Preview text:

lOMoAR cPSD| 46831624 Chapter

The Short-Run Tradeoff between Inflation

and Unemployment 1.

Most macroeconomists agree that the fundamental issues facing an economy are

a. unemployment and inflation, and what should be done about them.

b. the economy’s long-run equilibrium position and how to get there.

c. the quantity of money and its velocity.

d. the long-run Phillips curve and the Laffer curve and whether they generate conflicting outcomes. 2.

One explanation that economists offer to explain why a decline in the

unemployment rate can raise the rate of inflation is that

a. firms will be put in a position of competing more intensely for scarce resources.

b. people will pay higher prices because competition among the suppliers—the firms—intensifies.

c. workers will focus more directly on protecting their jobs.

d. firms will refuse to shift higher labor costs along to consumers for fear of losing their markets. 3.

The short-run Phillips Curve is drawn on the assumption that

a. technology does not affect output in the short run.

b. the skill level of the workforce does not affect output in the short run.

c. prices and wages are sticky in the short run.

d. All of the above are correct. 4.

The Phillips curve traces a set of combinations of rates of a. interest and unemployment. b. real GDP and inflation. c. real GDP and interest.

d. unemployment and inflation. 5.

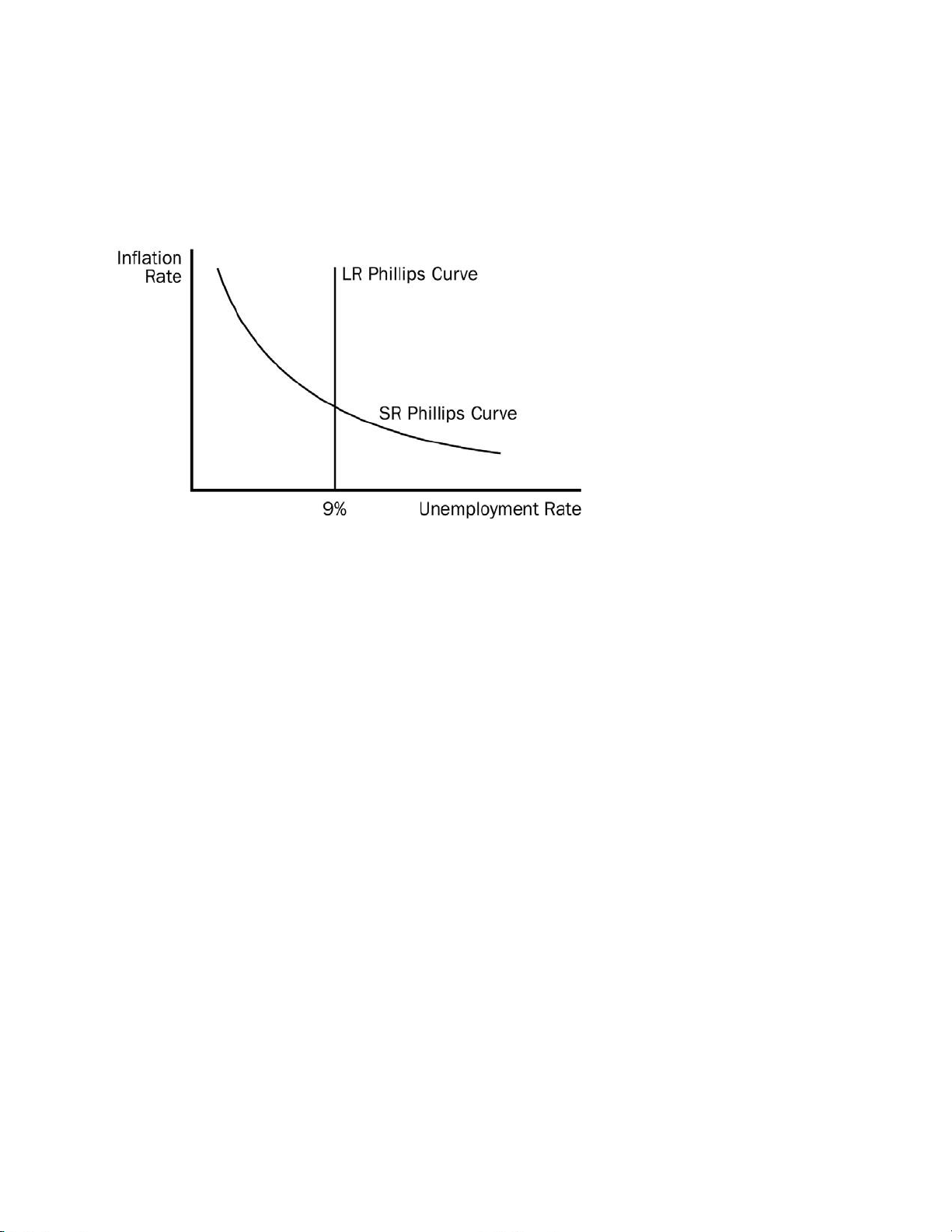

Suppose that the government in the economy of this diagram regards 9 percent

unemployment as unacceptable. If the government insists on reducing the

unemployment rate from 9 percent to 7 percent, regardless of the consequences, then

a. pressure will build in the economy to continuously reduce the rate of inflation.

b. the long-run Phillips curve becomes horizontal, freezing the rates of inflation and unemployment.

c. the inflation rate will increase but the unemployment rate will stay at 7 percent. lOMoAR cPSD| 46831624 207

d. in the long run the rate of unemployment remains unchanged, but inflation will likely accelerate. 6.

