Preview text:

lOMoARcPSD|44862240

III. CHANGES IN ACCOUNTING ESTIMATES

Ngày 1/1/20XX, cty mua 1 cái máy: + Trị giá $ 10,000

+ Thời gian sử dụng: 10 năm

+ Salvage value = Giá trị có thể thu hồi được = $ 1,000 Vào ngày 1/1/20XX + 5 (5 năm sau):

+ Last another 10 years = Kéo dài thêm 10 năm nữa

+ Salvage value = Giá trị có thể thu hồi được = $ 800

Câu hỏi: Định khoản nghiệp vụ ở từng năm

Solution

Year 1

Cost (Nguyên giá) – Residual value/ Salvage value (Giá trị có thể thu hồi Depreciation= (Khấu hao) Useful life (Thời gian sử dụng)

10,000 – 1,000

= = $ 900/year

10

Nợ 6….: $ 900 Dr Depreciation expense : $ 900

Có 214: $ 900 Cr Accumulated Depreciation : $ 900

Year 2 Year 5: Similar to Year 1:

+ Depreciation = $ 900/year

Nợ 6….: $ 900 Dr Depreciation expense : $ 900

Có 214: $ 900 Cr Accumulated Depreciation : $ 900

Year 6:

Accumulated Depreciation = Tổng Khấu hao = 900 x 5 = $ 4,500

Carrying amount of asset = Giá trị còn lại của TS = 10,000 – 4,500 = $ 5,500

Cost (Nguyên giá) – Residual value/ Salvage value (Giá trị có thể thu hồi)

Depreciation= (Khấu hao) Useful life (Thời gian sử dụng)

5,500 - 800

= = $ 470/year

10

Nợ 6….: $ 470 Dr Depreciation expense : $ 470

Có 214: $ 470 Cr Accumulated Depreciation : $ 470

Year 7 nine years later: Similar to Year 6

+ Depreciation = $ 470/year

Nợ 6….: $ 470 Dr Depreciation expense : $ 470

Có 214: $ 470 Cr Accumulated Depreciation : $ 470

Homework: Bài tập về nhà

ABC company purchase a machine with a price of $ 280,000 and the useful life is 20 years, and the salvage value is $ 4,000. After using 8 years, ABC company decided that this machine last another 30 years and the salvage value = $ 2,000 Require:

- Calculate depreciation for each year.

- Journalize transactions of depreciation for each year.

Solution:

- Year 1

Cost – Residual value/ Salvage value

Depreciation=

Useful life

280,000 – 4,000

= = $ 13,800/year

20

Dr Depreciation expense : $ 13,800

Cr Accumulated Depreciation : $ 13,800 Year 2 Year 8: Every year is similar to Year 1:

+ Depreciation = $ 13,800/year

Dr Depreciation expense : $ 13,800

Cr Accumulated Depreciation : $ 13,800

- Year 9:

Carrying amount = Cost – Total Depreciation = 280,000 – (13,800 x 8) = $ 169,600

Cost – Residual value/ Salvage value

Depreciation= Useful life

169,600 – 2,000

= = $ 5,587/year

30

Dr Depreciation expense : $ 5,587

Cr Accumulated Depreciation : $ 5,587

* All the Years after Year 9: |

Every year is similar to Year 9

+ Depreciation = $ 5,587/year

Dr Depreciation expense : $ 5,587

Cr Accumulated Depreciation : $ 5,587 Exercise 2:

On 1st January 2019, Company B acquired a specilised computer system from an international supplier with an amount of 3 million dollar. Company B decided to depreciate computer systems over its estimated useful life of 8 years, spanning from 2019 to 2026. At the time of purchase, it was anticipated that the computer system would have zero residual value. Nevertheless, on 1 January 2021, Company B conducted a thorough assessment of the computer systems’ s useful life and concluded that it could only be effectively utilized for the next two years .

Require:

- Calculate depreciation for each year.

- Journalize transactions of depreciation for each year.

