Preview text:

Chapter 7

Efficiency, Exchange, and the Invisible Hand in Action

©2022 McGraw Hill. All rights reserved. Authorized only for instructor use in the classroom. No reproduction or distribution without the prior written consent of McGraw Hill. Learning Objectives

1. Define and explain the differences between accounting

profit, economic profit, and normal profit.

2. Explain the invisible hand theory and show how

economic profit and economic loss affect the allocation

of resources across industries.

3. Explain why economic profit, unlike economic rent,

tends toward zero in the long run.

4. Identify whether the market equilibrium is socially

efficient and why no opportunities for gain remain open

for individuals when a market is in equilibrium.

5. Calculate total economic surplus and explain how it is

affected by policies that prevent the market from reaching equilibrium. 2 ©2022 McGraw Hill. The Invisible Hand

• Individuals act in their own interests

– Aggregate outcome is collective well-being • Profit motive

– Produces highly valued goods and services

– Allocates resources to their highest value use 3 ©2022 McGraw Hill. Accounting Profit Accounting profit =

Total revenue Ð Explicit costs

– Explicit costs are payments firms make to purchase

• Resources (labor, land, etc.) and • Products from other firms • Easy to compute

• Easy to compare across firms 4 ©2022 McGraw Hill. Economic Profit Economic profit =

Total revenue Ð Explicit costs Ð Implicit costs – Also called excess profits

• Implicit costs are the opportunity costs of the

resources supplied by the firm's owners

• Normal profit is the difference between

accounting profit and economic profit

– Normal profits keep the resources in their current use 5 ©2022 McGraw Hill. Three Kinds of Profit

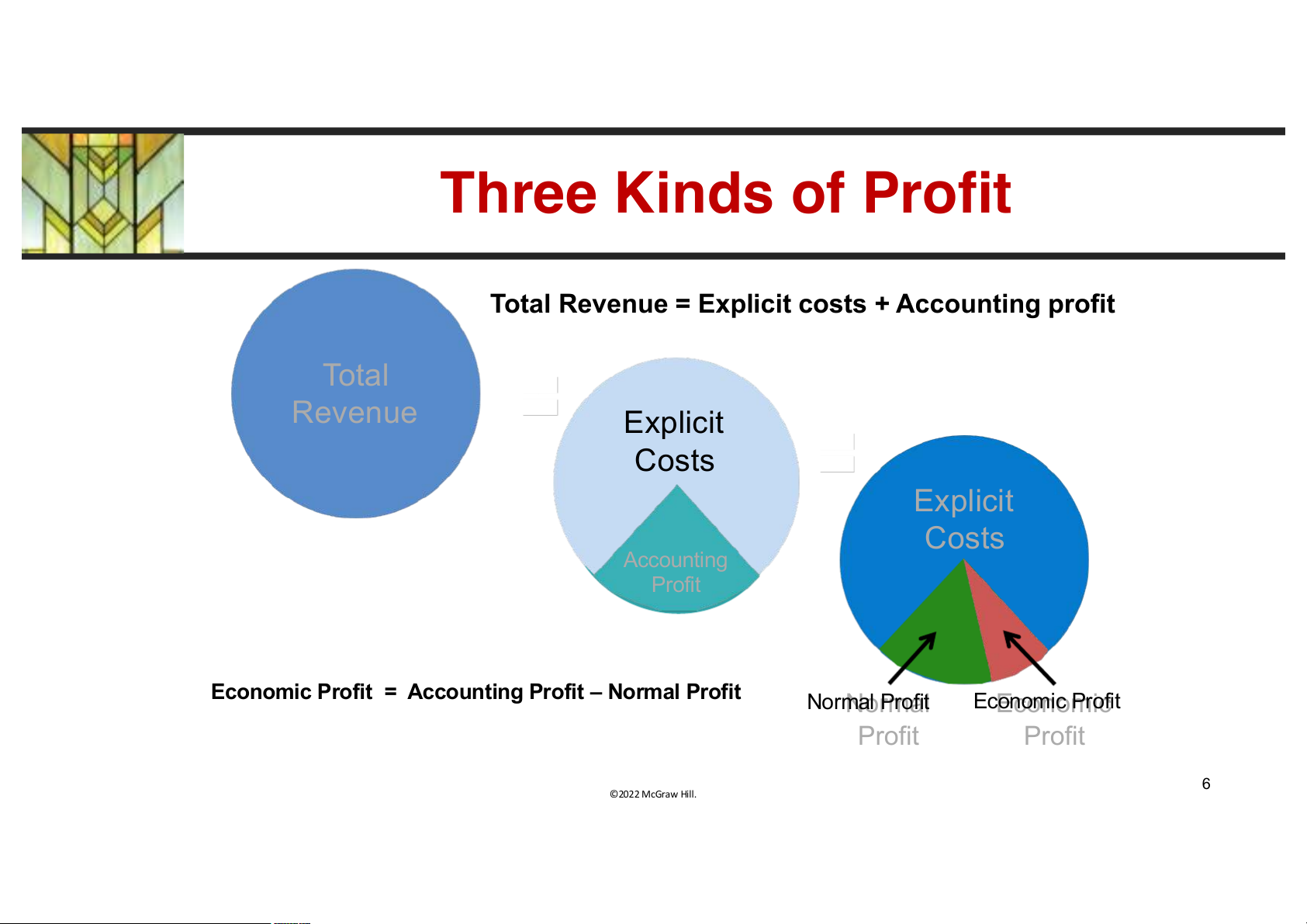

Total Revenue = Explicit costs + Accounting profit Total Revenue Explicit Costs Explicit Costs Accounting Profit

Economic Profit = Accounting Profit – Normal Profit Nor N m o al r ma Profilt E E co c n o o n mio c mi Pr c ofit Profit Profit 6 ©2022 McGraw Hill.