Suppose the federal government decreases tax rates dramatically in order to

decrease the level of employment. We would expect to see aggregate demand shift to the

a. left and a move up the Phillips curve.

b. left and a move down the Phillips curve.

c. right and a move up the Phillips curve.

d. right and a move down the Phillips curve. 7.

If the economy were left on its own without the interference of government or the

Fed, it would move toward an equilibrium rate of growth that would produce,

with only minor interruptions, the natural rate of unemployment without changes

in the inflation rate. What economists would support this view? a. Friedman and Phelps. b. Phillips. c. Samuelson and Solow. d. Greenspan. 8.

The tradeoffs between rates of employment and inflation during the 1970s and

1980s forced economists to reassess their earlier beliefs about the Phillips curve to conclude that

a. the Phillips curve was upward sloping, not downward sloping as first thought.

b. rather than there being one Phillips curve, there is a set of such curves.

c. the expected trade-offs did not occur, meaning that policy to lower

unemployment rates would not cause inflation.

d. the aggregate supply curve actually sloped downward because price levels fell when real GDP rose. lOMoAR cPSD| 46831624 9.

When an economy is at full employment, this means

a. the unemployment rate is zero.

b. unemployment is at its natural rate.

c. frictional unemployment is zero.

d. job creation equals job destruction.

10. The long-run Phillips curve is vertical at a. zero unemployment.

b. zero frictional unemployment.

c. the natural rate of unemployment.

d. the natural rate of inflation.

11. We would be most likely to experience a shift from one Phillips curve to another if the government attempts to

a. reduce the unemployment rate, and workers, fearing inflation, react by bargaining for higher wages.

b. reduce the unemployment rate, and consumers, fearing higher taxes, cut their spending.

c. reduce the unemployment rate and firms hire more employees without having to raise wage rates.

d. reduce the unemployment rate and the inflation rate simultaneously.

12. As prices adjust to a change in economic conditions, the

a. aggregate demand curve becomes horizontal.

b. aggregate demand curve becomes vertical.

c. Phillips curve and the aggregate supply curves become vertical.

d. Phillips curve and the aggregate supply curves become horizontal.

13. According to Friedman and Phelps, the unemployment rate is equal to

a. (the natural rate) (the expected inflation rate).

b. (the natural rate) – (the expected inflation rate).

c. (the expected inflation rate) + (the actual inflation rate).

d. (the natural rate) – (the actual inflation rate – the expected inflation rate).

14. An increase in expected inflation will shift

a. both the short-run and the long-run Phillips curves to the right.

b. only the short-run Phillips curve to the right.

c. only the long-run Phillips curve to the right.

d. the short-run Phillips curve to the right and increase the slope of the long-run Phillips curve.

15. If people expect less inflation in the future, then the

a. long-run Phillips curve will become steeper. lOMoAR cPSD| 46831624

b. long-run Phillips curve will become flatter.

c. short-run Phillips curve will become steeper.

d. short-run Phillips curve will shift down and to the left.

16. A movement along a short-run Phillips curve holds which of the following constants? a. the level of GDP b. actual inflation c. expected inflation d. employment

17. An increase in worker productivity brought about by the introduction of new

technology into the workplace will

a. shift the long-run Phillips curve to the left.

b. shift the long-run Phillips curve to the right.

c. decrease aggregate demand, since workers will lose their jobs.

d. cause the aggregate demand curve to become horizontal.

18. Which of the following will reduce the price level and increase real output in the long run?

a. an increase in the money supply b. an increase in wage rates

c. a decrease in the money supply d. technical progress

19. The natural rate hypothesis argues that

a. inflation eventually returns to its natural rate, regardless of the rate of unemployment.

b. the inflation rate and the unemployment rate always return to their natural levels.

c. inflation will increase at a natural rate, regardless of monetary policy.

d. unemployment eventually returns to its natural rate, regardless of the rate of inflation.

20. Suppose that an economy is currently experiencing 10 percent unemployment and

15 percent inflation. If in the process of bringing inflation down by 2 percent real

GDP falls by 4 percent, the sacrifice ratio is a. 5 percent. b. 2 percent. c. 12 percent.

d. None of the above are correct.

21. To bring inflation down, an economy must sacrifice lOMoAR cPSD| 46831624 a. real GDP. b. exports.

c. employment for some people. d. Both a and c are correct.

22. Which of the following would tend to shorten recessions associated with anti

inflation policies of the Federal Reserve?

a. People adjust their expectations of inflation slowly.

b. People believe policy announcements made by Fed officials.

c. The short-run Phillips curve does not shift immediately.

d. All of the above are correct.

23. The largest recession in the United States since the Great Depression occurred

a. after the Vietnam War ended in 1975.

b. after President Carter imposed credit controls on the economy in 1980.

c. after Paul Volcker reduced the growth rate of the money supply in 1981.

d. when consumer confidence fell in 1990.

24. According to the theory of rational expectations,

a. workers’ experience tells them that government action to lower

unemployment will not affect inflation.

b. consumers and investors generally behave so that rationally formed

government attempts to stimulate aggregate demand have their desired effects.

c. policy goals can be achieved more easily in the short run than in the long run.

d. workers’ wage demands include anticipated inflation.

25. According to the theory of rational expectations,

a. the Phillips curve is upward sloping in the short run and downward sloping in the long run.

b. both for the short and long runs, the Phillips curve is horizontal.

c. both for the short and long runs, the Phillips curve is vertical.

d. there is no Phillips curve.