Preview text:

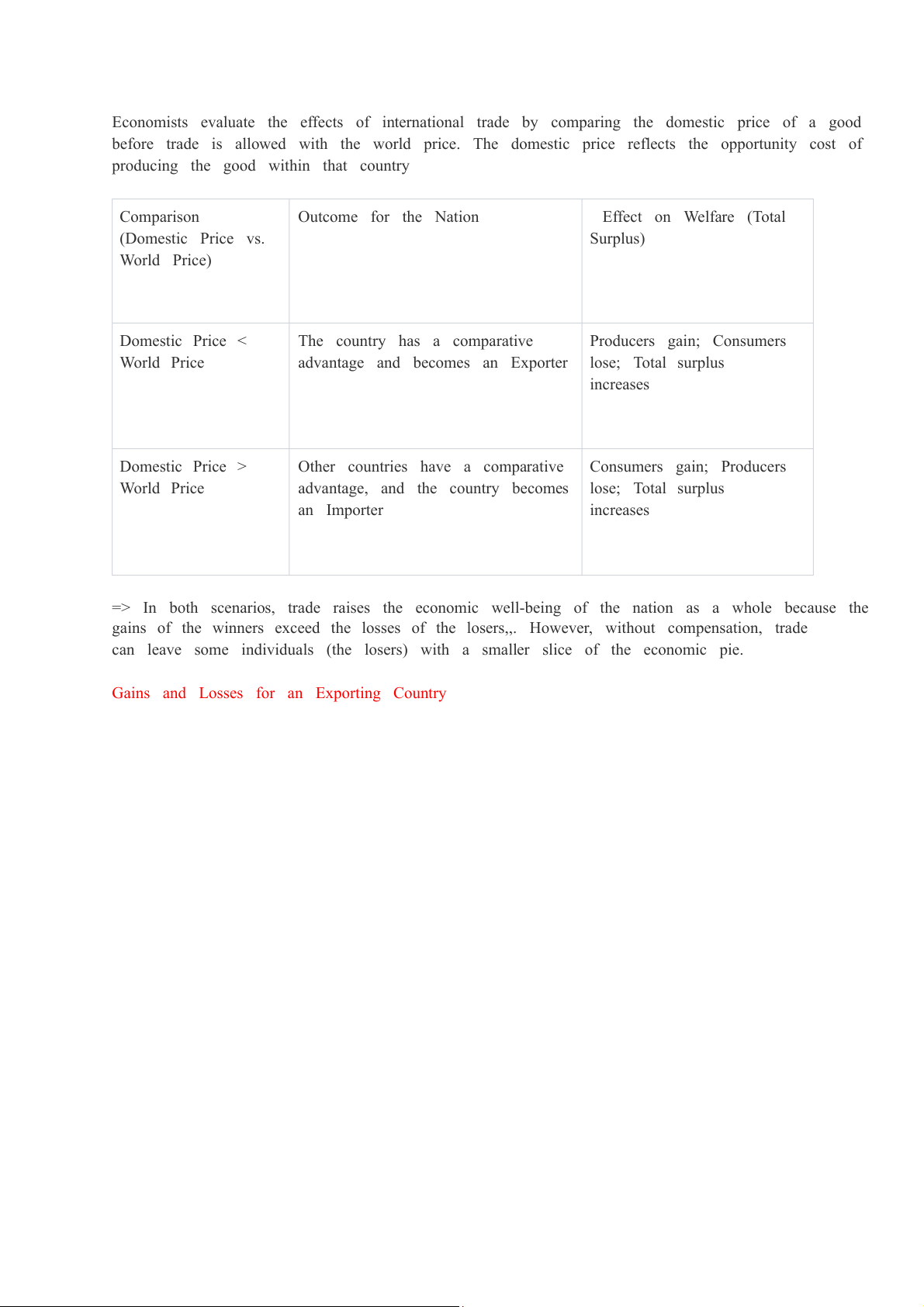

Economists evaluate the effects of international trade by comparing the domestic price of a good

before trade is allowed with the world price. The domestic price reflects the opportunity cost of

producing the good within that country Comparison Outcome for the Nation Effect on Welfare (Total (Domestic Price vs. Surplus) World Price)

Domestic Price < The country has a comparative Producers gain; Consumers World Price

advantage and becomes an Exporter lose; Total surplus increases

Domestic Price >

Other countries have a comparative Consumers gain; Producers World Price

advantage, and the country becomes lose; Total surplus an Importer increases

=> In both scenarios, trade raises the economic well-being of the nation as a whole because the

gains of the winners exceed the losses of the losers,,. However, without compensation, trade

can leave some individuals (the losers) with a smaller slice of the economic pie.

