Preview text:

lOMoARc PSD|36244503

TRƯỜNG ĐẠI HỌC TÀI CHÍNH MARKETING

KHOA TÀI CHÍNH- NGÂN HÀNG TIỂU LUẬN

FINANCIAL ANALYSIS OF Yen Bai Forestry Agro-Food

Products Joint Stock Company

Sinh viên thực hiện: Nguyễn Ngọc Thanh

Mã số sinh viên: 2021009780 Lớp: 20DTC01

Hồ Chí Minh, ngày 3 tháng 9 năm 2021 MỤC LỤC lOMoARc PSD|36244503 N i dungô

I. Introduction..................................................................................................................................3

II.The general information..............................................................................................................3

1 Business name...............................................................................................................................3

2 Common-size.................................................................................................................................3

III: Time series analysis..................................................................................................................10

1 Turnover.......................................................................................................................................10

2 .Profitability..................................................................................................................................11

IV: Financial ratios.........................................................................................................................11

V: The pros and cons of financial ratio analysis..........................................................................13

Advantages................................................................................................................... ...................13 Defect13

VI. Analyse the reason of changes in financial

situations...........................................................13

Subjective reasons...........................................................................................................................13

Objective reasons............................................................................................................................13 VII. Problems and

solutions...........................................................................................................14

1 Problems.......................................................................................................................................14

2 Solutions........................................................................................................................................14

VIII. Conclution..............................................................................................................................15

REFERENCES...............................................................................................................................16 2 lOMoARc PSD|36244503 I. Introduction

The study of financial statements is a crucial task in company. Not only does it assist

firms in reevaluating the method and outcomes of their operations, but it also aids

managers in creating efficient long-term development plans. An individual investor can

compare businesses in the same industry to assist them make investment decisions by

looking at a company's financial statements.

II. The general information

Yen Bai Forestry Agro-Food Products Joint Stock Company, formerly known as

Yen Bai Paper Factory, was established in 1972. In 1994, it was re-established and

renamed Yen Bai Forestry Products Processing Company. Main business lines:

processing, outsourcing, trading in forest products, agricultural products and food;

trading in spare parts, materials, equipment, and general goods; business travel services, general commerce.

During the operation, the Company has been granted 10 times the Business

Registration Certificate regarding the change of charter capital, business address,

legal representative. The 10th modified business registration certificate No.

5200116441 was issued by the Department of Planning and Investment of Yen Bai province on October 2, 2020.

Charter capital of the company according to the 10th business registration

certificate: VND 52,360,230,000. Actual contributed charter capital as of September 30, 2020: VND 52,360,230,000. 1 Business name

