Preview text:

ASSIGNMENT 1 FRONT SHEET Qualification

BTEC Level 4 HND Diploma in Business Unit number and title

Unit 5: Accounting Principles (5038) Submission date 26/6/2022

Date received (1st submission) 26/6/2022 Re-submission date

Date received (2nd submission) Student name Do Huyen Trang Student ID BH00323 Class BA0501 Assessor name Hoang My Linh Student declaration

I certify that the assignment submission is entirely my own work and I fully understand the consequences of plagiarism. I understand that

making a false declaration is a form of malpractice. Student’s signature: Grading grid P1 P2 M1 D1 Ư

Summative Feedbacks: Resubmission Feedbacks: Grade: Assessor Signature: Date:

Internal Verifier’s Comments: Signature & Date: Dear Valued Client

Our cordial welcome goes to you! Your presence is an absolute delight for us, and we are happy as

ever to serve you! Hope you like it here! First of all, let us introduce shortly about our company. It’s

a large accountancy firm that undertakes extensive business consultancy work for our client base.

We have a central London head office and regional offices in the UK in Birmingham and

Southampton and a small regional office in Vietnam. Nowadays, in any company, accounting is

considered as one of the most important departments. Practice has proven that when a business is

established, the first position to be recruited will be an accountant and even when the company is on

the verge of bankruptcy, laying off a series of employees, the accountant is also the last to "get" to

leave. We can see that accounting is really important in, any company or business needs an

accountant. As you know, accounting only collects, processes, checks, analyzes, recognizes

revenue,... but besides that it also supports superiors in risk, assessment, strategy,... That's why

today, we want to share and help you have a deeper knowledge about the role of accountants in

general and in an organization in particular.

So, what is the meaning accounting? Currently, there are many concepts of accounting, due to many

different approaches, there are many different definitions. One definition of accounting that has been

accepted throughout the years is the one presented in the "Report on Basic Accounting Theory"

issued by the American Accountants Association: “Accounting is the process of identifying,

measuring and communicating economic information to permit informed judgements and decisions

by users of the information." (Financial Accounting, 2022). It reveals profit or loss for a given

accounting period and the value of a firm's assets, liabilities and owners' equity. From there

providing financial information useful for making socio-economic decisions and evaluating the

effectiveness of business activities. Role of an accountant is doing functions related to the

collection, accuracy, recording, analysis, and presentation of a business, company or organization’s

financial operations. hat also holds a number of administrative functions in the company. Statutory

auditing, internal audit, taxation are some of the roles of accountant.

