Preview text:

Chapter 3 The adjusting process 201044 - The adjusting process Learning objectives

• Differentiate between accrual and cash-basis accounting

• Explain why adjusting entries are needed

• Journalise and post adjusting entries

• Explain the purpose of and prepare an adjusted trial balance

• Prepare the financial statements from the adjusted trial balance

• Describe the ethical challenges in accrual accounting 201044 - The adjusting process 3/10/2022 2

3.1. Why we adjust the accounts

• Accrual accounting requires adjusting entries at the end of the period

• Adjusting entries assign revenues to the period when they are

earned and expenses to the period when they are incurred

• Adjustments are needed to properly measure two things: (1) profit

(loss) in the income statement, and (2) assets and liabilities in the balance sheet 201044 - The adjusting process 3/10/2022 5

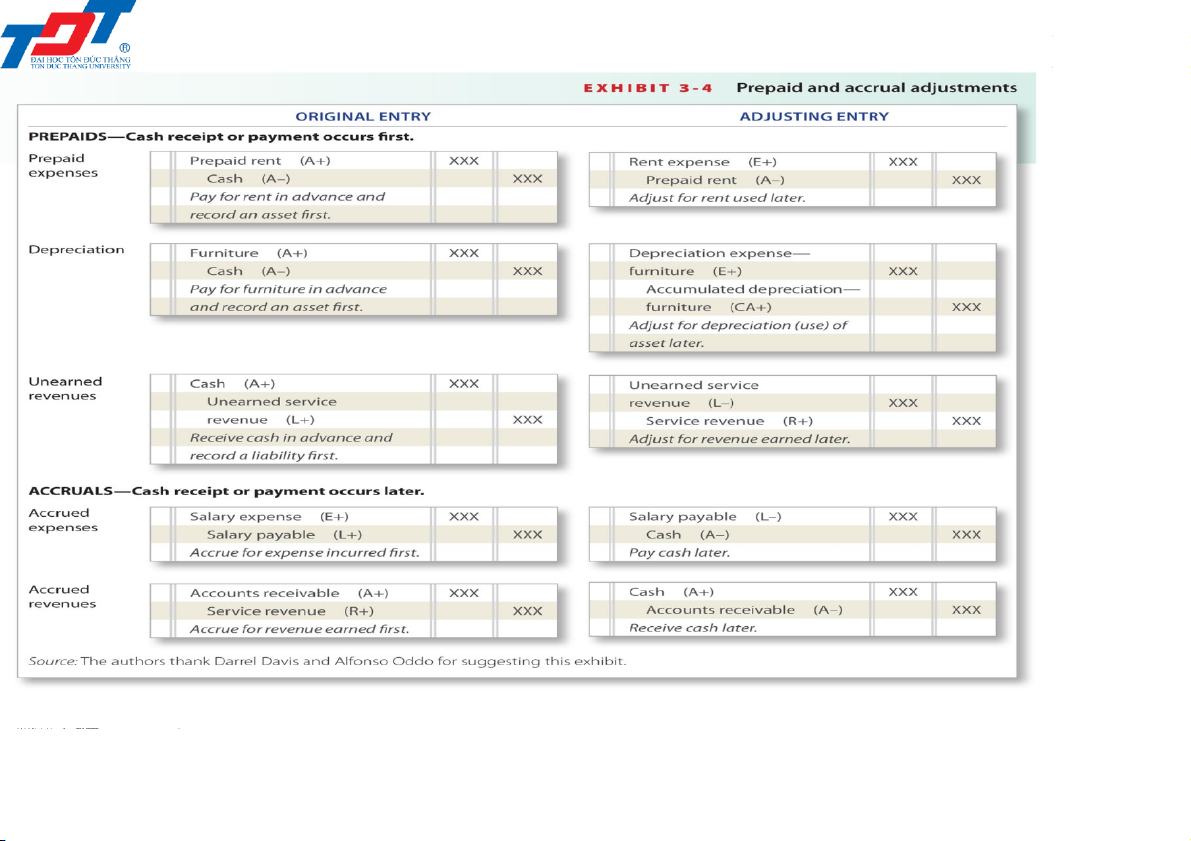

3.2. Two categories of adjusting entries

• The two basic categories of adjusting entries are prepayments (defferals) and accruals

• In a prepaid adjustment, the cash payment occurs before an

expense is recorded or the cash receipt occurs before the revenue is earned

• An accrual records an expense before the cash payment or it

records the revenue before the cash is received

• Adjusting entries fall into five types: prepaid expenses, depreciation

of non-current assets, accrued expenses, accrued revenues, unearned revenues 201044 - The adjusting process 3/10/2022 6

