Preview text:

Chapter 17 Oligopoly TRUE/FALSE 1.

The essence of an oligopolistic market is that there are only a few sellers.

Dịch: Bản chất của một thị trường độc quyền là chỉ có một vài người bán 2. ANS: T DIF: 1 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Definitional 2.

Game theory is just as necessary for understanding competitive or monopoly markets as it is for understanding oligopolistic markets. ANS: F DIF: 2 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Game theory MSC: Interpretive 3.

In a competitive market, strategic interactions among the firms are không important. ANS: T DIF: 1 REF: 17-0 NAT: Analytic LOC: Oligopoly

TOP: Game theory | Competitive markets MSC: Interpretive 4.

For a firm, strategic interactions with other firms in the market become more important as the number of firms in the market becomes larger. ANS: F DIF: 2 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Game theory MSC: Interpretive 5.

Suppose three firms form a cartel and agree to charge a specific price for their output. Each individual firm

has an incentive to maintain the agreement because the firm’s individual profits will be the greatest under the cartel arrangement. ANS: F DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Collusion MSC: Interpretive 6.

If firms in an oligopoly agree to produce according to the monopoly outcome, they will produce the same level

of output as they would produce in a Nash equilibrium. ANS: F DIF: 1 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Cooperation MSC: Interpretive 7.

Whether an oligopoly consists of 3 firms or 10 firms, the level of output likely will be the same. ANS: F DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 8.

Cartels with a small number of firms have a greater probability of reaching the monopoly outcome than do

cartels with a larger number of firms. ANS: T DIF: 1 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 9.

As the number of firms in an oligopoly becomes very large, the price effect disappears. ANS: T DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 10.

If all of the firms in an oligopoly successfully collude and form a cartel, then total profit for the cartel is equal

to what it would be if the market were a monopoly. ANS: T DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 11.

As the number of firms in an oligopoly increases, the magnitude of the price effect increases. ANS: F DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 1153 1154 Chapter 17/Oligopoly 12.

All examples of the prisoner’s dilemma game are characterized by one and only one Nash equilibrium. ANS: F DIF: 3 REF: 17-2 NAT: Analytic LOC: Oligopoly

TOP: Nash equilibrium | Prisoners' dilemma MSC: Interpretive 13.

If two players engaged in a prisoner’s dilemma game are likely to repeat the game, they are more likely to

cooperate than if they play the game only once. ANS: T DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Prisoners' dilemma MSC: Interpretive 14.

The story of the prisoners' dilemma contains a general lesson that applies to any group trying to maintain cooperation among its members. ANS: T DIF: 1 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Prisoners' dilemma MSC: Interpretive 15.

In the prisoners' dilemma game, one prisoner is always better off confessing, no matter what the other prisoner does. ANS: T DIF: 1 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Prisoners' dilemma MSC: Interpretive 16.

In the prisoners' dilemma game, confessing is a dominant strategy for each of the two prisoners. ANS: T DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly

TOP: Prisoners' dilemma | Dominant strategy MSC: Interpretive 17.

The game that oligopolists play in trying to reach the oligopoly outcome is similar to the game that the two

prisoners play in the prisoners' dilemma. ANS: T DIF: 1 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Interpretive 18.

In the case of oligopolistic markets, self-interest makes cooperation difficult and it often leads to an

undesirable outcome for the firms that are involved. ANS: T DIF: 1 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Interpretive 19.

When prisoners' dilemma games are repeated over and over, sometimes the threat of penalty causes both parties to cooperate. ANS: T DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Prisoners' dilemma MSC: Interpretive 20.

A tit-for-tat strategy, in a repeated game, is one in which a player starts by cooperating and then does whatever

the other player did last time. ANS: T DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Definitional 21.

One way that public policy encourages cooperation among oligopolists is through antitrust law. ANS: F DIF: 1 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Antitrust MSC: Interpretive 22.

The Sherman Antitrust Act prohibits competing firms from even talking about fixing prices. ANS: T DIF: 1 REF: 17-3 NAT: Analytic LOC: Oligopoly

TOP: Sherman Antitrust Act of 1890 MSC: Interpretive Chapter 17/Oligopoly 1155 23.

Resale price maintenance prevents retailers from competing on price. ANS: T DIF: 1 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Resale price maintenance MSC: Interpretive 24.

Some business practices that appear to reduce competition, such as resale price maintenance, may have legitimate economic purposes. ANS: T DIF: 2 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Resale price maintenance MSC: Interpretive 25.

In 2007 the U.S. Supreme Court ruled that it was không necessary illegal for manufacturers and distributors to

agree on minimum retail prices. ANS: T DIF: 2 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Resale price maintenance MSC: Definitional 26.

Tying can be thought of as a form of price discrimination. ANS: T DIF: 1 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Tying MSC: Interpretive 27.

Policymakers should be aggressive in using their powers to place limits on firm behavior, because business

practices that appear to reduce competition never have any legitimate purposes. ANS: F DIF: 2 REF: 17-4 NAT: Analytic

LOC: The role of government TOP: Antitrust MSC: Interpretive SHORT ANSWER 1.

Even when allowed to collude, firms in an oligopoly may choose to cheat on their agreements with the rest of the cartel. Why? ANS:

Individual profits can be increased at the expense of group profits if individuals cheat on the cartel's cooperative agreement. DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 2.

What effect does the number of firms in an oligopoly have on the characteristics of the market? ANS:

As the number of firms increases, the equilibrium quantity of goods provided increases and price falls; the market

begins to resemble a competitive one. DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Analytical 1156 Chapter 17/Oligopoly 3.

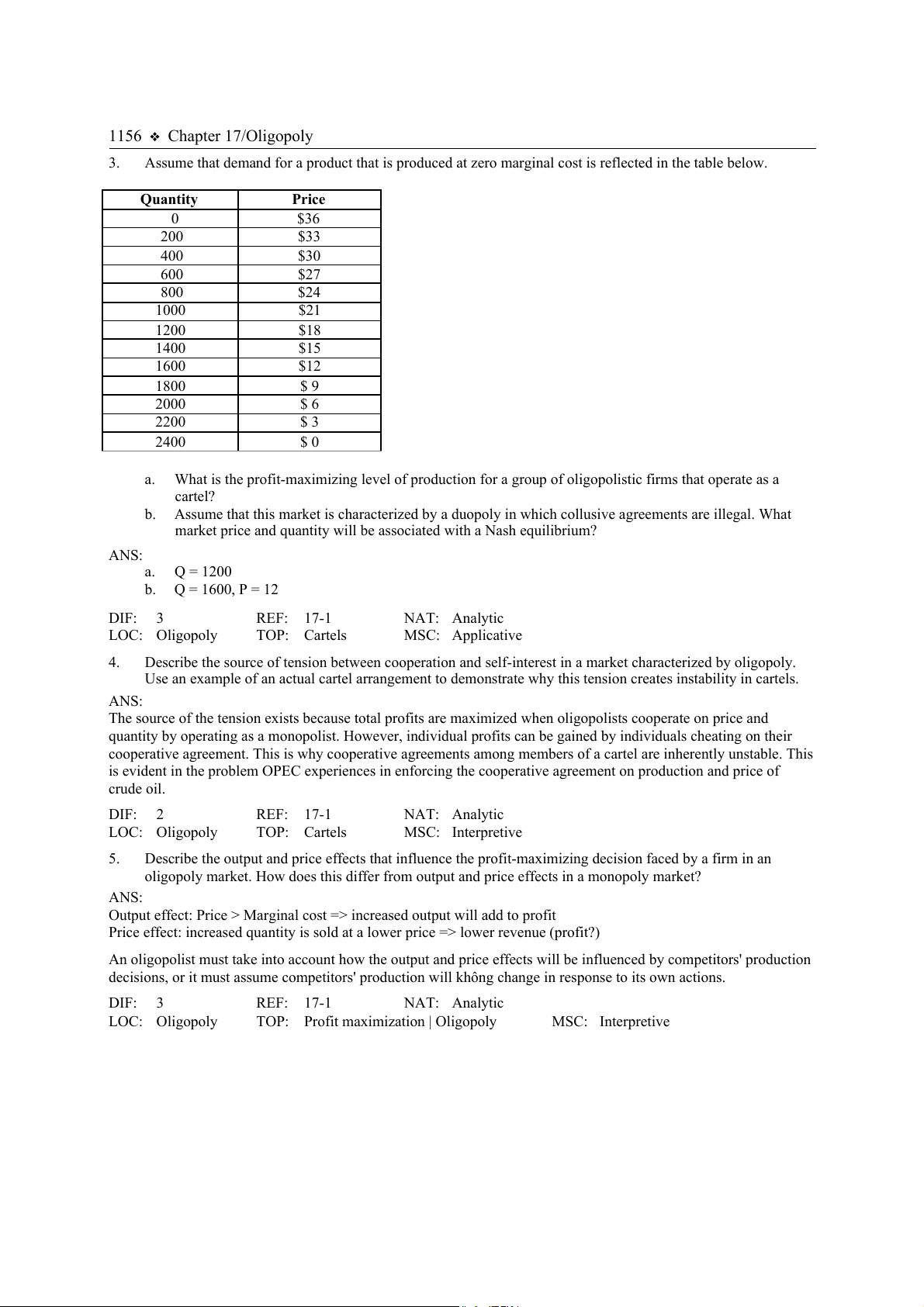

Assume that demand for a product that is produced at zero marginal cost is reflected in the table below. Quantity Price 0 $36 200 $33 400 $30 600 $27 800 $24 1000 $21 1200 $18 1400 $15 1600 $12 1800 $ 9 2000 $ 6 2200 $ 3 2400 $ 0 a.

What is the profit-maximizing level of production for a group of oligopolistic firms that operate as a cartel? b.

Assume that this market is characterized by a duopoly in which collusive agreements are illegal. What

market price and quantity will be associated with a Nash equilibrium? ANS: a. Q = 1200 b. Q = 1600, P = 12 DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Applicative 4.