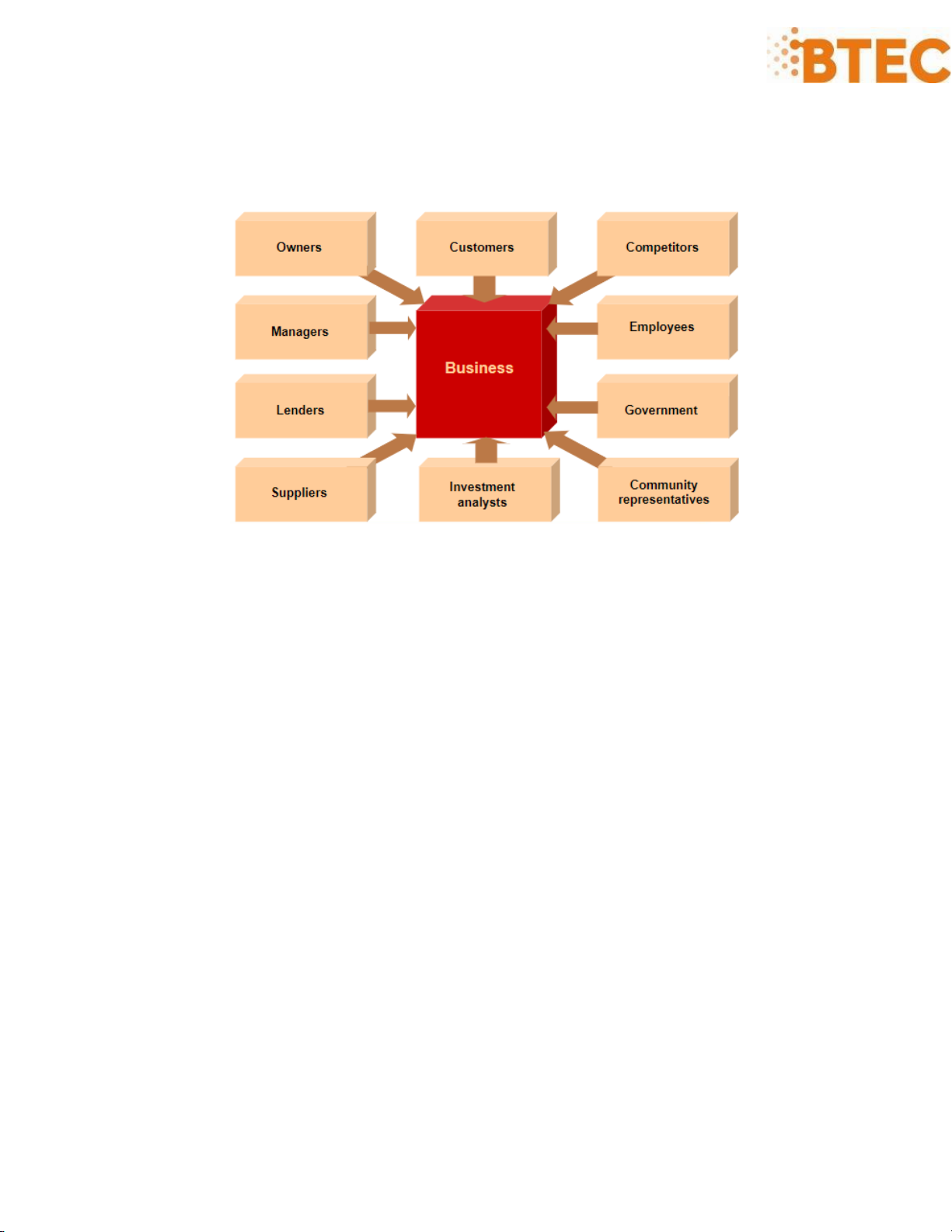

Who are the Users of Accounting Information? The users of managerial accounting information are

pretty easy to identify-basically, they’re a firm’s managers. We need to look a little more closely,

however, at the users of financial accounting information, and we also need to know a little more

about what they do with the information that accountants provide them. • Internal Users:

Owners and Managers: in summarizing the outcomes of a company’s financial activities over a

specified period of time, financial statements are, in effect, report cards for owners and managers.

They show, for example, whether the company did or didn’t make a profit and furnish other

information about the firm’s financial condition.

Investors and Creditors: if you loaned money to a friend to start a business, wouldn’t you want to

know how the business was doing? Investors and creditors furnish the money that a company needs

to operate, and not surprisingly, they feel the same way. Because they know that it’s impossible to

make smart investment and loan decisions without accurate reports on an organization’s financial

health, they study financial statements to assess a company’s performance and to make decisions about continued investment.

Governments: businesses are required to furnish financial information to a number of government

agencies. Publicly owned companies, for example—the ones whose shares are traded on a stock

exchange—must provide annual financial reports to the Securities and Exchange Commission

(SEC), a federal agency that regulates stock trades.

Suppliers: Just like lenders, suppliers need accounting information to assess the credit-worthiness

of its customers before offering goods and services on credit. • External Users:

Lenders: Lenders use accounting information of borrowers to assess their credit worthiness, i.e.

their ability to pay back any loan.

Governments: businesses are required to furnish financial information to a number of government

agencies. Publicly owned companies, for example-the ones whose shares are traded on a stock

exchange-must provide annual financial reports to the Securities and Exchange Commission (SEC),

a federal agency that regulates stock trades.

Customers: Most consumers don’t care about the financial information of its suppliers. Industrial

consumers however need accounting information about its suppliers in order to assess whether they

have the required resources that are necessary for a steady supply of goods or services in the future.

Community representatives: General public may also be interested in accounting information of a

company. These could include journalists, analysts, academics, activists and individuals with an

interest in economic developments.

Other users: a number of other external users have an interest in a company’s financial statements.

Suppliers, for example, need to know if the company to which they sell their goods is having trouble

paying its bills or may even be at risk of going under.

Just as there are many types of economic decisions, so there are many types of accounting

information. Financial Accounting, Management Accounting and Tax accounting often are

describing three types of accounting information that are widely used business decisions:

• Financial Accounting: records accounting

transactions and converts the resulting

information into financial statements.

• Cost and Management accounting: this is

process of identification, measurement,

accumulation, analysis, preparation,

interpretation and communication of

information used by management to plan, evaluate and control Others:

• Public Accounting: investigate the

financial statements and supporting

accounting systems of client companies

• Government Accounting: create and manage funds to pay for a number of expenditures

related to the provision of services by a government entity.

• Tax Accounting: ensures that complies with the applicable tax regulations, tax returns are

completed correctly and filed in a timely manner.

• Forensic Accounting: reconstruction of financial information when a complete set of

financial records is not available.

Accounting is an indispensable part of any company, organization or business. This is the part that

plays an important role in supporting the business in general and the financial performance of the

business in particular. Therefore, career opportunities in Accounting are also very diverse and highly stable.

Managerial: General accounting, Cost accounting, Budgeting, Internal auditing, Consulting,

Controller, Treasurer, Strategy,...

