Preview text:

lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan Chap 30

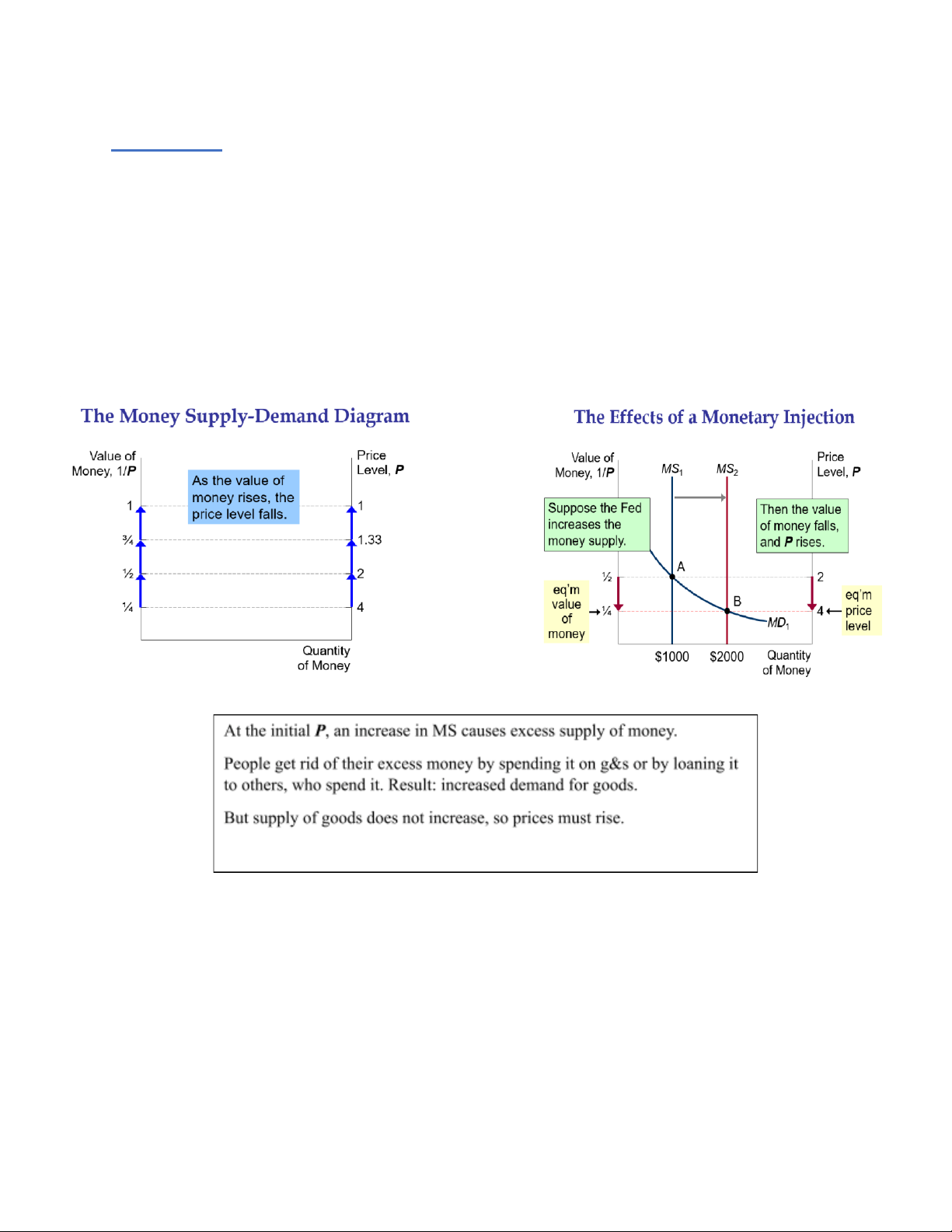

-P = the price level (e.g., the CPI or GDP deflator). P is the price of a basket of goods, measured in money.

-Supply of the money: In real world, determined by Federal Reserve, the banking system, consumers.

-Demand for the money: Refers to how much wealth people want to hold in liquid form.

+ Depends on P: An increase in P reduces the value of money, so more money is required to buy

g&s. Thus, quantity of money demanded is negatively related to the value of money and positively

related to P

▪ Nominal variables are measured in monetary units.

▪ Real variables are measured in physical units.

