Preview text:

Group assignment presentation 7

– Phạm Thảo Nguyên

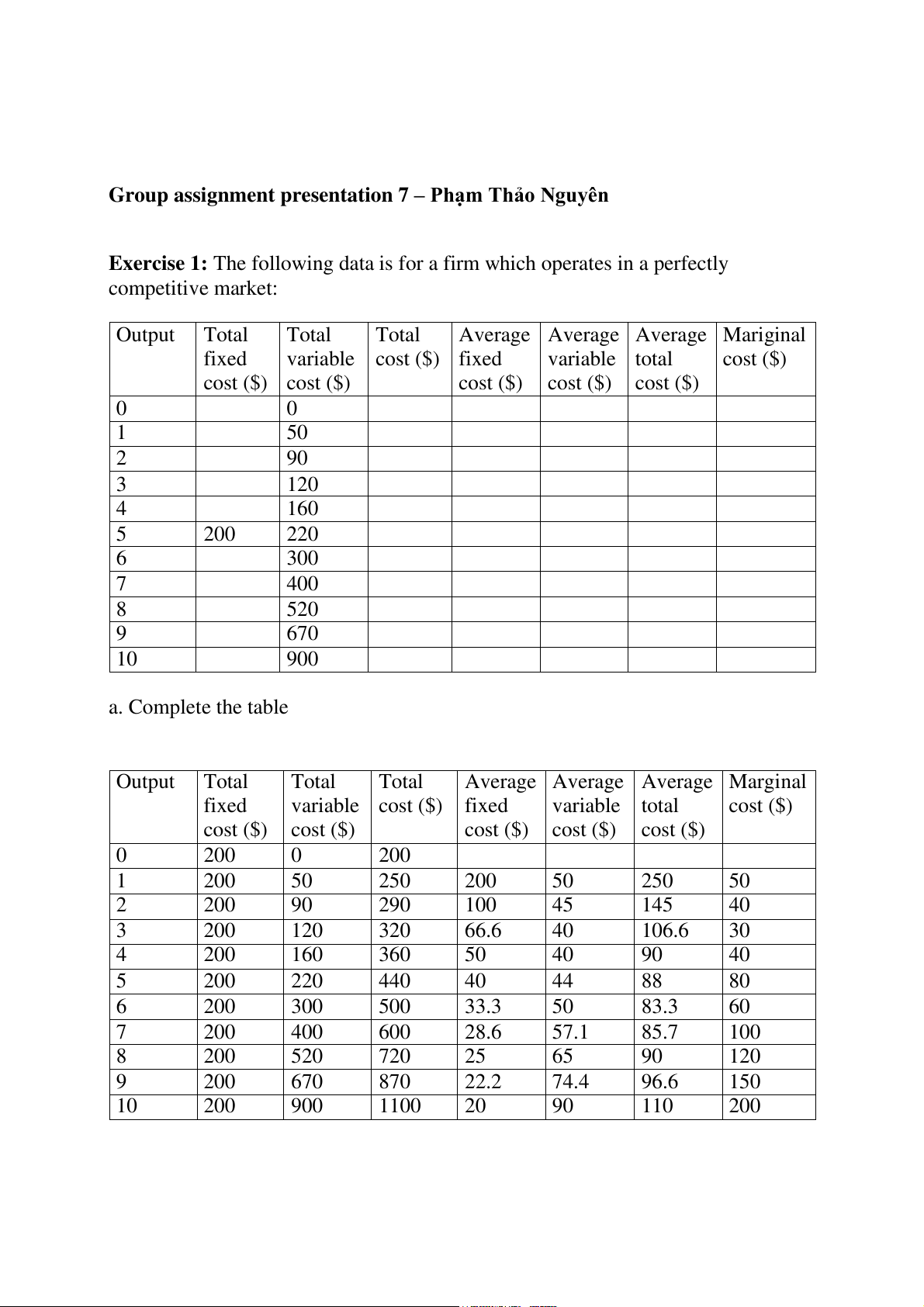

Exercise 1: The following data is for a firm which operates in a perfectly competitive market: Output Total Total Total

