Preview text:

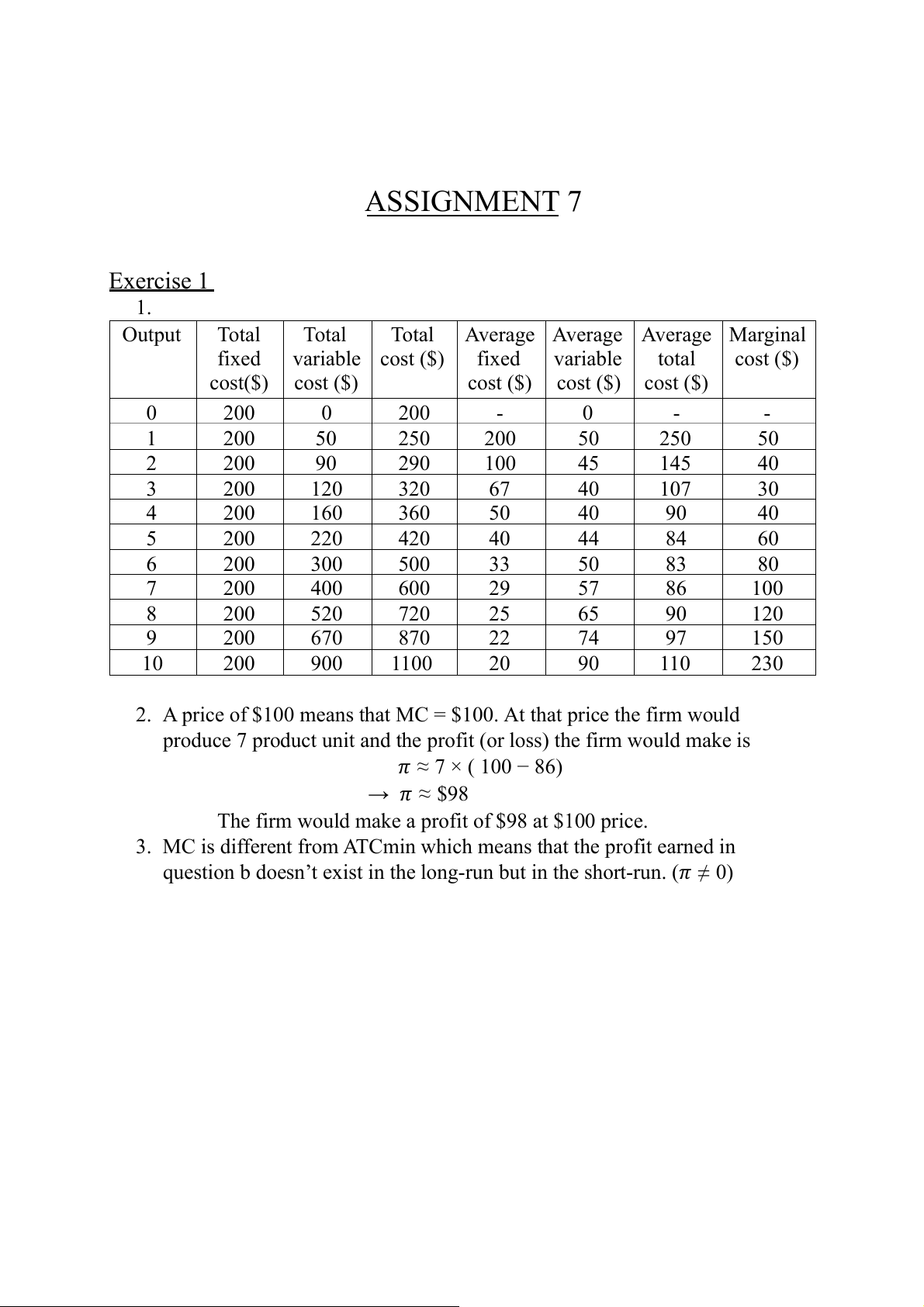

ASSIGNMENT 7 Exercise 1 1. Output Total Total Total

Average Average Average Marginal fixed variable cost ($) fixed variable total cost ($) cost($) cost ($) cost ($) cost ($) cost ($) 0 200 0 200 - 0 - - 1 200 50 250 200 50 250 50 2 200 90 290 100 45 145 40 3 200 120 320 67 40 107 30 4 200 160 360 50 40 90 40 5 200 220 420 40 44 84 60 6 200 300 500 33 50 83 80 7 200 400 600 29 57 86 100 8 200 520 720 25 65 90 120 9 200 670 870 22 74 97 150 10 200 900 1100 20 90 110 230

2. A price of $100 means that MC = $100. At that price the firm would

produce 7 product unit and the profit (or loss) the firm would make is 𝜋 ≈ 7 × ( 100 − 86) → 𝜋 ≈ $98

The firm would make a profit of $98 at $100 price.