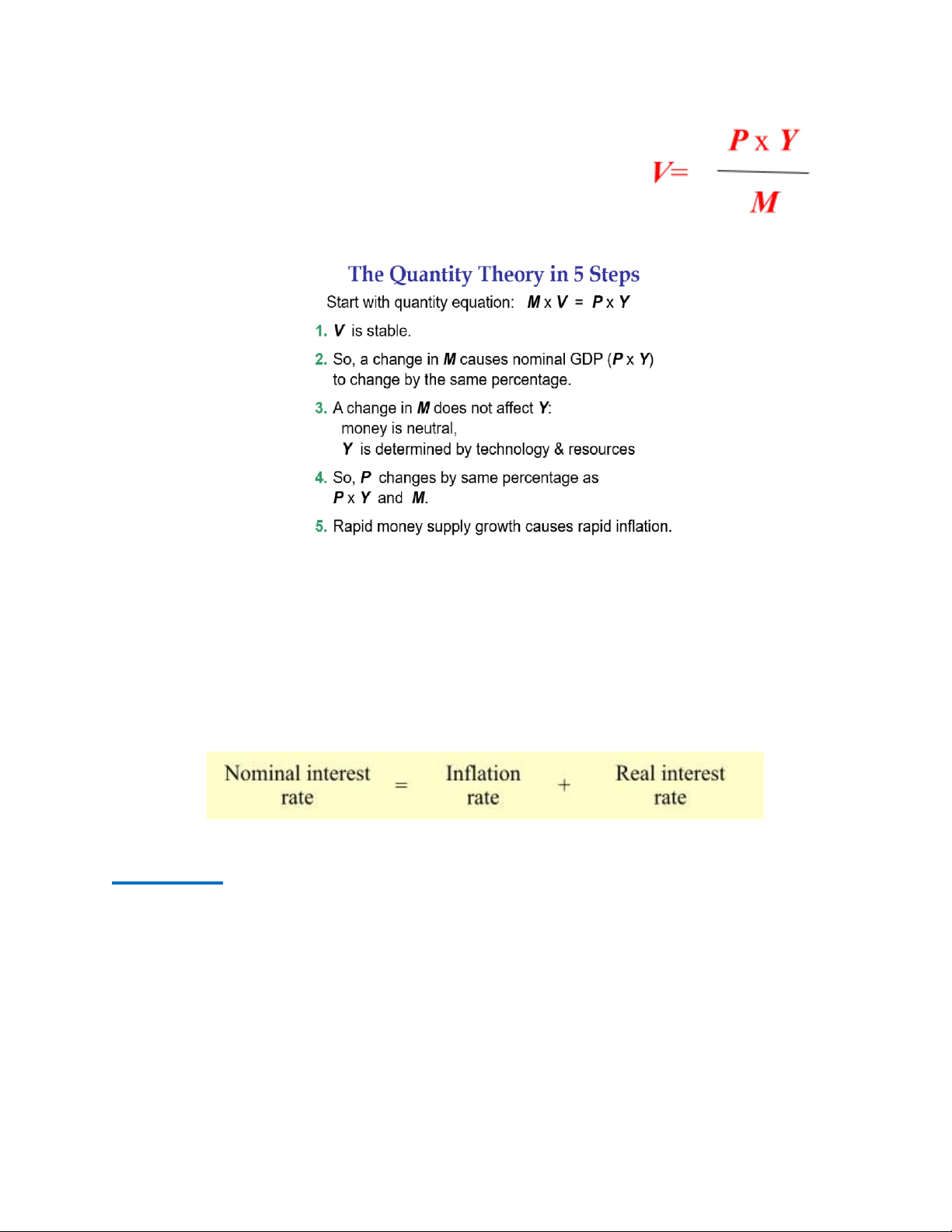

The Velocity of Money (độ xoay vòng của tiền)

▪ Velocity of money: the rate at which money changes hands lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

P x Y = nominal GDP = (price level) x (real GDP) M = money supply V = velocity

-The revenue from printing money is the inflation tax: printing money causes inflation, which is like

a tax on everyone who holds money.

▪ The real interest rate is determined by saving & investment in the loanable funds market.

▪ Money supply growth determines inflation rate.

▪ So, this equation shows how the nominal interest rate is determined. Chap 31

▪ A closed economy does not interact with other economies in the world.

▪ An open economy interacts freely with other economies around the world.

-Net exports (NX), as known as the trade balance. NX= value of exports – value of imports

-NX can be influenced by: Consumers’ preferences for foreign and domestic goods; Prices of goods

at home and abroad; Incomes of consumers at home and abroad; The exchange rates at which foreign

currency trades for domestic currency; Transportation costs; Govt policies, …

▪ Trade deficit: an excess of imports over exports (NX<0, E)

▪ Trade surplus: an excess of exports over imports (NX>0, E>I, Saving increase)

▪ Balanced trade: when exports = imports (NX=0, E=I) lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

THE FLOW OF THE CAPITAL

-Net capital outflow (NCO): domestic residents’ purchases of foreign assets minus foreigners’

purchases of domestic assets. NCO is also called net foreign investment.