Solution:

- Year 1

Cost – Residual value/ Salvage value

Depreciation=

Useful life

3,000,000 - 0

8

Dr Depreciation expense : $ 375,000

Cr Accumulated Depreciation : $ 375,000 Year 2 is similar to Year 1:

+ Depreciation = $ 375,000

Dr Depreciation expense : $ 375,000

Cr Accumulated Depreciation : $ 375,000

- Year 3:

Carrying amount = Cost – Total Depreciation = 3,000,000 – (375,000 x 2) = $ 2,250,000

Cost – Residual value/ Salvage value

Depreciation= Useful life

2,250,000 - 0

= = $ 1,125,000/year

2

Dr Depreciation expense : $ 1,125,000

Cr Accumulated Depreciation : $ 1,125,000

Year 4 is similar to Year 3

+ Depreciation = $ 1,125,000

Dr Depreciation expense : $ 1,125,000

Cr Accumulated Depreciation : $ 1,125,000

Exercise 3:

In a manufacturing company, there is a machine on 1st January 2019 with information as follows: + Purchase price: $ 150,000

+ Useful life: 8 years

+ Company uses straight-line method

+ Salvage value: 0

However, after 3 years, the manager changes its estimate of the machine, determining that it can be used effectively for a total of 5 years.

Require:

- Calculate depreciation for each year.

- Journalize transactions of depreciation for each yearSolution:

- Year 1

Cost – Residual value/ Salvage value

Depreciation=

Useful life

150,000 - 0

= = $ 18,750/year

8

Dr Depreciation expense : $ 18,750 Cr Accumulated Depreciation : $ 18,750 Year 2 -> Year 3: Every year is similar to Year 1:

+ Depreciation = $ 18,750 /year

Dr Depreciation expense : $ 18,750 Cr Accumulated Depreciation : $ 18,750

- Year 4:

+ Carrying amount = Cost – Total Depreciation = 150,000 – (18,750 x 3) = $ 93,750

+ Useful life = 5 -3 = 2 years

Cost – Residual value/ Salvage value

Depreciation= Useful life

93,750 - 0

= = $ 46,875/year

2

Dr Depreciation expense : $ 46,875

Cr Accumulated Depreciation : $ 46,875

Year 5 -> Year 8: Every year is similar to Year 4 + Depreciation = $ 46,875 / year Dr Depreciation expense : $ 46,875

Cr Accumulated Depreciation : $ 46,875

Giải :

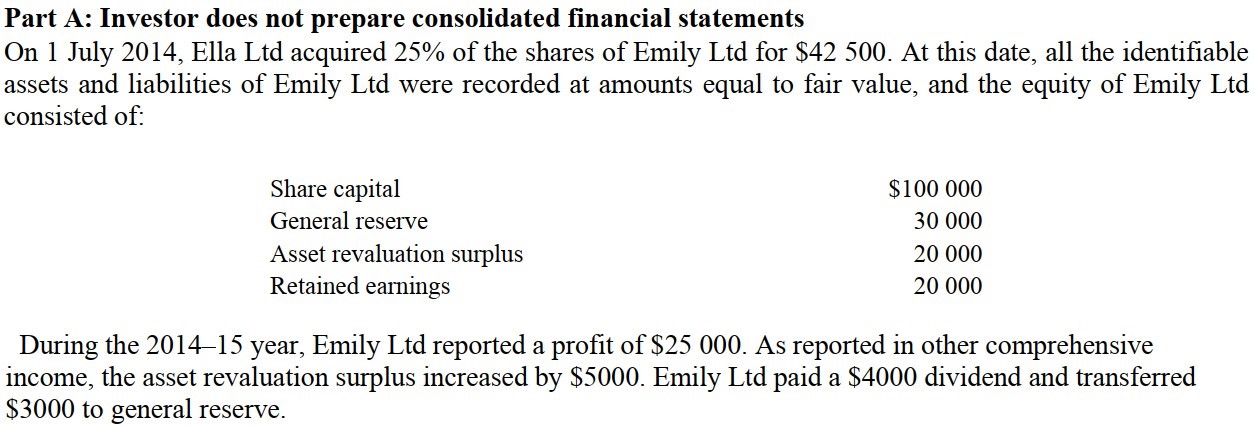

Ngày 1/7/2014, cty Ella mua 25% cổ phần của cty Emily với giá $ 42,500. Những thông tin về Equity (=VCSH = TK 4) của cty Emily là như sau:

+ Share capital = TK 411 | = $ 100,000 |

+ General reserve = Quỹ = TK 414 (Quỹ ĐTPT) + Asset revaluation surplus = Chênh lệch đánh giá lại TS = TK 412 = $ 20,000 | = $ 30,000 |

+ Retained earnings = Lợi nhuận = TK 421 | = $ 20,000 |

Cty Emily:

+ Ghi nhận Profit = Ghi nhận Lợi nhuận = $ 25,000

+ Asset revaluation surplus increase = TK 412 tăng = $ 5,000

+ Trả cổ tức = $ 4,000

+ Transfer to general reserve = Chuyển từ lợi nhuận sang quỹ = $ 3,000

Yêu cầu: Journalize the transactions, using the accounts as follows: Định khỏan nghiệp vụ kinh tế phát sinh bằng cách dùng các Tài khoản sau:

