Preview text:

10/25/2021 N. GREGORY MANKIW PRINCIPLES OF ECONOMICS Eight Edition CHAPTER Supply, Demand, and Government Policies Premium PowerPoint Slides by: V. Andreea CHIRITESCU Eastern Illinois University

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 1

management system for classroom use. 1

Look for the answers to these questions:

• What are price ceilings and price floors?

What are some examples of each?

• How do price ceilings and price floors affect market outcomes?

• How do taxes affect market outcomes?

How do the effects depend on whether

the tax is imposed on buyers or sellers?

• What is the incidence of a tax?

What determines the incidence?

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 2 2

Government Policies That Alter the Private Market Outcome • Price controls

– Price ceiling: legal maximum on the price at which a good can be sold • Rent-control laws

– Price floor: legal minimum on the price at which a good can be sold • Minimum wage laws

• Taxes: government can make buyers or

sellers pay a specific amount on each unit

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 3

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning

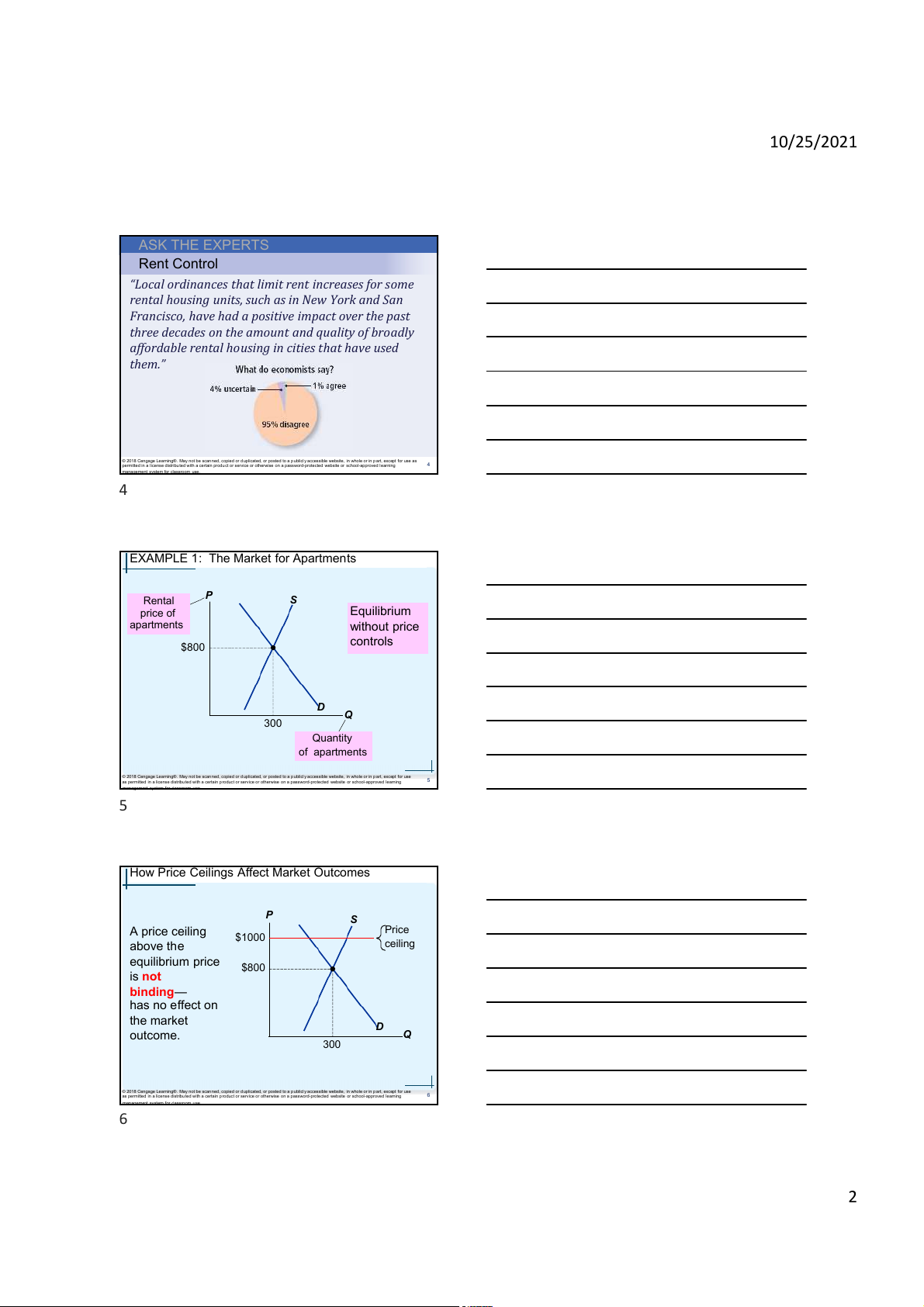

management system for classroom use. 3 1 10/25/2021 ASK THE EXPERTS Rent Control

“Local ordinances that limit rent increases for some

rental housing units, such as in New York and San

Francisco, have had a positive impact over the past

three decades on the amount and quality of broadly

affordable rental housing in cities that have used them.”