Average Average Average Mariginal fixed variable cost ($) fixed variable total cost ($) cost ($) cost ($) cost ($) cost ($) cost ($) 0 0 1 50 2 90 3 120 4 160 5 200 220 6 300 7 400 8 520 9 670 10 900 a. Complete the table

Output Total Total Total Average Average Average Marginal fixed variable cost ($) fixed variable total cost ($) cost ($) cost ($) cost ($) cost ($) cost ($) 0 200 0 200 1 200 50 250 200 50 250 50 2 200 90 290 100 45 145 40 3 200 120 320 66.6 40 106.6 30 4 200 160 360 50 40 90 40 5 200 220 440 40 44 88 80 6 200 300 500 33.3 50 83.3 60 7 200 400 600 28.6 57.1 85.7 100 8 200 520 720 25 65 90 120 9 200 670 870 22.2 74.4 96.6 150 10 200 900 1100 20 90 110 200

b. If the price was 100$, what output would the firm produce and what type of

profit (or loss) would the firm make?

- If the price was 100$, the firm would produce 7 outputs → the profit that the firm made is at max

c. Does the profitable situation in the question b exist in the long r – un? Why?

- The profitable situation in the question b exist in the long r – un because P = MC

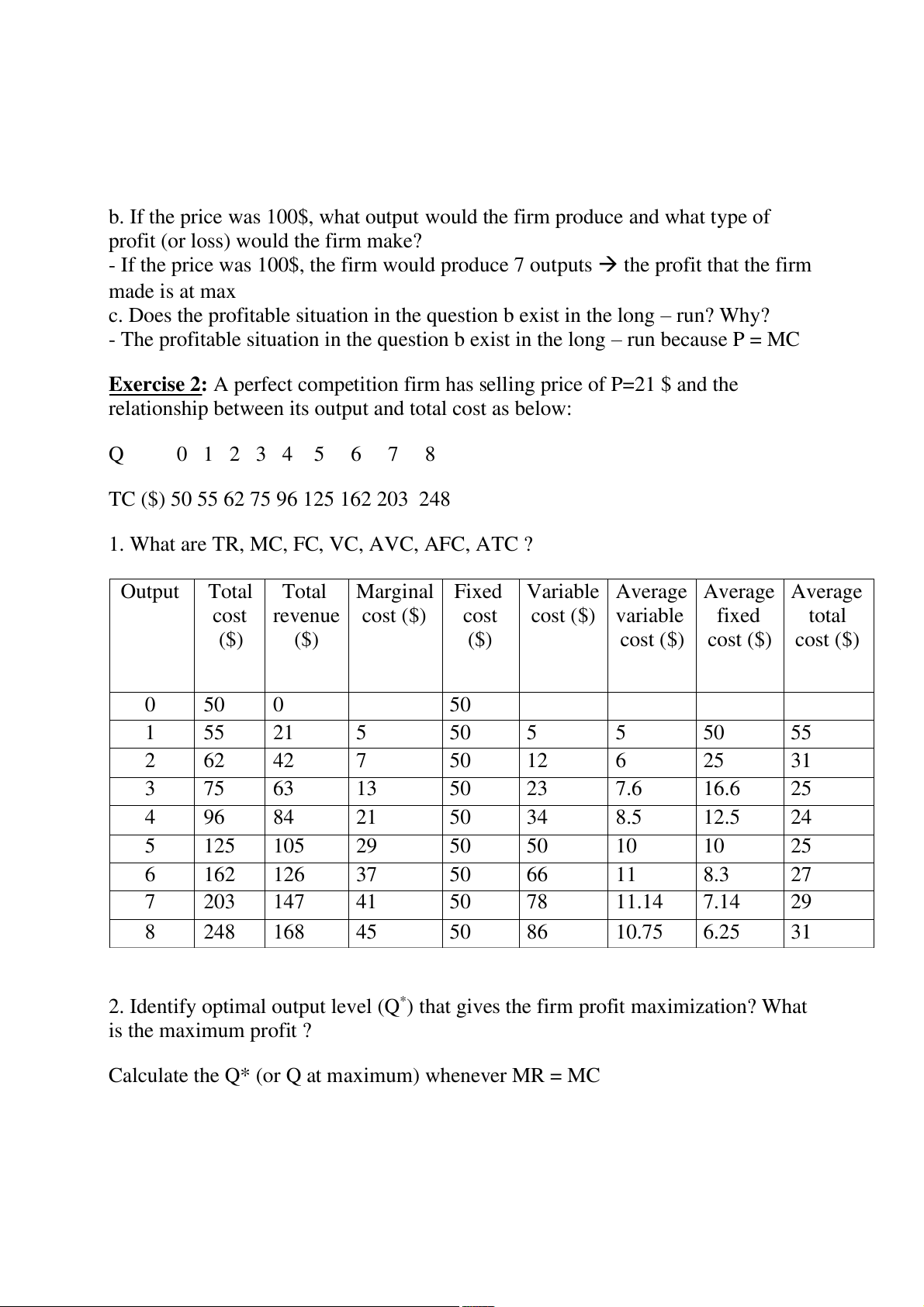

