Preview text:

Micro economics cheat sheet Cheat Sheet

by egomezc via cheatography.com/146282/cs/31608/ Law of demand Law of supply

Competitive market equilibrium

Demand: the quantity of a good or service

Supply: quantity of goods and services that

Market equilibrium: When the quantity

that consumers are willing and able to

firms are willing and able to sell at any

demanded for a product is equal to the

purchase at a given price in a particular time given price

quantity supplied of the product period Law of supply

Law of supply: As price increases, supply Equilibrium price

Equilibrium price: the point where the Law of demand

Law of demand: quantity demanded increases

demand for the product matches the supply

increases when prices decrease and vise ASSUMPTIONS of the product versa

Diminishing marginal returns

Diminishing marginal returns: after some

Market disequilibrium: when the quantity ASSUMPTIONS

optimal level of capacity is reached, adding

demanded for a product is either higher or

Income effect: lower price = higher income =

an additional factor of production will

lower than the quantity supplied for the higher demand

actually result in smaller increases in output product

Substitution effect: consumers replace

Increasing marginal costs: firms are willing Excess supply

Excess supply: e price of a product is set

higher priced products with lower priced

and able to increase production only if they

above equilibrium price, creating a surplus ones.

receive a higher price for the additional

in the market represented by the higher

quantity supplied than demanded

Diminishing marginal utility

Diminishing marginal utility: as consumption units of output.