+ Investment in Associate and Joint Venture (TK 222)

+ Cash (TK 111, 112)

+ Share of profit or loss of Associate and Joint Venture (TK 515.1/635.1)

+ Share of other comprehensive income of Associate and Joint Venture (TK 515.2/635.2) + Asset revaluation surplus (TK 412)

Solution:

Step 1: Ella company invest Emily company (Cty Ella đầu tư vào cty Emily)

Nợ TK 222: $ 42,500 Dr Investment in Associate and Joint Venture: $ 42,500

Có TK 111, 112: $ 42,500 Cr Cash: $ 42,500

Step 2: Recognize Profit (Ghi nhận Lợi nhuận)

Nợ 222: 25,000 x 25% = $ 6,250

Có 515.1: 25,000 x 25% = $ 6,250

Dr Investment in Associate and Joint Venture: 25,000 x 25% = $ 6,250

Cr Share of profit or loss of Associate and Joint Venture: 25,000 x 25% = $ 6,250

Step 3: Recognize Asset revaluation surplus (Ghi nhận TK 412) a.

Nợ 222: 5,000 x 25% = $ 1,250

Có TK 412: 5,000 x 25% = $ 1,250

Dr Investment in Associate and Joint venture: 5,000 x 25% = $ 1,250 Cr Asset revaluation surplus: 5,000 x 25% = $ 1,250 b.

Nợ 412: $ 1,250

Có 515.2: $ 1,250

Dr Asset Revaluation surplus: $ 1,250

Cr Share of other comprehensive income of Associate and Joint Venture Step 4: Recognize dividend (Ghi nhận cổ tức)

Nợ TK 635.2: 4,000 x 25% = $ 1,000

Có TK 222: 4,000 x 25% = $ 1,000

Dr Share of other comprehensive income of Associate and Joint Venture: 4,000 x 25% = $ 1,000 Cr Investment in Associate and Joint Venture: 4,000 x 25% = $ 1,000

Solution:

Step 1: Sarah company invest in Madison company

Dr Investment in Associate and Joint Venture: $50,000

Cr Cash: $ 50,000 Year 2013:

Step 2: Recognize Profit

Dr Investment in Associate and Joint Venture: (80,000 – 30,000) x 30% = 15,000

Cr Share of profit or loss of Associate and Joint Venture: (80,000 – 30,000) x 30% = 15,000

Step 3: Recognize Dividend

Dr Share of other comprehensive income of Associate and Joint Venture: 80,000 x 30% = $ 24,000 Cr Investment in Associate and Joint Venture: $ 24,000

Year 2014:

Step 4: Recognize Profit

Dr Investment in Associate and Joint Venture: (70,000 – 25,000) x 30% = $ 13,500

Cr Share of profit or loss of Associate and Joint Venture: $ $ 13,500

Step 5: Recognize Dividend

Dr Share of other comprehensive income of Associate and Joint Venture: 15,000 x 30% = 4,500 Cr Investment in Associate and Joint Venture: $ 4,500 Year 2015:

Step 6: Recognize Profit

Dr Investment in Associate and Joint Venture: (60,000 – 20,000) x 30%= $ 12,000

Cr Share of profit or loss of Associate and Joint Venture: $ 12,000

Step 7: Recognize Dividend

Dr Share of other comprehensive income of Associate and Joint Venture: 10,000 x 30% = 3,000 Cr Investment in Associate and Joint Venture: $ 3,000

Exercise 2:

Maridomo Ltd acquired a 30% interest in PA Ltd for $80,000 on 1 January 2020 by contributing a Equipment and cash. Know that, the Equipment has $22,000 in fair value. The equity of of PA Ltd at the acquisition date was:

Share capital $100.000

Asset revaluation surplus: 20,000

Retained earning $100.000

All the identifiable asset and liabilities of PA Ltd were recorded at fair value. Profit and dividends for the year end 31 Dec 2020 to 2021 were as follows:

Profit Before tax | Dividend | Asset Revaluation | |||||||

2020 | ($50,000) | $ 40,000 | |||||||

2021 | $60,000 | $12,000 | |||||||

Notes:

- The income tax rate is 20%.

- |

Dividend had been declared by Maridomo Ltd but only paid 50%

- In 2021, PA Ltd transferred $6,000 from retained earnings to general reserve.

