Preview text:

Group assignment presentation 4: Case STUDY ANALYSIS

Student’s name: Vương Thảo Linh

Student’s ID: 11223858 Class: 14.1

The Surprising Elasticity of Demand for Luxuries

As part of an overall package to reduce the US Budget deficit, the Congress adopted a 10%

'luxury tax" on such big-ticket items as pleasure boats, private airplanes, high- priced cars,

jewelry... Such luxury taxes are often popular because most people do not have to pay them. All

taxes are painful to someone, but surely a tax that weighs only on rich people who are buying

frivolous luxuries is one of the more socially painless ways to raise money.

However, the discussion of elasticity and inelasticity in this chapter should make you suspicious

of a key assumption underlying this tax. The assumption was that the demand for these luxury

goods was quite inelastic. We can think of the luxury tax as increasing the total cost of producers

face in bringing a goods to market, so the supply curve effectively shifts up. Thus, when the

industry supply curve shifted up in response to the new luxury tax, the equilibrium quantity

would change little while the equilibrium price would rise much, as the rich simply paid the extra cost.

If the demand for these luxury goods was reasonable elastic, however, then the upward shift in

the supply curve would lead to a much smaller rise in equilibrium price and a lager fall in

equilibrium quantity. As it happened, sale of pleasure boats fell by nearly 90% in South Florida,

as prospective buyers bought boats in the Bahamas to avoid paying the tax. Sale of high- priced

cars like Mercedes and Lexus also fell substantially when their customers moved to buy substitution products.

This unexpected elasticity of demand carried two bits of bad news for the economy. First, rather

than falling on the wealthy as had been hoped, the burden of the new luxury tax actually ended

up falling on the workers and retailers who manufacture and sell these luxury items, many of

whom are middle class at best. Second, the luxury tax raised far less money than had been

expected. The Congressional Budget Office had forecast that the tax would raise about $1.5

billion over five years. But in the first year, it raised only about $ 20 million. Once the costs of

setting up and enforcing the new tax were considered, it probably lost money for the Government in its first year. Discussion Questions

1. How can you use the theory of "Supply, Demand- and elasticity " to explain the case (by using graphs)?

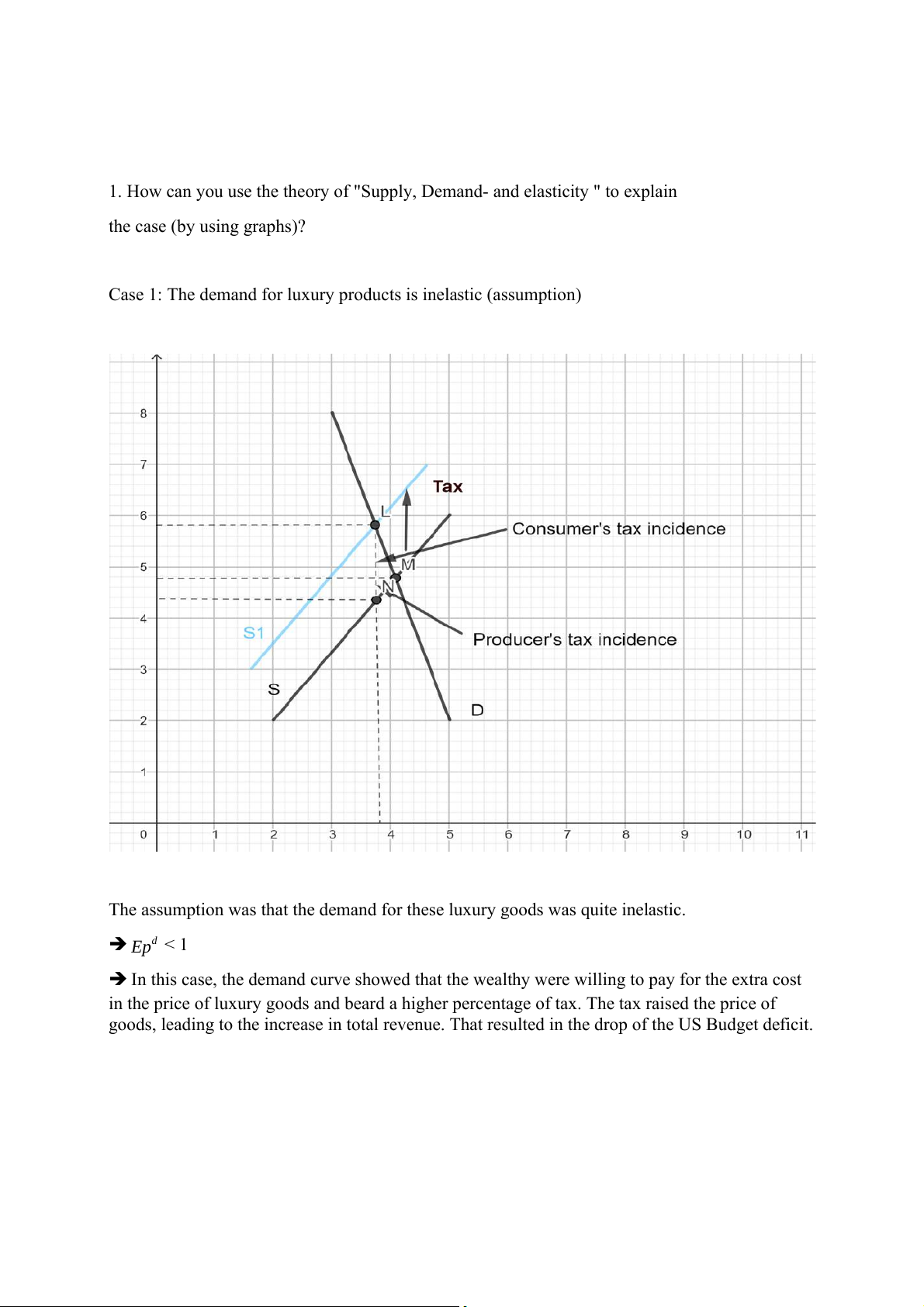

Case 1: The demand for luxury products is inelastic (assumption)

The assumption was that the demand for these luxury goods was quite inelastic. Epd < 1

In this case, the demand curve showed that the wealthy were willing to pay for the extra cost

in the price of luxury goods and beard a higher percentage of tax. The tax raised the price of

goods, leading to the increase in total revenue. That resulted in the drop of the US Budget deficit.

