Preview text:

Multiple choice topic – 9

Question 1: Under monopolistic competition, entry to the industry is:

A: completely free of barriers.

B: more difficult than under pure competition, but not nearly as difficult as under pure monopoly.

C: more difficult than under pure monopoly. D: blocked.

Question 2: Which of the following is not characteristic of monopolistic competition?

A: Easy entry to the industry.

B: Relatively large numbers of sellers. C: Product differentiation.

D: Production at minimum ATC in the long run.

Question 3: If the number of firms in a monopolistically competitive industry increases,

and the degree of product differentiation diminishes:

A: the likelihood of realising economic profits in the long run would be enhanced.

B: individual firms would now be operating at outputs where their average total costs would be higher.

C: the industry would more closely approximate pure competition.

D: the likelihood of collusive pricing would increase.

Question 4: The monopolistic competition model predicts that:

A: allocative efficiency will be achieved.

B: productive efficiency will be achieved.

C: firms will engage in non-price competition.

D: firms will realise economic profits in the long run.

Question 5: A monopolistically competitive firm has a :

A: highly elastic demand curve.

B: highly inelastic demand curve.

C: perfectly inelastic demand curve.

D: perfectly elastic demand curve.

Question 6: The monopolistically competitive seller's demand curve will tend to become more elastic, the: 1

A: more significant the barriers to entering the industry.

B: greater the degree of product differentiation.

C: larger the number of competitors.

D: smaller the number of competitors.

Question 7: A monopolistically competitive firm's marginal revenue curve:

A: is downsloping and coincides with the demand curve.

B: coincides with the demand curve and is parallel to the horizontal axis.

C: is downsloping and lies below the demand curve.

D: does not exist because the firm is a ‘price maker’.

Question 8: Monopolistically competitive firms:

A: realise normal profits in the short run, but losses in the long run.

B: tend to incur persistent losses in both the short run and long run.

C: may realise either profits or losses in the short run, but tend to realise a normal profit in the long run.

D: persistently realise economic profits in both the short run and long run.

Question 9: The monopolistically competitive seller maximises profits by producing at the point where:

A: total revenue is at a maximum.

B: average costs are at a minimum.

C: marginal revenue equals marginal cost.

D: price equals marginal revenue.

Question 10: In the long run, a monopolistically competitive firm's economic profits:

A: will be maximised where price equals average cost.

B: may be positive, zero, or negative. C: are always positive. D: tend towards zero.

Question 11: Other things being the same, if more firms enter a monopolistically

competitive industry, we would expect:

A: the demand curves facing existing firms to shift to the right.

B: the demand curves facing existing firms to shift to the left.

C: the demand curves facing existing firms to become less elastic.

