Preview text:

Group 5 Class: EBDB 6 GROUPASSIGNMENTPRESENTATION

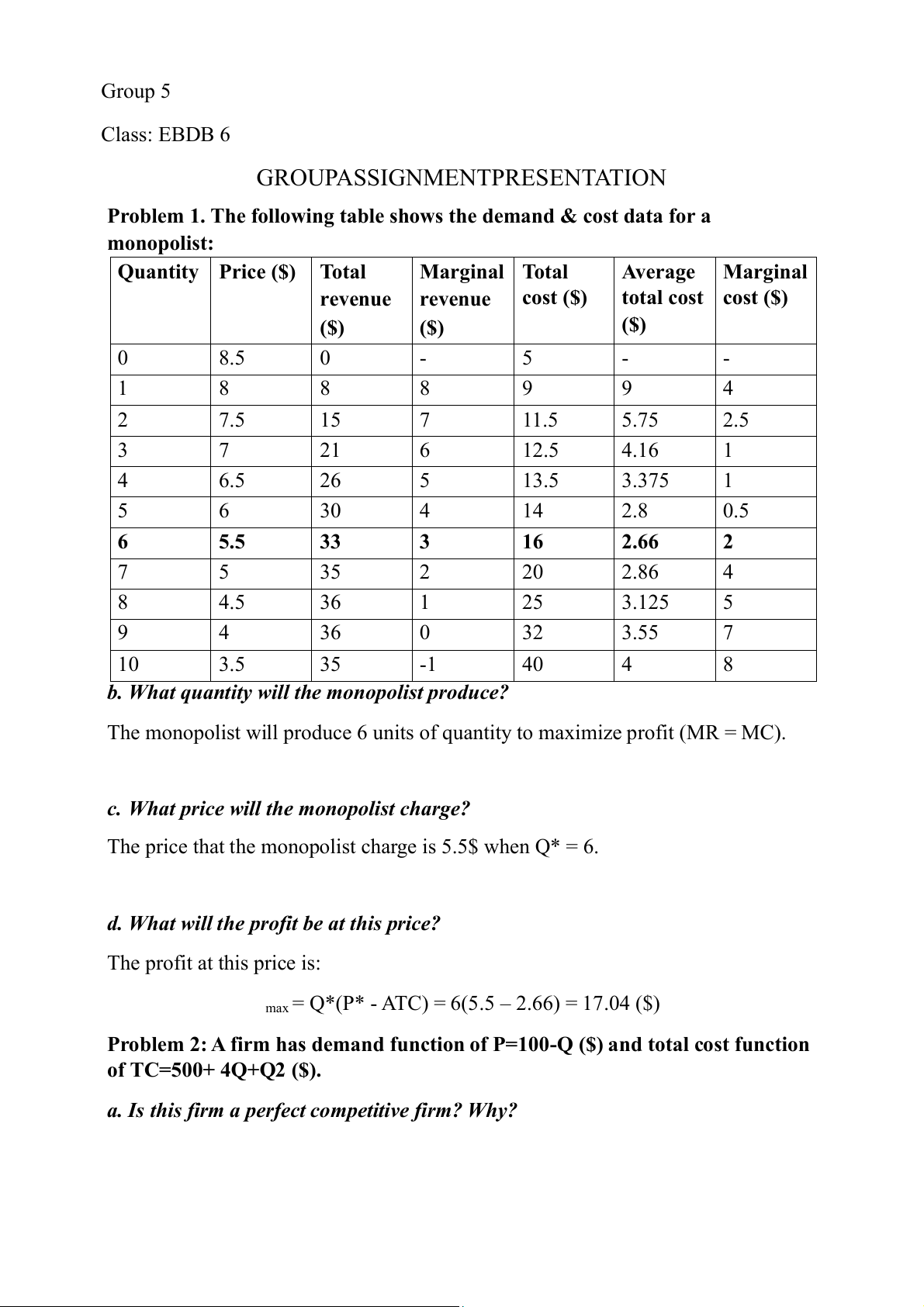

Problem 1. The following table shows the demand & cost data for a monopolist: Quantity Price ($) Total Marginal Total Average Marginal revenue revenue cost ($) total cost cost ($) ($) ($) ($) 0 8.5 0 - 5 - - 1 8 8 8 9 9 4 2 7.5 15 7 11.5 5.75 2.5 3 7 21 6 12.5 4.16 1 4 6.5 26 5 13.5 3.375 1 5 6 30 4 14 2.8 0.5 6 5.5 33 3 16 2.66 2 7 5 35 2 20 2.86 4 8 4.5 36 1 25 3.125 5 9 4 36 0 32 3.55 7 10 3.5 35 -1 40 4 8

b. What quantity will the monopolist produce?

The monopolist will produce 6 units of quantity to maximize profit (MR = MC).

c. What price will the monopolist charge?

The price that the monopolist charge is 5.5$ when Q* = 6.

d. What will the profit be at this price? The profit at this price is:

max = Q*(P* - ATC) = 6(5.5 – 2.66) = 17.04 ($)

Problem 2: A firm has demand function of P=100-Q ($) and total cost function of TC=500+ 4Q+Q2 ($).

a. Is this firm a perfect competitive firm? Why?

This firm isn’t a perfect competitive beacause if the firm is perfect competition, D

is horizontal, perfectly elastic.

