Preview text:

INTRODUCTION:

In the backdrop of an increasingly complex business environment that demands

confronting various challenges, market research is no doubt becoming more and more

important to understand thoroughly and develop the economy. This study will further

analyze Vietnam’s oil and petroleum market, which is a significant force that impacts and

molds many aspects of business and life.

Many reasons lead us to this topic. As we all know, oil and petroleum are essential

components of the complex web of global energy resources, vehicle economies,

industrial revolutions, and changing geopolitical environments. As the world’s day-by-

day changes, the petroleum market is observing several intricate several undergoing

several intricate adjustments as well. Despite that fact, due to its impact on the

environment, petroleum has remained one of the most talked-about topics in recent years.

Based on a grasp of microeconomics, this research will analyze the market structures of

Vietnam's petroleum industry. In addition, our team will also determine the main factors

that have impacted the petroleum market's supply and demand over the previous few years.

Because of our lack of experience, this study may have some mistakes. We are looking

forward to receiving the teacher’s comments and suggestions. Thank you! Contents 1

INTRODUCTION:.......................................................................................................................................... 1

CONTENT:.................................................................................................................................................... 3 I.

Why oligopoly..................................................................................................................................3 1.

About oligopolistic market..........................................................................................................3 2.

Petroleum market is an oligopolistic market................................................................................4 II.

Market............................................................................................................................................. 7 1.

Demand.......................................................................................................................................7 2.

Supply........................................................................................................................................10 III.

Problem and solution.................................................................................................................13 1.

Problem.....................................................................................................................................13 2.

Economic and political situation in the world............................................................................14 3.

Solutions....................................................................................................................................14 4.

Building a competitive petroleum market..................................................................................15

OUTRO:...................................................................................................................................................... 15 CONTENT:

a. Definition of petroleum

Petroleum is a naturally occurring liquid found in geological formations beneath

the Earth's surface. It is a complex mixture of hydrocarbons, which are organic 2

compounds composed primarily of carbon and hydrogen atoms, with small

amounts of other elements such as nitrogen, sulfur, and oxygen. The specific

composition of petroleum can vary widely, leading to different types of crude oil

with distinct properties. Crude oil extracted from the ground is the primary raw

material to produce various fuels, such as gasoline, diesel, and jet fuel. It is also

used as a feedstock for the petrochemical industry, where it serves as a base for

producing a wide range of chemicals and products. Petroleum extraction, refining,

and processing are critical components of the global energy economy, with

substantial economic implications around the world.

b. Overview of Vietnam's petroleum and oil industry

Vietnam is a net importer of crude oil and petroleum products. Since the first

foundation of Vietnam's petroleum market was established in 1986, the industry's

development can be divided into three stages: before 2000, 2000 to 2008, and

2008 to the present. After nearly three decades, the Vietnam National Oil and Gas

Group (Petrovietnam) has made significant progress and strived to be the

backbone of the national economy. Petrovietnam also plays an important role in

the country's industrialization and modernization, accounting for approximately 25

- 30 percent of total annual state budget revenues. I. W HY OLIGOPOLY

1. About oligopolistic market. a. Number of firms

An oligopoly is a market structure with a small number of firms, none of which

can keep the others from having significant influence. b. Nature of product

The firms under the oligopoly market may produce differentiated or homogeneous

products. The firms producing homogeneous products are known as pure

oligopolies. Whereas the firms producing heterogeneous products are known as imperfect oligopolies. c. Ease of entry/exit

Barriers to entry in an oligopoly market:

Economies of scale. The first firms to enter the market often enjoy economies of

scale. This is a big disadvantage that often turns away potential competition. 3

Control over resources and factors of production. If the first entrants in a market

control all the resources, other firms will have no way to enter the market and compete with them.

Government regulations. If a new firm needs to be licensed by the government to

enter the market, this acts as a barrier to entry and protects the existing firms from competition.

d. Market power ( Price maker/Price taker )

Market power refers to a company's relative ability to manipulate the price of an

item in the marketplace by manipulating the level of supply, demand, or both. In

markets with perfect or near-perfect competition, producers have little pricing

power and so must be price-takers.

e. Non-price competition

Non-price competition is a strategy that implies attracting customers and

increasing sales by providing superior product quality, a unique selling

proposition, a great location, and excellent service rather than lower prices. It

helps brands stand out and win new consumers.

