Preview text:

lOMoAR cPSD| 46988474

TỔNG LIÊN ĐOÀN LAO ĐỘNG VIỆT NAM

TRƯỜNG ĐẠI HỌC TÔN ĐỨC THẮNG

KHOA TÀI CHÍNH NGÂN HÀNG

BÀI NGHIÊM CỨU NHÓM

MÔN: THỰC HÀNH MÔ HÌNH TOÁN KINH TẾ ĐỀ TÀI:

PHÂN TÍCH CÁC NHÂN TỐ ẢNH HƯỞNG ĐẾN

HIỆU QUẢ TÀI CHÍNH: NGHIÊN CỨU ĐIỂN

HÌNH TẠI CÁC CÔNG TY CỔ PHẦN NGÀNH

CÔNG NGHỆ THÔNG TIN ĐƯỢC NIÊM YẾT

TRÊN SÀN CHỨNG KHOÁN VIỆT NAM

Giảng viên hướng dẫn: PHÙNG QUANG HƯNG

Lớp: MÔ HÌNH TOÁN KINH TẾ (Ca 3, Thứ ba) – Nhóm: 03

Danh sách Sinh viên thực hiện :

VÕ HOÀNG NHÂN (B19H0263)

PHAN THANH HIẾU (B19H0195)

HỒ THỊ TUYẾT ĐOAN (B19H0177)

TỪ LÊ MINH NGÂN (B19H0247) lOMoAR cPSD| 46988474

COMPANY LISTED INFORMATION TECHNOLOGY ON VIETNAM STOCK EXCHANGE ABSTRACT:

The objective of the study is to examine the factors that affect the financial performance of

the companies from which to make some suggestions for managers to improve financial

performance. The study used data from 22 companies that share the information

technology sector listed on stock exchanges in Vietnam period 2007-2018 in the field of

information technology. The research results have shown that the effectiveness main (ROA)

of companies significantly affected by the ratio of the state capital (STATE), the

management capacity (MC), firm size (SIZE), and the company's business cycle (BS). On

the other hand, the study also pointed out the positive impact (+) of ROA on the

profitability ratio on equity (ROE).

Keywords: Production cycle business, financial performance, the company shares listed

information technology industry. VITECO Telecommunications

technology (VIE) ... However, there are 1. INTRODUCTION:

companies with profits after higher taxes

Today, technology is proliferating,

or even flourished during that period. For

especially in information technology have example, Van Lang Technology

an important role in bringing a new era of

Development and Investment Joint Stock modern advanced technologies

Company (VLA), Vietnam Electronics worldwide, including Vietnam.

and Informatics Corporation (VEC), ...

Therefore, need to understand the factors

This leads to the question: What factors

affecting financial performance and this

affect the financial performance of the

will be the baggage to participate in the

market in this area, most notably as ROA,

company shares listed on the stock

ROE, MC, SIZE, STATE, BS, CR, QR,

exchange in Vietnam? If so, how many

factors? In addition, the level of impact

and DFL. Vietnam's stock market in the

period 2011-2013 continuously fluctuated like?

strongly, seriously affecting companies.

The research focused on studying the

Two factors may explain this, which is

factors that affect the financial

endogenous and exogenous in which one

performance of the listed joint-stock

of the endogenous factors is very

important that the financial performance

of companies. When analyzing the

research and data companies in the

information technology industry, we

discovered that there are companies with

negative profits after tax during 2011,

2012, and 2013. For example, the

company technical Services Joint-stock Telecommunications (TST), JSC Telecommunications (UNI), JSC 2 | P a g e lOMoAR cPSD| 46988474 lOMoAR cPSD| 46988474 4 | P a g e lOMoAR cPSD| 46988474

