Preview text:

lOMoAR cPSD| 58504431

THE INTERNATIONAL UNIVERSITY– VIETNAM NATIONAL UNIVERSITY – HCMC SCHOOL OF BUSINESS

FINAL EXAMINATION (K22) SEMESTER 2 2022 – 2023 Date: Duration: 90 minutes

Student ID: ..................................

Name:............................................................

SUBJECT: Introduction to Macroeconomics Dean of School Lecturers Signature: Signature: Dr. Hoang Thi Anh Ngoc Dr. Nguyen Ba Trung Dr. Nguyen Tra My MA. Bui Thi Thao Hien GENERAL INSTRUCTION(S)

1) This is a closed-book examination. However, students can bring one A4 sheet of handwritten

notes and calculator(s) to the exam room.

2) Electronic decides and mobile phone are strictly prohibited.

3) No Discussion and sharing Materials. lOMoAR cPSD| 58504431

Question 1 (25 pts) Part A (15 pts)

Consider an economy in which the velocity of money (V) equals 2 and real GDP (Y) equals 4.

a. If the money supply equals 2, what is the value of nominal GDP? (5 pts)

b. If the money supply equals 2, what is the value of the economy-wide price level (P)? (5 pts)

c. If the money supply doubles while velocity and real GDP remain unchanged, what happens to

the economy wide- price level (P): Does it rise, fall, or stay the same? (5 pts) Part B (10 pts)