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use as

permitted in a l icense distribu ted with a certain produ ct or service or otherwise on a password-protected website or school-approved l earning 4

management system for classroom use. 4

EXAMPLE 1: The Market for Apartments P Rental S price of Equilibrium apartments without price controls $800 D Q 300 Quantity of apartments

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 5

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 5

How Price Ceilings Affect Market Outcomes P S A price ceiling Price $1000 above the ceiling equilibrium price $800 is not binding— has no effect on the market D outcome. Q 300

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 6 6 2 10/25/2021

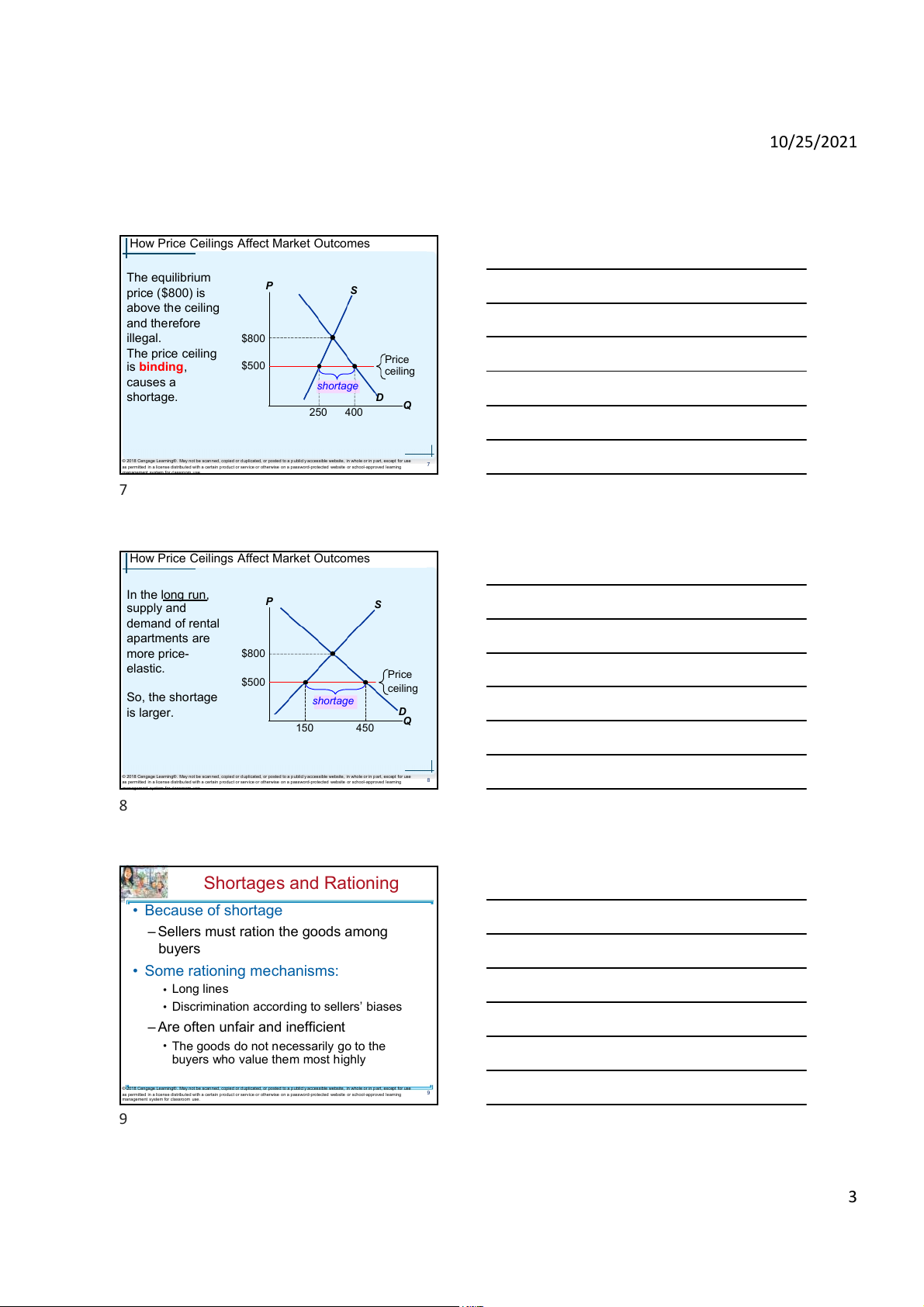

How Price Ceilings Affect Market Outcomes The equilibrium P price ($800) is S above the ceiling and therefore illegal. $800 The price ceiling Price is binding, $500 ceiling causes a shortage shortage. D Q 250 400

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 7

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 7

How Price Ceilings Affect Market Outcomes In the long run, P supply and S demand of rental apartments are more price- $800 elastic. Price $500 ceiling So, the shortage shortage is larger. DQ 150 450

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 8

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 8 Shortages and Rationing • Because of shortage