Financial: Preparation, Analysis, Auditing, Regulatory, Consulting, Planning, Criminal investigation,...

Taxation: Preparation, Planning, Regulatory, Investigations, Consulting, Enforcement, Legal services, Estate plans,..

Accounting-related: FBI investigators, Market researchers, Systems designers, Merger services,

Business valuation, Human services, Litigation support, Entrepreneurs,...

Accountant competencies are the technical skills and attributes that help professionals succeed in

accounting jobs and remain valuable to their businesses. These competencies can help accountants

complete their job responsibilities efficiently while maintaining accuracy.

Accountant competencies highlight to employers that an accountant possesses the skills to maintain

accurate financial records and interpret that information appropriately to provide quality advice. 10 accountant competencies:

There are many competencies accountants may possess that can contribute to a company's financial

success. Here are 10 highly valued competencies for accountants: 1. Research skills

Accountants often conduct research to understand economic conditions that may affect a company,

such as supply and demand. This research helps accountants gather information and clearly present

it to company leaders to help with their decision-making processes. Some research skills that can be

valuable for accountants include:

Data collection: This skill can help accountants gather information to answer client-specific questions.

Analysis: Accountants use analysis in their research to understand a concept more thoroughly.

Attention to detail: While researching, accountants may work with large volumes of data. They use

attention to detail to identify inconsistencies or discrepancies that can affect the results of their research. 2. Financial reporting

Financial reporting entails preparing statements to summarize a company's financial performance.

There are four types of statements that accountants often prepare to compile a financial report:

Balance sheet: This financial document defines a company's assets, liabilities and equity.

Income statement: This statement summarizes a company's revenue, expenses and profit margins.

Statement of equity changes: This report reveals the company's changes in equity over time.

Cash flow statement: This provides information on a company's cash movement, which includes the

business's profits and expenses. 3. Budgeting and forecasting

Budgeting determines a company's financial expectations over a short period, which companies

typically conduct annually. To compare figures from the start and conclusion of a fiscal year.

Forecasting helps companies predict their financial metrics based on historical data. Company

leaders often ask accountants to develop forecasting models that help them make short- and long- term financial decisions.

→ Both budgeting and forecasting are critical tools that help a business plan for future growth, and

understanding both concepts can help accountants guide companies effectively. 4. Spreadsheet proficiency

To collect, organize and analyze large amounts of data related to their business. Accountants often

use spreadsheet programs to perform mathematical calculations quickly and accurately. Common

spreadsheet skills that accountants often possess include:

Pivot tables: Accountants can use pivot tables to analyze a set of data from different perspectives.

Formulas: This can assist accountants in performing complex mathematical calculations quickly and effectively.

Charts: Which represent numerical information graphically. They can use these charts to

communicate key financial information in a simple and concise way. 5. Accuracy

This information can help businesses fulfill their tax requirements, make payments on time and

control cash flow effectively. To demonstrate accuracy in their work, accountants can complete

tasks in a timely manner, remain attentive when analyzing data and double-check their mathematical calculations frequently. 6. Time management

Some accounting firms may charge clients hourly, and accountants help create an accurate record of

the time they spend working on each account. Effective time management skills help accountants

meet their deadlines while balancing other priorities simultaneously. Some aspects of good time management include: • Organization • Prioritization • Planning • Delegation • Problem-solving 7. Business acumen

Business acumen is the understanding of how a business operates. While accounting is one

component of comprehensive business acumen, accountants can also benefit from understanding

other business concepts, such as marketing, human resources and operations. Help accountants

collaborate with managers or company executives to identify opportunities for growth and maximize

profits. Some skills that can help professionals develop business acumen include: • Strategic thinking • Technology skills • Negotiation • Team-building • Creativity 8. Mathematical skills

Many accounting responsibilities require formulas to calculate metrics and analyze data. While

many companies have software programs that can automate some of those processes, accountants

may still benefit from understanding calculations in case technology falters. Specific mathematical

skills that can be beneficial for accountants include: • Basic arithmetic • Statistics • Algebra • Mathematical modeling • Calculus 9. Communication

Accountants communicate with many individuals daily, such as clients, peers, managers,

stakeholders or financial institutions. Effective communication skills can help accountants explain

financial terminology and complex concepts to those whose of expertise lie outside of accounting.

Other communication skills that can benefit accountants include:

• Confident speaking voice and body language • Presentation skills

• Clear and concise language 10. Teamwork

Many accountants work as part of a team to accomplish the financial objectives of an organization.

They use teamwork skills to collaborate productively with others on common tasks or shared goals.

