Preview text:

lOMoAR cPSD| 59085392 2/12/2025

Lecturer in Finance and Banking,

linkedin.com/in/tien-nguyen-rei- lOMoAR cPSD| 59085392 2/12/2025 lOMoAR cPSD| 59085392 2/12/2025 n n 1

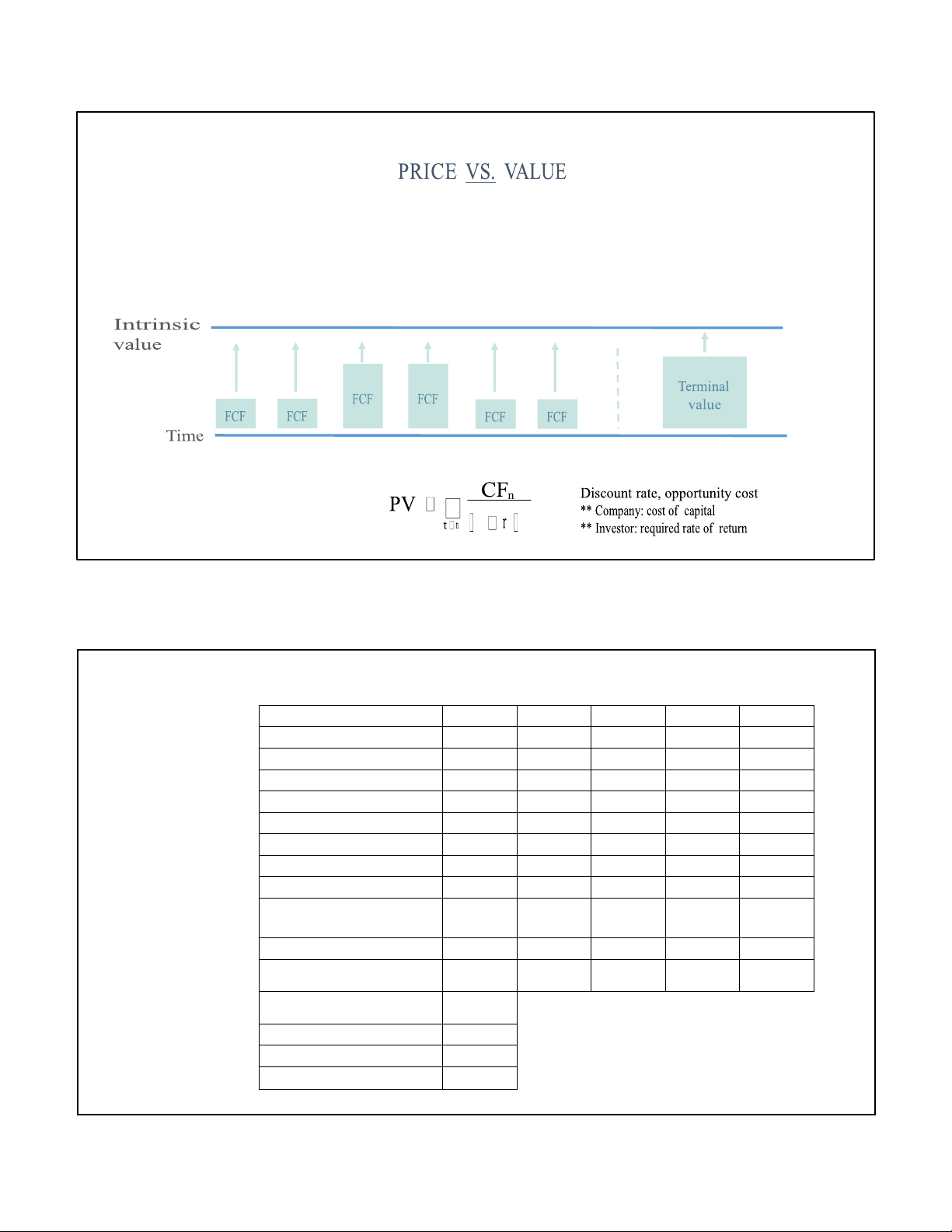

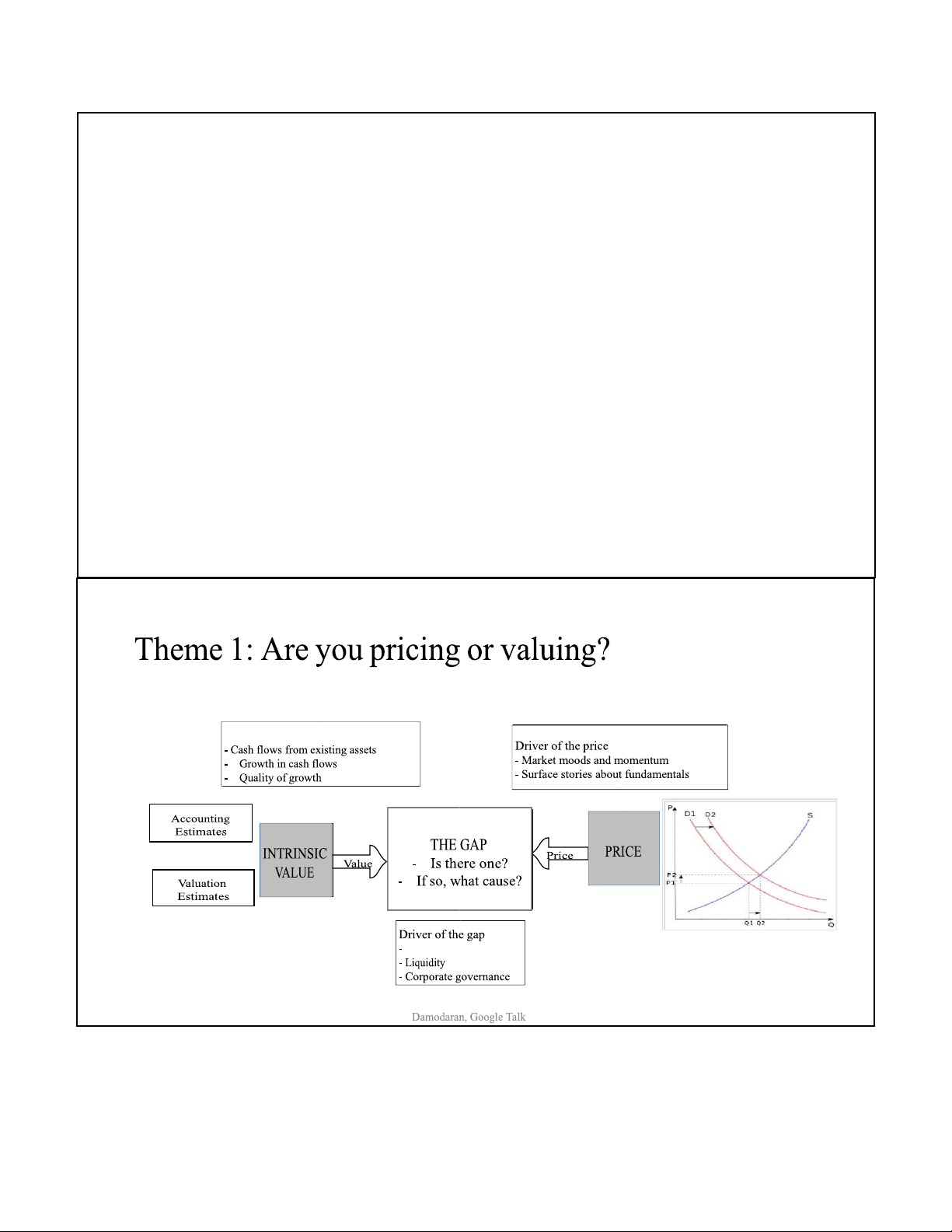

Theme 1: Are you pricing or valuing? EBITDA $100.00 $120.00 $144.00 $172.80 $207.36 - Depreciation $20.00 $24.00 $28.80 $34.56 $41.47 EBIT $80.00 $96.00 $115.20 $138.24 $165.89 - Taxes $24.00 $28.80 $34.56 $41.47 $49.77 EBIT (1-t) $56.00 $67.20 $80.64 $96.77 $116.12 + Depreciation $20.00 $24.00 $28.80 $34.56 $41.47 - Cap Ex $50.00 $60.00 $72.00 $86.40 $103.68 - Chg in WC $10.00 $12.00 $14.40 $17.28 $20.74 FCFF $16.00 $19.20 $23.04 $27.65 $33.18 Terminal Value $1,658.88 Cost of capital 8.25% 8.25% 8.25% 8.25% 8.25% Present Value $14.78 $16.38 $18.16 $20.14 $1,138.35