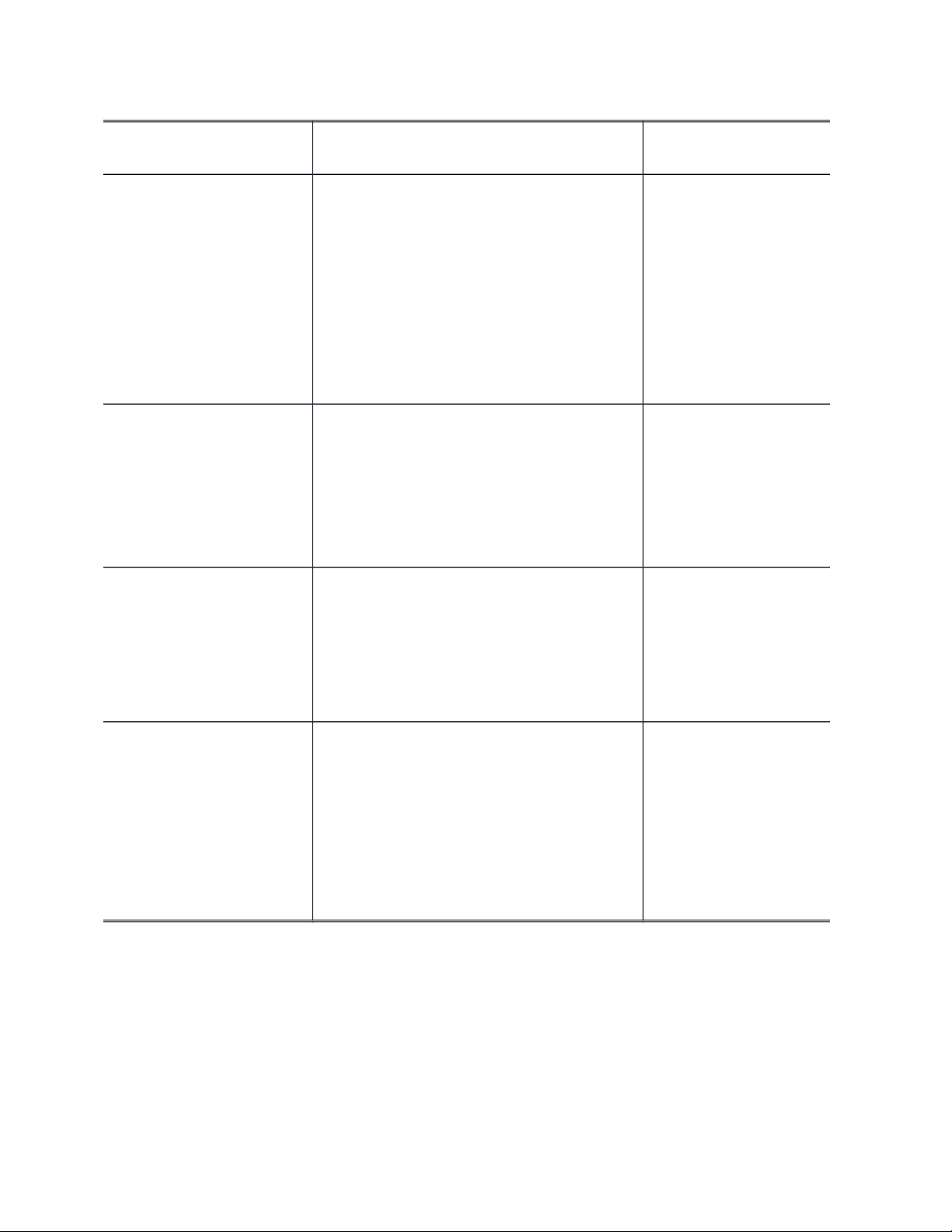

Table 0. The previous related research Author

Research method and sample Research results

Investigate the factors affecting the Factors such as the profitability and growth of size of a company

employment in the manufacturing and economic ratios Agiomirgiannakis, G.,

sector of Greece in the period from that affect the growth Voulgaris, F. and

1995 to 1999, analyzing the question of of the company in

Papadogonas, T. (2006) whether factors such as company size, particular and the

age, leverage debt, management national economy in efficiency, and export-oriented general companies If company size is too large, it can harm financial Yuqi, L. (2008) performance due to

Determinant of bank profitability poorly controlled or even corruption

Based on the disclosure of timely Factors affecting the financial Liargovas and

annual reports to confirm and modify performance of the Skandalis (2008)

their expectations about the current

economic outlook and the future of the company company Factors affecting the financial

Based on the disclosure of timely performance of

Almajali, Y.A, Alamro, annual reports to confirm and modify insurance companies

S.H. and Al-Soub, Y.Z. their expectations about the current in Jordan listed in (2012)

economic outlook and the future of the Amman Stock company Exchange

companies listed on Vietnam's stock

exchanges, more precisely Corporation

Information Technology. The team used

the method of correlation analysis and

multiple regression analysis. Strictly

capacity management, business cycle

research also indicates factors the state

strong impact on financial performance.

capital ratios, company size, ratio of lOMoAR cPSD| 46988474

Moreover, the group is strictly between

meaning of each financial indicators used the ROA and ROE depth.

in this study is what? And why they need to analyze the company shares

The layout of the study will include: information technology financial I. Introduction

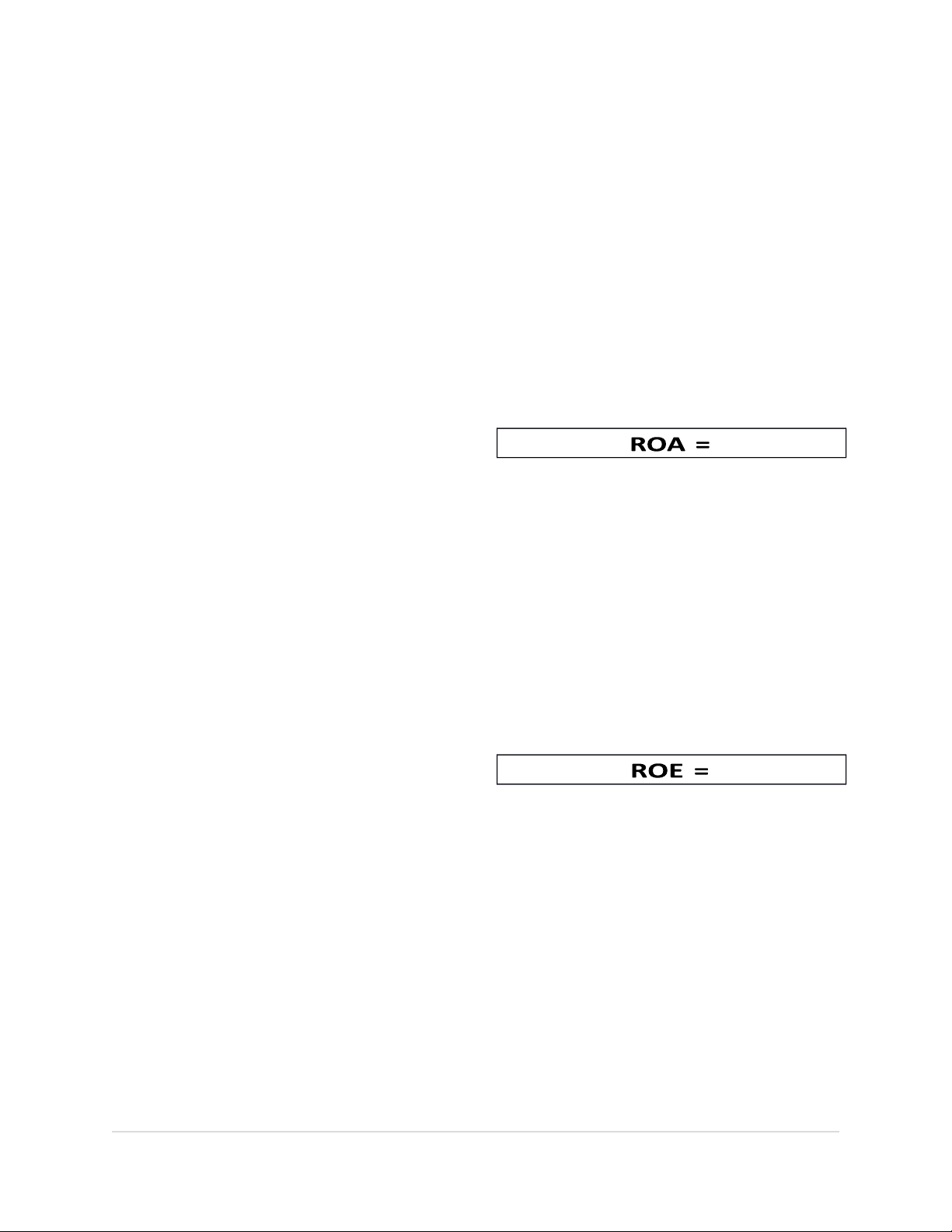

performance on the stock market. i. Return on Asset (ROA) II. Basic theory

ROA (Return on Assets) - it is the return

a. The previous related research

on assets, an indicator showing the

correlation between the profitability of a b. The concept and meaning of

company compared to its main assets.

eachfinancial indicators used in the

ROA gives to know the effectiveness of

study III. Data and research methods

the company is using assets to generate earnings. IV. Research model, research hypotheses V.

