Preview text:

ĐỀ 1

Section 1: T/F/NG and explanation (4pt)

1. Barking dogs cannot be considered an externality because externalities must be

associated with some forrm of market exchange (F)

Externalities do not require a market exchange.

Barking dogs impose noise costs on neighbors without compensation, so they are a negative externality.

2. Diminshing marginal productivity implies decreasing total product. (F)

Diminishing marginal productivity means total product increases at a decreasing

rate, not that total product decreases.

3. Cocoa and marshamllows are complements, so a decrease in the price of cocoa

will cause an increase in the demand for marshmallows. (T) Cocoa and marshmallows are ,

complements so a fall in the price of cocoa

increases its consumption, which raises the demand for marshmallows.

4. In the short run, a firm should exit the industry if its marginal cost exceeds its marginal revenue (F)

In the short run, a firm exits only if price (or MR) is below average variable cost (AVC).

Having MC > MR only means the firm should reduce output, not exit.

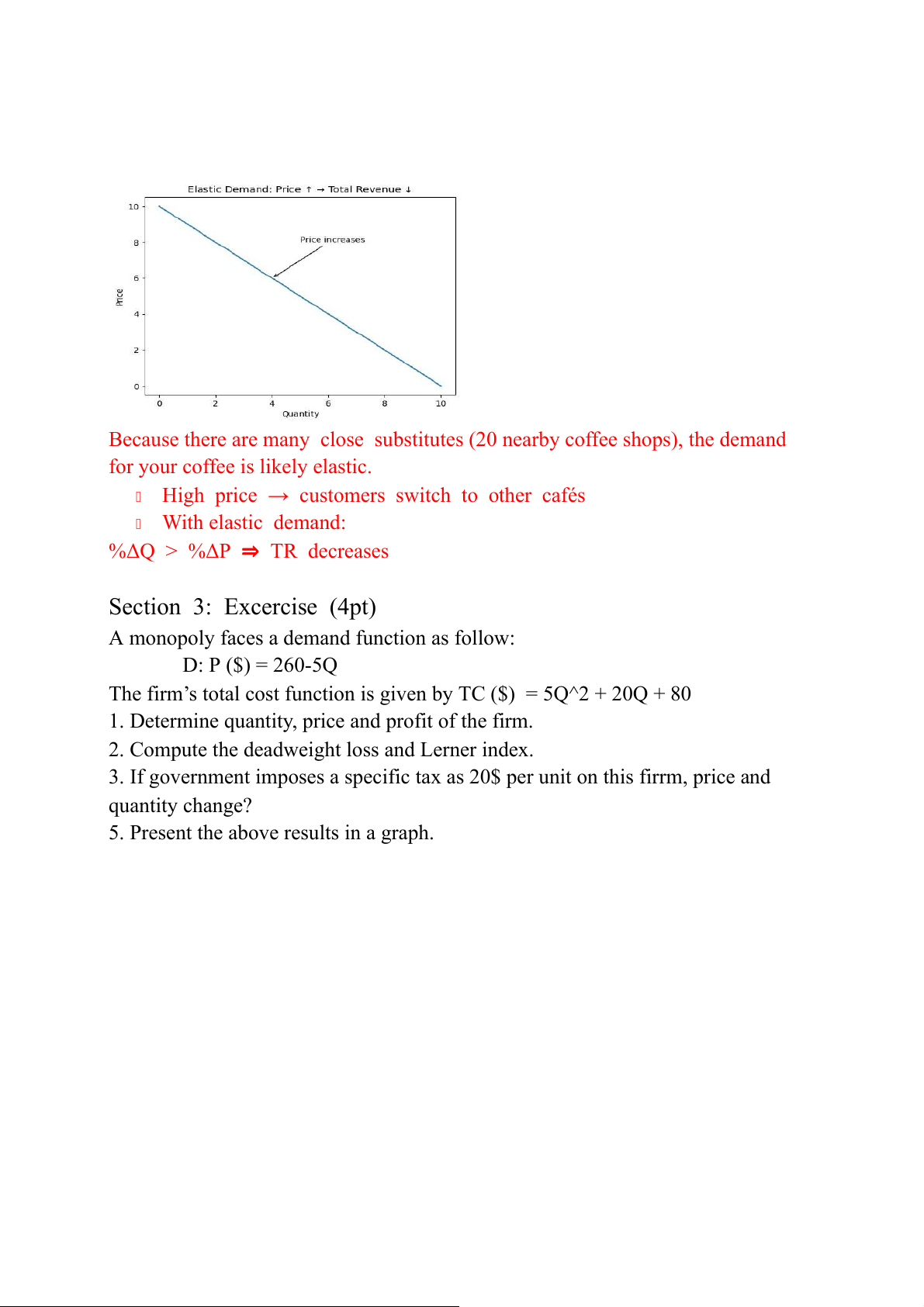

Section 2: Short ans (2pt)