▪ Foreign direct investment: Domestic residents actively manage the foreign

investment, e.g., McDonalds opens a fast-food outlet in Moscow.

▪ Foreign portfolio investment: Domestic residents purchase foreign stocks or bonds,

supplying “loanable funds” to a foreign firm.

⇨ FDI vs FPI: FDI is better. Since investment has plan to invest by using the FDI =>

They want to stay longer in our country or in the “long-term” => better for the economy’s development.

-NCO measures the imbalance in a country’s trade in assets:

▪ When NCO > 0, “capital outflow” Domestic purchases of foreign assets exceed

foreign purchases of domestic assets.

▪ When NCO < 0, “capital inflow” Foreign purchases of domestic assets exceed

domestic purchases of foreign assets.

-When a foreigner purchases a good from the U.S., the foreigner pays with currency or assets, so

the U.S. acquires some foreign assets, causing NCO to rise.

-When a U.S. citizen buys foreign goods, the U.S. buyer pays with U.S. dollars or assets, so the

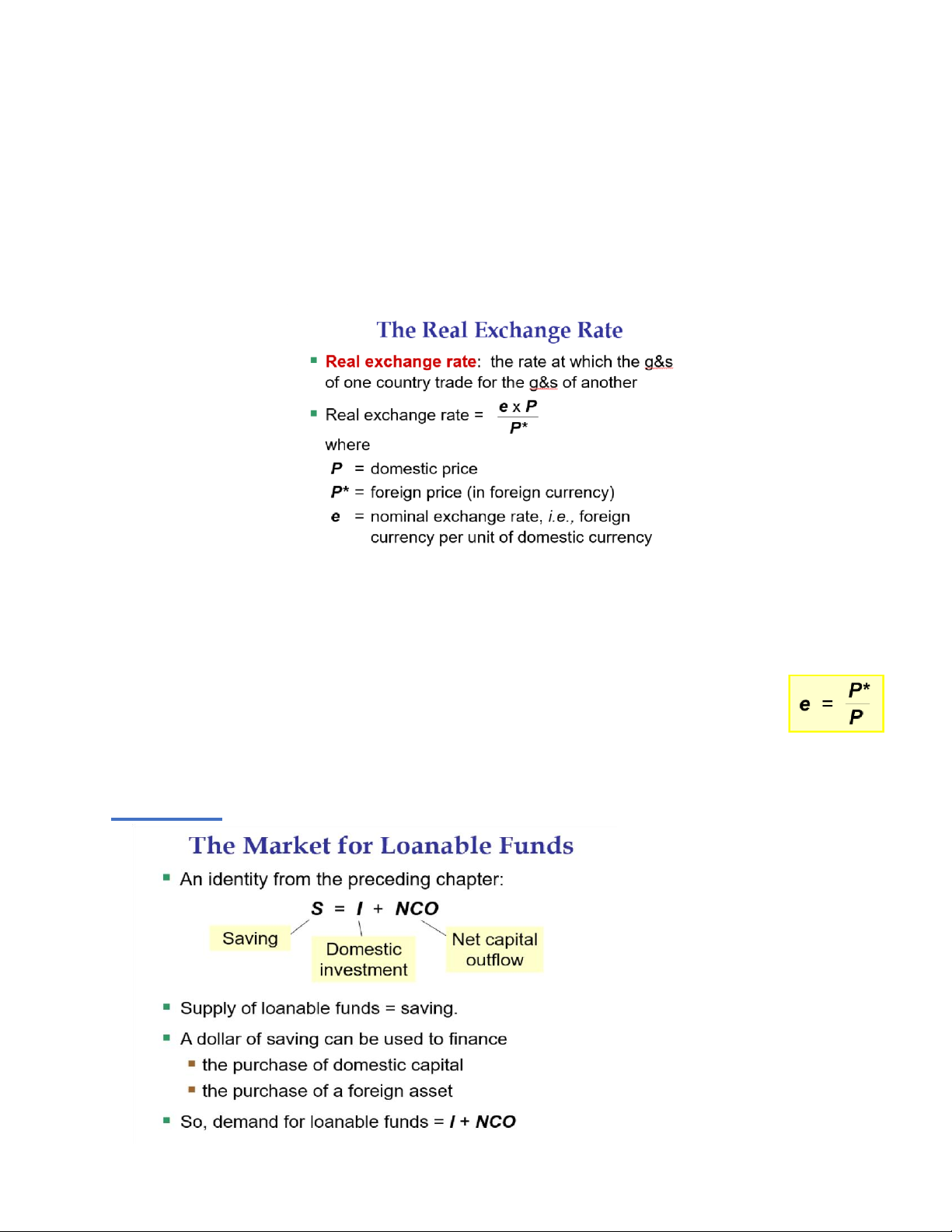

other country acquires U.S. assets, causing U.S. NCO to fall. THE EXCHANGE RATE

▪ Nominal exchange rate: the rate at which one country’s currency trades for another