Describe the source of tension between cooperation and self-interest in a market characterized by oligopoly.

Use an example of an actual cartel arrangement to demonstrate why this tension creates instability in cartels. ANS:

The source of the tension exists because total profits are maximized when oligopolists cooperate on price and

quantity by operating as a monopolist. However, individual profits can be gained by individuals cheating on their

cooperative agreement. This is why cooperative agreements among members of a cartel are inherently unstable. This

is evident in the problem OPEC experiences in enforcing the cooperative agreement on production and price of crude oil. DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 5.

Describe the output and price effects that influence the profit-maximizing decision faced by a firm in an

oligopoly market. How does this differ from output and price effects in a monopoly market? ANS:

Output effect: Price > Marginal cost => increased output will add to profit

Price effect: increased quantity is sold at a lower price => lower revenue (profit?)

An oligopolist must take into account how the output and price effects will be influenced by competitors' production

decisions, or it must assume competitors' production will không change in response to its own actions. DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly

TOP: Profit maximization | Oligopoly MSC: Interpretive Chapter 17/Oligopoly 1157 6.

Explain how the output effect and the price effect influence the production decision of the individual oligopolist. ANS:

Since the individual oligopolist faces a downward-sloping demand curve, she realizes that if she increases output, all

output must be sold at a lower market price. As such, the revenue from selling the additional units at the lower

market price must exceed the loss in revenue from selling all previous units at the new lower price. Otherwise,

profits will fall as output (production) is increased. DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly

TOP: Profit maximization | Oligopoly MSC: Interpretive 7.

Ford and General Motors are considering expanding into the Vietnamese automobile market. Devise a simple

prisoners' dilemma game to demonstrate the strategic considerations that are relevant to this decision. ANS:

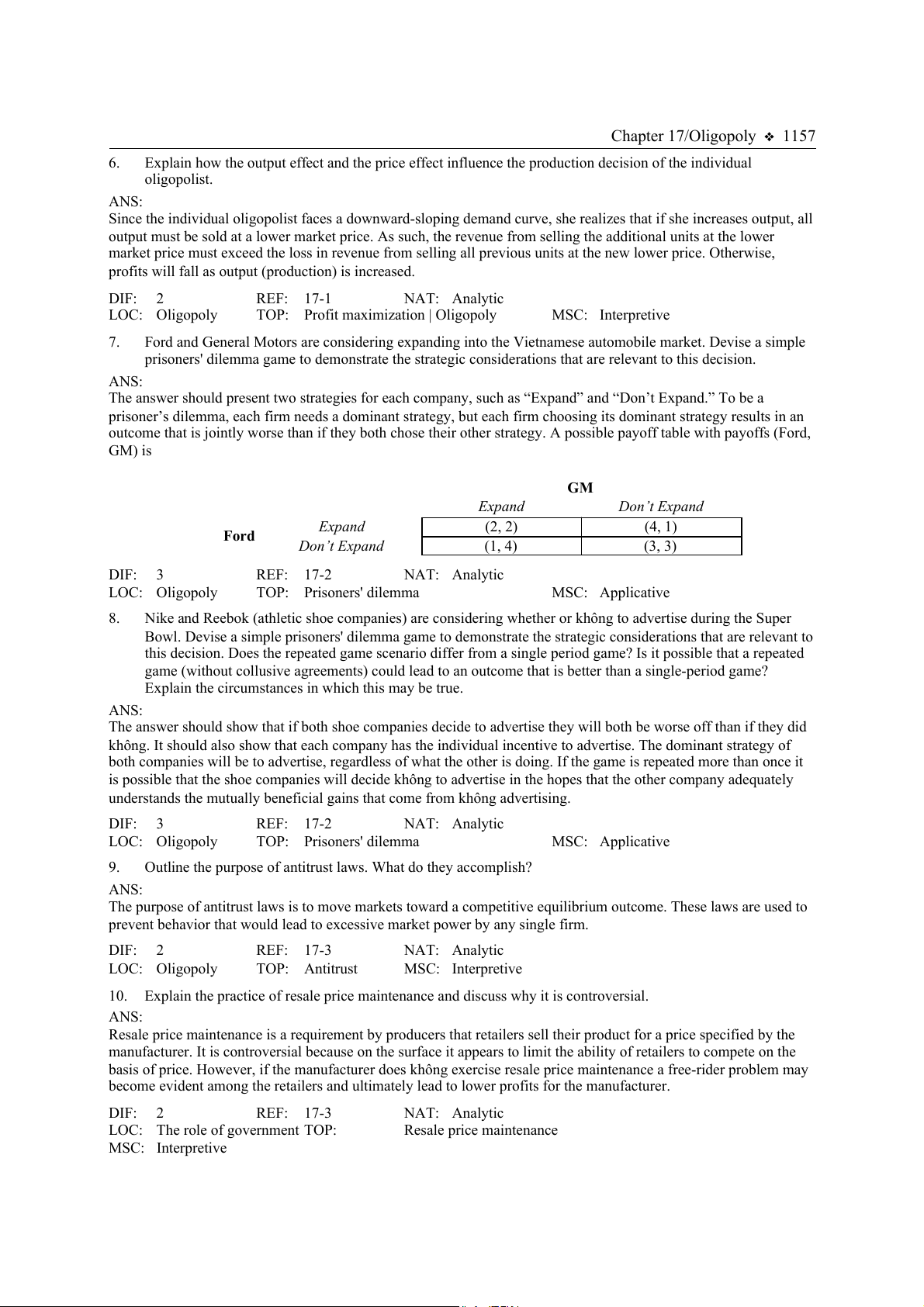

The answer should present two strategies for each company, such as “Expand” and “Don’t Expand.” To be a

prisoner’s dilemma, each firm needs a dominant strategy, but each firm choosing its dominant strategy results in an

outcome that is jointly worse than if they both chose their other strategy. A possible payoff table with payoffs (Ford, GM) is GM Expand Don’t Expand Expand (2, 2) (4, 1) Ford Don’t Expand (1, 4) (3, 3) DIF: 3 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Prisoners' dilemma MSC: Applicative 8.

Nike and Reebok (athletic shoe companies) are considering whether or không to advertise during the Super

Bowl. Devise a simple prisoners' dilemma game to demonstrate the strategic considerations that are relevant to

this decision. Does the repeated game scenario differ from a single period game? Is it possible that a repeated

game (without collusive agreements) could lead to an outcome that is better than a single-period game?

Explain the circumstances in which this may be true. ANS:

The answer should show that if both shoe companies decide to advertise they will both be worse off than if they did

không. It should also show that each company has the individual incentive to advertise. The dominant strategy of

both companies will be to advertise, regardless of what the other is doing. If the game is repeated more than once it

is possible that the shoe companies will decide không to advertise in the hopes that the other company adequately

understands the mutually beneficial gains that come from không advertising. DIF: 3 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Prisoners' dilemma MSC: Applicative 9.

Outline the purpose of antitrust laws. What do they accomplish? ANS:

The purpose of antitrust laws is to move markets toward a competitive equilibrium outcome. These laws are used to

prevent behavior that would lead to excessive market power by any single firm. DIF: 2 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Antitrust MSC: Interpretive 10.

Explain the practice of resale price maintenance and discuss why it is controversial. ANS:

Resale price maintenance is a requirement by producers that retailers sell their product for a price specified by the

manufacturer. It is controversial because on the surface it appears to limit the ability of retailers to compete on the

basis of price. However, if the manufacturer does không exercise resale price maintenance a free-rider problem may

become evident among the retailers and ultimately lead to lower profits for the manufacturer. DIF: 2 REF: 17-3 NAT: Analytic

LOC: The role of government TOP: Resale price maintenance MSC: Interpretive 1158 Chapter 17/Oligopoly 11.

Explain the practice of tying and discuss why it is controversial. ANS:

Tying is the practice of bundling goods for sale. It is controversial because it is perceived as a tool for expanding the

market power of firms by forcing consumers to purchase additional products. However, economists are skeptical

that a buyer's willingness to pay increases just because two products are bundled together. In other words, simply

bundling two products together doesn't necessarily add any value. It is more accurately believed to be a form of price discrimination. DIF: 2 REF: 17-3 NAT: Analytic LOC: Oligopoly TOP: Tying MSC: Interpretive Sec00 - Oligopoly MULTIPLE CHOICE 1.

In the language of game theory, a situation in which each person must consider how others might respond to

his or her own actions is called a a. quantifiable situation. b. cooperative situation. c. strategic situation. d. tactical situation. ANS: C DIF: 1 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Definitional 2. In general, is the study of game theory a.

how people behave in strategic situations.

b. how people behave when the possible actions of other people are irrelevant. c. oligopolistic markets.

d. all types of markets, including competitive markets, monopolistic markets, and oligopolistic markets. ANS: A DIF: 2 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Definitional 3.

Which of the following statements is correct? a.

Strategic situations are more likely to arise when the number of decision-makers is very large rather than very small.

b. Strategic situations are more likely to arise in monopolistically competitive markets than in oligopolistic markets. c.

Game theory is useful in understanding certain business decisions, but it is không really applicable

to ordinary games such as chess or tic-tac-toe.

d. Game theory is không necessary for understanding competitive or monopoly markets. ANS: D DIF: 2 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Interpretive 4.

In which of the following markets are strategic interactions among firms most likely to occur? a.

markets to which patent and copyright laws apply

b. the market for piano lessons c. the market for tennis balls d. the market for corn ANS: C DIF: 2 REF: 17-0 NAT: Analytic LOC: Oligopoly TOP: Game theory MSC: Interpretive Chapter 17/Oligopoly 1159

Sec01 - Oligopoly - Markets with Only a Few Sellers MULTIPLE CHOICE 1.

A distinguishing feature of an oligopolistic industry is the tension between a.

profit maximization and cost minimization.

b. cooperation and self interest. c.

producing a small amount of output and charging a price above marginal cost.

d. short-run decisions and long-run decisions. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 2.