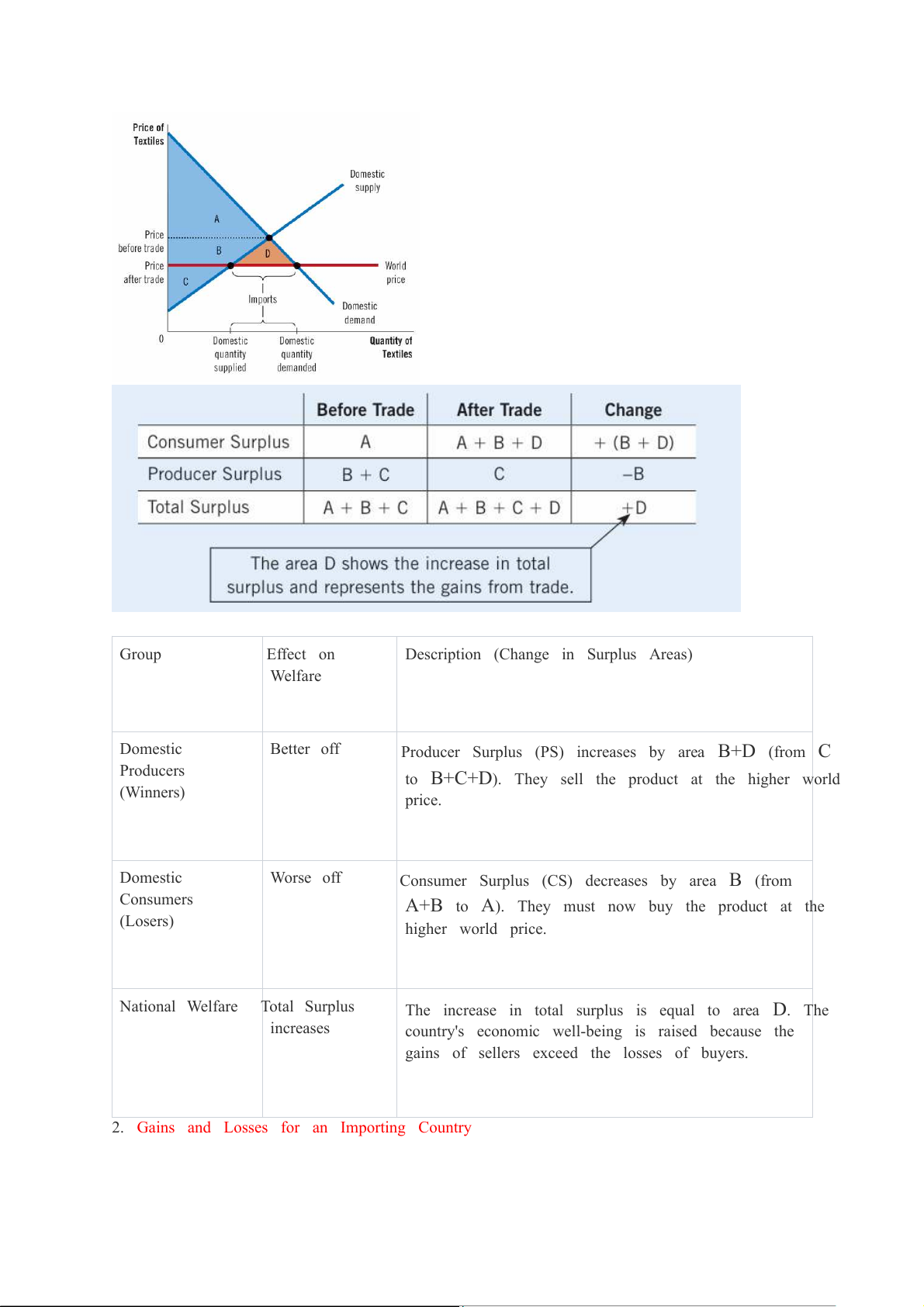

Gains and Losses for an Exporting Country Group Effect on

Description (Change in Surplus Areas) Welfare Domestic Better off

Producer Surplus (PS) increases by area B+D (from C Producers

to B+C+D). They sell the product at the higher world (Winners) price. Domestic Worse off

Consumer Surplus (CS) decreases by area B (from Consumers

A+B to A). They must now buy the product at the (Losers) higher world price. National Welfare Total Surplus

The increase in total surplus is equal to area D. The increases

country's economic well-being is raised because the

gains of sellers exceed the losses of buyers.