ROA shows that a business has invested Research results

how much profit on assets. The higher the

VI. Conclusions and recommendations

ROA, the use of corporate assets more VII. effectively. References ii. Return On Equity (ROE) 2. BASIC THEORY

ROE (Return On Equity) - it is the return

a. The previous related research

on equity, and return on equity also. If the

Financial performance important role for

analysis, there will be a lot of interesting

businesses in particular and the economy

information about the business results as

in general. There are many studies on

well as the financial picture of the

financial performance and the factors

business behind this indicator.

affecting it. Search gives different figures

on financial performance but the main index was ROA, ROE, MC, SIZE,

ROE shows one pile of equity which now

STATE, BS, CR, QR, and DFL, the

spent to serve activity, how much profit.

popularity index for measuring the

The higher the ROE, the use of corporate

competitiveness of the company's ROA funds as efficiently. and ROE. iii.

The size of business (SIZE) Large

Table 0. The previous related research

companies can exploit economies

b. The concept and meaning of each of scale and therefore more

financial indicators used in the study

efficient than small companies.

If the financial performance measures are The size of a business can be

a common and important concept and

evaluated based on criteria such as 6 | P a g e lOMoAR cPSD| 46988474

the total number of employees,

BS = Turnaround time inventory +

total revenue, or total assets. Turnaround time accounts receivables

Company size is calculated by total assets is measured Shorter production cycles, which

indicates how efficient the use of

Moreover, small companies may have less

machinery and production areas.

energy than large companies can because

Production cycles affect working capital

they are difficult to compete with larger

needs and the effective use of working

companies, especially in a highly

capital in production. In competitive

competitive market. On the other hand,

markets, production cycles shorter change

when companies become larger, they may

the ability of the production system as

be ineffective, leading to reduced

possible to respond to the changes. financial performance.

Moreover, trade receivables faster iv.

Management competence in an

turnaround, the company recover the debt index (MC)

faster, increasing capital turnover, reduce

Management competence in an index

costs related to accounts receivable. The

(MC) is an indicator of leadership and

dual impact of the shortened business

supervision of the management level in

cycles increases profitability. the company. vi.

Degree Of Financial Leverage (DFL)

Degree Of Financial Leverage (DFL) is a

It may include the ability to plan and

combination between liabilities and

divide the work efficiently, respond

equity in the management of the financial

quickly to solve the problem, have policy of the enterprise.

indepth knowledge and skills necessary software. DFL= v. Business cycle (BS)

Degree Of Financial Leverage is the

Business cycle (BS) is the period from

degree of use of loans in the total capital

when the raw materials are put into

of a company in the hope of increasing

production until the finished product

return on equity (ROE), or earnings per

fabrication, inspection, and storage of ordinary share (EPS).

finished products. It includes the time to vii. Quick raito (QR)

complete the work in process technology;

Quick ratio (QR) is an indicator of the

time to deliver; technical testing time;

short-term liquidity position of the

work in progress stops at work, in the

company and measures the ability to meet intermediate repository, and non-

the short-term obligations of the company production shifts. with its liquid assets. lOMoAR cPSD| 46988474

It shows the ability of the company to

business cycle (BS) Degree of Financial

immediately use assets almost his cash

Leverage (DFL) and the proportion of the

(assets that can be converted quickly into

state capital (state) and the percentage

cash) to pay the debts of your current, it is

measure the impact of factors such as

also known as the acid test ratio. solvency (QR, CR), capacity management committee (MC). viii. Current ratio (CR)

Current ratio (CR) is the ratio of liquidity

+ Advantages: it evaluates the efficiency

solvency measure short-term obligations

and performance of the company's

of the company or the obligations due

business operations, evaluates the within one year.

efficiency of the use of company

resources. The ratio of financial structure:

reflects the extent to which businesses use

It gives investors and analysts to know

to paying off debt reflects the degree of

how a company can maximize existing

financial autonomy of enterprises.

assets on the balance sheet accounting to

Moreover, it also guides the forecast and

meet its current liabilities and other

plans production and business activities, payables.

investment decisions and funding to deal 3. DATA AND RESEARCH

with the financial markets determine the risks and profits. METHODS

Research samples are 22 joint-stock

+ Disadvantages: we cannot recognize

companies in the information technology

inaccurate financial statements. The time

sector listed on stock exchanges period

element is not mentioned and is difficult

2007 - 2018. Group uses the information

to conclude the financial situation good or

gathered from the report prospectus,

bad. Moreover, the planning could not

financial reports, and information on the feasible for the business's

companies on the website of the company multidisciplinary activities.

and the site CafeF, Vietstock, cophieu68.

Besides, the group also uses statistical

The data analysis method used in the

analysis methods. Statistics is a system of

study is the ratio method. Analyzing

methods (collecting, synthesizing, and

financial ratios is the use of various

presenting data, and calculate the

techniques to analyze the financial

characteristics of the object of study) to

statements of the enterprise to grasp the

cater for the analysis, prediction, and

situation of the financial realities of the

decision making. Purpose cranes Group

business, which made plans for

was to examine the relationship between

production and business most effective the dependent variable and the

for calculating the ratios measuring the

independent variables, the paper uses the

financial performance (ROA, ROE),

statistical method described, correlation 8 | P a g e lOMoAR cPSD| 46988474 matrix, check the phenomenon

used the three most popular in autocorrelation (Durbin-Watson), assessing the financial multiple regression method and

performance of the business. In multicollinearity test.

this study, the group will mainly use ROA and ROE to assess the 4. RESEARCH MODEL AND financial performance of the RESEARCH HYPOTHESES companies that share industry

a. Research model Based on research

information technology listed on

and the reality of Vietnam, offering

Vietnam's stock by these indicators theoretical models are: may reflect how to look past, shows the operation of the

ROA = β0 + β1*STATE+ β2*CR+

enterprise business-like. Besides, β3*DFL+ β4*MC+ β5*SIZE+

these indicators also help us have a β6*BS+ β8*QR+ ε (1) look at easy ways to compare ROE = β0 + β1*ROA+ ε (2)

businesses together. Moreover, the final objective of financial ROA: Return on total assets management is to maximize the ROE: Return on equity

benefit of the owner so that after STATE: State capital ratio

examining the factors affecting the

DFL: Degree of Financial Leverage ROA, the authors examine the

MC: Management competence index impact of ROA over ROE.

