Preview text:

lOMoAR cPSD| 58504431 I. Introduction:

1. What is the tariff policy?

Most countries face limitations in terms of natural resources and their ability to produce

certain goods and services needed by their populations. To overcome these constraints,

nations engage in international trade, they trade with other countries to get what their

population needs and demands. However, trade is not always smooth or mutually

agreeable between trading partners and makes them unhappy by policies, geopolitics,

competition, and many other factors. In response to such disagreements, one common

tool used by governments is the tariff. According to information from investopedia,

Tariffs are taxes imposed by a government on goods and services imported from

other countries. Today, other taxes account for most government revenue in developed

countries.Tariffs are often used as a tool of trade policy to regulate foreign trade, protect

domestic industries from overseas competition, or generate revenue for the government.

By increasing the cost of imported goods, tariffs can make domestic products more

competitively priced, encouraging consumers to buy locally-produced items.

2. Overview of recent tax policies:

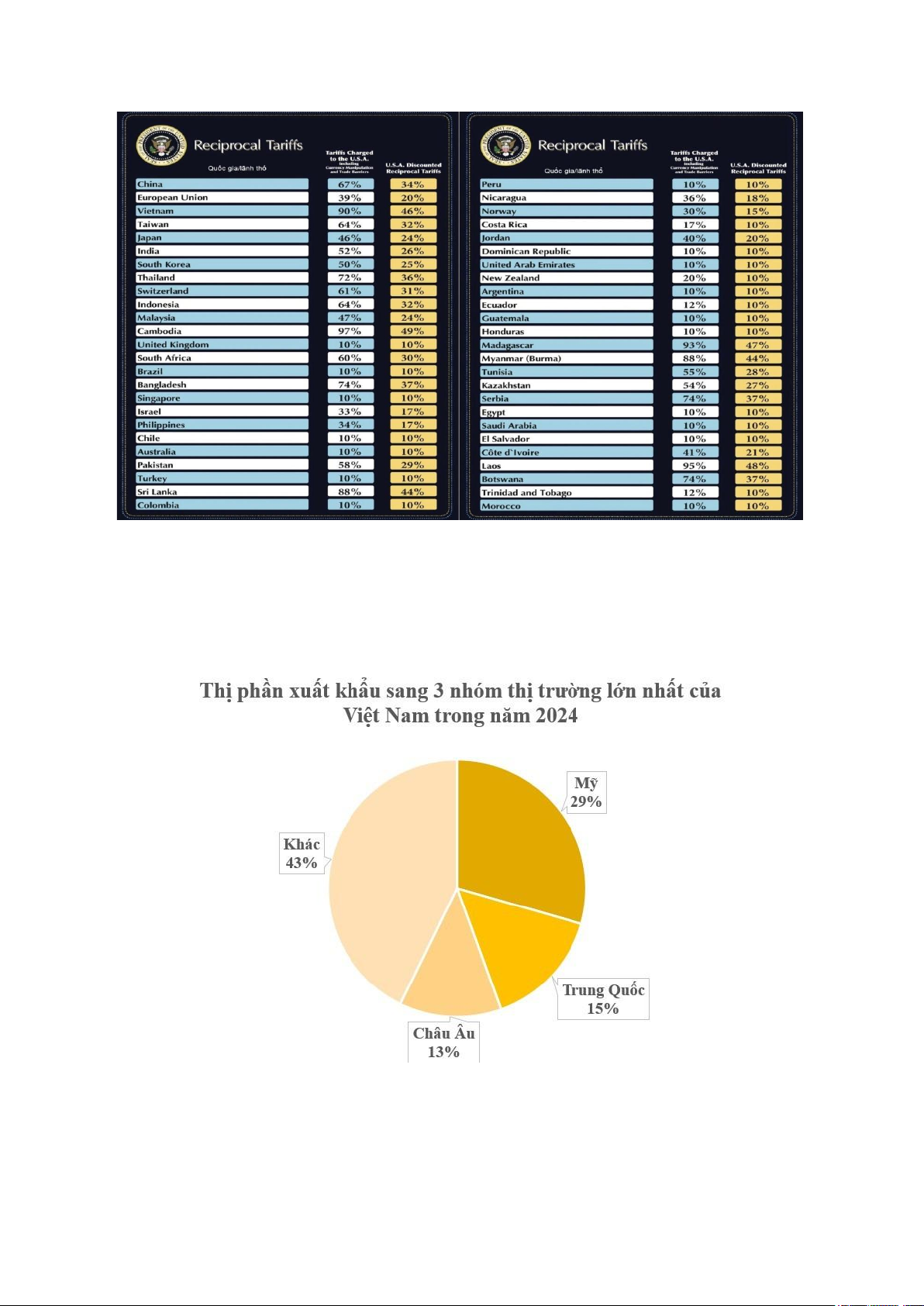

The United States has adopted an aggressive tariff policy in recent years, most notably

in the US-China trade war. A series of increasingly high tariffs has seen the United

States impose a 145% tariff on Chinese goods and China impose a 125% tariff on US

goods in response; these measures are expected to result in a 0.2% loss in global goods

trade. However, both countries have excluded certain items from their tariff lists and

continue to try to find a solution to the trade war. On April 2, US President Donald

Trump announced import tariffs on more than 180 trade items, ranging from 10% to

50%. In this order, Vietnam is among the countries subject to the highest tax of 46%.

This will negatively affect many of Vietnam's manufacturing industries, especially

those exporting to the US such as electronics, agriculture, and textiles. lOMoAR cPSD| 58504431