Legal name: Yen Bai Forestry Products Joint Stock Company

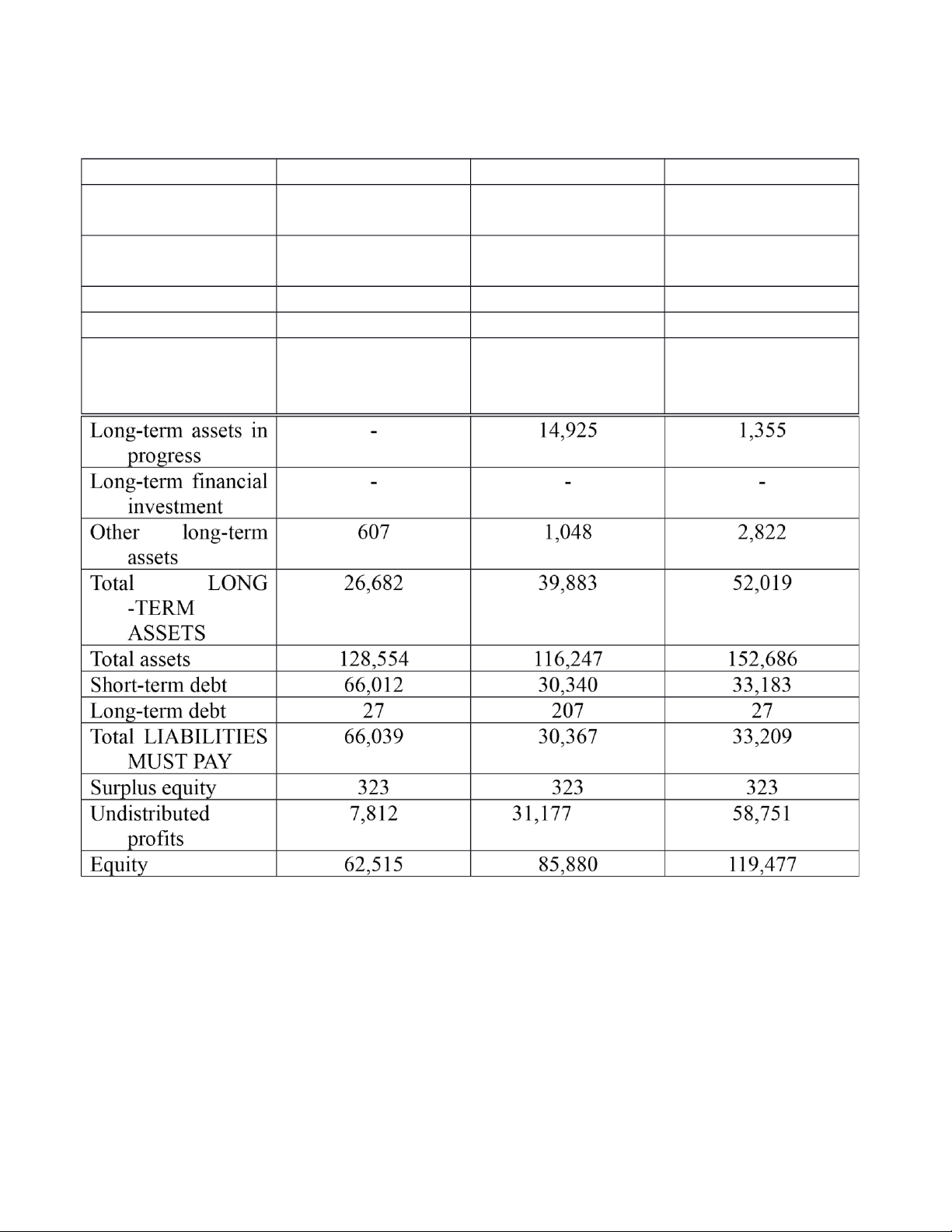

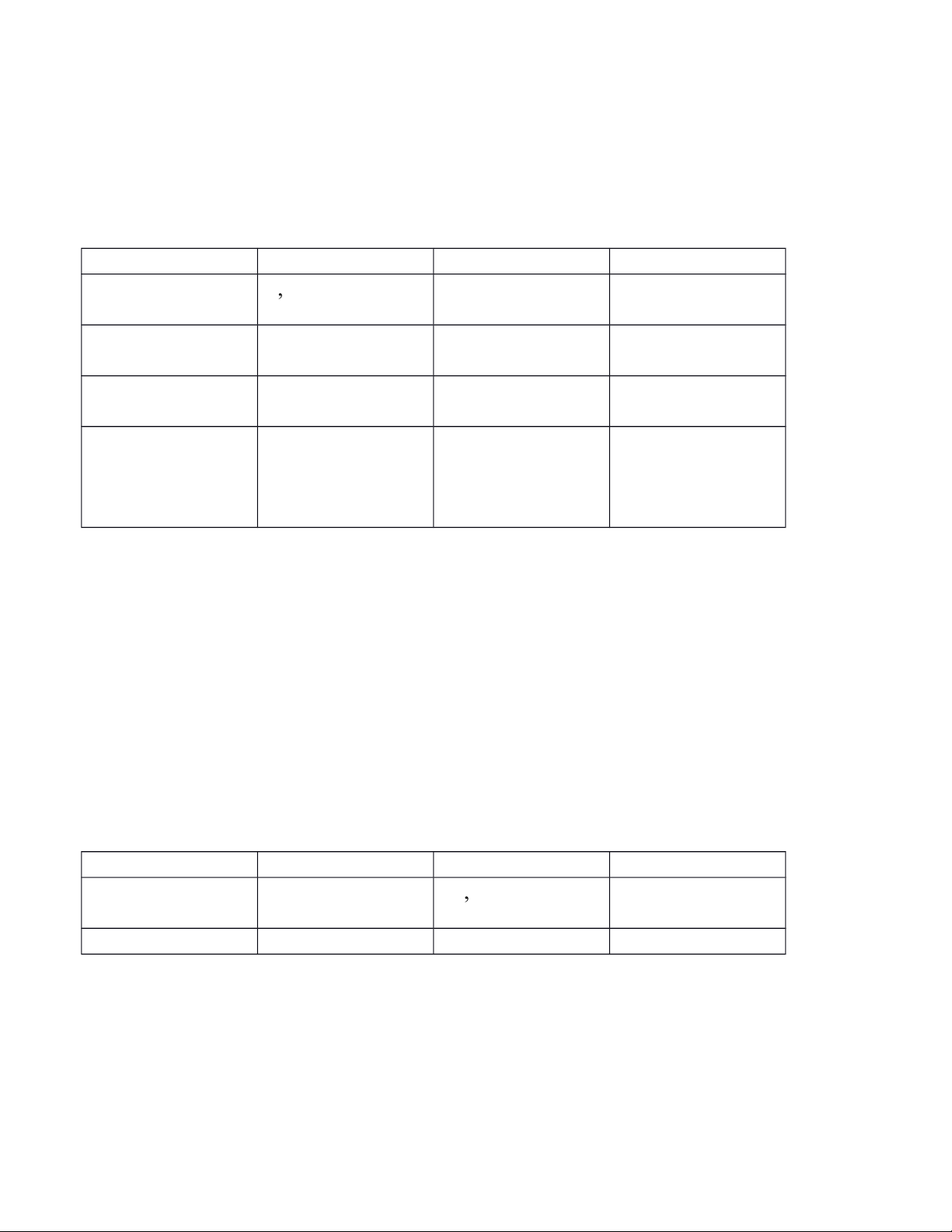

International name: YenBai Joint – stock Forest agricultural and Foodstuffs Company 3 lOMoARc PSD|36244503 2 Common-size BALANCE SHEET Unit : triệu đồng 2019 2020 2021 Cash and cash 37,351 39,633 78,943 equivalents Short-term 20,292 24,724 6,157 receivables Inventory 43,110 11,506 15,167 Other current assets 716 2,349 477 TOTAL SHORT- 101,873 76,364 100,667 TERM ASSETS 4 lOMoARc PSD|36244503 STATEMENT OF INCOME Năm Năm 2020 Năm 2021 UNIT : Triệu 2019 đồng 1 . Revenue from Sales of 473,26 376.791 519,48 goods and provision of 7 2 services 2 . The deduction from - 1.080 1,513 revenue