In studying oligopolistic markets, economists assume that a.

there is no conflict or tension between cooperation and self-interest.

b. it is easy for a group of firms to cooperate and thereby establish and maintain a monopoly outcome. c.

each oligopolist cares only about its own profit.

d. strategic decisions do không play a role in such markets. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Cooperation MSC: Interpretive 3.

The simplest type of oligopoly is a. monopoly. b. duopoly. c. monopolistic competition. d. oligopolistic competition. ANS: B DIF: 1 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Interpretive 4.

A special kind of imperfectly competitive market that has only two firms is called a.

a two-tier competitive structure. b. an incidental monopoly. c. a doublet. d. a duopoly. ANS: D DIF: 1 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Definitional 5.

An agreement between two duopolists to function as a monopolist usually breaks down because a.

they cankhông agree on the price that a monopolist would charge.

b. they cankhông agree on the output that a monopolist would produce. c.

each duopolist wants a larger share of the market in order to capture more profit.

d. each duopolist wants to charge a higher price than the monopoly price. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Interpretive 6.

Which of the following statements is correct? a.

If duopolists successfully collude, then their combined output will be equal to the output that would

be observed if the market were a monopoly.

b. Although the logic of self-interest decreases a duopoly’s price below the monopoly price, it does

không push the duopolists to reach the competitive price. c.

Although the logic of self-interest increases a duopoly’s level of output above the monopoly level,

it does không push the duopolists to reach the competitive level.

d. All of the above are correct. ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Interpretive 1160 Chapter 17/Oligopoly 7.

Suppose that Sonny and Cher are duopolists in the music industry. In January, they agree to work together as

a monopolist, charging the monopoly price for their music and producing the monopoly quantity of songs. By

February, each singer is considering breaking the agreement. What would you expect to happen next? a.

Sonny and Cher will determine that it is in each singer’s best self interest to maintain the agreement.

b. Sonny and Cher will each break the agreement. The new equilibrium quantity of songs will

increase, and the new equilibrium price will decrease. c.

Sonny and Cher will each break the agreement. The new equilibrium quantity of songs will

decrease, and the new equilibrium price will increase.

d. Sonny and Cher will each break the agreement. The new equilibrium quantity of songs will

increase, and the new equilibrium price also will increase. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Interpretive 8.

As the number of firms in an oligopoly increases, the a.

price approaches marginal cost, and the quantity approaches the socially efficient level.

b. price and quantity approach the monopoly levels. c.

price effect exceeds the output effect.

d. individual firms’ profits increase. ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 9.

If a certain market were a monopoly, then the monopolist would maximize its profit by producing 1,000 units

of output. If, instead, that market were a duopoly, then which of the following outcomes would be most likely

if the duopolists successfully collude? a.

Each duopolist produces 1,000 units of output.

b. Each duopolist produces 600 units of output. c.

One duopolist produces 400 units of output and the other produces 600 units of output.

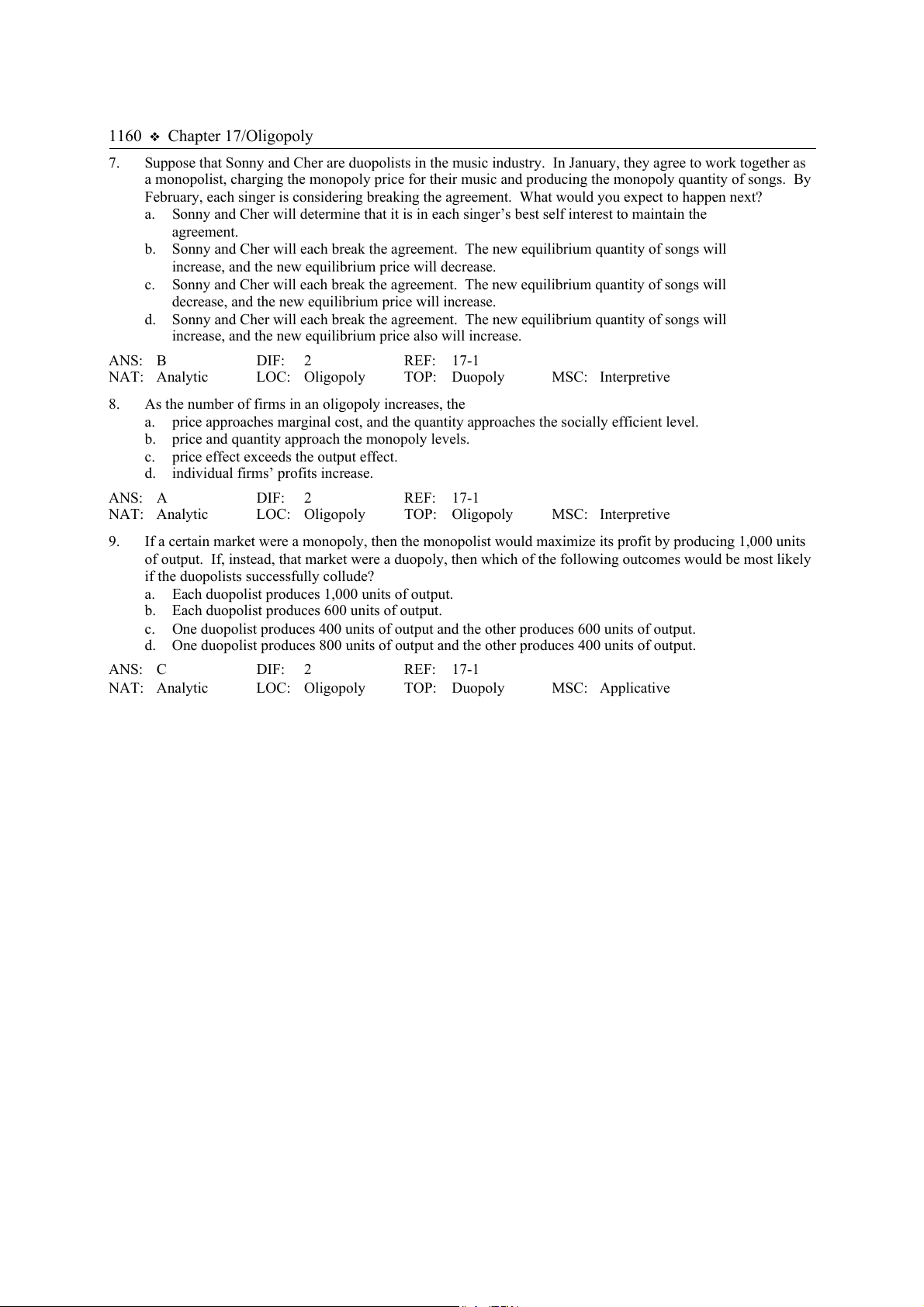

d. One duopolist produces 800 units of output and the other produces 400 units of output. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Applicative Chapter 17/Oligopoly 1161 Table 17-1

Imagine a small town in which only two residents, Lisa and Mark, own wells that produce safe drinking water. Each

week Lisa and Mark work together to decide how many gallons of water to pump. They bring the water to town and

sell it at whatever price the market will bear. To keep things simple, suppose that Lisa and Mark can pump as much

water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule

and total revenue schedule for water is shown in the table below: Quantity Price Total Revenue (in gallons) (and Total Profit) 0 $120 $0 100 110 11,000 200 100 20,000 300 90 27,000 400 80 32,000 500 70 35,000 600 60 36,000 700 50 35,000 800 40 32,000 900 30 27,000 1,000 20 20,000 1,100 10 11,000 1,200 0 0 10.

Refer to Table 17-1. If Lisa and Mark operate as a profit-maximizing monopoly in the market for water, what price will they charge? a. $20 b. $40 c. $60 d. $70 ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Monopoly MSC: Applicative 11.

Refer to Table 17-1. If Lisa and Mark operate as a profit-maximizing monopoly in the market for water, how

many gallons of water will be produced and sold? a. 0 b. 500 c. 600 d. 1,200 ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Monopoly MSC: Applicative 12.

Refer to Table 17-1. If Lisa and Mark operate as a profit-maximizing monopoly in the market for water, how

much profit will each of them earn? a. $0 b. $18,000 c. $32,000 d. $36,000 ANS: B DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Monopoly MSC: Applicative 1162 Chapter 17/Oligopoly 13.

Refer to Table 17-1. If the market for water were perfectly competitive instead of monopolistic, how many

gallons of water would be produced and sold? a. 0 b. 600 c. 900 d. 1,200 ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Competitive markets MSC: Applicative 14.

Refer to Table 17-1. What is the socially efficient quantity of water? a. 0 gallons b. 600 gallons c. 900 gallons d. 1,200 gallons ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Competitive markets MSC: Applicative 15.

Refer to Table 17-1. If this market for water were perfectly competitive instead of monopolistic, what price would be charged? a. $0 b. $50 c. $60 d. $120 ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Competitive markets MSC: Applicative 16.

Refer to Table 17-1. Suppose the town enacts new antitrust laws that prohibit Lisa and Mark from operating

as a monopoly. What will be the price of water once Lisa and Mark reach a Nash equilibrium? a. $30 b. $40 c. $50 d. $60 ANS: B DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Analytical 17.