3. Why is Vietnam affected by the US tariff?

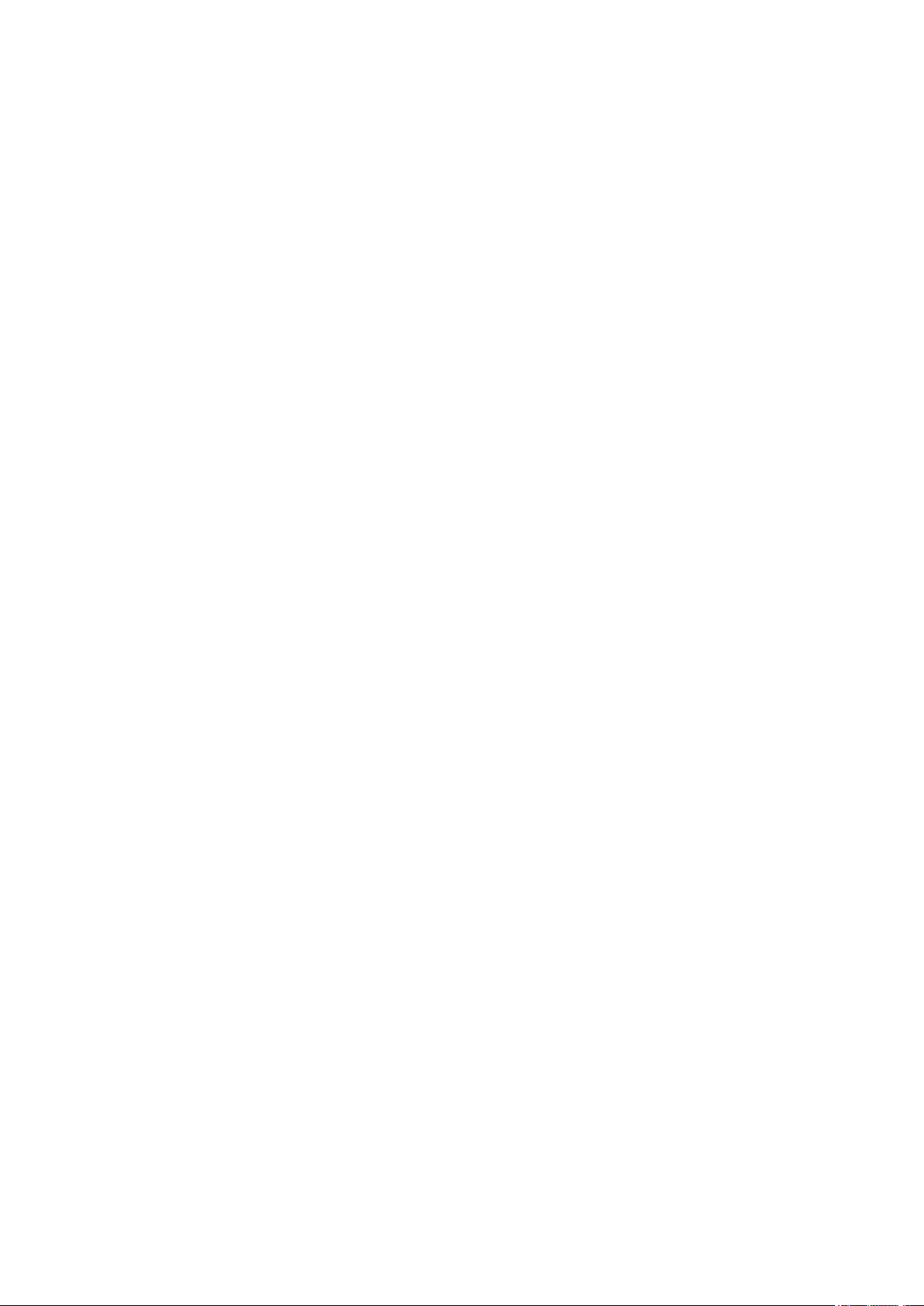

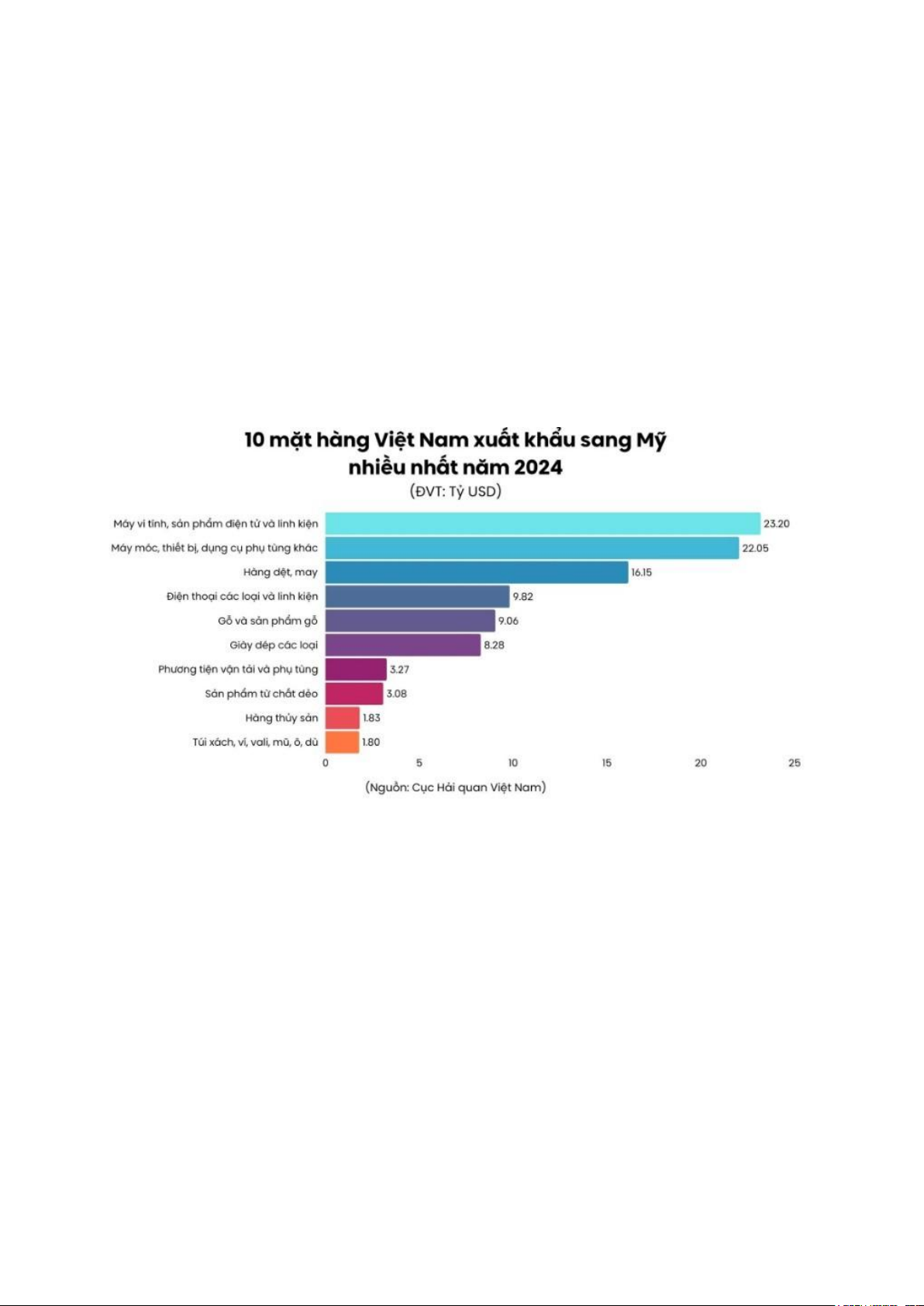

According to the Vietnam Federation of Commerce and Industry (VCCI), more

than 29% of Vietnam's total export turnover in 2024 will be to the US market with key

products such as electronics, textiles, footwear, wood and wood products, seafood, machinery and equipment.

In particular, many industries have an export proportion to the US of up to 40%, even

exceeding 50%, such as wood, textiles, electronic equipment... Therefore, Vietnam's

key export industries all depend on the US market. In addition, the Trump

administration is currently implementing many policies targeting China, where lOMoAR cPSD| 58504431

Vietnam's exports to the US all have large imported input materials, so they are easily

subject to anti-dumping taxes by the US. The United States remains Vietnam's largest

export market, with a turnover of 31.4 billion USD, accounting for nearly 30% of the

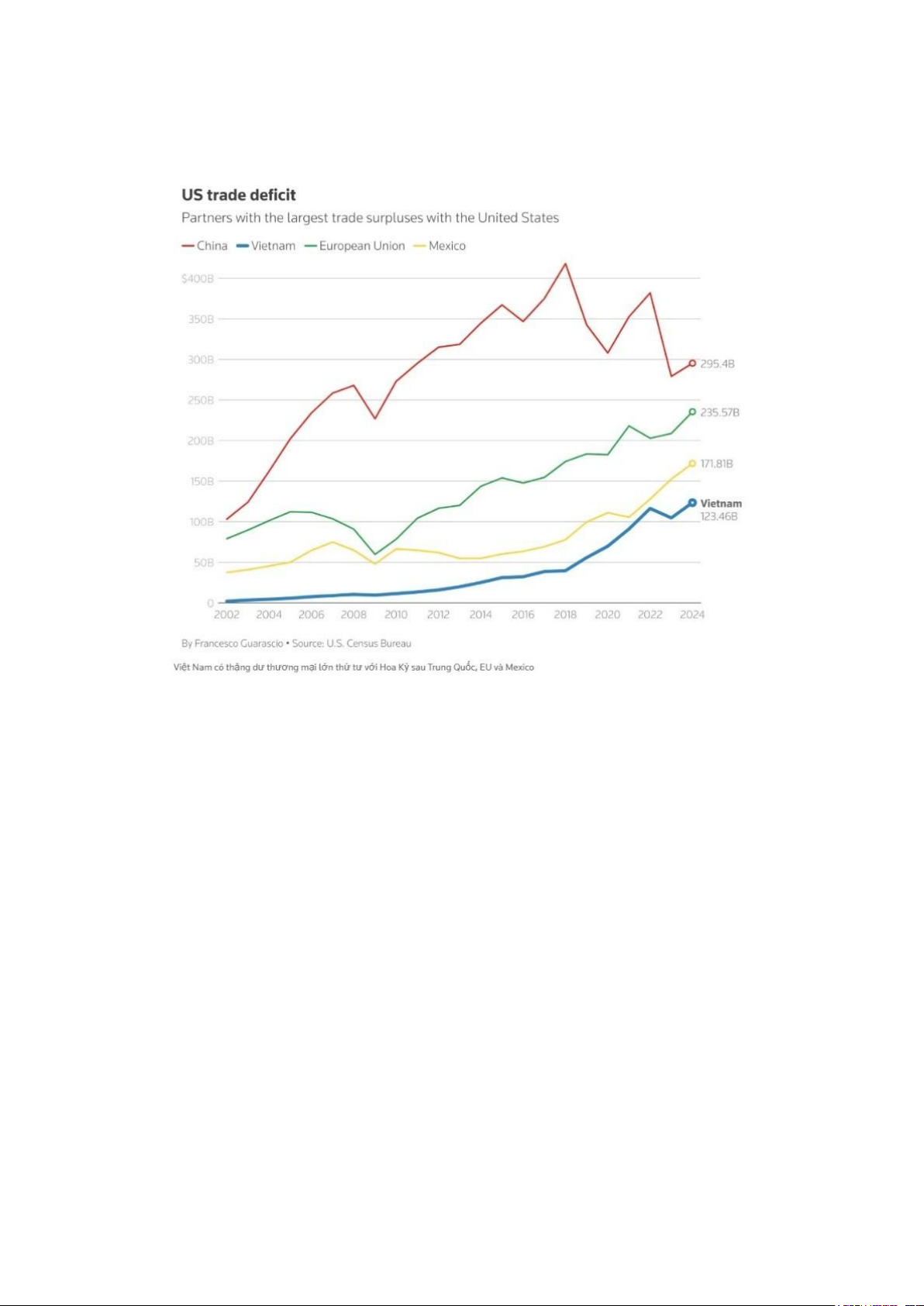

country's total export turnover. According to data related to trade relations between

Vietnam and the United States in 2024 announced by Vietnam Investment Review

(VIR), In terms of exports, the United States is Vietnam's largest export market,

accounting for about 30% of total exports ($136.6 billion in 2024) and 26% of GDP.

In terms of imports, Vietnam can increase imports from the United States to reduce the

trade surplus ($123.5 billion in 2024) to ease tariff pressure. This proves that Vietnam

has a large trade surplus with the United States.