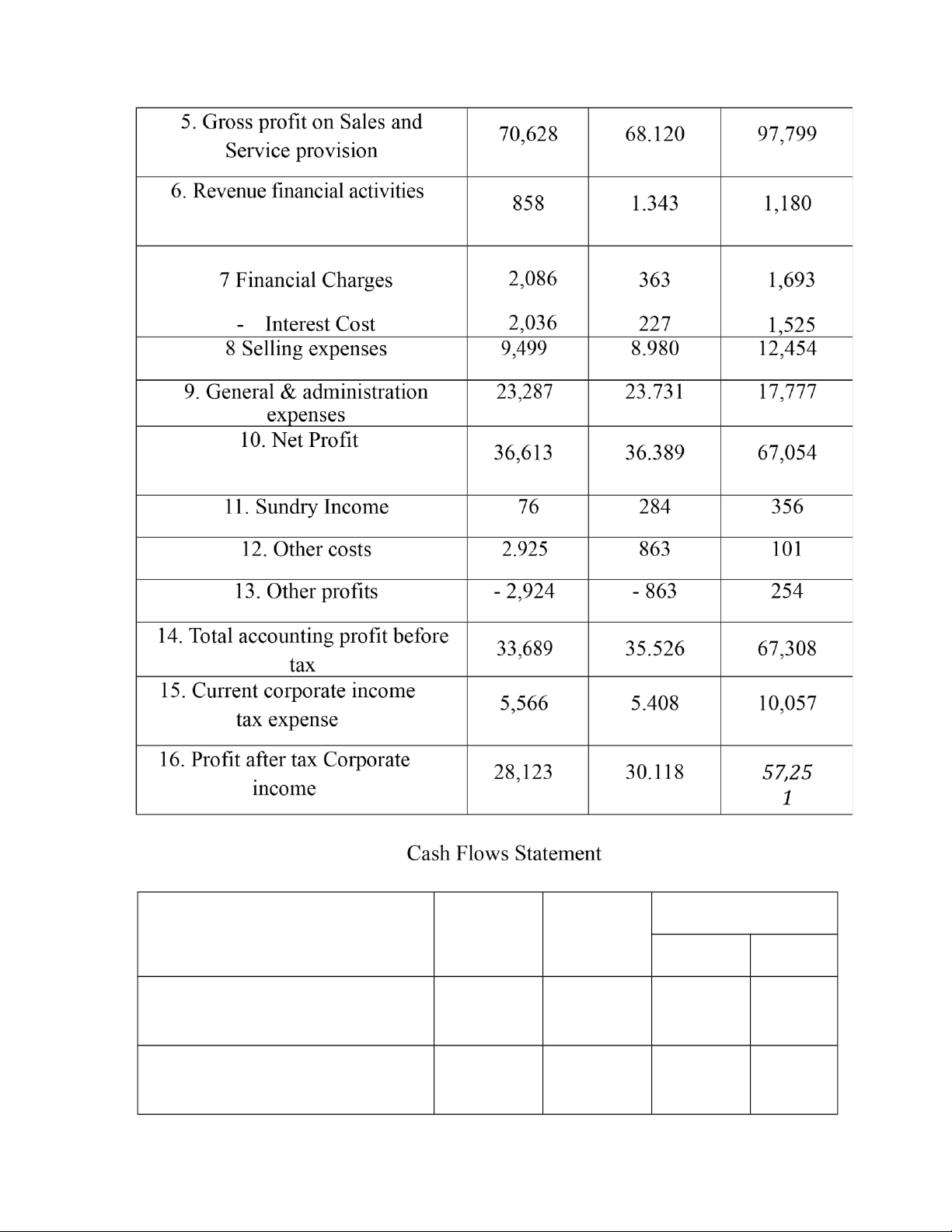

3 . Net Revenue from Selling and 402,63 375.711 517,96 Providing Services 9 9

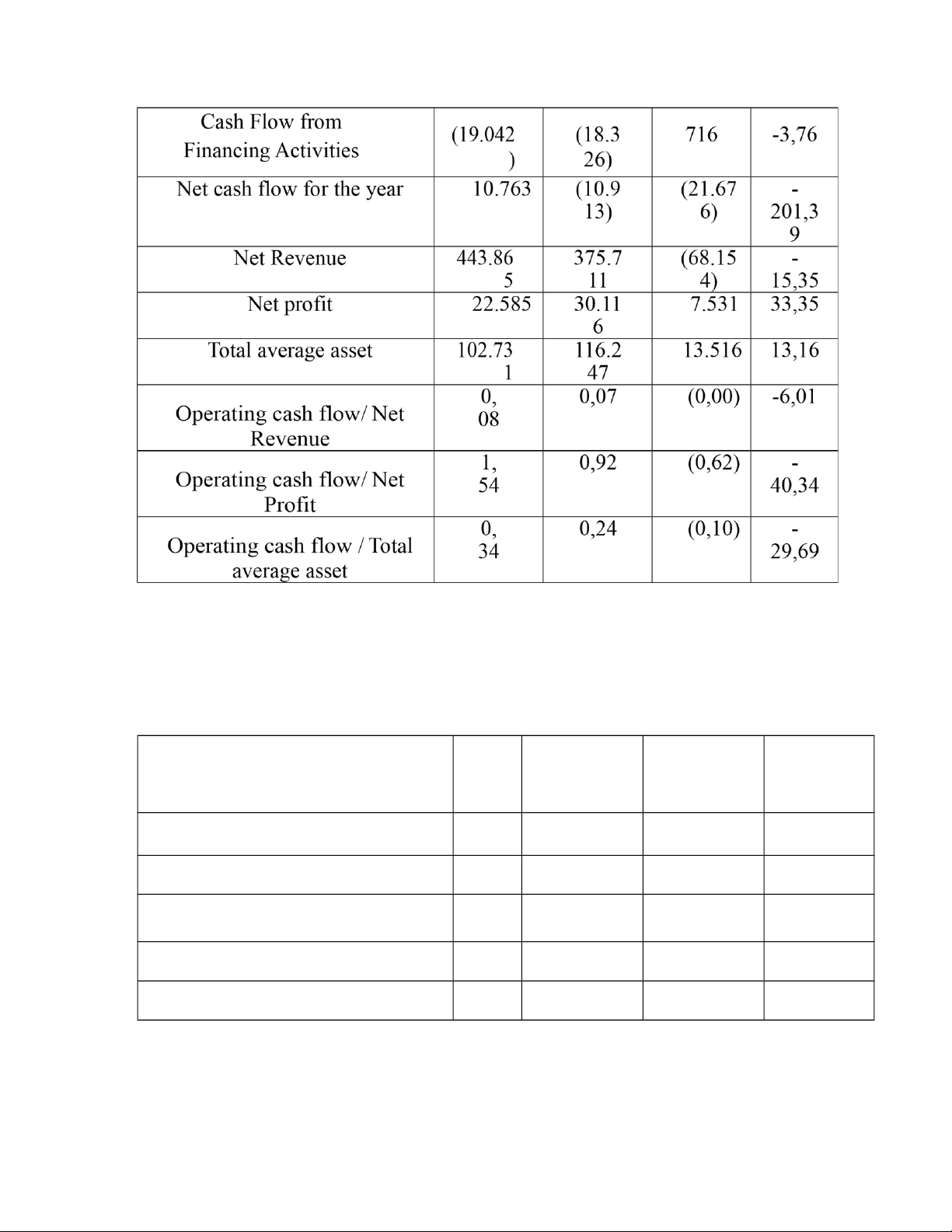

4 . Cost of goods sold ( COGS ) 380.21 307.591 420,17 2 0 5 lOMoARc PSD|36244503 Deviant 2019 ( tr 2020 ( tr đ) + / - % đ) Net cash from operating 34.822 27.70 (7.118 - activities 4 ) 20 , 44 Cash Flow from Investing (5.017 (20.2 (15.27 304,4 Activities ) 91) 4) 4 6 lOMoARc PSD|36244503 FINANCIAL GROWTH Đv Năm Năm Năm t 2019 2020 2021 Revenue % 21.8 -20.4 37.9 Net profit % 5 ,84 8.02 11.05 EBIT % 7 ,54 9.52 13 , 29 Owner's Equity % -18.8 37.4 39.1 total assets % 7.2 -9.6 31.4 LIQIDITY RATIO a.Formula