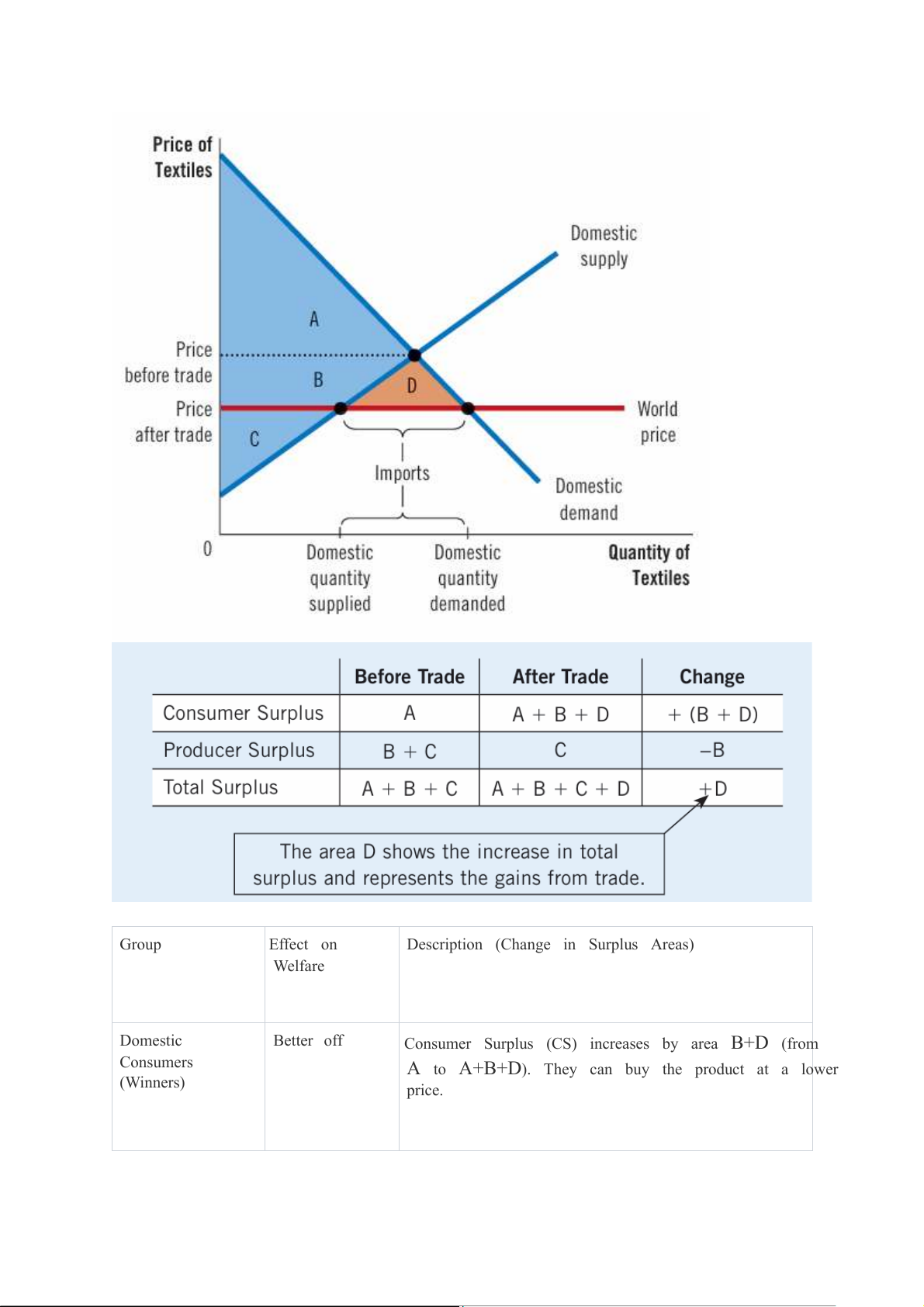

2. Gains and Losses for an Importing Country Group Effect on

Description (Change in Surplus Areas) Welfare Domestic Better off

Consumer Surplus (CS) increases by area B+D (from Consumers

A to A+B+D). They can buy the product at a lower (Winners) price. Domestic Worse off

Producer Surplus (PS) decreases by area B (from Producers

B+C to C). They must now sell the product at a lower (Losers) price. National Welfare Total Surplus

The increase in total surplus is equal to area D. The increases

country's economic well-being is raised because the

gains of buyers exceed the losses of sellers. 1. Tariff (Tax on Imports)