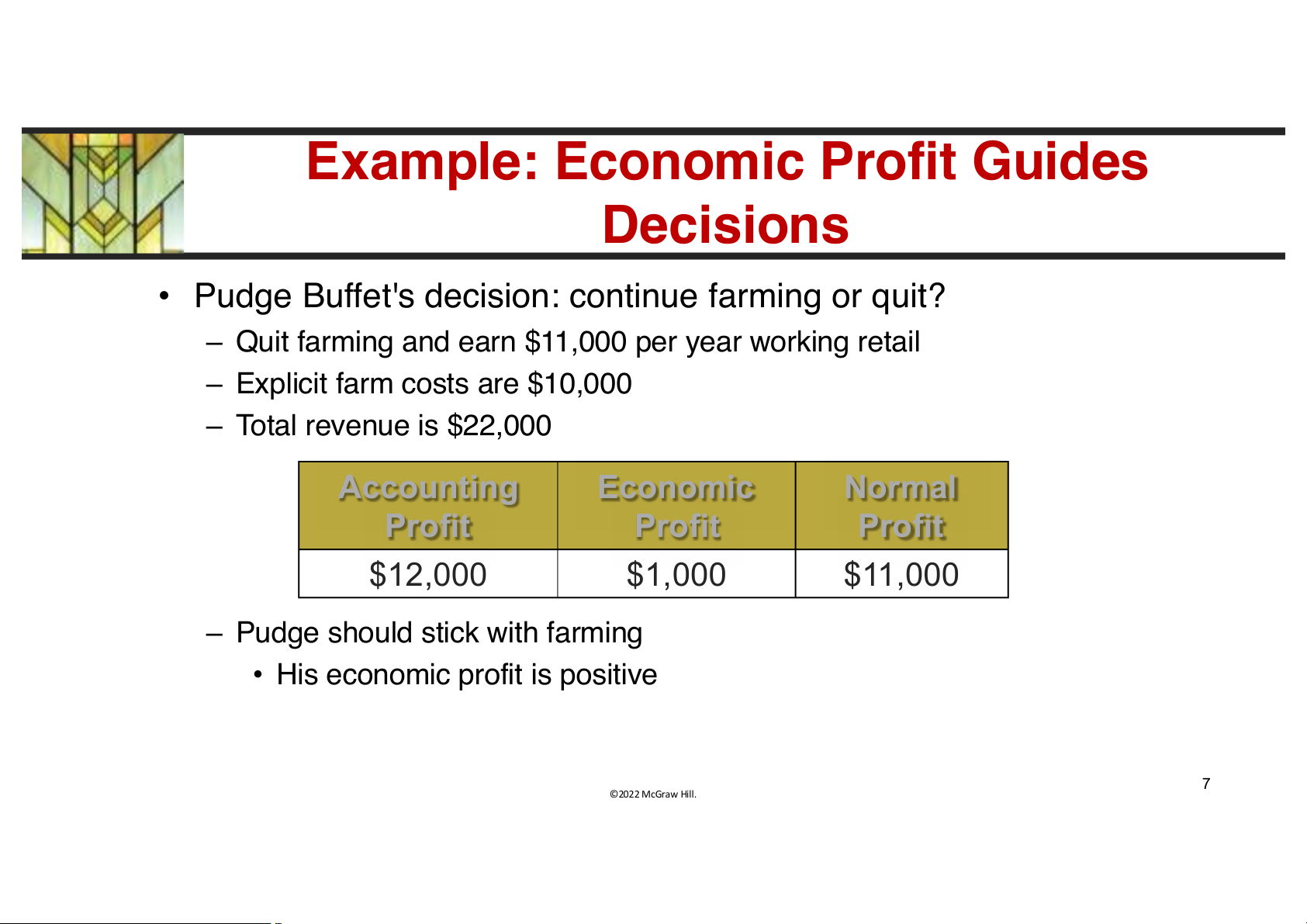

Example: Economic Profit Guides Decisions

• Pudge Buffet's decision: continue farming or quit?

– Quit farming and earn $11,000 per year working retail

– Explicit farm costs are $10,000 – Total revenue is $22,000 Accounting Economic Normal Profit Profit Profit $12,000 $1,000 $11,000

– Pudge should stick with farming

• His economic profit is positive 7 ©2022 McGraw Hill.

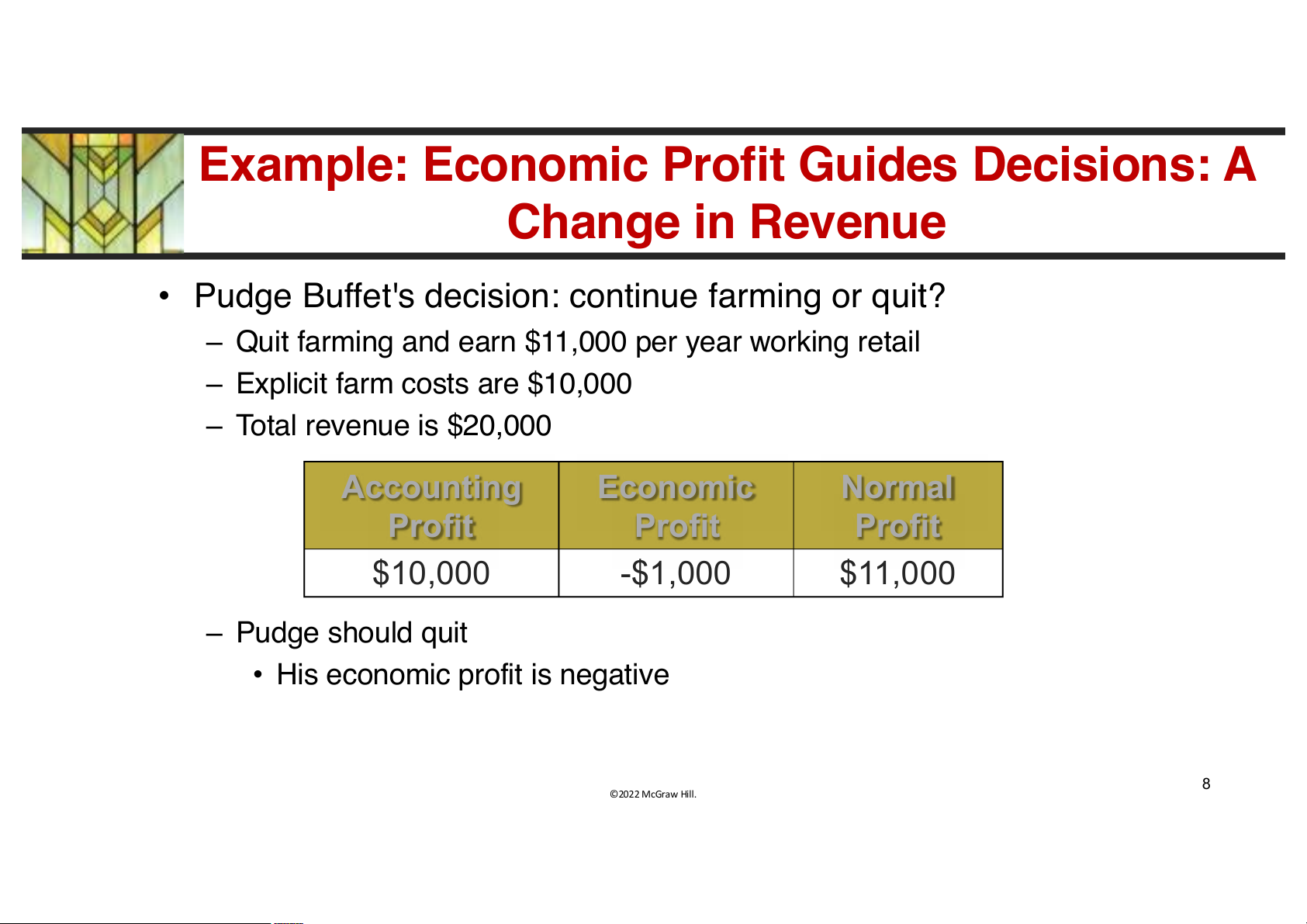

Example: Economic Profit Guides Decisions: A Change in Revenue

• Pudge Buffet's decision: continue farming or quit?