Refer to Table 17-1. Suppose the town enacts new antitrust laws that prohibit Lisa and Mark from operating

as a monopoly. How many gallons of water will be produced and sold once Lisa and Mark reach a Nash equilibrium? a. 600 b. 700 c. 800 d. 900 ANS: C DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Analytical Chapter 17/Oligopoly 1163

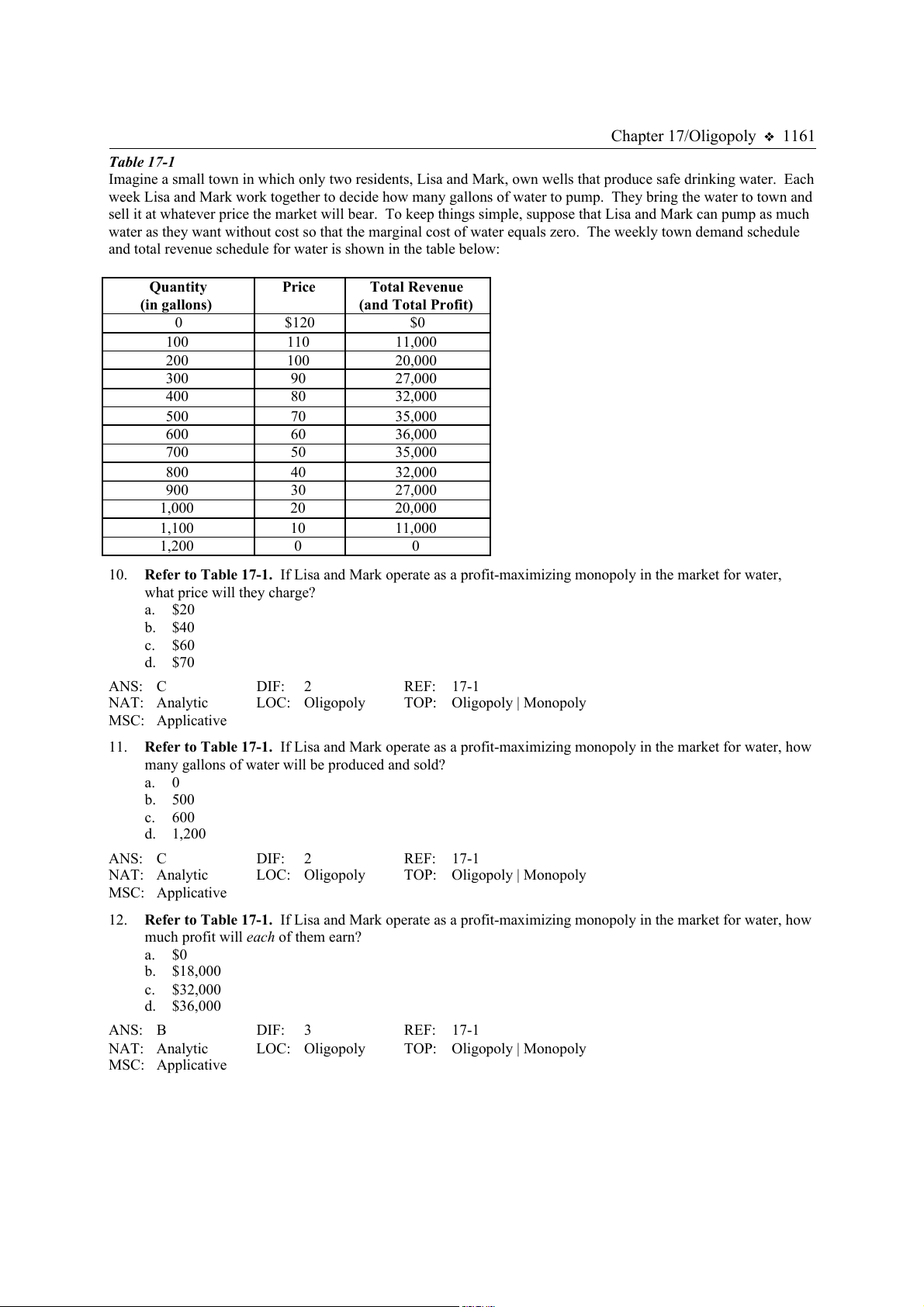

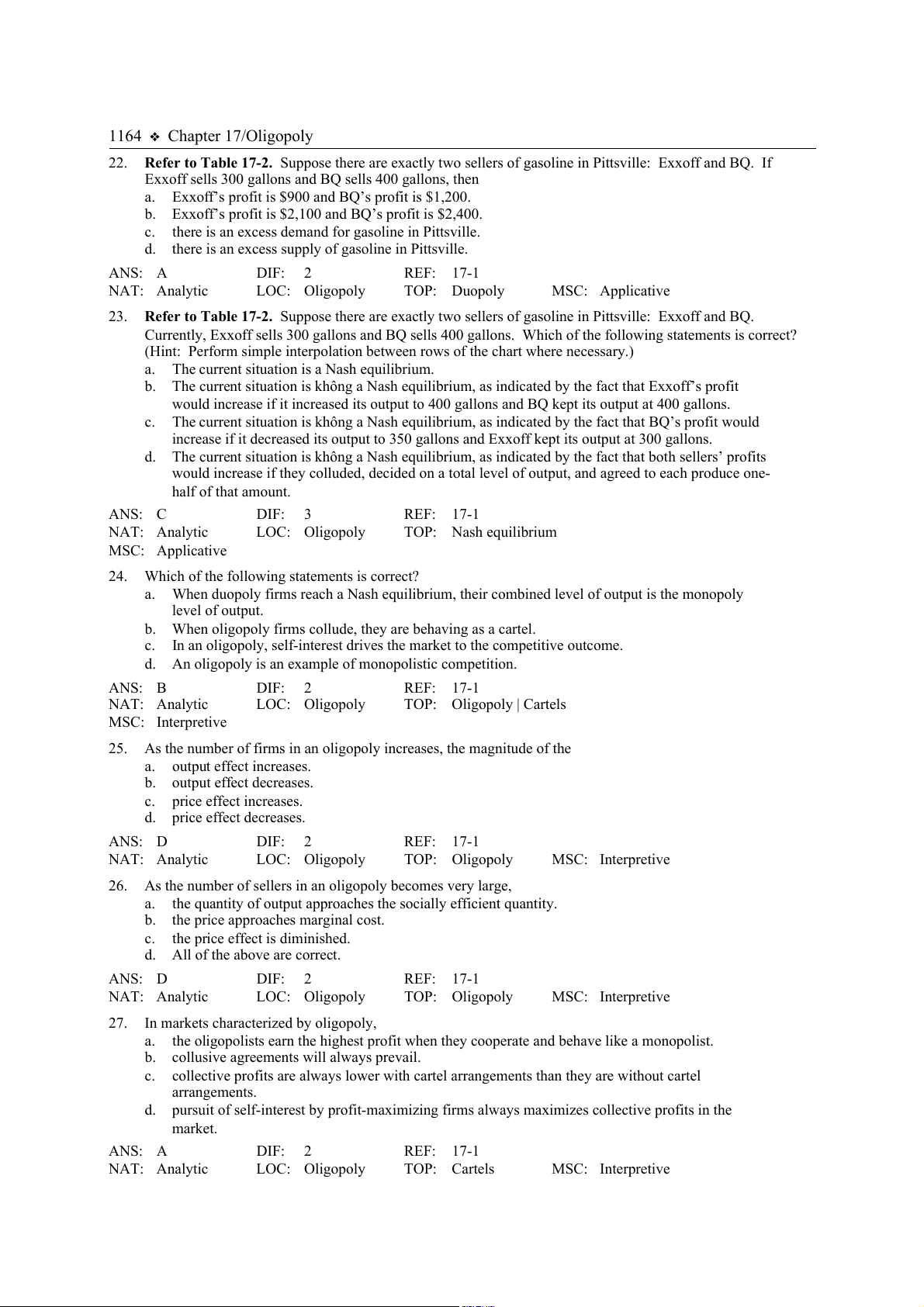

Table 17-2. The table shows the town of Pittsville’s demand schedule for gasoline. For simplicity, assume the

town’s gasoline seller(s) incur no costs in selling gasoline. Quantity Total Revenue (in gallons) Price (and total profit) 0 $10 $0 100 9 900 200 8 1,600 300 7 2,100 400 6 2,400 500 5 2,500 600 4 2,400 700 3 2,100 800 2 1,600 900 1 900 1,000 0 0 18.

Refer to Table 17-2. If the market for gasoline in Pittsville is perfectly competitive, then the equilibrium price of gasoline is a.

$8 and the equilibrium quantity is 200 gallons.

b. $5 and the equilibrium quantity is 500 gallons. c.

$2 and the equilibrium quantity is 800 gallons.

d. $0 and the equilibrium quantity is 1,000 gallons. ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Perfect competition TOP: Perfect Competition MSC: Applicative 19.

Refer to Table 17-2. If the market for gasoline in Pittsville is a monopoly, then the profit-maximizing

monopolist will charge a price of a. $8 and sell 200 gallons. b. $5 and sell 500 gallons. c. $2 and sell 800 gallons. d. $0 and sell 1,000 gallons. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Monopoly TOP: Monopoly MSC: Applicative 20.

Refer to Table 17-2. If there are exactly two sellers of gasoline in Pittsville and if they collude, then which of

the following outcomes is most likely? a.

Each seller will sell 500 gallons and charge a price of $5.

b. Each seller will sell 500 gallons and charge a price of $2.50. c.

Each seller will sell 350 gallons and charge a price of $3.

d. Each seller will sell 250 gallons and charge a price of $5. ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Applicative 21.

Refer to Table 17-2. If there are exactly three sellers of gasoline in Pittsville and if they collude, then which

of the following outcomes is most likely? a.

Each seller will sell 166.67 gallons and charge a price of $1.33.

b. Each seller will sell 166.67 gallons and charge a price of $5. c.

Each seller will sell 200 gallons and charge a price of $4.

d. Each seller will sell 233.33 gallons and charge a price of $5. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Applicative 1164 Chapter 17/Oligopoly 22.

Refer to Table 17-2. Suppose there are exactly two sellers of gasoline in Pittsville: Exxoff and BQ. If

Exxoff sells 300 gallons and BQ sells 400 gallons, then a.

Exxoff’s profit is $900 and BQ’s profit is $1,200.

b. Exxoff’s profit is $2,100 and BQ’s profit is $2,400. c.

there is an excess demand for gasoline in Pittsville.

d. there is an excess supply of gasoline in Pittsville. ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Applicative 23.

Refer to Table 17-2. Suppose there are exactly two sellers of gasoline in Pittsville: Exxoff and BQ.

Currently, Exxoff sells 300 gallons and BQ sells 400 gallons. Which of the following statements is correct?

