Preview text:

EXERCISE 1

a/ On 1 September 2009, a company paid £80,000 to replace the wall lining of

one of its furnaces. The furnace had been acquired several years previously

and its carrying amount on 1 September 2009 (before accounting for the

replacement of the lining) was £320,000. Of this amount, £10,000 related to the original wall lining.

b/ On 1 September 2009, a company paid £250,000 for a major inspection of

one of its aircraft. It is a legal requirement that such an inspection is carried

out at least once every three years. The previous inspection took place in

March 2007 at a cost of £210,000. The carrying amount of the aircraft on 1

September 2009 (before account-ing for the new inspection) was £1,200,000.

Of this amount, £70,000 related to the previous inspection.

Explain how each of these transactions should be accounted for in accordance

with the requirements of IAS16. Solution:

a/ £80,000 + £320,000 - £10,000 = £390,000

b/ £250,000 + £1,200,000 - £70,000 = £1,380,000 EXERCISE 2

On 31 July 2009, a company which prepares financial statements to 31 March

each year bought a machine for £621,000. This amount was made up as follows: £ Manufacturer's list price 500,000 Less: Trade discount 30,000 ––––––– 470,000 Delivery charge 4,300

Installation and testing charges 24,500 Minor spare parts 5,200

Servicing contract for the year to 31 July 2010 36,000 ––––––– 540,000 Value added tax at 15% 81,000 ––––––– –––––––

The company is VAT-registered and reclaims VAT charged to it by its

suppliers. Calculate the cost of the machine in accordance with the requirements of IAS16. Solution

470.000 + 4.300 + 24.500 = 498.800 Exercise 3:

On 1 January 2009, a company which prepares financial statements to 31 December

each year buys a machine at a cost of £46,300. The machine's useful life is estimated at

four years with a residual value of £6,000. The machine is expected to achieve 50,000

units of production over its useful life, as follows: year to 31 December 2009 10,000 units year to 31 December 2010 20,000 units year to 31 December 2011 15,000 units year to 31 December 2012 5,000 units

Calculate depreciation charges for each of these four years using: the straight-line method

the diminishing balance method (at a rate of 40%)

the units of production method. Exercise 4:

a/ Company X prepares financial statements to 31 May each year. On 31 May

2009, the company acquired land for £400,000. This land was revalued at

£450,000 on 31 May 2010 and at £375,000 on 31 May 2011

b/ Company Y prepares financial statements to 30 June each year. On 30 June

2009, the company acquired land for £600,000. This land was revalued at

£540,000 on 30 June 2010 and at £620,000 on 30 June 2011.

Assuming that both companies use the revaluation model, explain how each

revaluation should be dealt with in the financial statements. Ignore depreciation. Solution a/ 31 May 2010 Dr PPE £50,000 Cr Revaluation Surplus £50,000 Dr Revaluation Surplus £50,000 Dr Loss £25,000 Cr PPE £75,000 b/ 30 June 2009 Dr Loss £60,000 Cr PPE £60,000 Dr PPE £80,000 Cr Gain £60,000 Cr Revaluation Surplus £20,000 Exercise 5:

On 01.01.X0, XY Inc. purchases an aircraft to extend its existing fleet. The aircraft is

available for use immediately and is put to use starting 01.01.X0. Depreciation is

calculated on a straight-line basis.

Purchasing costs for the aircraft can be sub-categorized into the following parts (in EUR): Parts Purchasing costs Engines 2.450.000 Avionics 970.000 Galley and seats 820.000 Undercarriage 1.430.000 Sum 5.670.000

XY Inc. is assuming a useful life of the aircraft of 20 years. However, due to the strains

of take-off and landing, the undercarriage needs to be replaced every two years.

Avionics, as well as the galley and seats need to be replaced every five years, the

engines need to be replaced every four years.

On 01.01.X2, the undercarriage is replaced. The new undercarriage costs EUR

1.580.000 and has a useful life of two years. The old undercarriage can no longer be

used by XY Inc., but neither gives rise to any costs of disposal.