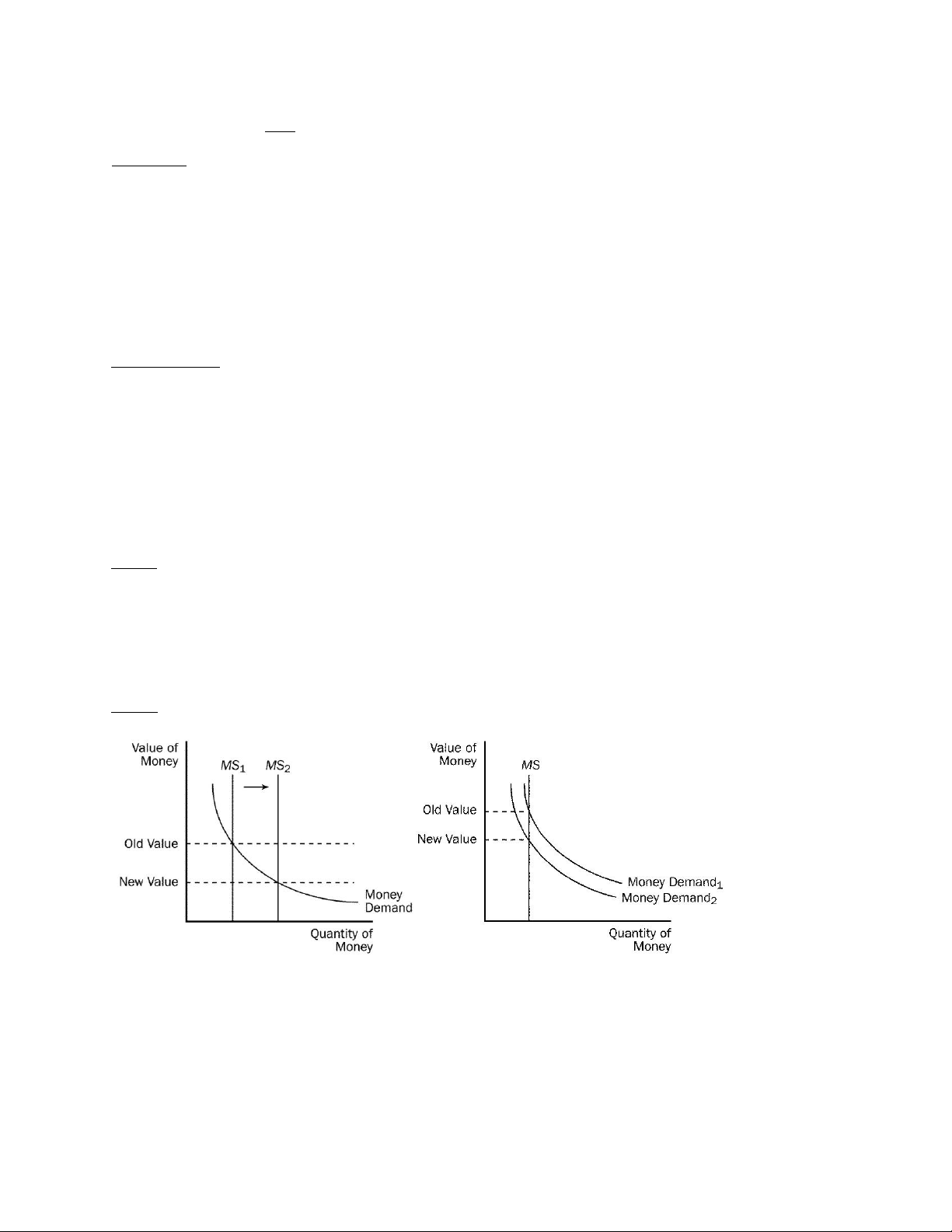

Using separate graphs, demonstrate what happens to the money supply, money demand, the value

of money, and the price level if:

a. The central bank buys government bonds. (5 pts)

b. People decide to demand less money at each value of money. (5 pts) ANSWER Part A

a. Nominal GDP = P*Y = V*M = 2*2 = 4 b. P*Y = 4 => P = 4/4 = 1 c. rise Part B

a. The central bank increases the money supply. When the central bank increases the money

supply, the money supply curve shifts right from MS1 to MS2. This shift causes the value

of money to fall, so the price level rises.

b. People decide to demand less money at each value of money. Since people want to hold

less at each value of money, it follows that the money demand curve will shift to the left lOMoAR cPSD| 58504431

from MD1 to MD2. The decrease in money demand results in a lower value of money and so a higher price level. Question 2: (25pts)

a. If a Japanese car costs 1,500,000 yen, a similar American car costs $30,000, and a dollar can buy

100 yen, what are the nominal and real exchange rates? (6 pts)

b. If the U.S dollar appreciated, would the following groups be happy or unhappy? Explain (6 pts)

▪ Singaporean tourists planning a trip to the United States.

▪ An American firm trying to purchase property overseas.