(Hint: Perform simple interpolation between rows of the chart where necessary.) a.

The current situation is a Nash equilibrium.

b. The current situation is không a Nash equilibrium, as indicated by the fact that Exxoff’s profit

would increase if it increased its output to 400 gallons and BQ kept its output at 400 gallons. c.

The current situation is không a Nash equilibrium, as indicated by the fact that BQ’s profit would

increase if it decreased its output to 350 gallons and Exxoff kept its output at 300 gallons.

d. The current situation is không a Nash equilibrium, as indicated by the fact that both sellers’ profits

would increase if they colluded, decided on a total level of output, and agreed to each produce one- half of that amount. ANS: C DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative 24.

Which of the following statements is correct? a.

When duopoly firms reach a Nash equilibrium, their combined level of output is the monopoly level of output.

b. When oligopoly firms collude, they are behaving as a cartel. c.

In an oligopoly, self-interest drives the market to the competitive outcome.

d. An oligopoly is an example of monopolistic competition. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Cartels MSC: Interpretive 25.

As the number of firms in an oligopoly increases, the magnitude of the a. output effect increases. b. output effect decreases. c. price effect increases. d. price effect decreases. ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 26.

As the number of sellers in an oligopoly becomes very large, a.

the quantity of output approaches the socially efficient quantity.

b. the price approaches marginal cost. c.

the price effect is diminished.

d. All of the above are correct. ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 27.

In markets characterized by oligopoly, a.

the oligopolists earn the highest profit when they cooperate and behave like a monopolist.

b. collusive agreements will always prevail. c.

collective profits are always lower with cartel arrangements than they are without cartel arrangements.

d. pursuit of self-interest by profit-maximizing firms always maximizes collective profits in the market. ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive Chapter 17/Oligopoly 1165 28.

As a group, oligopolists would always be better off if they would act collectively a.

as if they were each seeking to maximize their own individual profits.

b. in a manner that would prohibit collusive agreements. c. as a single monopolist.

d. as a single perfectly competitive firm. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 29.

As a group, oligopolists would always earn the highest profit if they would a.

produce the perfectly competitive quantity of output.

b. produce more than the perfectly competitive quantity of output. c.

charge the same price that a monopolist would charge if the market were a monopoly.

d. operate according to their own individual self-interests. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 30.

Because each oligopolist cares about its own profit rather than the collective profit of all the oligopolists together, a.

they are unable to maintain the same degree of monopoly power enjoyed by a monopolist.

b. each firm's profit always ends up being zero. c.

society is worse off as a result. d. Both a and c are correct. ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive

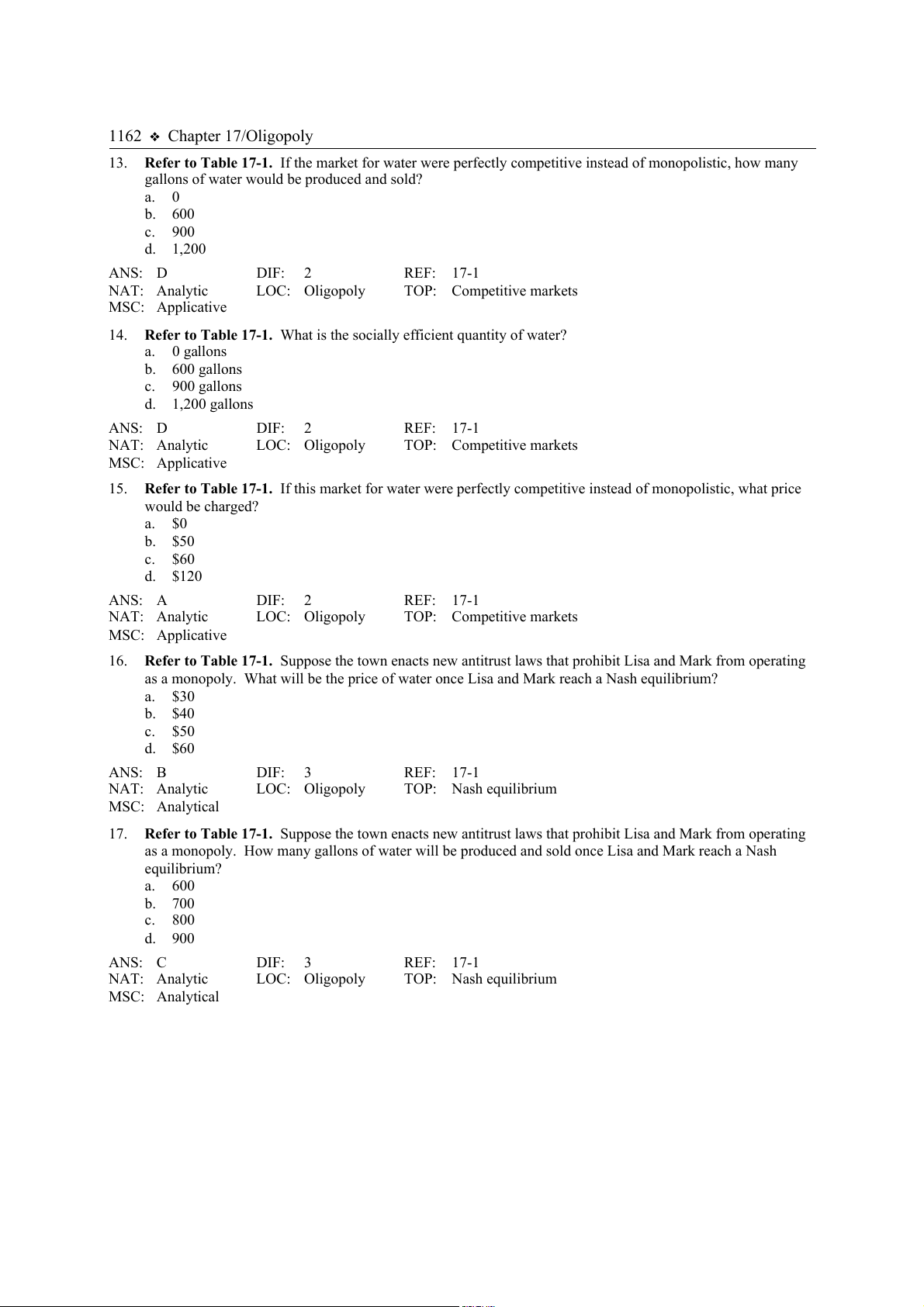

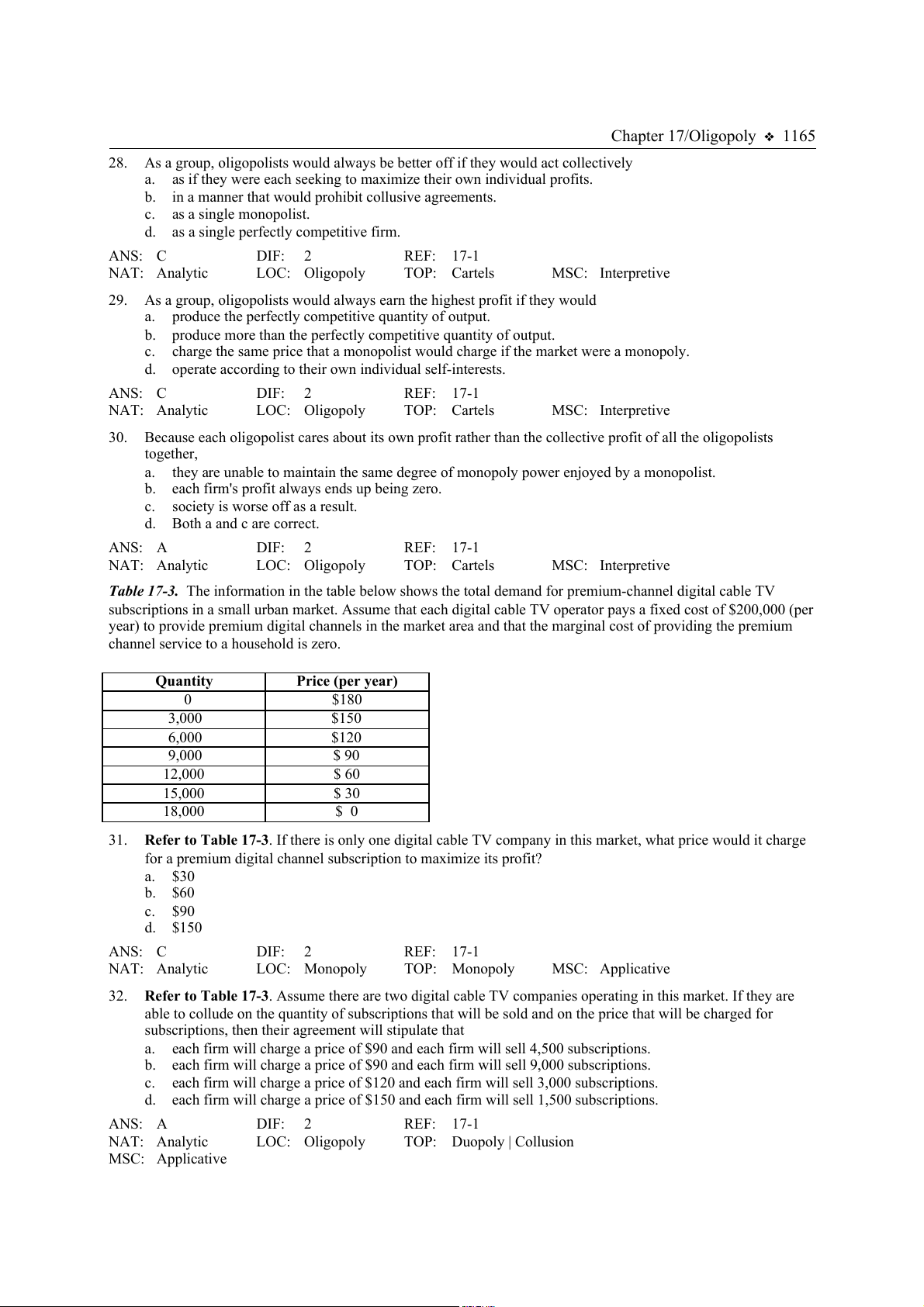

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV

subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per

year) to provide premium digital channels in the market area and that the marginal cost of providing the premium

channel service to a household is zero. Quantity Price (per year) 0 $180 3,000 $150 6,000 $120 9,000 $ 90 12,000 $ 60 15,000 $ 30 18,000 $ 0 31.