Exercise 2: A perfect competition firm has selling price of P=21 $ and the

relationship between its output and total cost as below: Q 0 1 2 3 4 5 6 7 8

TC ($) 50 55 62 75 96 125 162 203 248

1. What are TR, MC, FC, VC, AVC, AFC, ATC ?

Output Total Total Marginal Fixed Variable Average Average Average cost revenue cost ($) cost cost ($) variable fixed total ($) ($) ($) cost ($) cost ($) cost ($) 0 50 0 50 1 55 21 5 50 5 5 50 55 2 62 42 7 50 12 6 25 31 3 75 63 13 50 23 7.6 16.6 25 4 96 84 21 50 34 8.5 12.5 24 5 125 105 29 50 50 10 10 25 6 162 126 37 50 66 11 8.3 27 7 203 147 41 50 78 11.14 7.14 29 8 248 168 45 50 86 10.75 6.25 31

2. Identify optimal output level (Q*) that gives the firm profit maximization? What is the maximum profit ?

Calculate the Q* (or Q at maximum) whenever MR = MC Output

Marginal revenue Marginal cost 0 1 21 5 2 21 7 3 21 13 4 21 21 5 21 29 6 21 37 7 21 41 8 21 45

→ The optimal output that gives the firm maximization are 4 outputs → The maximum profit is -12

3. With the above profit (in the question 2), should the firm continue the production? Why?

- The firm shouldn’t continue the production since the profit is a negative number

