Preview text:

Microeconomics EBDB5 - Group 3 ASSIGNMENT 9 - TOPIC 9

MARKET ENTRY AND MONOPOLISTIC COMPETITION

OLIGOPOLY AND STRATEGIC BEHAVIOR Members: 1. Hoàng Trọng Hiếu 2. Trương Thu Thủy 3. Cao Văn Tài

4. Phạm Thị Nguyệt Thảo 5. Nguyễn Trung Kiên

6. Lương Thị Bạch Dương Answer

a. To maximize the profit, MR=MC

+ TR = P.Q = (15 - Q).Q = 15Q - Q2

+ MR = TR’ = (15Q - Q2)’ = 15 - 2Q + MC = TC’ = (7Q)’ = 7 => 15 - 2Q = 7 => Q = 4 => P = 15 - 4 = 11$ P−MC 11−7

Market power of this firm by Lenner indicator: L = = = 0.3636 P 11

b. For a perfect competitive market, the marginal cost in this case is given by the

total cost function's derivative, which is MC = 7. => 7 = 15 - Q => Q = 8 => P = 7

To find the consumer surplus, we need to calculate the area under the demand curve

up to the corresponding quantities:

+ Consumer surplus under monopoly = (1/2).(15-11).4 = 8

+ Consumer surplus under perfect competition = (1/2).(15-7).8 = 32

=> Therefore, the deadweight loss (DWL) is the difference in consumer surplus: DWL = 32 - 8 = 24. Microeconomics EBDB5 - Group 3 Answer

a. Profit maximization when: MR = MC

+ TR = P.Q = (100 - Q).Q = 100Q - Q^2 => MR = (TR)’ = 100 - 2Q

+ TC = FC + VC = FC + AVC.Q = 200 + (Q + 4).Q = Q^2 + 4Q + 200 => MC = (TC)’ = 2Q + 4

=> MR = MC ⇔ 100 - 2Q = 2Q + 4 ⇔ 4Q = 96

⇔ Q = 24 is optimal output level.

=> Maximum profit (with Q* = 24): 𝜋 = 𝜋 TR - TC = 952 ($) b.

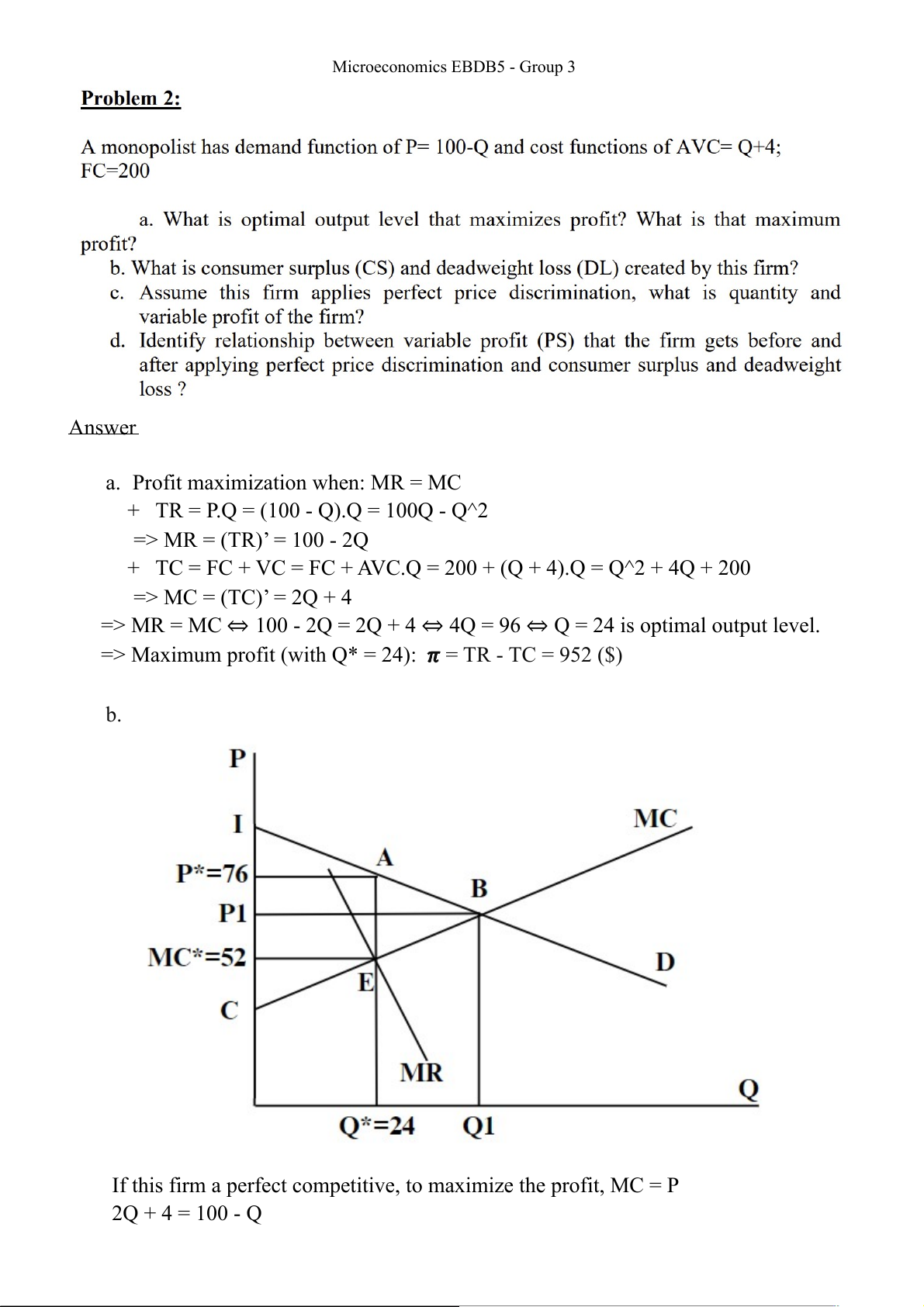

If this firm a perfect competitive, to maximize the profit, MC = P 2Q + 4 = 100 - Q Microeconomics EBDB5 - Group 3 ⇔ Q1 = 32 ⇔ P1 = 68

The consumer surplus = SIAP* = 24.(100-76)/2 = 288$

The deadweight loss (DL) = SAEB = BE.AE/2 = (32-24).(76-52)/2 = 96$ c.

- If this firm applies perfect price discrimination, they will set the price

according to the demand curve, at the point where supply and demand intersect.

- At that, aligning to the horizontal axis we have output of Q = 32

=> The firm increase profit by taking more CS and DWL

=> Profit = 952.08 + 288 + 96 = 1,336.08 d. - Before discrimination:

PS = P*AEC = (AE+CP*).AP*/2 1152$ CS = 288$ DWL = 96$ - After discrimination:

Firm expanded output to Q1 = 32

We got new PS = 1024$, CS = 512$

So, by perfect price discrimination, firm increased profit by getting more CS and DWL.