After recognition, the airplane is measured using the cost model in accordance with

IAS 16. During the entire useful life, there are no indications of impairment. Required:

Prepare necessary journal entries

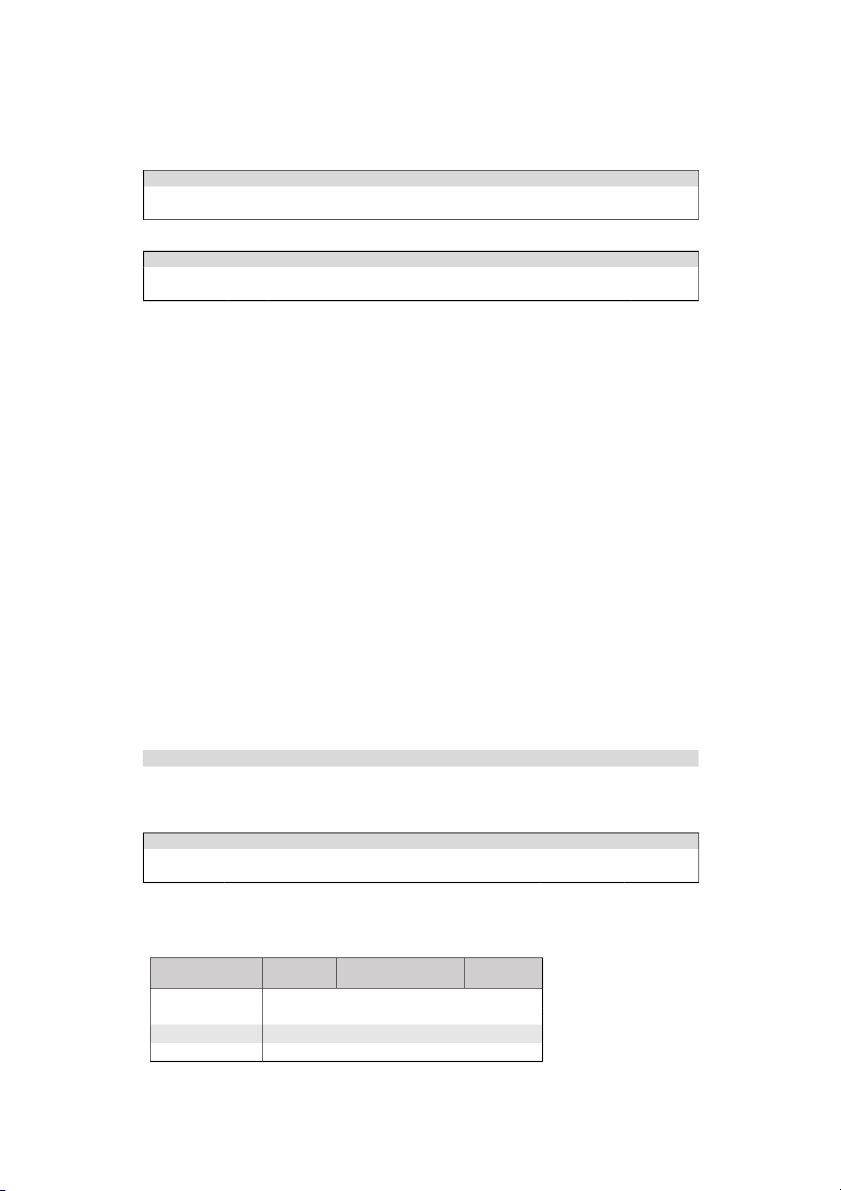

Solution Date Account 01.01.X0 Dr Aircraft 5.670.000 Cr Cash 5.670.000 Initial costs Useful life Depreciation Parts (in EUR) (in years) (in EUR) Engines 2.450.000 4 612.500 Galley/Seats/Avionics 1.790.000 5 358.000 Undercarriage 1.430.000 2 715.000 Sum 5.670.000 1.685.500 Date Account 31.12.X0 to X1 Dr Depreciation 1.685.500 Cr Aircraft 1.685.500 Date Account 01.01.X2 Dr Aircraft 1.580.000 Cr Cash 1.580.000 Initial costs Useful life Depreciation Parts (in EUR) (in years) (in EUR) Engines 2.450.000 4 612.500 Galley/Seats/Avionics 1.790.000 5 358.000 Undercarriage 1.580.000 2 790.000 Sum 5.820.000 1.760.500