Refer to Table 17-3. If there is only one digital cable TV company in this market, what price would it charge

for a premium digital channel subscription to maximize its profit? a. $30 b. $60 c. $90 d. $150 ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Monopoly TOP: Monopoly MSC: Applicative 32.

Refer to Table 17-3. Assume there are two digital cable TV companies operating in this market. If they are

able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for

subscriptions, then their agreement will stipulate that a.

each firm will charge a price of $90 and each firm will sell 4,500 subscriptions.

b. each firm will charge a price of $90 and each firm will sell 9,000 subscriptions. c.

each firm will charge a price of $120 and each firm will sell 3,000 subscriptions.

d. each firm will charge a price of $150 and each firm will sell 1,500 subscriptions. ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly | Collusion MSC: Applicative 1166 Chapter 17/Oligopoly 33.

Refer to Table 17-3. Assume there are two profit-maximizing digital cable TV companies operating in this

market. Further assume that they are able to collude on the quantity of subscriptions that will be sold and on

the price that will be charged for subscriptions. How much profit will each company earn? a. $610,000 b. $550,000 c. $410,000 d. $205,000 ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly | Collusion MSC: Applicative 34.

Refer to Table 17-3. Assume there are two profit-maximizing digital cable TV companies operating in this

market. Further assume that they are không able to collude on the price and quantity of premium digital

channel subscriptions to sell. How many premium digital channel cable TV subscriptions will be sold

altogether when this market reaches a Nash equilibrium? a. 6,000 b. 9,000 c. 12,000 d. 15,000 ANS: C DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative 35.

Refer to Table 17-3. Assume there are two profit-maximizing digital cable TV companies operating in this

market. Further assume that they are không able to collude on the price and quantity of premium digital

channel subscriptions to sell. What price will premium digital channel cable TV subscriptions be sold at when

this market reaches a Nash equilibrium? a. $30 b. $60 c. $90 d. $120 ANS: B DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative 36.

Refer to Table 17-3. Assume that there are two profit-maximizing digital cable TV companies operating in

this market. Further assume that they are không able to collude on the price and quantity of premium digital

channel subscriptions to sell. How much profit will each firm earn when this market reaches a Nash equilibrium? a. $25,000 b. $90,000 c. $160,000 d. $215,000 ANS: C DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative Chapter 17/Oligopoly 1167