3. MC is different from ATCmin which means that the profit earned in

question b doesn’t exist in the long-run but in the short-run. (𝜋 ≠ 0) Exercise 2 1. Q TC TR MC TFC TVC AFC AVC ATC 0 50 - - 50 0 - - - 1 55 21 5 50 5 50 5 55 2 62 42 7 50 12 25 6 31 3 75 63 13 50 25 17 8 25 4 96 84 21 50 46 12 12 24 5 125 105 29 50 75 10 15 25 6 162 126 37 50 112 8 19 27 7 203 147 41 50 153 7 22 29 8 248 168 45 50 198 6 25 31

2. For the profit to be maximized, MR=MC and MR=P=21. At the output of 4

products, MC=21 which means at Q=4 the profit is maximized and that profit is 𝜋 )

𝑚𝑎𝑥 = 4 × (21 − 24 = −12

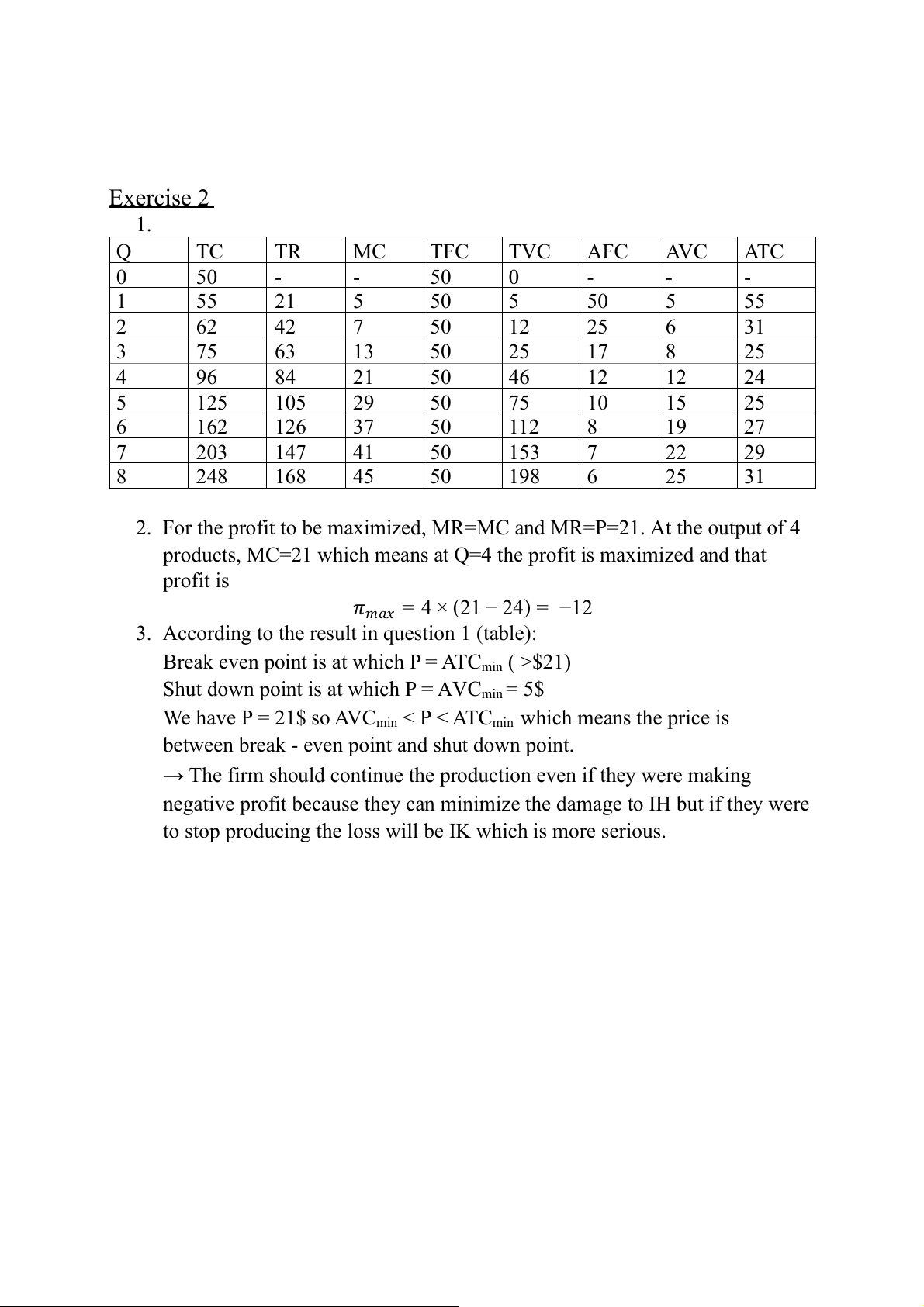

3. According to the result in question 1 (table):

Break even point is at which P = ATCmin ( >$21)

Shut down point is at which P = AVCmin = 5$

We have P = 21$ so AVCmin < P < ATCmin which means the price is

between break - even point and shut down point.

→ The firm should continue the production even if they were making

negative profit because they can minimize the damage to IH but if they were

to stop producing the loss will be IK which is more serious. MC=S ATC AVC P=MR 60 50 40 30 I 20 H 10 K 0 0 1 2 3 4 5 6 7 8 Exercise 3

1. 𝑇𝑅 = 𝑃. 𝑄 = 8𝑄 𝑀𝑅 = 𝑃 = 8

2. 𝑀𝐶 = (𝑇𝐶)′ = 2𝑄 + 2 𝑄