II. Theoretical Framework

This research aims to assess the economic consequences of the recent U.S. tariff policy,

particularly the 46% tax levied on certain exports from Vietnam. To comprehensively

grasp how this policy influences the Vietnamese economy, the theoretical framework is

constructed on two foundational concepts of (1) Supply and

Demand Theory along with International Trade, and (2) the Aggregate Demand–

Aggregate Supply (AD–AS) Model. The amalgamation of these frameworks facilitates

analysis at the microeconomic level (prices, production, and company behavior) as well

as the macroeconomic level (GDP growth, trade balance, and inflation) in relation to the effects of tariff policy.

1. Supply and Demand Theory and International Trade

The theory of supply and demand, in economics, relationship between the quantity of

a commodity that producers wish to sell at various prices and the quantity that

consumers wish to buy. It is the main model of price determination used in economic

theory. The price of a commodity is determined by the interaction of supply and demand

in a market. The resulting price is referred to as the equilibrium price and represents an

agreement between producers and consumers of the good. In equilibrium the quantity

of a good supplied by producers equals the quantity demanded by consumers.

The implementation of a 46% tariff by the U.S. increases the price of goods from

Vietnam in the American market, thereby lowering consumer demand—this change is

represented by a leftward shift in the demand curve. On the supply side, Vietnamese

companies facing increased export costs and shrinking profit margins might cut back

on production or look for other markets, resulting in a decrease in the supply of goods available to the U.S. market.

In the realm of International trade is an exchange involving a good or service conducted

between at least two different countries. The exchanges can be imports or exports. An

import refers to a good or service brought into the domestic country. An export refers

to a good or service sold to a foreign country. lOMoAR cPSD| 58504431

Furthermore, exchange rates are significant in balancing trade. A drop in exports to the

U.S could lower the demand for the Vietnamese dong, potentially putting downward

pressure on its valuation. However, the degree to which exchange rates adjust relies on

the flexibility of monetary policy and Vietnam's foreign exchange reserves.

2. The Aggregate Demand – Aggregate Supply (AD–AS) Model The AD–AS or

aggregate demand–aggregate supply model (also known as the aggregate supply–

aggregate demand or AS–AD model) is a widely used macroeconomic model that

explains short-run and long-run economic changes through the relationship of

aggregate demand (AD) and aggregate supply (AS) in a diagram. It coexists in an older

and static version depicting the two variables output and price level, and in a newer

dynamic version showing output and inflation (i.e. the change in the price level over

time, which is usually of more direct interest).

Short Run Aggregate Supply (SRAS) refers to the total amount of goods and services

that all firms within an economy are willing and able to produce at different price levels

in the short run, assuming other factors remain constant. It represents the productive

capacity of an economy in the short run, usually within a year or less.

The economy's long-run aggregate supply curve shows the level of output that an

economy can produce in the long run. All production factors, including labor, capital,

technology, and natural resources, become variable in this time frame. They adjust to

changes in price. Thus, the long-run aggregate supply graph is vertical because the price

cannot influence the output. Due to this, during the long run, an economy's economic

growth continues despite inflation in the short run. III. Short-run Impacts

1. GDP (Gross Domestic Product):

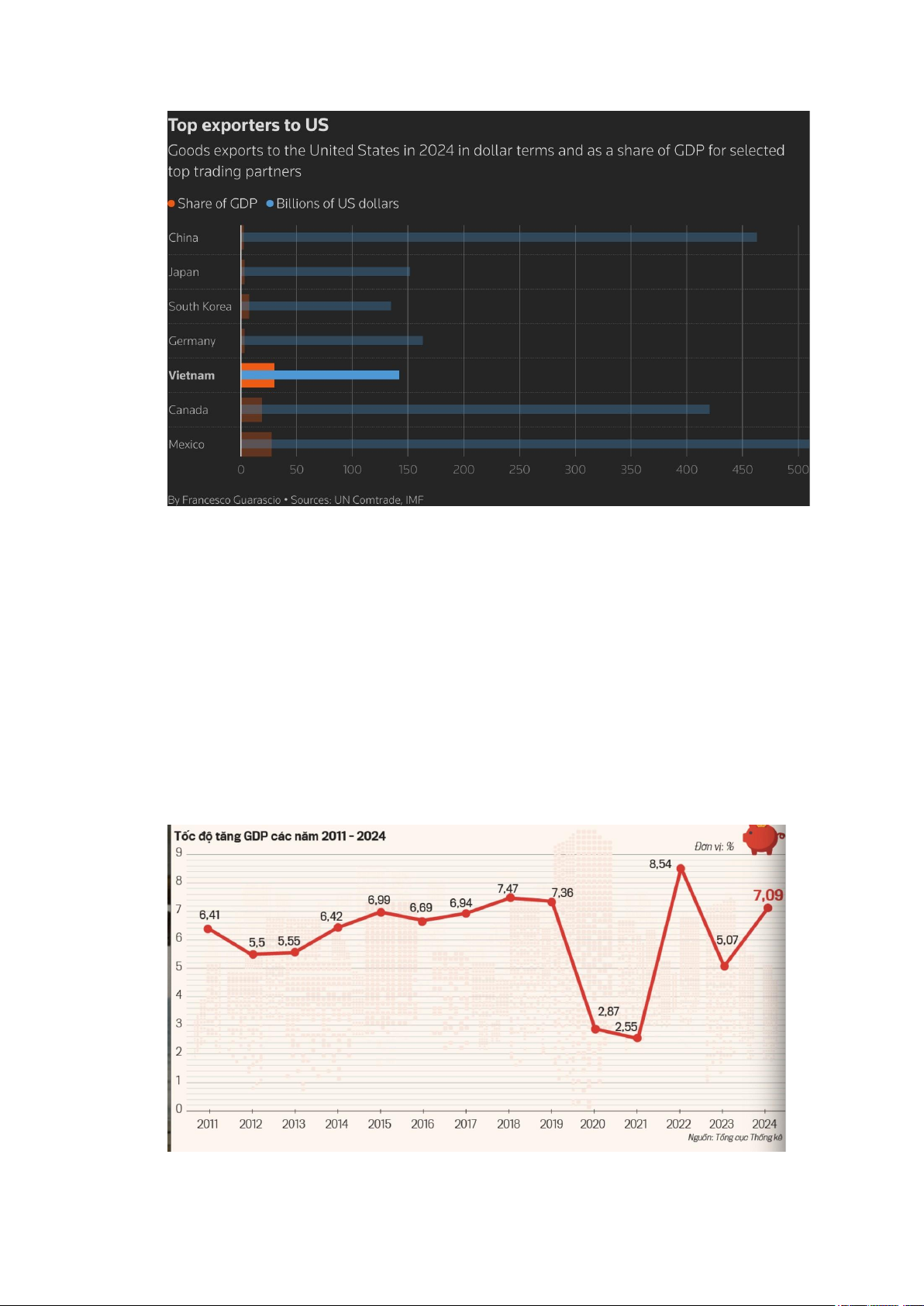

According to IMF estimates, exports to the United States will account for about 30% of

Vietnam's GDP of $468 billion, which is the largest market for all US trade products. lOMoAR cPSD| 58504431

Regarding the information that the US Government is considering imposing a tax rate

of up to 46% on Vietnamese exports to this market. The proposed 46% tariff would

make Vietnamese goods virtually uncompetitive in the US market, leading to a

significant drop in export revenue, especially when compared to goods from Mexico,

India or Bangladesh, which are not subject to such tariffs. According to VNDIRECT

experts forecast that exports to the US could fall by 20-25%, total export turnover

could fall by 9%-11%. Some experts estimate that this tax rate, if realized, will not only

have a strong impact on foreign trade activities but also GDP growth in 2025 could be

2%-3% points lower than the scenario without taxes. Moreover, the global economic

downturn caused by trade tensions could reduce demand for Vietnamese goods,

threatening the ability to achieve the 8% growth target. 2. Inflation: lOMoAR cPSD| 58504431

In the short run, the U.S tariff policy faces significant inflationary risk to Vietnam’s

export-driven economy. According to Mr. Giang, Chairman of the Vietnam Textile and

Apparel Association, Vietnamese textile exports already face tariffs averaging 12%,

with some items taxed up to 27%. These enhanced costs may lead to higher retail prices.