Current ratio= Current Assets/Short term Liabilities 7 lOMoARc PSD|36244503

Quick ratio=(Cash and Cash Euivalents + Short term financial investment + Short

term Account Receivables) / Short term Liabilities

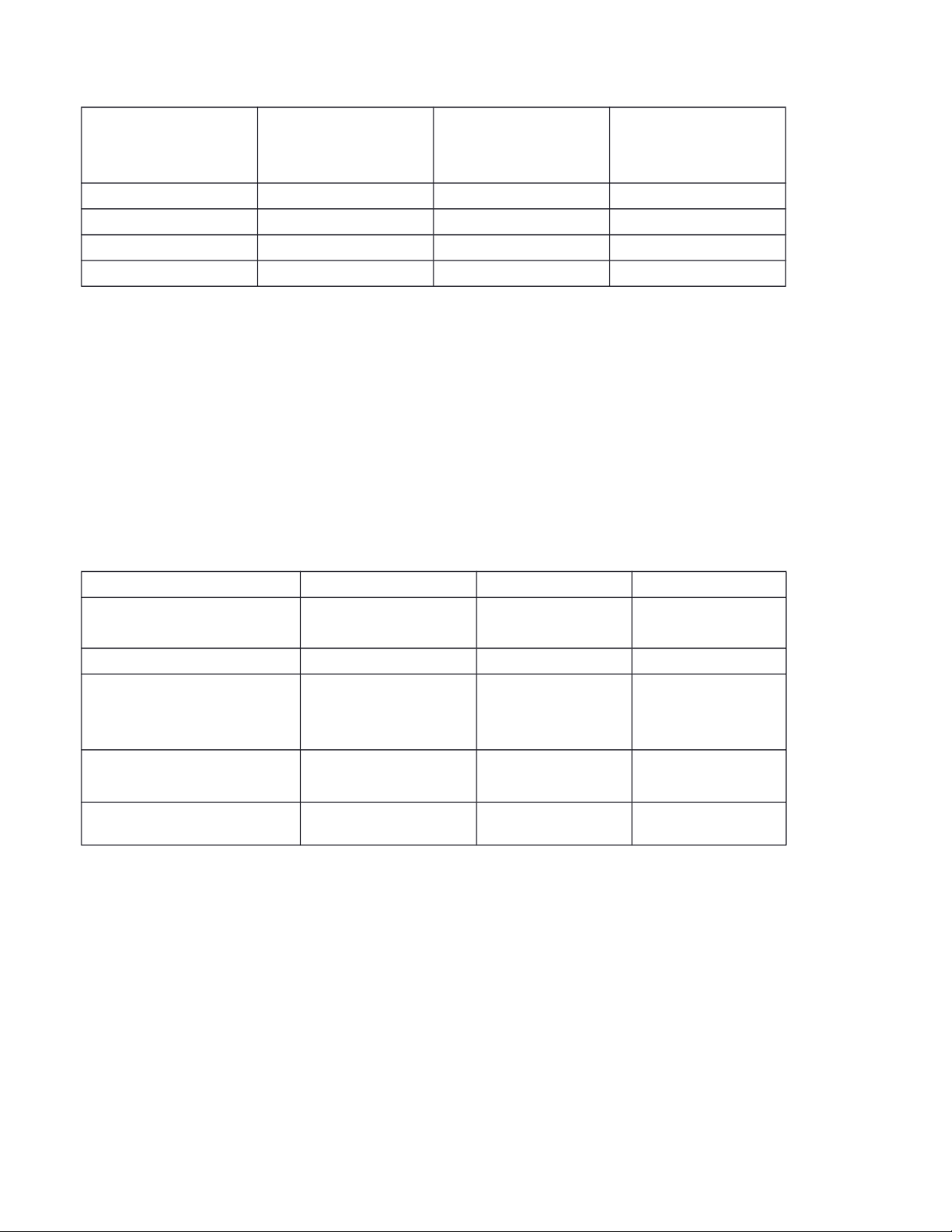

Cash Ratio = Cash /Current liabilities b) Information table UNITS: TIMES 2019 2020 2021 1, 54 2 , 52 3 , 03 Current Ratio 0 , 89 2,138 2 , 57 Quick Ratio 0,565 1 , 3 2 , 38 Cash Ratio 5 , 66 13 , 06 23 , 79 Interest coverage ratio PROFITLIABILITY a.Formula Gross profit margin = Gross profit / Net Sales

Operating profit margin = Net Profit from Operating activities / Net Sales Net profit margin

= Profit after Corporate Income Tax / Net Sales

ROA = Profit from financial activities / Total Assets

ROE = Profit from financial activities / Owners equity b) Information table 2019 2020 2021 GROSS PROFIT 14 ,92% , 18 1 3% 18 ,88% MARGIN 7 ,12% 8 % 11 ,05% 8 lOMoARc PSD|36244503 OPERATING PROFIT RATE Net profit margin 11 % 8 % 5, 9% ROE 45 % 35 ,1% 47 ,9% ROA 21 , 9 25 ,9% 37 ,5% ROIC 7% % 10 14 % FINANCIAL LEVERAGE a) Formula

Total debt ratio = Total debt/ Total assets

Debt-equity ratio =Total debt/ Total equity

Equity multiplier= Total assets/Total equity b) Information table Unit : TIMES 2019 2020 2021 OWNER'S CAPITAL/ 0,486 0,738 0 , 78 TOTAL ASSETS Total debt ratio 0,513 0 , 26 0,217 SHORT-TERM 0.35 0.90 0.44 DEMAND/Owner 's Equity Debt - equity ratio 1,056 0 , 35 0,278 Equity multiplier 1,278 1 , 35 2,056 TURN OVER a.Formula

Total asset turnover= Net Sales current year/((Total Assets old year + Total Assets current year)/2) Receivable turnover

=Net Sales current year/(( Short term Account

Receivables old year + Short term Account Receivables current year)/2)