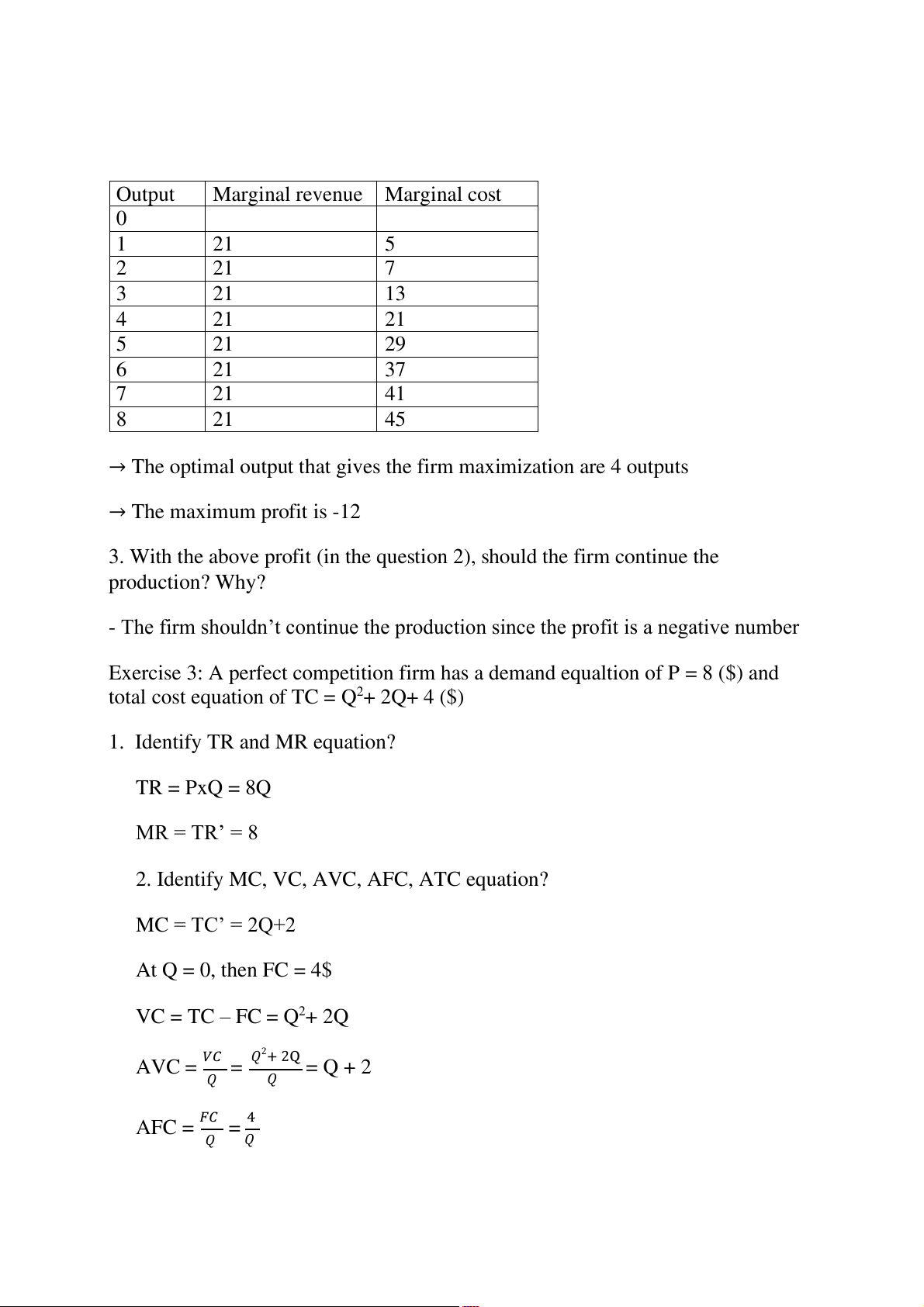

Exercise 3: A perfect competition firm has a demand equaltion of P = 8 ($) and

total cost equation of TC = Q + 2 2Q+ 4 ($)

1. Identify TR and MR equation? TR = PxQ = 8Q MR = TR’ = 8

2. Identify MC, VC, AVC, AFC, ATC equation? MC = TC’ = 2Q+2 At Q = 0, then FC = 4$ VC = TC – FC = Q + 2 2Q

AVC = 𝑉𝐶 = 𝑄2+ 2Q = Q + 2 𝑄 𝑄 AFC = 𝐹𝐶 = 4 𝑄 𝑄 ATC = 𝑇𝐶 = Q2+ 2 + 4 Q = Q + 2 + 4 𝑄 𝑄 𝑄

3. What is optimal output level (Q*) that gives the firm profit maximization? What is the maximum profit ?

To maximize the profit, the firm needs to satisfy MR = MC

↔ 2Q+2=8 ↔ Q* = 3 → ATC* = $6.3 𝜋max = Q*( P A – TC*) = 3.(8-6.3) = $5.1

4. What is break even price and break even quantity?

We get the break even price ↔ P = ATCmin = MC

ATCmin ↔ Q + 2 + 4 ≥ 2√𝑄. 4 + 2 = 6 → Q = 2 𝑄 𝑄

→ The break even price is $6 and the break even quantity is 2

5. If market price decrease to P= 4$, should the firm continue the production? Why?

We get the shut down price ↔ P = AVCmin = MC ↔ Q 2 = 2Q – + 2 ↔ Q = -4 → P = AVCmin = MC = -2

Since AVCmin < P < ATCmin (-2 < 4 < 6), then the firm should continue the

productioin to minimize the total cost because of the decrease of the market price