– Quit farming and earn $11,000 per year working retail

– Explicit farm costs are $10,000 – Total revenue is $20,000 Accounting Economic Normal Profit Profit Profit $10,000 -$1,000 $11,000 – Pudge should quit

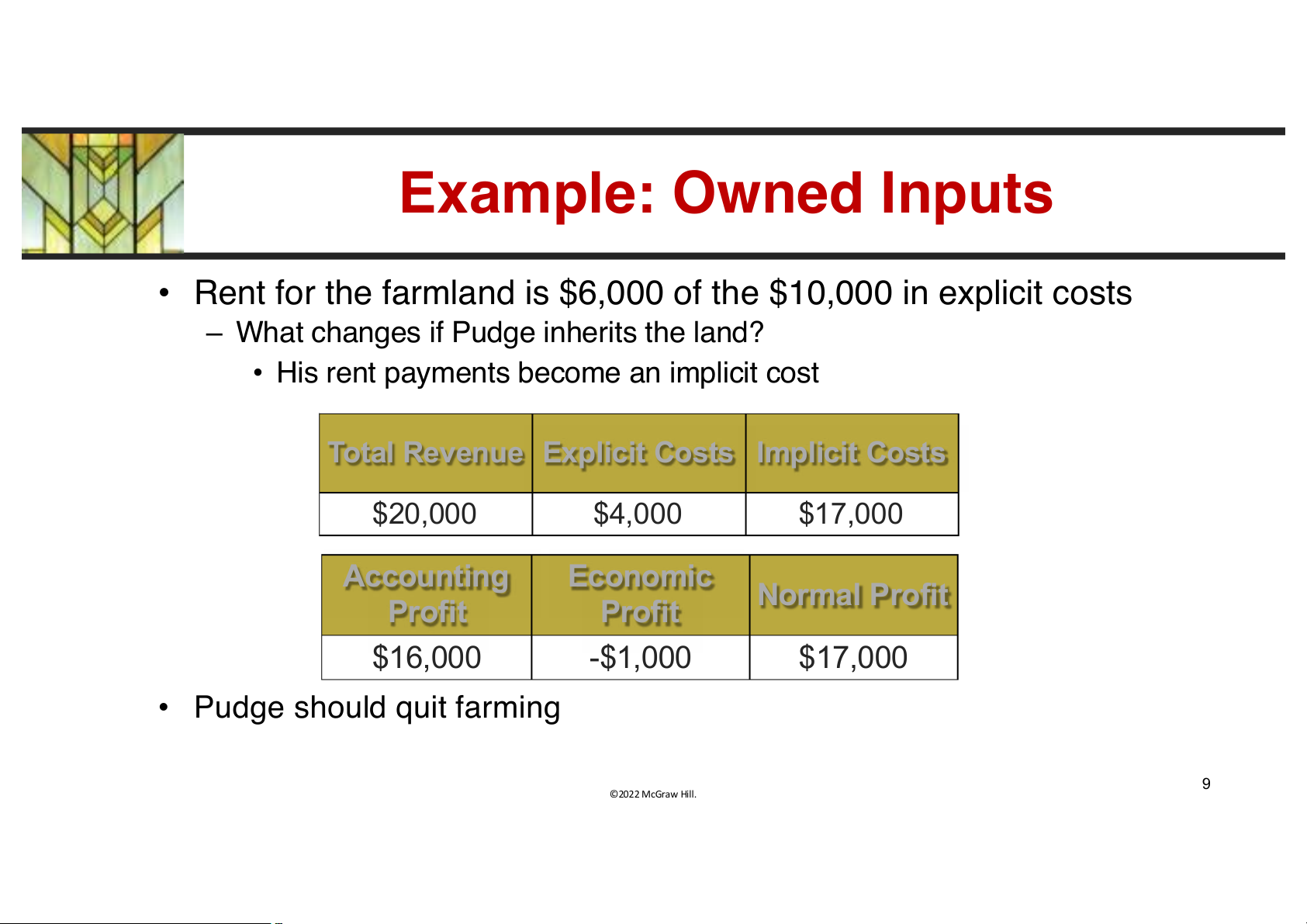

• His economic profit is negative 8 ©2022 McGraw Hill. Example: Owned Inputs

• Rent for the farmland is $6,000 of the $10,000 in explicit costs

– What changes if Pudge inherits the land?

• His rent payments become an implicit cost

Total Revenue Explicit Costs Implicit Costs $20,000 $4,000 $17,000 Accounting Economic Normal Profit Profit Profit $16,000 -$1,000 $17,000 • Pudge should quit farming 9 ©2022 McGraw Hill. Two Functions of Price

• Rationing function of price distributes scarce goods to the

consumers who value them most highly

• Allocative function of price directs resources away from

overcrowded markets to markets that are underserved

• Invisible hand theory states that the actions of independent, self-

interested buyers and sellers will often result in the most efficient allocation of resources – Adam Smith 10 ©2022 McGraw Hill.

Responses to Profits and Losses

• Will the firm remain in business in the long run?

– If it covers ALL of its costs

• Firms that earn normal profit recover only their opportunity cost

• Firms that earn positive economic profit recover more than their opportunity cost

• Markets in which firms are earning economic profit will attract resources

• Markets in which firms are suffering economic losses will lose resources 11 ©2022 McGraw Hill.