SIZE: The size of the company ii. BS: Business cycle

Short-term solvency (QR & CR) To

measure the short-term solvency QR, CR: Short-term solvency

of researchers usually use the

b. Research hypotheses

current ratio (CR) and quick ratio i. Financial performance The (QR). Solvency impacts on business performance of the

financial performance in detail:

enterprise is a general economic

According to Almajali et al (2012),

indicator that reflects the level of Maleya and Muturi (2013), the use of the elements of the

solvency relationship the same production process. Business

way with financial performance.

performance is also reflected in the

But conversely, Khalifa and Zurina maneuver of the corporate

(2013) indicate solvency opposite governance between theory and

impact on financial performance.

practice to make the most of the

So the research hypothesis pair is weakness of the manufacturing given as:

process, such as machinery and

H01: Short-term solvency does not affect

equipment, raw materials, labor to financial performance

improve profitability. Overall ROS, ROA, ROE is a measure lOMoAR cPSD| 46988474 H11: Short-term solvency affects

Liargovas and Skandalis (2008), Lee financial performance

(2009), Amalendu (2010), Almajali, et al

(2012) showed the impact of firm size and iii.

Degree of Financial Leverage

efficiency finance. These studies present (DFL)

conflicting views on the relationship

Degree of Financial Leverage refers to the

between size and financial performance.

use of debt in the capital structure of the

However, the opposite view that the scale

company. The Degree of Financial

has a relationship inversely to the

Leverage is one of the important decisions

financial performance due to some

of financial managers because it is a

problems with corruption and several

double-edged sword and affects the

other reasons: operating inefficiencies

benefits and risks of the owner as well as

due to poor control. The hypothesis is

the market value of the company. Besides, given as:

many researchers consider the impact of

the degree of financial leverage on

H03: Company size does not affect

financial performance in detail: Ghosh, financial performance

Nag and Sirmans (2000), Berger and di

H13: Company size has an impact on

Patti (2006) in his study had indicated the financial performance

degree of financial leverage has a positive

impact on financial performance, but on v. Business cycle (BS)

the contrary, Gleason et al (2000),

A company's business is the period from

Simerly and Li (2000), Maleya and

when a company buys goods to when the

Muturi (2013) in his study again indicates

company sells goods and collects money.

the negative impact of the degree of

The company's business cycle shorter, financial leverage to financial

shorten the turnaround time and

performance. The hypothesis is given as:

inventory turnaround time, the accounts

H02: Degree of financial leverage has no receivable increasing

impact on financial performance

financial performance. The main reason

due to goods sold faster, less storage

H12: Degree of financial leverage has an

time, increasing sales, reducing costs of

impact on financial performance iv. The

inventory investment. Moreover, trade

size of the company (SIZE) Company size

receivables faster turnaround, the

has measured the size of total assets.

company recover the debt faster,

Enterprise-scale is one of the first criteria

increasing capital turnover, reduce costs

to the company affirmed its position in the

related to accounts receivable. The dual

sector and attract investments of

impact of the shortened business cycles

investors. Ammar et al (2003), Amato and

increases profitability. So the hypothesis Burson (2007), is given as: 10 | P a g e lOMoAR cPSD| 46988474

H04: Business cycle has no impact on

team when it satisfies at least three of the financial performance

following five conditions: (1) The

average managerial experience is 20

H14: Business has an impact on financial

years, (2 The management group holds an performance

average of 34% of the company shares, vi.

State capital ratio (STATE)

(3) Most managers in the university

The state capital ratio is measured by the

graduate group (4) Average age of

percentage of state capital in total equity.

managers in the group from 50 to 60 years

The joint-stock company listed on the

old, ( 5) All managers in the group

stock market and have long years of

undertake innovation activities - an

operation of most of the large-scale

innovation that refers to the introduction

capital mainly been equitized. So the

of new products, new production hypothesis is given as:

technologies, new market developments

or reforms of organizational structure.

H05: The ratio of state capital has no

function in the company. The hypothesis

impact on financial performance is given:

H15: The ratio of state capital has an

H07: Management competence index has

impact on financial performance vii.

no impact on financial performance

Management competence index (MC)

H17: Management competence index has

According to Timmons (1994), successful

an impact on financial performance

companies have a significant contribution

to the skills and creativity of managers. 5. RESEARCH RESULTS

Bird (1995) also pointed out that the

a. Descriptive statisticsIn Table 1,

capacity to manage a strong impact on the

the Descriptive Statistics provide data

financial performance and operational

minimum, maximum and average, the

efficiency of the company. These

standard deviation of the independent successful companies are those

variables and the dependent variable of 22

companies that have managers capable of

companies share industry information

"core" - the ability to combine the

technology on the Stock Exchange in the

knowledge, experience, expertise, and

period 2007 to 2018, with observation is

skills to the executive management team

80. production and business cycle (BS),

to achieve the objectives of Co. (Coyne,

an average of about 309 days. The short-

Hall and Clifford, 1997). According to

term solvency of the company average

MaMerikas et al. (2006), “professionals”

(CR) is about 2.79 times. Degree of

are managers who meet the following two

financial leverage (DFL) average 0.42

criteria: (1) Have a university degree and

times. The ratio of management capacity

(2) Direct management or be part of the

(MC) averaged about 1,261 billion VND.

management team. (management team).

Quick ratio averaging time is 2:04. Rate

According to Liargovas and Skandalis

of Return on total assets (ROA) 3.8%

(2008), a company has a management

average in 12 years and the profitability lOMoAR cPSD| 46988474

ratio on average equity 7.2%. The average

company size (SIZE) is about 552,354

billion VND. The proportion of state

ownership (STATE) average about 12.5%.