2. Petroleum market is an oligopolistic market. a. Number of firms

In Vietnam, there are only two major petroleum companies with the capacity for

nationwide distribution and supply. While there are several smaller companies,

they are primarily limited to local distribution within specific geographical areas.

b. Nature of product - homogeneous

Homogeneity in the oil market contributes to market stability which includes

maintaining the quality standard, competition among suppliers, performance and

compatibility, safety and environmental protection, global trade and transport.

Consumers and other stakeholders can trust in the quality and performance of oil

products, fostering a stable and reliable market environment. c. Ease of entry: Economies of scale

By economies of scale, Standard Oil increased its profits by reducing its per-unit

costs. This meant that Standard Oil was able to produce more goods for less

money. The fact that Standard Oil's per-unit costs were being reduced did not

make it likely that the prices consumers had to pay would also decrease. However,

Standard Oil was determined to be successful and so continued with its large-scale

production processes. This helped Standard Oil maintain its competitive advantage 4

over its competitors. Standard Oil came to dominate the petroleum industry by

economies of scale. It expanded its production and used this to gain an advantage

over its competitors. In addition to expanding production, Standard Oil was also

able to increase its product differentiation to become more successful than other businesses in its field. Control of resources

South Korea, Singapore and Malaysia are the 3 main petrol suppliers to Vietnam,

accounting for more than 81% of Vietnam's total petroleum imports.

Accumulated in the first 9 months of 2023, Vietnam spent over 2.7 billion

USD to import petroleum from South Korea, which increased 29,1% in

volume but decreased 1.6% in value compared to the same period in 2022.

Ranked second is Singapore, this market has supplied Vietnam with 22,7%

of Vietnam's total petroleum imports in the first nine months of 2023.

The third market in the structure of petroleum imports of all kinds of

Vietnam is Malaysia, imports of this item witnessed an increase of 22.7%

in volume and 6% in turnover compared with the same period last year.

Malaysia accounted for 17.5% of the structure of Vietnam's petroleum

import markets in the past 9 months. Government restrictions Licence requirement:

An application for a Certificate of eligibility to be a petroleum trading focal trader;

A copy of the Certificate of Business Registration.

A statement of material and technical foundations serving petroleum trading as

prescribed, enclosed with supporting documents.

List of petroleum retail outlets owned or owned and co-owned, list of general

agents and agents belonging to the petroleum distribution system of traders as

prescribed, together with supporting documents. Policy of Government

The enterprise is established by the provisions of law, in the Certificate of

Business Registration with petroleum business registration.

Besides certifications, every petroleum business must acquire domestic petroleum

transport vehicles, a warehouse, and a specific number of shops and retail stores.

Petroleum distribution traders are traders who purchase petroleum from wholesale

traders, in addition to self-consumption at their petroleum retail outlets, must also

have a system of affiliated agents or through traders receiving the right to retail

petroleum for retail petroleum sale. They are further required to own a laboratory 5

or have a service contract hired by a state agency with a laboratory capable of

inspecting and testing petroleum quality.

Conditions for petroleum import and export business include having a dedicated

wharf located in Vietnam's international port system and having a warehouse

receiving imported petroleum with a stated capacity. Collusion strategies

The base price of petroleum is determined by = the price of gasoline from

imported sources x the proportion (%) of petroleum output from imported sources

+ the price of gasoline from domestic sources x the proportion (%) of petroleum output from domestic sources.

The price of petroleum from imported sources is determined by = world petroleum

price + transferring fee + rated business expenses + the appropriation level of the

Price Stabilization Fund + the rated profit + tax costs + fees and other deductions following current laws. d. Market power:

Organizations in an oligopoly market are interdependent. Every one of them has to take

into account the reaction of its competitors to make its own decision. In an oligopoly

market the participants have to make important decisions like whether they should

cooperate or compete with competitors, should they implement a new strategy and they

should lower or raise the prices of their products.