In addition, tariffs on imported input materials—such as electronics and textile

components which improve the cost of production in Vietnam. These results are likely

to be passed on customers, contributing to short-term cost-push inflation. 3. Unemployment:

When the U.S increases the import levy to goods from Vietnam, especially key items

such as electronics, textiles and shoes, this leads to the sharp decline in export turnover

through the HCMC Institute for Development. Moreover, according to the city

Department of Industry and Trade’s report, many items including textiles and footwear

are heavily affected by the tariffs which account for around 21% of exports to the U.S.,

electronics and components (20%), wood and furniture (8%), and seafood (2%). Then,

the export enterprises are restricted from order, they will be forced to cut down the

production and labor force. In the short-run, the places which have many industrial

parks that are seriously affected by job reduction are Bac Ninh, Binh Duong, and Dong

Nai. Taking Dong Nai as a main example, the province had set an ambitious target of

double-digit economic growth for 2025, with export turnover projected to increase by

10%, reaching nearly US$26.4 billion. However, under the new US tariff policy, Dong

Nai’s exports to the US may decline by 30–50%, equivalent to a drop of US$2.3–3.8

billion. This would reduce the province’s total export turnover to an estimated

US$22.5–24 billion, a year-on-year decrease of 9– 15%. The results create pressure on

unemployment rates, especially unskilled workers. Although Vietnam has benefited

from the wave of shift production from China because of the U.S tariffs on China before,

if Vietnam becomes the object of new measures from the U.S, this positive trend will

reverse, negatively affecting the labor market. 4. Capital flows:

In 2023, it is a year of a significant change in Vietnam’s capital market with a total

market capitalization of $240 billion, accounting for 56% of GDP, attracting foreign

investment. Ho Chi Minh Stock Exchange (HOSE) takes up about $186 billion of the

total capitalization of the Vietnam stock market. lOMoAR cPSD| 58504431

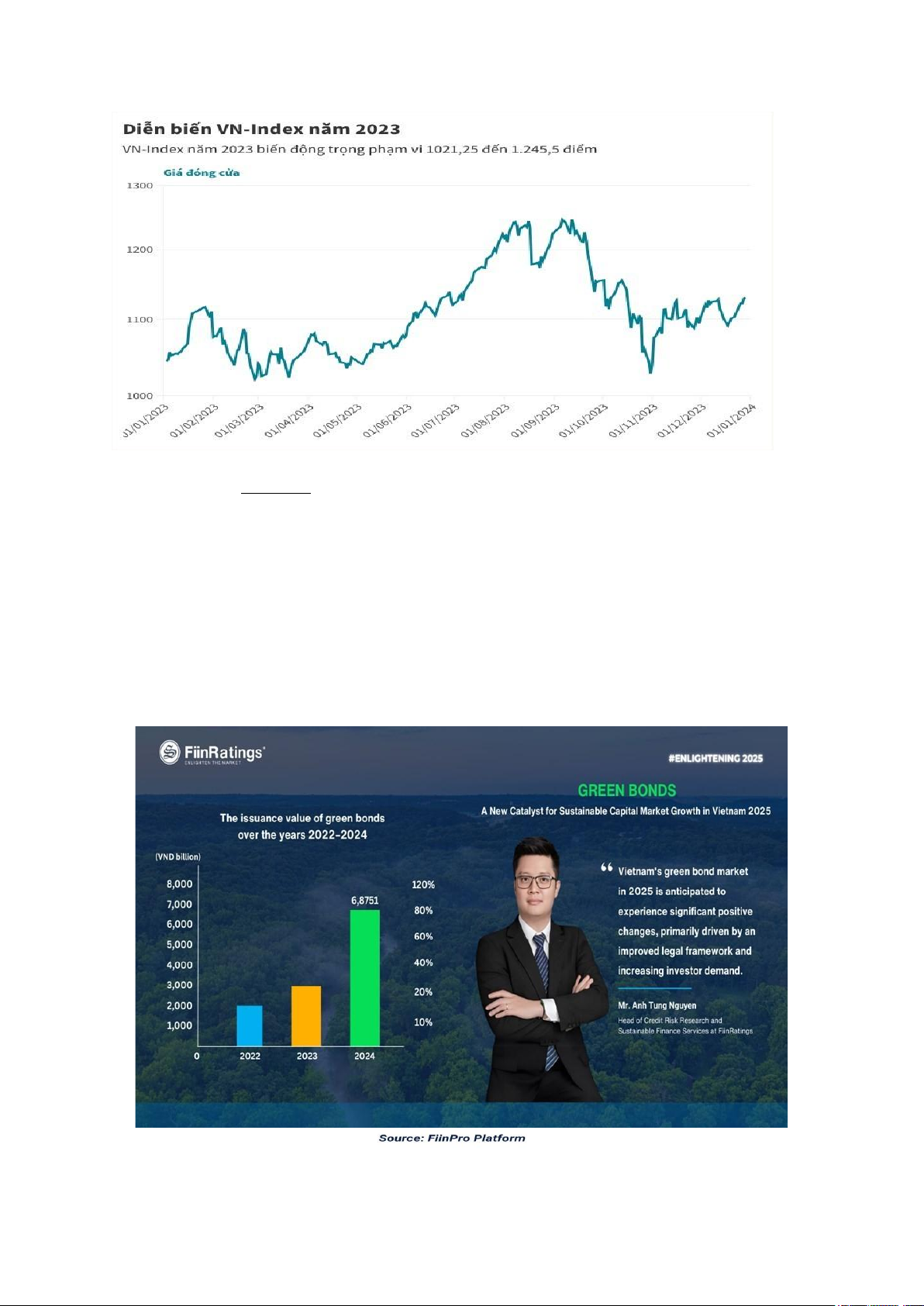

We can see that the chart illustrates that in the beginning of 2023, the VN-index tended

to fluctuate about 1,100 points. From March to August, the index increased sharply and

peaked at approximately 1 250 points in August. October decreases rapidly. At the end

of the year, there was a slight recovery but not yet returning to the peak in the middle of the year.

However, the Frontier markets of Morgan Stanley Capital International and many

administrative barriers have restricted the flow of capital flowing. The bond market,

verified $74 billion measured in 2022, mainly due to banks and immovable promotion,

with green bonds increasingly used to sponsor for net emission goals of 0 at Vietnam. lOMoAR cPSD| 58504431

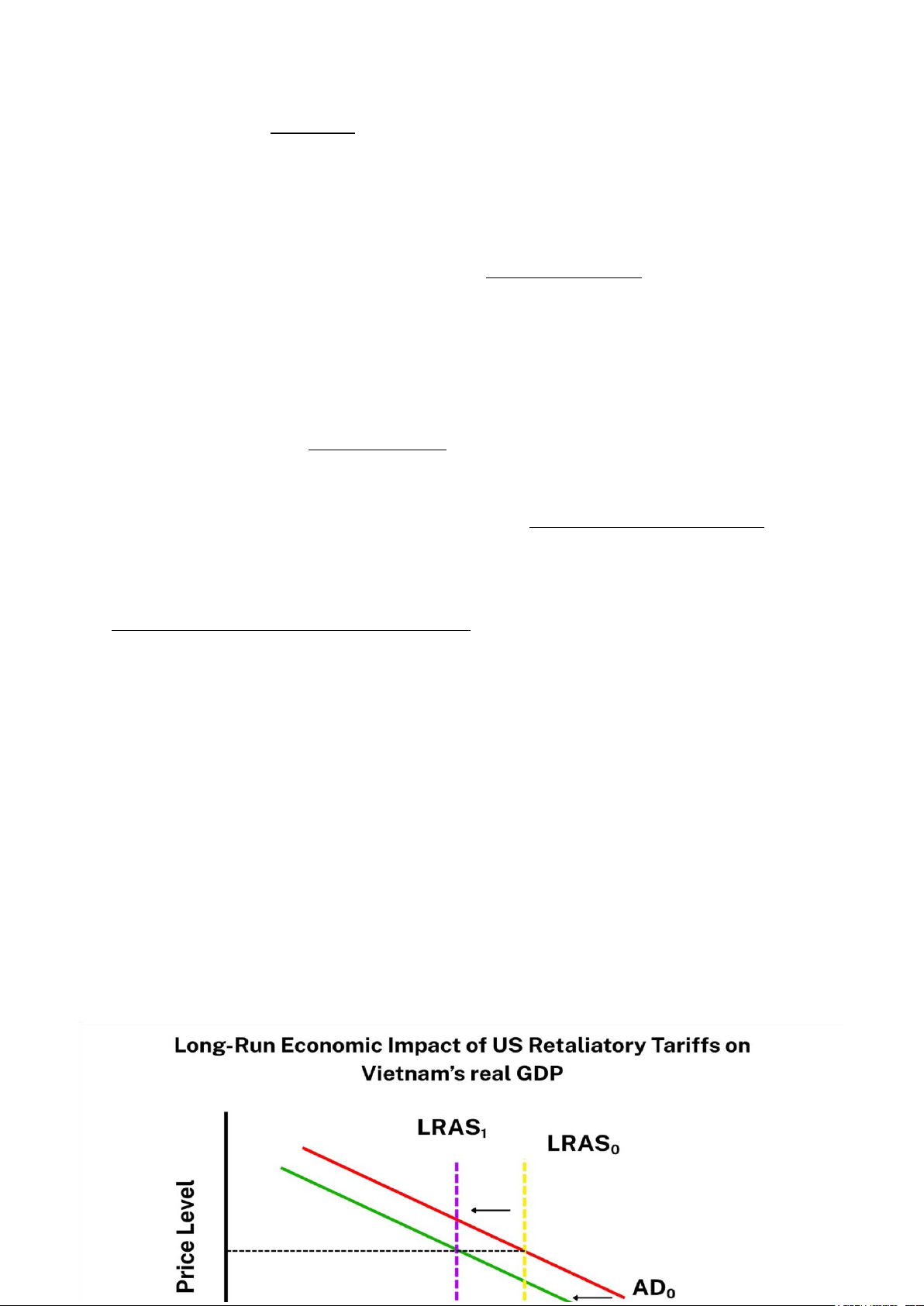

We can see that the bar graph shows that in 2022 recorded about VND 1 800 billion,

increasing slightly around VND 2 400 billion in 2023, before surging to VND 6 875.1

billion in 2024. This upward trend reflects that investors have a massive consideration

for sustainable financial instruments, as well as the efforts of businesses and financial

institutions to raise capital for environmentally friendly projects.