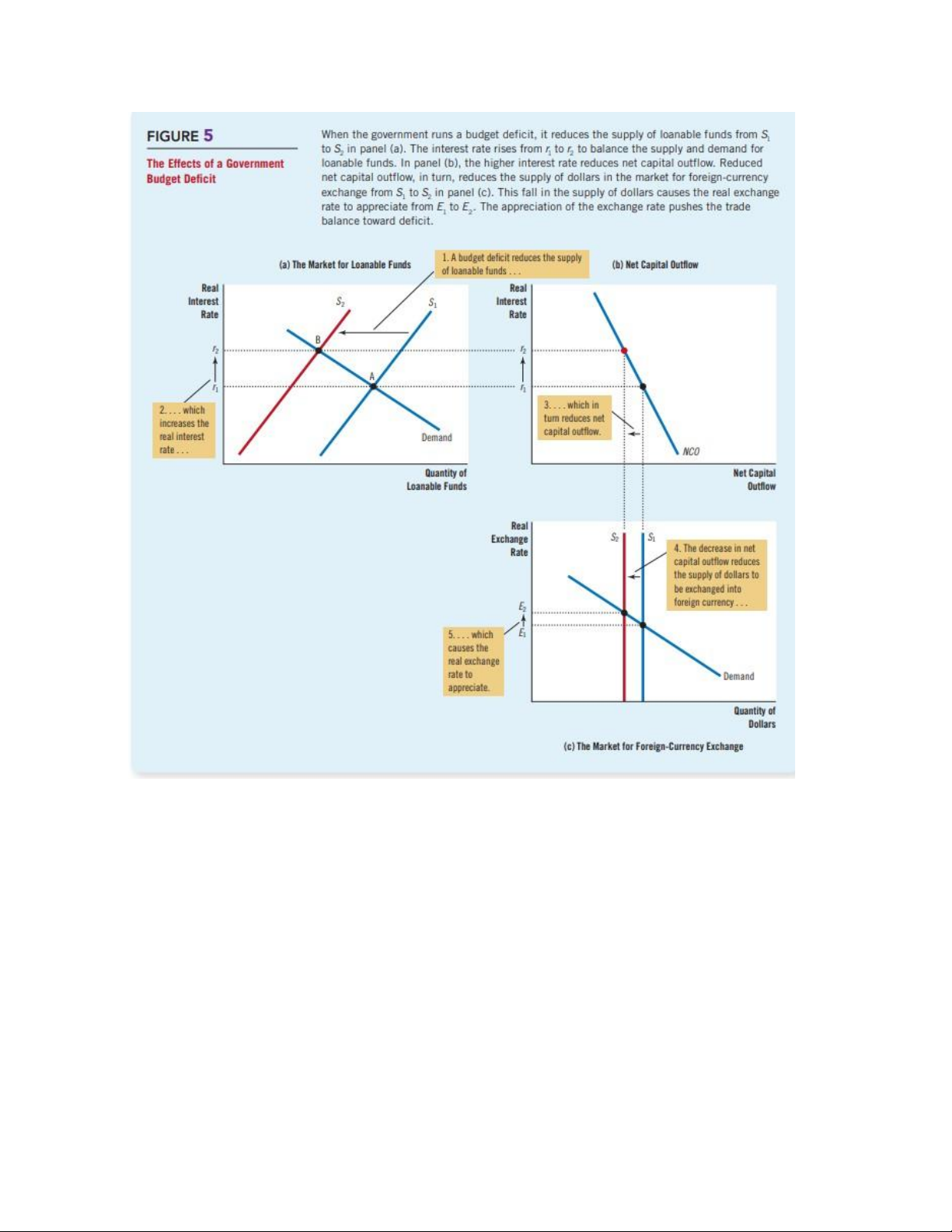

c. Suppose Singapore runs budget deficit. Using three panel diagrams, show what happens to

national saving, domestic investment, net capital outflow, the interest rate, the exchange rate, and the trade balance. (13 pts). ANSWER

a. If a dollar can buy 100 yen, the nominal exchange rate is 100 yen per dollar. The real exchange

rate equals the nominal exchange rate times the domestic price divided by the foreign price,

which equals 100 yen per dollar times $30,000 per American car divided by 1,500,000 yen per

Japanese car, which equals two Japanese cars per American car.

b. Singaporean tourists planning a trip to the United States would be unhappy if the U.S. dollar

appreciated because they would get fewer U.S. dollars for each Singaporean dollar, so their

vacation will be more expensive.

An American firm trying to purchase property overseas would be happy if the U.S. dollar

appreciated because it would get more units of the foreign currency and could thus buy more property. lOMoAR cPSD| 58504431 c. Question 3: (25 pts)