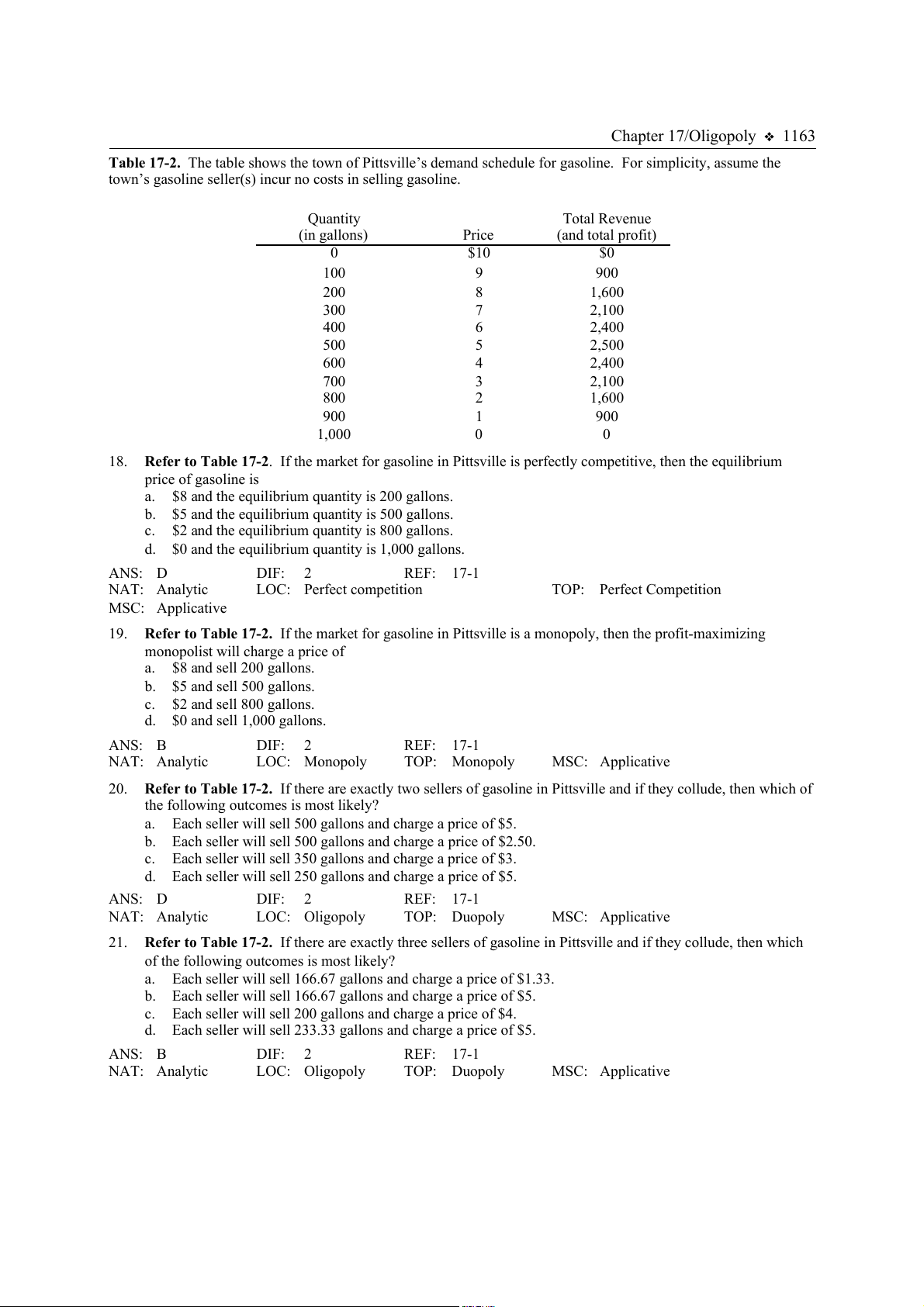

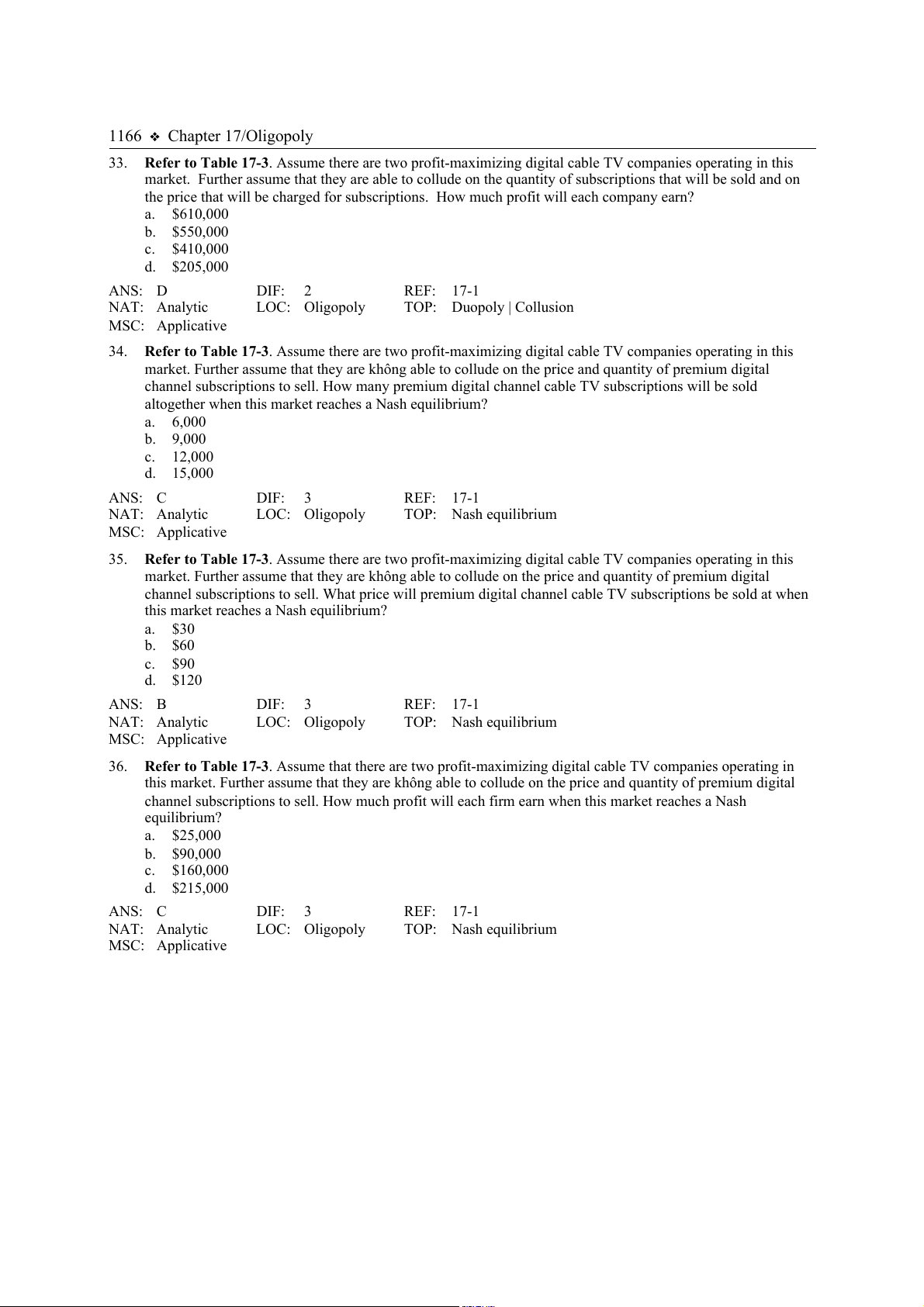

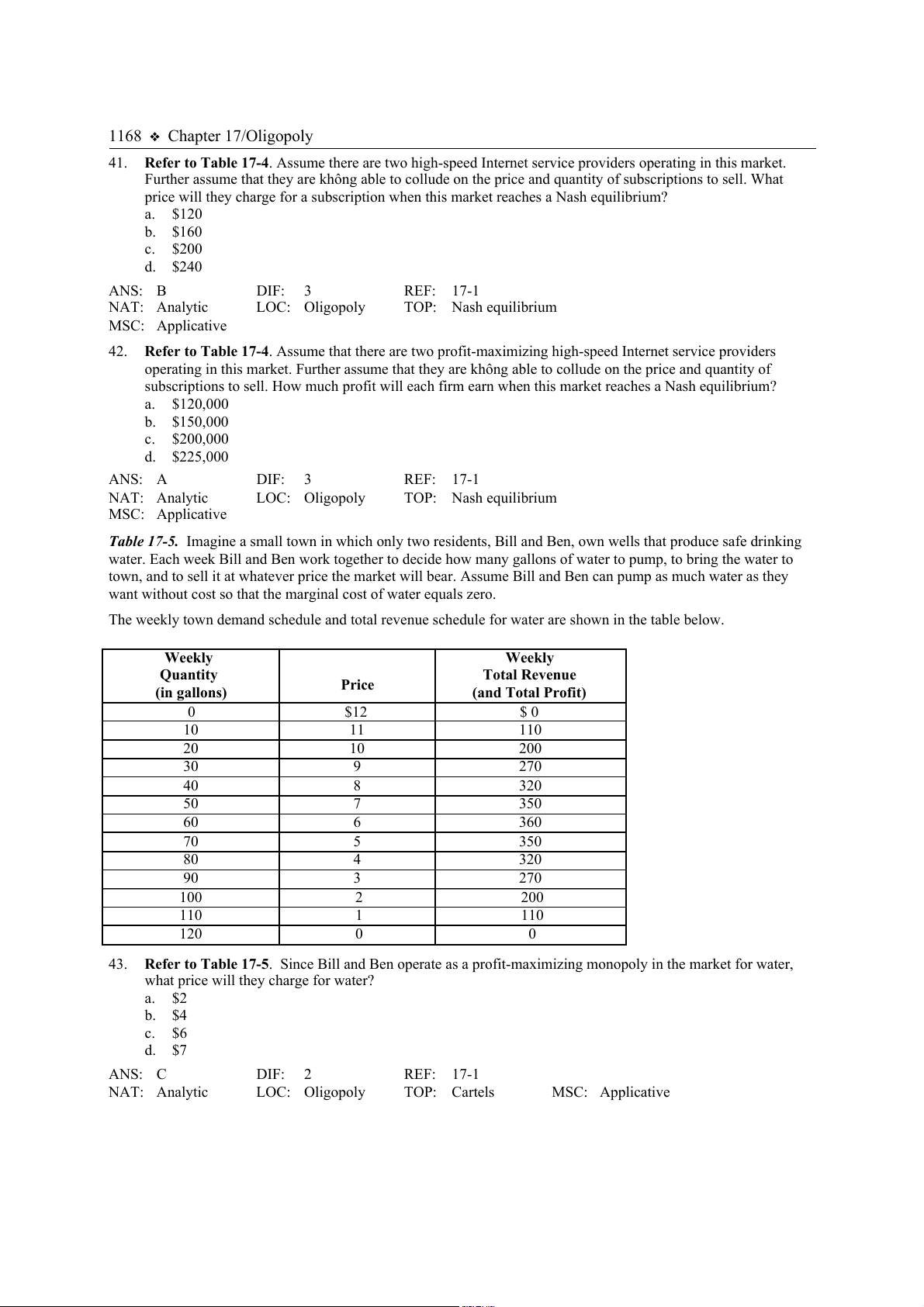

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a

small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of

$200,000 (per year) and that the marginal cost of providing an additional subscription is always $80. Quantity Price (per year) 0 $320 2,000 $280 4,000 $240 6,000 $200 8,000 $160 10,000 $120 12,000 $ 80 14,000 $ 40 16,000 $ 0 37.

Refer to Table 17-4. Suppose there is only one high-speed Internet service provider in this market and it seeks

to maximize its profit. The company will a.

sell 6,000 subscriptions and charge a price of $200 for each subscription.

b. sell 8,000 subscriptions and charge a price of $160 for each subscription. c.

sell 10,000 subscriptions and charge a price of $120 for each subscription.

d. sell 12,000 subscriptions and charge a price of $80 for each subscription. ANS: A DIF: 3 REF: 17-1 NAT: Analytic LOC: Monopoly TOP: Monopoly MSC: Applicative 38.

Refer to Table 17-4. Assume there are two high-speed Internet service providers that operate in this market. If

they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged

for subscriptions, then their agreement will stipulate that a.

each firm will charge a price of $120 and each firm will sell 5,000 subscriptions.

b. each firm will charge a price of $160 and each firm will sell 4,000 subscriptions. c.

each firm will charge a price of $100 and each firm will sell 3,000 subscriptions.

d. each firm will charge a price of $200 and each firm will sell 3,000 subscriptions. ANS: D DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly | Collusion MSC: Applicative 39.

Refer to Table 17-4. Assume there are two profit-maximizing high-speed Internet service providers operating

in this market. Further assume that they are able to collude on the quantity of subscriptions that will be sold

and on the price that will be charged for subscriptions. How much profit will each company earn? a. $80,000 b. $120,000 c. $160,000 d. $210,000 ANS: C DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly | Collusion MSC: Applicative 40.

Refer to Table 17-4. Assume there are two profit-maximizing high-speed Internet service providers operating

in this market. Further assume that they are không able to collude on the price and quantity of subscriptions to

sell. How many subscriptions will be sold altogether when this market reaches a Nash equilibrium? a. 6,000 b. 8,000 c. 10,000 d. 12,000 ANS: B DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative 1168 Chapter 17/Oligopoly 41.

Refer to Table 17-4. Assume there are two high-speed Internet service providers operating in this market.

Further assume that they are không able to collude on the price and quantity of subscriptions to sell. What

price will they charge for a subscription when this market reaches a Nash equilibrium? a. $120 b. $160 c. $200 d. $240 ANS: B DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative 42.

Refer to Table 17-4. Assume that there are two profit-maximizing high-speed Internet service providers

operating in this market. Further assume that they are không able to collude on the price and quantity of

subscriptions to sell. How much profit will each firm earn when this market reaches a Nash equilibrium? a. $120,000 b. $150,000 c. $200,000 d. $225,000 ANS: A DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Applicative

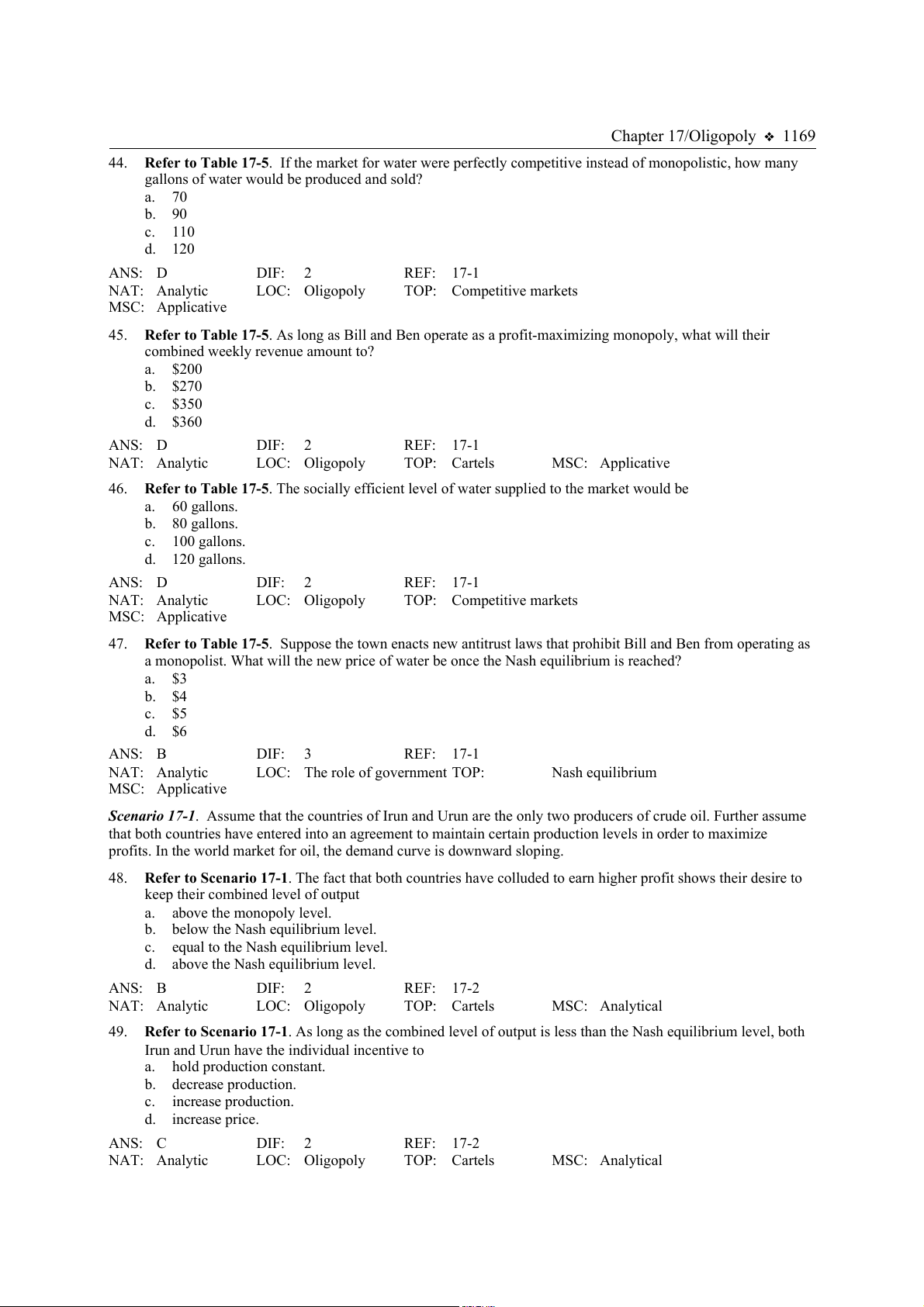

Table 17-5. Imagine a small town in which only two residents, Bill and Ben, own wells that produce safe drinking