To sum up, the government offers reforms like Laws On Securities modified to improve

the transparency of the market and consolidate beliefs of investors. Moreover, Supply

Chain Finance (SCF) new solutions, such as ASYX foundation that helps the small and

medium enterprises manage money better, lead to taking attention to foreign funds into the supply chain of Vietnam. 5. Exchange rate:

In the short - term, the new tariff policy of the U.S - such as tax 46% applied from

July/2025- negatively affecting Vietnam’s economy. Particularly, high tax will decrease

Vietnam’s goods demand in the U.S, making the export decrease in which capital is the

main source of bringing in large amounts of USD (trade surplus of 111.6 billion USD

from January–November 2024). This leads to the depreciation of the Vietnamese Dong

pressure. However, if tariffs also reduce imports of electronics and components, the

current account surplus could increase from 5.8% GDP in 2023 through the

International Money Funds (IMF) report. In general, the short term brings the

disadvantage for market, especially the key export sectors. IV. Long-run Impacts

1. FDI (Foreign Direct Investment) :

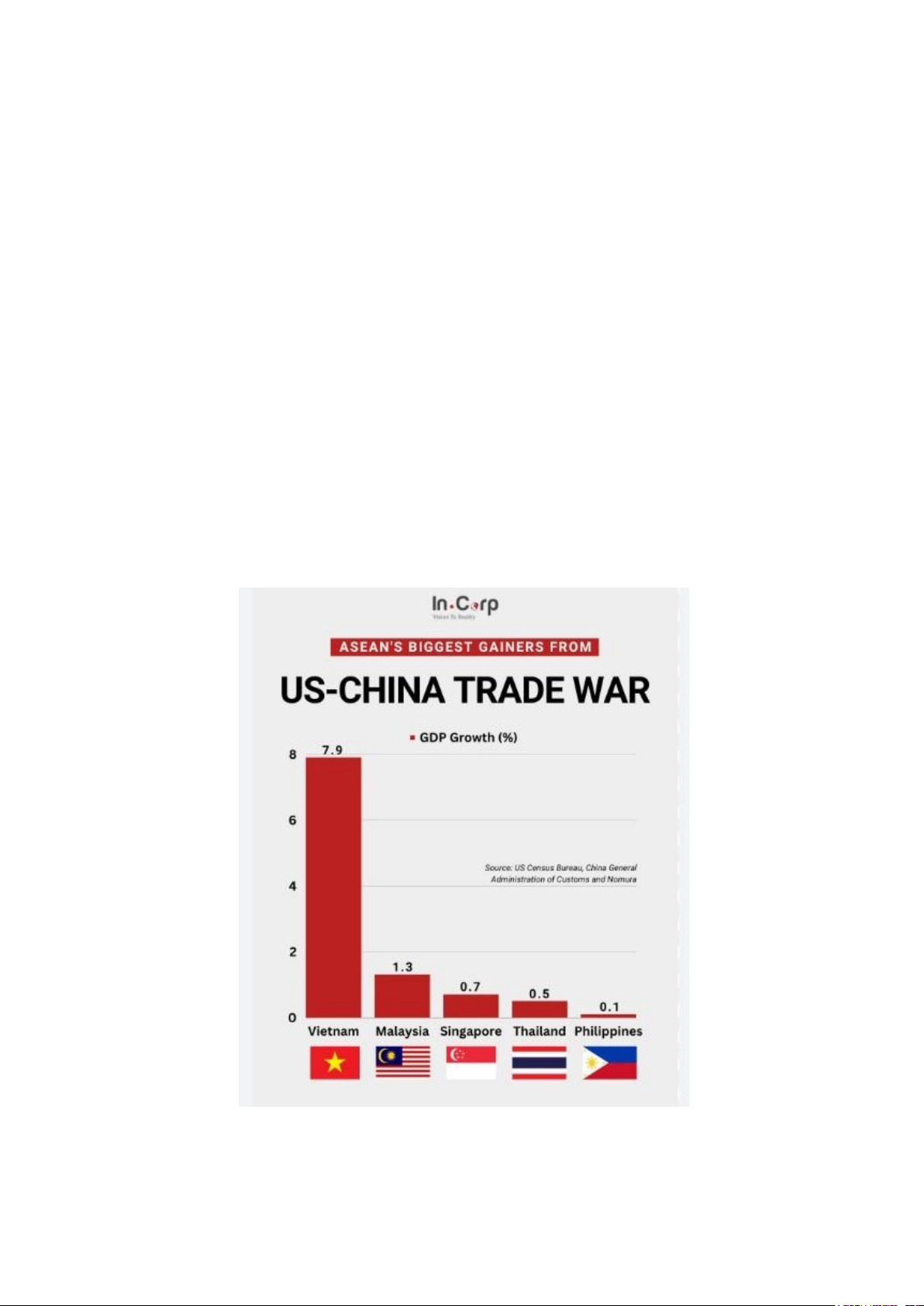

In the context of the US-China trade war, Vietnam is considered an “alternative

destination” in the supply chain under the “China +1” strategy. According to the Foreign

Investment Agency ( Ministry of Planning and Investment ) data, the total FDI capital

in the first quarter of 2025, which reached nearly 11 billion USD, represents a 34.7%

increase compared to the same period last year. This figure shows that Vietnam is seeing

positive signs in attracting foreign investors. However, the US imposes a 46%

retaliatory tariff on Vietnam’s goods, leading to FDI enterprises being heavily affected,

resulting in reduced investment and a contraction in production capacity. In the long

run, a FDI capital flow may decrease when enterprises decide to relocate their product lines to lower tariffs. lOMoAR cPSD| 58504431

2. GDP (Gross Domestic Product):

The US is the largest export market in Vietnam. In 2024, Vietnam’s export turnover of

goods reached 119.5 billion USD, accounting for about 29.5% of the total export

turnover (Thương, 2025c). According to some research organizations, if the US tariff

policies influence export products, Vietnam’s GDP growth will decrease significantly.

KB Securities Vietnam estimates that Vietnam’s GDP growth may drop by

approximately 0.7-1.3% compared to the initial forecast when the US imposes

retaliatory tariffs on Vietnamese goods (KB Securities Vietnam, 2024, p. 1). VCCI

evaluates that 46% of the retaliatory tariffs causes a decrease in the US-dependent

industries such as electronics, textiles, footwear, and so on. (VCCI, 2025) A prolonged

export downturn causes a reduction in foreign exchange earnings and pressure on the

exchange rate, which leads to a negative effect on GDP and overall economic growth. 3. Unemployment:

As stated by the Department of Employment Analysis (Ministry of Labour, War

Invalids and Social Affairs), US tariff policies and the responses of other countries are

expected to substantially impact Vietnam’s labor market, especially for export

businesses. Export businesses employ up to 30% of Vietnam's labor force (Minh, 2025).

The reduction in key export products leads businesses to cut down on personnel or

reallocate labor. To address these difficulties, the authorities have planned to support

affected workers through unemployment insurance. 4. Inflation :

The reduction in exports and weakened foreign exchange earnings place pressure on the

domestic currency, causing the prices of imported products to increase. An analysis

report by InterLOG warns that the drop in foreign exchange earnings can lead to

consequences such as the depreciation of the Vietnamese dong, rising import prices, lOMoAR cPSD| 58504431

and persistent inflation. However, some domestic experts believe the pressures are

under control. Vietcombank Securities (VCBS) assumes that inflation in 2025 will

remain within the Government’s target and under control due to the ability to be

selfsufficient in food and the supply of essential goods and services. Specifically, the

government possesses several tools and flexible monetary policies to stabilize prices.

Therefore, inflation will still be under mild upward pressure instead of surging excessively. 5. Capital Flow:

Foreign Direct Investment (FDI) Growth: Thanks to the US raising tariffs on China,

long-term FDI flows into Vietnam have increased sharply, as many global companies

choose Vietnam to set up factories to reduce their dependence on China (such as Apple,

Samsung, Nike,...) This has created a new wave of FDI, with Vietnam becoming a

“China+1” strategy destination, helping economic growth, creating many job

opportunities, and technological innovation.

Since China is not able to export its products to the U.S., many foreign investors,

especially Chinese have flocked to Vietnam and increased their manufacturing capacity lOMoAR cPSD| 58504431

to export goods to the U.S. According to a forecast done by Bloomberg, Vietnam’s

exports to the US are expected to hike further to US$69 billion in 2019 – a significant

growth as compared to US$62 billion in 2018 after signing the total bilateral trade.

Portfolio Investment (FPI): The US-China trade war, along with GDP growth (average

6-7% before Covid), has attracted many investors to the stock market (e.g. HOSE,

HNX) and government bonds. As of 2023, FPI into Vietnam reached over 45 billion

USD, and most of the FDI capital flows are affected by Fed interest rates, global market

sentiment, and tax-related supply chain shifts. From there, it helps develop Vietnam's

financial market and diversify capital sources.