Value of operating assets today $1,207.81 + Cash $125.00 - Debt $200.00 Value of equity $1,132.81 lOMoAR cPSD| 59085392 2/12/2025 1 2 3 4 5 6 Driver of intrinsic value Information lOMoAR cPSD| 59085392 2/12/2025 BUY/SELL/HOLD • Liquidity of stock

• Intrinsic value (fundamentals: rev, exp, capital expenditure (capex),

working capital ..) 30,000/share

• Market price 44,000 /share • Over-valued

If you were asked to categorized yourself as more a number person or a story person, . Precision: data is precise

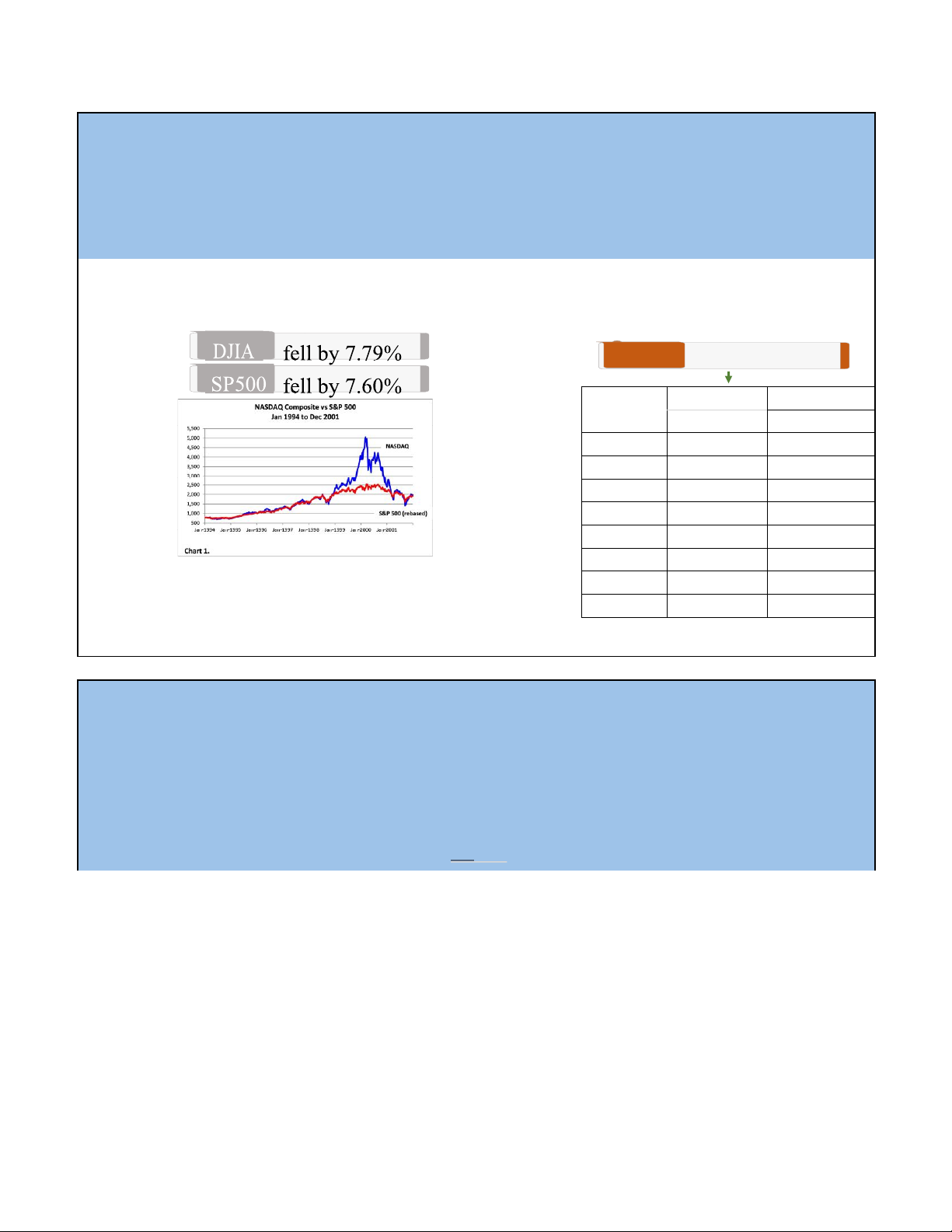

. Control: data can control reality lOMoAR cPSD| 59085392 2/12/2025 position lOMoAR cPSD| 59085392 2/12/2025 position lOMoAR cPSD| 59085392 2/12/2025 WHY VALUATION? Dot-Com Crash of 2000

• The Dot-Com crash in 2000: from 07/1999 to 02/2000 … Market Cap ($) Net income ($) Company 3-Jan-00 99/00 Amazon.com 33,800,000,000 -720,000,000 BoubleClick 30,100,000,000 -56,000,000 Akamai Tech 29,700,000,000 -58,000,000 VerticalNet 12,400,000,000 -53,000,000

Nasdaq rose by Priceline.com 8,400,000,000 -1,055,000,000 Etrade 7,100,000,000 -57,000,000 74.4% EarthLink 5,200,000,000 -174,000,000 Bdrugstore.co 1,600,000,000 -116,000,000

ROLE OF FINANCIAL STATEMENT INFORMATION

& NATURE OF THE INVESTMENT MARKET lOMoAR cPSD| 59085392 2/12/2025

• What is the main assumption of fundamental analysis? # technical analysis

• Traders who use fundamental analysis assume that the market does not

always value all stocks accurately.