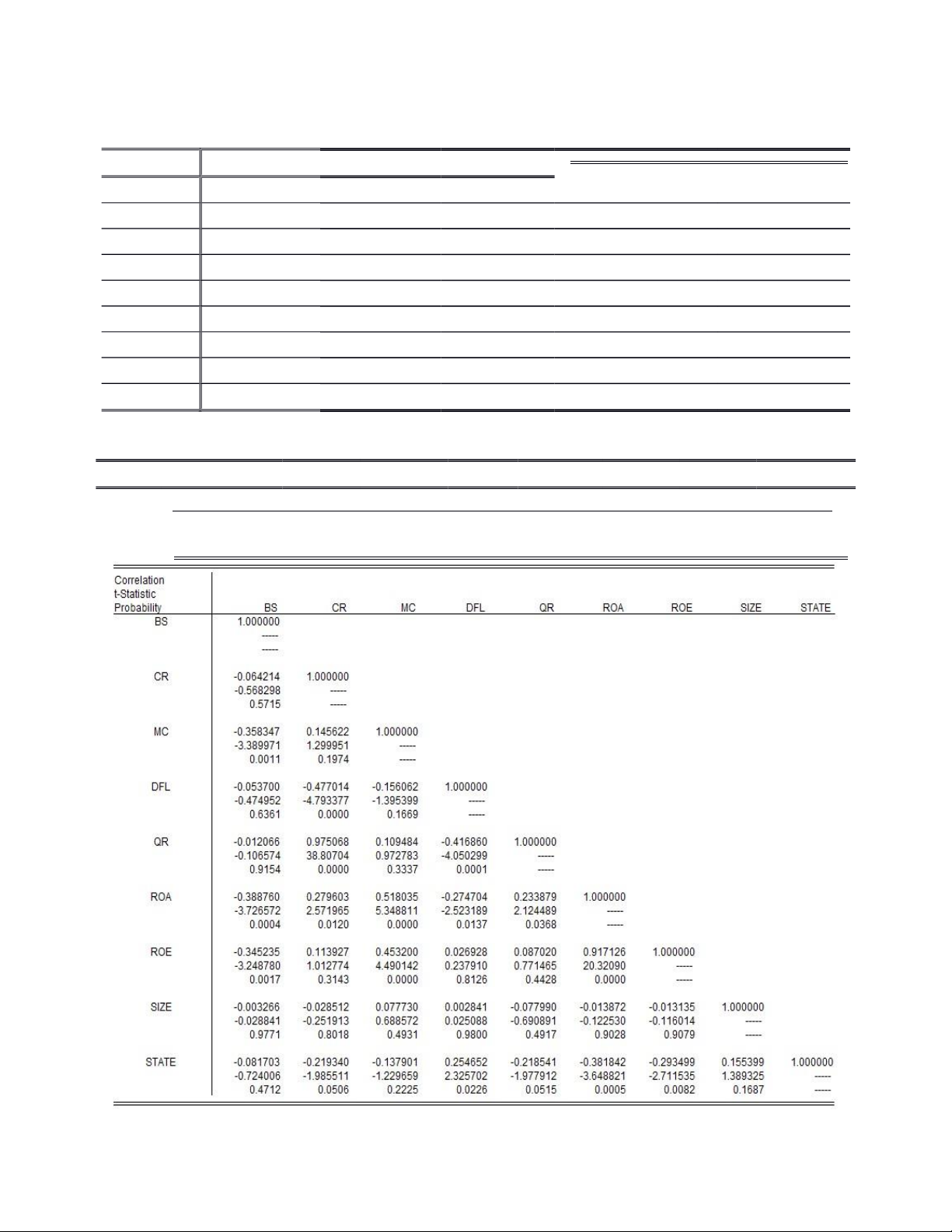

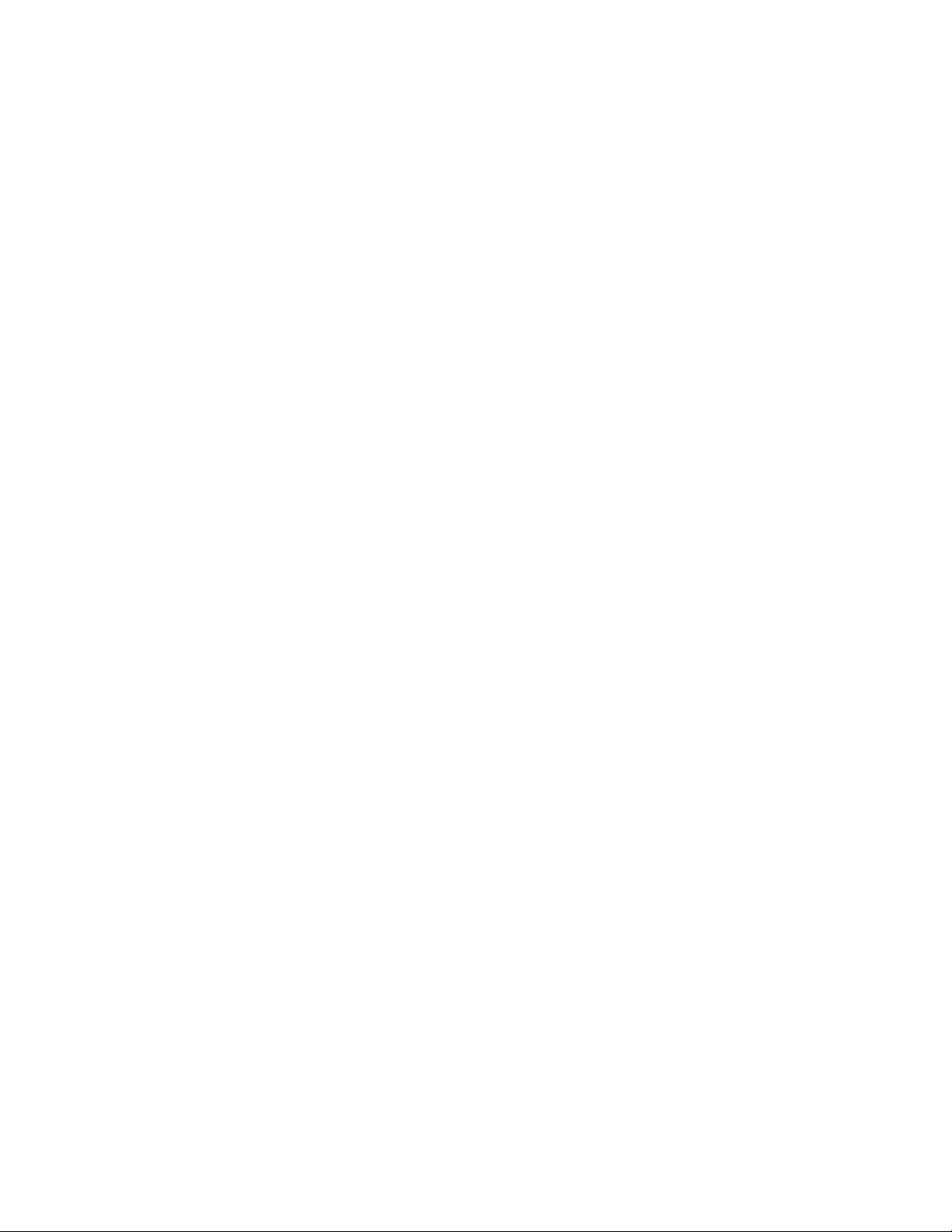

b. Check correlationIn Table 2, the

variables include the production and

business cycles (BS), ratio management

capacity (MC) have a significant impact

on the financial performance ROA. MC

impact the same way with financial

efficiency, while BS opposite impact financial performance. 12 | P a g e lOMoAR cPSD| 46988474

Table 1. Descriptive Statistics variables Mean

Minimum Maximum Std. Deviation Observation BS 308.275 47.647 1243.352 212.482 80 CR 2.790 1.148 25.688 3.303 80 DFL 0.424 0.007 0.861 0.221 80 MC 1.261 -5.838 9.037 2.233 80 QR 2.038 0.512 17.425 2.526 80 ROA 0.038 -0.121 