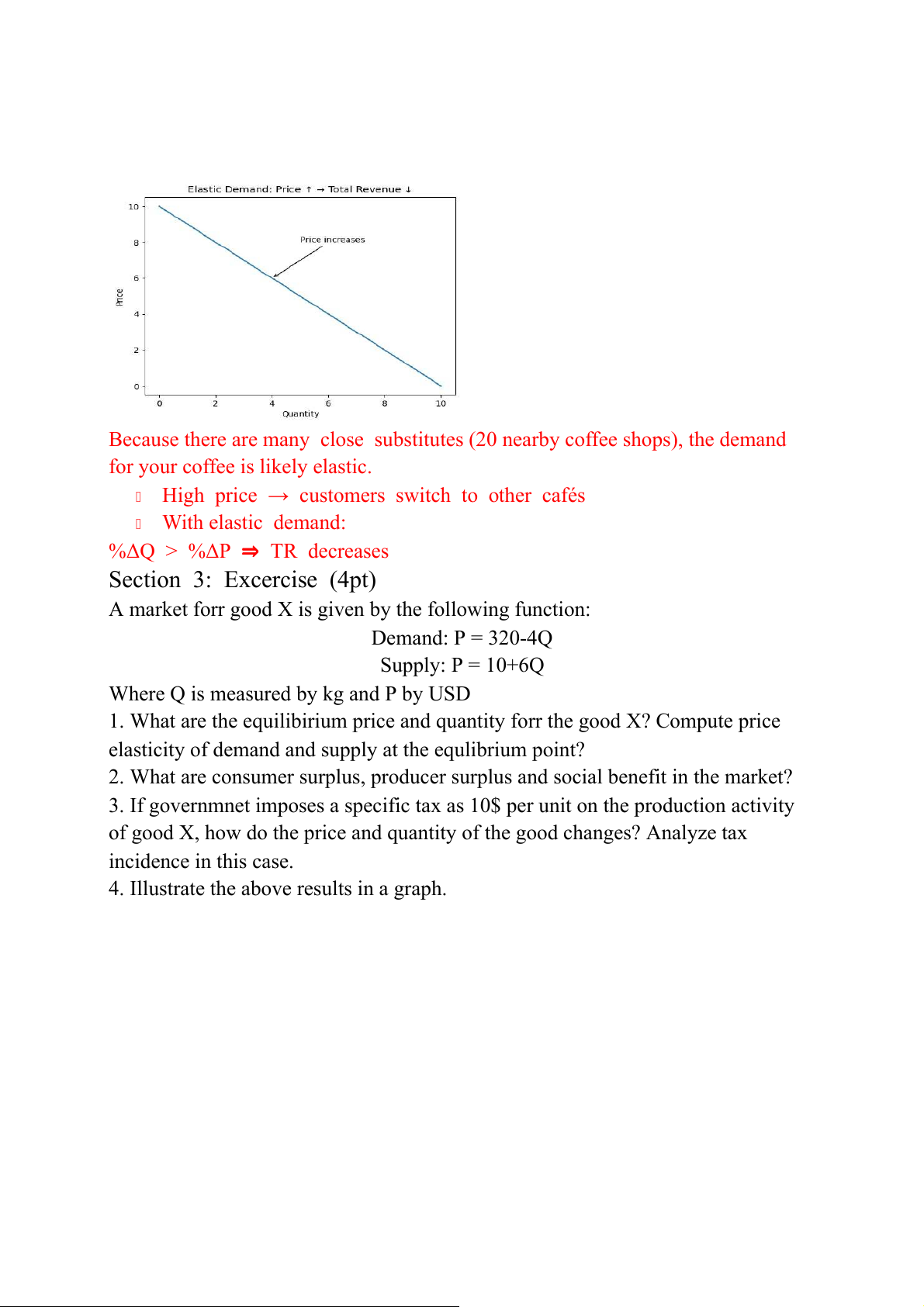

You manage a coffee shop at Dang Van Ngu Street. There are about 20 other

coffee shops nearby. Due to an increase in input price, you raise your price, hoping

to increase your total ravenue to cover the increase in input price. But you find that

your total revenue actually falls. Using a diagram, explain why this might have happened.bec

Because there are many close substitutes (20 nearby coffee shops), the demand

for your coffee is likely elastic.

High price → customers switch to other cafés With elastic demand:

%ΔQ > %ΔP ⇒ ⇒ TR decreases

Section 3: Excercise (4pt)

A monopoly faces a demand function as follow: D: P ($) = 260-5Q

The firm’s total cost function is given by TC ($) = 5Q^2 + 20Q + 80

1. Determine quantity, price and profit of the firm.

2. Compute the deadweight loss and Lerner index.

3. If government imposes a specific tax as 20$ per unit on this firrm, price and quantity change?

5. Present the above results in a graph. ĐỀ 2

Section 1: T/F/NG and explanation (4pt)

1. Barking dogs cannot be considered an externality because externalities must be

associated with some forrm of market exchange (F)

Externalities do not require a market exchange.

Barking dogs impose noise costs on neighbors without compensation, so they are a negative externality.

2. When the market price is above the equalibirium price, the quantity of the good

demanded exceeds the quantity supplied. (F)

the market price is above the equalibirium price => a surplus => the quantity of the

good supplied exceeds the quantity demanded.

3. Fixed costs are those costs that remain fixed no matter how long the time horizon is (F)

Fixed costs are costs that do not vary with the level of output in the short run

4. A firm operating in a perfectly competitive industry will shut down in the short

run if its economic profits fall to zero because it is likely to be earning negative accounting profits. (F)

break-even point điểm hoà vốn

In perfect competition, a firm shuts down in the short run only if the price falls