𝑉𝐶 = 𝑇𝐶 − 𝐹𝐶 = 𝑇𝐶 − 𝑇𝐶(0) = 𝑄2 + 2𝑄 + 4 − 4 = 𝑄2 + 2𝑄 𝑉𝐶 𝑄2 + 2𝑄 𝐴𝑉𝐶 = = = 𝑄 + 2 𝑄 𝑄 𝑇𝐶(0) 4 𝐴𝐹𝐶 = = 𝑄 𝑄 𝑇𝐶 𝑄2 + 2𝑄 + 4 4 𝐴𝑇𝐶 = = = 𝑄 + 2 + 𝑄 𝑄 𝑄

3. The firm profit maximized when MR=MC

→ 8 = 2𝑄 + 2 → 𝑄 = 3

The profit maximized when Q* = 3 4 → 𝜋 )

𝑚𝑎𝑥 = 3 × (8 − 3 − 2 − 3 → 𝜋𝑚𝑎𝑥 = $5

4. Break-even price ↔ 𝐴𝑇𝐶𝑚𝑖𝑛 = 𝑀𝐶 4 → 𝑄 + 2 + = 2𝑄 + 2 𝑄 4 → 𝑄 = 𝑄 → 𝑄2 = 4 → 𝑄 = 2

The break-even price is 𝑃 = 𝑀𝐶 = 2𝑄 + 2 = $ 6 and break-even quantity is 2 products.

5. The shut-down point of the firm is when 𝑃 = 𝐴𝑉𝐶𝑚𝑖𝑛 → 𝑀𝐶 = 𝐴𝑉𝐶𝑚𝑖𝑛 → 2𝑄 + 2 = 𝑄 + 2 → 𝑄 = 0

The shut-down price is 𝑃 = 𝑀𝐶 → 𝑃 = 2 × 0 + 2 = $ 2

→ The firm shouldn’t shut down when the price drop to $4. Case study

1. How can you understand the term "Exit" refereed to in the above Pan Am's situation ?

As we can see from the case, the strategy of Pam Am was selling off their

assets they built in profitable their years and slowly selling their route,

reducing their size while minimize their losses until they completely exited

the business. From that we can understand that the term “exit” here means

that the firm is slowly exiting the market while continue to generate revenue

until the firm don’t have any assets left and completely close.