0.193 0.056 80 ROE 0.072 -0.309 0.324 0.099 80 SIZE 552.354 70.336 2983.032 688.897 80 STATE 0.125 0 0.590 0.155 80

Table 2. Matrix correlation between ROA and the independent variables BS CR QR DFL MC SIZE STATE Correlation -0.388 0.279 0.234 -0.274 0.518 -0.013 -0.293 ROA Probability 0.000 0.012 0.036 0.013 0.000 0.907 0.008 lOMoAR cPSD| 46988474

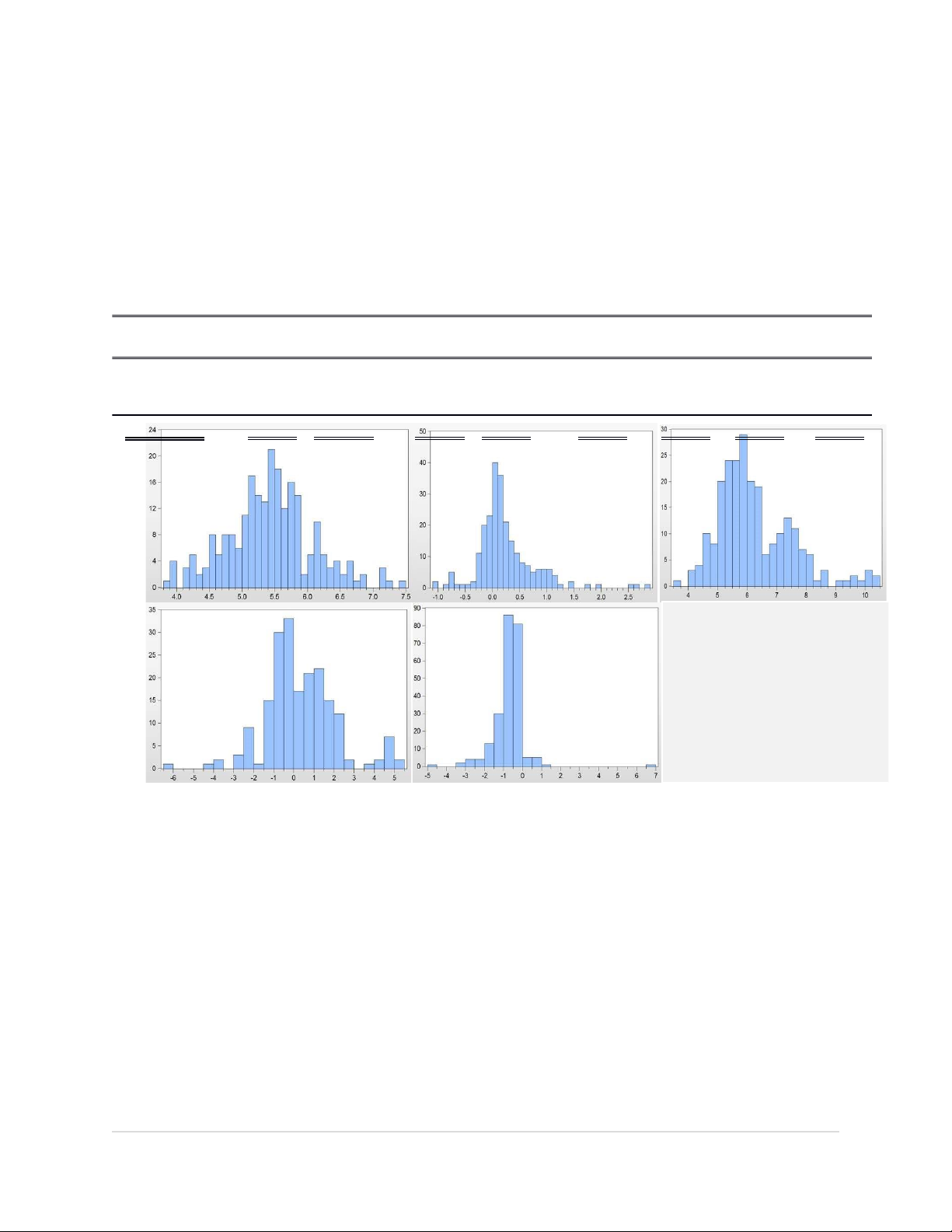

c. Test of the standard distribution To

variation from 1,165 VIF to 4114 to

estimate the linear regression to consider

model the phenomenon of no multi-

the variables have normal distribution or

collinearity between the independent

not. Initially, when examining several variables.

