Preview text:

lOMoAR cPSD| 58504431

THE INTERNATIONAL UNIVERSITY– VIETNAM NATIONAL UNIVERSITY – HCMC

SCHOOL OF ECONOMICS, FINANCE, AND ACCOUNTING FINAL EXAMINATION

SEMESTER 2 2023 – 2024 Date: 03rd July 2024 Duration: 90 minutes

Student ID: ..................................

Name:................................................

SUBJECT: INTRODUCTION TO MACROECONOMICS

School of Economics, Finance, and Lecturer Accounting Signature: Signature: Dr. Hoang Thi Anh Ngoc Dr. Nguyen Ba Trung Dr. Bui Thi Thao Hien Full name: Dr. Do Hoang Phuong MA. Duong Minh Hoang Proctor 1: Proctor 2:

GENERAL INSTRUCTION(S)

1) This is a closed-book examination. However, students can bring ONE A4 sheet of handwritten notes

and calculator(s) to the exam room.

2) Electronic decides and mobile phone are strictly prohibited.

3) No discussion and no sharing Materials.

4) Please round the results of ALL questions to 2 decimal places, e.g. 0.23 GOOD LUCK! lOMoAR cPSD| 58504431 Question 1 (20 pts) PART A

Consider an economy in which the velocity of money (V) equals 2 and real GDP (Y) equals 4. a.

If the money supply equals 2, what is the value of nominal GDP? (5 pts)

b. If the money supply equals 2, what is the value of the economy-wide price level (P)? (5 pts)

c. If the money supply doubles while velocity and real GDP remain unchanged, what happens to

the economy wide- price level (P): Does it rise, fall, or stay the same? Explain. (5 pts) PART B

Using a diagram to demonstrate what happens to the money supply, money demand, the value of

money, and the price level if the central bank sells government bonds. (5 pts) Answer Part A

a. Nominal GDP = P*Y = V*M = 2*2 = 4 b. P*Y = 4 => P = 4/4 = 1 c. rise Part B

When the central bank decreases the money supply, shifting money supply to left. This shift causes

the value of money to increase, so the price level falls. Question 2: (20 pts)

Consider the US as the domestic economy, with its currency being the US dollar (USD). The

foreign currency under comparison is Canadian dollar (CAD). Burgers are the sole product

produced and consumed in both economies.

a. The nominal exchange rate is 1.4 CAD/USD. The prices of a burger are respectively $10 USD

in the US and $7 CAD in Canada. What is the real exchange rate for the US dollar? (6 pts)

b. Assuming the price levels in both Canada and the US unchanged, when the nominal exchange

rate of CAD/USD changes to 1.2, which currency appreciates in nominal and real terms? (6 pts)

c. Assume there are no transaction and transportation costs in international trade. Explain how

traders can exploit the price difference between the two countries to make a profit. What

happens to the real exchange rate when the law of one price applies between two countries in the long run? (4 pts) lOMoAR cPSD| 58504431

d. Is this law of one price (the purchasing-power parity condition) accurate in reality? Justify your answer. (4 pts) Answer a. Real exchange = 𝑒 𝑃∗ 7

b. CAD appreciates in both terms because it becomes more valuable.

c. Traders would buy burgers in Canada and export them to the US to earn profit. The price of

burgers in Canada increases due to higher demand, and the price of burgers in the US decreases

due to a more abundant supply from abroad. In the long run, the convergence point is when

the purchasing power of the USD and CAD is the same, meaning each unit of both currencies

can buy the same number of burgers. At this point, the real exchange rate would be 1.

d. It rarely happens in reality because of transportation costs, transaction costs (taxes…),

imperfect substitute of goods and services, and non-tradable services (haircut, healthcare…). Question 3: (20 pts)

Suppose Vietnamese people are encouraged to buy only Vietnamese-made clothes.

a. Explain by words and a three-panel diagram how would this event affect the trade balance and

the real exchange rate? (10 pts)

b. Would the Vietnamese clothing firms gain? Discuss your reasoning. (5 pts)

c. Would Vietnamese firms in other industries gain? Discuss your reasoning. (5 pts) Answer