In this case, P = 100 – Q → This firm is monopoly

b. What is price and quantity to maximize total revenue ? What is that maximum total revenue ? TR = P×Q = 100Q – Q2

TR’ = 0 → 100 – 2Q = 0 → Q = 50 (units)

P = 100 – Q = 100 – 50 = 50($) → TR max = 2500 ($)

c. What is price and optimal quantity to maximize profit? What is that maximum total profit ? Formula: D: P = a – bQ MR: P = a – 2bQ

In this case, D: P = 100 – Q → MR: P = 100 - 2Q

MC = (TC)’ = (500 + 4Q + Q2) = 4 + 2Q

To maximize profit, MC = MR → 100 – 2Q = 4 + 2Q → Q* = 24

→ P* = 100 – Q* = 100 – 24 = 76 ($) ATC = TC = 500+4Q+Q2 = $48.83 Q Q

→ max= Q(P – ATC) = 24(76 – 48.83) = 652.08 ($)

d. Asume government imposes a tax of 8 $ per unit of good sold, what is price and

optimal quantity that gives the firm maximum profit? What is this maximum profit?

Government imposes a tax of 8$ per unit of good sold:

TC = 500 + 4Q + Q2+ 8Q = 500 + 12Q + Q2

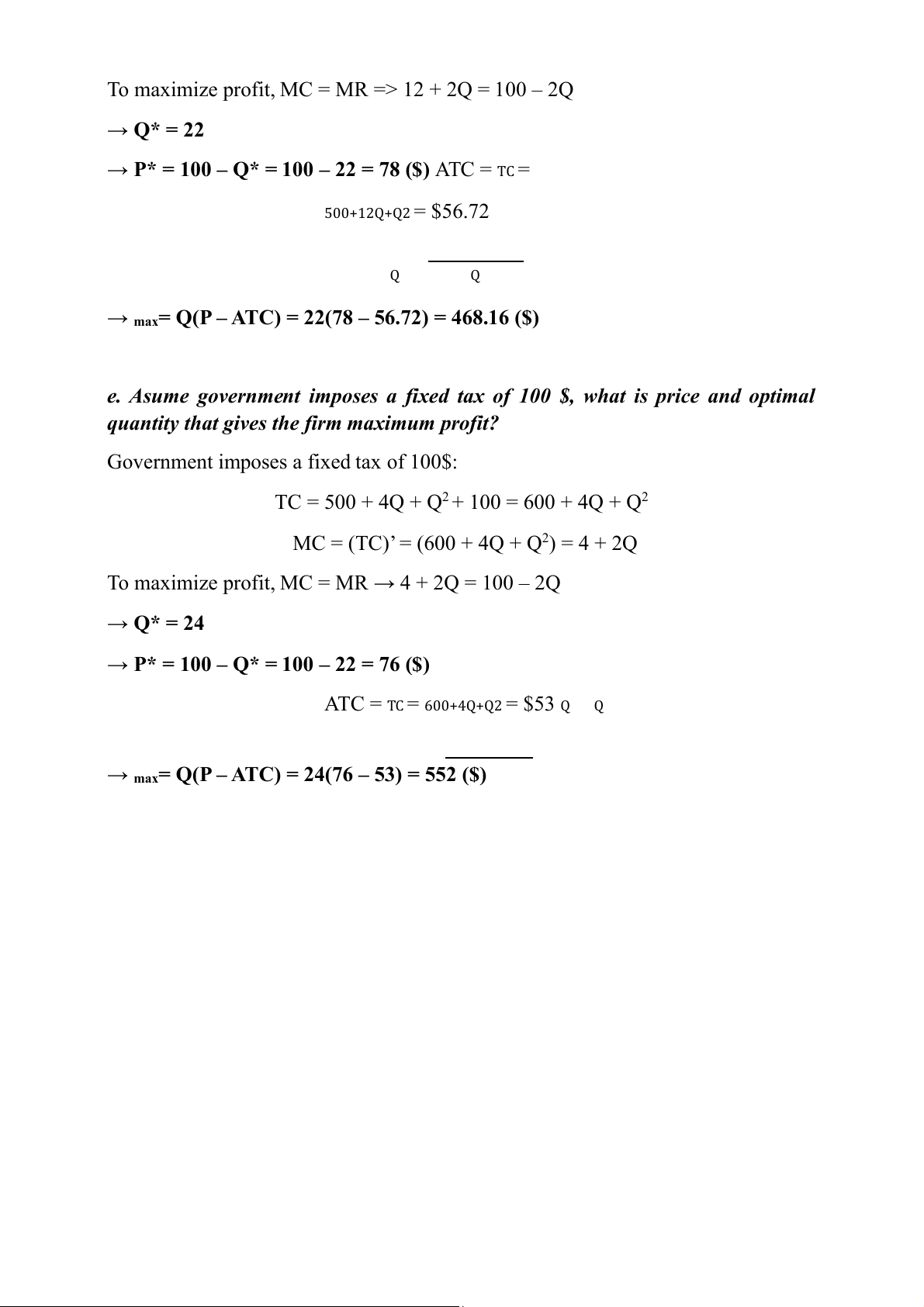

MC = (TC)’ = (500 + 12Q + Q2) = 12 + 2Q

To maximize profit, MC = MR => 12 + 2Q = 100 – 2Q → Q* = 22

→ P* = 100 – Q* = 100 – 22 = 78 ($) ATC = TC = 500+12Q+Q2 = $56.72 Q Q

→ max= Q(P – ATC) = 22(78 – 56.72) = 468.16 ($)

e. Asume government imposes a fixed tax of 100 $, what is price and optimal

quantity that gives the firm maximum profit?

Government imposes a fixed tax of 100$:

TC = 500 + 4Q + Q2 + 100 = 600 + 4Q + Q2

MC = (TC)’ = (600 + 4Q + Q2) = 4 + 2Q

To maximize profit, MC = MR → 4 + 2Q = 100 – 2Q → Q* = 24

→ P* = 100 – Q* = 100 – 22 = 76 ($)

ATC = TC = 600+4Q+Q2 = $53 Q Q

→ max= Q(P – ATC) = 24(76 – 53) = 552 ($)