Accountants may work with their team to ensure accurate data, improve operational processes and

help business leaders make informed decisions. Accountants often use these teamwork skills: • Leadership • Collaboration • Listening • Empathy • Conflict resolution

There are common accounting skills that you will be expected to know how to utilize as a new

member of a public accounting firm or as a corporate accountant. Top Five Accounting Skills 1. Analytical

Accounting professionals must read, compare, and interpret figures and data. For example,

accountants might work to minimize a client’s tax liability by looking at their finances. Auditors

might analyze data to find instances of people misusing funds. Being able to analyze numbers and

figures in documents is a critical skill for all accounting jobs.

2. Communication/Interpersonal

Accountants have to be able to communicate with other departments, colleagues, and clients. They

might have to communicate in person, via email, or over the phone. Accountants also often have to

give presentations. Therefore, their written and oral communication must be strong. 3. Detail Oriented

A lot of accounting is about paying attention to the little details. Accounting professionals often

wade through a lot of data that they must analyze and interpret. This requires great attention to detail. 4. Information Technology

Accounting jobs often require knowledge of a variety of computer programs and systems. For

example, an accountant might need to use finance-related software systems (like QuickBooks), a

bookkeeper might need advanced Excel skills, or an auditor might need to know certain data modeling programs. 5. Organizational/Business

Organizational skills are important for accounting jobs. Accountants, bookkeepers, and others in the

accounting field must work with and manage a range of client’s documents. They need to be able to

keep these documents in order, and manage each client’s data.

What is an Accounting Information System (AIS)? It is a structured system where all the

information of an organization (business entity or non-profit organization) is collected, stored, and

managed in the form of data which is thereafter processed to prepare financial records of

importance. (Accounting As An Information System, 2022)

The accounting information system should have certain features that are common to all information

systems within a business. These are:

• Identifying and capturing relevant information.

• Recording, in a systematic way, the information collected.

• Analysing and interpreting the information collected.

• Reporting the information in a manner that suits user’s needs.

