a select few

major players who wield considerable influence over pricing, supply chains, and overall

market dynamics. These companies typically possess well-established brands, extensive

distribution networks, and economies of scale, providing them with a competitive

advantage. The significant market power of these major bottled water firms can create

obstacles for new entrants, as high barriers to entry such as capital requirements,

distribution complexities, and strong brand loyalty make it challenging for smaller

competitors to enter the market and compete effectively. This lack of competition can

further reinforce the stronghold of existing companies within the industry. In addition,

government regulations, encompassing price controls, food safety standards, and

competition policies, may restrict their capacity to manipulate the market. Moreover,

consumer consciousness is on the rise, with an increasing number of consumers opting

for environmentally sustainable and cost-effective brands, potentially impacting the sales of major brands. Conclusion:

Aquafina, La Vie, and Dasani have high Market Power. Their market power depends on

various factors such as business strategies, marketing activities, and the competitive

landscape of the market. This lack of competition can further solidify the dominance of existing companies. 2.5.

Non – price competition (advertising):

Non-price competition involves strategies other than lowering prices to attract customers,

and advertising is a key component of this approach. Advertising allows companies to

promote their products or services, build brand awareness, and differentiate themselves

from competitors without necessarily changing the price of their offerings. Here's some

advertising strategies for Aquafina, La Vie, and Dasani: Aquafina:

Campaign "Pure Water, Perfect Taste": Aquafina has executed advertising campaigns

with a clear message about providing pure water and perfect taste. For example, Aquafina

launched the "For Happy Bodies" television advertising campaign, focusing on

promoting a healthy lifestyle and the importance of consuming pure water for maintaining health. La Vie:

Sponsorship of Sporting Events: La Vie often sponsors sports events such as golf

tournaments, marathons, or other outdoor sporting events. For instance, in 2020, La Vie

was the main sponsor for the Danang International Marathon, providing opportunities for

the brand to be widely promoted and strengthen its association with a healthy lifestyle. Dasani:

Digital Marketing and Social Media Campaigns: Dasani has utilized social media and

digital marketing to generate engagement with consumers and enhance brand awareness.

For example, Dasani frequently shares content about the health benefits of water

consumption and how to incorporate Dasani water as part of a healthy lifestyle on social

media platforms such as Facebook and Instagram. III. Supply and demand 1. Supply 1.1. Supply in Vietnam:

Currently, the bottled water market in Vietnam is very vibrant, causing many brands and

production units to spring up with around 1,000 bottled water production units and more

than 130 bottled water products. Including famous brands: Aquafina, Lavie, Vinh Hao…

In general, in the bottled pure water market, the big names Lavie, Aquafina, Dasani

are the brands that dominate the remaining bottled pure water products being distributed

on the market. The advantage in the bottled water product market is still in favor of

foreign manufacturers. 70 - 80% of the bottled water market share is in the hands of

foreign manufacturers, with only a small share of the market share belonging to domestic

manufacturers, Ms. Nguyen Huong Quynh (director of Customer Service in Nielsen

Market Research Company) said. 1.2.

Factors that have affected the supply of bottled water: a. Non - price factors: Input prices:

Price of ingredients: The price of ingredients such as water, bottles, caps and

labels can affect the production cost of bottled water. For example, if the price of

tap water increases, the cost of producing bottled water will also increase, which

may lead to higher prices for consumers.

Transportation costs: The cost of transporting raw materials and finished products

from the factory to the point of sale can affect the production costs and selling price of the product.

Energy costs: The price of energy, including electricity and fuel, can also affect

the production cost of bottled water.

Labor costs: The cost of labor can affect the production cost of bottled water. An

increase in labor costs can increase production costs and affect business profits.

Marketing costs: Costs associated with marketing and promoting the product can

also affect the selling price of bottled water. An increase in advertising and

marketing costs can increase the selling price of a product.

In conclusion, increased input prices lead to decreased supply.

Technology: New technology can improve the production speed of bottling lines,

save energy and raw materials. Advanced automation technologies reduce labor

intervention and increase efficiency. In short, technology plays an important role

in improving the efficiency, quality and flexibility of the bottled water production

process, thereby affecting the supply.