below average variable cost (A . VC)

Section 2: Short ans (2pt)

You manage a coffee shop at Dang Van Ngu Street. There are about 20 other

coffee shops nearby. Due to an increase in input price, you raise your price, hoping

to increase your total ravenue to cover the increase in input price. But you find that

your total revenue actually falls. Using a diagram, explain why this might have happened.

Because there are many close substitutes (20 nearby coffee shops), the demand

for your coffee is likely elastic.

High price → customers switch to other cafés With elastic demand:

%ΔQ > %ΔP ⇒ ⇒ TR decreases

Section 3: Excercise (4pt)

A market forr good X is given by the following function: Demand: P = 320-4Q Supply: P = 10+6Q

Where Q is measured by kg and P by USD

1. What are the equilibirium price and quantity forr the good X? Compute price

elasticity of demand and supply at the equlibrium point?

2. What are consumer surplus, producer surplus and social benefit in the market?

3. If governmnet imposes a specific tax as 10$ per unit on the production activity

of good X, how do the price and quantity of the good changes? Analyze tax incidence in this case.

4. Illustrate the above results in a graph. ĐỀ 3

Section 1: T/F/NG and explanation (4pt)

1. A firm in a perfectly competitive industry will maximize profits in the short run

at the rate of output at which the difference between the price and the marginal cost is the greatest. F

A perfectly competitive firm is a price taker, so it maximizes profit by producing the output where: P = MC = MR

2. An increase in the price of a product and a decrease in the price of the inputs for

that product affect the supply curve in the same general way. T

will make production more profitable for firms

3. Marginal cost curve are downward sloping. F U-shaped

4. Along any downward sloping straight-line demand curve, the price elasticity

varies, but the slope is constant. T

Section 2: Short ans (2pt)

Explain the concept of positive externality. Use appropriate graphs to analyze the

impacts of positive externality on social welfare.