▪ Appreciation (or “strengthening”): an increase in the value of a currency, as measured by the

amount of foreign currency it can buy (giá trị đồng tiền đang xét tăng) lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

▪ Depreciation (or “weakening”): a decrease in the value of a currency, as measured by the

amount of foreign currency it can buy (giá trị đồng tiền đang xét giảm)

Ex: Nếu 1 USD= 100VND

● Depreciate: 1USD= 90VND, Dollar Mỹ bị “mất giá”

● Appreciate: 1USD= 120VND Dollar Mỹ “tăng giá”

- Depreciate sẽ tốt hơn cho EXPORT. Appreciate tốt hơn cho IMPORT

-Law of one price: the notion that a good should sell for the same price in all markets -Purchasing-

power parity: (PPP) a theory of exchange rates whereby a unit of any currency should

be able to buy the same quantity of goods in all countries Chap 32 lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

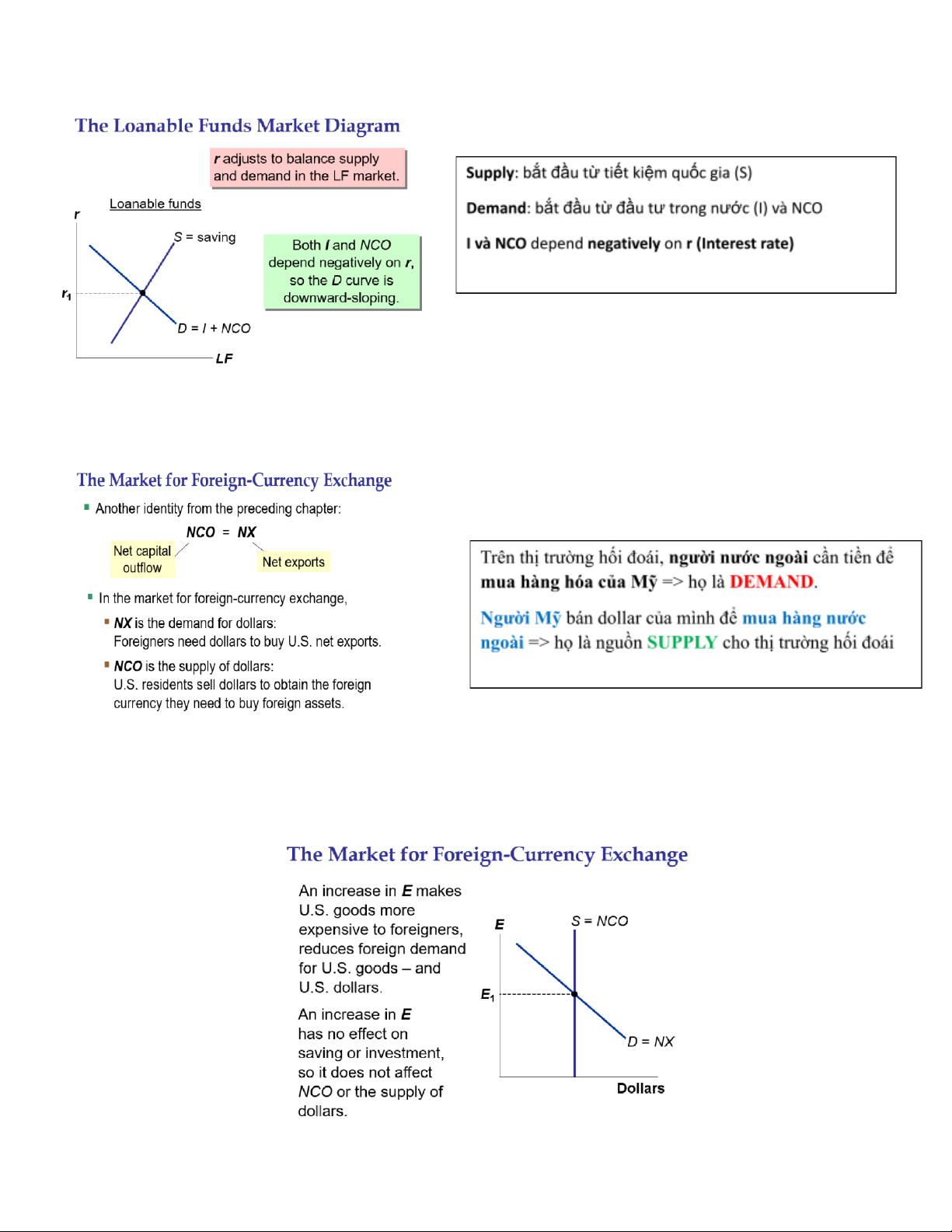

-E (Real Exchange rate) is the real value of a dollar in the market for foreign-currency exchange.

