Preview text:

Final Kế toán quốc tế (code 1)

PART 2. PROBLEM ANALYSIS (2 points)

December 1, 2016, Eximco Inc., a U.K company, makes a sale and ships goods to Rose Inc., a U.S. company. •

Sales price is 8,000 U.S. dollars •

Rose Inc. agrees to pay in U.S dollar by bank account on March 1, 2017. •

Spot rate as of December 1, 2016: 1GBP (£) = 1.28 USD ($) •

Spot rate as of December 31, 2016: 1£= $1.29

Spot rate as of March 1, 2017: 1£ = $1.30

Eximco Inc. has a December 31 year end. Required:

1. How Eximco Inc. records the sale on December 1, 2016?

2. How Eximco Inc. records the foreign exchange gain/loss on December 31, 2016 and on March 1, 2017?

Note: Round percentages to three decimals place.

PART 3. TRANSLATION OF FINANCIAL STATEMENTS (4 points) (Note: ko

có Inventory ở balance sheet, ko có Cost of goods sold ở Income statement) Balance sheet € Translation rate $ Assets

Brookhurst Company (a U.S.-based company) established a subsidiary in Spain on January 1,

2010, by investing €800,000. The subsidiary's opening balance sheet (in Euro) was as follows:

Balance Sheet January 1, 2010 € € Cash 200,000

Inventory 600,000 Capital Stock 800,000

Total Assets 800,000 Total Liabilities and Equity 800,000

Relevant exchange rates for 2010 are as follows: Jan 1. 2010 1.00 Average 2010 0.950

Rate when property and equipment were acquired and long-term debt was incurred. Jan 15. 2010 0.980

Rate when capital was increased Feb 1. 2010 0.970

Rate when dividends were declared. Dec 1. 2010 0.920

Average for the month of December… 0.910 December 31. 2010.. 0.900

The subsidiary's financial statements for the year ended December 31. 2010 are as follows.

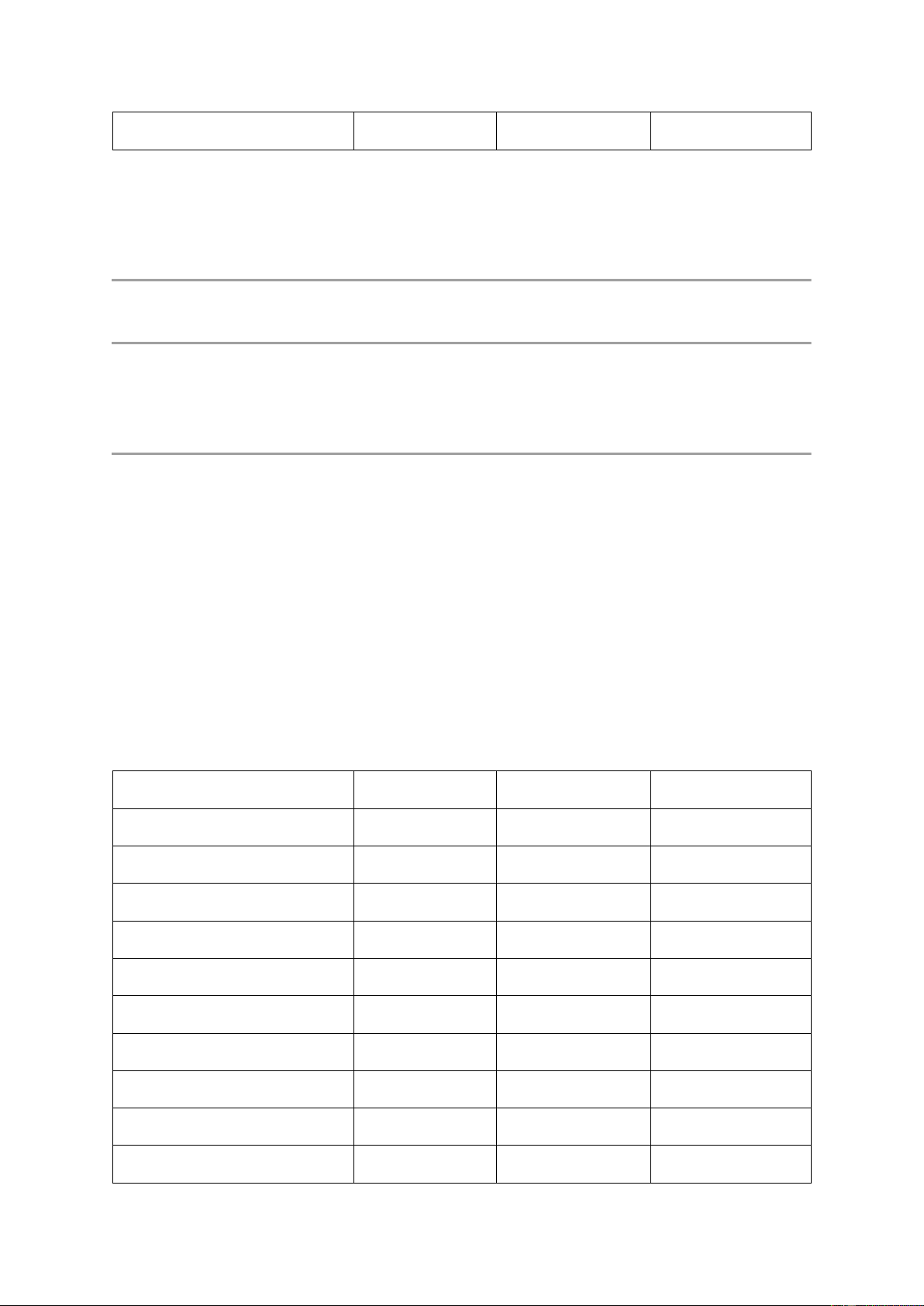

Required: Translate the Spain subsidiary's financial statements into U.S. dollars using Temporal Method. Cash 550,000 Account Receivable 600,000 Property and equipment 2,080,000 Accumulated Depreciation (200,000) Total Assets 3,830,000 Liabilities and Equity Account Payable 330,000 Long-term Debt 2,000,000 Total Liabilities 2,330,000 Capital Stock 1,000,000 Retained Earnings 500,000 Total Equity 1,500,000

