Preview text:

Group 6 – EBBA 16.2

Group assignment presentation 4: Case STUDY ANALYSIS

The Surprising Elasticity of Demand for Luxuries

1. How can you use the theory of "Supply, Demand- and elasticity " to

explain the case (by using graphs)? -

When the Congress imposed the 10% tax on luxury goods, the producers

reacted to the cost increase created by the tax by trying to increase prices to cover this new cost

-> The Supply curve shifted up to the left 1.1.

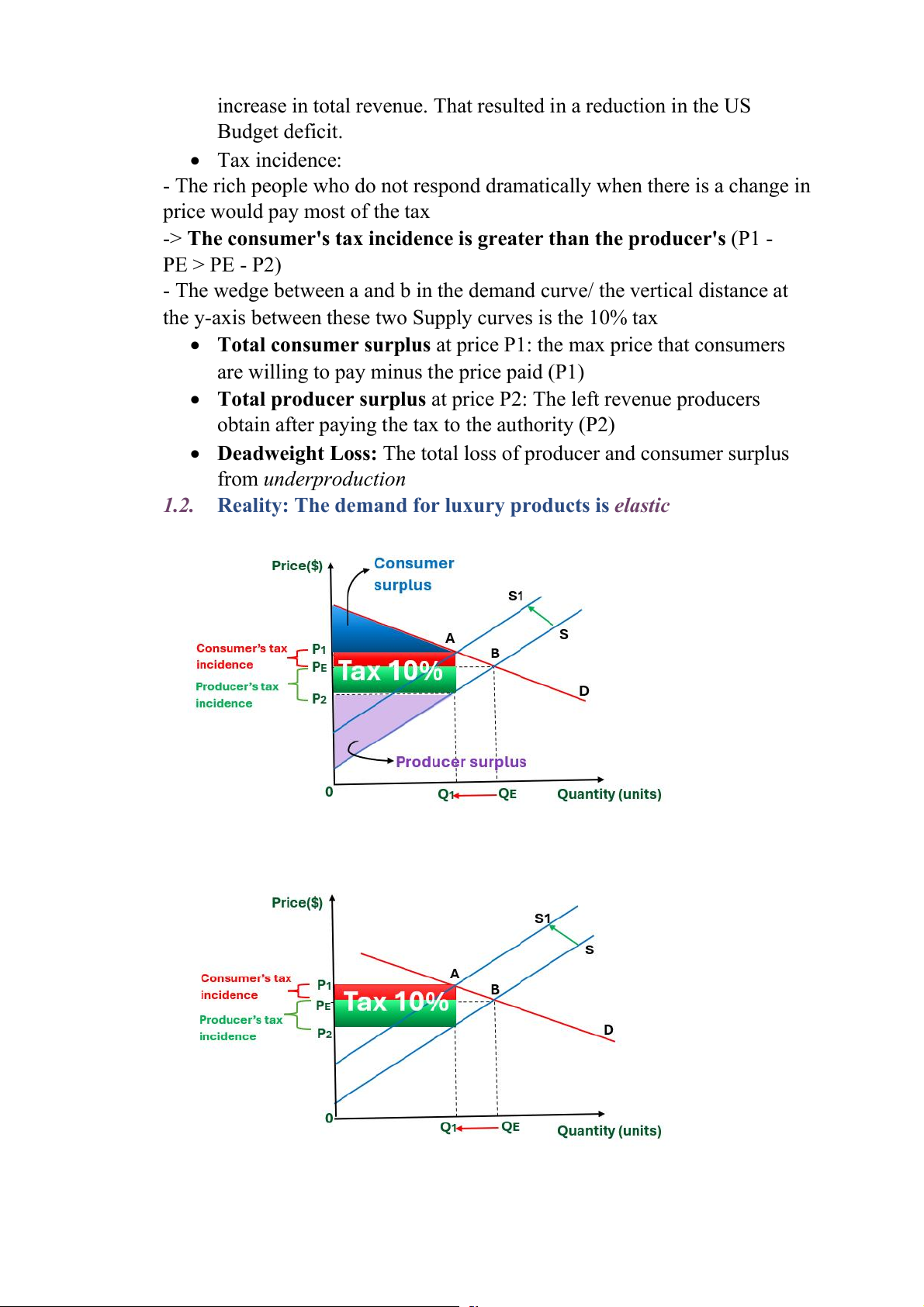

Case 01 - Assumption: The demand for luxury products is inelastic

The government assumed that the demand for big-ticket items was

relatively inelastic, which meant that:

- the supply curve shifted up with a larger rise in equilibrium price and a

relatively small fall in equilibrium quantity

In this case, the demand curve showed that the wealthy were willing

to pay for the extra cost in the price of luxury goods and bore a higher

percentage of tax. The tax raised the price of goods, leading to an

increase in total revenue. That resulted in a reduction in the US Budget deficit. Tax incidence:

- The rich people who do not respond dramatically when there is a change in

price would pay most of the tax

-> The consumer's tax incidence is greater than the producer's (P1 - PE > PE - P2)

- The wedge between a and b in the demand curve/ the vertical distance at

the y-axis between these two Supply curves is the 10% tax

Total consumer surplus at price P1: the max price that consumers

are willing to pay minus the price paid (P1)

Total producer surplus at price P2: The left revenue producers

obtain after paying the tax to the authority (P2)

Deadweight Loss: The total loss of producer and consumer surplus from underproduction 1.2.

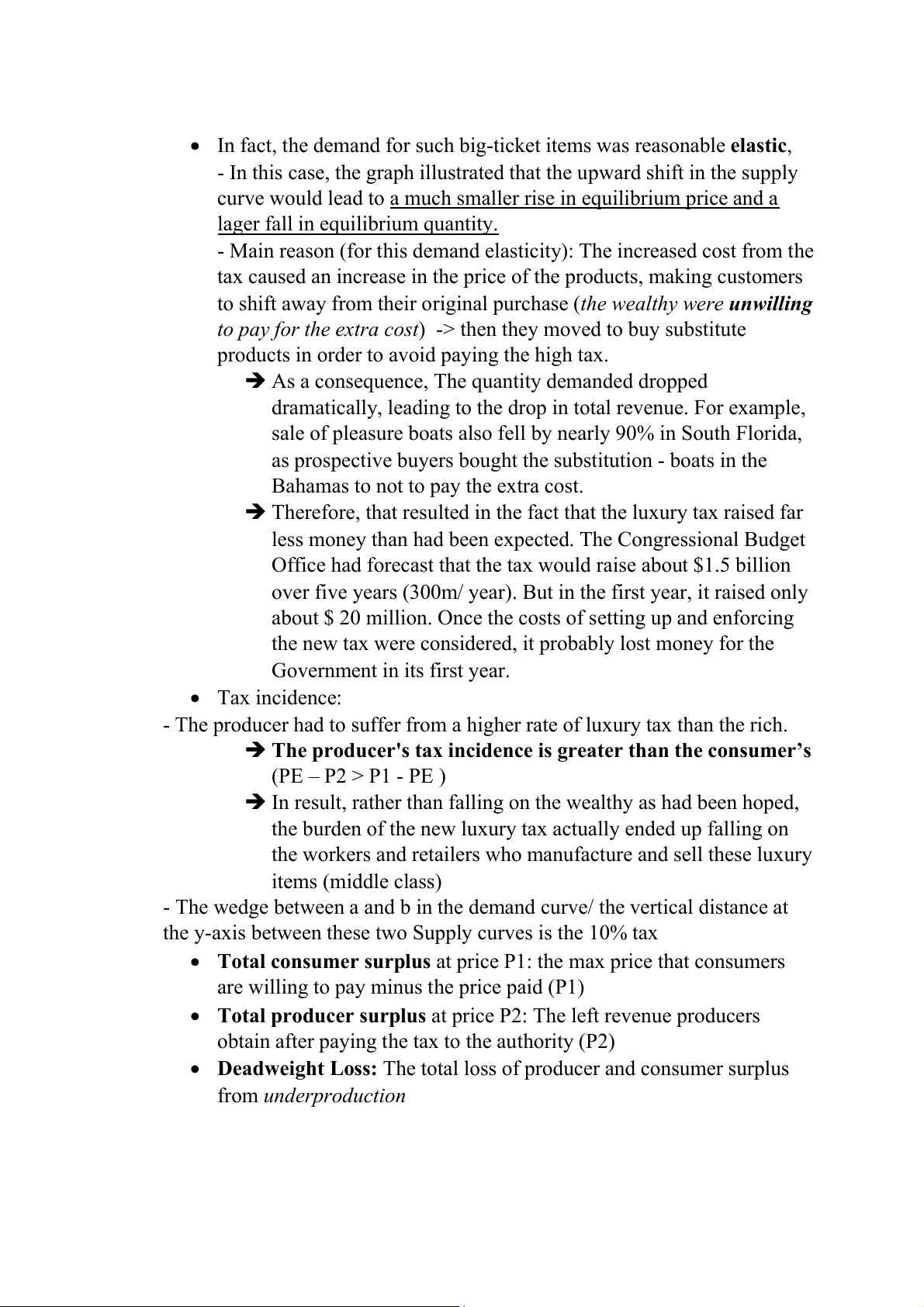

Reality: The demand for luxury products is elastic

In fact, the demand for such big-ticket items was reasonable elastic,

- In this case, the graph illustrated that the upward shift in the supply

curve would lead to a much smaller rise in equilibrium price and a

lager fall in equilibrium quantity.

- Main reason (for this demand elasticity): The increased cost from the

tax caused an increase in the price of the products, making customers

to shift away from their original purchase (the wealthy were unwilling

to pay for the extra cost) -> then they moved to buy substitute

products in order to avoid paying the high tax.

As a consequence, The quantity demanded dropped

dramatically, leading to the drop in total revenue. For example,

sale of pleasure boats also fell by nearly 90% in South Florida,

as prospective buyers bought the substitution - boats in the

Bahamas to not to pay the extra cost.

Therefore, that resulted in the fact that the luxury tax raised far

less money than had been expected. The Congressional Budget

Office had forecast that the tax would raise about $1.5 billion

over five years (300m/ year). But in the first year, it raised only

about $ 20 million. Once the costs of setting up and enforcing

the new tax were considered, it probably lost money for the Government in its first year. Tax incidence:

- The producer had to suffer from a higher rate of luxury tax than the rich.

The producer's tax incidence is greater than the consumer’s (PE – P2 > P1 - PE )