Required:

- 1. Prepare journal entries in the records of Maridomo Ltd for each of the years ended 31 Dec 2020 and 2021 in relation to its investment in the associate, PA Ltd.

- 2. Measured of investment in associate of Maridomo Ltd at 31 Dec 2021

- 3. Show the equity of PA Ltd at 31 Dec 2021

Solution:

Step 1: Maridomo company invest in PA company

Dr Investment in Associate and Joint Venture: $ 80,000

Cr Cash: $ 58,000 (= 80,000 – 22,000)

Cr Equipment: $ 22,000

Year 2020

Step 2: Recognize Loss

Dr Share of profit or loss of Associate and Joint Venture: 50,000 x 30% = $ 15,000

Cr Investment in Associate and Joint Venture: $ 15,000

Step 3: Recognize Asset Revaluation

a.Dr Investment in Associate and Joint Venture: $ 40,000 x 30% = $ 12,000 Cr Asset Revaluation Surplus: $ 12,000 b.Dr Asset Revaluation Surplus: $ 12,000

Cr Share of other comprehensive income of Associate and Joint Venture: $ 12,000

Year 2021

Step 4: Recognize Profit

Dr Investment in Associate and Joint Venture: [(60,000 – (60,000 x 20%)] x 30% = $ 14,400

Cr Share of profit or loss of Associate and Joint Venture: $ 14,400

Step 5: Recognize Dividend

Dr Share of other comprehensive income of Associate and Joint Venture: (12,000 x 50%) x 30% = $ 1,800

Cr Investment in Associate and Joint Venture: $ 1,800

- Measured of investment in associate of Maridomo Ltd at 31 Dec 2021= 80,000-15,000+12,000 +14,400 -3,600 = $87,800

- Show the equity of PA Ltd at 31 Dec 2021

Share capital $100.000

Asset revaluation surplus : 60,000 (20,000 +40,000)

General reserve 6,000

Retained earning 80,000 ($100.000- 50,000+60,000*80%-6,000-12,000)

Bai tap on – Chuong 6 Question:

A Ltd acquired 30% interest in B Ltd for 60,000 on 1 January 2015 by contributing a machine and cash. Know that, the machine has $ 20,000 in fair value. The equity of B Ltd at the acquisition date was:

+ Share capital = $ 40,000

+ Retained earnings = $ 120,000

All the identifiable assets and liabilities of B Ltd were recorded at fair value. Profits and dividends for the years ended 31 December 2015 to 2016 were as follows:

Profit | before tax | Dividend paid | Asset Revaluation | ||||

2015 | ($40,000) | 0 | $18,000 | ||||

2016 | $ 90,000 | $21,000 | ($15,000) | ||||

Notes: The | income tax rate is 30% | ||||||

In 2016, B Ltd transferred $ 8,000 from retained earnings to general reserves Require:

Prepare journal entries from 2015 to 2016

Dich De:

Nam 2015:

Cty A Mua 30% Von = Cty B + LN truoc thue = (40,000) TK 421 (LN sau thue)

$ 60,000 Nam 2016: + TK 412 (Asset Revaluation Surplus) 18,000

+ TK 411 = $ 40,000

+ TK 421 = $ 120,000 + LN truoc thue = 90,000 TK 421 = 90,000 – 30% x 90,000

+ Tra co tuc = 21,000

+ TK 412 (Asset Revaluation Surplus) (15,000)

+ Chuyen tu LN sang quy: 8,000Thue Thu nhap doanh nghiep: 30%

Solution:

Year 2015:

Step 1: A Ltd invested in B Ltd: Cty A dau tu vao cty B

No 222: 60,000 Dr Investment in Associate and Joint Venture: $ 60,000

Co 111, 112: 40,000 Cr Cash: $ 40,000

Co 211: 20,000 Cr Machine: $ 20,000

Step 2: Recognize Loss = Ghi nhan 1 khoan LO

No 635: 40,000 x 30% = 12,000

Co 222: 40,000 x 30% = 12,000

Dr Share of profit or loss of Associate and Joint Venture: 40,000 x 30% = 12,000

Cr Investment in Associate and Joint Venture: 40,000 x 30% = 12,000

Step 3: Recognize Asset Revaluation surplus = Ghi nhan TK 412 a.No 222: 18,000 x 30% = 5,400 Co 515: 18,000 x 30% = 5,400

Dr Investment in Associate and Joint Venture = 18,000 x 30% = 5,400

Cr Share of other comprehensive income of Associate and Joint Venture = 18,000 x 30% = 5,400 b.No 515: 5,400