-If Exchange rate increase (decrease) => our currency will be appreciated (depreciated). lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

The Effects of a Budget Deficit ▪ National saving falls

▪ The real interest rate rises

▪ Domestic investment and net capital outflow both fall

▪ The real exchange rate appreciates (import> export => NCO decrease, real interest increase)

▪ Net exports fall (or, the trade deficit increases) CHAP 33

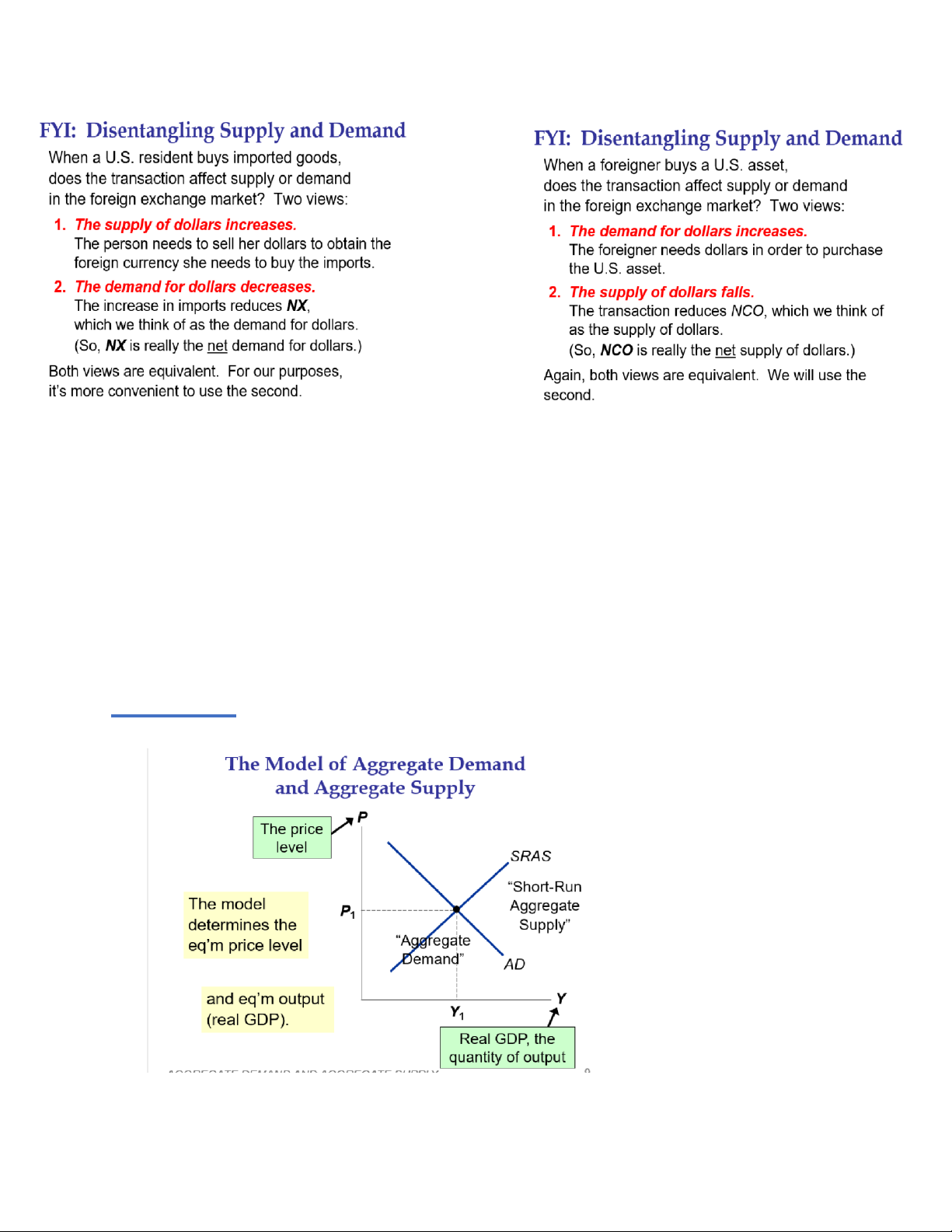

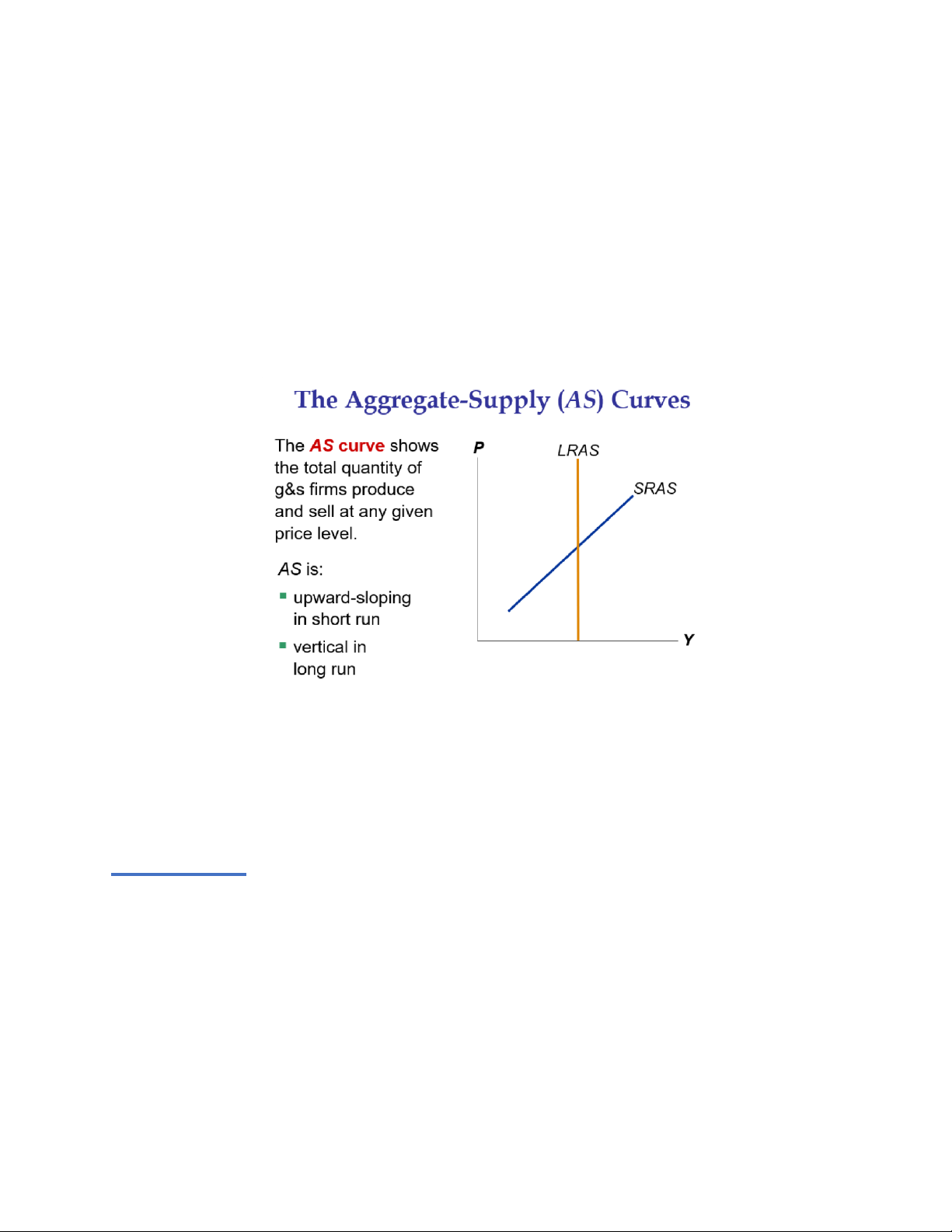

-Aggregate Demand (Tổng cầu) and Aggregate Supply lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

AD dịch chuyển vì:

▪ Changes in C

- Stock market boom/crash

- Preferences re: consumption/saving tradeoff - Tax hikes/cuts

▪ Changes in I

- Firms buy new computers, equipment, factories

- Expectations, optimism/pessimism

- Interest rates, monetary policy lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

- Investment Tax Credit or other tax incentives

▪ Changes in G

- Federal spending, e.g., defense

- State & local spending, e.g., roads, schools

▪ Changes in NX

- Booms/recessions in countries that buy our exports.