Petroleum is one of the significant products that are significantly influenced by external

factors as scarcity as well as excessive usage keep its prices fluctuating. This is why

governments have set up bodies to keep a check on it.

e. Non-price competition: Advertising and promotion:

Outdoor advertising has the longest customer exposure time. The average time a

person spends refueling at a gas station is 42 seconds, the highest among various forms of outdoor advertising.

In Vietnam, the consumption of petroleum is considered to be high. According to

a 2022 report, there are over 45 million motorcycles and 2,5 million cars in use in

the country. If a person uses a motorcycle as their daily means of transportation,

on average, they need to refuel at least once a week, not to mention the potential 6

exposure to 5-10 different gas stations during their travels. This demonstrates that

the audience reach for your advertising is relatively significant.

To meet the fueling needs of over 45 million motorcycles with small fuel tank

capacities, a dense and evenly distributed network of gas stations has been

established in Vietnam. According to the latest data, the country boasts around

8,000 retail fuel stations, particularly concentrated in major cities like Hanoi and

Ho Chi Minh City. In urban areas, it's common to encounter a small gas station

within approximately 2 kilometers. The widespread, uniform, and dense coverage

of these gas stations makes them ideal advertising spaces for businesses.

=> These are the three most visibly apparent advantages of gas station advertising. This

form of outdoor advertising provides numerous benefits for businesses looking to invest in advertising. II. M ARKET 1. Demand a. Income:

In 2022, the IMF calculates GDP per capita for countries around the world. In particular,

Vietnam's GDP per capita in 2022 will reach about 4,162.94 USD, ranking 117th in the

world. With this figure, Vietnam's GDP per capita in 2022 will jump 7 places compared

to 2021 and 56 places compared to 2000 on the world scale.

According to the National Master Plan for the period of 2021 - 2030, vision to 2050, to

2050, development goals to 2030, in terms of economy, striving for an average GDP 7

growth rate of about 7% / year from 2021 to 2030. By 2030, GDP per capita at current

prices will reach about $7,500.

The Resolution stated that with a vision to 2050, Vietnam will be a developed, high-

income country with a full, synchronous, modern, just, democratic, and civilized market

economy institution, and social governance on a complete digital social platform.

Along with that, Vietnam belongs to the group of leading industrialized countries in Asia;

is a regional and international financial center; Economic development of high-value

ecological agriculture among the world's leading groups. b. Substitution

The rise of electric bicycles causes gasoline demand to decrease.

There are already 280 million e-bikes worldwide, causing global oil demand to fall by

about 1%. As of 2022, worldwide with 20 million electric cars and 1.3 million electric

buses, delivery trucks, and trucks in operation, there are more than 280 million electric

scooters, e-bikes, and electric tricycles in operation according to The Conversation.

According to data reported by The Conversation, e-bikes have cut oil demand by 1 million barrels per day.

Environmentally friendly energy

With the use of hydrogen energy, coke and petroleum can be replaced to reduce CO2 emissions.

The Ministry of Industry and Trade is seeking comments on the draft Strategy for

hydrogen energy production to 2030, with a vision to 2050. According to the Ministry of

Industry and Trade, currently, hydrogen energy has not been used for energy purposes,

mainly used for non-energy raw materials in the oil refining, fertilizer, and chemical industries. c. Non-price factors Economic impact:

In the production of goods and services, depending on the production process of

each industry, most industries use petroleum. The cost of gasoline accounts for

about 3.52% of the total production cost of the whole economy. This shows that

petroleum accounts for a fairly high proportion and has a strong impact on the cost

of manufactured products. In particular, the increase in gasoline prices has a strong

impact on petroleum-intensive industries such as fishing, cargo transportation and

passengers by road, waterway and air. 8 Impact of the epidemic:

The fourth wave of the COVID-19 pandemic is the fundamental reason why our

country's economic growth in 2021 reached a much lower level than the set target.

2022 is an important year, creating a foundation for the implementation of the

goals of the 5-year Plan 2021-2025. Therefore, to successfully implement the

socio-economic development goals in 2022; In particular, there is a target growth

rate of gross domestic product of about 6-6.5%; The average consumer price index

increased by about 4% in the context of forecasting the international and domestic

situation with advantages and disadvantages, intertwined challenges, but more

difficulties and challenges; world economic growth in 2022 is forecast to be lower

than 2021, risks continue to increase; domestically, the resilience and resources of

the State, businesses and people decreased, inflationary pressure was high

Political situation in the world:

The impact of exchange rate policy on gasoline prices. Oil import transactions are

denominated in US dollars, which means that the US-VND exchange rate policy

has a direct impact on domestic gasoline prices. In addition to the exchange rate

policy, Vietnam's basket of commodities and foreign exchange reserves also have

a significant impact on domestic gasoline prices.