– Sellers must ration the goods among buyers

• Some rationing mechanisms: • Long lines

• Discrimination according to sellers’ biases

– Are often unfair and inefficient

• The goods do not necessarily go to the

buyers who value them most highly

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 9

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning

management system for classroom use. 9 3 10/25/2021

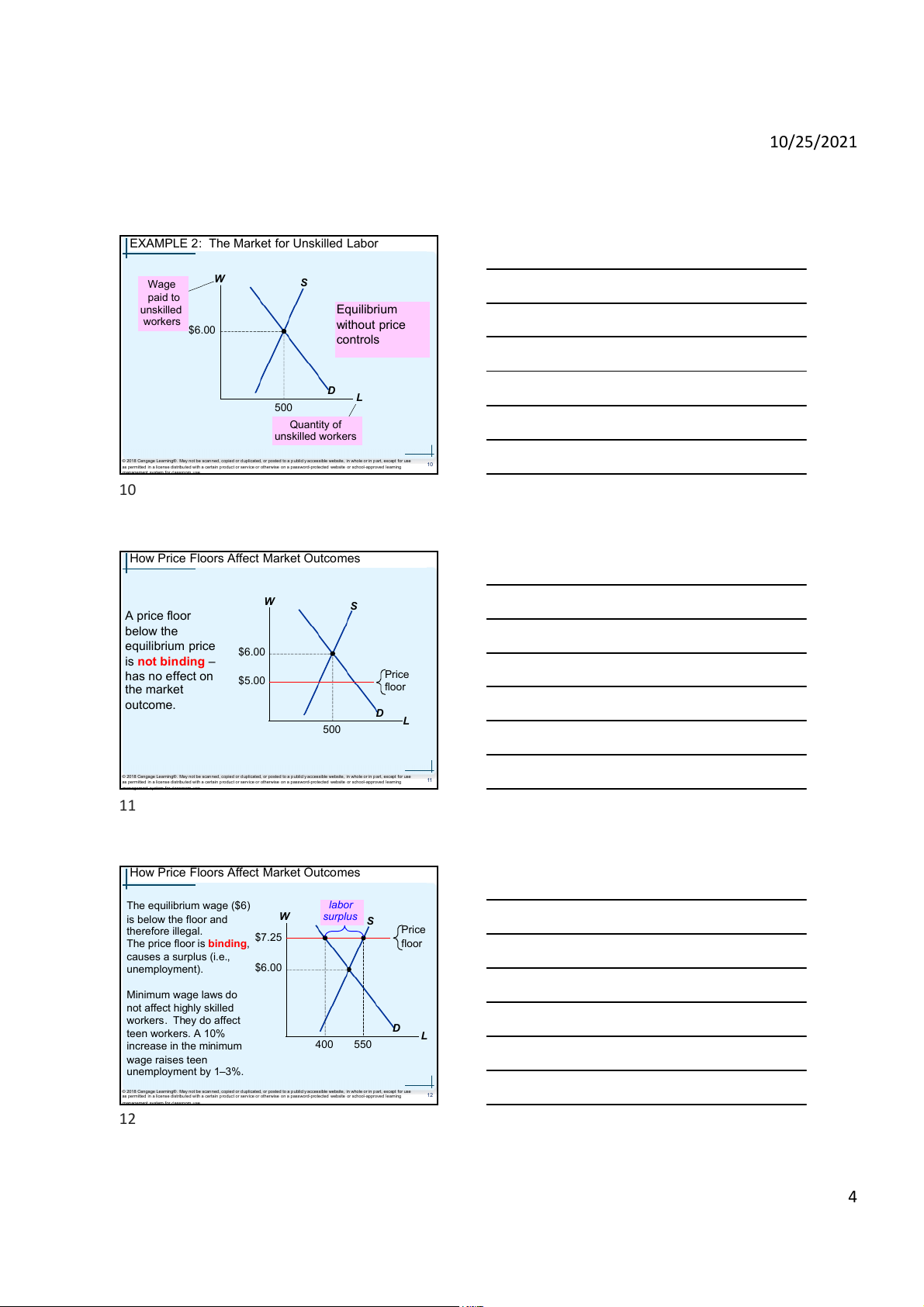

EXAMPLE 2: The Market for Unskilled Labor W Wage S paid to unskilled Equilibrium workers without price $6.00 controls D L 500 Quantity of unskilled workers

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 10

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 10

How Price Floors Affect Market Outcomes W S A price floor below the equilibrium price $6.00 is not binding – has no effect on Price $5.00 the market floor outcome. D L 500

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 11

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 11

How Price Floors Affect Market Outcomes The equilibrium wage ($6) labor is below the floor and W surplus S therefore illegal. Price $7.25 The price floor is binding, floor causes a surplus (i.e., unemployment). $6.00 Minimum wage laws do not affect highly skilled workers. They do affect teen workers. A 10% D L increase in the minimum 400 550 wage raises teen unemployment by 1–3%.

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 12 12 4 10/25/2021 ASK THE EXPERTS The Minimum Wage

“If the federal minimum wage is raised gradually

to $15-per-hour by 2020, the employment rate for

low-wage U.S. workers will be substantially lower

than it would be under the status quo.”

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use as

permitted in a l icense distribu ted with a certain produ ct or service or otherwise on a password-protected website or school-approved l earning 13