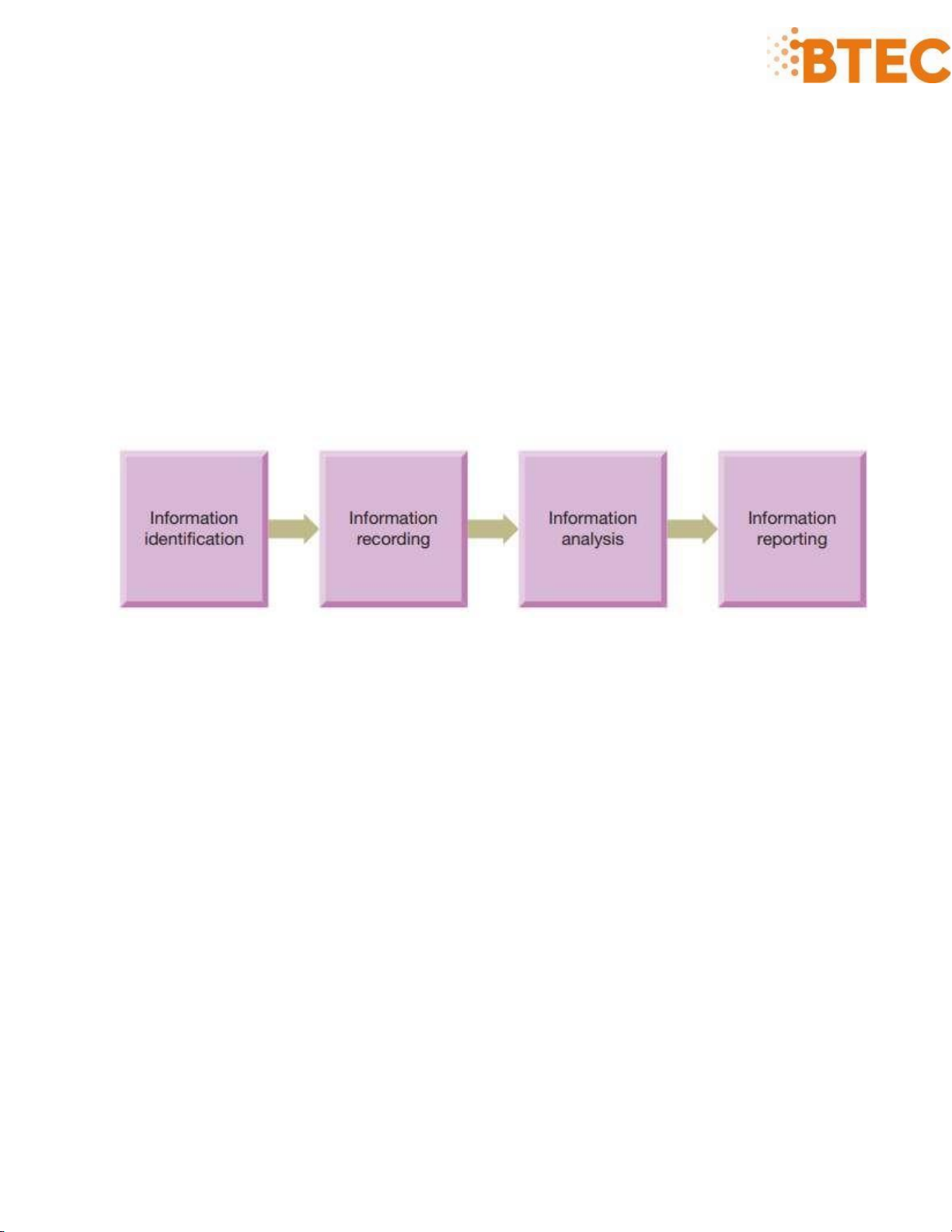

The relationship between these features is set out in Figure 1

Figure 1: The accounting information system

There are four sequential stages of an accounting information system. The first two stages are

concerned with preparation, whereas the last two stages are concerned with using the information collected.

The Role of Accounting Information System in an Organization:

Detailedents Analysis: In this, all end-users of the accounting information system are examined by

questions, to make sure that the system is fully understood, including the complete documentation collected.

System Design: After the detailed analysis, a new system is formed. The system is so designed that

it incorporates relevant internal controls to provide the management with the necessary information

to make important decisions for the organizations.

Documentation: While the system is being made, it is ensured that data is well documented. The

detailed documentation provides the users with accurate instructions regarding the new system.

Documentation plays an important role and is used for testing and training before rolling out the system.

Testing: The processes are tested before launching the system. The documentation collected ensures

the processes are well documented and procedures are followed. This phase is considered a “trial and

error” stage. At this stage, some system modifications can be done. Ensure that all processes are tested.

Training: All the staff is provided training to implement the changes as per the AIS software. Also,

at this stage staff can give better input to improve the system. Since they are only going to use it.

Data Conversion: In this stage, the existing data is transferred to the new system. Before converting

the data, it should be well tested and verified. And also, it is always advisable to have a data backup

at the time when it is needed to restart.

Rolling Out the New System: The entire company must know the date of the launch of the new

system. And this will be the ideal time for the organizations to switch over from one platform to the other.

Tools: The company should ensure that all possible online resources are made available to the staff

involved in using the new Account information system. The company should define the

responsibilities of each and every employee involved in this system. Requirem

Support: It should be ensured that the management and its end-users have on-going support available

at all times. Since the upper management depends on the AIS to meet the success goals of the

organization, system upgrades should be kept monitored at all costs.

→ In summary, the accounting information system has partly solved the three major problems of

today's private enterprises. Firstly, support and enhance the competitiveness of enterprises; the

second is to support decision making for businesses; finally, professional support, production and

business activities help businesses develop more and more prosperously.