3.2. Two categories of adjusting entries Prepaid expenses

• Prepaid expenses are advance payments of expenses

• Examples include prepaid rent, insurance, supplies

• Prepaid expenses are considered assets rather than expenses

• When the prepayment is used up, the used portion of the asset

becomes an expense via an adjusting journal entry

Ex: Smart Touch prepays three months’ office rent of $3,000 ($1,000

per month x 3 months) on 01 June 201N 201044 - The adjusting process 3/10/2022 7

3.2. Two categories of adjusting entries Depreciation

• Property, plant and equipment assets are long-lived, non-current,

tangible assets used in the operation of a business

• As a business uses non-current assets, their value and usefulness decline

• The decline in usefulness of a non-current asset is an expense, and

accountants systematically spread the asset’s cost over its useful life

• The allocation of a non-current asset’s value to expense is called depreciation 201044 - The adjusting process 3/10/2022 8

3.2. Two categories of adjusting entries Depreciation

• The accumulated depreciation account is the sum of all the

depreciation recorded for the asset, and that total increases (accumulates) over time

• Accumulated depreciation is a contra asset

Ex: On 01 June, Smart Touch purchased furniture for $18,000. Its

expected useful life is five years. The annual depreciation amount was $3,600. 201044 - The adjusting process 3/10/2022 9

3.2. Two categories of adjusting entries Accrued expenses

• The term accrued expense refers to an expense incurred before paying for them

• Examples include accruing salary expense and accruing interest expense

• An accrued expense hasn’t been paid for yet and always creates a liability

Ex: Sheena Bright pays its employee a monthly salary of $1,800 - half

on the 17th and half on the first day of next month. 201044 - The adjusting process 3/10/2022 10

3.2. Two categories of adjusting entries Accrued revenues

• Businesses can earn revenue before they receive the cash, which creates accrued revenues

• Accrued revenue is revenue that has been earned but for which the

cash has not yet been collected

Ex: Assume that Smart Touch is hired on 16 June to perform e-

learning services for the Central Queensland University. Under this

agreement, Smart Touch will earn $800 monthly.

During June, for work performed from 16 June to 30 June, Smart

Touch will earn half a month’s fee, $400 (Assumed that the financial year ended every 30 June) 201044 - The adjusting process 3/10/2022 11

3.2. Two categories of adjusting entries

Unearned revenues (Deferred revenue)

• Some businesses collect cash from customers in advance of performing work

• Receiving cash before earning it creates a liability to perform work in

the future called unearned revenue

• The business owes a product or a service to the customer, or it

owes the customer his or her money back

• Only after completing the job will the business earn the revenue.

Because of this delay, unearned revenue is also called deferred revenue 201044 - The adjusting process 3/10/2022 12

3.2. Two categories of adjusting entries

Unearned revenues (Deferred revenue)

• Ex: A legal firm engages Smart Touch to provide e-learning

services, agreeing to pay $600 in advance for 3 months, beginning

immediately. Sheena Bright collects the first amount on 1 J une. 201044 - The adjusting process 3/10/2022 13