The impact of inflation on gasoline prices

Vietnam's inflation in the past and later has always been considered a chronic

disease of the economy. The impact of inflation on domestic gasoline prices is

inevitable. Inflation erodes the payment value of the currency or reduces the

purchasing power of the currency, causing knock-on effects on the economy.

Assuming, as soon as gasoline prices do not change, but domestic inflation

increases, limiting the purchasing power of the dong, it is clear that gasoline has

increased in price in the context of escalating inflation.

Thus, it can be affirmed that inflation is part of the reason for the increase in

gasoline prices in Vietnam with different characteristics compared to countries with stable inflation.

In addition, because the amount of petroleum in the country is mainly imported,

the purchasing power of the dong compared to other currencies also shows a

problem, gasoline in Vietnam is a "luxury" item compared to some other countries. 9 2. Supply a. Technology Technology level:

Through international cooperation, many new and advanced technologies have

been transferred to Vietnam and accordingly trained a force of highly qualified

science and technology researchers, while saving costs in oil and gas exploitation and processing Harness:

Most of the information technology, such as data processing and interpretation

software, geophysical documents, mine modeling and simulation, mining design,

and oil extraction technology in rocks and foundations.

Automatic control technology in drilling and mining is also widely applied such as

horizontal drilling technology, small well body drilling, automatic operation of

mining wells on light rigs, and operation of underground wellheads in mining, ...

Biotechnology and chemistry have been applied to improve the oil recovery

coefficient in fields such as White Tiger, Rang Dong, Black Lion, Golden Lion Oil refining:

Dung Quat Oil Refinery belongs to the Dung Quat Economic Zone, is the first oil

refinery built in Vietnam in Binh Thuan and Binh Tri communes, Binh Son

district, Quang Ngai province. This is one of the major and key national economic