In result, rather than falling on the wealthy as had been hoped,

the burden of the new luxury tax actually ended up falling on

the workers and retailers who manufacture and sell these luxury items (middle class)

- The wedge between a and b in the demand curve/ the vertical distance at

the y-axis between these two Supply curves is the 10% tax

Total consumer surplus at price P1: the max price that consumers

are willing to pay minus the price paid (P1)

Total producer surplus at price P2: The left revenue producers

obtain after paying the tax to the authority (P2)

Deadweight Loss: The total loss of producer and consumer surplus from underproduction

2. What is implication for the Government in the tax policy ?

“If the demand for these luxury goods was reasonably elastic, however, then the

upward shift in the supply curve would lead to a much smaller rise in equilibrium

price and a larger fall in equilibrium quantity. As it happened, sale of pleasure

boats fell by nearly 90% in South Florida, as prospective buyers bought boats in

the Bahamas to avoid paying the tax. Sales of high-price cars like Mercedes and

Lexus also fell substantially when their customers moved to buy substitution products.”

*To avoid paying tax, buyers had done:

- buying goods in other places where the price weren’t affected by the luxury tax

- buying substitution products => the fall in the sales of luxury goods

For those reasons, there were some negative consequences including:

When the taxes are high, businesses will find ways to deal with them,

one of which is to reduce worker’s wages and increase export prices

for retailers. Thus, the people who subject to this tax are workers and

retailers instead of the wealth => this is the wrong direction

high taxes will lead to a decrease in supply so the government loses.

This is because too high taxes lead to some cases of tax evasion so

the government have to spend money to make up for the loses

*To fix this, the policy tax should be change as:

Lower tax collection or before taxation must be tested in some places to see as if it is positive

Anti tax evasion and anti dumping

raising the import duty to prevent consumers from buying the

substitution products with lower or no taxes

setting import quota on certain luxury goods to benefit local producers and workers

=> All these alternatives are supposed to prevent the wealth from

buying things without paying taxes; pressing the workers and retailers who

are mostly in the middle class and losing money on the government’s budget.