Preview text:

lOMoAR cPSD| 46831624

Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand 201 Chapter 34

The Influence of Monetary and

Fiscal Policy on Aggregate Demand 1.

The opportunity cost of holding money is the

a. dollar cost necessary to change other assets into money.

b. time cost of accessing funds.

c. value of the goods and services a person is able to obtain with the money.

d. interest a person could have earned by holding other forms of wealth instead. 2.

Which of the following is the opportunity cost of money?

a. money being a means of payment

b. the trouble of having to get money out of the bank

c. the interest forgone by holding money

d. the ability to purchase things at a moment’s notice 3. When the interest rate falls,

a. the opportunity cost of holding money rises.

b. people shift out of holding interest-yielding assets and into holding more liquid forms of money.

c. the quantity of money people will hold decreases.

d. investment spending decreases. 4.

The equilibrium interest rate occurs in the money market where the

a. quantity of money available is zero.

b. the maximum quantity of funds has been borrowed and loaned.

c. the money supply is equal to the money demand.

d. the quantity of money demanded is zero. 5.

As the price level increases, the money demand curve will lOMoAR cPSD| 46831624

202 Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand a. shift to the left. b. become steeper. c. stay in the same position. d. shift to the right. 6.

The money supply curve is vertical because

a. real income does not influence the quantity of money supplied.

b. the price level does not influence the level of spending.

c. only the interest rate influences the quantity of money supplied.

d. the Federal Reserve sets the money supply. 7. The federal funds rate is the

a. federally mandated upper limit on credit card interest rates.

b. interest rate that banks charge to their most preferred clients.

c. interest rate that the Fed charges member banks for loans of reserves.

d. interest rate that banks charge for lending their excess reserves to other banks. 8.

When the Fed increases the money supply, the interest rate

a. rises and spending increases.

b. rises and spending decreases.

c. falls and spending increases lOMoAR cPSD| 46831624

Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand 203

d. falls and spending decreases. 9.

In the short-run macro model, an open-market purchase of bonds by the Fed will

a. raise the interest rate, reduce spending, and increase output.

b. raise the interest rate, reduce spending, and decrease output.

c. lower the interest rate, reduce spending, and decrease output.

d. lower the interest rate, increase spending, and increase output.

10. Open market sales of bonds by the Federal Reserve reduce the money supply and

a. reduce aggregate expenditures.

b. increase real aggregate expenditures.

c. are helpful in monetizing the federal debt.

d. stimulate purchases of consumer durables.