variables such as DFL, SIZE, MC, BS,

QR are not normally distributed variables

e. Check autocorrelation To examine

so the group moved into the natural

the serious autocorrelation often used at

Table 3. Check the normal distribution STATE CR

LNDFL ROA LNSIZE LNMC LNBS LNQR Skewnes 1.030 s 5.218 -1.998 1.302 0.779 -0.433 -0.428 1.771 Kurtosis 3.261 32.637 8.853 3.656 3.233 2.801 2.497 7.282 LNBS LNQR LNSIZE LNMC LNDFL VARIABLES HAVE CONVERTED TO NATURAL LOGA FUNCTION

logarithm function. After using this

the Durbin-Watson test, if the coefficient

method, it is almost all the variables was

of Durbin-Waston in the region from 1 to

transformed into a normal distribution

3 there will be no selfcorrelation

with the data in Table 3 is located.

phenomenon. Through Durbin-Watson test data on Eview8

multi-collinear when the VIF ratio greater

than 10. In Table 4, the coefficient of

d. Multi-collinearity test

Collinearity Statistics. The independent

Regression analysis to correlate the first

variables will have the phenomenon of

group will examine the phenomenon of

software with D = 1.582 (Table 5), the multi-collinear with model has no autocorrelation expertise phenomenon.

Table 4. Verification of multi-collinearity phenomenon 2 | P a g e lOMoAR cPSD| 46988474 STATE CR LNDFL LNSIZE LNMC LNBS LNQR 15 | P a g e VIF 1.165 3.552 2.729 1.866 2.893 2.037 4.114

Table 5. Test of Anova and Durbin-Watson R-squared 0.763673 Adjusted R-squared 0.736554

collinearity test team used multiple S.E of regression 0.024897

regression analysis to examine the Sum squared resid

relationship between the dependent 0.037812 Log likelihood

variable and independent variables. 161.1615 (Table 6) F-statistic 28.15958 Prob(F-statistic) 0.000000

f. Multiple Regression i.

Inspection of the suitability of the model ROA

We have R-Square = 0.763 (Table 5) is the

mean of independent variables was 76.3%

which explains the change of financial performance. Besides, through accreditation A-nova on the

appropriateness of the model and may

find this model perfectly suited to

consider the impact of the independent

variables to effectively finance at (Pvalue = 4.72% <5%). ii.

A multiple regression model of

ROA and explain its meaning

After checking the normal distribution,

the autocorrelation test and multi- Mean dependent var 0.047279 S.D. dependent var 0.048507 Akaike info criterion - 4.439463 Schwarz criterion - 4.180436 Hanna-Quinn criter - 4.336699 Durbin-Waston stat 1.582219 lOMoAR cPSD| 46988474

- State capital ratio (STATE): P- Therefore, the state invested

value = 1.94% <5% can reject

the greater the profit achieved the hypothesis H0 or the rate at low levels.

of state capital has an impact on financial performance and - Management Competency

has a negative impact (-) at a Ratio 5% significance level.

(LnMC): P-value is very small and less Companies with large-scale

than 5% which means is enough to reject state capital will have solid

the hypothesis H0 or the ratio of the

financial resources, scale, and

capacity of the management of the

the protection of the state of

company has an impact on performance. the outputs. In addition, for

finance. On the other hand, the ratio of the companies in the sector

capacity of the Management Board with

Table 6. The multiple regression model of ROA Variable Coefficient Std. Error t-Statistic Prob. C 0.267 0.033 7.957 0.0000 STATE -0.054 0.022 -2.401 0.0194 CR -0.003 0.002 -1.592 0.1166 LNDFL -0.008 0.006 -1.407 0.1644 LNMC 0.028 0.004 7.227 0.0000 LNSIZE -0.026 0.005 -5.576 0.0000 LNBS -0.011 0.005 -2.100 0.0399 LNQR 0.006 0.009 -1.592 0.5658

ROA = 0.267 – 0.054*STATE – 0.003*CR – 0.008*LNDFL + 0.028*LNMC –

0.026*LNSIZE – 0.011*LNBS + 0.006*LNQR

telematics with the proportion

effect positive (+) to the financial

of equity capital high state will

performance, is consistent with severe have products and services to

early work of Timmons (1994), Bird the public post for mutual

(1995), Liargovas and Skandalis (2008), interest leads to profits is

Almajali et al (2012), ... with companies maximized. Moreover,

in the field of information technology companies with state capital

leaders needed a deep understanding of

have been high, the profits also

technology and creativity they needed for

belong to the state, businesses

work, only some very needed in this field. and just enjoy a fixed rate. 4 | P a g e lOMoAR cPSD| 46988474 - Company size (LnSIZE): the

Thus, this is fully consistent size of thecompany p-value

with the theory. For companies <5%, company size has a in the fields of information significant impact on the technology to manage two financial performance of the types of mobile assets company and the impact (inventories and trade counterclockwise (-) for

receivables) faster turnaround effectiveness main. This is will help companies shorten consistent with the serious the production cycle of research on the relationship business because of business between the size of Ammar et in this area, there are many al (2003), Amato and Burson electronic devices very fast

(2007), Lee (2009), ... indicate depreciation should shorten the financial performance the production cycle of decreases as firm size business. Since then, the

increases. When the size of the company will save the company is enhanced, the investment costs and the cost control process becomes of inventories, trade

Table 7. Simple regression between ROE and ROA Variable Coefficient Std. Error t-Statistic Prob. C 0.011 0.004 2.273 0.0239 27.858 R-squared 0.766819

ROE = 0.011 + 2.085 * RO A ROA 2.085 0.075 0.0000 17 | P a g e complex, difficult to manage, receivables management, and this leads to corruption and increase profits. some other reasons. For the field of information iii.