The depreciation charge of the new undercarriage is EUR 790.000. Therefore, depreciation of the

aircraft increases from EUR 1.685.500 to EUR 1.760.500. Date Account 31.12.X2 to X3 Dr Depreciation 1.760.500 Cr Aircraft 1.760.500 Exercise 6: Solution

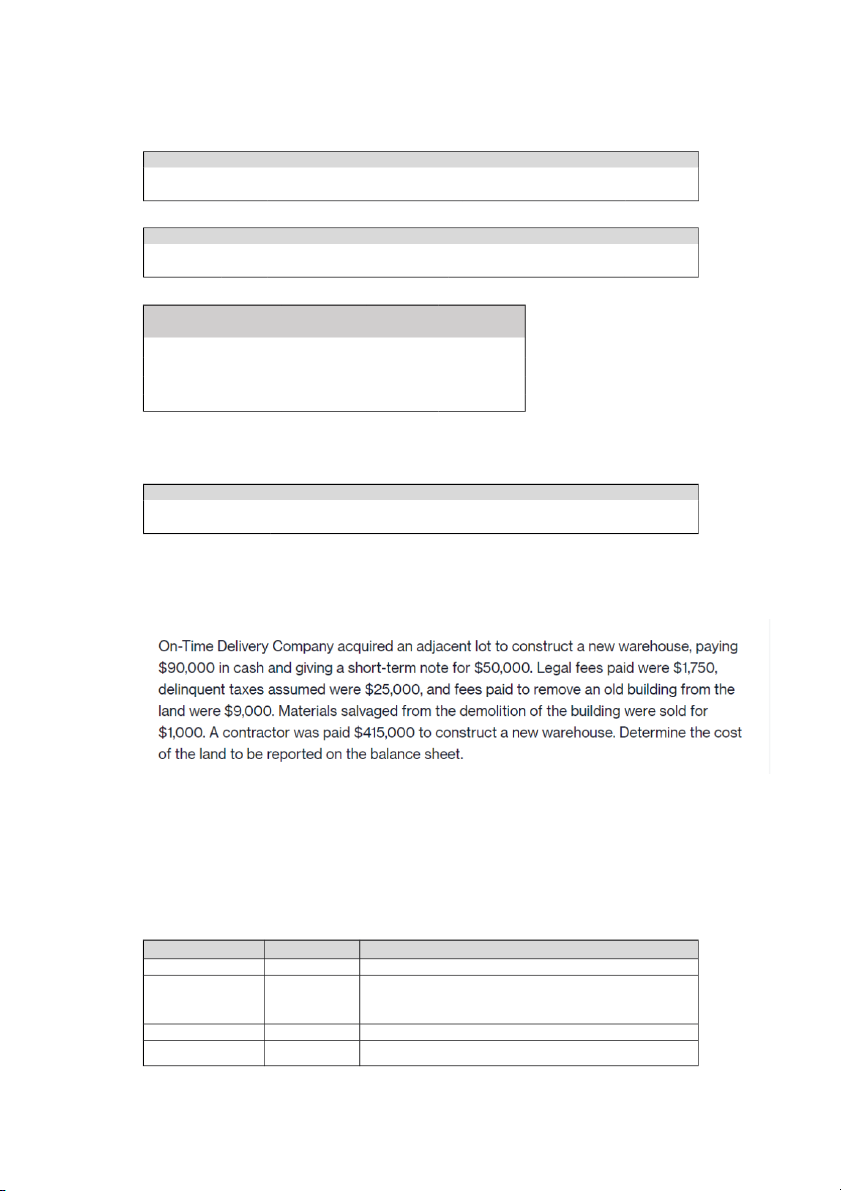

= $90,000 + $50,000 + $1,750 + $9,000 - $1,000 = $149,750 Exercise 7:

Entity A incurred (and paid) the following expenditures in acquiring an

administration building and the land on which it is built: Date EUR Additional information 1 January 2017

200.000.000 20% of the price is attributable to the land 1 January 2017

20.000.000 Non-refundable transfer taxes (not included in the EUR 200.000.000 purchase price) 1 January 2017

1.000.000 Legal costs directly attributable to the acquisition 1 January 2017

10.000 Reimbursing the previous owner for prepaying the non-

refundable local government property taxes

for the six- month period ending 30 June 2017 30 June 2017

20.000 Non-refundable annual local government property taxes for the year ending 30 June 2018 End of 2017

120.000 Day-to-day repairs and maintenance, including the salary

and other costs of the administration and maintenance staff.

The land and building are available for use on 1

January 2017. At 31 December 2017 Entity A made the following assessments:

Useful life of the building: 50 years from the date of acquisition

Residual value of the building: EUR 20,000,000

The entity will consume the building’s future economic benefits evenly over 50 years from the date of acquisition Required:

1.) Calculate the cost of the land and the cost of the building. Assume that 20% of the

expenditures that can be capitalised are attributable to the land

2.) Calculate the depreciation.

3.) Prepare the journal entries to record all effects of the property, plant and equipment in

the accounting records of Entity A throughout 2017. (cái này các bạn họ c cái gì thì đị nh

kho n cái đó thôi, không cầần đ ả nh kho ị n hếết) ả Solution:

Total directly attributable cost Land (20%) Building (80%) Purchase price 200.000.000 40.000.000 160.000.000 Non-refundable transfer taxes 20.000.000 4.000.000 16.000.000

Legal costs directly attributable 1.000.000 200.000 800.000 Total 221.000.000 44.200.000 176.800.000 Cost of building

176 800 000 = 200.000.000*0,8+20.000.000*0,8+1.000.000*0,8 Cost of land

44 200 000 = 200.000.000*0,2+20.000.000*0,2+1.000.000*0,2

Useful life: 50 years; Residual value: 20 000 000; Straight-line depreciation Depreciation

3 136 000 = (176.800.000 – 20.000.000)/50

Recognise the cost of land and building Date Account 01.01.2017 Dr Land 44 200 000 Cr Cash 44 200 000 Date Account 01.01.2017 Dr Building 176 800 000 Cr Cash 176 800 000

Recognise the depreciation of the building Date Account 31.12.2017 Dr Depreciation 3 136 000 Cr Accumulated Depreciation 3 136 000

Recognise maintenance expense Date Account 31.12.2017 Dr Operating Expense 120 000 Cr Cash 120 000 Exercise 8:

On 01.01.X1, XY Inc. purchases a kiln for the pyrolysis of plastic. The kiln is available

for use right away. The useful life is nine years, depreciation is calculated on a straight-

line basis. The purchase price of the kiln is EUR 27.000.000. The combustion chamber

needs to be replaced after three years

Replacement costs are estimated to be EUR 3.000.000. Furthermore, every three years,

maintenance work to test seals and valves is necessary, resulting in costs of EUR

1.500.000. The original acquisition costs already include the combustion chamber and

the maintenance work for the first three years

After recognition, XY Inc. uses the cost model in accordance with IAS 16 as its

accounting policy for subsequent measurement. During the entire useful life, there

are no indications of impairment.