projects of Vietnam in the early 21st century. Foreign supply

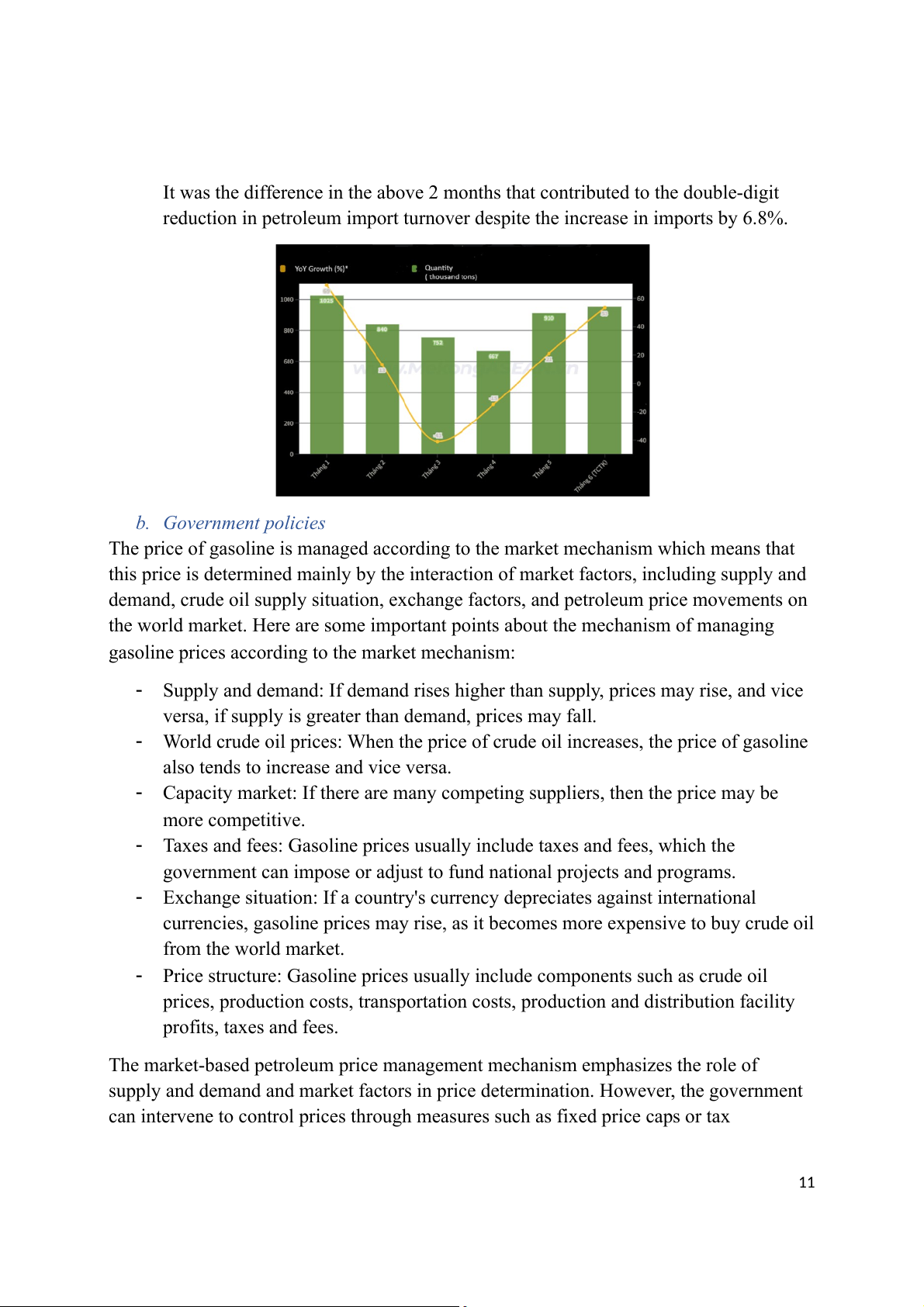

Accumulated in the first 6 months of 2023, Vietnam's petroleum imports reached

5.1 million tons with a turnover of 4.07 billion USD, up 6.8% in volume and down

18.4% in value over the same period in 2022.

In May and 6, the volume and value of petroleum imports recorded a marked

difference. Specifically, Vietnam's petroleum imports grew by 21% in May and

53% in June respectively compared to the same period in 2022. Meanwhile, the

import value of petroleum recorded a decrease of 26% (May) and an 18% decrease (June). 10

It was the difference in the above 2 months that contributed to the double-digit

reduction in petroleum import turnover despite the increase in imports by 6.8%. b. Government policies

The price of gasoline is managed according to the market mechanism which means that

this price is determined mainly by the interaction of market factors, including supply and

demand, crude oil supply situation, exchange factors, and petroleum price movements on

the world market. Here are some important points about the mechanism of managing

gasoline prices according to the market mechanism:

Supply and demand: If demand rises higher than supply, prices may rise, and vice

versa, if supply is greater than demand, prices may fall.

World crude oil prices: When the price of crude oil increases, the price of gasoline

also tends to increase and vice versa.

Capacity market: If there are many competing suppliers, then the price may be more competitive.

Taxes and fees: Gasoline prices usually include taxes and fees, which the

government can impose or adjust to fund national projects and programs.

Exchange situation: If a country's currency depreciates against international

currencies, gasoline prices may rise, as it becomes more expensive to buy crude oil from the world market.

Price structure: Gasoline prices usually include components such as crude oil

prices, production costs, transportation costs, production and distribution facility profits, taxes and fees.

The market-based petroleum price management mechanism emphasizes the role of

supply and demand and market factors in price determination. However, the government

can intervene to control prices through measures such as fixed price caps or tax 11

incentives, especially in special situations such as sharp fluctuations in crude oil prices or economic emergencies. Taxes 1. Value Added Tax (10%)

The value-added tax rate applied to petroleum is 10% on the selling price according to

Clause 3, Article 8 of the 2008 Law on Value Added Tax.