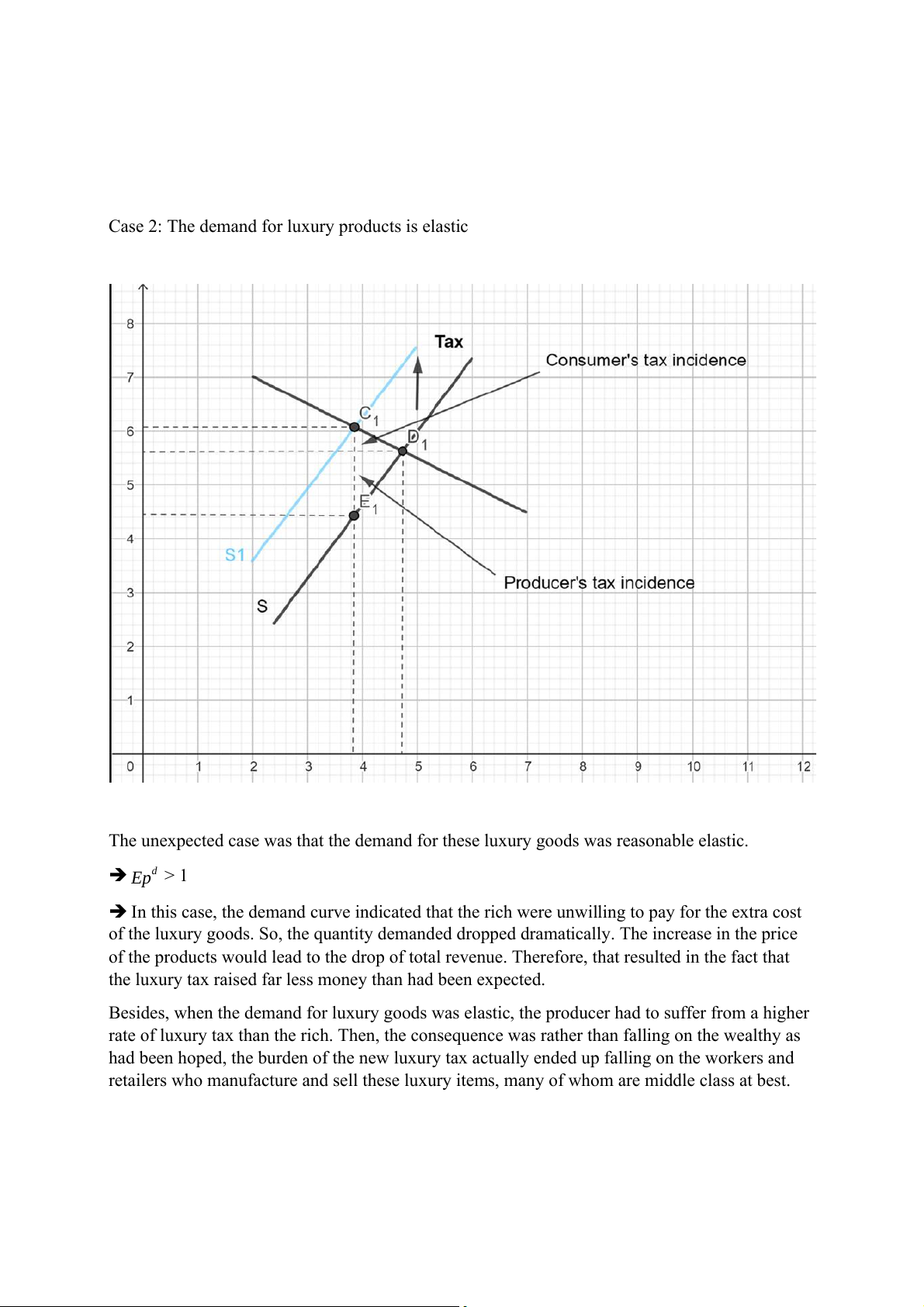

Case 2: The demand for luxury products is elastic

The unexpected case was that the demand for these luxury goods was reasonable elastic. Epd > 1

In this case, the demand curve indicated that the rich were unwilling to pay for the extra cost

of the luxury goods. So, the quantity demanded dropped dramatically. The increase in the price

of the products would lead to the drop of total revenue. Therefore, that resulted in the fact that

the luxury tax raised far less money than had been expected.

Besides, when the demand for luxury goods was elastic, the producer had to suffer from a higher

rate of luxury tax than the rich. Then, the consequence was rather than falling on the wealthy as

had been hoped, the burden of the new luxury tax actually ended up falling on the workers and

retailers who manufacture and sell these luxury items, many of whom are middle class at best.

2. What is implication for the Government in the tax policy ?

When the demand for luxury goods is elastic. The increase in the price of the products would

lead to the drop of total revenue. Therefore, that resulted in the fact that the luxury tax raised far

less money. To address that issue, the government should cut down on the tax or delete it.