Preview text:

INDIVIDUALS ASSIGNMENT – DANG QUOC HUY EBBA 14.1 – Topic 4

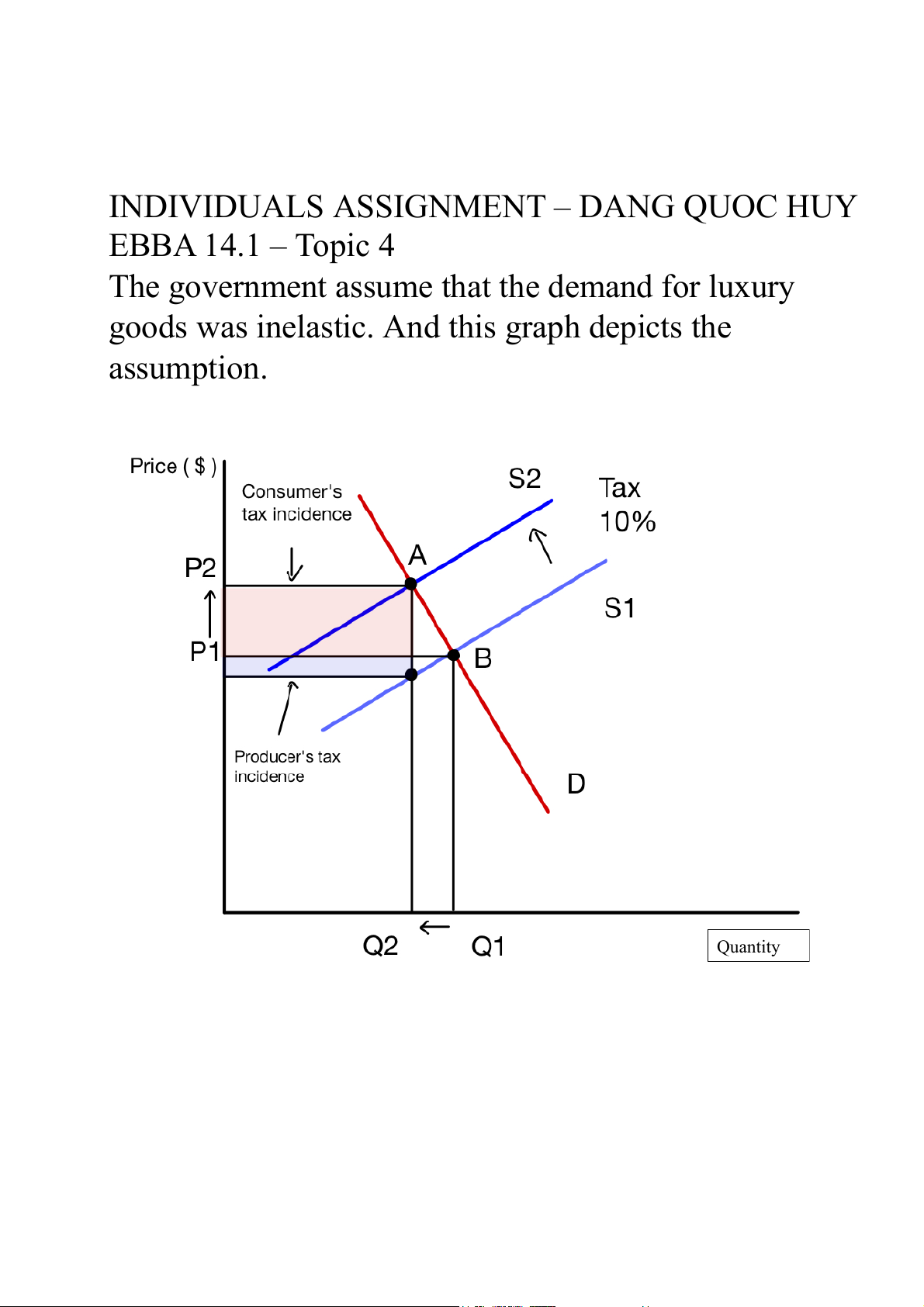

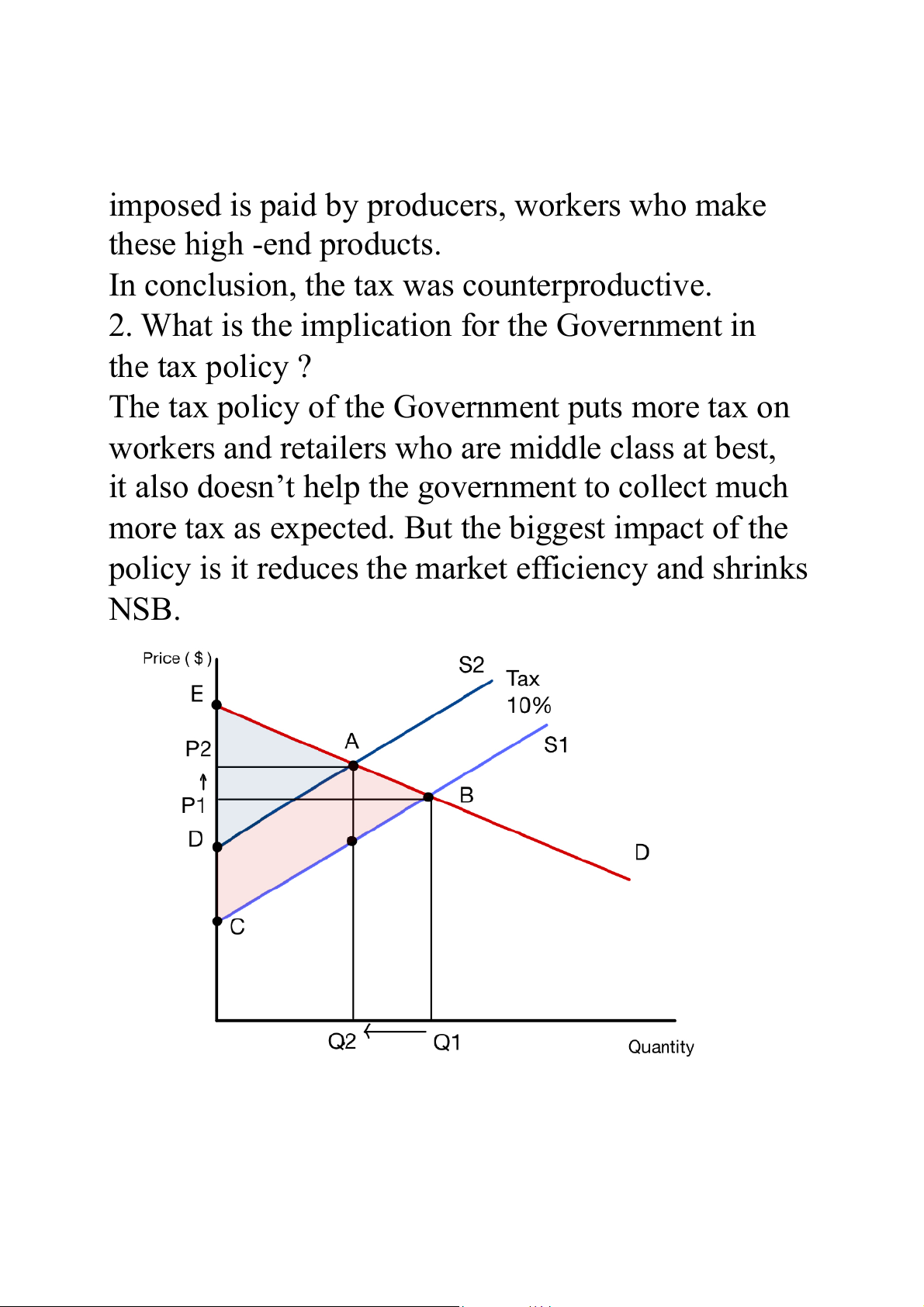

The government assume that the demand for u l xury

goods was inelastic. And this graph depicts t e h assumption. Quantity

The change from S1 to S2 shows the 10% tax increase. By assuming the demand w as inelastic, the demand

curve is steep. As a result, when the supply u c rve

shifted up, the price rise significantly, while the

quantity demanded fall slightly from Q1 to Q2. The government assum d e that the wealthy was

willing to pay more money on luxury goods because

they were rich and t hey would not react severely and they would pay the a m jority of a t x imposed.