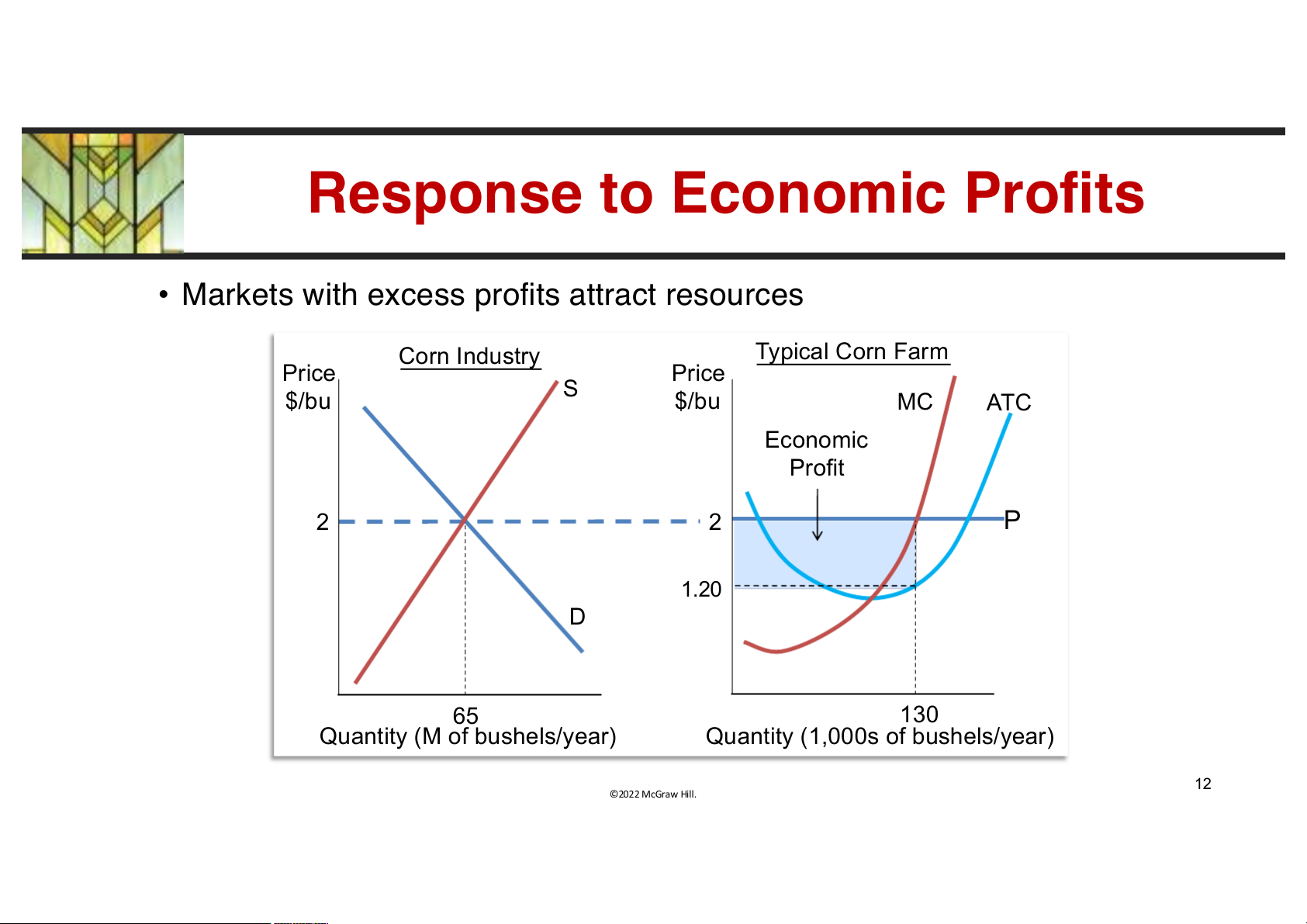

Response to Economic Profits

• Markets with excess profits attract resources Typical Corn Farm Corn Industry Price Price S $/bu $/bu MC ATC Economic Profit 2 2 P 1.20 D 65 130 Quantity (M of bushels/year)

Quantity (1,000s of bushels/year) 12 ©2022 McGraw Hill.

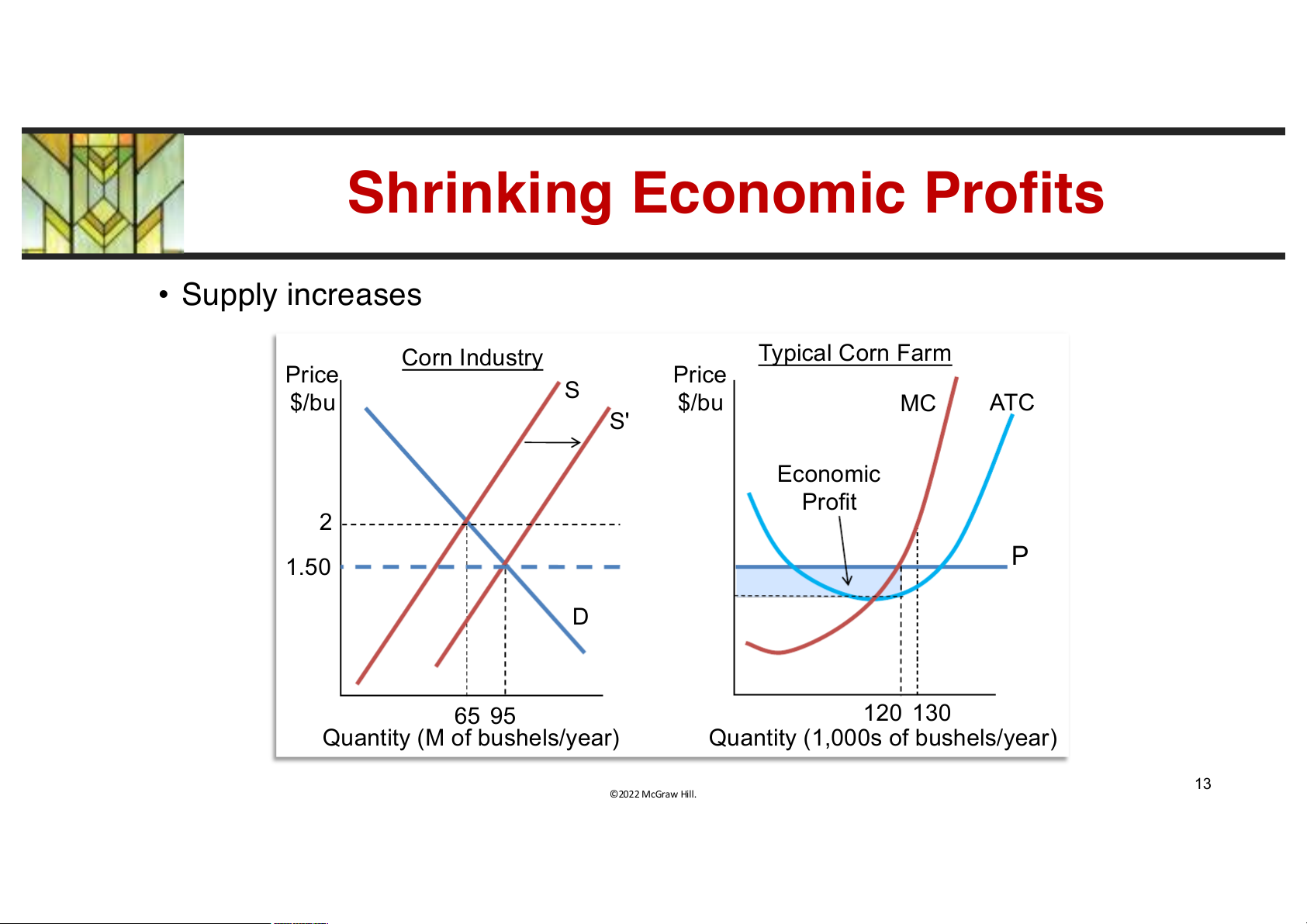

Shrinking Economic Profits • Supply increases Typical Corn Farm Corn Industry Price Price S $/bu $/bu MC ATC S' Economic Profit 2 P 1.50 D 65 95 120 130 Quantity (M of bushels/year)