- Appreciation/depreciation resulting from international speculation in foreign exchange market b)

Three Facts About Economic Fluctuations FACT 1:

Economic fluctuations are irregular and unpredictable. FACT 2:

Most macroeconomic quantities fluctuate together. FACT 3:

As output falls, unemployment rises. CHAP 34:

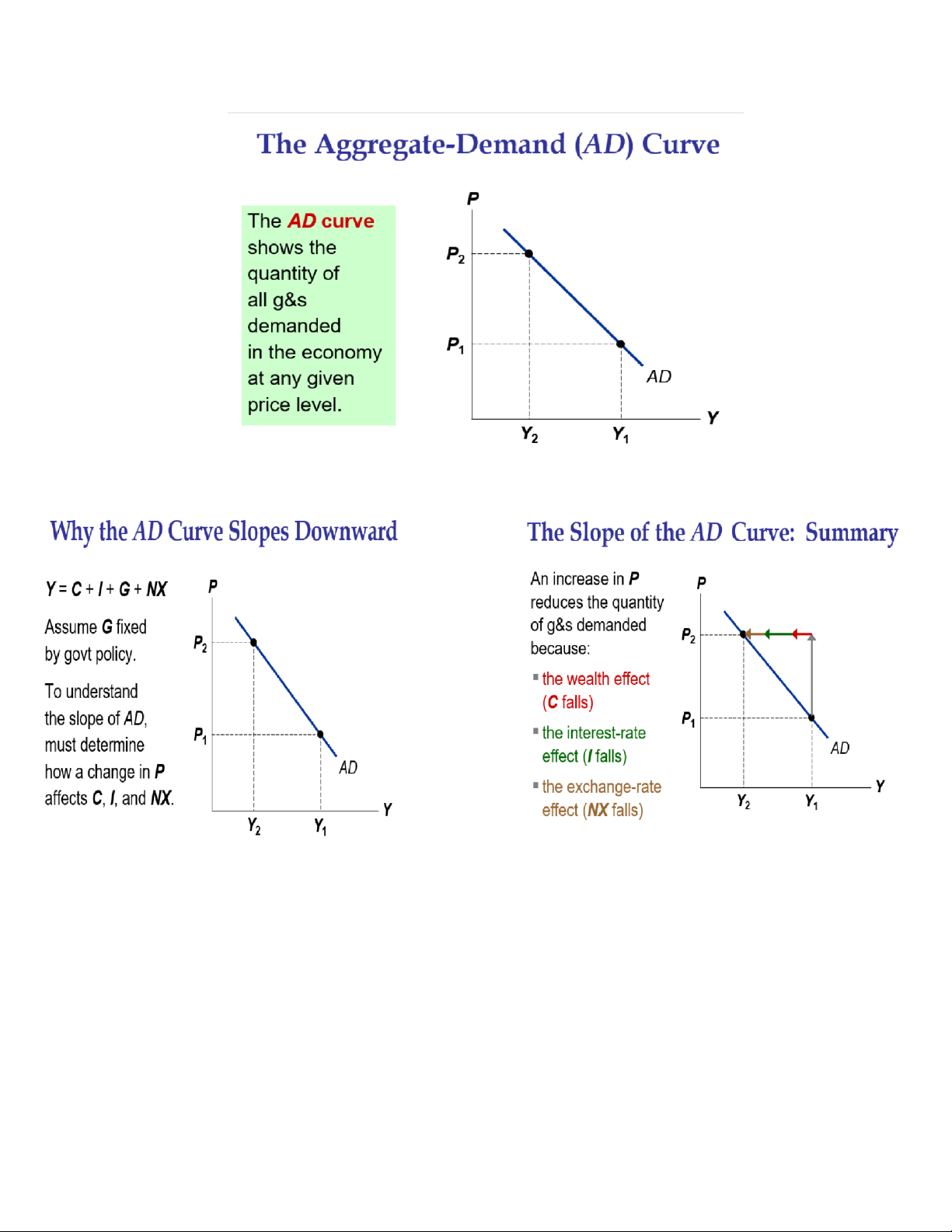

▪ Recall, the AD curve slopes downward for three reasons:

▪ The wealth effect (Hiệu ứng của cải)