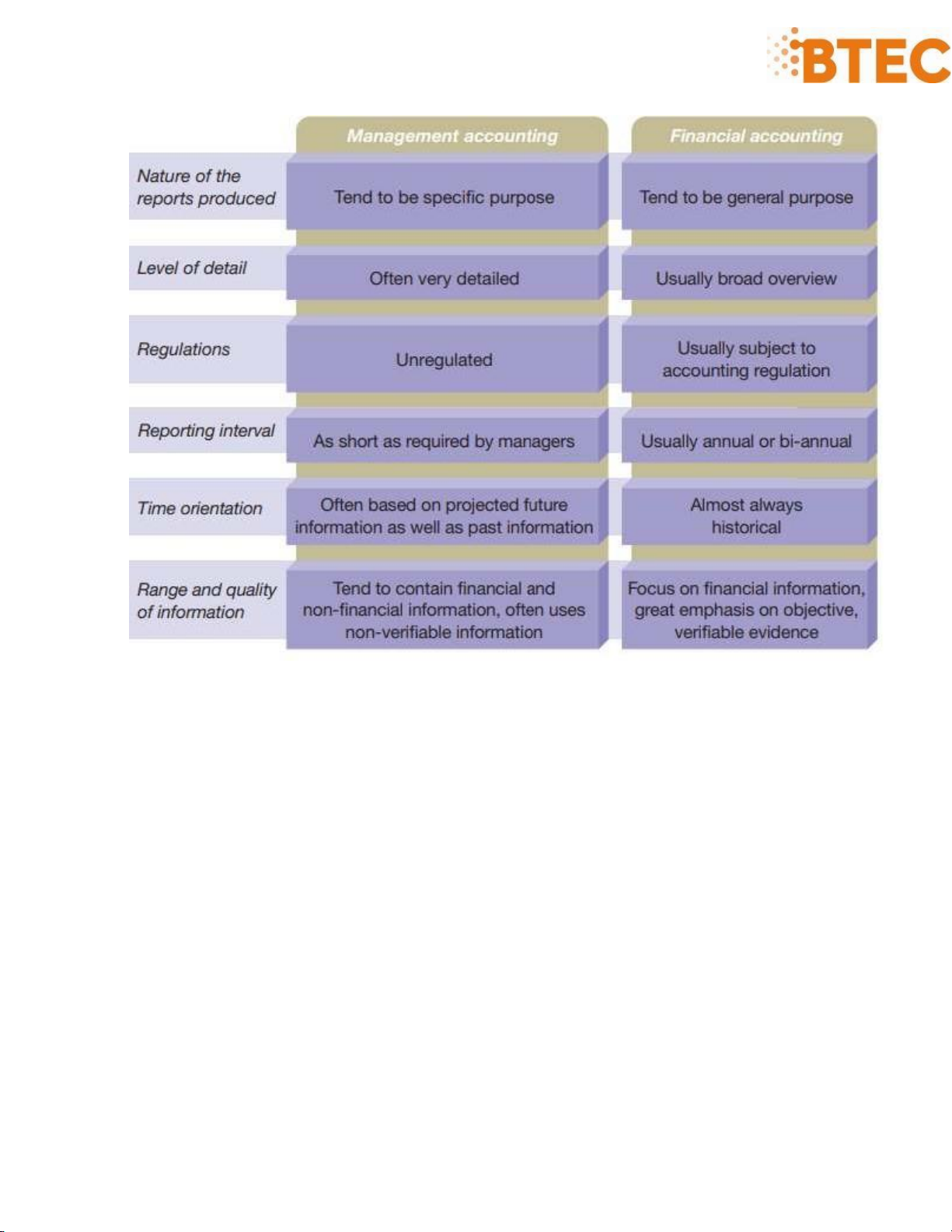

Accounting is usually seen as having two distinct strands. These are:

• Management accounting, which seeks to meet the accounting needs of managers.

• Financial accounting, which seeks to meet the needs of the other users identified

The difference in their targeted user groups has led each strand of accounting to develop along

different lines. The main areas of difference are as follows:

Nature of the reports produced. Financial accounting reports tend to be general-purpose.

Although they are aimed primarily at providers of finance such as owners and lenders, they contain

financial information that will be useful for a broad range of users and decisions. Management

accounting reports, meanwhile, are often specific-purpose reports. They are designed with a

particular decision in mind and/or for a particular manager.

Level of detail. Financial accounting reports provide users with a broad overview of the

performance and position of the business for a period. As a result, information is aggregated (that is,

added together) and detail is often lost. Management accounting reports, however, often provide

managers with considerable detail to help them with a particular operational decision.

\\Regulations. The financial accounting reports of many businesses are subject to regulations

imposed by the law and by accounting rule makers. These regulations often require a standard

content and, perhaps, a standard format to be adopted. Management accounting reports, on the other

hand, are not subject to regulation and can be designed to meet the needs of particular managers.

Reporting interval. For most businesses, financial accounting reports are produced on an annual

basis, though some large businesses produce half-yearly reports and a few produce quarterly ones.

Management accounting reports will be produced as frequently as needed by managers. A sales

manager, for example, may need routine sales reports on a daily, weekly or monthly basis so as to

monitor performance closely. Special-purpose reports can also be prepared when the occasion

demands: for example, where an evaluation is required of a proposed investment in new equipment.

Time orientation. Financial accounting reports reveal the performance and position of a business

for the past period. In essence, they are backward-looking. Management accounting reports, on the

other hand, often provide information concerning future performance as well as past performance. It

is an oversimplification, however, to suggest that financial accounting reports never incorporate

expectations concerning the future. Occasionally, businesses will release forward-looking

information to other users in an attempt to raise finance or to fight off unwanted takeover bids. Even

the routine preparation of financial accounting reports for the past period typically requires making

some judgements about the future.

Range and quality of information. Two key points are worth mentioning. First, financial

accounting reports concentrate on information that can be quantified in monetary terms.

Management accounting also produces such reports, but is also more likely to produce reports that

contain information of a non-financial nature, such as physical volume of inventories, number of

sales orders received, number of new products launched, physical output per employee and so on.

Second, financial accounting places greater emphasis on the use of objective, verifiable evidence

when preparing reports. Management accounting reports may use information that is less objective

and verifiable, but neneverthelessrovide managers with the information they need.

→ We can see from this that management accounting is less constrained than financial accounting.

It may draw from a variety of sources and use information that has varying degrees of reliability.

The only real test to be applied when assessing the value of the information produced for managers

is whether or not it improves the quality of the decisions made.