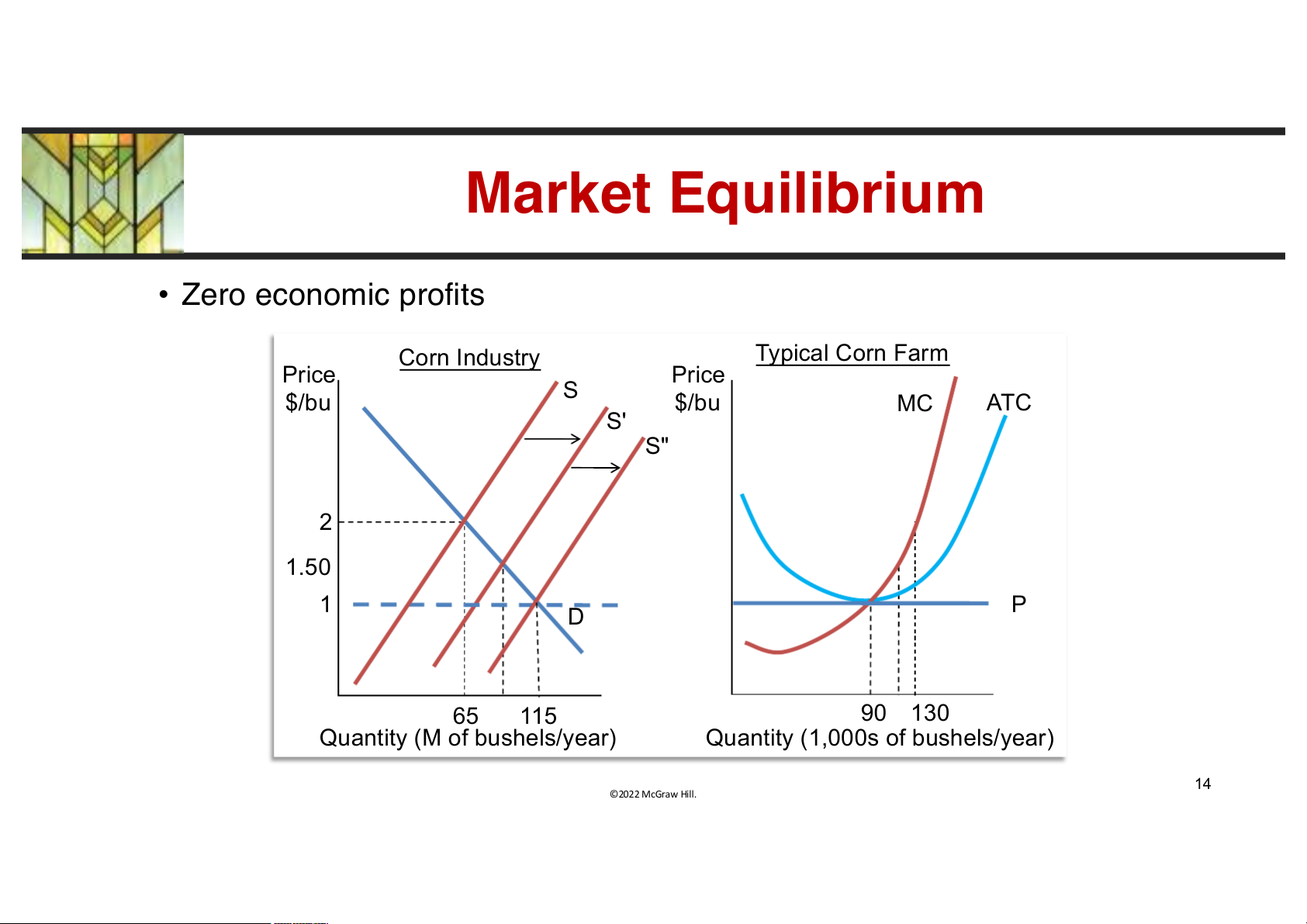

Quantity (1,000s of bushels/year) 13 ©2022 McGraw Hill. Market Equilibrium • Zero economic profits Typical Corn Farm Corn Industry Price Price S $/bu $/bu MC ATC S' S" 2 1.50 1 P D 65 115 90 130 Quantity (M of bushels/year)

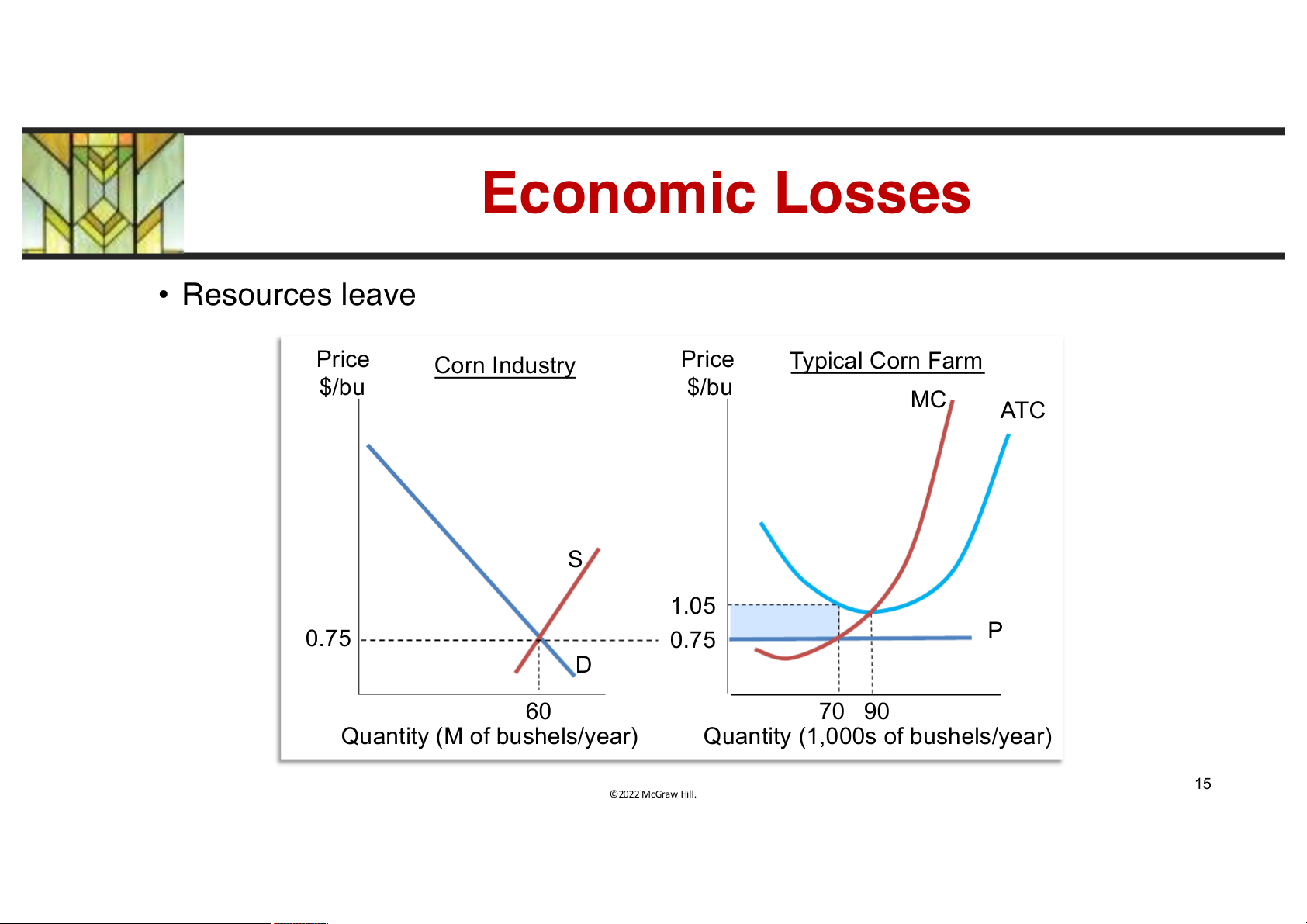

Quantity (1,000s of bushels/year) 14 ©2022 McGraw Hill. Economic Losses • Resources leave Price Price Typical Corn Farm Corn Industry $/bu $/bu MC ATC S 1.05 0.75 P 0.75 D 60 70 90 Quantity (M of bushels/year)