• This is antithetical to the efficient market hypothesis, which assumes all

stocks are accurately valued at all times

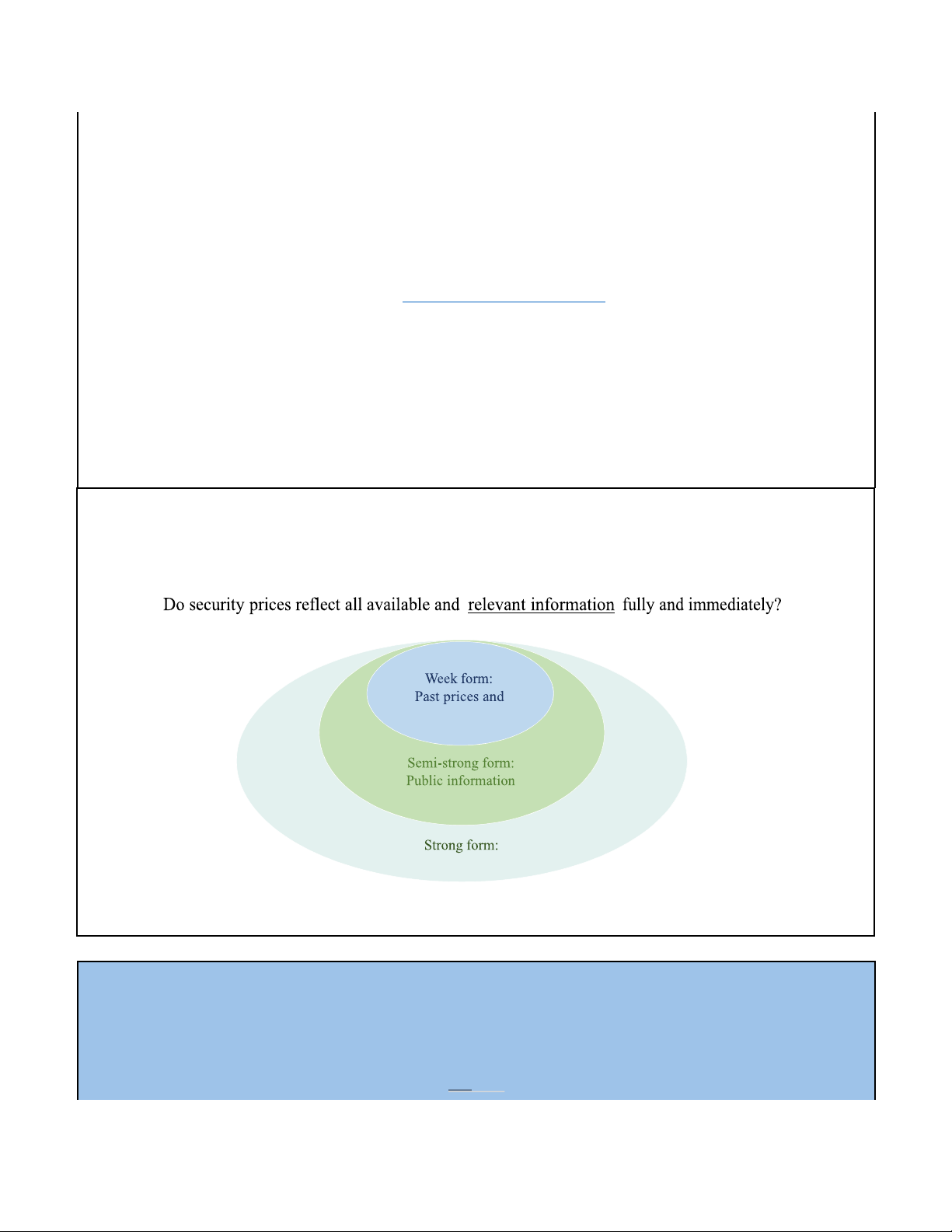

Efficient Markets and Information Sets volume information

Public and private information

ROLE OF FINANCIAL STATEMENT INFORMATION &

NATURE OF THE INVESTMENT MARKET lOMoAR cPSD| 59085392 2/12/2025

• Semi-strong efficient securities markets …

• Price at all time fully reflect all publicly available information

• Rational investors use new information instantaneously

• Markets are “fair game” as price reflects all publicly information

• Financial reporting numbers do not matter unless they have future cash flow effects

• Market efficiency is relative to a stock of publicly available

information and the level of rationality of investors – true prices are not known RECALL FS: Basic Concepts • The accounting equation:

• Assets – Liabilities = Equity

• Net assets = Equity Net book value Financial statements: From the balance sheet: ◦ Income Statement

Equity = RE + Reserves + Contributed ◦ Balance Sheet Equity ◦ Retained Earnings Income statement link: ◦ Cash Flows Statement

RE = Beg. RE +/- Net income/loss –

dividends +/- transfers from/to reserves lOMoAR cPSD| 59085392 2/12/2025 lOMoAR cPSD| 59085392 2/12/2025 lOMoAR cPSD| 59085392 2/12/2025 COMPANY RESEARCH PROJECT