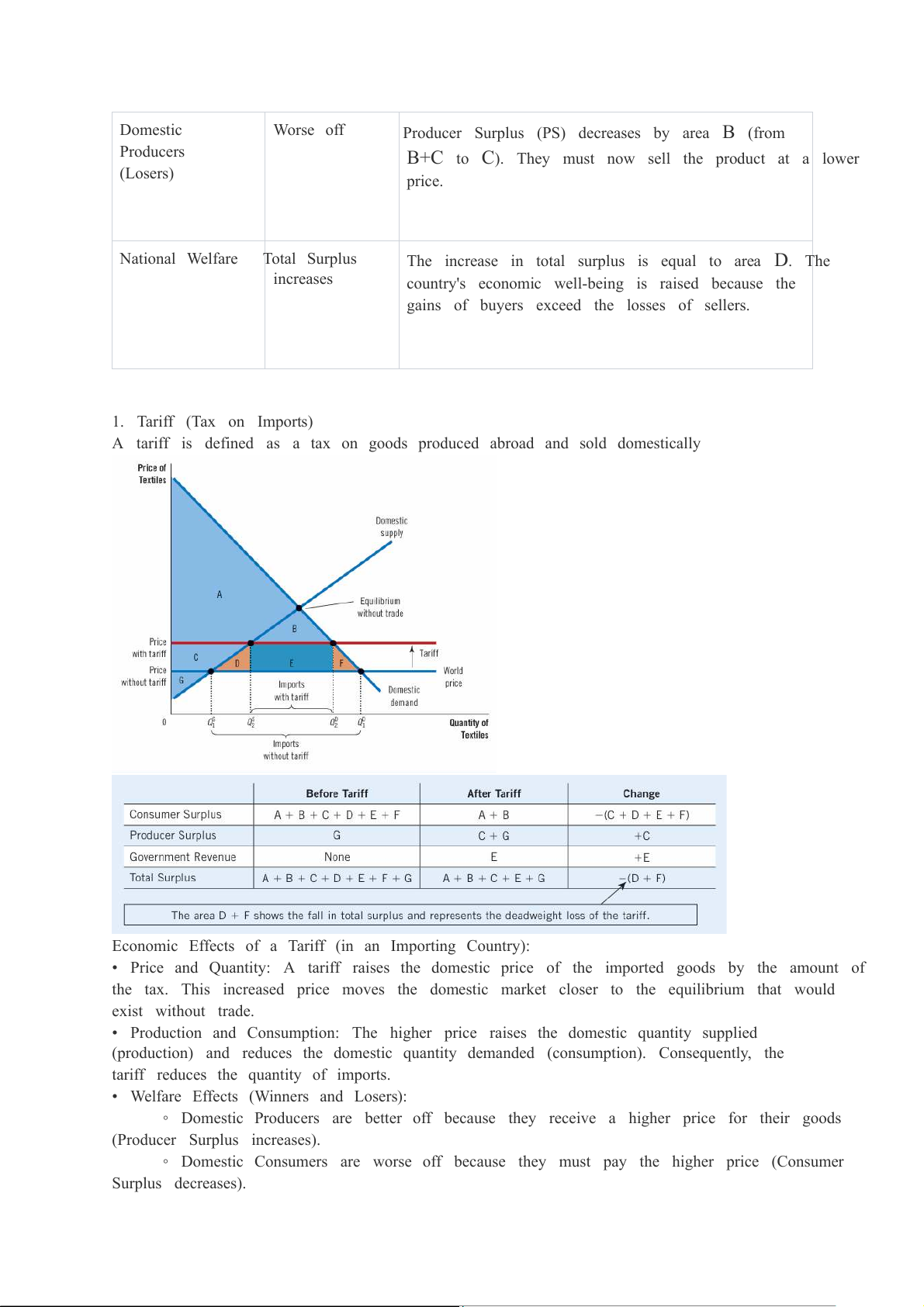

A tariff is defined as a tax on goods produced abroad and sold domestically

Economic Effects of a Tariff (in an Importing Country):

• Price and Quantity: A tariff raises the domestic price of the imported goods by the amount of

the tax. This increased price moves the domestic market closer to the equilibrium that would exist without trade.

• Production and Consumption: The higher price raises the domestic quantity supplied

(production) and reduces the domestic quantity demanded (consumption). Consequently, the

tariff reduces the quantity of imports.

• Welfare Effects (Winners and Losers):

◦ Domestic Producers are better off because they receive a higher price for their goods (Producer Surplus increases).

◦ Domestic Consumers are worse of

f because they must pay the higher price (Consumer Surplus decreases).

◦ The Government gains revenue equal to the size of the tariff multiplied by the quantity of

imports after the tariff is imposed.

• Overall Economic Welfare: A tariff reduces the gains from trade and causes a deadweight

loss (a fall in total surplus). This deadweight loss occurs because the losses suffered by

consumers exceed the combined gains of the domestic producers and the government revenue.

The deadweight loss arises from two distortions: encouraging domestic production that costs

more than the world price, and leading domestic consumers to reduce consumption even when

they value the goods above the world price.