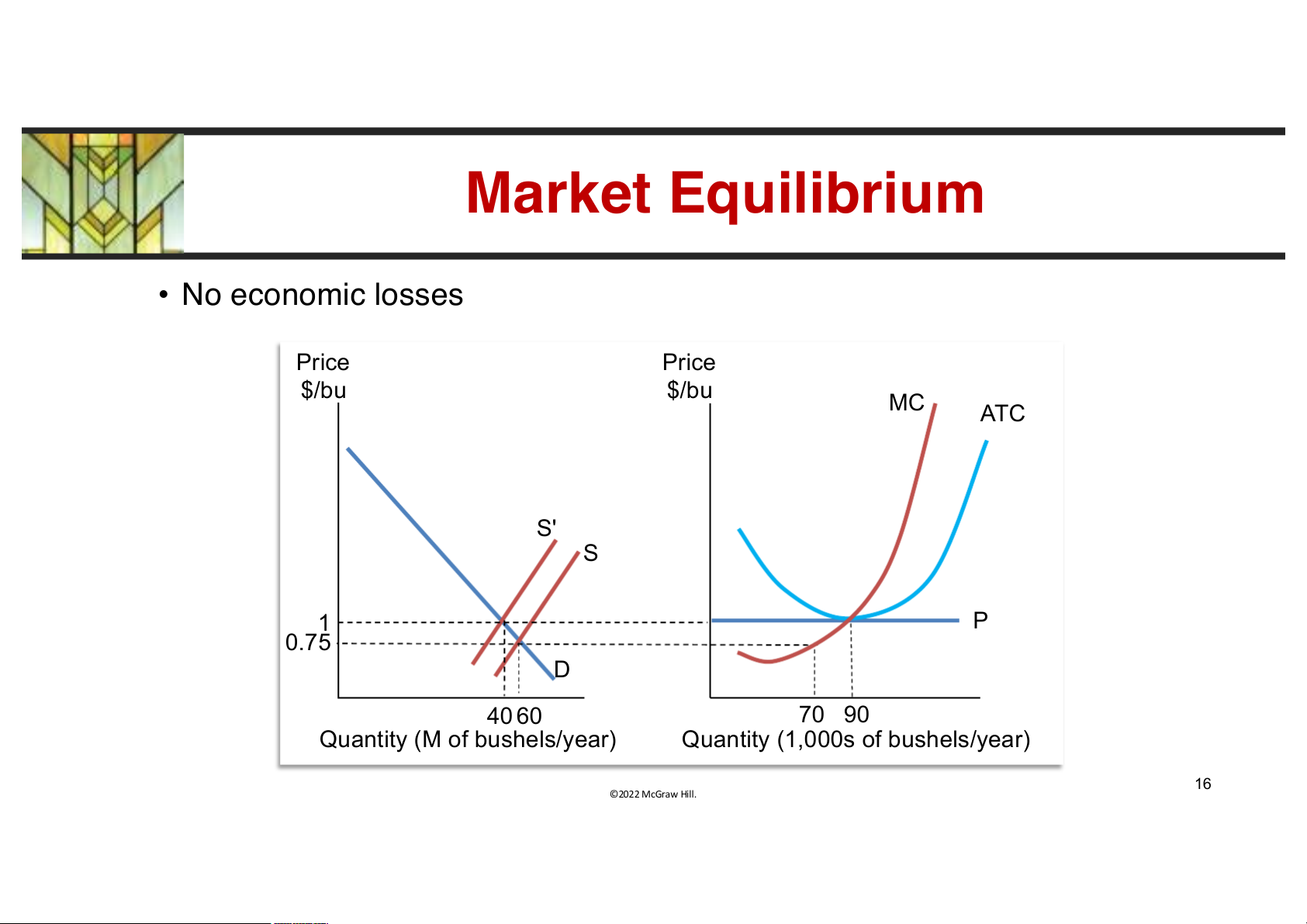

Quantity (1,000s of bushels/year) 15 ©2022 McGraw Hill. Market Equilibrium • No economic losses Price Price $/bu $/bu MC ATC S' S 1 P 0.75 D 40 60 70 90 Quantity (M of bushels/year)