Regression model ROE and ROA technology, while increasing

In Table 7, a significant impact the size of the company, the

ROA ROE (return rate of equity personnel should raise the

and earnings per share) with p- level to adapt to the new

value <5%. Besides, Rsquared is equipment and software. meant 0767 was 76.7% ROA explains the change in ROE. - Business production cycle

Moreover, we can see the positive (LnBS): Thisindex has a

impact of ROA (+) with ROE. As negative impact (-) on a result, an increase in ROA financial performance and is increases ROE.

statistically significant at 5%. lOMoAR cPSD| 46988474 6. CONCLUSIONS AND 7. REFERENCES RECOMMENDATIONS

managing inventory and customer

Research by the group has shown that

receivables more efficiently, it will reduce

STATE, MC, SIZE, BS have a significant

the turnaround time of two types of assets.

impact on financial performance. In it,

Moreover, to improve the financial

STATE, SIZE, BS harms financial

performance of the company should focus performance or companies sector on increasing the capacity of

information technology wants to increase

management. Besides, serious also found

financial efficiency need to shorten the

no relationship in the same direction

production cycle of business by

between the ROA and ROE, to increase

the profitability ratio of equity companies

should adopt strategies to increase their

ability to generate profits of assets.

Agiomirgiannakis, G., Voulgaris, F. And Papadogonas, T. (2006), ‘Financial factors

affecting profitability and employment growth: the case of Greek manufacturing’,

Int. J. Financial Services Management, Issue 1, volume 2/3, pages 232 - 242.

Amalendu, Bhunia (2010), ‘Financial Performance of Indian Pharmaceutical Industry:

A Case Study’, Asian Journal of Management Research, Issue 1, volume 2, page 427-451.

Ammar, A., Hanna, A.S., Nordheim, E.V. andRussell, J.S. (2003), ‘Indicator Variables

Model of Firm's Size-Prof- itability Relationship of Electrical Contractors Using

Financial and Economic Data’, Journal of Construction Engineering and

Management, No. 129, page 192-197.

Amato, L.H. and Burson, T.E. (2007), ‘The effects of firm size on profit rates in the

financial services’, Journal of Economics and Economic Education Research, Issue 8, volume 1, page 67-81.

Almajali, Y.A, Alamro, S.H. and Al-Soub, Y.Z. (2012), 'Factors Affecting the Financial

Performance of Listed Companies at Amman Jordanian Insurance Stock Exchange',

Journal of Management Research, Issue 4, Volume 2, page 226- 289.

Berger, A. N and di Patti, E.B (2006), ‘Capital Structure and Financial performance: A

New Approach to Testing Agency Theory and an Application to the Banking

Industry’, Journal of Banking and Finance, No. 30, page 1065-1102

Bird, B. (1995), ‘Toward a theory of entrepreneurial competency.’ In J.A.Katz (ed)

Advances in Entrepreneurship, Firm Emerence, and Growth, Greenwich, CT: JAI Press 2, page 52–72. 6 | P a g e lOMoAR cPSD| 46988474

Coyne, K.P., Hall, J.D. and Clifford, P.G. (1997), ‘Is your Core Competence a Mirage?’,

The McKinsey Quarterly, Issue 1, Page 40-45.

Ghosh, C., Nag, R., and Sirmans, C. (2000), ‘The pricing of seasoned equity offerings:

Evidence from REITs’, Real Estate Economics, Issue 28, page 363-384.

Gleason, K., Mathur, L. and Mathur, I. (2000), ‘The interrelationship between culture,

capital structure, and perfor- mance: Evidence from European retailers’, Journal of

Business Research, Issue 50, page 185-191.

Hart, S. L. and Ahuja, G. (1996), ‘Does it pay to be green? An empirical examination of

the relationship between emission reduction and firm performance’, Business

Strategy and the Environment, Issue 5, page 30-37.

Khalifa, M.K. and Zurina, S. (2013), ‘Financial Performance and Identify Affecting

Factors in this Performance of Nonoil Manufacturing Companies Listed on Libyan

Stock Market (LSM)’, European Journal of Business and Management, Issue 5, Volume 12, page 82-89.

Konar, S. and Cohen, M. A. (2001), ‘Does the Market Value Environmental

Performance?’, Review of Economics and Statistics, Issue 83, Volume 2, page 281- 309.

Russo, M.V. and Fouts, P.A. (1997), ‘A resource-based perspective on corporate

environmental performance and profitability’, Academy of Management Journal,

Issue 40, Volume 3, page 534–559.

Liargovas, P. and Skandalis, K. (2008), ‘Factor affecting firms’ financial performance:

The Case of Greece’, American Economic Review, Issue 48 page 261-297.

Lee, J. (2009), ‘Does Size Matter in Firm Performance? Evidence from US Public

Firms’, Int. J. of the Economics of Business’, Issue 16, Volume 2, page 189-203.

McGuire, J. B., Sundgren, A. and Schneeweis, T. (1988), ‘Corporate social

responsibility and firm financial performance’, Academy of Management Journal,

Issue 31, Volume 4, page 854- 872.

Maleya, M.O. and Muturi, W. (2013), ‘Factors Affecting the Financial Performance of

Listed Companies at the Nairobi Securities Exchange in Kenya’, Research Journal

of Finance and Accounting, Issue 4, Volume 15, page 99-104.

Tarawneh, M. (2006), ‘A Comparison of Financial Performance in the Banking Sector:

Some Evidence from Omani Commercial Banks’, International Research Journal of

Finance and Economics, Issue 3, page 103-112. lOMoAR cPSD| 46988474

Simerly, R. andLi, M. (2000), ‘Environmental dynamism, financial leverage and

performance: A theoretical integration and an empirical test’, Strategic

Management Journal, Vol. 21, volume 1, page 31-49.

Stanwick, S. andStanwick, P. (2000), ‘The relationship between environmental

disclosures and financialperformance: An empirical study of the US corporation ',

Eco-Management and Auditing, No. 7, page 155-164.

Timmons, J.A. (1994), New Venture Creation: Entrepreneurship for the 21st Century,

4th edition. Irwin Press, Chica- go.

Yuqi, L. (2008), ‘Determinants of Banks’ Profitability and Its Implication on Risk

Management Practices: Panel Evidence from the UK ', PhD Thesis, The University of Nottingham, UK.

Yuqi, L. (2008), 'The determinants of bank returns' and its implications for risk

management practices: Council evidence from UK', University of Nottingham, UK 8 | P a g e