3.2. Two categories of adjusting entries 201044 - The adjusting process 3/10/2022 14

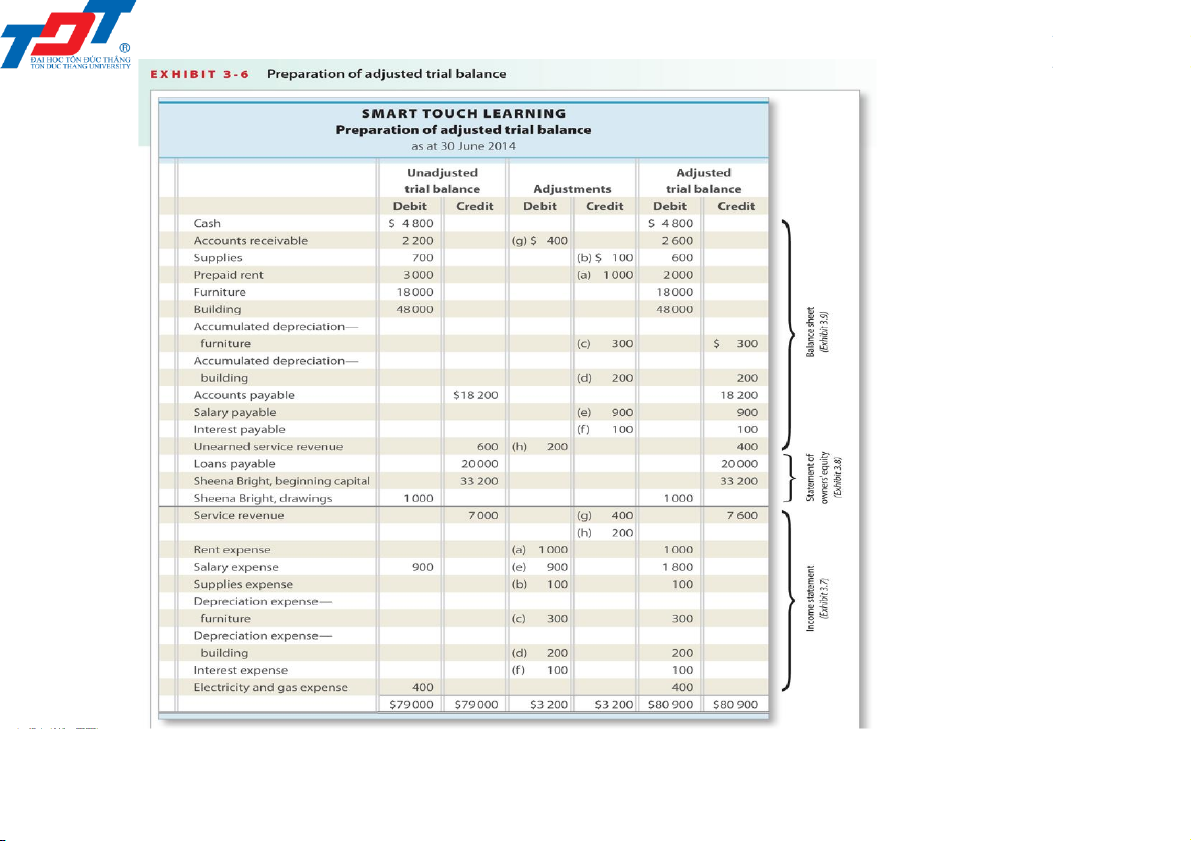

3.3. Two categories of adjusting entries

Ex: Information for the adjustments at 30 June 201N of Smart Touch

(a) Prepaid rent expired, $1,000 (b) Supplies used , $100

(c) Depreciation on furniture, $300

(d) Depreciation on building, $200

(e) Accrued salary expense, $900

(f) Accrued interest on loan, $100

(g) Accrued service revenue, $400

(h) Service revenue that was collected in advance and now had been earned, $200 Required:

Journalising and posting to T-accounts all the above adjustments. 3/10/2022 15

3.3. The adjusted trial balance

• Prepared after adjusting entries are posted

• Useful step in preparing financial statements

• Often appears on a work sheet (Chapter 4) 201044 - The adjusting process 3/10/2022 16