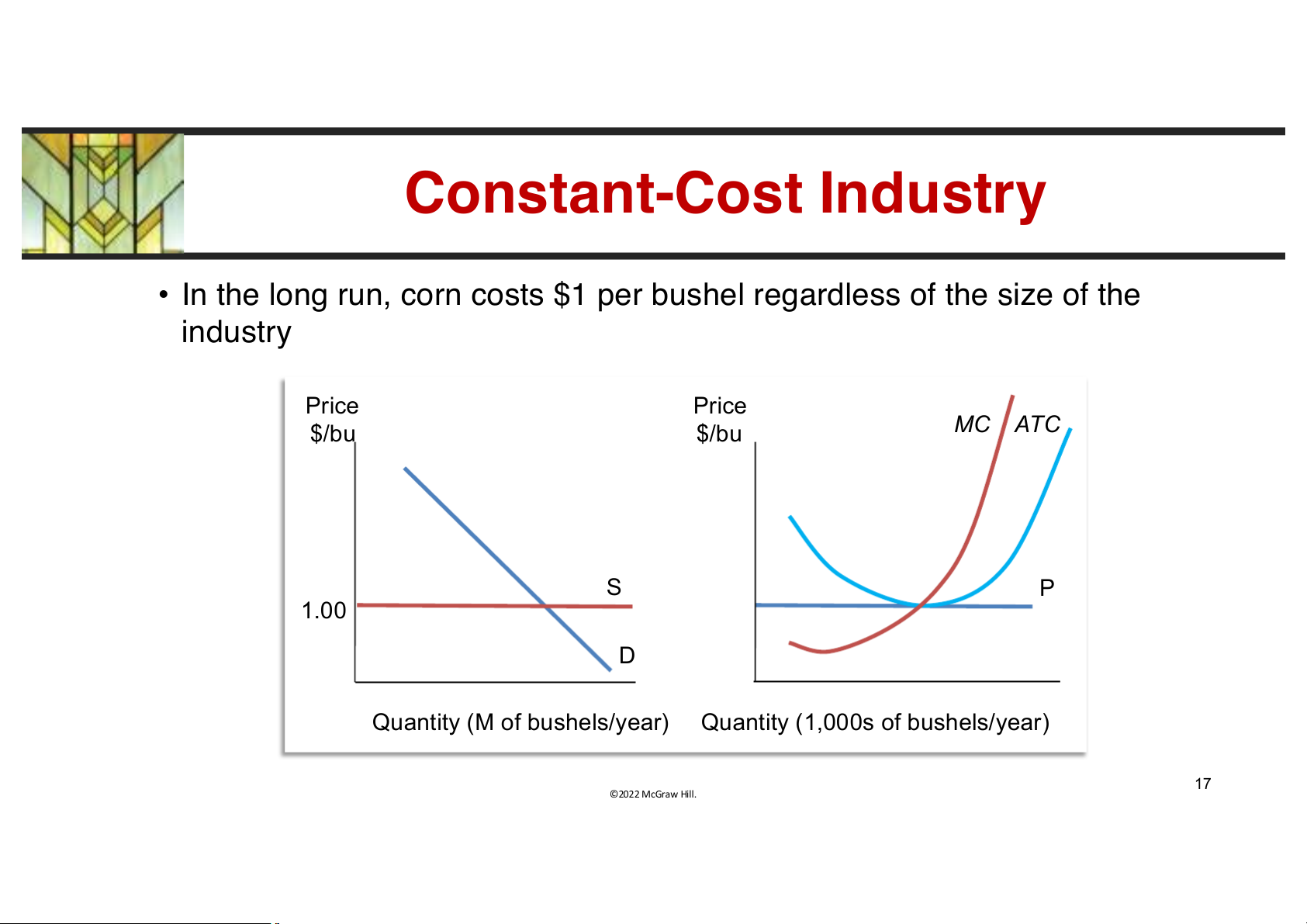

Quantity (1,000s of bushels/year) 16 ©2022 McGraw Hill. Constant-Cost Industry

• In the long run, corn costs $1 per bushel regardless of the size of the industry Price Price MC ATC $/bu $/bu S P 1.00 D Quantity (M of bushels/year)

Quantity (1,000s of bushels/year) 17 ©2022 McGraw Hill.