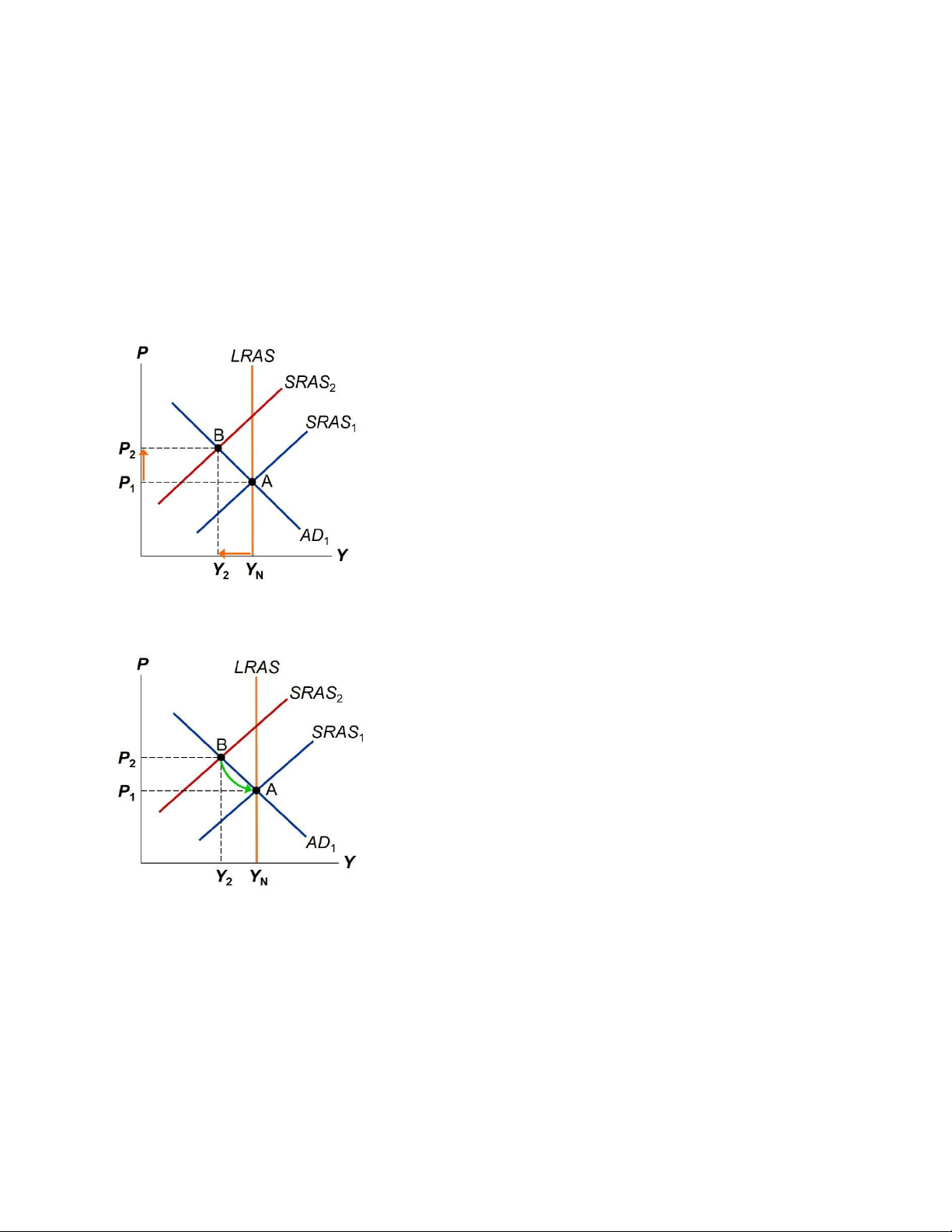

Suppose the economy is initially at a long-run equilibrium. Then there comes an adverse oil price

shock (i.e. oil price increases). Use the AD-AS model to answer the following questions.

a. What happens to output and the price level in the short run? What is this phenomenon called? (10 pts)

b. If policymakers do nothing, explain how the economy transitions from the short-run equilibrium

to the long-run equilibrium. (7 pts)

c. However, now suppose the Central Bank wants to step in to stabilize output in response to an

adverse oil price shock. What policy action should the Central Bank conduct? How does it affect