Recently, the Government has adopted a policy to reduce the value-added tax rate by 2%

in 2022, applicable to groups of goods and services that are applying the value-added tax

rate of 10%. However, the gasoline group is not included in this tax reduction. 2. Import duty (10%)

Currently, Vietnam has many petrochemical refineries but operates with low capacity, not

enough to meet domestic demand, so Vietnam still has to regularly import petroleum

products. Petroleum imported through Vietnamese border gates and borders according to

Clause 1 Article 2 of the Law on Import and Export Tax 2016. 3. Excise tax (7-10%)

According to Point g, Clause 1, Article 2 of the Law on Excise Tax 2008 amended in

2014, gasoline of all kinds will be subject to excise tax. From this it can be understood,

for oil will not be subject to excise tax.

According to the excise tariff in Article 7 of the 2008 Law on Excise Tax amended in

2014, the specific tax rate for gasoline is 10%, E5 gasoline is 8%, E10 gasoline is 7% on the import price at the port.

4. Environmental protection tax (VND 1,000 - 4,000/liter)

Gasoline (except ethanol), diesel, kerosene, and diesel are all subject to environmental

protection tax under Clause 1 Article 3 of the 2010 Law on Environmental Protection Tax

with taxes ranging from VND 1,000 per liter to VND 4,000 per liter. Specifically,

E5RON92 gasoline is 3,800 VND, RON 95 gasoline is 4,000 VND, diesel is 2,000 VND ...

In the context of tensions between Russia and Ukraine, the world gasoline price may

continue to rise, the domestic gasoline selling price is also greatly affected. Therefore, on

March 3, 2022, Vietnam's Ministry of Finance proposed to reduce environmental tax by

1,000 VND/liter for gasoline, and 500 VND/liter for diesel. The reduction of

environmental protection tax is essential to stabilize gasoline prices in the country. 12

Petrol Price Stabilization Fund:

In addition to the gasoline tax, one of the tools that the State uses to stabilize the

petroleum market is the Petroleum Price Stabilization Fund. The Petroleum Price

Stabilization Fund is established based on deducting an amount before corporate income

tax from the selling price of gasoline.

This stabilization fund is based on the world and domestic price movements to prescribe

specific deductions from time to time accordingly, and at the same time guide the

mechanism of operation, management and use of this fund III. P ROBLEM AND SOLUTION 1. Problem 1. Problems

The oil and gas market in the first 2 quarters of 2023 in Vietnam and the world has been

experiencing many fluctuations. Two factors have a significant impact on the gasoline market:

The increase in the consumption demand for oil and gasoline Global supply shortages

Supply shortages from Russia:

Russian supplies have grown better than expected, with India, China, and several

other smaller markets increasing their purchases of Russian crude oil to take

advantage of existing deep discounts. According to data from the statistical site

Statista, Russia's oil exports in November 2022 reached 9.8 million barrels/day,

down less than 200,000 barrels/day compared to the same period last year in 2021.

However, the impact of the EU ban and the Group of Seven (G7) price ceiling

policy on Russian crude oil is not yet completely clear. In addition, the market

still has to wait for the European Union's (EU) ban on Russian refined products to

take effect in early February 2023. The ability of India and China to absorb larger

amounts of Russian oil may be limited. ING forecasts that Russia's supply in the

first quarter will decrease by about 1.6-1.8 million barrels/day compared to the

same period in 2022. Regarding the impact of the G7's price ceiling policy, ING

believes that they will have little direct impact on Russia's oil supply in the short

term. Because the ceiling of 60 USD/barrel is still higher than Russia's Urals oil trading price. 13

OPEC continues to maintain its policy of limiting output:

The Organization of the Petroleum Exporting Countries (OPEC), and other major

producers (the OPEC group) have ignored calls from the United States and other

major oil consumers to sharply increase oil supplies when oil prices kept rising and

there were many concerns about supply. OPEC's decision to reduce production

targets by about 2 million barrels/day from November 2022 to the end of 2023.

2. Economic and political situation in the world

The oil price war between Russia and Saudi Arabia in 2020 led to a decrease in

global oil prices by 65% in conjunction with the start of the COVID-19 pandemic.

In 2021, the oil price reached the highest level due to a surge in global demand as

the world recovered from the COVID-19 recession.

In 2022, the political crisis along with the Russia-Ukraine war caused the oil price

to reach the highest level because of the fears of supply shortages from Russia as

well as Western sanctions on the country.