Government policies and taxes: to maintain stability and develop this market, the

government has imposed several policies. For example: pursuant to Article 1 of

Decree 94/2023/ND-CP regulating value added tax reduction according to

Resolution 110/2023/QH15, bottled water is not subject to tax exemption and is

subject to 0% tax and tax. yield 5%. Therefore, spring water is subject to a VAT

rate of 10%. However, because it is not on the list of goods not eligible for tax

reduction specified in Appendix 1, 2 and 3 issued with Decree 94/2023/ND-CP,

spring water (bottled water) will Apply the 8% VAT reduction policy until June 30, 2024.

Numbers of producers: Currently, in the bottled water market there are hundreds

of brands competing fiercely, some small brands are only present in a certain area;

while big brands are trying to strengthen their positions. The number of firms in

the market will affect the total supply. An increase in the number of sellers

supplying shifts the supply curve to the right.

The expectation of the suppliers: Producers also base their supply decisions on

expectations. For example, an increase in tourism has a significant impact on

various aspects of a country's economy and culture, including the bottled water

market. As travelers look for convenient and reliable water delivery options,

demand for bottled water will increase significantly. Since then, bottled water

suppliers have increased and production volumes have also increased for this demand b. Price factors:

Selling prices of some bottled water brands in Vietnam:

Vinh Hao bottled water price list Lavie bottled water price list

Aquafina bottled water price list

Satori bottled water price list

The price of bottled water has a significant impact on quantity supplied in a number

of ways: Increasing the selling price can reduce the supply: If the selling price of bottled

water increases, this can make consumers wary and reduce their purchases of the product.

This is especially true when selling prices increase significantly and exceed consumers'

ability to pay. Increasing selling prices can generate higher profits: Although increasing

selling prices can reduce the number of products sold, it can also generate higher profits

for the manufacturer. This may influence their supply decisions, especially if higher

profits can be guaranteed. In summary, the selling price of bottled water has a significant

influence on the decisions of consumers and businesses about purchasing and supplying

the product. Price fluctuations can affect supply through changes in consumer demand

and manufacturers' business strategies. 2. Demand 2.1. Demand in Vietnam:

Currently, the bottled water market in Vietnam is very vibrant and dynamic.

Renowned for its convenience, affordability, variety, quality and safety, bottled water has

become popular with Vietnamese people. It often is a go-to choice for offices, schools,

and families seeking health and wellness drinking water. To have a deeper understanding