increases, the satisfaction gained from Excess demand

Excess demand: price for a product is set

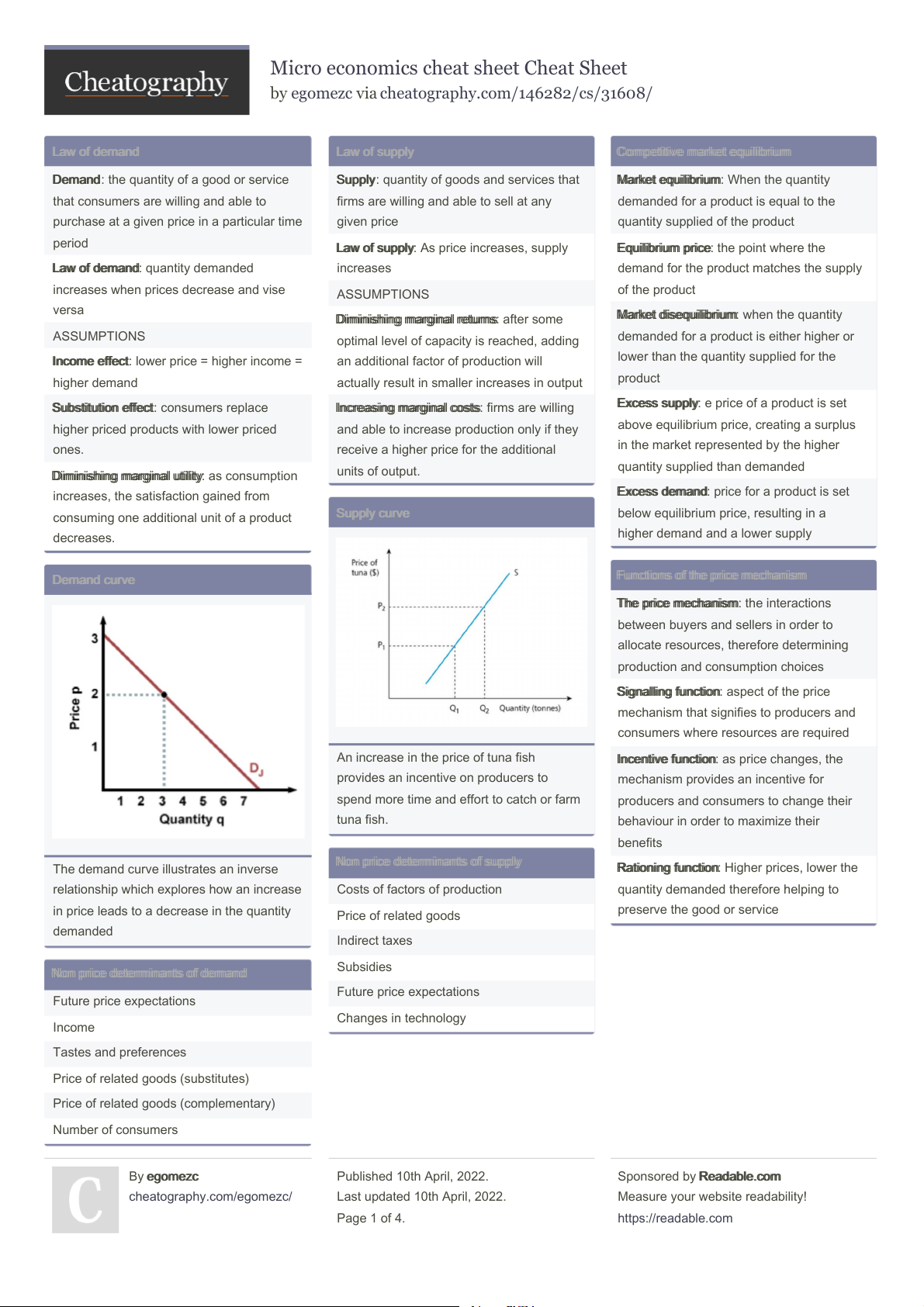

consuming one additional unit of a product Supply curve

below equilibrium price, resulting in a decreases.

higher demand and a lower supply Demand curve

Functions of the price mechanism

The price mechanism: the interactions

between buyers and sellers in order to

allocate resources, therefore determining

production and consumption choices Signalling function

Signalling function: aspect of the price

mechanism that signifies to producers and

consumers where resources are required

An increase in the price of tuna fish Incentive function

Incentive function: as price changes, the

provides an incentive on producers to

mechanism provides an incentive for

spend more time and effort to catch or farm

producers and consumers to change their tuna fish.

behaviour in order to maximize their benefits

Non price determinants of supply

The demand curve illustrates an inverse

Rationing function: Higher prices, lower the

relationship which explores how an increase Costs of factors of production

quantity demanded therefore helping to

in price leads to a decrease in the quantity preserve the good or service Price of related goods demanded Indirect taxes Subsidies

Non price determinants of demand Future price expectations Future price expectations Changes in technology Income Tastes and preferences

Price of related goods (substitutes)

Price of related goods (complementary) Number of consumers By egomezc egomezc Published 10th April, 2022. Sponsored by Readable.com Readable.com cheatography.com/egomezc/ Last updated 10th April, 2022.

Measure your website readability! Page 1 of 4. https://readable.com

Micro economics cheat sheet Cheat Sheet

by egomezc via cheatography.com/146282/cs/31608/ Surpluses Behavioural economics

Price elasticity of demand (cont)

Consumer: Benefit to buyers who can

Choice architecture: the deliberate design of

PED < 1 → price inelastic demand

purchase the product at a lower price than

different ways of presenting choices to

PED = 0 → perfectly price inelastic demand

they were willing and able to pay

members of society, and the impact of these

PED = ∞ → perfectly price elastic demand

Producer: Benefit to firms who receive a

methods on decision-making.

PED = 1 → unitary elastic demand

price that is higher than the price at which

Nudge theory: the practice of influencing the they were willing to supply at

choices that people make. Nudges are Price elasticity of supply

Social: Sum of consumer and producer

created by choice architects using small

The degree of responsiveness of quantity

surplus at a given market price and output,

prompts or tweaks to alter social and

supplied of a product due to a change in its

thereby maximizing economic welfare

economic behaviour, but without taking

away the power for people to choose. price Allocative efficiency Formula

Formula: PES = % change in quantity Business objectives supplied / % change in price profit maximization

profit maximization: Sales level where DEGREES OF PES VALUES profits are the highest

PES > 1 → price elastic supply CSR

CSR: commit ethical objectives to benefit

PES < 1 → price inelastic supply stakeholders

PES = 0 → perfectly price inelastic supply Market share

Market share: a firm's portion of the total

PES = ∞ → perfectly price elastic supply value of sales revenue

PES = 1 → unitary elastic supply

Satisfaction: aim for a satisfactory or

Socially optimum situation that occurs when adequate level or profit

resources are distributed in a way that Income elasticity of demand

allows consumers and producers to gain the Growth

Growth: increasing the size and scale of

The degree of responsiveness of demand operations of a firm maximum benefit following a change in income Formula

Formula: YED = % change in QD / % Price elasticity of demand Rational consumer choice change in income

The responsiveness of quantity demanded

decision-making process based on the YED SIGNS

assumption that people make choices that

for a good in relation to a change in the price for the product YED + < 1 → normal goods

result in the optimal level of benefits YED + > 1 →Luxury goods ASSUMPTIONS Price elastic

Price elastic: if a slight change in the price

or income leads to a large change in the YED - → Inferior goods Consumer rationality demand for the product. Utility maximization

Price inelastic: if a change in price or YED Engel curve Perfect information

income has little impact on the demand for LIMITATIONS a good or service.