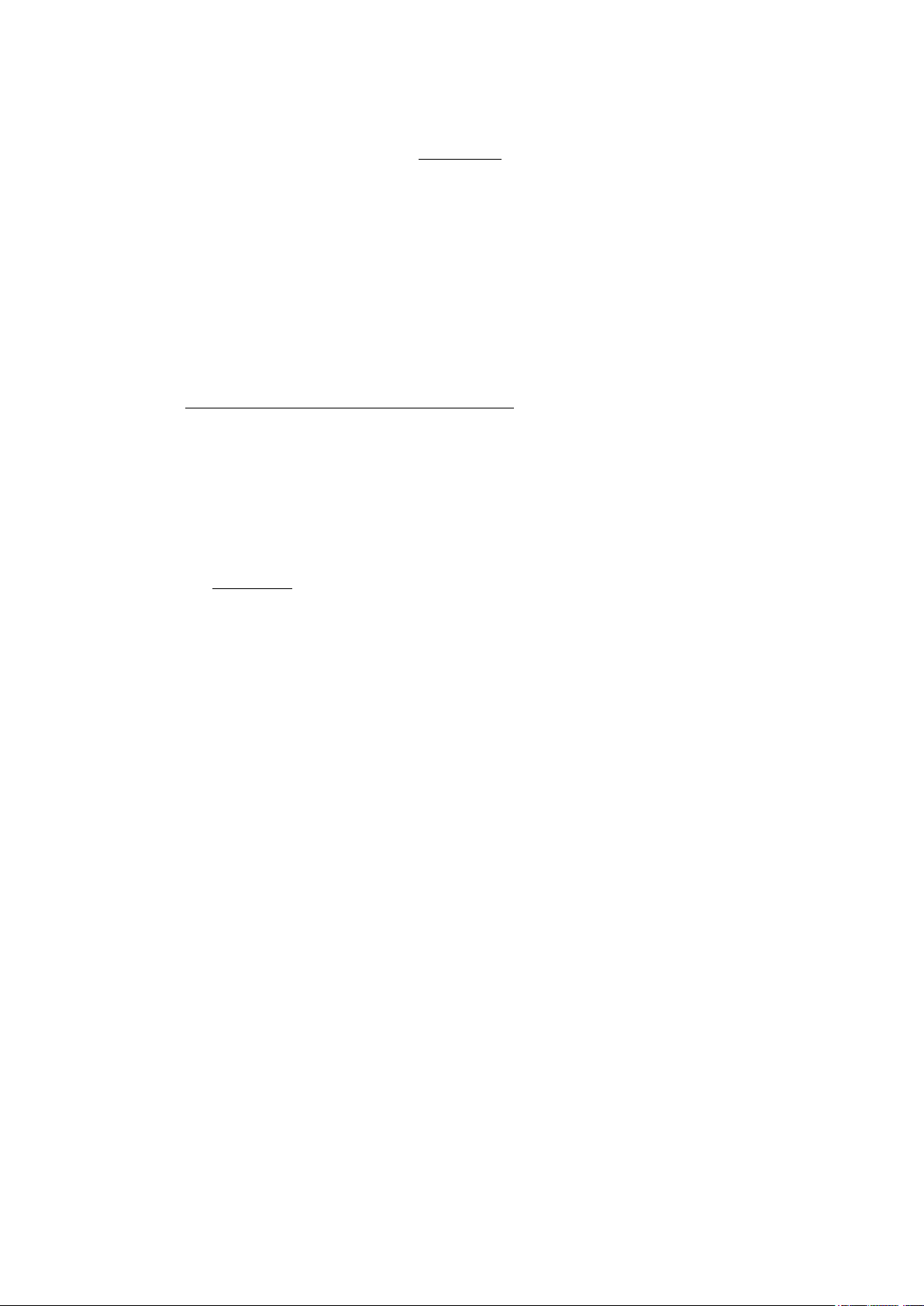

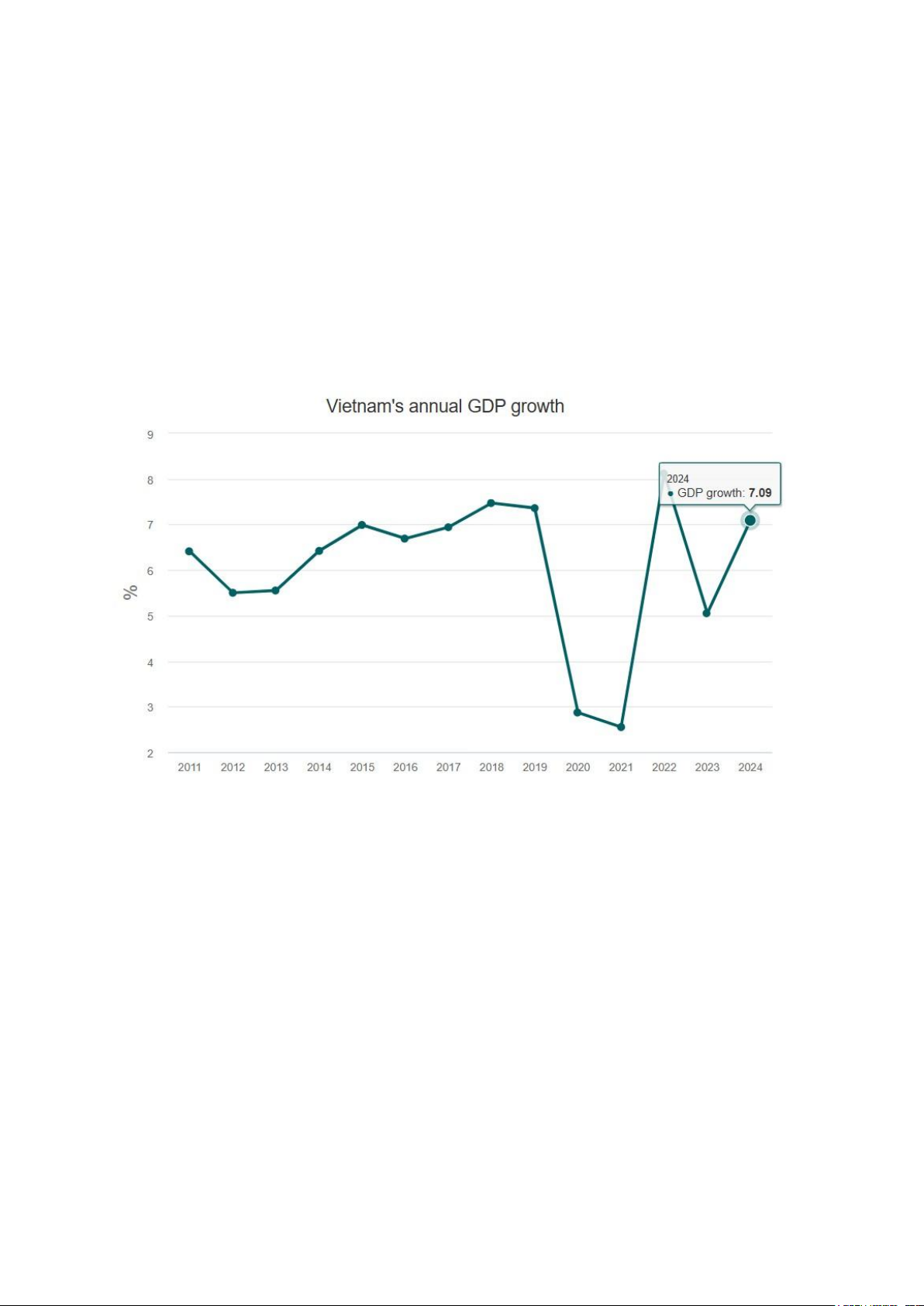

According to Vietnam’s General Statistics Office (GSO), the country’s GDP expanded

at a rate of 7.09 percent in 2024 despite external volatilities and uncertainties. Although

this growth rate is slightly lower than the peaks seen in 2018, 2019, and 2022, it still

represents an impressive rebound of the economy and positions Vietnam as a bright spot

in the region. In 2024, the economy showed gradual recovery through consistent

quarterly improvements. The growth trajectory increased from 5.98 percent in Q1 to

7.25 percent in Q2, reaching 7.43 percent in Q3, and climbing to 7.55 percent in Q4. 6. Exchange rate:

Trade diversion and Current Account Surplus: The US-China trade war (2018-2020)

has led to trade diversion. US importers have sought alternative suppliers, and Vietnam

is one of the prominent candidates. As Vietnam’s exports to the US increase, so does

Vietnam’s current account surplus. According to the General Department of Customs,

the Vietnam-US trade surplus is expected to exceed US$90 billion in 2022, up from lOMoAR cPSD| 58504431

US$39 billion in 2018. The increased inflow of foreign currency (mainly USD) has

increased pressure on the Vietnamese Dong (VND) to appreciate.

Vietnam is now one of the world’s most trade-dependent economies, with exports

accounting for about 90% of its GDP. The United States is its most important export

market, especially after US-China trade tensions erupted during President Donald

Trump’s first term, leading to a wave of production shifts from China to Vietnam.