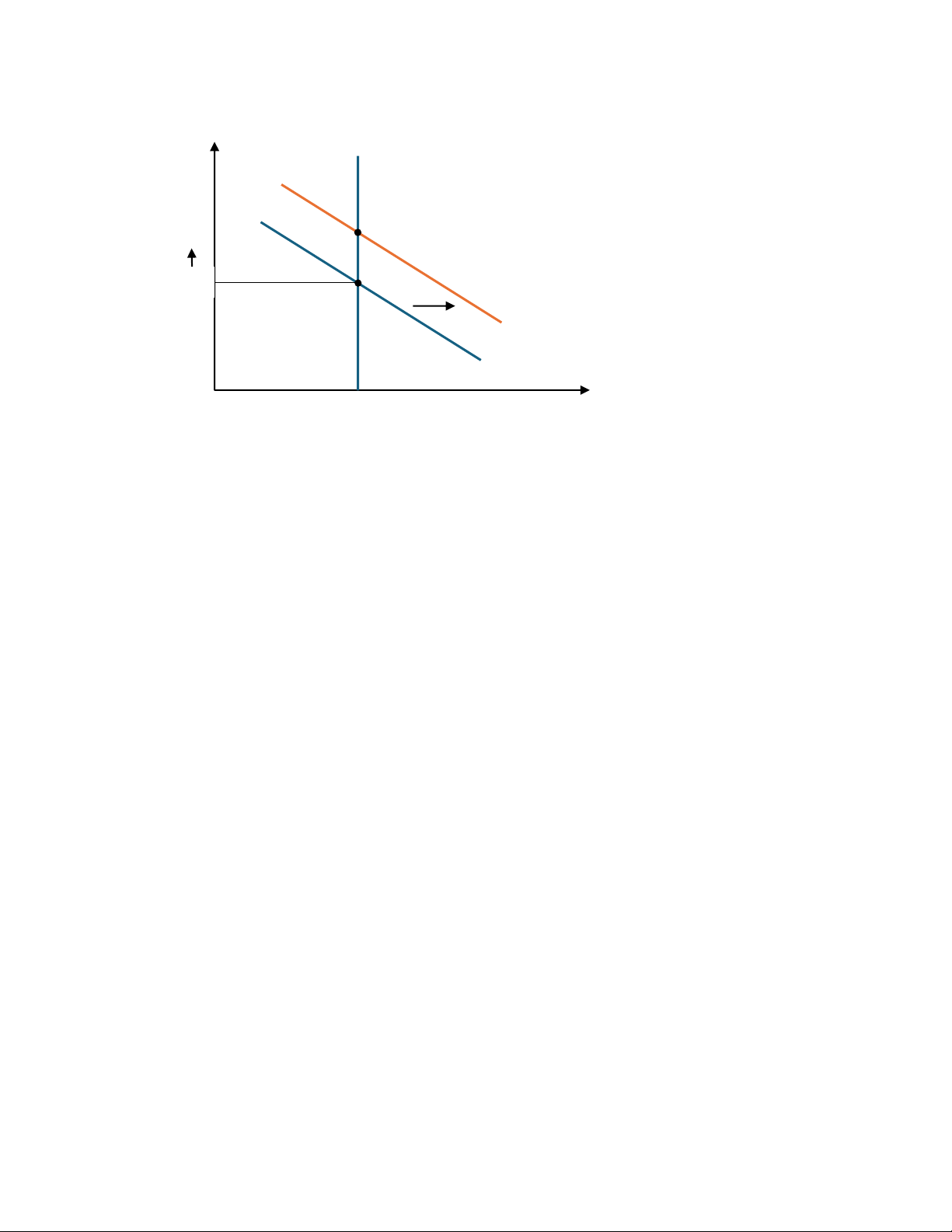

a. Explain by words and figures how this event would affect the trade balance and the real exchange rate. (10 points) •

If people are encouraged to buy only Vietnamese-made clothes, imports would decrease,

leading to an increase in net exports for any given real exchange rate. •

This would shift the demand curve in the foreign exchange market to the right, as

illustrated in the figure below. The result would be an increase in the real exchange rate,

but the trade balance would remain unchanged. lOMoAR cPSD| 58504431

b. Would the Vietnamese clothing firms be better off? Discuss your reasoning. (5 points) •

The domestic clothing industry would face less competition from imports, allowing them

to sell more products locally. As a result, Vietnamese clothing firms would be better off.

c. Would Vietnamese firms in other industries be better off? Discuss your reasoning. (5 points) •

Vietnamese firms in other industries would face increased competition due to the higher

real exchange rate, which could make imports cheaper for consumers and more

competitive for local firms. Therefore, firms in other industries might be worse off. Question 4 (20 pts)

Assume Vietnam is in a long-run equilibrium with full employment. In the short run, nominal wages are fixed.

a. Draw a diagram showing the short-run AS, long-run AS and AD. Show each of the following: (5 pts)

▪ Equilibrium output, labeled Y1

▪ Equilibrium price level, labeled P1

b. Assume that there is an increase in government in public infrastructure in Vietnam. Continue

from diagram from the question a, please show the effect of this event on the equilibrium in

the short run, labeling the new equilibrium output and price level Y2 and P2, respectively. (10 pts)

c. Based on your answer in part b, what is the impact of the increase in government spending in

public infrastructure on real wages in the short run? Explain. (5 pts) lOMoAR cPSD| 58504431 Answer

a.Draw a correctly labeled graph and show the AD and SRAS curves and P1.

b. There will be a rightward shift of the AD curve and showing Y2 and P2

c. Real wages will fall because the price level has increased.

d. In the long run, the short-run aggregate-supply curve shifts to the left to restore equilibrium at

point C, with unchanged output and a higher price level compared to point A. Question 5 (20 pts)

Suppose households in the United States attempt to reduce money holdings.

a. Assume the Fed does not change the money supply. According to the theory of liquidity

preference, what happens to the interest rate? What happens to aggregate demand? Using MS-

MD and AS-AD graphs to support your answers. (8 pts)

b. If the Fed wants to stabilize aggregate demand, how should it change the money supply? (5 pts)

c. If the Fed wants to accomplish this change in the money supply using open-market operations, what should it do? (5 pts) Answer

a. When households in the United States attempt to reduce money holdings, money demand is

decreased and the money-demand curve shifts to the left from MD1 to MD2, as shown two

diagrams below. If the Fed does not change the money supply, which is at MS1, the interest

rate will fall from r1 to r2. The decrease in the interest rate shifts the aggregate-demand curve

to the right, as consumption and investment rise.

Students should use 2 diagrams (MS-MD and AS-AD diagrams) to support their answers.

b. If the Fed wants to stabilize aggregate demand, it should decrease the money supply to MS2,

so the interest rate will remain at r1 and aggregate demand will not change.

c. To decrease the money supply using open market operations, the Fed should sell government bonds.