Inventory turnover = Cost of goods sold current year/(( Inventory old year + Inventory current year)/2) 9 lOMoARc PSD|36244503

Payable turnover = Cost of goods sold current year/(( Trade Creditors old year +

Trade Creditors current year)/2)

DOR = 365 / Receivable turnover

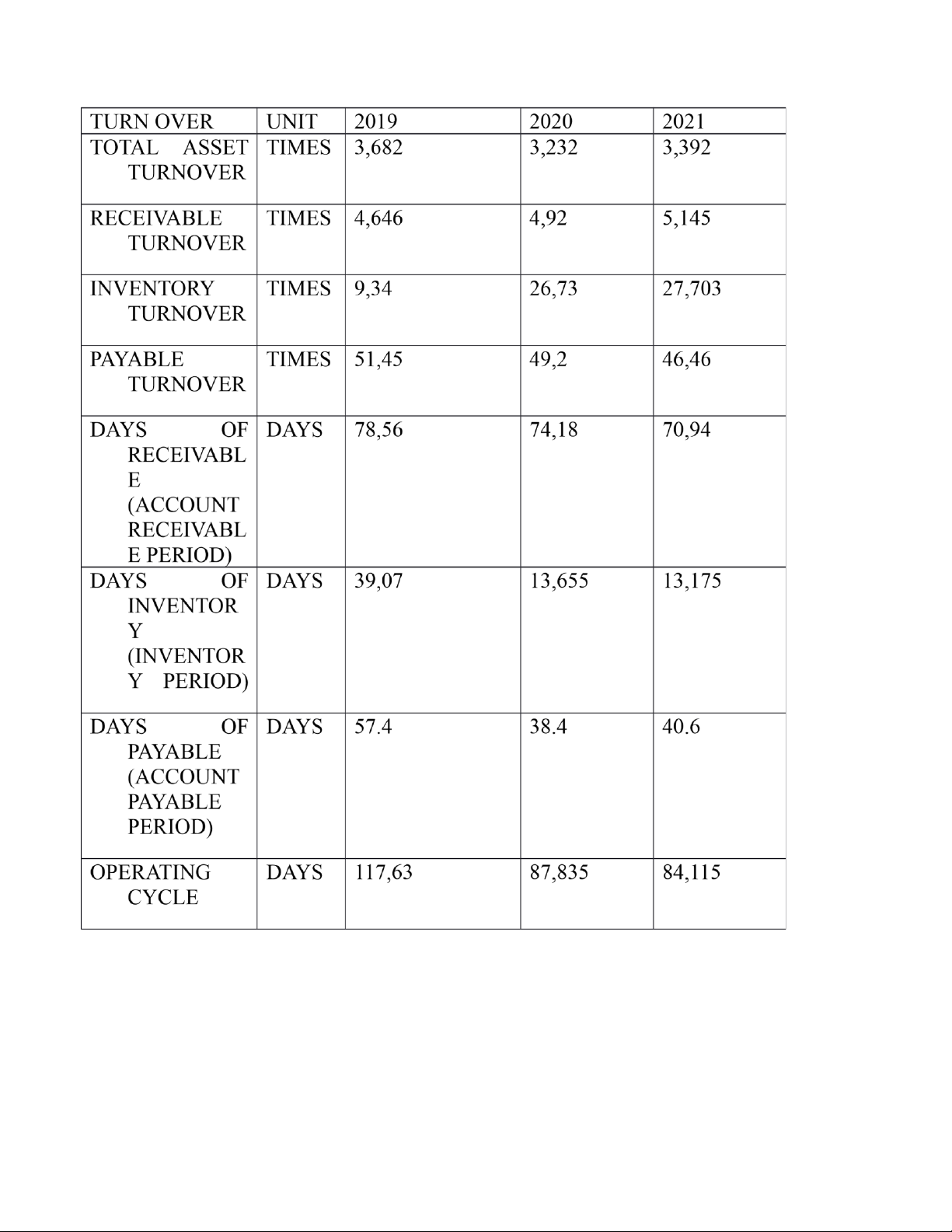

DOI = 365 / Inventory turnover DOP = 365 / Payable turnover Operating cycle = DOR + DOI b.Information table 10 lOMoARc PSD|36244503

ASSET VALUATION - MARKET VALUE RATIOS 11 lOMoARc PSD|36244503 UNIT: TIMES 2019 2020 2021 EPS 4,422 5751,76 10934,09 PE 6.58 6.69 7.96 PB 2.01 2.35 3.81 Dividend yield 0.0 % 1 ,5% 0 ,7% EV/EBITDA - - - EV/EBIT 3.69 4.53 5.58

