Preview text:

MicroeconomicsEBDB5-Group3

TOPIC4:MARKETEFFICIENCYANDGOVERNMENT

INTERVENTION:TAXANDPRICECONTROLS ASSIGNMENT4::CASESTUDYANALYSIS

TheSurprisingElasticityofDemandforLuxuries Members: 1. Hoàng Trọng Hiếu 2. Trương Thu Thủy 3. Cao Văn Tài

4. Phạm Thị Nguyệt Thảo 5. Nguyễn Trung Kiên

6. Lương Thị Bạch Dương

Question1:How can you use the theory of "Supply, Demand- and elasticity "

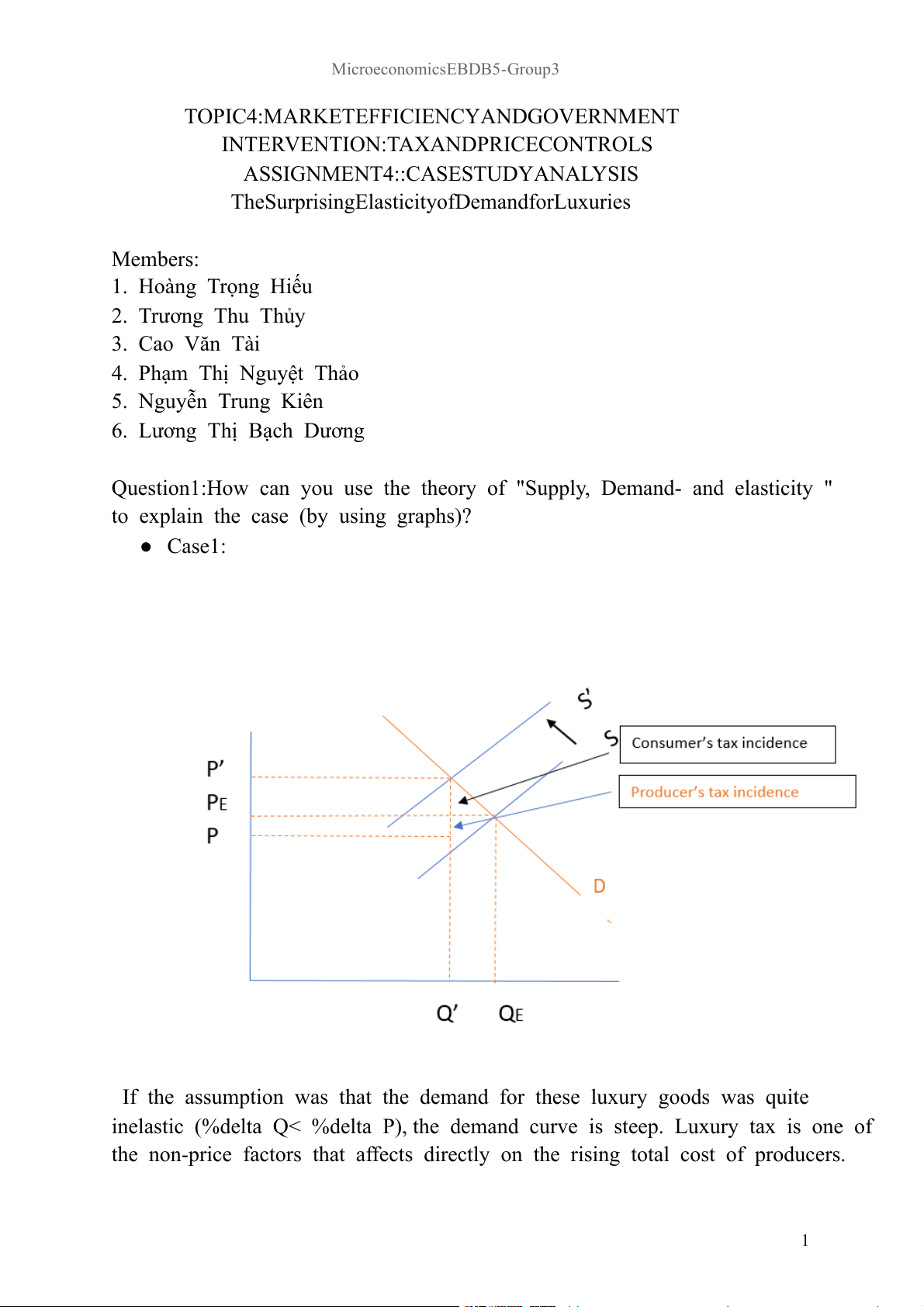

to explain the case (by using graphs)? ● Case1:

If the assumption was that the demand for these luxury goods was quite

inelastic (%delta Q< %delta P), the demand curve is steep. Luxury tax is one of

the non-price factors that affects directly on the rising total cost of producers. 1 MicroeconomicsEBDB5-Group3

