Preview text:

lOMoAR cPSD| 46578282 7/29/2020 CHAPTER 10: PARTIAL DIFFERENTIATION

PREPARED BY: FINANCE DEPARTMENT COURSE CODE: B03013 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash 1 flow matching LEARNING OBJECTIVES

Understanding short term financing problems

Applying the linear for the cash short

term financing and cash flow matching. 1 lOMoAR cPSD| 46578282 7/29/2020 CONTENT

• Short term financing 1

• Dedication/ cash flow matching 2 • Sensitive analysis for linear 3 programming 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 3 matching SHORT TERM FINANCING • Problems of financing short-term cash commitments.

• Linear programming can help in figuring out an

optimal combination of financial instruments to meet those commitments.

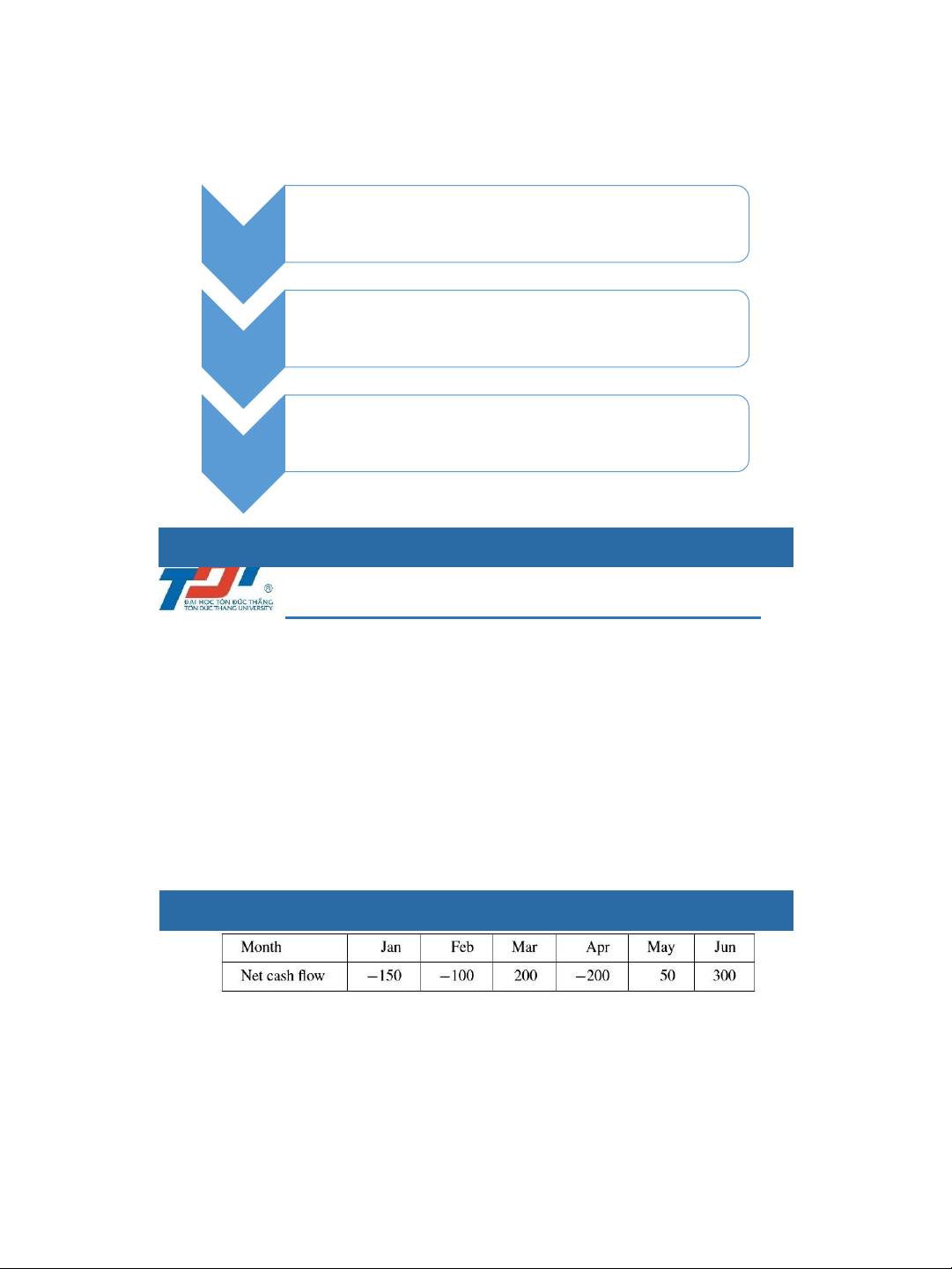

• For example: a company has a problem 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 4 matching SHORT TERM FINANCING

• The company has the sources of fund: 2 lOMoAR cPSD| 46578282 7/29/2020

+ A line of credit of up to $100k at an interest rate of 1% per month.

+ In any one of the first three months, it can

issue 90-day commercial paper bearing a total

interest rate of 2% for the three-month period. 3 lOMoAR cPSD| 46578282 7/29/2020

+ Excess funds can be invested at an interest rate of 0.3% per month. 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 5 matching SHORT TERM FINANCING • There are many questions:

• What interest payments will be the company

need to make between Jan and June?

• Is it economical to use the line of credit in some

of the months? If so, when? How much?

=> They will be answered by the linear programming. SHORT TERM FINANCING

• There are three steps in applying linear programming: modeling, solving and interpreting. 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 6 matching 4 lOMoAR cPSD| 46578282 7/29/2020

1. Modeling: need to focus on decision variables,

objective and constraints. For the short-term

financing problems, there are several possible

choices: the amount xi drawn from the line of

credit in month i; the amount yi of commercial

paper issued in month i, the excess funds zi in

month i and the company’s wealth v in June. 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash 7 flow matching SHORT TERM FINANCING

• Objective: minimized or maximized => it has to

be linear in the decision variables, it implies

that sum of constant times decision variables.

• Constraints: linear program has constraints

limiting feasible decisions. We have 3 constraints:

(i): cash inflow= cash outflow for each month.

(ii): upper bound on xi.

(iii): Nonnegativity of the decision variables xi, yi and zi. DEDICATION

• Dedication/cash-flow matching: a technique

used to fund known liabilities in the future. 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow matching 8 5 lOMoAR cPSD| 46578282 7/29/2020

• Dedicated portfolios usually only consist of risk-

free non-callable bonds since the portfolio

future cash inflows need to be known when the portfolio is constructed. 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 9 matching Sensitive analysis

• All variables are constant except the one?

• What happens if data values are changed?

• We all know the data? Or guess it? Or accuracy? Summary

• Linear programming for decision-making. • Definition of dedication. • Accuracy of the data.

• The estimated results and sensitive analysis. 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 10 matching 6 lOMoAR cPSD| 46578282 7/29/2020 7/29/2020

B03013 – Chapter 10: Asset/Liability Cash flow 11 matching 7