The main differences between financial accounting and management accounting are summarised in figure 2:

Figure 2: Management and financial accounting compared

Although management and financial accounting are closely linked and have broadly common

objectives, there are a number of differences in emphasis. The differences between management

accounting and financial accounting suggest differences in the information needs of managers and

those of other users. While differenceses undoubtedly exist, there is also a good deal of overlap

between the information needs of both.

ƯTo some extent, differences between the two strands of accounting reflect differences in access to

financial information. Managers have much more control over the form and content of the

information that they receive. Other users have to rely on what managers are prepared to provide or

what financial reporting regulations insist must be provided. Although the scope of financial

accounting reports has increased over time, fears concerning loss of competitive advantage and user

ignorance about the reliability of forecast data have meant that other users do not receive the same

detailed and wide-ranging information as that available to managers.

The differences between IFRS and GAAP IFRS GAAP Local vs.

Is used in more than 110 countries around

Is only used in the United States. Global

the world, including the EU and many

Asian and South American countries Rules vs. Principles-based Rules-based Principles Inventory First In, First Out (FIFO) First In, First Out (FIFO) Methods Last In, First Out (LIFO) Inventory

Allow inventories to be written down to

Allow inventories to be written Write-Down

market value. If the market value later

down to market value. Reversal of Reversals

increases, IFRS allows the earlier write-

earlier write-downs is prohibited down to be reversed Fair Value

Allow revaluation of the following assets

Revaluation is prohibited except Revaluations

to fair value if fair value can be measured for marketable securities

reliably: inventories, property, plant &

equipment, intangible assets, and

investments in marketable securities Fixed Assets

Under IFRS, these same assets are GAAP requires that long-lived

initially valued at cost, but can later be

assets, such as buildings, furniture

revalued up or down to market value and equipment, be valued at historic cost and depreciated appropriately. Investment

Includes the distinct category of Has no such separate category Property investment property

• Allows lessees to exclude leases • Has no such exception Lease for low-valued assets • Excludes leases of all Accounting

• Includes leases for some kinds of intangible assets from the intangible assets scope of the lease accounting standard

The constraints and threats of IFRS and GAAP: IFRS:

• IFRS is less detailed than GAAP

• Implementation costs for small businesses: The transition to IFRS for these businesses far outweighs the benefits

• Capital markets and the standards are not the same in different countries GAAP: • Not being used globally

• GAAP tends to take a "one-size-fits-all" approach rather than accounting for the immense

diversity that is often seen between companies.

• Long wait times for new standards: GAAP policy boards go through rigorous deliberation

and an extensive process to set new standards for the generally accepted accounting principles

Principles as well as ethics in accounting Ethics in Accounting Ethics:

• Beliefs that distinguish right from wrong

• Accepted standards of good and bad behavior

Five fundamental principles of ethics in accounting: • Integrity • Objectivity

• Professional competence and due care • Confidentiality • Professional behaviour

Conceptual Framework Approach: Members shall identify, evaluate and address threats to

compliance with the rules and fundamental ethical principles.

Generally Accepted Accounting Principles (GAAP) from Financial Accounting Standard Board (FASB)

International Financial Reporting Standards (IFRS) from International Accounting Standard Board (IASB)