Co 412: 5,400

Dr Share of other comprehensive income of Associate and Joint Venture: 5,400 Cr Asset Revaluation Surplus: 5,400 Year 2016:

- Recognize Profit = Ghi nhan Loi Nhuan

No 222: (90,000 – 30% x 90,000) x 30% = 63,000 x 30% = $ 18,900

Co 515: $ 18,900

Dr Investment in Associate and Joint Venture: (90,000 – 30% x 90,000) x 30% = 63,000 x 30% = $ 18,900 Cr Share of Profit or Loss of Associate and Joint Venture : 18,900

- Recogize “Dividend” = Ghi nhan “Tra co tuc”

No 111 , 112: 21,000 x 30% = $ 6,300

Co 222: $ 6,300

Dr Cash: 21,000 x 30% = $ 6,300

Cr Investment in Associate and Joint Venture: $ 6,300

- Recogize “Asset Revaluation Surplus”

c.1 No 635: 15,000 x 30% = 4,500

Co 222: 15,000 x 30 % = 4,500

Dr Share of other comprehensive income of Associate and Joint Venture: 15,000 x 30% = 4,500 Cr Investment in Associate and Joint Venture: 15,000 x 30 % = 4,500 c.2 No 412: 4,500 Dr Asset Revaluation Surplus: 4,500

Co 635: 4,500 Cr Share of other comprehensive of Associate and Joint Venture: 4,500

Bai on tap – Chuong 4:

Adjusting events vs Non-adjusting events

(Nhung su kien duoc dieu chinh va Nhung su kien khong duoc dieu chinh)

1. Adjusting events: Những sự kiện được điều chỉnh

- Mỗi tình huống đều phải giải thích. Nếu là adjusting events thì sự giải thích luôn là “This event provides evidence of conditions

that | existed at | the reporting date.” |

- The bankruptcy of a customer: Nếu khách hàng bị phá sản sau ngày lập báo tài chính It is an adjusting event

Dr Uncollectible account expense No TK 6….:

Cr Allowance for uncollectible account Co 2293:

Explain: This event provides evidence of conditions that existed at the reporting date

- The sale of inventory at a price substantially lower than its cost: Bán 1 HTK tại mức giá thấp hơn giá gốc It is an adjusting event

Dr Cost of Goods Sold No TK 632

Cr Inventory Co 156

Explain: This event provides evidence of conditions that existed at the reporting date

- The sale of property, plant, and equipment for a net selling price that is lower than the carrying amount: Bán 1 TSCDHH ( nhà xưởng , máy móc ) với giá thấp hơn giá trị còn lại của tài sản

It is an adjusting event

Explain: This event provides evidence of conditions that existed at the reporting date

- The determination of an incentive or bonus payment: Nhận đc tiền thưởng cho 1 sáng kiến It is an adjusting event

Explain: This event provides evidence of conditions that existed at the reporting date

- The discovery of a fraud which had occurred during the year: Phát hiện 1 lỗi đã xảy ra trong năm It is an adjusting event

Explain: This event provides evidence of conditions that existed at the reporting date f. The disposal of inventory: Bỏ hàng tồn kho

It is an adjusting event

Dr Cost of goods sold No 632

Cr Inventory Co 156

Explain: This event provides evidence of conditions that existed at the reporting date g. The settlement of court case : Việc thanh toán nghĩa vụ từ 1 phiên tòa It is an adjusting event

Dr Expense Cr Provision

Explain: This event provides evidence of conditions that existed at the reporting date

2. Non-adjusting events: Những sự kiện không được điều chỉnh

- Mỗi tình huống đều phải giải thích. Nếu là adjusting events thì sự giải thích luôn là “This event provides evidence of conditions

that existed | after | the reporting date.” |

a. Stock split = Right issue = Announce a bonus issue = Dividend : Quyền nhận được thêm cổ phiếu / Thông báo cổ phiếu thường /

Chia cổ tức

It is a non-adjusting event

Explain: This event provides evidence of conditions that existed after the reporting date b. A change in tax rate = Sự thay đổi về thuế suất thuế TNDN

It is a non-adjusting event

Explain: This event provides evidence of conditions that existed after the reporting date

- Announcing a plan to discontinue on operation: Doanh nghiệp / Bộ phận không thể hoạt động It is a non-adjusting event

Explain: This event provides evidence of conditions that existed after the reporting date

- The destruction of a building by fire/by flood/by earthwake: 1 tòa nha bị hủy hoại bởi hỏa hoạn / động đất / lũ lụt It is a non-adjusting event

Explain: This event provides evidence of conditions that existed after the reporting date