Section 3: Excercise (4pt)

A market for good X is given by the following function: Demand: P = 200-4Q Supply: P = 8+2Q

Where Q is measured by kg and P by USD

1. What are the equilibirium price and quantity forr the good X? Compute price

elasticity of demand and supply at the equlibrium point?

2. What are consumer surplus, producer surplus and social benefit in the market?

3. If governmnet imposes a specific tax as 6$ per unit on the production activity of

good X, how do the price and quantity of the good changes? Analyze tax incidence in this case.

4. Illustrate the above results in a graph. ĐỀ 4

Section 1: T/F/NG and explanation (4pt)

1. If the marginal cost of producing the tenth unit of output is $3, and if the average

total cost of producing the tenth unit of output is $2, than at ten units of output,

average total cost is rising. T

If MC > ATC, then ATC is rising MC=3 and ATC=2

Since 3>2, which means ATC must be rising at 10 units of output.

2. When the price of knee braces increased by 25%, the Brace Yourself Company

increased its quantity supplied of knee braces per week by 75%, BYC’s price

elasticity of supply of knee braces is 0.33 F Esd is calculated as: Es= %ΔQs / % ΔP %ΔQs = 75% %ΔP = 25% So: Es=3

3. A price ceiling set below the equilibrium price causes quantity demanded to exceed quantity supplied.

4. Firms operating in perfectly competitive markets produce an output level where

marginal revenue equals marginal cost.

Section 2: Short ans (2pt)

Explain the concept of positive externality. Use appropriate graphs to analyze the

impacts of positive externality on social welfare.

Section 3: Excercise (4pt)

A perfectly competitive firm has the followin total cost function: TC ($) = 5Q^2 + 10Q + 125

Where Q represents the quantity produced, and TC is the total cost in dollar

1. What are the firm’s break-even output and price?

2. If the market price is 50$, should the firm produce? Why or why not?

3. If the market price is 80$, what are the firrm”s output, producer surplus and

profit? What is the firm’s supply function?

4. Present the abpve results in a graph. ĐỀ 5

Section 1: T/F/NG and explanation (4pt)

1. A firm in a perfectly competitive industry will maximize profits in the short run

at the rate of output at which the difference between the price and the marginal cost is the greatest.

2. An increase in the price of a product and a decrease in the price of the inputs for

that product affect the supply curve in the same general way.

3. Marginal cost curve are downward sloping.

4. Along any downward sloping straight-line demand curve, the price elasticity

varies, but the slope is constant.

Section 2: Short ans (2pt)

Use appropriate graphs to analyze changes in social benefit if the government

imposes a blinding price ceiling.

Section 3: Excercise (4pt)

A monopoly faces a demand function as below: D: P ($) = 180-6Q

The firm’s total cost function is given by TC ($) = 2Q^2 + 4Q + 70

1. Determine quantity, price and profit of the firm.

2. Compute the deadweight loss and Lerner index.

3. If government imposes a specific tax as 16$ per unit on this firm, price and quantity change?

5. Present the above results in a graph. ĐỀ 6

Section 1: T/F/NG and explanation (4pt)

1. Normal goods have negative income elasticties of demand, while inferior goods

have positive income elasticities of demand.

2. Any point that lies on the production possibilities curve of within the curve is

said to be an unattainable point while points that lie to the right of the production

possibilities curve are said to be attainable.

3. “Steak” and “Eggs” are “complemantảy goods”. If the price of steak increase, in

egg market equilibrium price will increase and equilibrium quantity will decrease.

4. Economic profit is alway higher than accounting profit.

Section 2: Short ans (2pt)

Use appropriate graphs to analyze changes in social benefit if the government

imposes a blinding price ceiling.