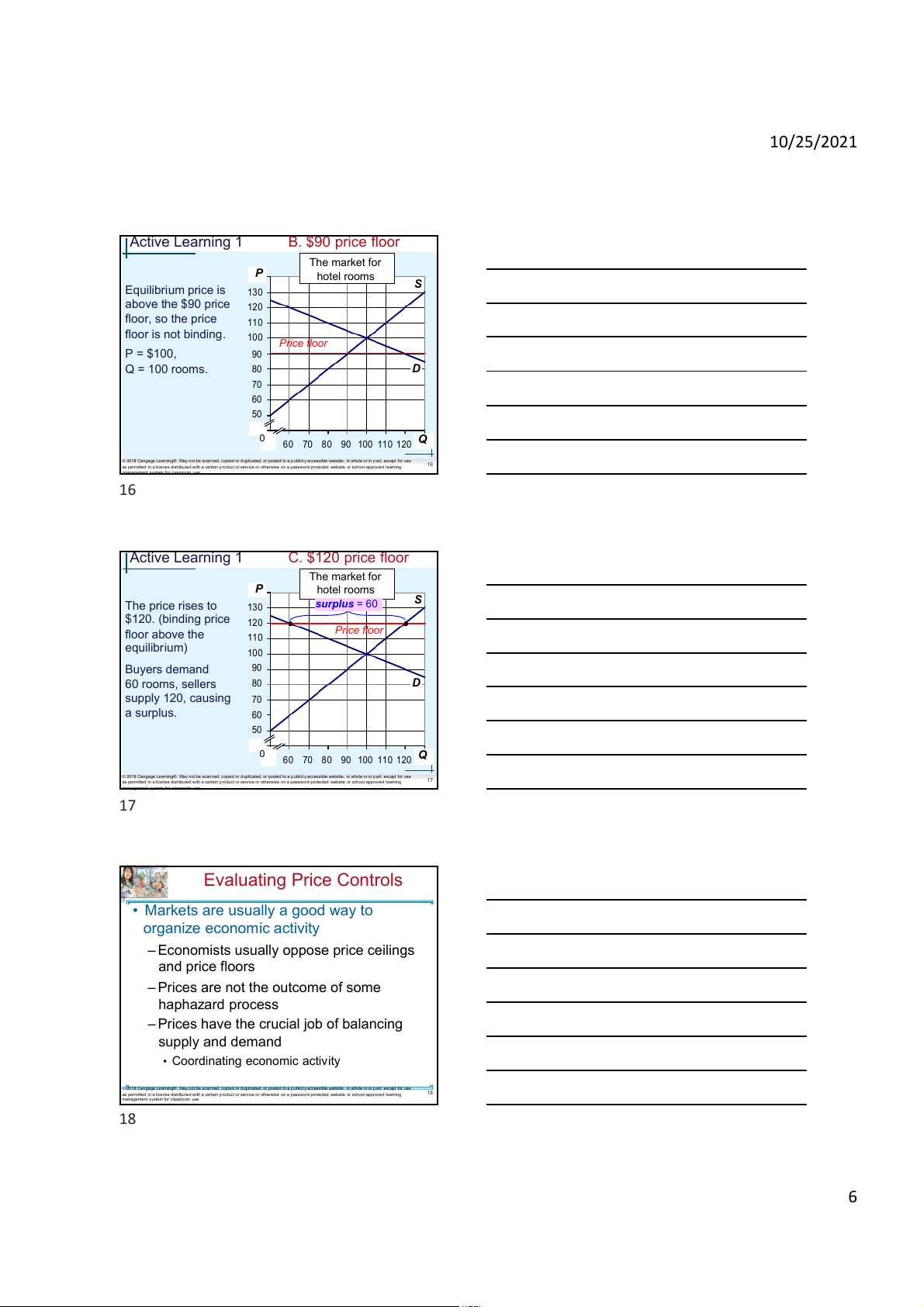

management system for classroom use. 13 Active Learning 1 Price controls The market for The market for hotel P hotel rooms rooms is in equilibrium S 130 as in the graph. 120 • Determine the 110 effects of: 100 A. $90 price ceiling 90 B. $90 price floor 80 D 70 C. $120 price floor 60 50 0 60 70 80 90 100 110 120 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 14

management system for classroom use. 14 Active Learning 1 A. $90 price ceiling The market for P hotel rooms The price falls to S 130 $90. (binding price 120 ceiling below the equilibrium) 110 100 Buyers demand Price ceiling 90 120 rooms, sellers 80 D supply 90, leaving a shortage = 30 70 shortage. 60 50 0 60 70 80 90 100 110 120 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 15 15 5 10/25/2021 Active Learning 1 B. $90 price floor The market for P hotel rooms S Equilibrium price is 130 above the $90 price 120 floor, so the price 110 floor is not binding. 100 Price floor P = $100, 90 Q = 100 rooms. 80 D 70 60 50 0 60 70 80 90 100 110 120 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 16

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 16 Active Learning 1 C. $120 price floor The market for P hotel rooms S The price rises to 130 surplus = 60 $120. (binding price 120 floor above the Price floor 110 equilibrium) 100 Buyers demand 90 60 rooms, sellers 80 D supply 120, causing 70 a surplus. 60 50 0 60 70 80 90 100 110 120 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 17

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 17 Evaluating Price Controls

• Markets are usually a good way to organize economic activity

– Economists usually oppose price ceilings and price floors

– Prices are not the outcome of some haphazard process

– Prices have the crucial job of balancing supply and demand

• Coordinating economic activity

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 18

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning

management system for classroom use. 18 6 10/25/2021 Evaluating Price Controls

• Governments can sometimes improve market outcomes – Want to use price controls

• Because of unfair market outcome • Aimed at helping the poor

– Often hurt those they are trying to help

– Other ways of helping those in need • Rent subsidies

• Wage subsidies (earned income tax credit)