D: that losses would necessarily occur. 2

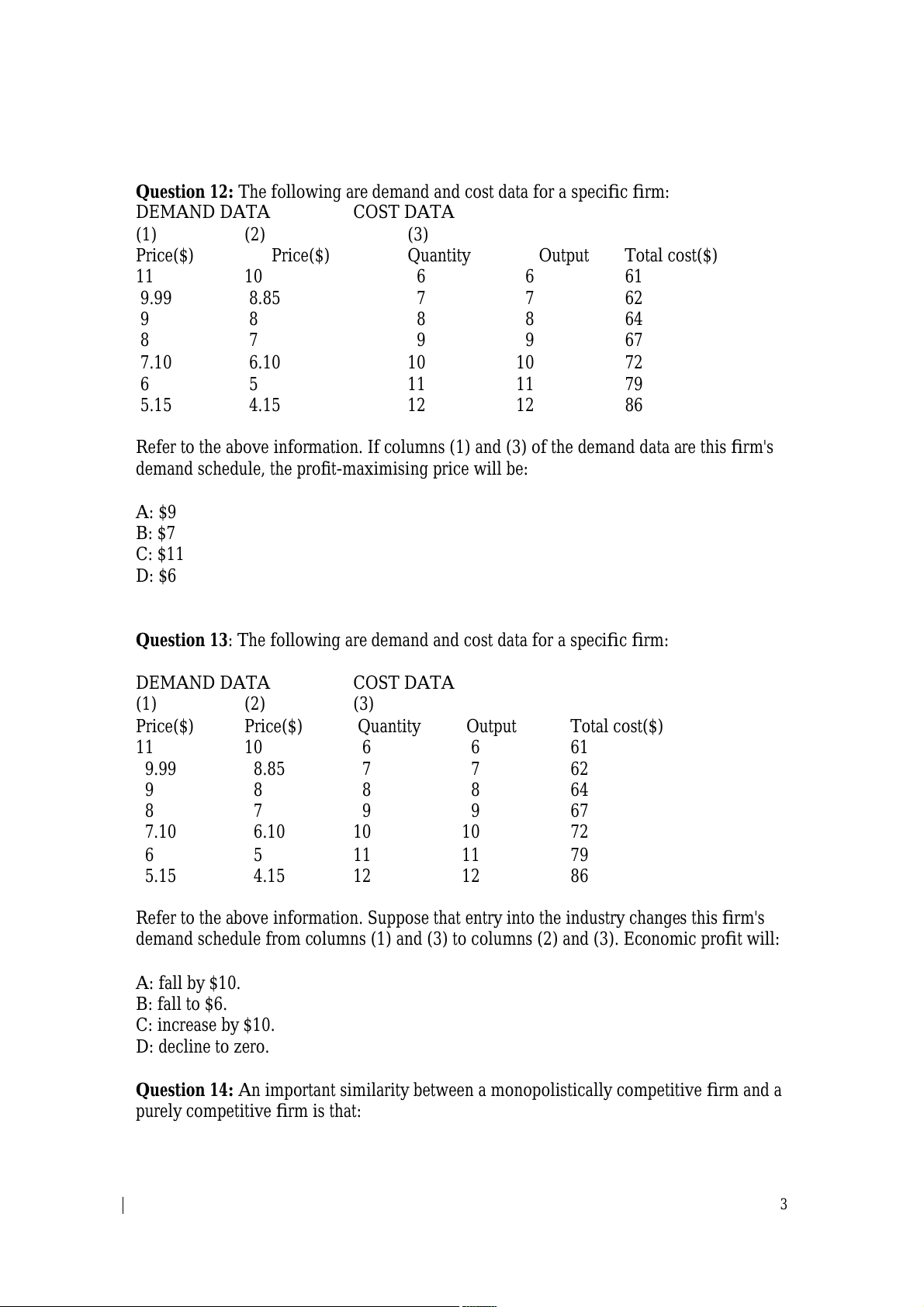

Question 12: The following are demand and cost data for a specific firm: DEMAND DATA COST DATA (1) (2) (3) Price($) Price($) Quantity Output Total cost($) 11 10 6 6 61 9.99 8.85 7 7 62 9 8 8 8 64 8 7 9 9 67 7.10 6.10 10 10 72 6 5 11 11 79 5.15 4.15 12 12 86

Refer to the above information. If columns (1) and (3) of the demand data are this firm's

demand schedule, the profit-maximising price will be: A: $9 B: $7 C: $11 D: $6

Question 13: The following are demand and cost data for a specific firm: DEMAND DATA COST DATA (1) (2) (3) Price($) Price($) Quantity Output Total cost($) 11 10 6 6 61 9.99 8.85 7 7 62 9 8 8 8 64 8 7 9 9 67 7.10 6.10 10 10 72 6 5 11 11 79 5.15 4.15 12 12 86

Refer to the above information. Suppose that entry into the industry changes this firm's

demand schedule from columns (1) and (3) to columns (2) and (3). Economic profit will: A: fall by $10. B: fall to $6. C: increase by $10. D: decline to zero.

Question 14: An important similarity between a monopolistically competitive firm and a

purely competitive firm is that: 3

A: both face perfectly elastic demand schedules.

B: economic profits tend toward zero for both.

C: both realise productive efficiency.

D: both realise allocative efficiency.

Question 15: In equilibrium, a monopolistically competitive producer achieves:

A: neither ‘productive efficiency’ nor ‘allocative efficiency’.

B: both ‘productive efficiency’ and ‘allocative efficiency’.

C: ‘productive efficiency’, but not ‘allocative efficiency’.

D: ‘allocative efficiency’, but not ‘productive efficiency’.

Question 16: Non-price competition refers to:

A: competition between products of different industries, e.g. competition between

aluminium and steel in the manufacture of automobile parts.

B: price increases by a firm, which are ignored by its rivals.

C: advertising, product promotion, and changes in the real or perceived characteristics of a product.

D: reductions in production costs which are not reflected in price reductions.

Question 17: Oligopolistic industries are characterised by:

A: a few dominant firms and substantial entry barriers.

B: a few dominant firms and no barriers to entry.

C: a large number of firms and low entry barriers.

D: a few dominant firms and low entry barriers.

Question 18: The mutual interdependence which characterises oligopoly arises because:

A: the products of various firms are homogeneous.

B: the products of various firms are differentiated.

C: a small number of firms produce a large proportion of industry output.

D: the demand curves of firms are kinked at the prevailing price.

Question 19: Barriers to entry in oligopolistic industries may consist of: A: economies of scale. B: patents.

C: ownership of essential resources. D: all of the above.

Question 20: Economists use game theory to analyse the choices faced by the managers

of oligopolistic firms primarily because: 4

A: the number of firms is too large to make collusion understandable.

B: the price and output decisions of any one firm depend upon the reactions of its rivals.

C: output may be either homogeneous or differentiated.

D: neither allocative nor productive efficiency is achieved.

Question 21: Concentration ratios measure the:

A: geographic location of the largest corporations in each industry.

B: degree to which product price exceeds marginal cost in various industries.

C: percentage of total sales accounted for by a given number of the largest firms in the industry.

D: number of firms in an industry.

Question 22: Game theory can be used to demonstrate:

A: that oligopolistic firms are mutually interdependent.

B: that independent pricing will lead to low-price policies.

C: that oligopolists can increase their profits through collusion. D: all of the above.

Question 23: The kinked demand curve model helps to explain price rigidity because:

A: there is a gap in the marginal revenue curve, within which changes in marginal cost

will not affect output or price.

B: demand is inelastic above and elastic below the ‘going’ price.

C: the model assumes firms are engaging in some form of collusion.

D: the associated marginal revenue curve is perfectly elastic at the ‘going’ price. 5