Biases (rule of thumb, anchoring, framing Formula:

Formula: PED = % change in QD / % and availability) change in price Bounded rationality DEGREES OF PED VALUES Bounded self control

PED > 1 → price elastic demand Bounded selfishness

The engel curve is used to demonstrate the Imperfect information

relationship between income and the quantity demanded By egomezc egomezc Published 10th April, 2022. Sponsored by Readable.com Readable.com cheatography.com/egomezc/ Last updated 10th April, 2022.

Measure your website readability! Page 2 of 4. https://readable.com

Micro economics cheat sheet Cheat Sheet

by egomezc via cheatography.com/146282/cs/31608/

Reasons for government intervention

Market failure - externalities main terms Externalities Earn government revenue

Market failure: when the signalling,

The external costs or benefits of an Support firms

incentive and rationing functions of the price

economic transaction, causing the market

mechanism fail to operate optimally, which

to fail to achieve the socially optimal level of

Support households on low incomes

leads to a loss in economic welfare. It is consumption and production

Influence the level of production

when there is a misallocation of resources

Positive consumption: When consuming a

Influence the level of consumption private benefits

private benefits: advantages or gains of

good or service, provides a benefit to an To correct market failure

production and consumption enjoyed by an unrelated third party Promote equity individual firm or person.

Positive production: the positive effect an

Private costs: actual expenses incurred by

activity imposes on an unrelated third party

Main forms of government intervention an individual firm or person Negative consumption

Negative consumption: when consuming a PRICE CONTROLS Social benefits

Social benefits: benefits of consumption or

good causes a harmful effect to a third party

Government regulations establishing a

production, that is, the sum of private

Negative production: the production process

maximum or minimum price to be charged benefits and external benefits

results in a harmful effect on a third party.

for certain goods and services. They consist

Social costs: costs of consumption or

INTERVENTION TO CORRECT EXTERN‐

of price ceilings and price floors.

production, that is, the sum of private costs ALITIES

price ceilings: limits the maximum price in and external costs

Indirect taxes, carbon taxes, education,

order to encourage output and consum‐

MPB: additional value enjoyed by

international agreements, subsidies, direct ption.

households and firms from the consumption provision Price floor

Price floor: binding minimum price in order

or production of an extra unit of a particular

to encourage production and supply good or service. Public goods INDIRECT TAXES MPC

MPC additional expense of production for

Collective consumption goods that have

firms or the extra charge paid by customers

A government levy or charge on the sale of

two key characteristics of being non

for the output or consumption of an extra

goods and services, rather than on incomes rivalrous and non excludable unit of a good or service or wealth.

Non rivalrous: a person’s consumption of a

MSB: total gains to society from an extra

specific: charge a fixed amount of tax per

public good does not limit the benefits

unit of production or consumption of a unit sold available to other people. particular good or service Ad valorem

Ad valorem: impose a percentage tax on the

Non excludable: firms cannot exclude MSC

MSC total expenses to society from an extra value of a good or service.

people from the benefits of consumption

unit of production or consumption of a SUBSIDIES FREE RIDER PROBLEM particular product

a sum of money granted to help keep the

When people have access to a good or

price of a commodity or service low.

service without having to pay for it. As a

result, the good or service will be under DIRECT PROVISION

provided or not provided at all in the free

Government provides certain goods and market

services deemed to be in the best interest of the public. By egomezc egomezc Published 10th April, 2022. Sponsored by Readable.com Readable.com cheatography.com/egomezc/ Last updated 10th April, 2022.

Measure your website readability! Page 3 of 4. https://readable.com

Micro economics cheat sheet Cheat Sheet

by egomezc via cheatography.com/146282/cs/31608/ Asymmetric information

A source of market failure that exists when

one economic agent (buyer or seller) has

more information than the other in an

economic transaction. It occurs owing to

incomplete information or inaccessibility to information. Adverse selection

Adverse selection: the undesired decisions

or outcomes that occur when buyers and

sellers have access to imperfect inform‐ ation. Moral hazard

Moral hazard: situation where a party

protected from risk behaves differently than

if they were fully exposed to the risk.

Responses to asymmetric information GOVERNMENT RESPONSES legislation Provision of information PRIVATE RESPONSES

Signalling: used by parties with access to

more information to maximize their own level of satisfaction Screening

Screening: used by parties with access to

less information to maximize their own level of satisfaction By egomezc egomezc Published 10th April, 2022. Sponsored by Readable.com Readable.com cheatography.com/egomezc/ Last updated 10th April, 2022.

Measure your website readability! Page 4 of 4. https://readable.com