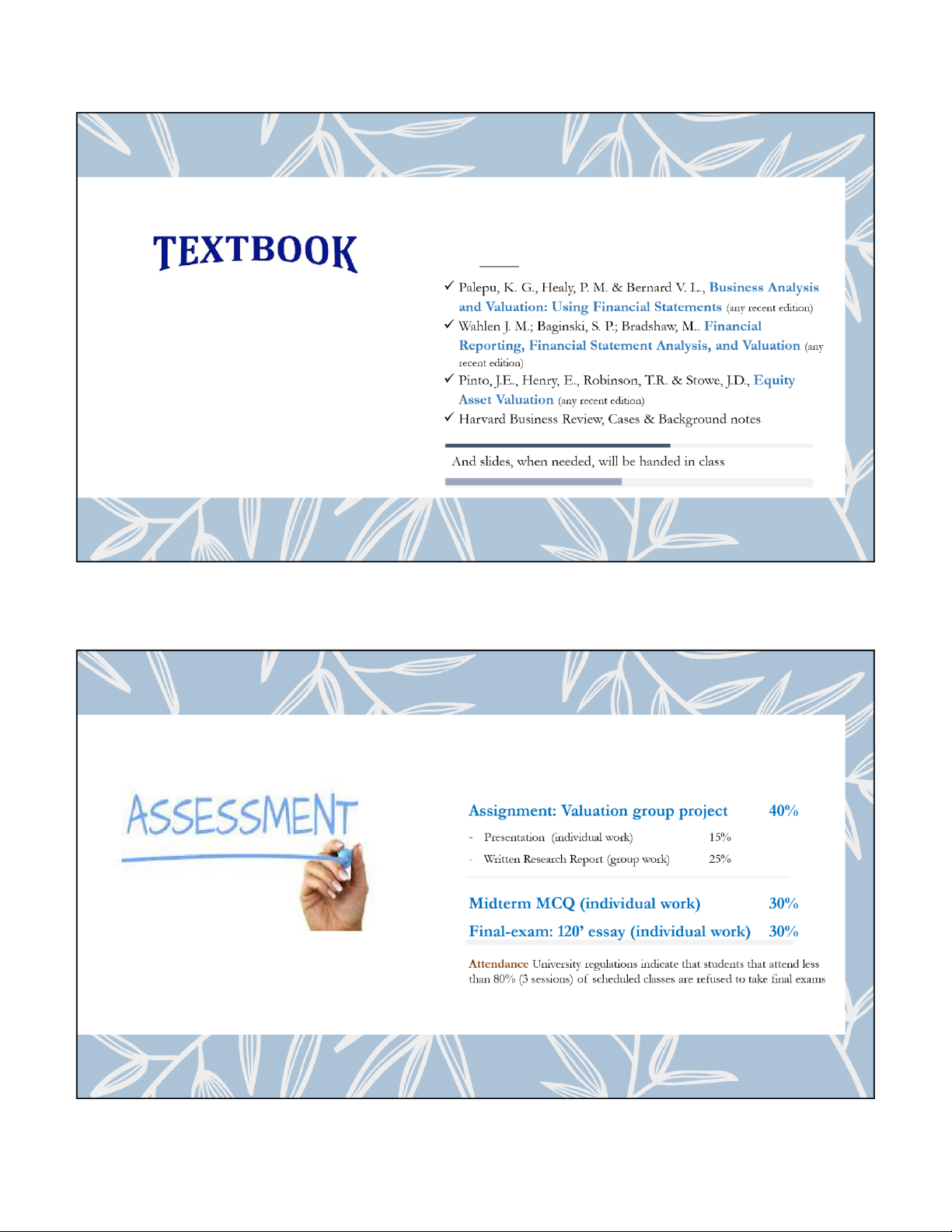

• Student team: groups of 4 students

• Your group decides on which company to be analyzed and valued: • which company?

publicly traded company on HOSE in 5 years (no private firm)

Your decision should be based on your observation, including:

• VNINDEX 30, size (market capitalization), historical fluctuation on price, Time to go public

• Excluding companies from: Financial industry, e.g. Banking (e.g. VCB, STB, EIB, ..); Insurance (e.g. BVH,

OCG, ..; Financial Services (SSI, PVF, …), Real estates Investment Services (e.g. QCG) COMPANY RESEARCH PROJECT

• Student team: groups of 4 students

• Your group decides on which company to be analyzed and valued: • how format? 15 – 20 pages

CFA ref. CFA website challenges winners reports

https://www.wallstreetprep.com/knowledge/sample-equity-research-report/

E.g.http://www.cfasociety.org/france/Global%20IRC%20Documents/IRC%202012/Rapport%20Chal

lenge%20IRC%202012%20-%20ESSEC.pdf • examined period?

2020 - 2024, value stock price as of the end of its financial year 2024 • how data?

Annual reports from companies websites (under “Investor Relations” lOMoAR cPSD| 59085392 2/12/2025 COMPANY RESEARCH PROJECT

• Submission of Group members & Target company

• No later than 11:59 PM, 28/03/2025

• Final research project (syllabus)

• Due date: on the presentation date 19 – 20 – 21 /05/2025 (hard copy)

• Due date on Blackboard submission: 11:59 PM, 19/05/2025 (include: presentation file, excel file of

calculation, and written report file)

• All your file should be named as (where XYZ is the Ticker of your target firm):

• [BAV_Assignment] _ Group XYZ_EXCEL

• [BAV_Assignment] _ Group XYZ_PDF

• [BAV_Assignment] _ Group XYZ_PPT

“Some men know the price of everything and the value of nothing” - Oscar Wilde lOMoAR cPSD| 59085392 2/12/2025 END OF LECTURE 1