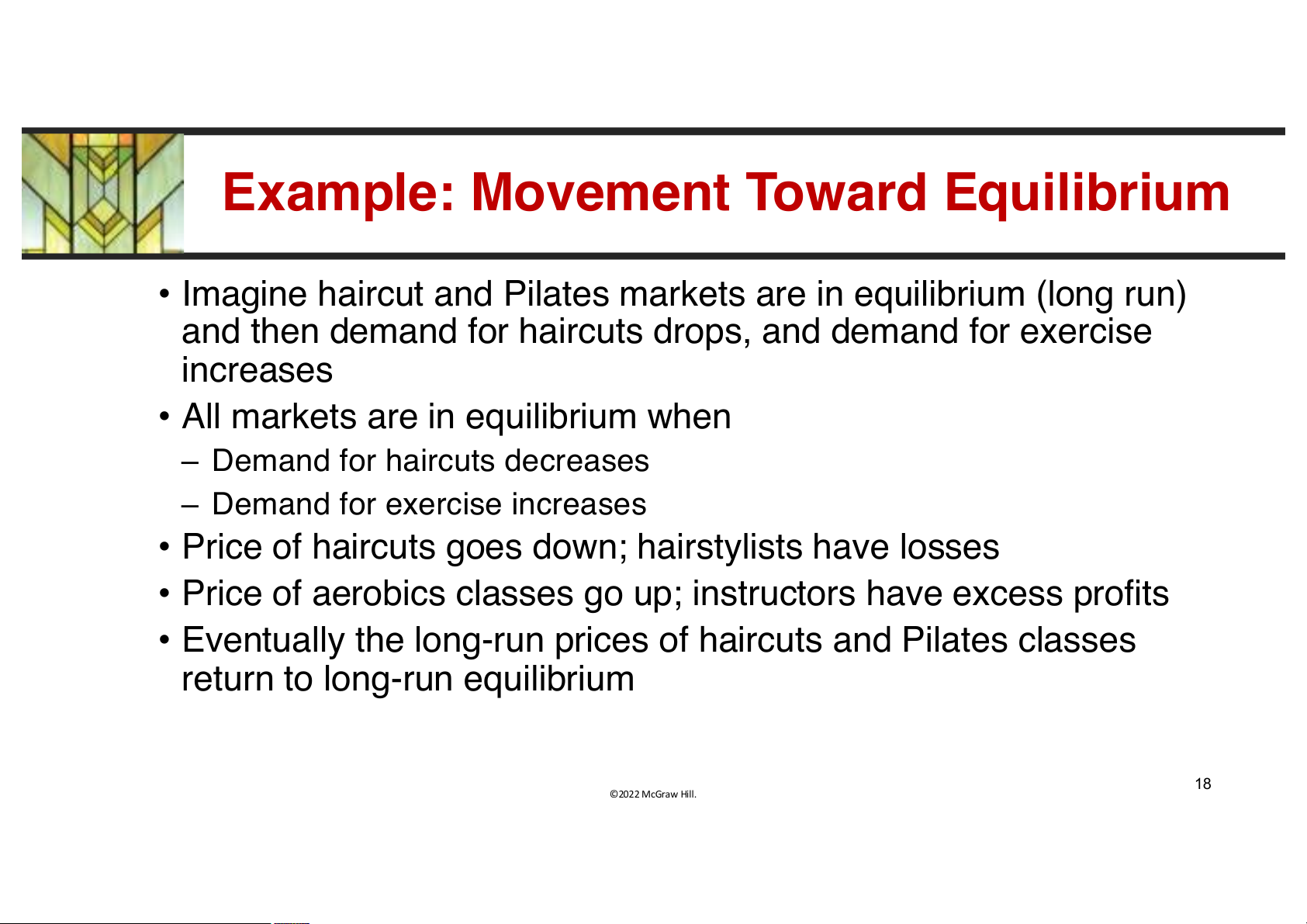

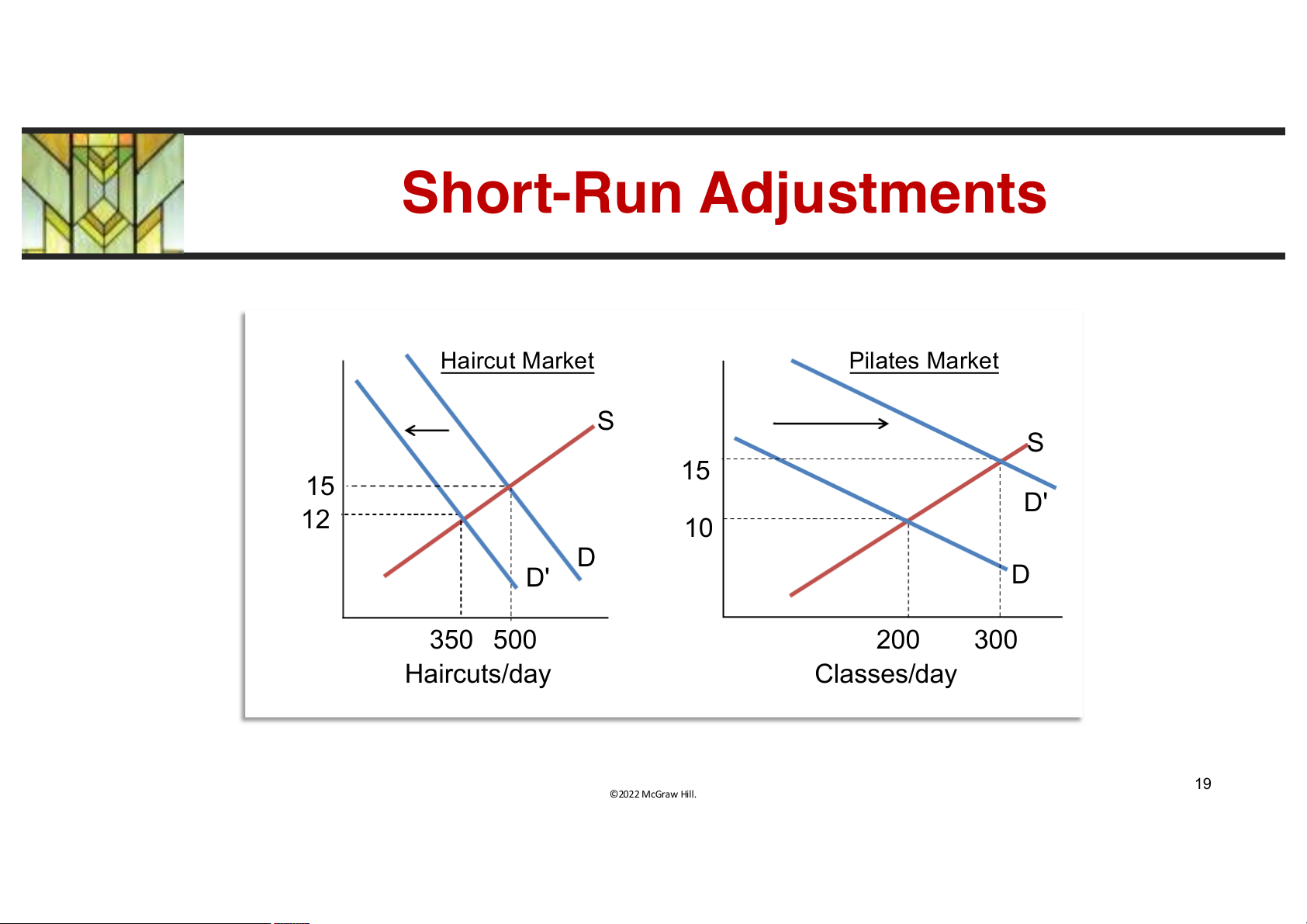

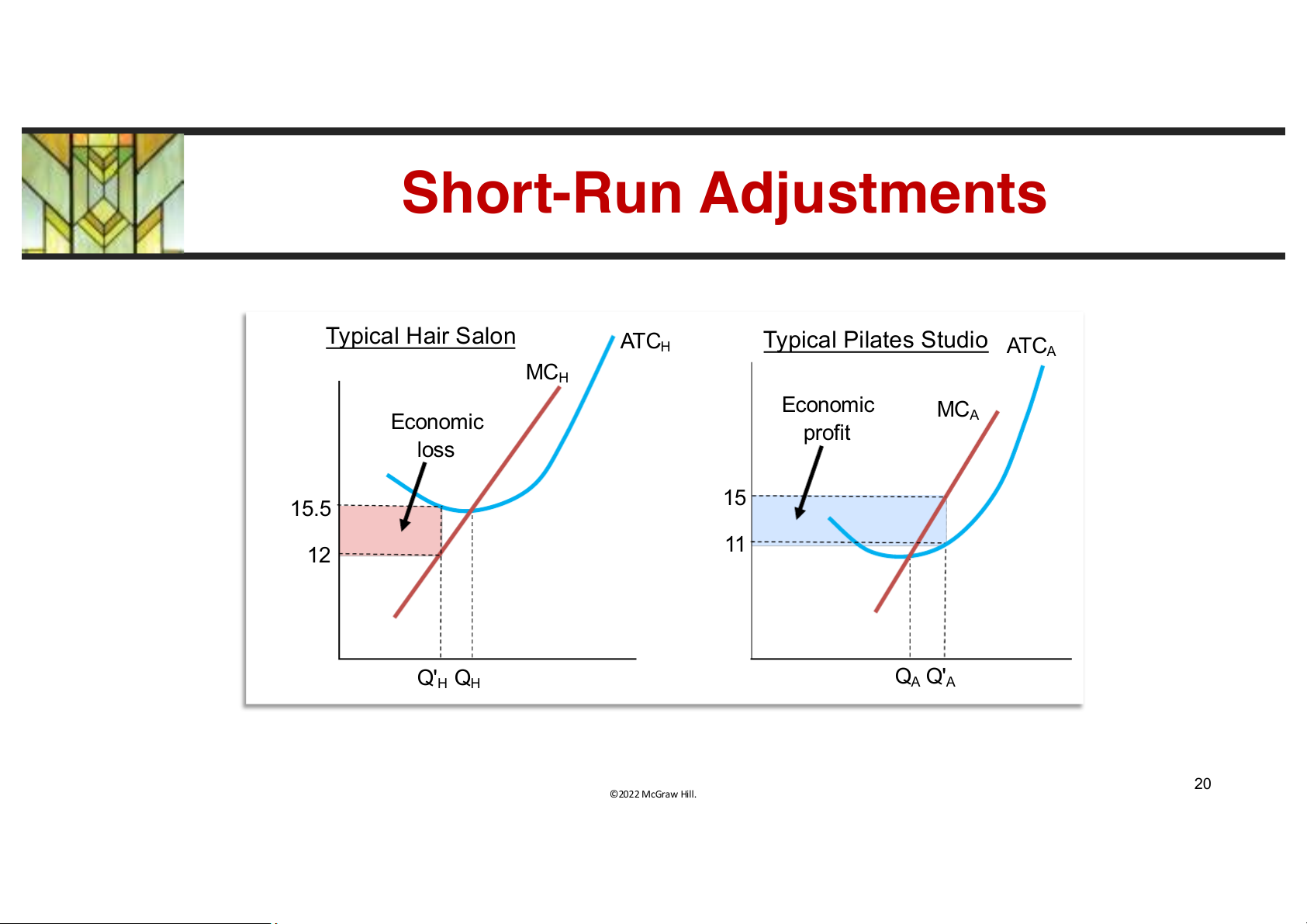

Example: Movement Toward Equilibrium

• Imagine haircut and Pilates markets are in equilibrium (long run)

and then demand for haircuts drops, and demand for exercise increases

• All markets are in equilibrium when

– Demand for haircuts decreases

– Demand for exercise increases

• Price of haircuts goes down; hairstylists have losses

• Price of aerobics classes go up; instructors have excess profits

• Eventually the long-run prices of haircuts and Pilates classes return to long-run equilibrium 18 ©2022 McGraw Hill. Short-Run Adjustments Haircut Market Pilates Market t) u S ) s irc s S a 15 /h 15 /cla D' ($ 12 ($ e e 10 ic D ic Pr D' Pr D 350 500 200 300 Haircuts/day Classes/day 19 ©2022 McGraw Hill. Short-Run Adjustments Typical Hair Salon ATC Typical Pilates Studio H ATCA MCH Economic MC Economic A profit ) loss ) ut s rc las ai /c 15 /h 15.5 ($ ($ 11 12 rice rice P P Q' Q Q Q' H H A A 20 ©2022 McGraw Hill.