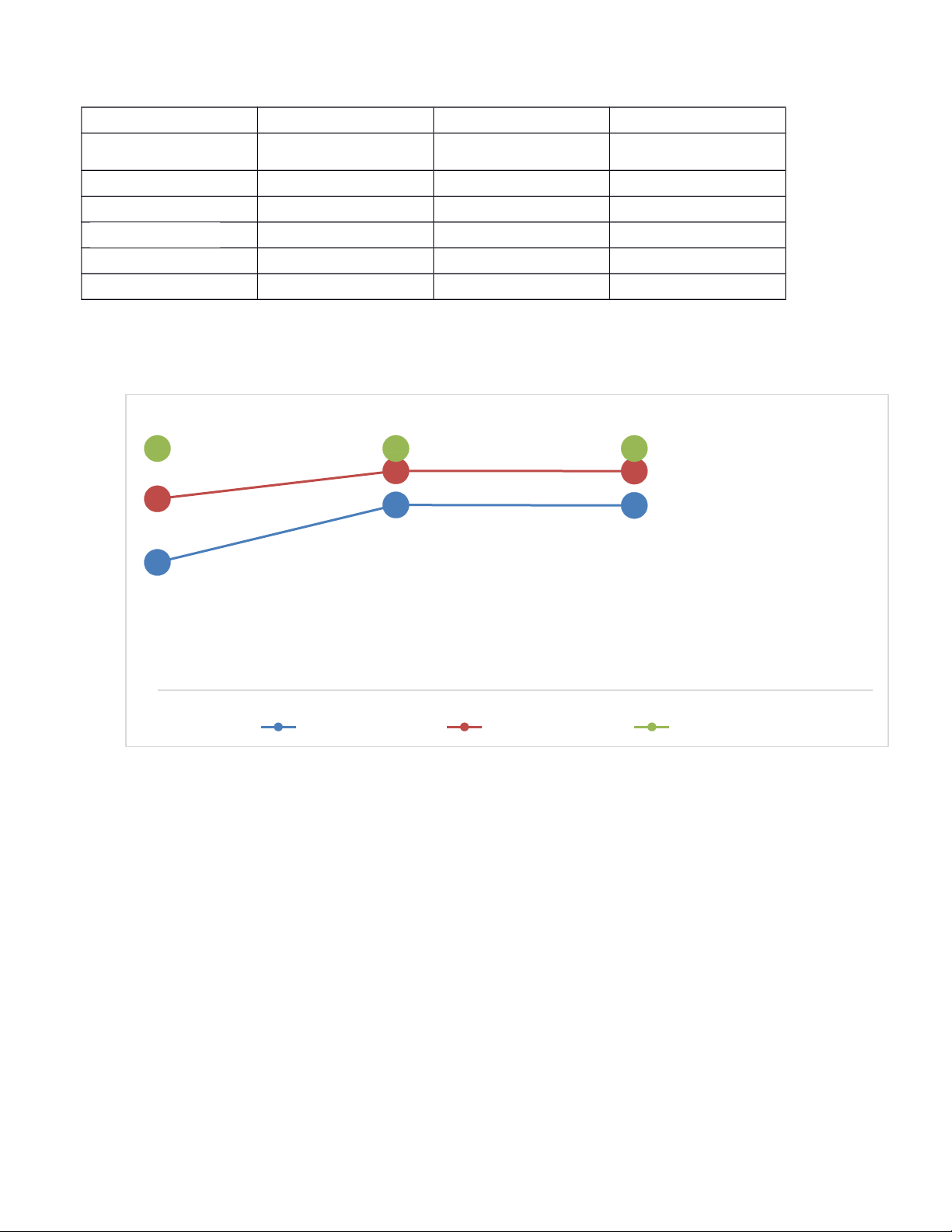

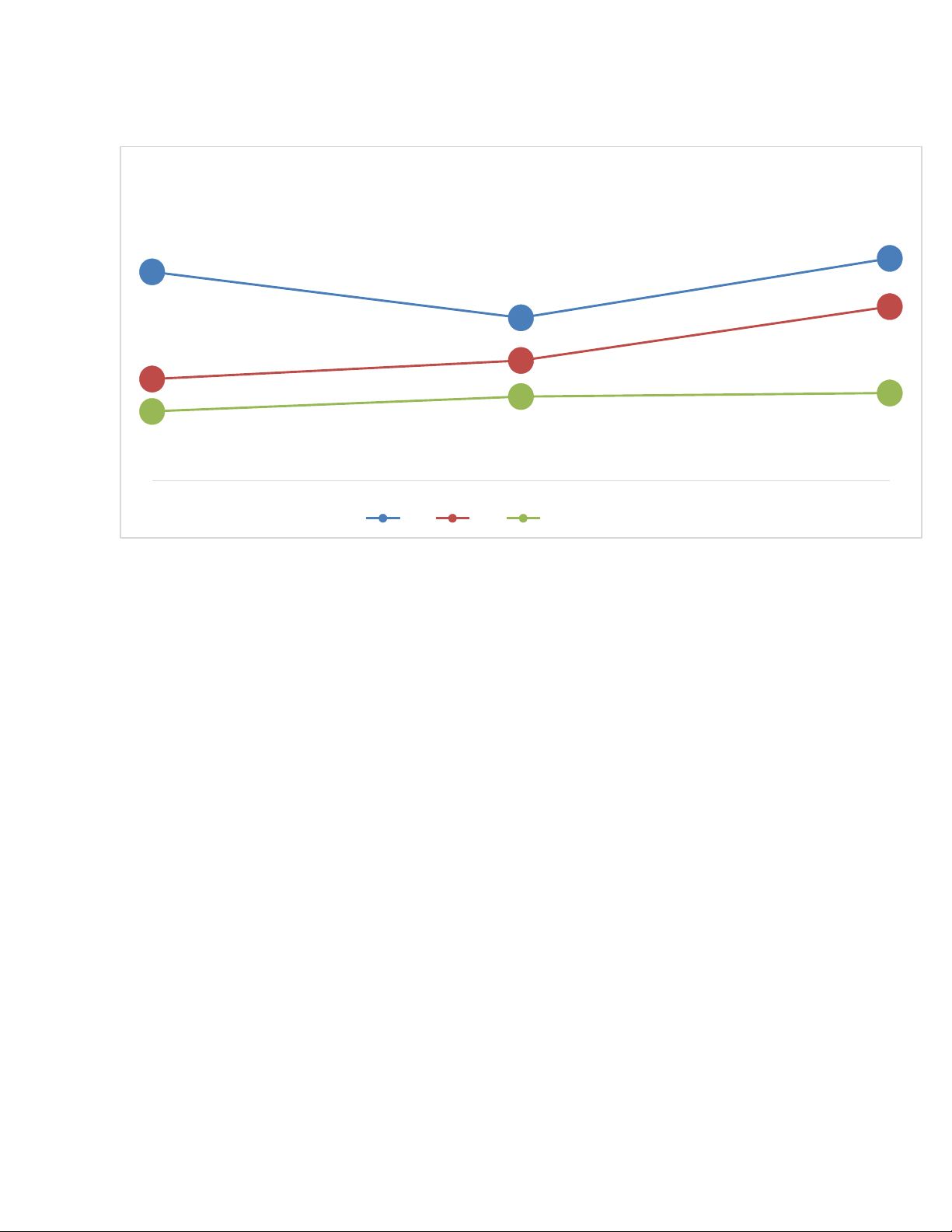

III: Time series analysis 1 Turnover Turnover 21 0. 0.09 09 0. 0.14 0.14 0.26 0.77 0.76 0.53 2019 2020 2021 INVENTORY TURNOVER RECEIVABLE TURNOVER TOTAL ASSET

Inventory turnover has increased significantly between 2019 and 2021, going from

9.34 to 27,703, indicating that the group is displaying symptoms of extraordinarily strong development.

Receivables turnover is consistent and ranges between 4,646 and 5,145. This

demonstrates how well the group's solvency policy is working.