water. Each week Bill and Ben work together to decide how many gallons of water to pump, to bring the water to

town, and to sell it at whatever price the market will bear. Assume Bill and Ben can pump as much water as they

want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below. Weekly Weekly Quantity Total Revenue Price (in gallons) (and Total Profit) 0 $12 $ 0 10 11 110 20 10 200 30 9 270 40 8 320 50 7 350 60 6 360 70 5 350 80 4 320 90 3 270 100 2 200 110 1 110 120 0 0 43.

Refer to Table 17-5. Since Bill and Ben operate as a profit-maximizing monopoly in the market for water,

what price will they charge for water? a. $2 b. $4 c. $6 d. $7 ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Applicative Chapter 17/Oligopoly 1169 44.

Refer to Table 17-5. If the market for water were perfectly competitive instead of monopolistic, how many

gallons of water would be produced and sold? a. 70 b. 90 c. 110 d. 120 ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Competitive markets MSC: Applicative 45.

Refer to Table 17-5. As long as Bill and Ben operate as a profit-maximizing monopoly, what will their

combined weekly revenue amount to? a. $200 b. $270 c. $350 d. $360 ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Applicative 46.

Refer to Table 17-5. The socially efficient level of water supplied to the market would be a. 60 gallons. b. 80 gallons. c. 100 gallons. d. 120 gallons. ANS: D DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Competitive markets MSC: Applicative 47.

Refer to Table 17-5. Suppose the town enacts new antitrust laws that prohibit Bill and Ben from operating as

a monopolist. What will the new price of water be once the Nash equilibrium is reached? a. $3 b. $4 c. $5 d. $6 ANS: B DIF: 3 REF: 17-1 NAT: Analytic

LOC: The role of government TOP: Nash equilibrium MSC: Applicative

Scenario 17-1. Assume that the countries of Irun and Urun are the only two producers of crude oil. Further assume

that both countries have entered into an agreement to maintain certain production levels in order to maximize

profits. In the world market for oil, the demand curve is downward sloping. 48.

Refer to Scenario 17-1. The fact that both countries have colluded to earn higher profit shows their desire to

keep their combined level of output a. above the monopoly level.

b. below the Nash equilibrium level. c.

equal to the Nash equilibrium level.

d. above the Nash equilibrium level. ANS: B DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Analytical 49.

Refer to Scenario 17-1. As long as the combined level of output is less than the Nash equilibrium level, both

Irun and Urun have the individual incentive to a. hold production constant. b. decrease production. c. increase production. d. increase price. ANS: C DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Analytical 1170 Chapter 17/Oligopoly 50.

Refer to Scenario 17-1. The agreed-upon production level between the two countries will invariably be a.

lower than the Nash equilibrium level.

b. equal to the Nash equilibrium level. c.

equal to the duopoly market equilibrium level.

d. higher than the duopoly market equilibrium level. ANS: A DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Analytical 51.

Refer to Scenario 17-1. If Irun fails to live up to the production agreement and overproduces, which of the

following statements will be true of Urun's condition? a.

Urun will invariably be worse off than before the agreement was broken.

b. Urun will counter by decreasing its production in order to maintain price stability. c.

Urun's profit will be maximized by holding its production constant.

d. Urun’s profit will decrease if it follows suit and increases production. ANS: A DIF: 2 REF: 17-2 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Analytical 52.

Assuming that oligopolists do không have the opportunity to collude, once they have reached the Nash equilibrium, it a.

is always in their best interest to supply more to the market.

b. is always in their best interest to supply less to the market. c.

is always in their best interest to leave their quantities supplied unchanged.

d. may be in their best interest to do any of the above, depending on market conditions. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Interpretive 53.

When an oligopoly market reaches a Nash equilibrium, a.

the market price will be different for each firm.

b. the firms will không have behaved as profit maximizers. c.

a firm will have chosen its best strategy, given the strategies chosen by other firms in the market.

d. a firm will không take into account the strategies of competing firms. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Interpretive 54.

In a duopoly situation, the logic of self-interest results in a total output level that a.

equals the output level that would prevail in a competitive market.

b. equals the output level that would prevail in a monopoly. c.

exceeds the monopoly level of output, but falls short of the competitive level of output.

d. falls short of the monopoly level of output. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Analytical 55.

As a group, oligopolists earn the highest profit when they a. achieve a Nash equilibrium.

b. produce a total quantity of output that falls short of the Nash-equilibrium total quantity. c.

produce a total quantity of output that exceeds the Nash-equilibrium total quantity.

d. charge a price that falls short of the Nash-equilibrium price. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly

TOP: Oligopoly | Nash equilibrium MSC: Analytical Chapter 17/Oligopoly 1171 56.

In order to be successful, a cartel must a.

find a way to encourage members to produce more than they would otherwise produce.

b. agree on the total level of production for the cartel, but they need không agree on the amount produced by each member. c.

agree on the total level of production and on the amount produced by each member.

d. agree on the prices charged by each member, but they need không agree on amounts produced. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 57.

In a particular town, Metrovision and Cableview are the only two providers of cable TV service. Metrovision and Cableview constitute a a.

duopoly, whether they collude or không.

b. cartel, whether they collude or không. c.

Nash industry, whether they collude or không.

d. monopolistically competitive market if they charge the same price. ANS: A DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Duopoly MSC: Interpretive 58.

Which of these situations produces the largest profits for oligopolists? a.

The firms reach a Nash equilibrium.

b. The firms reach the monopoly outcome. c.

The firms reach the competitive outcome.

d. The firms produce a quantity of output that lies between the competitive outcome and the monopoly outcome. ANS: B DIF: 3 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 59.

When firms have agreements among themselves on the quantity to produce and the price at which to sell

output, we refer to their form of organization as a a. Nash arrangement. b. cartel. c.

monopolistically competitive oligopoly.

d. perfectly competitive oligopoly. ANS: B DIF: 1 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Definitional 60.

The equilibrium quantity in markets characterized by oligopoly is a.

higher than in monopoly markets and higher than in perfectly competitive markets.

b. higher than in monopoly markets and lower than in perfectly competitive markets. c.

lower than in monopoly markets and higher than in perfectly competitive markets.

d. lower than in monopoly markets and lower than in perfectly competitive markets. ANS: B DIF: 1 REF: 17-1 NAT: Analytic LOC: Oligopoly

TOP: Oligopoly | Equilibrium quantity MSC: Analytical 61.

The equilibrium price in a market characterized by oligopoly is a.

higher than in monopoly markets and higher than in perfectly competitive markets.

b. higher than in monopoly markets and lower than in perfectly competitive markets. c.

lower than in monopoly markets and higher than in perfectly competitive markets.

d. lower than in monopoly markets and lower than in perfectly competitive markets. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly

TOP: Oligopoly | Equilibrium price MSC: Analytical 1172 Chapter 17/Oligopoly 62.

When oligopolistic firms interacting with one akhôngher each choose their best strategy given the strategies

chosen by other firms in the market, we have a. a cartel.

b. a group of oligopolists behaving as a monopoly. c. a Nash equilibrium.

d. the perfectly competitive outcome. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Nash equilibrium MSC: Definitional 63.

As the number of firms in an oligopoly market a.

decreases, the price charged by firms likely decreases.

b. decreases, the market approaches the competitive market outcome. c.

increases, the market approaches the competitive market outcome.

d. increases, the market approaches the monopoly outcome. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Analytical 64.

Assume oligopoly firms are profit maximizers, they do không form a cartel, and they take other firms'

production levels as given. Then in equilibrium the output effect a.

must dominate the price effect.

b. must be smaller than the price effect. c.

must balance with the price effect.

d. can be larger or smaller than the price effect. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly | Equilibrium MSC: Analytical 65.

For cartels, as the number of firms (members of the cartel) increases, a.

the monopoly outcome becomes more likely.

b. the magnitude of the price effect decreases. c.

the more concerned each seller is about its own impact on the market price.

d. the easier it becomes to observe members violating their agreements. ANS: B DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive 66.

Suppose a market is initially perfectly competitive with many firms selling an identical product. Over time,

however, suppose the merging of firms results in the market being served by only three or four firms selling

this same product. As a result, we would expect a.

an increase in market output and an increase in the price of the product.

b. an increase in market output and an decrease in the price of the product. c.

a decrease in market output and an increase in the price of the product.

d. a decrease in market output and a decrease in the price of the product. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Oligopoly MSC: Interpretive 67.

Cartels are difficult to maintain because a.

antitrust laws are difficult to enforce.

b. cartel agreements are conducive to monopoly outcomes. c.

there is always tension between cooperation and self-interest in a cartel.

d. firms pay little attention to the decisions made by other firms. ANS: C DIF: 2 REF: 17-1 NAT: Analytic LOC: Oligopoly TOP: Cartels MSC: Interpretive