Given that Vietnam is a country with oil extraction, export, and processing

activities, before October 2018, Vietnam still has to import about 70% of

petroleum from the world market to satisfy the domestic consumption demand.

Currently, Vietnam’s gasoline and oil processing meet 75% of the domestic

consumption demand. However, domestic oil prices always depend on the world market prices.

Recently, in Vietnam, to hedge against price risks in gasoline and oil trading, we

often use the Petrol Price Stabilization Fund or buy reserve goods when world oil

prices tend to fluctuate and diversify supply sources to create supply at the lowest price. 3. Solutions

Using Petrol Price Stabilization Fund effectively: Price insurance is based on the

principle of an agreement to fix a transaction price for a shipment at a time within a

certain period, delivered in the future. This transaction is characterized by payment at a

fixed price and a floating return every month for a specified period. The advantage of the

price insurance method is that it protects the interests of businesses when prices increase;

it does not affect the physical contract signed with the supplier; Simple and easy to

operate. However, this method has many disadvantages when prices fall. However,

using measures to prevent price fluctuation risks in business activities through insurance

tools will help businesses, including petroleum businesses, improve operational efficiency. 14

4. Building a competitive petroleum market

Promote competition between businesses in the market by limiting government intervention.

Restructure the petroleum market:

Redefining ownership of wharf systems, receiving warehouses, and

specialized transportation equipment

Restructuring key import enterprises

Reducing entry barriers to encourage the expansion of participants in the

wholesale/retail petroleum business. OUTRO: 1. Conclusion

After analyzing some distinguishing features of the Vietnamese petroleum industry, we

can conclude that petrol production is an oligopolistic market. In addition, we illustrated

several key factors influencing the demand and supply of this product. We researched

information from related firms, particularly big brands in Vietnam, to clarify the

characteristics of oligopoly. Importantly, when we completed this final project, we gained

a substantial amount of knowledge about Vietnam's beer industry, and we hope to apply

almost all this knowledge in real-world situations. Furthermore, the final results would

provide not only us but also economic students with an up-to-date understanding of this type of market. 2. References

Nguồn cung xăng, dầu đủ cho thị trường (baochinhphu.vn)

Việt Nam nhập khẩu xăng dầu từ thị trường nào nhiều nhất? - Tạp chí Kinh tế Môi trường (baomoi.com) 15

Thủ tục xin giấy chứng nhận đủ điều kiện kinh doanh xăng dầu (luatnguyen.com)

Điều kiện, thủ tục xin giấy phép kinh doanh xăng dầu đầy đủ (tuvanquangminh.com)

Tổng hợp các điều kiện kinh doanh xăng dầu mới nhất (luatvietnam.vn)

Nghị định 80/2023/NĐ-CP sửa đổi Nghị định về kinh doanh xăng dầu ra sao? Các nội

dung nổi bật của Nghị định 80/2023/NĐ-CP? (thuvienphapluat.vn)

Market Power - Definition, Meaning, Factors And Abuse (marketing91.com)

https://quangcaongoaitroi.org/dich-vu-quang-cao-tram-xang-2-4430.html

https://kinhtetrunguong.vn/kinh-te/kinh-tet-vi-mo/gdp-binh-quan-viet-nam-nam-2000-

xep-thu-173-200-the-gioi-nam-2022-thay-doi-the-nao-.html

https://plo.vn/su-gia-tang-cua-xe-dap-dien-khien-nhu-cau-xang-dau-giam- post763234.html

https://mekongasean.vn/viet-nam-nhap-khau-hon-5-trieu-tan-xang-dau-trong-nua-dau- 2023-post23998.html

https://luatminhkhue.vn/nguyen-tac-dieu-hanh-gia-xang-dau-hien-hanh.aspx

Thị trường dầu đối mặt nhiều bất ổn trong năm 2023 (pvoilhanoi.com.vn)

Sử dụng công cụ bảo hiểm giá xăng dầu nhằm phòng ngừa rủi ro biến động giá - Tạp chí

Tài chính (tapchitaichinh.vn)

Xây dựng thị trường xăng dầu cạnh tranh: Những bất cập và giải pháp (lapphap.vn) 16