Section 3: Excercise (4pt)

A market for good X is given by the following function: Demand: P = 146-4Q Supply: P = 2+5Q

Where Q is measured by kg and P by USD

1. What are the equilibirium price and quantity forr the good X? Compute price

elasticity of demand and supply at the equlibrium point?

2. What are consumer surplus, producer surplus and social benefit in the market?

3. If governmnet imposes a specific tax as 18$ per unit on the production activity

of good X, how the price and quantity of the good changes? Analyze tax incidence in this case.

4. Illustrate the above results in a graph. ĐỀ 7

Section 1: T/F/NG and explanation (4pt)

1. The marginal revenue curve for a monopolist will be “beneath” her demand

curve because in order to increase sales, the monopolist must lower the price of all output sold.

2. The law of supply states that when the price of a product increases, the quantity

supplied of the product increases, thus, the supply curve of the product shifts to the right.

3. Cross-price elasticity is used to determine whether goods are inferior or normal goods.

4. A firm which earn economic profits must also be earning accounting profits.

Section 2: Short ans (2pt)

Use appropriate graphs to analyze changes in social benefit if the government

imposes a blinding price floor.

Section 3: Excercise (4pt)

A perfectly competitive firm has a total cost function as below: TC ($) = 4Q^2 + 5Q + 576

1. What are the firm’s break-even output and price?

2. If the market price is 85$, should the firm produce? Why or why not?

3. If the market price is 181$, what are the firrm’s output, producer surplus and

profit? What is the firm’s supply function?

4. Present the abpve results in a graph. ĐỀ 8

Section 1: T/F/NG and explanation (4pt)

1. The marginal revenue curve for a monopolist will be “beneath” her demand

curve because in order to increase sales, the monopolist must lower the price of all output sold. T

2. The law of supply states that when the price of a product increases, the quantity

supplied of the product increases, thus, the supply curve of the product shifts to the

right. F this is a mving along the S curve

3. Cross-price elasticity is used to determine whether goods are inferior or normal goods. F

4. A firm which earn economic profits must also be earning accounting profits. T

Section 2: Short ans (2pt)

Use appropriate graphs to analyze changes in social benefit if the government

imposes a blinding price ceiling.

Section 3: Excercise (4pt)

A monopoly faces a demand function as below: D: P ($) = 84-6Q

The firm’s total cost function is given by TC ($) = 2Q^2 + 4Q + 50

1. Determine quantity, price and profit of the firm.

2. Compute the deadweight loss and Lerner index.

3. If government imposes a specific tax as 8$ per unit on this firm, price and quantity change?

5. Present the above results in a graph. ĐỀ 8

Section 1: T/F/NG and explanation (4pt)

1. An increase in supply will cáue a decrease in price, which will cause an change in quantity demand. F

2. The shape of the marginal cost curve tells a producer something about the

marginal product of her workers. T

3. A popular resort restaurant will maximize profits if it chooses to stay open

during the less-crowded “off season” when its total revenues exceed its variable costs. t

4. If the price elasticity of supply is 2 and the quantity supplied decreases by 6%,

then the price must have decreased by 3%. T

Section 2: Short ans (2pt)

What is the shape of a marginal cost curve? Explain the causes of that shape? ĐỀ 9

Section 1: T/F/NG and explanation (4pt)

1. Price will rise to eliminate a shortage. T

2. If the marginal cost of producing the tenth unit of output is $2.5, and if the

average total cost of producing the tenth unit of output is $3, than at ten units of

output, average total cost is rising. F

3. A firm is currently producing 100 units of output per day. The mânger reports to

the owner that producing the 100th unit costs the firm 5$. The firm can sell the unit

for 6$. The firm should produce more than 100 units in order to maximize its

profits (or minimize its losses). T

4. A price ceiling set above the equilibrium price causes a surplus in the market. F non blinding

Section 2: Short ans (2pt)

If a demand curve is linear, is the elasticity constant along the demand curve? no

Which part tends to be elastic and which part tends to be inelastic? Why?