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 19

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning

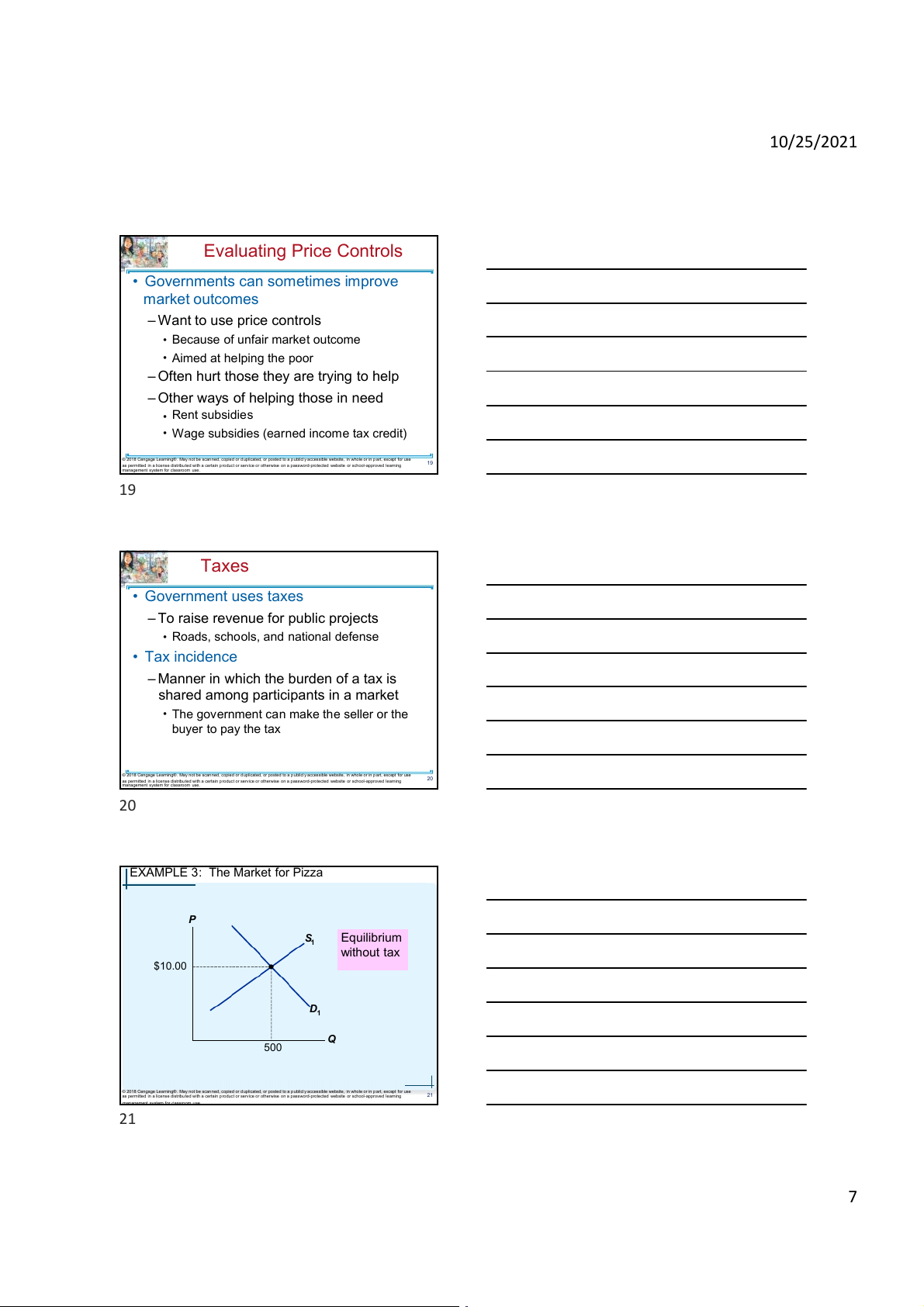

management system for classroom use. 19 Taxes • Government uses taxes

– To raise revenue for public projects

• Roads, schools, and national defense • Tax incidence

– Manner in which the burden of a tax is

shared among participants in a market

• The government can make the seller or the buyer to pay the tax

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 20

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning

management system for classroom use. 20

EXAMPLE 3: The Market for Pizza P S Equilibrium 1 without tax $10.00 D1 Q 500

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

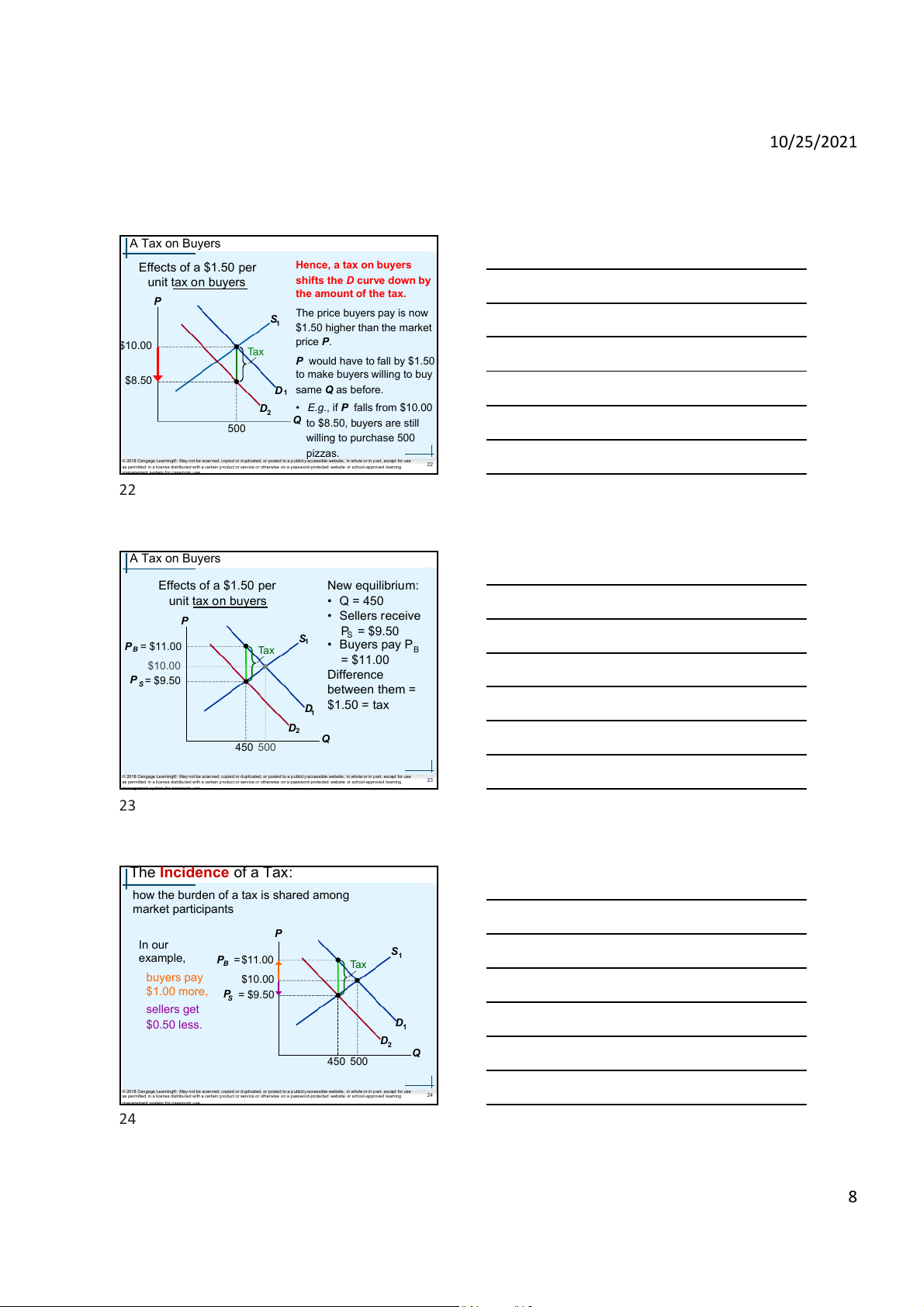

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 21 21 7 10/25/2021 A Tax on Buyers Hence, a tax on buyers Effects of a $1.50 per shifts the D curve down by unit tax on buyers the amount of the tax. P The price buyers pay is now S1 $1.50 higher than the market price P. $10.00 Tax P would have to fall by $1.50 to make buyers willing to buy $8.50 D 1 same Q as before. D

• E.g., if P falls from $10.00 2 Q to $8.50, buyers are still 500 willing to purchase 500 pizzas.