Therefore, the supply curve shifts to the left, which means the price on luxury

items will increase strongly. However, the rich actually are willing to pay the

extra cost to buy the luxury items which they really wanted. When price has a

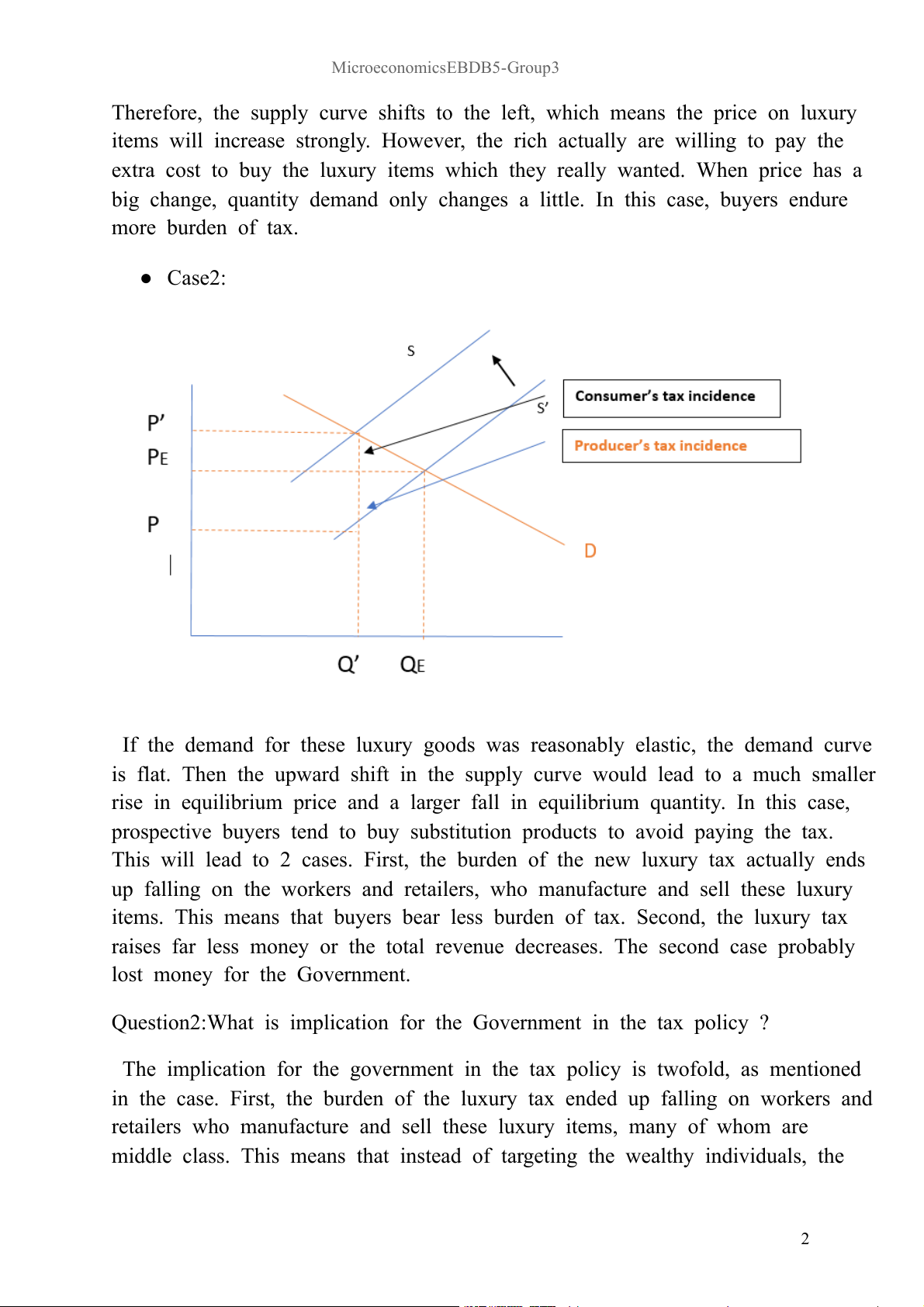

big change, quantity demand only changes a little. In this case, buyers endure more burden of tax. ● Case2:

If the demand for these luxury goods was reasonably elastic, the demand curve

is flat. Then the upward shift in the supply curve would lead to a much smaller

rise in equilibrium price and a larger fall in equilibrium quantity. In this case,

prospective buyers tend to buy substitution products to avoid paying the tax.

This will lead to 2 cases. First, the burden of the new luxury tax actually ends

up falling on the workers and retailers, who manufacture and sell these luxury

items. This means that buyers bear less burden of tax. Second, the luxury tax

raises far less money or the total revenue decreases. The second case probably lost money for the Government.

Question2:What is implication for the Government in the tax policy ?

The implication for the government in the tax policy is twofold, as mentioned

in the case. First, the burden of the luxury tax ended up falling on workers and

retailers who manufacture and sell these luxury items, many of whom are

middle class. This means that instead of targeting the wealthy individuals, the 2 MicroeconomicsEBDB5-Group3

tax indirectly affected the livelihoods of those involved in the production and sale of luxury goods.

Second, the luxury tax raised far less money than expected. The Congressional

Budget Office had forecasted that the tax would generate approximately $1.5

billion over five years, but in the first year, it only raised about $20 million. This

significant discrepancy suggests that the tax policy did not achieve its revenue-raising goal.

Furthermore, when considering the costs associated with setting up and

enforcing the new tax, it is likely that the government ended up losing money in

the first year. This implies that the tax policy did not fulfill its intended purpose

of improving the government's financial position and reducing the budget deficit. 3