Section 3: Excercise (4pt)

A monopoly faces a demand function as below: D: P ($) = 90-6Q

The firm’s total cost function is given by TC ($) = 3Q^2 + 18Q + 50

1. Determine quantity, price and profit of the firm.

2. Compute the deadweight loss and Lerner index.

3. If government imposes a specific tax as 16$ per unit on this firm, price and quantity change?

5. Present the above results in a graph. ĐỀ 10

Section 1: T/F/NG and explanation (4pt)

1. If the marginal cost of producing the tenth unit of output is $3, and if the average

total cost of producing the tenth unit of output is $2, than at ten units of output,

average total cost is rising. F dcreasing

2. When the price of knee braces increased by 25%, the Brace Yourself Company

increased its quantity supplied of knee braces per week by 75%, BYC’s price

elasticity of supply of knee braces is 0.33 F

3. A price ceiling set below the equilibrium price causes quantity demanded to

exceed quantity supplied. F non blinding

4. Firms operating in perfectly competitive markets produce an output level where

marginal revenue equals marginal cost. T

Section 2: Short ans (2pt)

What is the shape of a marginal cost curve in a typical firm? Why is it shaped this way?

Section 3: Excercise (4pt)

A market for good X is given by the following function: Demand: P = 134-8Q Supply: P = 2+4Q

Where Q is measured by kg and P by USD

1. What are the equilibirium price and quantity forr the good X? Compute price

elasticity of demand and supply at the equlibrium point?

2. What are consumer surplus, producer surplus and social benefit in the market?

3. If governmnet imposes a specific tax as 12$ per unit on the production activity

of good X, how the price and quantity of the good changes? Analyze tax incidence in this case.

4. Illustrate the above results in a graph. ĐỀ 11

Section 1: T/F/NG and explanation (4pt)

1. If the average cost of transporting a passenger on the train from Chicago to St.

Lo for 75$, it would be irrational for the railroad to allow any passenger to ride forr less than 75$ F

2. The flatter the demand curve that passes through a given point, the more elastic demand. T

3. A monopolist producers where P =4. The fixed cost curve is constant. F

Section 2: Short ans (2pt)

What is the shape of a marginal cost curve in a typical firm? Why is it shaped this way?

Section 3: Excercise (4pt)

A monopoly faces a demand function as below: D: P ($) = 100-12Q

The firm’s total cost function is given by TC ($) = 4Q^2 + 4Q + 50

1. Determine quantity, price and profit of the firm.

2. Compute the deadweight loss

3. If government imposes a specific tax as 32$ per unit on this firm, price and

quantity change? Analyze tax incidence in this case

5. Present the above results in a graph. ĐỀ 12

Section 1: T/F/NG and explanation (4pt)

1. In the short run, if a firm producers nothing, total cost are zero. f

2. A reduction in an input price will cause a change in quantity supplied, but not a change in supply. f

3. A firm operating in a perfectly competitive market may earn positive, negative

or zero economic profit in long run. f shorrt run

4. Barking dogs cannot be considered an externality because externalities must not

be associated with some forrm of market exchange f ĐỀ 13

Section 1: T/F/NG and explanation (4pt)

1. Một hãng tàu bán giá vé trung bình là 75$. Nếu hãng này bán giá vé dưới 75$ thì là irrational choice

2. Đường cầu càng thoải thì cầu càng co giãn.

3. Monopolist producers at P = MC = MR 4.

Section 2: Short ans (2pt)

Explain the concept of positive externality. Graph

Section 3: Excercise (4pt)

A market for good X is given by the following function: Demand: P = 134-8Q Supply: P = 2+4Q

Where Q is measured by kg and P by USD

1. What are the equilibirium price and quantity forr the good X? Compute price

elasticity of demand and supply at the equlibrium point?

2. What are consumer surplus, producer surplus and social benefit in the market?

3. If governmnet imposes a specific tax as 12$ per unit on the production activity

of good X, how the price and quantity of the good changes? Analyze tax incidence in this case.

4. Illustrate the above results in a graph.