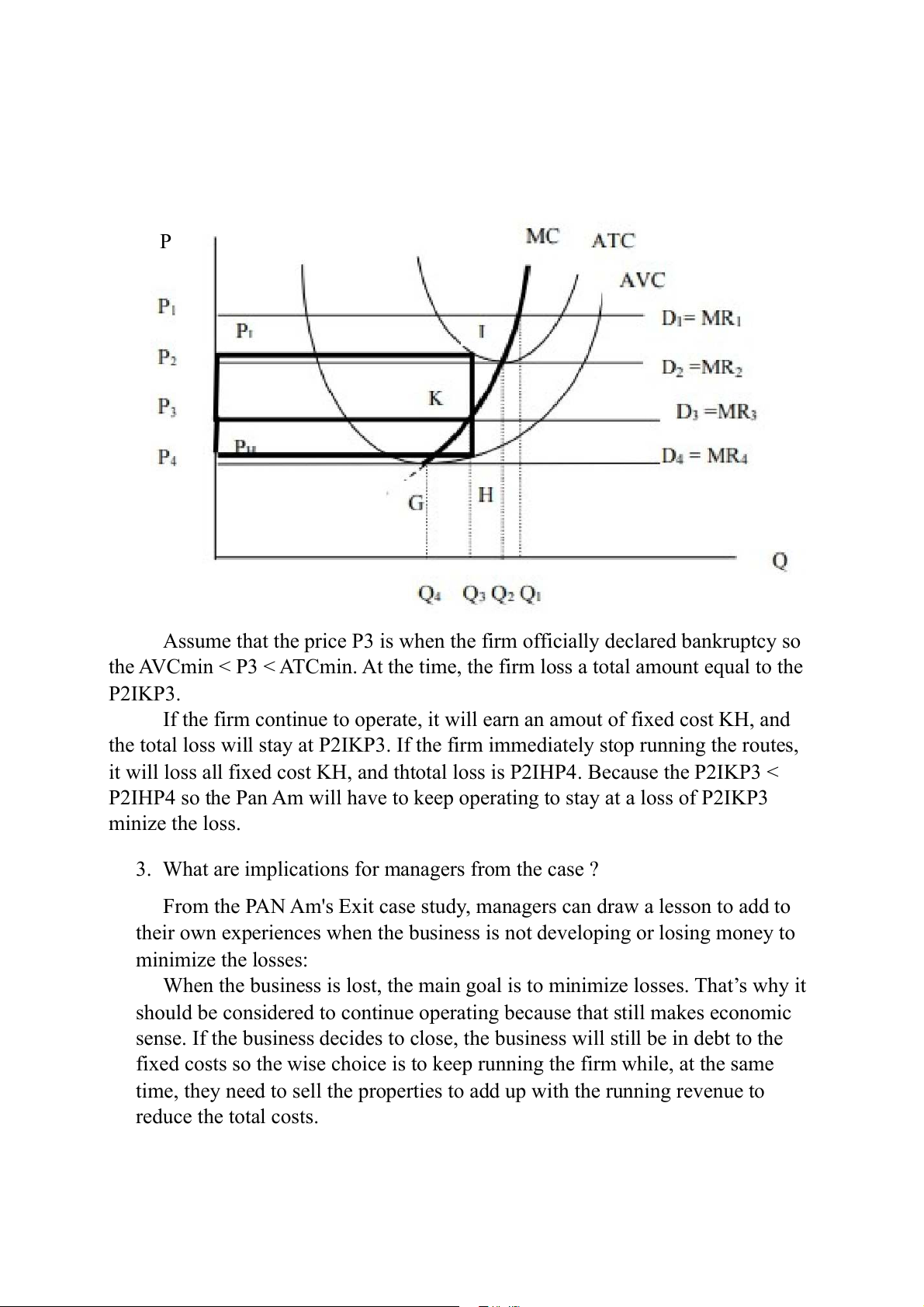

2. Why does Pan Am continue to operate even after it makes losses for a

decade ? Can you explain and illustrate by using the graph of cost curves ?

Pan Am continue to operate even after it makes losses for a decade to reduce

its losses year by year because if the firm shuts down as soon as it has a loss it can lead to larger losses. P Assume that the price P

3 is when the firm officially declared bankruptcy so

the AVCmin < P3 < ATCmin. At the time, the firm loss a total amount equal to the P2IKP3.

If the firm continue to operate, ti will earn an amout of fixed cost KH, and

the total loss will stay at P I

2 KP3. If the firm immediately stop running the routes,

it will loss all fixed cost KH, and thtotal loss is P2IHP4. Becau se the P2IKP3 <

P2IHP4 so the Pan Am will have to keep operating to stay at a loss of P2IKP3 minize the loss.

3. What are implications for managers from the case ?

From the PAN Am's Exit case study, managers can draw a lesson to add to

their own experiences when the business is not developing or losing money to minimize the losses:

When the business is lost, the main goal is to minimize losses. That’s why it

should be considered to continue operating because that still makes economic

sense. If the business decides to close, the business will still be in debt t o the

fixed costs so the wise choice is to keep running the firm while, at the same

time, they need to sell the properties to add up with the running revenue to reduce the total costs.