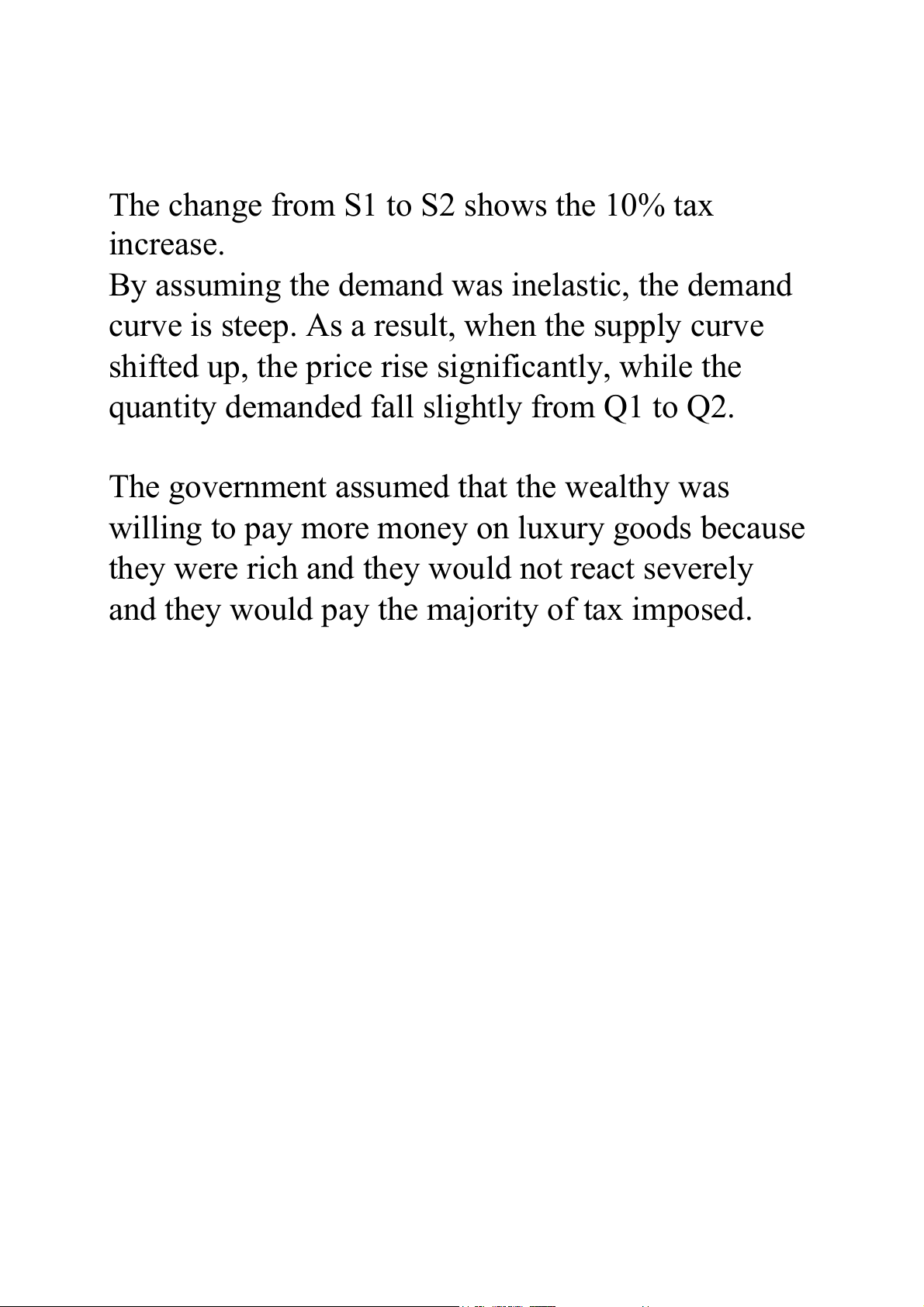

But in fact, they were wrong, t e h demand for t e h se

luxury goods is reasonably elastic. The demand u

c rve is actually flat because the

demand is elastic. The price go up slightly because

the rich had many alternative choices to avoid

paying taxes and it means that most of the tax

imposed is paid by producers, workers who make these high -end produ t c s.

In conclusion, the tax was counterproductiv . e

2. What is the implication for the Government in the tax policy ?

The tax policy of the Government puts more tax on

workers and retailers who are middle class at best,

it also doesn’t help the government to o c llect much

more tax as expected. But the biggest impact o f the

policy is it reduces the mark t e efficiency and shrinks NSB.

The new tax policy creates a deadweight loss = ABCD