Preview text:

Student name:__________

MULTIPLE CHOICE - Choose the one alternative that best completes the statement or

answers the question. 1)

If a good can be consumed by one person without reducing its availability to others, then it is a ______ good. A) nonexcludable B) pure public C) common D) nonrival 2)

A good or service that is highly nonrival and highly nonexcludable is a ______ good. A) pure public B) commons C) collective D) private 3)

To derive the market demand curve for a private good, one sums the ______. For a public good, one sums the ______.

A) individual quantities at various prices; individual quantities at various prices

B) individual prices at various quantities; individual quantities at various prices

C) individual quantities at various prices; individual prices at various quantities

D) individual prices at various quantities; individual prices at various quantities 4)

Suppose a private monopolist is supplying a good that is nonrival but excludable. The

market demand for the good is P = 24 – 3 Q. If the marginal cost of providing this good is $0,

but the firm charges $12, then the monopolist will provide ______ units, and the efficient number of units is ______. Version 1 1 A) 4; 8 B) 6; 8 C) 2; 2 D) 4; 2 5)

The accompanying table shows the marginal benefit and marginal cost of purchasing an

additional unit of three different public goods. Marginal Marginal Total spending on the benefit cost public good Public good 1 $ 20 $ 20 $ 1,500 Public good 2 15 25 800 Public good 3 10 5 700

The government is spending more than is socially optimal on A) public good 1. B) public good 2. C) public good 3.

D) public good 1 and public good 2. 6)

When a negative externality is present in a market, the government should A) always intervene.

B) intervene it if the public supports doing so. C) never intervene.

D) intervene if the benefit of doing so exceeds the cost. 7)

If low-income households spend a larger share of their income on food than do high-

income households, then a tax on food is Version 1 2 A) a progressive tax. B) a regressive tax. C) a proportional tax.

D) a way to redistribute from the wealthy to the poor. 8)

The deadweight loss from taxing a good will be smaller for goods

A) whose supply and demand curves are more inelastic.

B) whose supply and demand curves are more elastic.

C) that are relatively expensive.

D) that are consumed by a large fraction of the population. 9) A proportional tax results in

A) a larger percentage of income going to taxes as income rises.

B) a smaller percentage of income going to taxes as income rises.

C) the same dollar amount going to taxes for all taxpayers.

D) the same percentage of income going to taxes for all taxpayers. Version 1 3 10)

