Preview text:

Bojan Radojicic

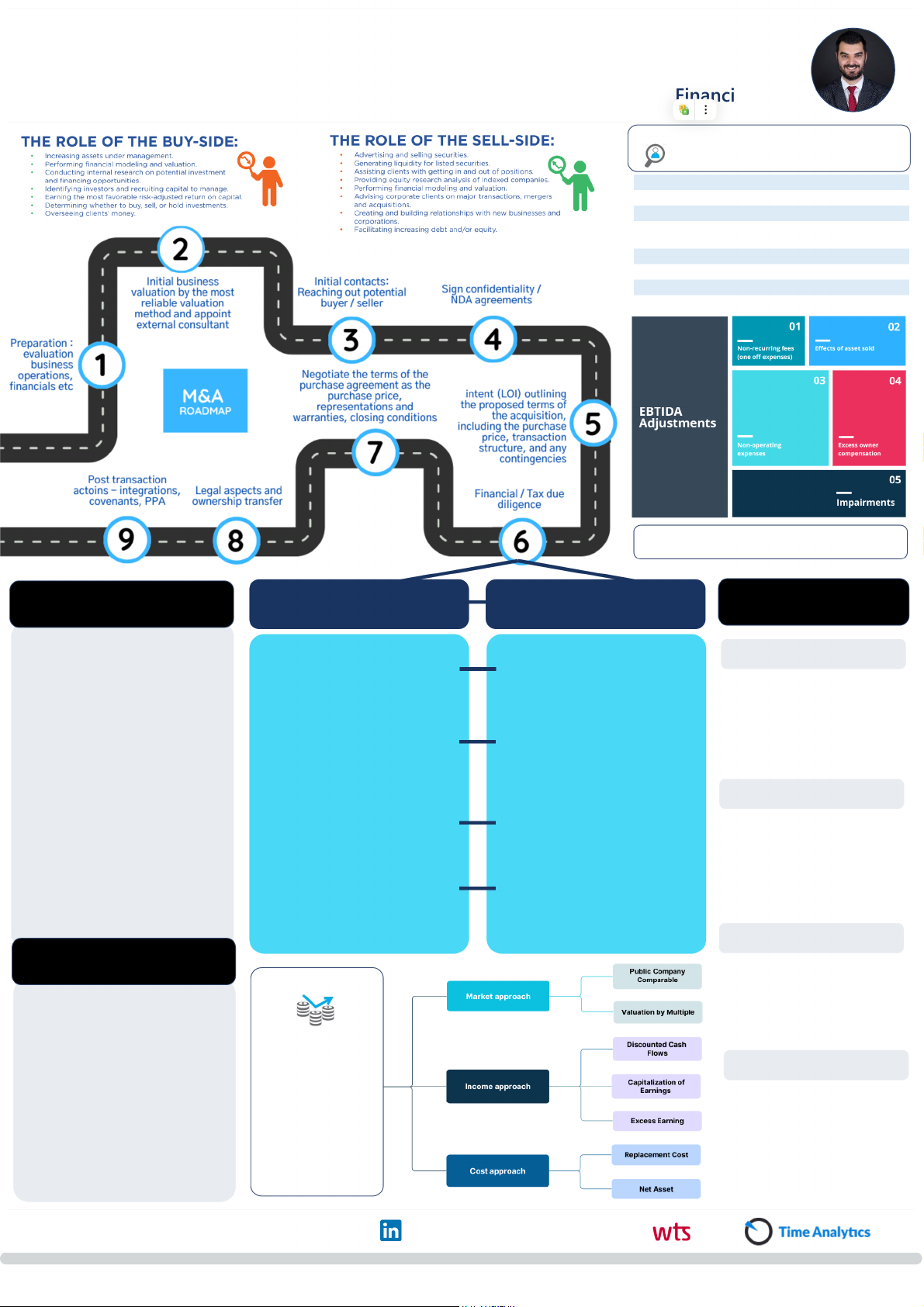

Financial analysis of target

Define scope for review e.g. 3-5 years Financial statements

Standalone positions in financials

Profitability, liquidity, activity and structure indicators EBITDA normalization

Revenue and expenses impact on EBITDA

Reviewing business units performance Analysis NWC and debt Cyber and tech check FINANCIAL Finance due diligence Tax due diligence COVENANTS PROJECTIONS

1. Sales and other revenue Business and processes

Understanding the tax function Non-Compete Covenant understanding projections

Review external advisor outputs 2. Earnings projections

This covenant prohibits the target

Finance function and team

company or its key employees 3. Operating expense assesment

Review current and past disputes

from engaging in activities that projections

with tax administration

compete with the acquiring 4. Net working capital

company's business for a

Overall Financial Statements

projections (receivables,

specified period of time and Reviewing

Check did the taxpayer submmt all

within a defined geographical

inventory, and liabilities to

tax returns and pay taxes timely area.

Reviewing Specific Balance Sheet suppliers)

Non-Solicitation Covenant Positions

Standardized list of questions to the

5. Long-term and fixed asset client

and depreciation projections

Analyzing Financial Performance

This covenant restricts the target

6. Financial liability and interest

Prepare sampling for reviews

company from soliciting or hiring expense projections

Assessing Financial Controls

employees or customers of the

7. Other balance sheet item CIT testing

acquiring company for a certain projections

period after the merger or

Examining Contracts and

acquisition. It helps prevent the 8. EBITDA projections Agreements VAT testing

loss of key talent or customers to

9. Cash flow projections competitors. POST TRANSACTION Assessing Contingencies

PIT and other taxes testing

Confidentiality Covenant ACCOUNTING

his covenant ensures that both parties maintain the

Financial consolidation and

confidentiality of sensitive

information shared during the integrations due diligence process and subsequent integration

Financial reporting requirements VALUATION Financial Covenant

Pruchase price allocation: APPROACH AND

These covenants are designed to

Indentificaion and valuation of

maintain certain financial ingnagbile asset METHOS

performance levels after the

merger or acquisition. They may FMV of tangible assets

include requirements related to

debt-to-equity ratios, liquidity,

Goodwil calculation and recognition

revenue targets, profitability, or other financial metrics.

CREDITS TO Bojan Radojicic | FOLLOW ON LINKEDIN

POWERED BY: WTS TAX AN FINANCE AND