Total Liabilities and Equity 3,830,000

Calculation for Capital € Translation rate $ Stock Beginning Added

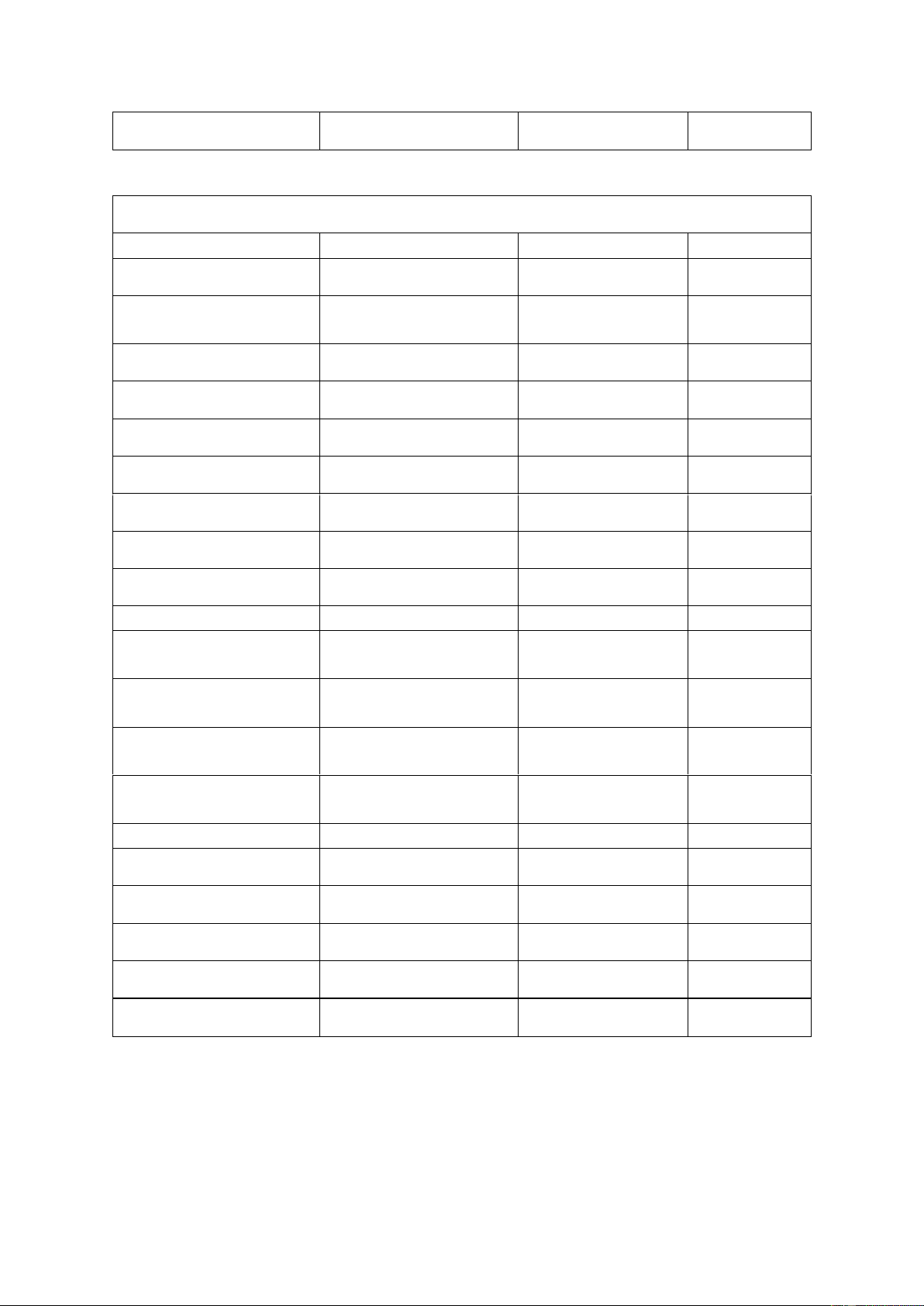

* Inventory is carried at FIFO cost, ending inventory was acquired evenly throughout the month of December IncomeStatement,2010 2010 € Translation rate $ Sales 8,000,000 Selling and 500,000 administrative expense Depreciation expense 200,000 Interest expense 180,000 Income before taxes 1,120,000 Income tax 280,000 Remeasurement Gain 89,200 Net income 840,000 Retained earning,2010 2010 € Translation rate $ Retained Earnings, 100,000 1/1/2010 Net Income 840,000 Calculation from Income Statement Less: Dividends (440,000) 12/1/2010 Retained Earnings, 500,000 31/12/2010 Calculation for COGS € Translation rate $ Beginning Inventory Plus: Purchases Less: Ending Inventory Cost of Goods Solds Ending