output and the price level? (8 pts) lOMoAR cPSD| 58504431

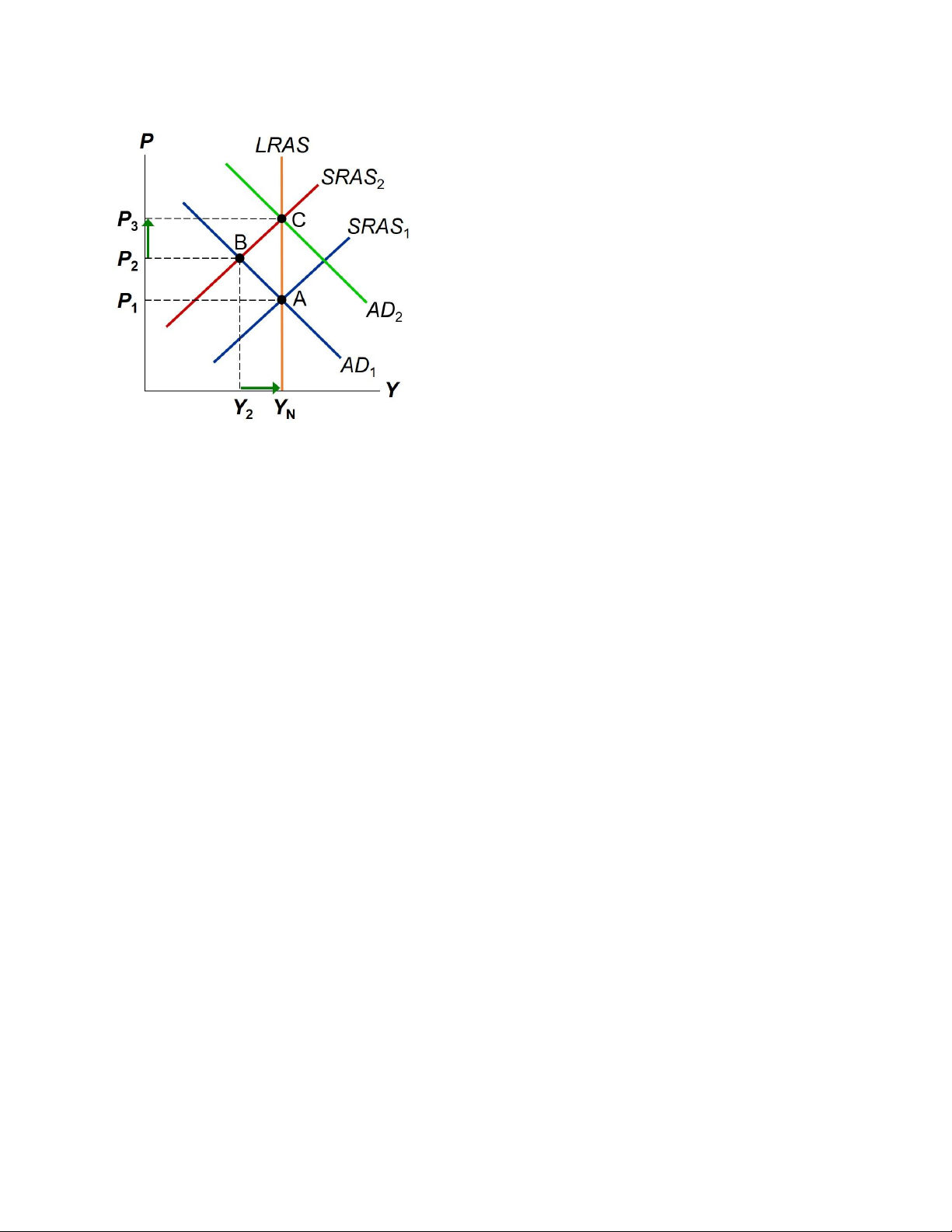

Give your explanation in both words and graphs. When you draw the graph, remember to label the axis and name the curves. ANSWER a.

Since oil is an important input to production process, the rise in oil price reduces

aggregate supply in the short run, so the SRAS shifts to the left (SRAS2). The economy reaches a

short-run equilibrium (point B) where output (Y2) is lower than the natural rate of output and the

price level (P2) is higher than the initial level. This phenomenon is called stagflation (low ouput,

i.e., stagnant growth and high inflation). b.

If policymakers do nothing, low employment (at point B) causes wages to fall, shifting the

SRAS rightward until the long-run equilibrium is reached at point A. c.

The Central Bank can counter stagflation by conducting expansionary monetary policy

and thus raising the money supply and aggregate demand. The AD curve shifts right (from AD1

to AD2), pulling the economy out of the recession as output recovers to YN and the price level

increases as well (P3). The long-run equilibrium is reached at point C. lOMoAR cPSD| 58504431 Question 4: (25 pts)

The economy is in recession. Policymakers think that a rise in Aggregate Demand (AD) of $100

billion would end the recession.

a. Explain the concept of Marginal Propensity to Consume (MPC). (5 pts)

b. Explain the concepts of multiplier effect and crowding-out effect of the Fiscal Policy on

Aggregate Demand (AD). (5 pts)

c. Suppose the Central Bank adjusts the money supply to hold the interest rate constant (i.e. no

crowding-out effect), and MPC is 0.75, how much should Congress increase government

purchases (G) to end the recession? (10 pts)

d. If the Central Bank instead holds the money supply constant and allows the interest rate to adjust

(i.e. crowding-effect exists), will the amount of government purchases be smaller or larger or the

same as the amount in (a)? Explain. (5 pts) ANSWER

a. MPC: Fraction of extra income that households consume rather than save.

b. Multiplier effect: the additional shifts in AD that result when fiscal policy increases income and

thereby increases consumer spending.

Crowding-out effect: the offset in aggregate demand that results when expansionary fiscal policy

raises the interest rate and thereby reduces investment spending.

c. Multiplier = 1/(1-0.75) = 4. Increase G by $100 billion/4 = $25 billion

d. Crowding out reduces the impact of G on AD. To offset this, Congress should increase G by a

larger amount than $25 billion.