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 22

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 22 A Tax on Buyers Effects of a $1.50 per New equilibrium: unit tax on buyers • Q = 450 • Sellers receive P PS = $9.50 S1 P B = $11.00 • Buyers pay PB Tax = $11.00 $10.00 Difference P S = $9.50 between them = $1.50 = tax D1 D2 Q 450 500

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 23

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 23 The Incidence of a Tax:

how the burden of a tax is shared among market participants P In our S1 example, PB = $11.00 Tax buyers pay $10.00 $1.00 more, PS = $9.50 sellers get D $0.50 less. 1 D2 Q 450 500

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

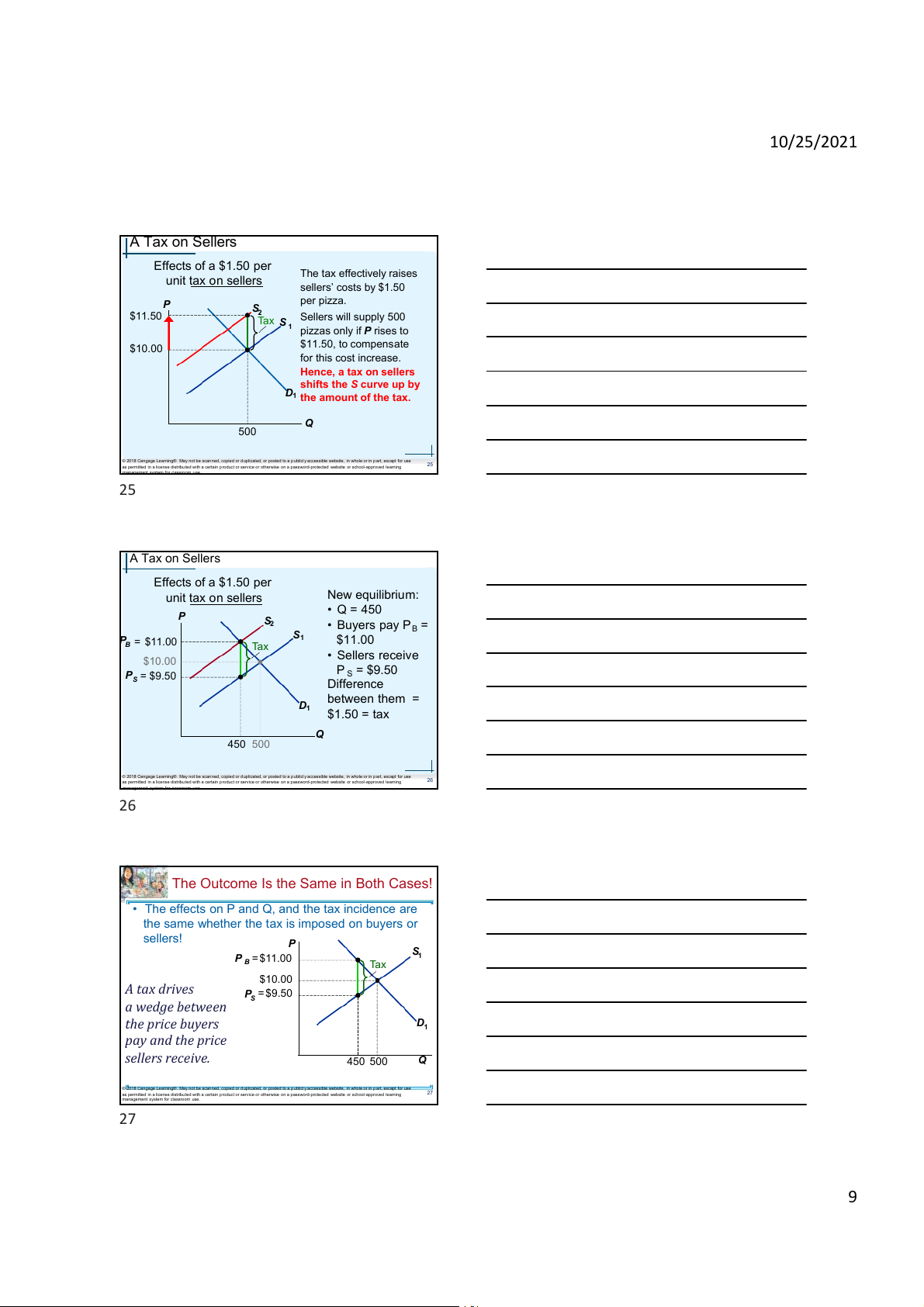

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 24 24 8 10/25/2021 A Tax on Sellers Effects of a $1.50 per The tax effectively raises unit tax on sellers sellers’ costs by $1.50 per pizza. P S2 $11.50 Sellers will supply 500

Tax S 1 pizzas only if P rises to $11.50, to compensate $10.00 for this cost increase. Hence, a tax on sellers shifts the S curve up by D1 the amount of the tax. Q 500

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 25

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 25 A Tax on Sellers Effects of a $1.50 per New equilibrium: unit tax on sellers • Q = 450 P S2 • Buyers pay PB = S1 PB = $11.00 $11.00 Tax • Sellers receive $10.00 P S = $9.50 PS = $9.50 Difference between them = D1 $1.50 = tax Q 450 500

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 26

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 26

The Outcome Is the Same in Both Cases!