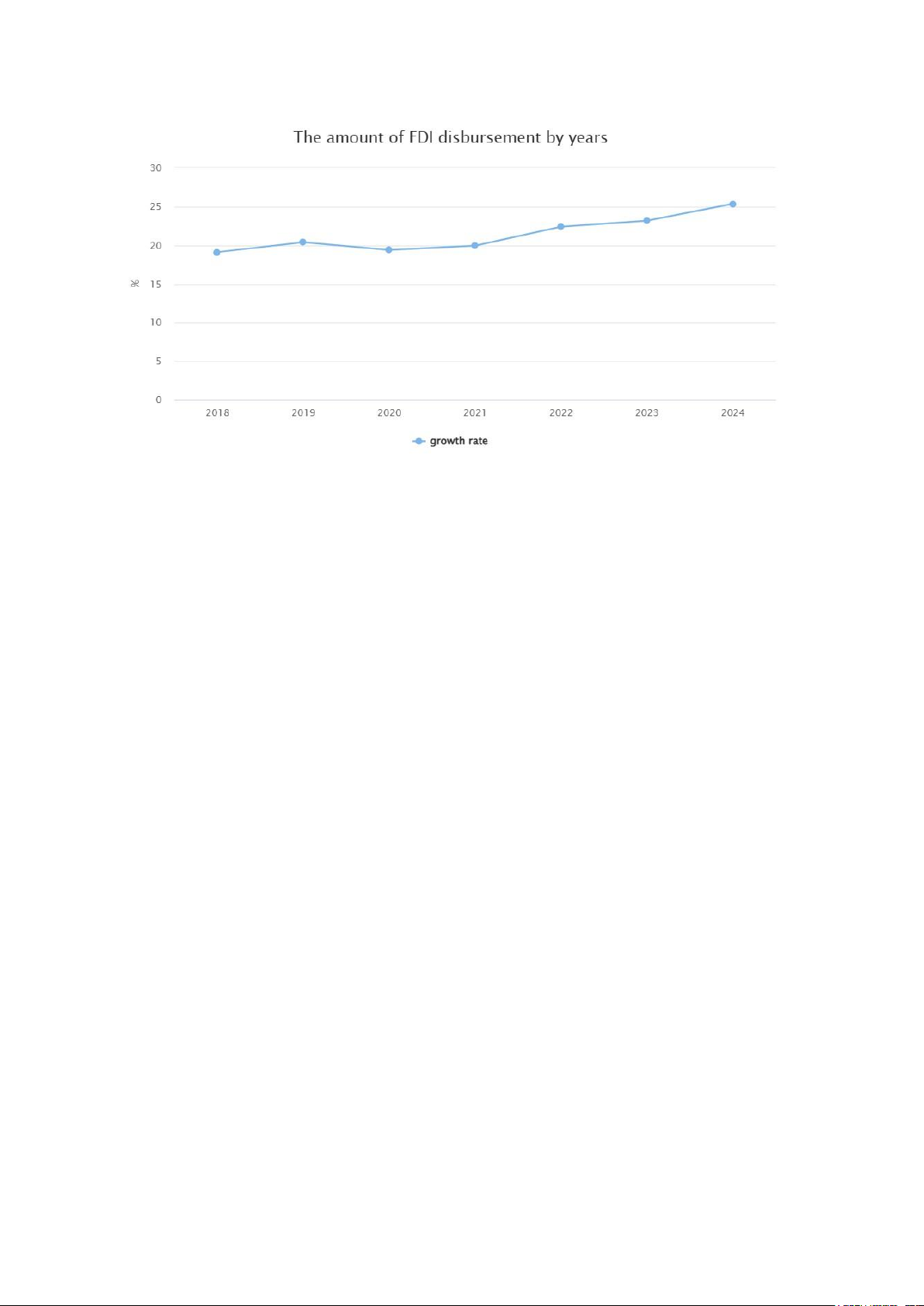

Capital Inflows and Foreign Investment (FDI): Trade diversion has helped the wave of

foreign direct investment in Vietnam increase sharply, many multinational corporations

have chosen Vietnam to locate factories to avoid Chinese taxes, but still be able to

access the US market. From 2018 to 2022, annual FDI disbursement in Vietnam reached

an average of 18-20 billion USD, mainly from the US, Japan, and South Korea. This is

also the reason for the increase in financial account surplus, leading to an increase in

VND value. However, to maintain export competitiveness, the State Bank of Vietnam

needs to sell VND and buy USD to curb the increase in value. lOMoAR cPSD| 58504431

VGP - The disbursed volume of FDI was estimated to reach a record high of

US$25.35 billion in 2024, a year-on-year increase of 9.4 percent, according to the

Foreign Investment Agency (FIA). In 2024, Viet Nam absorbed nearly US$38.23 billion

in FDI. Foreign investors poured capital in 18 out of 21 economic sectors, in which the

processing and manufacturing sector lured US$25.58 billion (66.9 percent of the total

registered capital), followed by real estate with US$6.31 billion (16.5 percent).

However, the widening U.S.–Vietnam trade surplus and the slow increase in exchange

rate have led to Vietnam being accused by the United States of currency manipulation.

In December 2020, the US Treasury Department put Vietnam on the list of currency

manipulators. Although it was removed in April 2021, it still reflects the political risk

in exchange rate policy. Therefore, Vietnam needs to consider between: exchange rate

stability - promoting exports - international reputation. VI. Conclusion

1. Summary of short- long run term impact

The US tariff policy, especially the US-China trade war, has created both opportunities

and challenges for the Vietnamese economy. In the short term, thanks to FDI capital

shifting away from China, Vietnam has achieved growth in exports, and development

from domestic infrastructure projects. From there, GDP increased, while creating many

job opportunities in fields such as electronics, textiles, and footwear. On the other hand,

risks have also increased, such as inflation due to high input costs, exchange rate

pressure, and the possibility of the US imposing tariffs on Vietnamese goods, causing

GDP to decrease by 7-7.5%. In the long term, Vietnam will become an alternative

manufacturing hub to China in the global supply chain (“China+1”). This will promote

FDI, create jobs and develop technology. However, if the U.S. imposes prolonged lOMoAR cPSD| 58504431

retaliatory tariffs, it may adversely affect FDI and export flows, leading to a decline in

GDP, employment and the balance of payments. The exchange rate is also under

pressure between the need to maintain stability and avoid accusations of currency

manipulation. Flexible government policies and the potential for food selfsufficiency

help control inflation within acceptable levels.

2. Policy recommendations

Some suitable policies that Vietnam can apply to cope with the short-term and longterm

impacts of the US tariff policy:

For the short term: Vietnam needs to stabilize the exchange rate and control inflation to

reduce the pressure on the domestic currency to increase, maintain the stability of export

enterprises and not be labeled by the US as a currency manipulator. The State Bank

must be flexible in monetary policies, such as intervening in the foreign exchange

market, selling USD - buying VND to stabilize the exchange rate. The government

needs to stimulate domestic consumption and investment, such as promoting public

investment (highways, clean energy), encouraging people to buy domestic products by

reducing VAT, supporting small businesses... From there, it is possible to offset the

decline in exports, and maintain stable GDP growth in the short term. Besides, we can

support manufacturing enterprises or improve social security and employment.

For the long term: Vietnam needs to diversify export markets, take advantage of FTAs

(EVFTA, RCEP, CPTPP), build a national brand to reduce dependence on the US, and

avoid risks from unilateral policies. Domestic supply chains need to be developed to

reduce dependence on imported components - improve domestic production by

improving supporting industry enterprises, linking FDI and domestic enterprises,

developing logistics, and digital technology. Furthermore, it is necessary to improve the

investment environment and attract quality FDI, and stabilize exchange rate policies

and enhance international reputation. VII. REFERENCE:

(1) Nevil, S. (2025, May 27). What is a tariff and why are they important?

Investopedia. https://www.investopedia.com/terms/t/tariff.asp lOMoAR cPSD| 58504431

(2) Vu, K. (2025, May 16). U.S. tells Vietnam trade deficit 'unsustainable' and major

concern during tariff talks. Reuters. https://www.reuters.com/world/asia-

pacific/ustells-vietnam-trade-deficit-unsustainable-major-concern-during-tariff- talks-2025-0516/

(3) Nguyen, P., & Guarascio, F. (2025, April 23). Vietnam starts trade talks with US as immense 46% tariffs loom, state media reports. Reuters.

https://www.reuters.com/world/asia-pacific/vietnam-starts-trade-talks-with-

usimmense-46-tariffs-loom-state-media-reports-2025-04-23/

(4) Vietnam Investment Review. (2025, April 3). 46 per cent US tariffs to pose big

challenges for Vietnam. Vietnam Investment Review - VIR. https://vir.com.vn/46-

percent-us-tariffs-to-pose-big-challenges-for-vietnam-125731.html

(5) VnExpress. (2025, April 18). “Việt Nam sẽ bị ảnh hưởng không đáng kể nếu thuế

đối ứng của Mỹ là 10%.” vnexpress.net. https://vnexpress.net/viet-nam-se-bi-

anhhuong-khong-dang-ke-neu-thue-doi-ung-cua-my-la-10-4875819.html

(6) Free Trade: How Trump’s tariff threatens Vietnam’s economy. (2025, August 5).