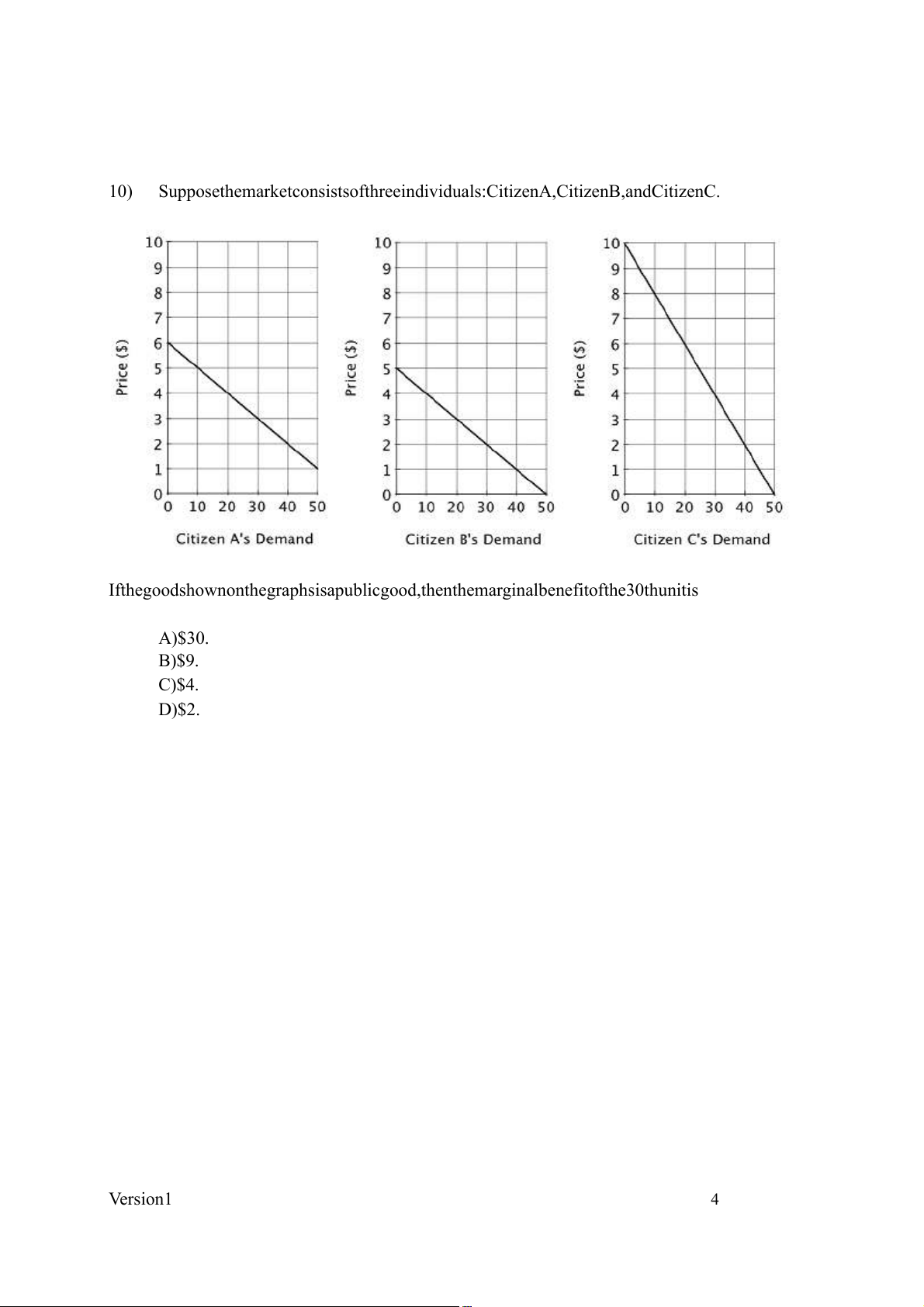

Suppose the market consists of three individuals: Citizen A, Citizen B, and Citizen C.

If the good shown on the graphs is a public good, then the marginal benefit of the 30th unit is A) $30. B) $9. C) $4. D) $2. Version 1 4 Answer Key

Test name: Chapter 14_Quiz 1) D

A nonrival good is a good whose consumption by one person does not

diminish its availability to others. 2) A

A pure public good is a good that, to a high degree, is both nonrival and nonexcludable. 3) C

Constructing the demand curve for a private good entails the horizontal

summation of individual demand curves, while constructing the demand

curve for a public good entails the vertical summation of individual demand curves. 4) A

From the demand curve, we can see that at a price of $12, the

monopolist will sell 4 units, but the optimal level of output occurs when

the marginal benefit of the good is equal to zero (its marginal cost).

From the demand curve, we can see that this occurs when Q = 8. 5) B

The marginal benefit of an additional unit of public good 2 is less than

its marginal cost, implying that the government is spending more than is

socially optimal on public good 2. 6) D

Since regulation entails costs, the government should only intervene if

the benefit of doing so exceeds the cost. Version 1 5 7) B

If low-income families spend a larger share of their income on food than

do high-income families, then a tax on food would take a larger share of

their income, making the tax regressive. 8) A

The deadweight loss from taxing a good will be smaller for goods whose

supply and demand curves are more inelastic. 9) D

A proportional tax is one under which all taxpayers pay the same

percentage of their income in taxes. 10) B

Citizen A is willing to pay $3 for the 30th unit, Citizen B is willing to pay $2, and Citizen C is

willing to pay $4. Thus, the marginal benefit of the 30th unit is $3 + $2 + $4 = $9. Version 1 6