• The effects on P and Q, and the tax incidence are

the same whether the tax is imposed on buyers or sellers! P S1 P B = $11.00 Tax $10.00 A tax drives P = $9.50 S a wedge between the price buyers D1 pay and the price sellers receive. 450 500 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 27

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning

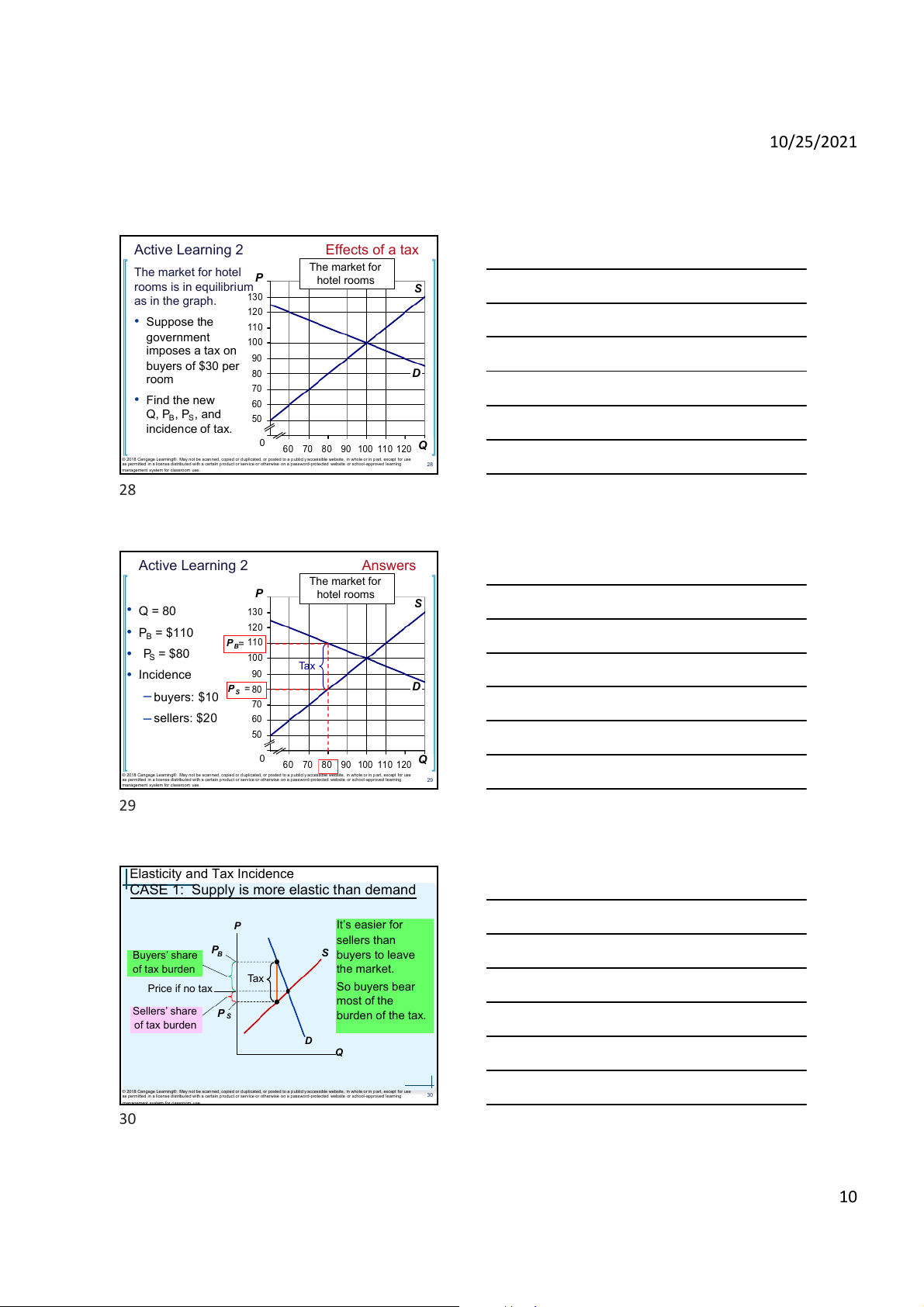

management system for classroom use. 27 9 10/25/2021 Active Learning 2 Effects of a tax The market for The market for hotel P hotel rooms rooms is in equilibrium S 130 as in the graph. 120 • Suppose the 110 government 100 imposes a tax on 90 buyers of $30 per 80 D room 70 • Find the new 60 Q, PB, PS, and 50 incidence of tax. 0 60 70 80 90 100 110 120 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 28

management system for classroom use. 28 Active Learning 2 Answers The market for P hotel rooms S • Q = 80 130 120 • PB = $110 P 110 • B= PS = $80 100 Tax 90 • Incidence P S = 80 D – buyers: $10 70 – sellers: $20 60 50 0 60 70 80 90 100 110 120 Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 29