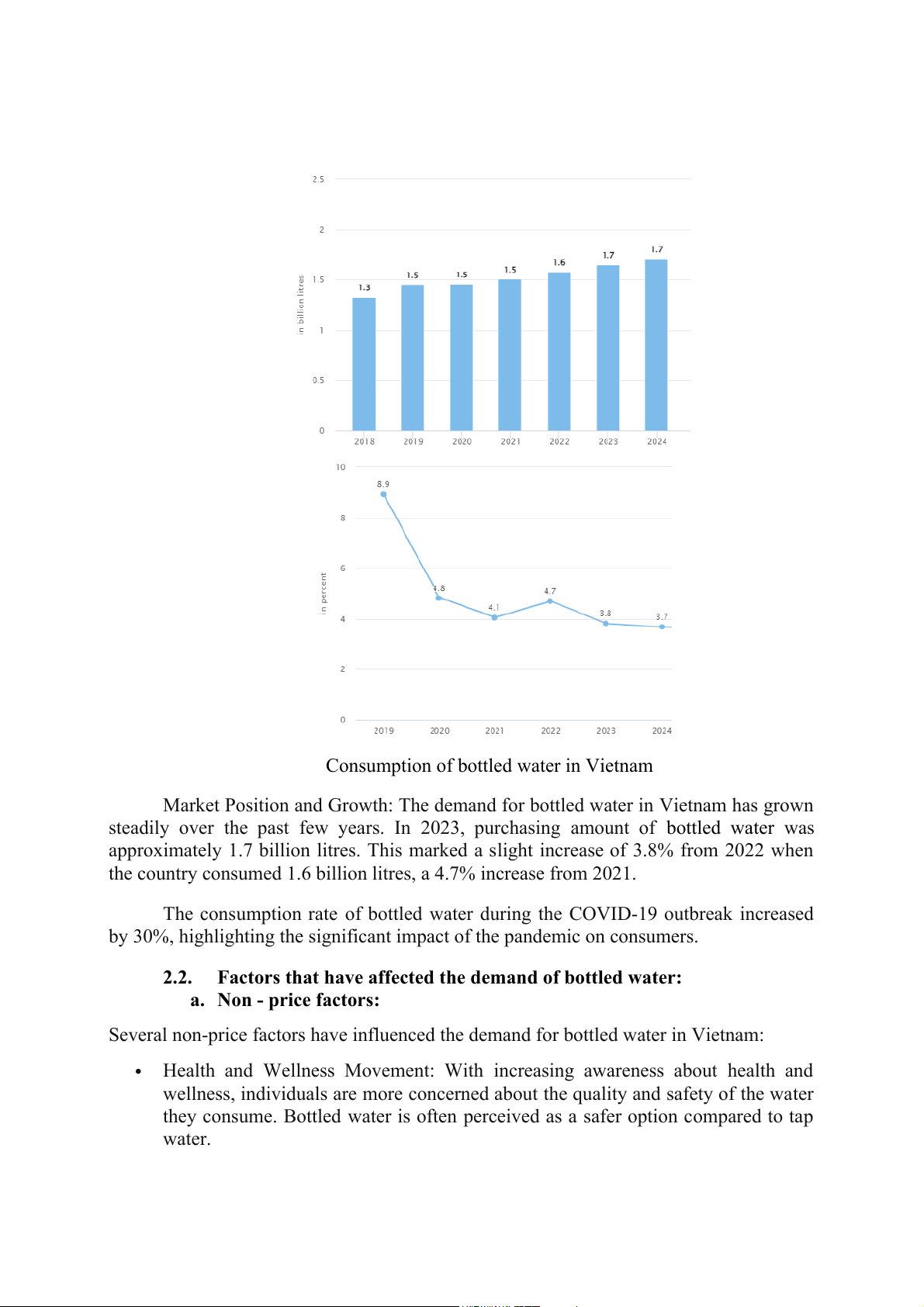

of this, let’s take a look at bottled water demand in Vietnam through the 2018 – 2023 period.

Consumption of bottled water in Vietnam

Market Position and Growth: The demand for bottled water in Vietnam has grown

steadily over the past few years. In 2023, purchasing amount of bottled water was

approximately 1.7 billion litres. This marked a slight increase of 3.8% from 2022 when

the country consumed 1.6 billion litres, a 4.7% increase from 2021.

The consumption rate of bottled water during the COVID-19 outbreak increased

by 30%, highlighting the significant impact of the pandemic on consumers. 2.2.

Factors that have affected the demand of bottled water: a. Non - price factors:

Several non-price factors have influenced the demand for bottled water in Vietnam:

Health and Wellness Movement: With increasing awareness about health and

wellness, individuals are more concerned about the quality and safety of the water

they consume. Bottled water is often perceived as a safer option compared to tap water.

Internet Penetration: The rise of internet usage has allowed consumers to become

more informed about their choices, including the benefits of drinking bottled water.

Population Growth: As the population of Vietnam grows, so does the demand for clean and safe drinking water.

Urbanization: The rapid urbanization in Vietnam has led to a surge in demand for

bottled water. As more people move to cities, the demand for clean and safe drinking water increases.

Decline in Alcohol Consumption: There has been a decline in alcohol

consumption in Vietnam, which has led to an increase in the consumption of non-

alcoholic beverages like bottled water.

Water Resources: The significance of natural water sources in rural areas of

Vietnam also contributes to water demand increase b. Price factors:

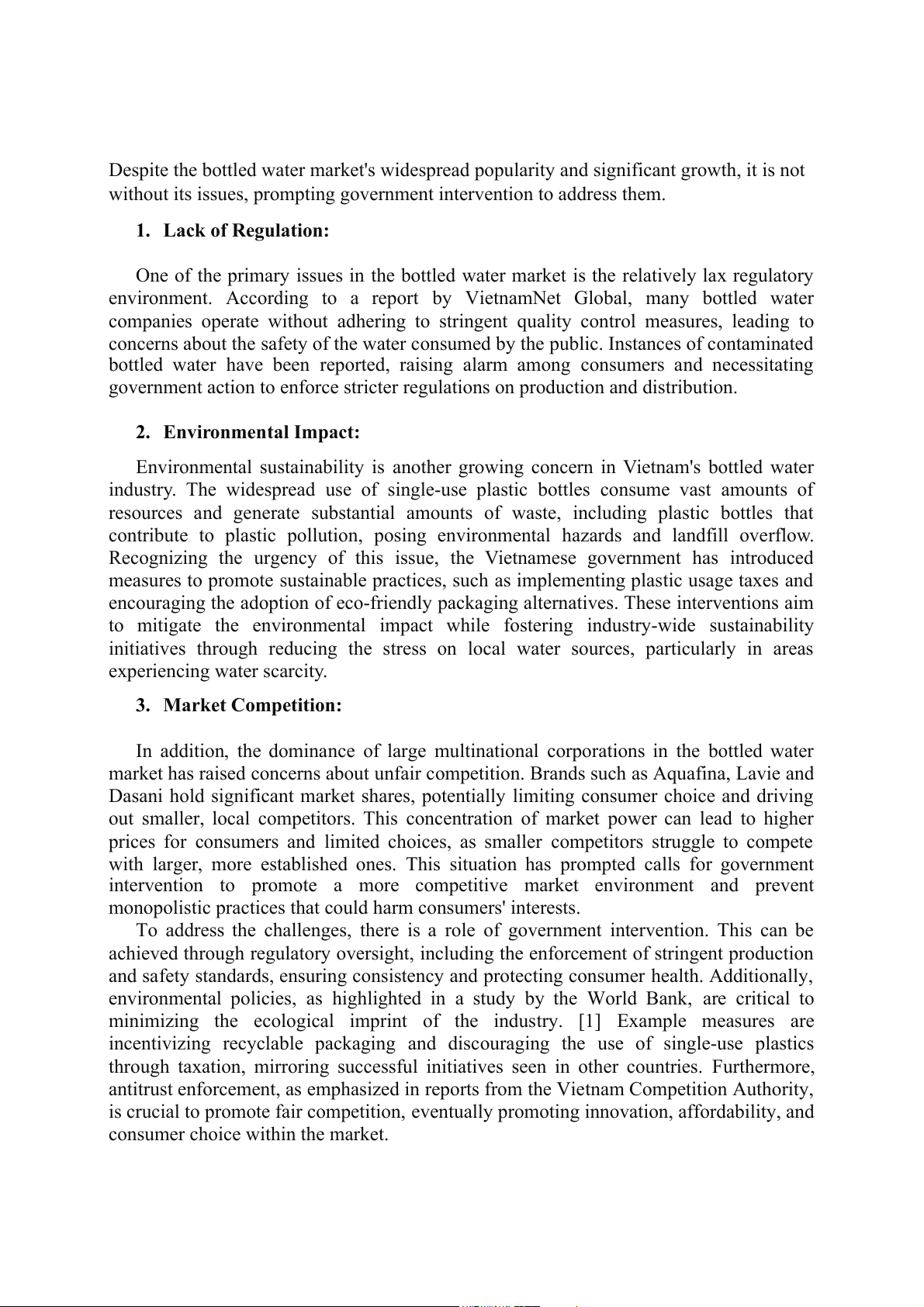

The affordability of bottled water plays a significant role in its popularity. The price

for a bottle of 1.5 litres of a local brand at an average price is approximately 11,000

VND; A smaller bottle of water (0.5 litres) can cost around 5,000 to 10,000 VND. The

average price for a bottle of 1.5 litres in all countries is 0.80 USD, approximately 20,000

VND. However, huge differences in the price of bottled water in different locations

(stores, hotels, airports,...)also indicate that price sensitivity is not the most important

factor in consumer decision-making. In addition, according to the law of demand, as the

product’s price goes up, the customer’s will to buy it goes down, as indicated in this graph: IV.

Problems and Government Intervention

Despite the bottled water market's widespread popularity and significant growth, it is not

without its issues, prompting government intervention to address them. 1. Lack of Regulation:

One of the primary issues in the bottled water market is the relatively lax regulatory

environment. According to a report by VietnamNet Global, many bottled water

companies operate without adhering to stringent quality control measures, leading to

concerns about the safety of the water consumed by the public. Instances of contaminated

bottled water have been reported, raising alarm among consumers and necessitating

government action to enforce stricter regulations on production and distribution.