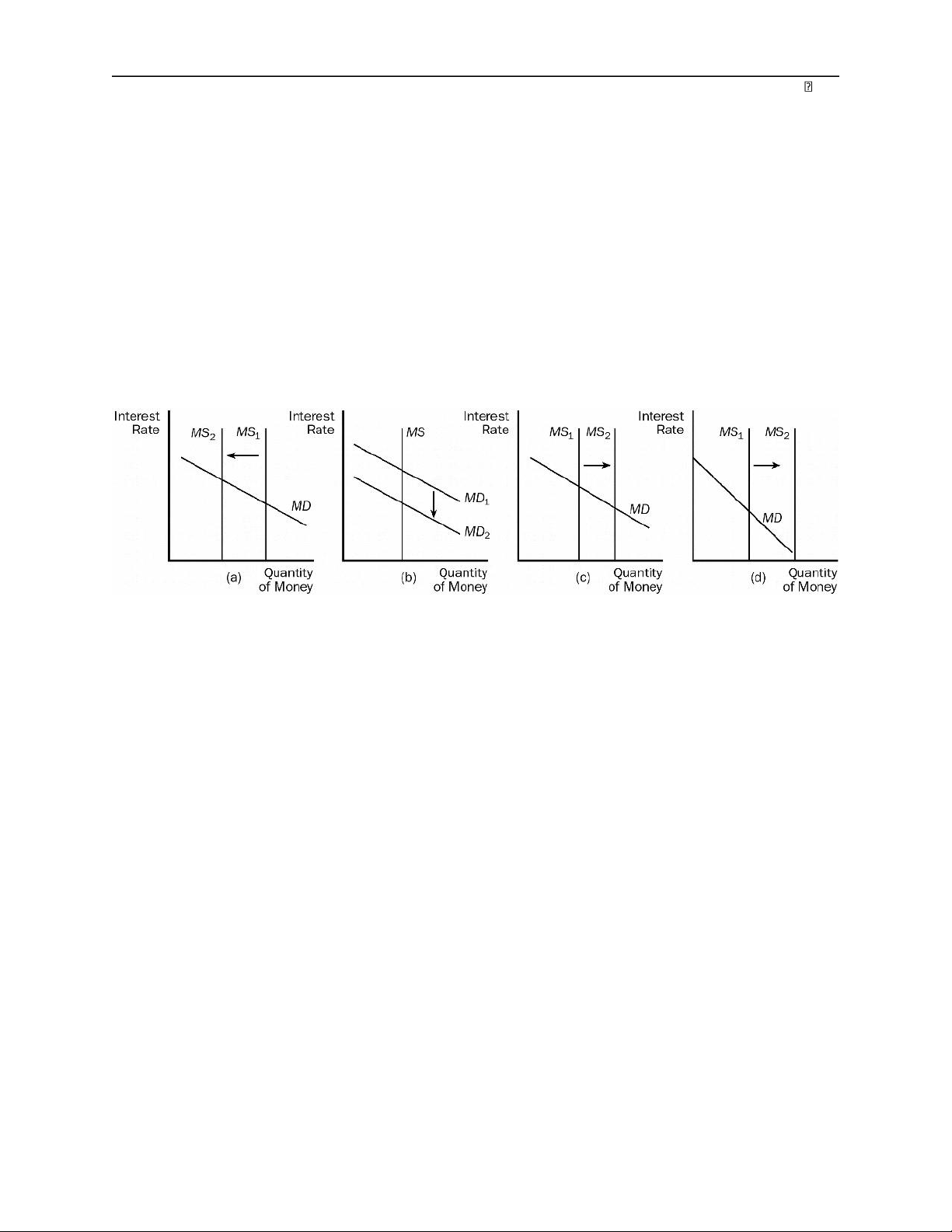

11. Which of these diagrams describes an open market sale by the Fed? a. a b. b c. c d. d

12. __________ is the use of government expenditures and taxes to promote full employment, stable prices,

and economic growth. a. Monetary policy b. Incomes policy c. Stabilization policy d. Fiscal policy lOMoAR cPSD| 46831624

204 Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand

13. The marginal propensity to consume (MPC) is

a. the change in consumption divided by the change in disposable income.

b. total consumption divided by total disposable income.

c. the change in disposable income divided by the change in consumption.

d. total disposable income divided by total consumption.

14. Use this table to determine the MPC. Disposable Consumption Income Spending ( $ billions) ($ billions) 0 $ 100 $200 280 $400 460 $600 640 a. 0 b. .8 c. .9 d. 1.0 15. The multiplier effect

a. tells us that a change in government spending changes equilibrium GDP by more than the change in government spending. lOMoAR cPSD| 46831624

Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand 205

b. works only for increases in investment.

c. is relevant only in situations where the MPC cannot be determined.

d. tells us whether a change in government policy has been effective.

16. If the marginal propensity to consume is .5, what is the value of the multiplier?a. 1.0 b. 1.5 c. 2.0 d. .5

17. If government spending decreases by $500 billion and if MPC = .6,

a. equilibrium GDP will rise by $1,250 billion.

b. equilibrium GDP will fall by $500 billion.

c. equilibrium GDP will fall by $1,250 billion.

d. nothing will happen in the short run, but real output will rise by $500 billion in the long run.

18. The crowding-out effect occurs when increased government expenditures and the subsequent budget deficits cause

a. the money supply to increase, which curtails loans to consumers.

b. interest rates to increase, which reduces investment spending.

c. inflation, which erodes the purchasing power of the dollar.

d. the imports of goods and services to rise, and exports to decline.

19. Which of the following is not true for the crowding-out effect?

a. Federal budget deficits increase interest rates, which reduces investment spending.

b. Crowding out reduces the ability of fiscal policy to combat a recession. lOMoAR cPSD| 46831624

206 Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand

c. If the government spends more on education, ceteris paribus, households may be forced to spend less on new homes.

d. Crowding out occurs especially when the economy is in a deep recession and people are not spending

all the available money.

20. When George W. Bush was elected, he promised sweeping decreases in income tax rates for households. His

idea with this plan was that the a. tax cuts would lead to increased savings.

b. tax cuts would stimulate household spending, even though they might cause minimal increases in interest rates.

c. tax cuts would stimulate household spending and at the same time lower interest rates.

d. long-run aggregate supply curve would remain fixed while the aggregate demand curve and interest rates increased. .

21. The Employment Act of 1946 provided that

a. the Federal Reserve should use monetary policy to stabilize the economy.

b. the Federal Deposit Insurance Corporation should insure bank deposits.

c. the federal government should use its spending and taxation powers to stabilize the economy.

d. state and local governments should regulate wages and employment in the electric and natural gas industries.

22. If the federal government announces a tax cut, which of the following is most likely in the short run?

a. a decrease in output, an increase in money demand, and an increase in the interest rate

b. an increase in output, a decrease in money demand, and a decrease in the interest rate

c. a decrease in output, a decrease in money demand, and a decrease in the interest rate

d. an increase in output, an increase in money demand, and an increase in theinterest rate

23. Government spending on infrastructure

a. increases aggregate demand but not aggregate supply.

b. increases productivity of private business firms and hence aggregate supply.

c. cannot affect aggregate demand because the money does not go to households.

d. shifts the long-run aggregate supply curve to the left.

24. The automatic fiscal stabilizers include all of the following except

a. corporate income taxes. lOMoAR cPSD| 46831624

Chapter 34/The Influence of Monetary and Fiscal Policy on Aggregate Demand 207

b. unemployment insurance benefits.

c. the prime interest rate. d. food stamps.

25. Unlike discretionary fiscal policy, automatic stabilizers consist of

a. deliberate changes in government spending to counteract recession and inflation.

b. deliberate changes in household taxes to counteract recession and inflation.

c. deliberate changes in corporation income taxes to counteract recession and inflation.

d. changes in government spending and tax revenues that occur automaticallyas the economy fluctuates.