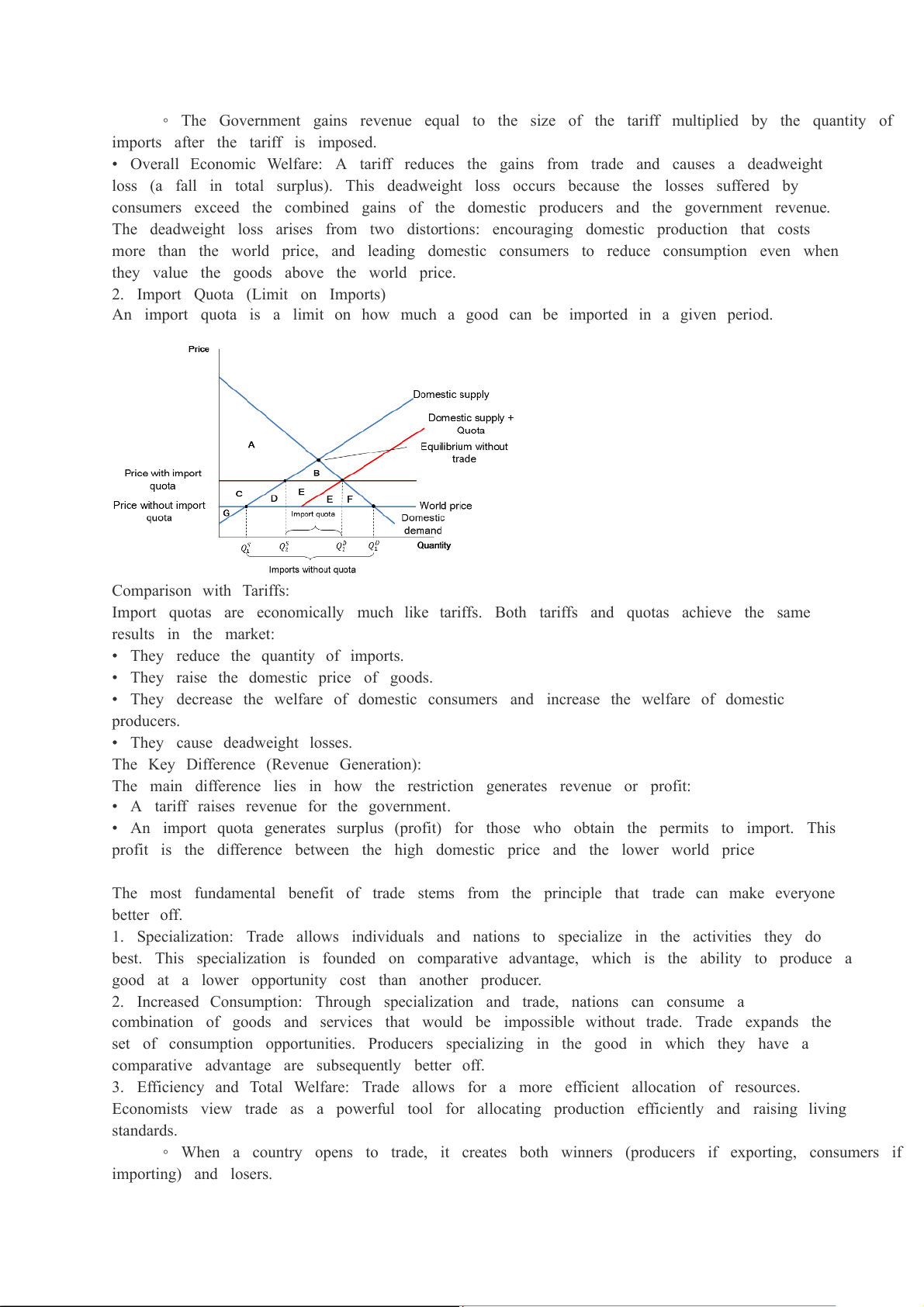

2. Import Quota (Limit on Imports)

An import quota is a limit on how much a good can be imported in a given period.

Comparison with Tariffs:

Import quotas are economically much like tariffs. Both tariffs and quotas achieve the same results in the market:

• They reduce the quantity of imports.

• They raise the domestic price of goods.

• They decrease the welfare of domestic consumers and increase the welfare of domestic producers.

• They cause deadweight losses.

The Key Difference (Revenue Generation):

The main difference lies in how the restriction generates revenue or profit:

• A tariff raises revenue for the government.

• An import quota generates surplus (profit) for those who obtain the permits to import. This

profit is the difference between the high domestic price and the lower world price

The most fundamental benefit of trade stems from the principle that trade can make everyone better off.

1. Specialization: Trade allows individuals and nations to specialize in the activities they do

best. This specialization is founded on comparative advantage, which is the ability to produce a

good at a lower opportunity cost than another producer.

2. Increased Consumption: Through specialization and trade, nations can consume a

combination of goods and services that would be impossible without trade. Trade expands the

set of consumption opportunities. Producers specializing in the good in which they have a

comparative advantage are subsequently better off.

3. Efficiency and Total Welfare: Trade allows for a more efficient allocation of resources.

Economists view trade as a powerful tool for allocating production efficiently and raising living standards.

◦ When a country opens to trade, it creates both winners (producers if exporting, consumers if importing) and losers.

◦ In both cases—whether the country becomes an exporter or an importer—the gains of the

winners exceed the losses of the losers. Consequently, free trade raises the total welfare (or

total surplus) of the country as a whole.

II. Other Benefits of International Trade

Beyond the static gains derived from comparative advantage, international trade offers several

additional benefits, contributing to increased prosperity:

1. Increased Variety of Goods: International trade provides consumers with a greater variety

of goods. Goods produced in different countries, such as German beer and U.S. beer (used as

a hypothetical example in the underlying text structure), are often not exactly the same, giving consumers more choices.

2. Lower Costs through Economies of Scale: Trade allows firms to sell to the larger world

market, which enables them to realize economies of scale (producing goods at a lower cost if

produced in large quantities) more fully.