Posting status for the year X1: With regards to the acquisition of the kiln, no bookings have been recorded. Required:

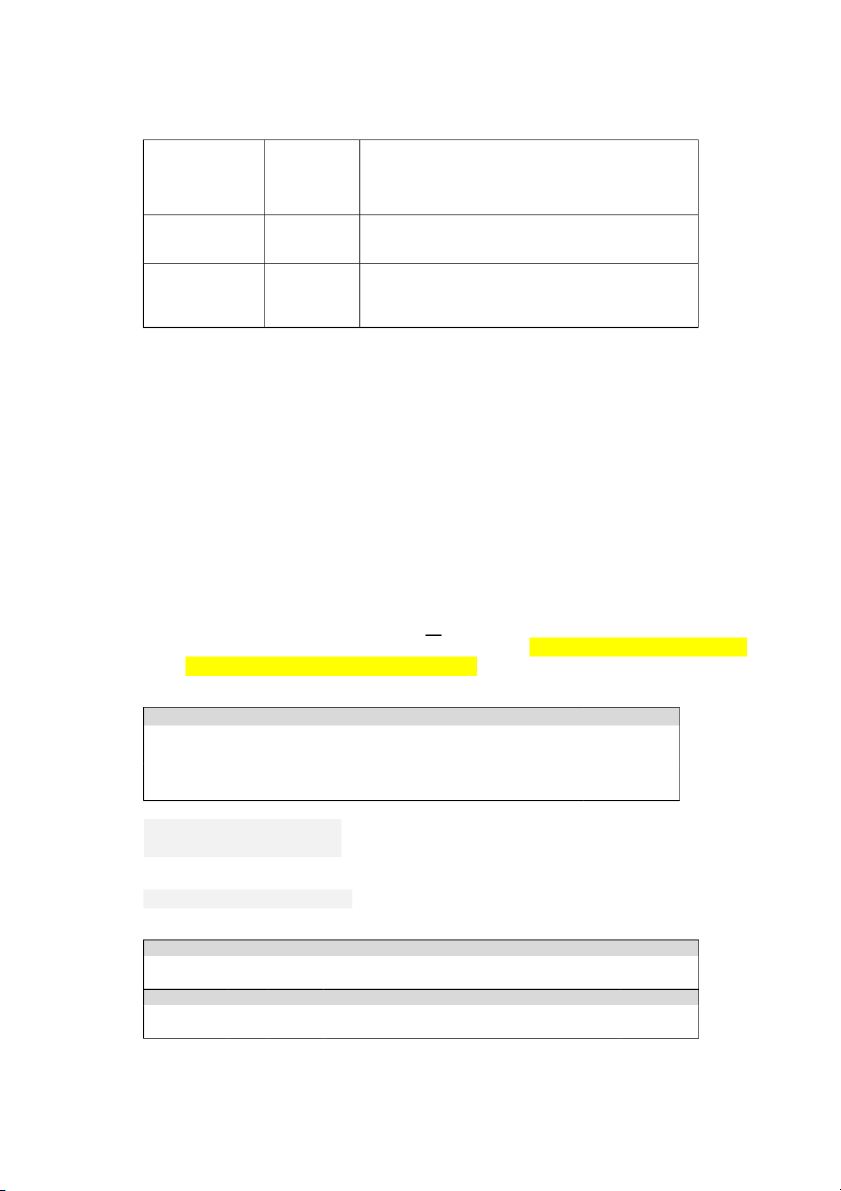

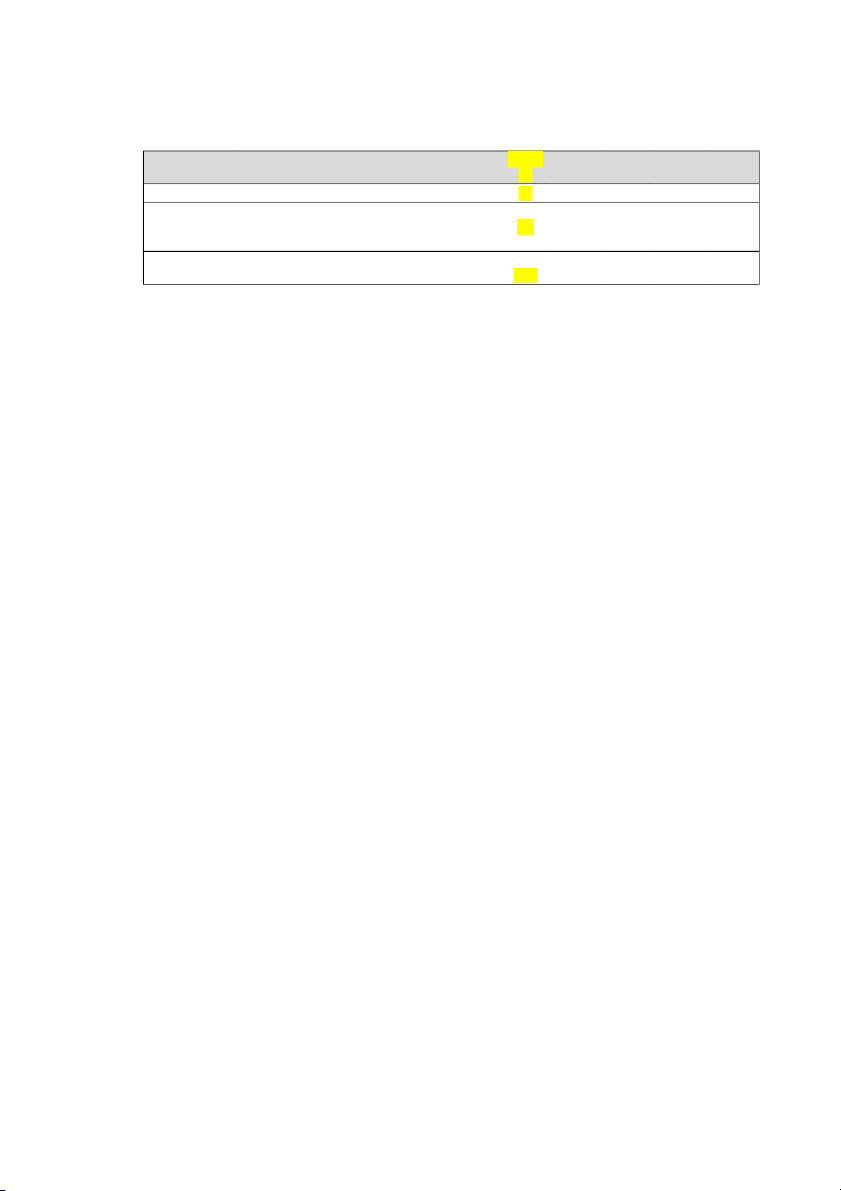

Calculating the carrying amount of the kiln at the beginning of X6 [IAS 16.43-45] a. Initial recognition Date Account 01.01.X1 Dr Kiln 27.000.000 Cr Cash 27.000.000 b. Depreciation Date Account 31.12.X1 Dr Depreciation 4.000.000 Cr

Kiln (or Accum. Dep. if indirect method) 4.000.000 Calculation:

Total depreciation is comprised of the depreciation charges of the individual parts of the asset (IAS 16.43). In

accordance with IAS 16.45 significant parts with the same useful lives can be grouped together to determine the depreciation charge: Depreciation in Combustion Chamber Total Mio. EUR Kiln and Maintenance depreciation CA 01.01.X1 22,5 4,5 Useful life (in years) 9 3 Depreciation 2,5 1,5 4,0 CA 31.12.X1 20,0 3,0 Assets in Mio. 01.01. 31.12. 31.12. 31.12. 31.12. 31.12. 31.12. 31.12. 31.12. 31.12. EUR X1 X1 X2 X3 X4 X5 X6 X7 X8 X9 Kiln 22,5 20 17,5 15 12,5 10 7,5 5 2,5 0 Combustion Chamber and 4,5 3 1,5 0 3 1,5 0 3 1,5 0 Maintenance Carrying Amount Kiln 27 23,0 19,0 15,0 15,5 11,5 7,5 8,0 4,0 0