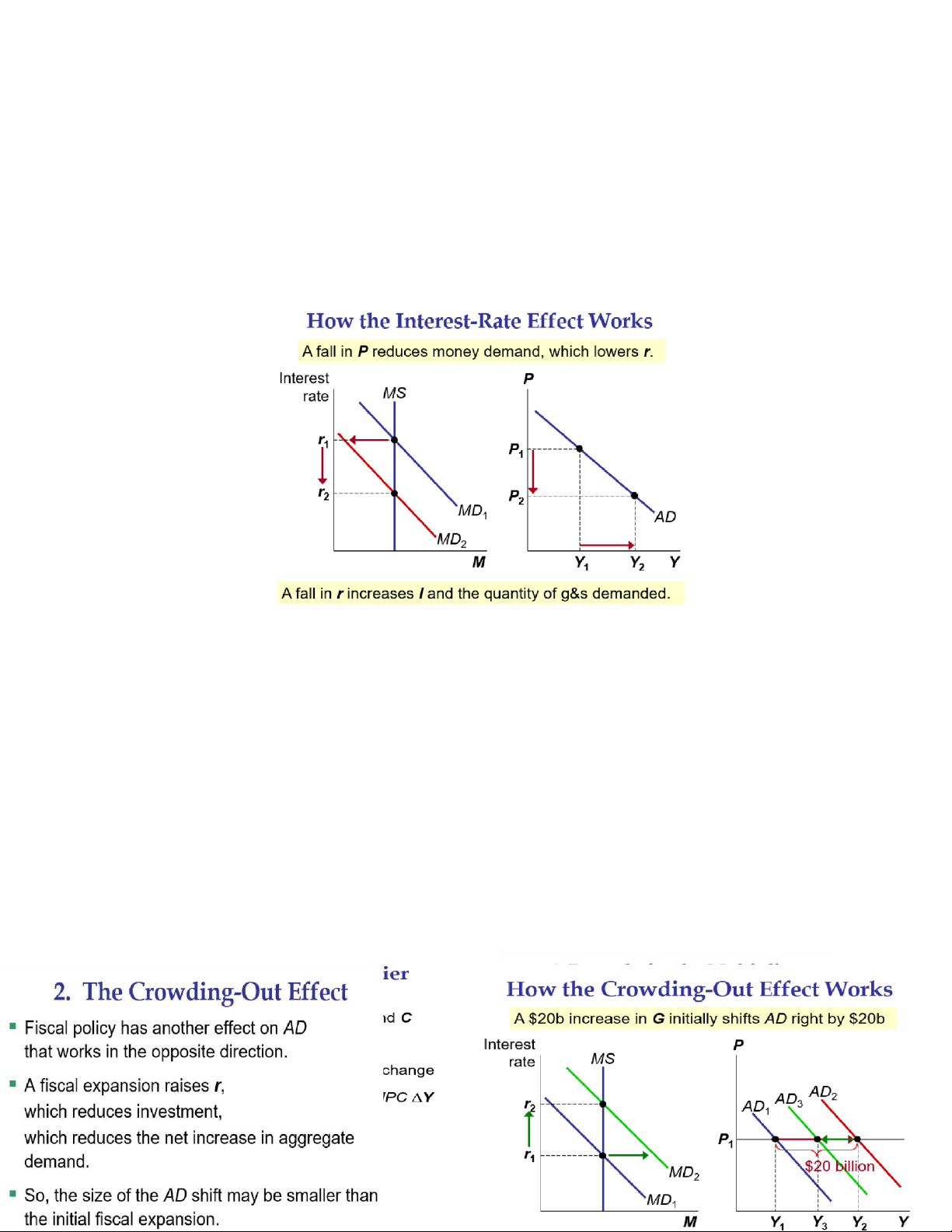

▪ The interest-rate effect (Hiệu ứng lãi suất) => QUAN TRỌNG NHẤT

Khi Price tăng, chúng ta cần thêm tiền để mua các loại hàng hóa => không có đủ tiền

để gửi vào ngân hàng => cung tiền giảm => Interest rate tăng => firm spend less than before.

▪ The exchange-rate effect (Hiệu ứng tỉ giá hối đoái)

Khi Price tăng => Interest rate tăng => NCO và exchange rate giảm => Không tốt cho

export => demand for the export giảm => Aggregate demand giảm. lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan

▪ Next: A supply-demand model that helps explain the interest-rate effect and how monetary

policy affects aggregate demand.

▪ The variables that influence money demand: Y, r, and P. r is the opportunity cost of money supply.

An increase in r causes a decrease in money demand, other things equal

An increase in P causes an increase in money demand, other things equal.

▪ Fiscal policy: the setting of the level of govt spending and taxation by govt policymakers

+ Expansionary fiscal policy

▪ an increase in G and/or decrease in T ▪ shifts AD right

+ Contractionary fiscal policy

▪ a decrease in G and/or increase in T ▪ shifts AD left

Multiplier effect: the additional shifts in AD that result when fiscal policy increases income and

thereby increases consumer spending lOMoAR cPSD| 58504431 Prepared by Trinh Ngoc Nhan Chap 35