2. Environmental Impact:

Environmental sustainability is another growing concern in Vietnam's bottled water

industry. The widespread use of single-use plastic bottles consume vast amounts of

resources and generate substantial amounts of waste, including plastic bottles that

contribute to plastic pollution, posing environmental hazards and landfill overflow.

Recognizing the urgency of this issue, the Vietnamese government has introduced

measures to promote sustainable practices, such as implementing plastic usage taxes and

encouraging the adoption of eco-friendly packaging alternatives. These interventions aim

to mitigate the environmental impact while fostering industry-wide sustainability

initiatives through reducing the stress on local water sources, particularly in areas experiencing water scarcity. 3. Market Competition:

In addition, the dominance of large multinational corporations in the bottled water

market has raised concerns about unfair competition. Brands such as Aquafina, Lavie and

Dasani hold significant market shares, potentially limiting consumer choice and driving

out smaller, local competitors. This concentration of market power can lead to higher

prices for consumers and limited choices, as smaller competitors struggle to compete

with larger, more established ones. This situation has prompted calls for government

intervention to promote a more competitive market environment and prevent

monopolistic practices that could harm consumers' interests.

To address the challenges, there is a role of government intervention. This can be

achieved through regulatory oversight, including the enforcement of stringent production

and safety standards, ensuring consistency and protecting consumer health. Additionally,

environmental policies, as highlighted in a study by the World Bank, are critical to

minimizing the ecological imprint of the industry. [1] Example measures are

incentivizing recyclable packaging and discouraging the use of single-use plastics

through taxation, mirroring successful initiatives seen in other countries. Furthermore,

antitrust enforcement, as emphasized in reports from the Vietnam Competition Authority,

is crucial to promote fair competition, eventually promoting innovation, affordability, and

consumer choice within the market.

To sum up, while the bottled water market offers convenience to consumers, it also

presents various challenges such as inadequate regulation, market concentration, and

environmental sustainability. By implementing effective policies and regulatory

measures, the government can help ensure the long-term viability and sustainability of

the bottled water industry while prioritizing public health and environmental conservation. CONCLUSION

The bottled water market in Vietnam plays a vital role in providing safe and

convenient drinking water options to consumers, particularly in areas where access to

clean water infrastructure may be limited. Additionally, it represents a significant

segment of the beverage industry, contributing to economic growth, employment, and investment in the country.

In reality, the market structure of bottled water in Vietnam exhibits characteristics of

oligopoly. Companies such as Nestlé and Coca-Cola hold significant market shares with

dominant brands like Aquafina and Lavie. However, there is still room for smaller

players to enter the market and differentiate themselves through various strategies.

Moreover, the influence of government regulations on quality standards and

environmental concerns adds another layer of complexity to the market dynamics. REFERENCE RESOURCE

1. 1.The Impact of Environmental Concern on Intention to Reduce Consumption of

Single-Use Bottled Water, Energies 2021, 147, Barbara Borusiak. Andrzej Szymkowiak

2. Bottled water – Vietnam - Statista

3. Vietnam - Bottled water - price, January 2024. globalproductprices.com

4. Thị trường nước uống đóng chai: Sân chơi của doanh nghiệp ngoại - Vef.vn Diễn đàn kinh tế việt

5. Thị trường nước khoáng Việt Nam: Dòng chảy tiềm năng hay "cơn sóng" cạnh tranh? Vietdata

6. Vietnam Bottled Water Market Competition Forecast & Opportunities, 2028 – ASD Reports

7. Báo cáo về thị trường nước tinh khiết đóng chai tại Việt Nam - Ocany

8. Thương hiệu nào sẽ dành ưu thế trong cuộc chiến thị phần nước đóng chai -

cafef.vn trang thông tin điện tử tổng hợp

9. Diễn đàn Kinh tế Việt Nam-VEF: Thị trường nước khoáng đóng chai: Sân chơi của doanh nghiệp ngoại.

10. CAFEF: Trang thông tin điện tử tổng hợp: Thương hiệu nào sẽ dành ưu thế trong

cuộc chiến thị phần nước đóng chai.

11. MALUDESIGN: NEWS: Detail analysis of aquafinas marketing strategy. 12. LAVIE: About Lavie