3. Increased Competition: Trade fosters competition in the domestic market, which prevents

domestic firms from gaining excessive market power and helps the "invisible hand" operate more effectively.

4. Enhanced Flow of Ideas and Productivity: The transfer of technological advances

worldwide is often linked to the exchange of goods that embody those advances. Trade generally

makes the economy more productive.

5. Economic Development: Free trade is considered a powerful tool for economic

development, helping to accelerate growth in poorer countries and acting as "the best anti-

poverty achievement in history" due to high growth spillovers.

Overall, economists overwhelmingly support free trade and often view it as analogous to a major

technological advance. Policy decisions that allow free trade are listed among those that can pursue economic growth.

1. The Jobs Argument Opponents of free trade often claim that it destroys domestic jobs. For

instance, if a country like Isoland were to allow free trade in textiles, the falling domestic

price would reduce the quantity produced domestically, thereby slashing employment in the local textile industry.

2. The National-Security Argument Proponents of this argument claim that certain

industries are vital to national security and must be protected from foreign competition. For

example, steel is used to make guns and tanks, and free trade in steel could make a nation

dependent on foreign countries for supply. If war interrupted that foreign supply, the nation

might be unable to produce enough weapons quickly to defend itself. While economists

recognize that protecting key industries might be appropriate, they caution that this argument

is often used by producers seeking financial gain at the consumers' expense.

3. The Infant-Industry Argument This argument suggests that new

industries need

temporary trade restrictions (protection) to help them get established and grow. The claim

is that after a period of protection, these industries will become strong enough to compete

effectively with foreign firms. Similarly, older industries sometimes seek temporary

protection to adjust to new market conditions.

4. The Unfair-Competition Argument This argument asserts that free trade is only fair if all

trading countries operate by the same rules. If companies in different countries are subject to

different laws and regulations, it is considered unfair to expect them to compete globally. For

example, a domestic industry might argue for protection if a competing foreign country

subsidizes its textile industry, thus lowering the foreign firm's production costs.

5. The Protection-as-a-Bargaining-Chip Argument Some policymakers argue that trade

restrictions can be used as a bargaining chip to extract concessions from trading partners.

The idea is to threaten to impose a tariff (e.g., on textiles) unless a trading partner agrees to

remove its own existing tariffs (e.g., on wheat). If the threat succeeds, the overall result is

freer trade for both countries.

2) If a basket of goods costs 1000 dollars in Canada and the Canadian dollar exchange rate on

the euro is 1.40, then the same basket of goods in Europe should cost ________ when priced in euros. A) $ 140.00 B) $ 714.29 C) $1400.00 D) $7142.90

cost in Euro = cost in Canadian dollar / exchange rate

3. If Canadian exports of goods and services were $40 billion, imports of goods and services

were $35 billion, transfers by Canadians to foreigners were $2 billion and transfers from

foreigners to Canadian citizens were $1 billion, then the current account balance would be A) plus $6 billion. B) plus $4 billion. C) minus $4 billion. D) minus $6 billion.

Current Account Balance = ( Exports - Imports ) + ( Transfers from Foreigners -

Transfers to Foreigners)

3. When the nation of Ectenia opens to world trade in coffee beans, the domestic price falls.

Which of the following describes the situation?

a. Domestic production of coffee rises, and Ectenia becomes a coffee importer.

b. Domestic production of coffee rises, and Ectenia becomes a coffee exporter.

c. Domestic production of coffee falls, and Ectenia becomes a coffee importer.

d. Domestic production of coffee falls, and Ectenia becomes a coffee exporter.

c. producer surplus and total surplus increase, but consumer surplus decreases.

d. producer surplus, consumer surplus, and total surplus all increase.

5. If a nation that imports a good imposes a tariff, it will increase

a. the domestic quantity demanded.

b. the domestic quantity supplied.

c. the quantity imported from abroad.

d. the efficiency of the equilibrium.

4. When a nation opens to trade in a good and becomes an importer,

a. producer surplus decreases, but consumer surplus and total surplus both increase. b.

producer surplus decreases, but consumer sur plus increases, so the impact on total surplus is

ambiguous. 6. Which of the following policies would benefit producers, hurt consumers, and

increase the amount of trade? a. the increase of a tariff in an importing country b. the

reduction of a tariff in an importing country c. starting to allow trade when the world price is

greater than the domestic price d. starting to allow trade when the world price is less than the domestic price