Friedrich Naumann Foundation. https://www.freiheit.org/vietnam/how-trumps-

tariffthreatens-vietnams-economy

(7) TTWTO VCCI - Xuất khẩu Việt Nam sang Mỹ sẽ bị tác động mạnh bởi chính sách

cải cách thuế mới. (n.d.). https://trungtamwto.vn/tin-tuc/10809-xuat-khau-viet-

namsang-my-se-bi-tac-dong-manh-boi-chinh-sach-cai-cach-thue-moi

(8) Vietnam+. (2025, April 6). Vietnam posts trade surplus of 3.16 billion USD in Q1. Vietnam+ (VietnamPlus).

https://en.vietnamplus.vn/vietnam-posts-trade-surplus-

of316-billion-usd-in-q1-post312945.vnp (9) Britannica money. (2025, May 18).

https://www.britannica.com/money/supplyand-demand

(10) Team, C. (2023, November 22). International trade. Corporate Finance Institute.

https://corporatefinanceinstitute.com/resources/economics/international-trade/

(11) Banerjee, P. (2022, December 13). Long-Run Aggregate Supply (LRAS) – Definition, Formula, Curve. WallStreetMojo.

https://www.wallstreetmojo.com/longrun-aggregate-supply-lras/

(12) Guarascio, F. (2025, February 25). Vietnam's US exports account for 30% of GDP, making it highly vulnerable to tariffs. Reuters.

https://www.reuters.com/markets/vietnams-us-exports-account-30-gdp-making-

ithighly-vulnerable-tariffs-2025-02-25/

(13) Nguyễn H. (2025, April 3). Chính sách thuế quan mới của Mỹ có thể ảnh hưởng 7,5% GDP Việt Nam. Vietnam+ (VietnamPlus).

https://www.vietnamplus.vn/chinhsach-thue-quan-moi-cua-my-co-the-anh-

huong-75-gdp-viet-nam-post1024605.vnp lOMoAR cPSD| 58504431

(14) Vietnam’s GDP likely to decrease by 2-3pp if 46% tariff is in effect: expert. (2025,

April 9). VOV.VN. https://english.vov.vn/en/economy/vietnams-gdp-likely-

todecrease-by-2-3pp-if-46-tariff-is-in-effect-expert-post1190842.vov

(15) An H. (2025, April 8). Chuyên gia Nguyễn Xuân Thành: Tăng trưởng GDP có thể

giảm 2 điểm % khi Mỹ áp thuế 46%. Vietnambiz. https://vietnambiz.vn/chuyengia-

nguyen-xuan-thanh-tang-truong-gdp-co-the-giam-2-diem-khi-my-ap-thue- 4620254710739530.htm

(16) VNDIRECT Research. (2025, April 4). Hit the tariff button: A devastating blow. VNDIRECT Securities Corporation.

https://www.vndirect.com.vn/cmsupload/beta/Special-Note_Trump- ReciprocalTariff_20250404.pdf

(17) Ackerman, A., & Cocco, F. (2025, May 24). Your new sofa could be the first sign tariff inflation is hitting home. The Washington Post.

https://www.washingtonpost.com/business/2025/05/24/trump-tariffs- furnitureinflation/

(18) Impact of US tariffs on Vietnam’s textile, clothing and footwear sector. (n.d.).

RMIT University. https://www.rmit.edu.vn/news/all-news/2025/may/impact-of-

ustariffs-on-vietnams-textile-clothing-and-footwear-sector

(19) thuynhimpi@gmail.com. (2025, April 17). TÌNH HÌNH THU HÚT ĐẦU TƯ

NƯỚC NGOÀI VÀ RA NƯỚC NGOÀI 03 THÁNG ĐẦU NĂM 2025 - IPCS. IPCS.

https://ipcs.mpi.gov.vn/tinh-hinh-thu-hut-dau-tu-nuoc-ngoai-va-ra-nuoc-ngoai- 03thang-dau-nam-2025/

(20) TTWTO VCCI - Dòng vốn FDI giữa “cơn bão” thuế quan Mỹ: Việt Nam có“vững

tay chèo”? (n.d.). https://trungtamwto.vn/tin-tuc/29237-dong-von-fdi-giuacon-

bao-thue-quan-my-viet-nam-co-vung-tay-cheo#

(21) Thương, T. (2025b, April 3). Mỹ là thị trường xuất khẩu lớn nhất của Việt Nam

nhiều năm qua. Báo Điện Tử Dân Trí. https://dantri.com.vn/kinh-doanh/my-la-

thitruong-xuat-khau-lon-nhat-cua-viet-nam-nhieu-nam-qua- 20250403102034520.htm

(22) Việt Nam trước cú sốc thuế quan 46 từ Mỹ: Tác động và kịch bản ứng phó. (n.d.).

interlogistics.com.vn. https://interlogistics.com.vn/vi/tin-tuc/blog/viet-nam-truoc-

cusoc-thue-quan-46-tu-my-tac-dong-va-kich-ban-ung-pho-n-869#nganh-hang-

nao-cuaviet-nam-bi-anh-huong-nang-ne-nhat

(23) KB Securities Vietnam. (2024). Vietnam in trade war 2.0: Potential impacts and policy responses (p. 1).

https://www.kbsec.com.vn/pic/Service/KBSV_VietnamInTradewar2.0_FTM_En g.pdf lOMoAR cPSD| 58504431

(24) Tác động của thuế quan Mỹ tới chính sách tiền tệ của Việt Nam | VCCI. (n.d.).

https://vcci.com.vn/tin-tuc/tac-dong-cua-thue-quan-my-toi-chinh-sach-tien-te- cuaviet-nam

(25) Dương N. (2025, May 10). Lên phương án hỗ trợ lao động bị ảnh hưởng bởi chính

sách thuế quan của Mỹ. Nhịp Sống Kinh Tế Việt Nam & Thế Giới.

https://vneconomy.vn/len-phuong-an-ho-tro-lao-dong-bi-anh-huong-boi-chinh- sachthue-quan-cua-my.htm

(26) Minh H. (2025, March 31). Chính sách thuế quan của Mỹ có “làm khó” các ngành

xuất khẩu của Việt Nam? Tạp Chí Tài Chính. https://tapchitaichinh.vn/chinhsach-

thue-quan-cua-my-co-lam-kho-cac-nganh-xuat-khau-cua-viet-nam.html?

(27) Dương N. (2023, July 6). 4 quyền lợi về bảo hiểm thất nghiệp mà người lao động

được hưởng. Nhịp Sống Kinh Tế Việt Nam & Thế Giới.

https://vneconomy.vn/4quyen-loi-ve-bao-hiem-that-nghiep-ma-nguoi-lao-dong- duoc-huong.htm?

(28) Hưng Q. (2025, April 9). Mỹ áp thuế đối ứng 46%: Lạm phát, tỷ giá, lãi suất và

ngành ngân hàng Việt Nam bị ảnh hưởng thế nào? Copyright (C) by Công Ty Cổ

Phần Vccorp. https://cafef.vn/my-ap-thue-doi-ung-46-lam-phat-ty-gia-lai-suat-

vanganh-ngan-hang-viet-nam-bi-anh-huong-the-nao-188250409141313886.chn

(29) Minh B. (2023b, May 16). Báo Trung Quốc: Nhiều công ty chuyển nhà máy đến

Việt Nam để đáp ứng đơn hàng tốt hơn. Nhịp Sống Kinh Tế Việt Nam & Thế Giới.

https://vneconomy.vn/bao-trung-quoc-nhieu-cong-ty-chuyen-nha-may-den-viet-

namde-dap-ung-don-hang-tot-hon.htm

(30) Le, D. (2024, November 29). China +1 strategy in Vietnam: Overview for Chinese investors. InCorp Vietnam.

https://vietnam.incorp.asia/china-1-strategy- invietnam/

(31) Loan, K. (2025, January 6). FDI disbursement rate reaches record high.

en.baochinhphu.vn. https://en.baochinhphu.vn/fdi-disbursement-reaches-record-

highin-2024-111250106164254425.htm

(32) Vu Nguyen Hanh (Jan 8, 2025). Vietnam’s Economic Report Card for 2024: GDP,

Trade, FDI https://www.vietnam-briefing.com/news/vietnam-economy-2024gdp- trade-fdi.html/

(33) Thặng dư thương mại của Việt Nam với Hoa Kỳ đạt hơn 123 tỷ USD. (n.d.). Vnbusiness.

https://vnbusiness.vn/the-gioi/thang-du-thuong-mai-cua-viet-nam-

voihoa-ky-dat-hon-123-ty-usd-1104844.html

(34) Vna. (2025, January 6). GDP expands by 7.09% in 2024. VnExpress International

– Latest News, Business, Travel and Analysis From Vietnam. lOMoAR cPSD| 58504431

https://e.vnexpress.net/news/business/economy/gdp-expands-by-7-09-in- 20244836083.html

(35) Vietnam+. (2024, November 19). Vietnam not manipulating currency: US Treasury. Vietnam+ (VietnamPlus).

https://en.vietnamplus.vn/vietnam-

notmanipulating-currency-us-treasury-post304228.vnp#:~:text=The%20U.S.

%20Department%20of%20the,Vietnam%20does%20not%20manipulate%20currency.

(36) VNDIRECT Research. (2022, November 30). Navigating Vietnam 2023: Investing

with responsibilities for sustainable growth. VNDIRECT Securities Corporation.

https://www.vndirect.com.vn/cmsupload/beta/Navigating_Vietnam_2023_22113 0.pdf