3.3. The adjusted trial balance 3/10/2022 17

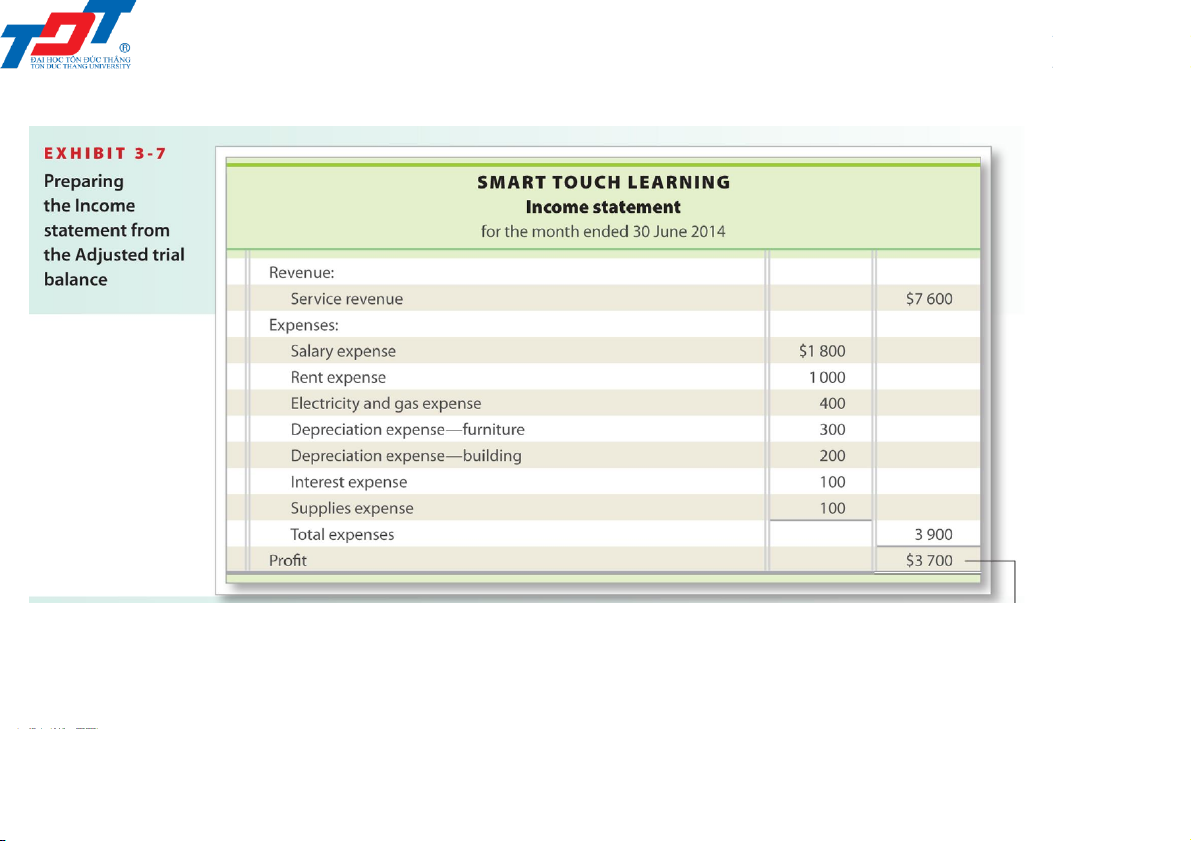

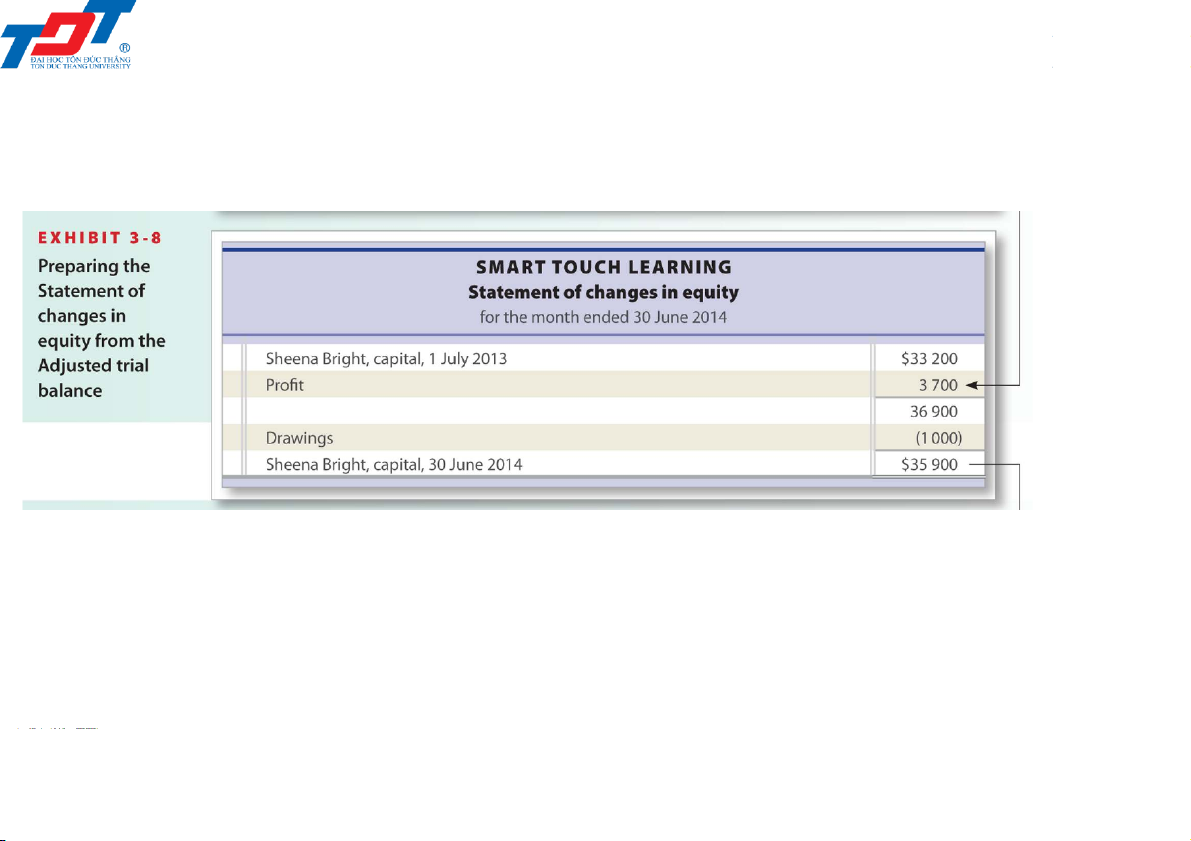

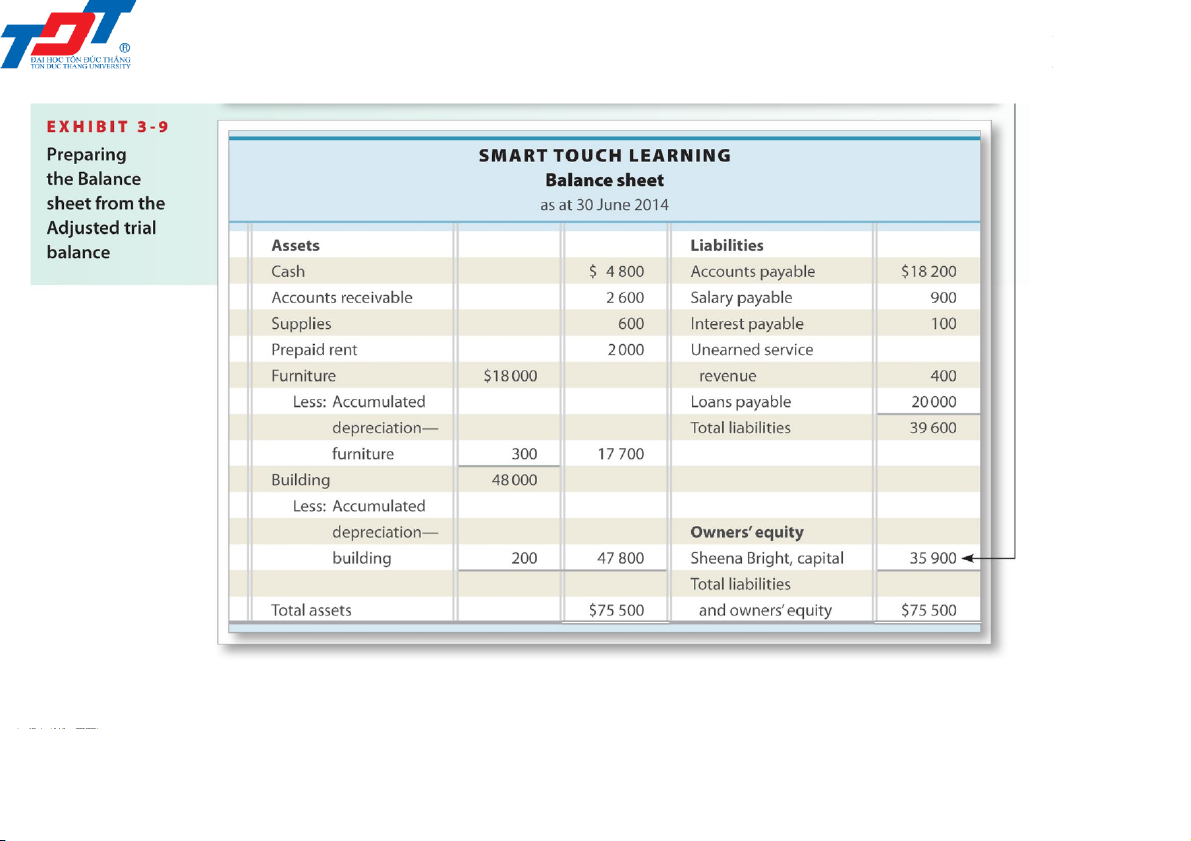

3.4. The financial statements

• The income statement reports revenues and expenses

• The statement of changes in equity shows why capital changed during the period

• The balance sheet reports assets, liabilities and owners’ equity

• The financial statements should be prepared in the following order:

(1) income statement to determine profit or loss;

(2) statement of changes in equity which needs profit or loss from the

income statement to calculate ending capital;

(3) balance sheet which needs the amount of ending capital to achieve its balancing feature 201044 - The adjusting process 3/10/2022 18

3.4. The financial statements 201044 - The adjusting process 3/10/2022 19

3.4. The financial statements 201044 - The adjusting process 3/10/2022 20

3.4. The financial statements 201044 - The adjusting process 3/10/2022 21

3.5. Ethical issues in accrual accounting

• Accrual accounting provides opportunities for unethical behaviour

• For example, a dishonest businessperson could omit depreciation expense at the end of the year

• Failing to record depreciation would overstate profit as calculated by

mandated accrual principles and disclose a more favourable picture

of the business’ financial position than actually existed 201044 - The adjusting process 3/10/2022 22