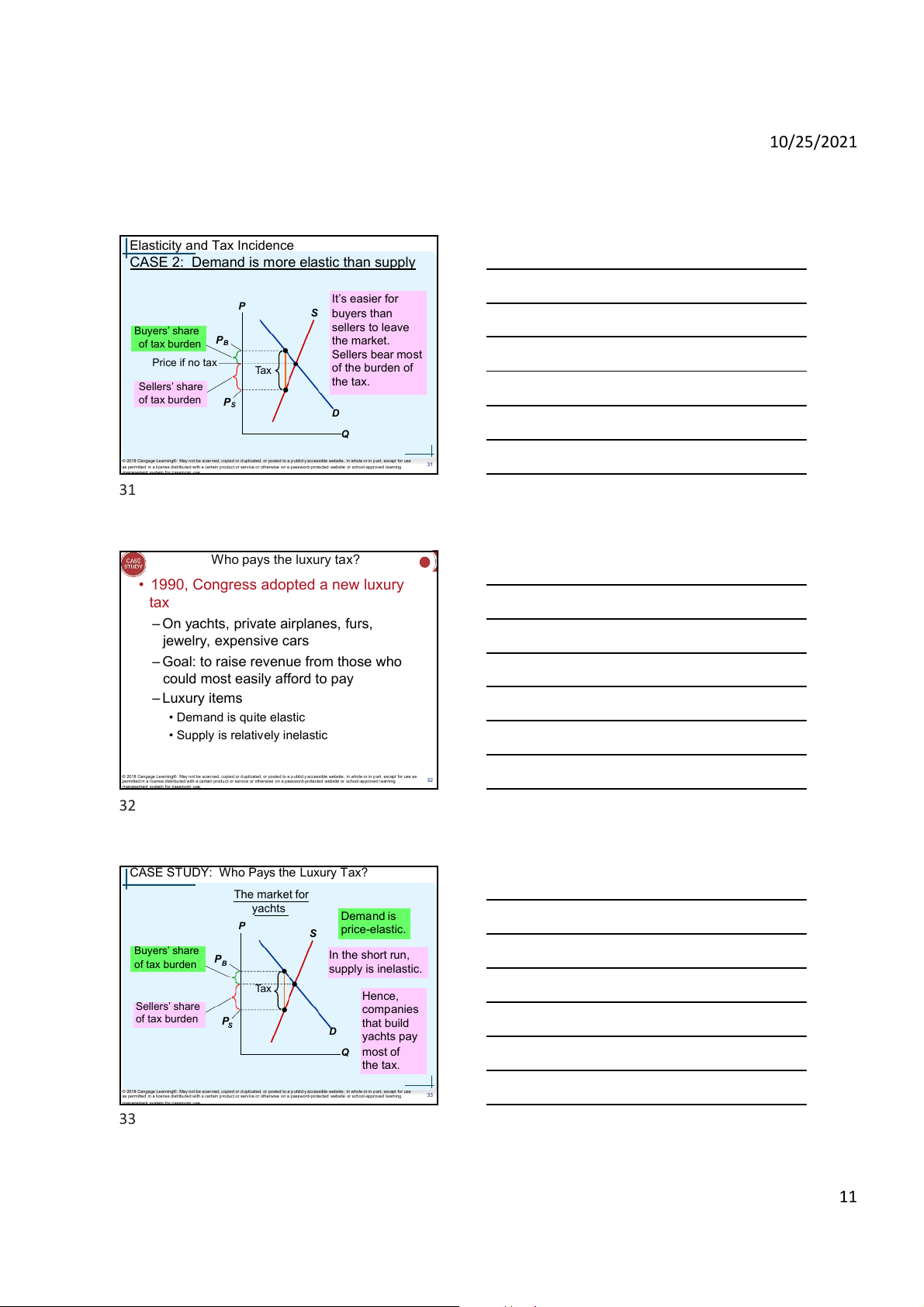

management system for classroom use. 29 Elasticity and Tax Incidence

CASE 1: Supply is more elastic than demand P It’s easier for sellers than PB S Buyers’ share buyers to leave of tax burden the market. Tax Price if no tax So buyers bear most of the Sellers’ share P S burden of the tax. of tax burden D Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 30 30 10 10/25/2021 Elasticity and Tax Incidence

CASE 2: Demand is more elastic than supply It’s easier for P S buyers than sellers to leave Buyers’ share PB the market. of tax burden Sellers bear most Price if no tax Tax of the burden of the tax. Sellers’ share of tax burden PS D Q

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use 31

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 31 Who pays the luxury tax?

• 1990, Congress adopted a new luxury tax

– On yachts, private airplanes, furs, jewelry, expensive cars

– Goal: to raise revenue from those who

could most easily afford to pay – Luxury items • Demand is quite elastic

• Supply is relatively inelastic

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use as

permitted in a l icense distribu ted with a certain produ ct or service or otherwise on a password-protected website or school-approved l earning 32 32

CASE STUDY: Who Pays the Luxury Tax? The market for yachts Demand is P S price-elastic. Buyers’ share In the short run, of tax burden PB supply is inelastic. Tax Hence, Sellers’ share companies of tax burden PS that build D yachts pay Q most of the tax.

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessible website, in whole or in p art, except for use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 33 33 11 10/25/2021 Active Learning 3 The 2011 payroll tax cut

Prior to 2011, the Social Security payroll tax was

6.2% taken from workers’ pay and 6.2% paid by

employers (total 12.4%). The Tax Relief Act (2010)

reduced the worker’s portion from 6.2% to 4.2% in

2011, but left the employer’s portion at 6.2%.

• Should this change have increased the typical

worker’s take-home pay by exactly 2%, more than

2%, or less than 2%? Do any elasticities affect your answer? Explain.

• FOLLOW-UP QUESTION: Who gets the bigger

share of this tax cut, workers or employers? How

do elasticities determine the answer?

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessibl e website, in whole or in part, except f or use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 34

management system for classroom use. 34 Active Learning 3 Answers

• As long as labor supply and labor demand both

have price elasticity > 0, the tax cut will be shared

by workers and employers, i.e., workers’ take-

home pay will rise less than 2%.

• The answer does NOT depend on whether labor

demand is more or less elastic than labor supply. FOLLOW-UP QUESTION :

• If labor demand is more elastic than labor supply,

workers get more of the tax cut than employers.

• If labor demand is less elastic than labor supply,

employers get the larger share of the tax cut.

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessibl e website, in whole or in part, except f or use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 35

management system for classroom use. 35 Summary

• A price ceiling is a legal maximum on the price

of a good. An example is rent control. If the

price ceiling is below the equilibrium price, it is

binding and causes a shortage.

• A price floor is a legal minimum on the price of

a good. An example is the minimum wage. If

the price floor is above the equilibrium price, it

is binding and causes a surplus. The labor

surplus caused by the minimum wage is unemployment.

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessibl e website, in whole or in part, except f or use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 36

management system for classroom use. 36 12 10/25/2021 Summary

• A tax on a good places a wedge between the

price buyers pay and the price sellers receive,

and causes the equilibrium quantity to fall,

whether the tax is imposed on buyers or sellers.

• The incidence of a tax is the division of the

burden of the tax between buyers and sellers,

and does not depend on whether the tax is imposed on buyers or sellers.

• The incidence of the tax depends on the price

elasticities of supply and demand.

© 2018 Cengage Learning® . May not be scan ned, copied or d uplicated, or posted to a p ublicl y accessibl e website, in whole or in part, except f or use

as permitted in a license distribu ted with a certain p roduct or service or otherwise on a password-protected website or school-approved l earning 37

management system for classroom use. 37 13