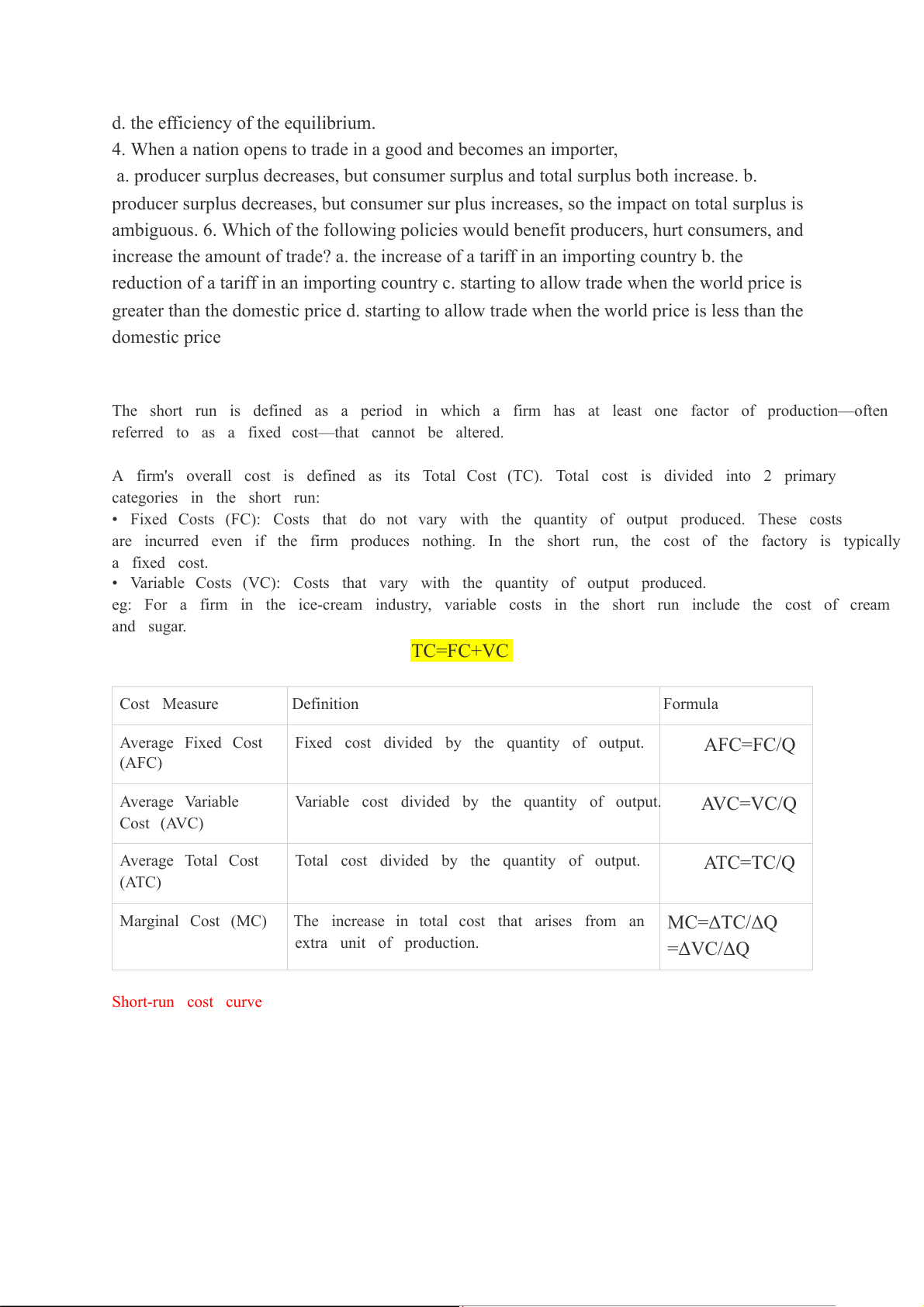

The short run is defined as a period in which a firm has at least one factor of production—often

referred to as a fixed cost—that cannot be altered.

A firm's overall cost is defined as its Total Cost (TC). Total cost is divided into 2 primary categories in the short run:

• Fixed Costs (FC): Costs that do not vary with the quantity of output produced. These costs

are incurred even if the firm produces nothing. In the short run, the cost of the factory is typically a fixed cost.

• Variable Costs (VC): Costs that vary with the quantity of output produced.

eg: For a firm in the ice-cream industry, variable costs in the short run include the cost of cream and sugar. TC=FC+VC Cost Measure Definition Formula

Average Fixed Cost

Fixed cost divided by the quantity of output. AFC=FC/Q (AFC)

Average Variable

Variable cost divided by the quantity of output. AVC=VC/Q Cost (AVC)

Average Total Cost

Total cost divided by the quantity of output. ATC=TC/Q (ATC)

Marginal Cost (MC)

The increase in total cost that arises from an MC=ΔTC/ΔQ extra unit of production. =ΔVC/ΔQ Short-run cost curve