Although the turnover of inventories and receivables is strong, the turnover of all

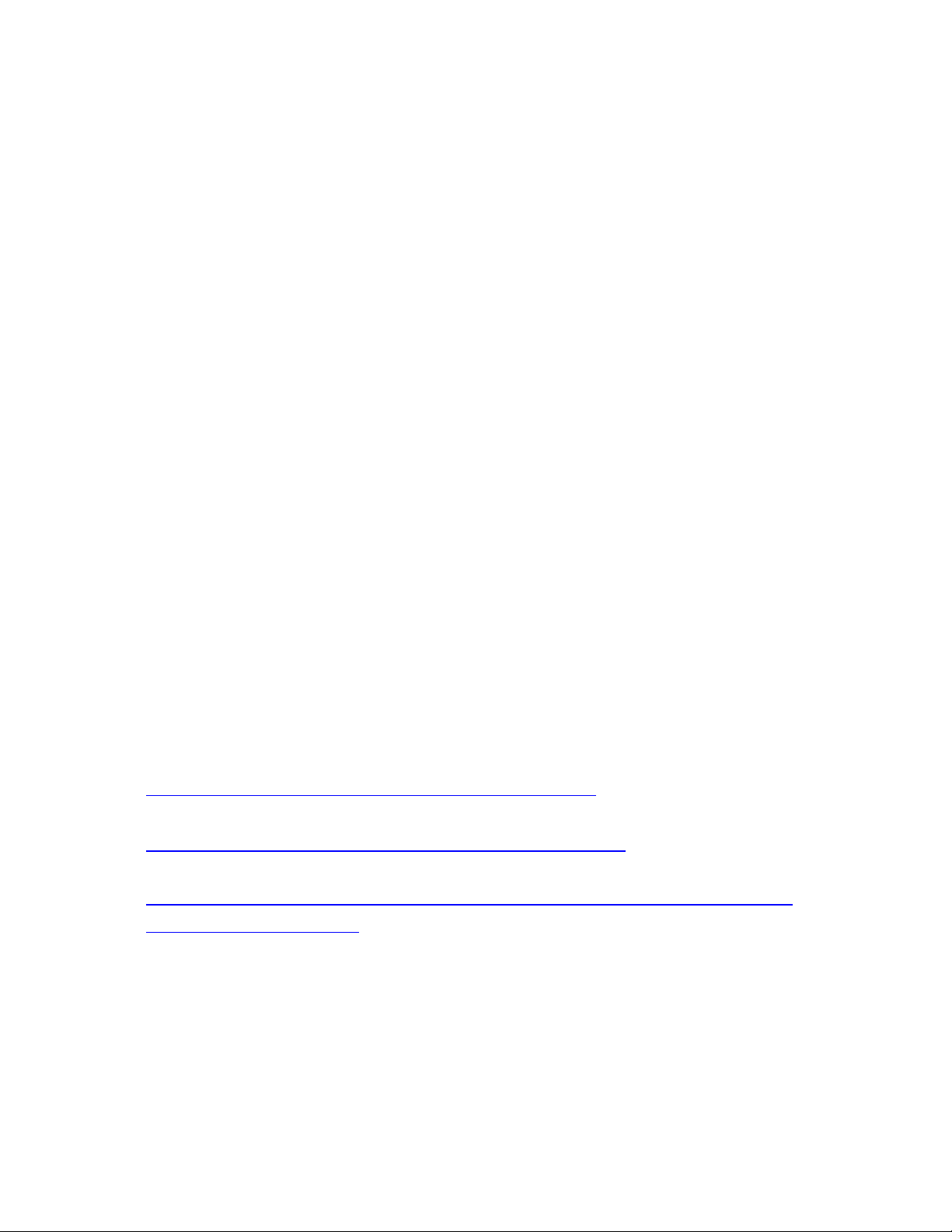

assets is low and tends to fall. This demonstrates how inefficiently the business is utilising its resources. 12 lOMoARc PSD|36244503 2 .Profitability Profitability 47.90 % 45.00 % 35.10 % 37.50 % 25.90 % 21.90 % 18.13 % 18.88 % 14.92 % 2019 2020 2021 ROE ROA GROSS PROFIT MARGIN

All three indicators are in an upward and downward trend. Because COVID had a

detrimental impact on the economy in 2019–2020, placing all firms in a challenging

situation. dramatically increases and decreases the statistics

However, by 2020–2021, the business had better numbers as a result of its recovery and

return to normal operations, which were occasionally even stronger than before. It made

a significant recovery and was virtually higher than before.

The most notable is ROE, which has almost fully recovered and increased from 35.1% to

47.9% in comparison to 2019. The ROA grew slightly from 35.9% to 37.5%, and the

gross profit margin increased slightly from 18.13% to 18,188, indicating that the other

two indices were not less competitive.

IV: Financial ratios A.The liquidity

From 2019 to 2021, the current ratios are all above 1, this ratio is stable because

short-term assets and short-term liabilities are maintained at a stable difference. This

shows that the group's debt solvency is guaranteed and its financial capacity is positive. 13 lOMoARc PSD|36244503

In 2019, the quick ratio is higher than 0.6, showing that the debt payment ability

is quite stable. But from 2020 to 2021, capacity has improved by increasing to 1,248

and 1.68. As liquid assets increase. It makes debt payment improved.

Cash ratio, from 2019 to 2020, cash ratio from 0.565 to 1.3 this is quite a

positive number. But by 2021, this ratio has increased to 2,38, proving the company

has succeeded in its strategies. B. Inventory ratio

From 2019 to 2020, the inventory ratio decreased sharply due to the impact of

the covid - 19 pandemic. But by 2021, this ratio will increase slightly, showing

that the company has reasonable adjustment plans for development. in the future and recover from covid-19 . C. Efficiency ratios

From 2019 to 2021, ROA continuously increased from 21.9% to 37.5%. This

proves that the company's development is very stable and suitable for safe

investors. This is a positive for business

From 2019 to 2020, the ROE ratio dropped sharply from 45% to 35.1% due to

the heavy impact of the covid-19 pandemic. But by 2021, the ROE will increase

sharply from 35.1% to 47.9. % . This proves that the financial management level,

cost management level, asset management level, capital management level of the

business is very good and there are many solutions to solve the problem extremely

effectively and efficiently. worthy of attention from investors. D. Price to Earning Ratio

P/E ratio, in 2019-2020, it increases from 6.58 to 6.69 but by 2021 it increases

quite a bit to 7.96. This ratio proves that the market is quite stable for business

development, which is also a positive and favorable point.