Vietnamese Accounting Standards (VAS) from Ministry of Finance Ư

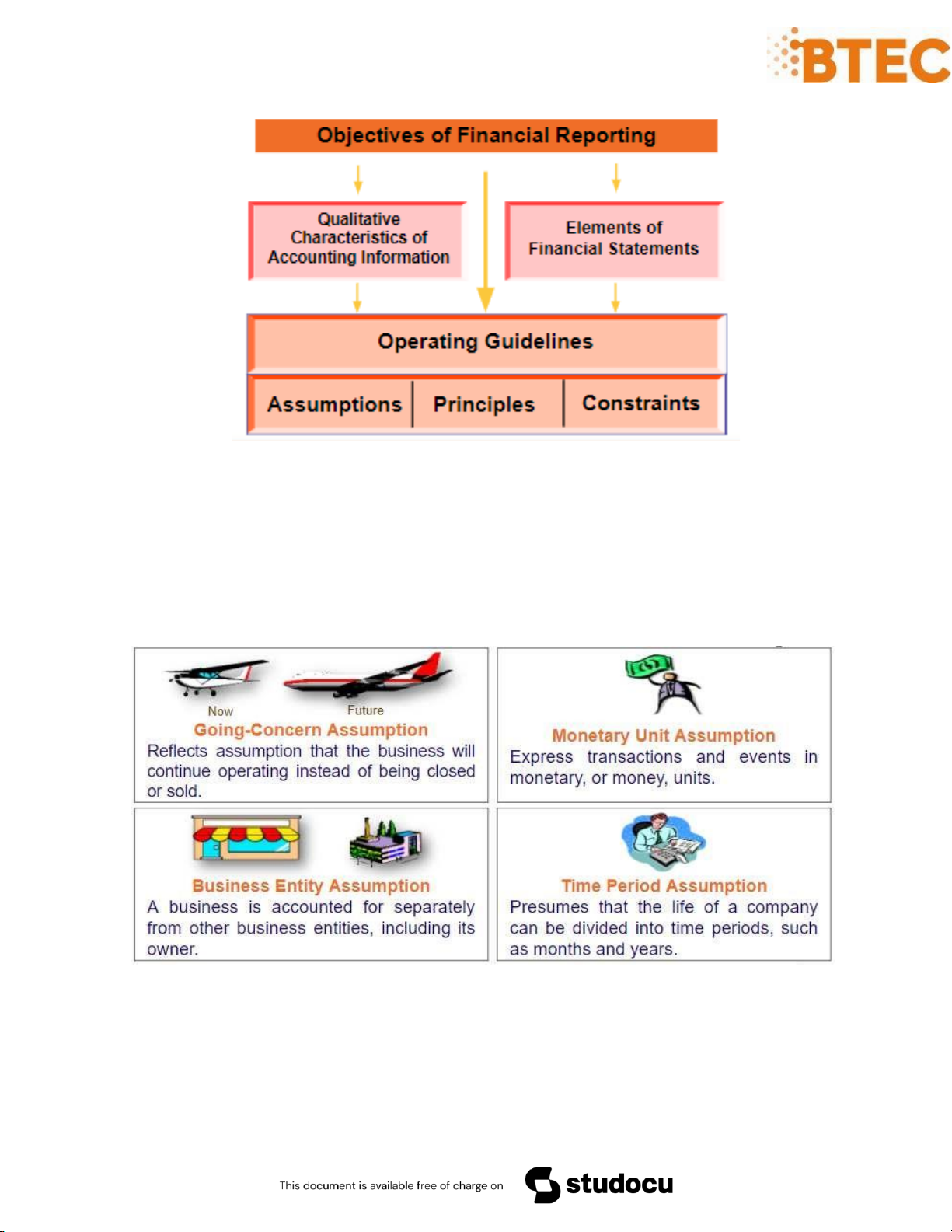

Operating guidelines are classified as assumptions, principles, and constraints.

Assumptions provide a foundation for the accounting process.

Principles indicate how transactions and other economic events should be recorded.

Constraints on the accounting process allow for a relaxation of the principles under certain circumstances. Two constraints

• Materiality relates to an item’s impact on a firm’s overall financial condition and operations.

• Conservatism dictates that when in doubt, choose the method that will be the least likely to overstate assets and income.

In conclusion, accounting is an essential part of running a business, whether big or small.

Accounting is included in those fields that are growing faster in this era. It is dynamic at the present

time and meets the growing demands of trade, commerce and industry. It is appropriate to mention

here that the advent of industrial revolution and technological advancements have given rise to

widen more business prospects at the same time as bringing about change in the domain of

accounting by which it has now begun to be known as a tool of management for planning and

controlling process. Thus, it can be rightly said, in the present day and age, no economic activity

can be carried out successfully with no thought of accounting.

Thank you for taking the time to read our blog! Reference

Investopedia. 2022. Financial Accounting. [online] Available at:

ps://www.investopedia.com/terms/f/financialaccounting.asp> [Accessed 16 June 2022].

Publisher, A., 2022. 12.1 The Role of Accounting. [online] Open.lib.umn.edu. Available at: [Accessed 19 June 2022].

Accountancyknowledge.com. 2022. Types of Accounting - Financial Accounting - Management

Accounting. [online] Available at: [Accessed 16 June 2022].

Bragg, S., 2022. Types of accounting — AccountingTools. [online] AccountingTools. Available at:

//www.accountingtools.com/articles/what-are-the-types-of-accounting.html> [Accessed 16 June 2022].

vedantu.com. 2022. Accounting As An Information System. [online] Available at:

ps://www.vedantu.com/commerce/accounting-as-an-information-system> [Accessed 20 June 2022].

Indeed Career Guide. 2022. 10 Essential Accountant Competencies That Employers Seek. [online]

Available at: ps://www.indeed.com/career-advice/career-development/accountant-

competencies> [Accessed 23 June 2022].

The Balance Careers. 2022. List of Accounting Skills With Examples. [online] Available at:

//www.thebalancecareers.com/list-of-accounting-skills-

2062348#:~:text=Accountants%20must%20be%20detail%20oriented%2C%20have%20strong%20a

nalytical,definitely%20help%20you%20land%20and%20keep%20a%20job.> [Accessed 23 June 2022].

SIDDIQUI, F., 2022. Accounting- Need and Importance - Businessandfinance Blog. [online]

Businessandfinance.expertscolumn.com. Available at: [Accessed 24 June 2022].