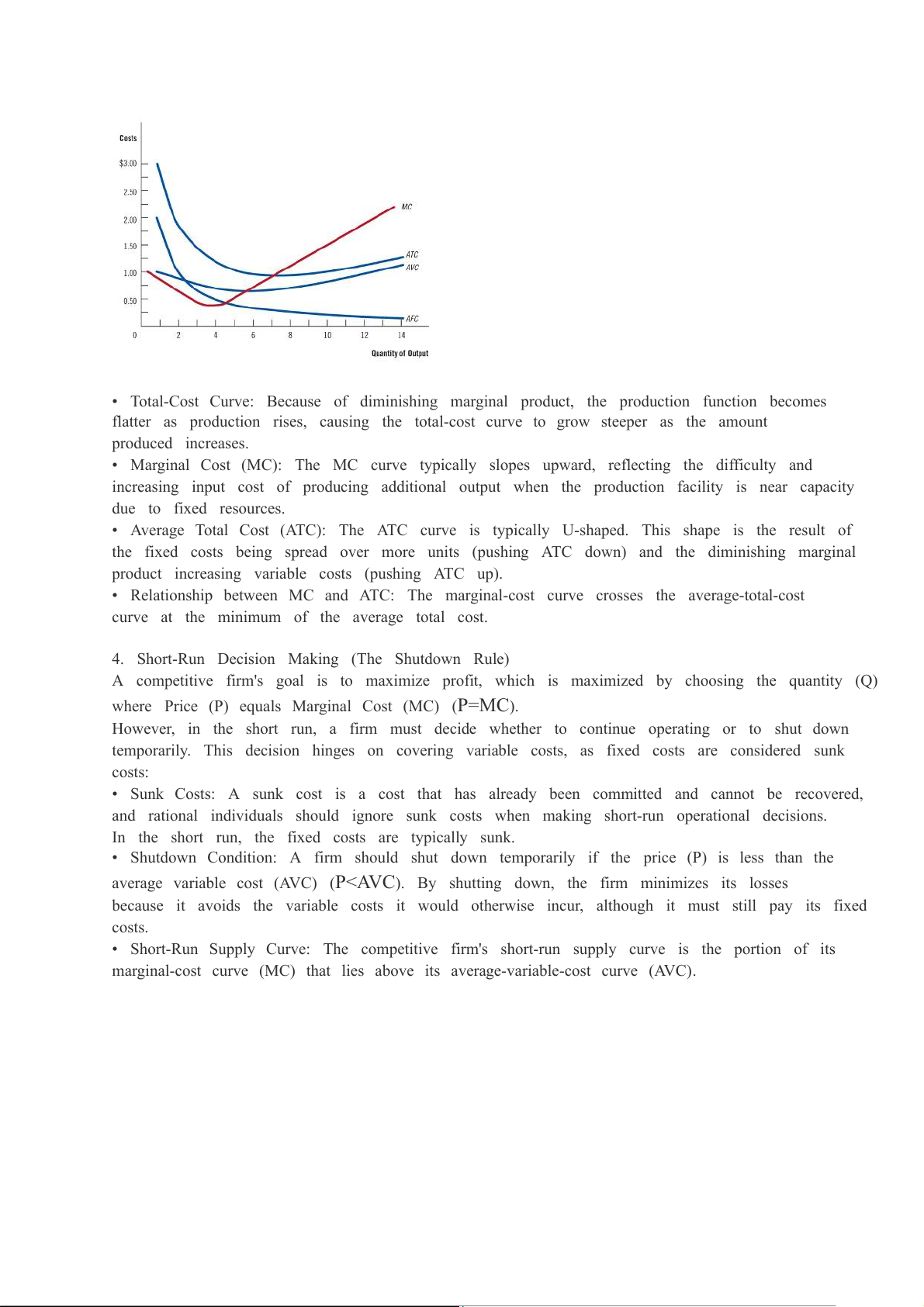

• Total-Cost Curve: Because of diminishing marginal product, the production function becomes

flatter as production rises, causing the total-cost curve to grow steeper as the amount produced increases.

• Marginal Cost (MC): The MC curve typically slopes upward, reflecting the difficulty and

increasing input cost of producing additional output when the production facility is near capacity due to fixed resources.

• Average Total Cost (ATC): The ATC curve is typically U-shaped. This shape is the result of

the fixed costs being spread over more units (pushing ATC down) and the diminishing marginal

product increasing variable costs (pushing ATC up).

• Relationship between MC and ATC: The marginal-cost curve crosses the average-total-cost

curve at the minimum of the average total cost.

4. Short-Run Decision Making (The Shutdown Rule)

A competitive firm's goal is to maximize profit, which is maximized by choosing the quantity (Q)

where Price (P) equals Marginal Cost (MC) (P=MC).

However, in the short run, a firm must decide whether to continue operating or to shut down

temporarily. This decision hinges on covering variable costs, as fixed costs are considered sunk costs:

• Sunk Costs: A sunk cost is a cost that has already been committed and cannot be recovered,

and rational individuals should ignore sunk costs when making short-run operational decisions.

In the short run, the fixed costs are typically sunk.

• Shutdown Condition: A firm should shut down temporarily if the price (P) is less than the

average variable cost (AVC) (Pbecause it avoids the variable costs it would otherwise incur, although it must still pay its fixed costs.

• Short-Run Supply Curve: The competitive firm's short-run supply curve is the portion of its

marginal-cost curve (MC) that lies above its average-variable-cost curve (AVC).