P/B ratio, in 2019-2020 it will increase from 2.01 to 2.35 but in 2021 it

increases quite ideally up to 3 81 , .This ratio proves the relationship between

market value and book value per share of the business tends to increase, which is

extremely beneficial for businesses and investors. 14 lOMoARc PSD|36244503

V: The pros and cons of financial ratio analysis. Advantages

- Assessing the effectiveness and efficiency of the business activities of the company.

- Financial structure ratios: show how much debt is used by the company to make a

profit or how financially independent the company is. Additionally, it is employed

to assess the effectiveness of the company's resources.

- The executives of the company can use it to predict and plan business and

production activities, as well as to decide whether to invest in order to finance

capital or trade on the financial market in order to assess risks and profit.

- In order to make investments, it can also be used to compare businesses.

- In order to assist executives in making better decisions, financial ratios can alsobe

seen as a strategy to influence the future of possible lenders and investors. Defect

- The time factor has not been indicated, and it is impossible to identify whether the

financial condition is excellent or poor. Inaccurate financial statements are not

recorded, and the accuracy of financial ratios is difficult to ascertain.

- Plans produced are not practical for businesses that operate in a variety of industries.

- Financial ratios frequently speak to the previous performance of the company

ratherthan its present or future performance, giving investors the chance to lose out

on a secure investment opportunity.

VI. Analyse the reason of changes in financial situations. Subjective reasons

- The cost of goods sold by the company is still high, and selling and

administrative costs still make up a sizable portion of total costs.

- Because of the excessive inventory, management costs have increased.

- The company's marketing and advertising efforts, while successful, are notas

successful as those of its big rivals and are not in line with the costs and

expectations of the business. -The level of staff is not high. Objective reasons

- The impact of the economic crisis made the company's business activities narrower than before. 15 lOMoARc PSD|36244503

- COVID-19 has had a significant impact on the company, leading to

significant losses, forcing companies to change the financial situation of the company.

VII. Problems and solutions 1 Problems

The economic situation in the world and in the country faces many

difficulties due to the impact of the Covid-19 pandemic; Therefore, most

customers are late to pay, affecting the company's production and business

process. Here are some limitations of the company when affected by the pandemic : Inventory

The company's inventory flows well, but the company's inventory level is

not reasonable, there are times when the company's inventory level is quite

low. It can be seen that a low level of inventory will lead to risks for the

company if the demand for products in the market spikes. At that time, the

company does not have enough goods to meet the needs of the market, and

creates an opportunity for competitors to invade the market for goods and

customers. It will be a great loss for the company if this is the case.

Accounts Receivable from Customers

With a decrease in receivables turnover, the company has a poor credit

recovery process from related transactions or debts, and the company's

credit policy is not good or customers are insolvent. debt settlement. This

will negatively affect the company's sales. For example: increasing bad

debt, difficult to control cash flow,.... Customers' inability to pay credit will

affect future transactions, and may even lead to the loss of customers. goods in the future. 2 Solutions

Solutions to improve inventory:

The company needs to build a reasonable inventory level to avoid low

inventory levels, then the company is always proactive in providing products to

consumers. Types of materials need to be built separately, specifically, then 16 lOMoARc PSD|36244503

information is provided to relevant departments for joint deployment and

implementation. The company also needs to actively develop a selective

purchasing plan right from the time of purchase, in order to find the source of

goods for the most convenient production and processing, and to meet the

requirements of the product. quantity, improve quality and reasonable price.

Solution for accounts receivable:

The company should change its credit policy, be cautious in granting credit and

change the credit recovery time to stimulate an increase in the receivables

turnover ratio. Credit solutions can be integrated in economic contracts and can

also be separate from economic contracts, flexible according to each specific situation.

The company needs to develop a debt collection and management process,

classify customers and apply payment discounts as well as different repayment periods.

The company needs to carry out detailed monitoring of receivables, detailed

classification of debts by size and debt duration; Regularly update the payment

situation and compare debts with customers, urge the recovery of lingering and prolonged debts.

Solutions to limit the company's financial risks:

From the perspective of risk management, the results of the analysis of

financial ratios are an important basis for identifying risks in business in order to

have solutions to overcome, thus preventing risks is at the same time improving. high business efficiency.

Being well aware of the impact of the trade war, Yen Bai Forestry Agro-Food

Products Joint Stock Company must operate in a fiercely competitive

environment, in order to survive and develop, businesses must constantly improve

quality management and improve restrictions as soon as possible

VIII. Conclution

The theoretical underpinning and the analysis and evaluation of the enterprise's

real financial state in the two parts have demonstrated the critical role that

financial position analysis plays in the operation of the business. For firms to

produce financial accounting reports that are accurate, the process of gathering 17 lOMoARc PSD|36244503

initial papers and documents is one that must be carefully organized. However,

businesses must frequently review financial and accounting data in order to be

able to make judgments about the best business plan in order to achieve high

efficiency based on the resources, money, and labor that are available superior.

Due to limitations in research time and qualifications, these analyzes and

evaluations will inevitably contain shortcomings, even being subjective, and the

proposed solutions may not be optimal. REFERENCES

o http://s.cafef.vn/hastc/CAP-cong-ty-co-phan-lam-nong-san-thuc-pham-yenbai.chn

o https://www.cophieu68.vn/financial.php?view=&id=cap&year=-1 o

https://finance.vietstock.vn/CAP/financials.htm?tab=CSTC

o https://vi.m.wikipedia.org/wiki/Ph%C3%A2n_t%C3%ADch_t%E1%BB%B7_s

%E1%BB%91_t%C%A0i_ch%C3%ADnh?fbclid=IwAR3hl25PQ0yPg2c7W990I

IsKJq7di4vCjL5epW-gwSAmXfTtYd33BVshWE

o https://vn.investing.com/equities/yen-bai-forest-jsc o

https://www.cophieu68.vn/calculate_index.php?id=cap

o https://vn.tradingview.com/symbols/HNX-CAP/financials-balance-sheet/? selected=total_liabilities 18 lOMoARc PSD|36244503