Preview text:

National Economic University NEU Business School …...0O0…… FINAL GROUP PROJECT MICROECONOMICS

The confectionery industry in Viet Nam Teacher: Dr. Tran Thi Hong Viet Class: E-BBA 15.1 Group: 3

Members: Nguyễn Thị Hương Giang Nguyễn Hương Giang Trịnh Thùy Linh Lê Hiểu Phương Ngô Thị Phương Thảo Ha Noi - 05/2024 1 TABLE OF CONTENT

1. Introduction and objectives..................................................................................... 3

2. Definition................................................................................................................... 3

2.1 What is confectionary..........................................................................................3

2.2 Effect on the economy in Viet Nam.................................................................... 3

3. Discussion.................................................................................................................. 4

3.1. The confectionery industry is closer to monopolistic........................................ 4

3.1.1. What is monopolistic competition..............................................................4

3.1.2. Why the confectionary market is monopolistic competition..................... 4

3.2. Factors affecting demand and supply of the market...........................................8

3.2.1. Demand of the market............................................................................... 8

3.2.2. Supply of the market..................................................................................9

3.2.3. Factors influencing the demand.................................................................9

3.2.4. Factors influencing the supply.................................................................11

4. Potential, challenging and market trend.............................................................. 12

5. Recommendation.................................................................................................... 14

6. Conclusion............................................................................................................... 14 2 1. Introduction and objectives Introduction

Cakes and candies hold a special place in Vietnamese culinary culture,

cherished as beloved snacks across the nation. They are a great treat for all ages,

especially for families with small children, because of their varied textures and tastes.

One of the food industries in Vietnam that is expanding the fastest is the candy

business, which makes the country's confectionery market one of the most promising

in Asia. According to research, sugary confections are consumed in the greatest

quantities, followed by sweet biscuits and preserved goods (Statista, 2024). In order to

have a more profound understanding of the Vietnamese confectionery business, we

have carried out a research named "The Vietnamese Confectionery Market." Objectives

Here are some objectives for our project (1) To prove that the confectionery

industry is monopolistic. (2) To identify factors that influence the demand and supply

of the confectionary industry in Viet Nam. (3) To provide recommendations for firms

in the market to improve their profits and revenues. 2. Definition 2.1 What is confectionary

The Confectionery segment covers food items with relatively high sugar.

Confectionery has a variety of flavorings, colorings, and other components that give

them their distinct taste, texture, and appearance. This segment is divided into four

subsegments: chocolate confectionery, ice cream, preserved pastry goods and cakes

and sugar confectionery (Statista, 2024).

2.2 Effect on the economy in Viet Nam

It is estimated that the total domestic production in 2023 reached 1.5 million

tons, generating revenue of 8,5 billion USD with an annual growth rate of 10.17%

(Vietnam Briefing, 2023). Between domestic and international businesses, there is

now considerable rivalry in the Vietnamese confectionery sector. Although the import

duty on candy from ASEAN nations has decreased to 0 percent, locally-made

confectionery continues to dominate the market in Vietnam, accounting for over 90

percent of the country’s total confectionery sales, according to state media (ANTV,

2023). According to Statista, as of March 2024, the revenue in the confectionery

market is estimated to reach $1.64 billion USD and continues to show growth 3

momentum. This not only contributes to the economic growth of Vietnam but also

enhances the potential for exporting these products to other countries. 3. Discussion

Question 1: Explain the main factors that have affected the supply and the

demand of the commodity chosen over the last years.

Question 2: Explain the main factors that have affected the supply and the

demand of the commodity chosen over the last years.

3.1. The confectionery industry is closer to monopolistic

3.1.1. What is monopolistic competition

Based on microeconomics, monopolistic competition has four main

characteristics, including actions of firms, product differentiation, market power,

barrier to entry, and non-price competition. Monopolistic competition has a relatively

large number of small firms with small market shares, also, these firms operate

independently, which means that there is no collusion among firms. One of the most

important features of this kind of competition is the products are similar, but not identical.

3.1.2. Why the confectionary market is monopolistic competition Number of firms

The confectionery market in Vietnam is vibrant and diverse, with a large

number of companies operating in the market. While the exact number of

confectionery firms in Vietnam is not specified in our search, it is estimated that there

are hundreds of small companies, approximately 30 large domestic enterprises, and

many foreign confectionery import companies operating in the Vietnamese confectionery market (Vietdata, 2023). This suggests a dynamic and competitive industry, with a mix of local and international firms meeting Vietnam's expanding demand for confectionery products. In Viet Nam, opportunities can be very

open for businesses, there are many enterprises that can be mentioned such as Kido, 4

Hai Ha, Bibica, Orion Viet Nam, Lotte, Hai Chau, Trang An… like large firms. Also,

Viet Nam’s confectionary market has many small companies such as:

In conclusion, the confectionary industry in Viet Nam contains a lot of types of

firms, but there are many small businesses compared to an estimated 30 large

businesses, one of the characteristics of monopolistic competition. Market share

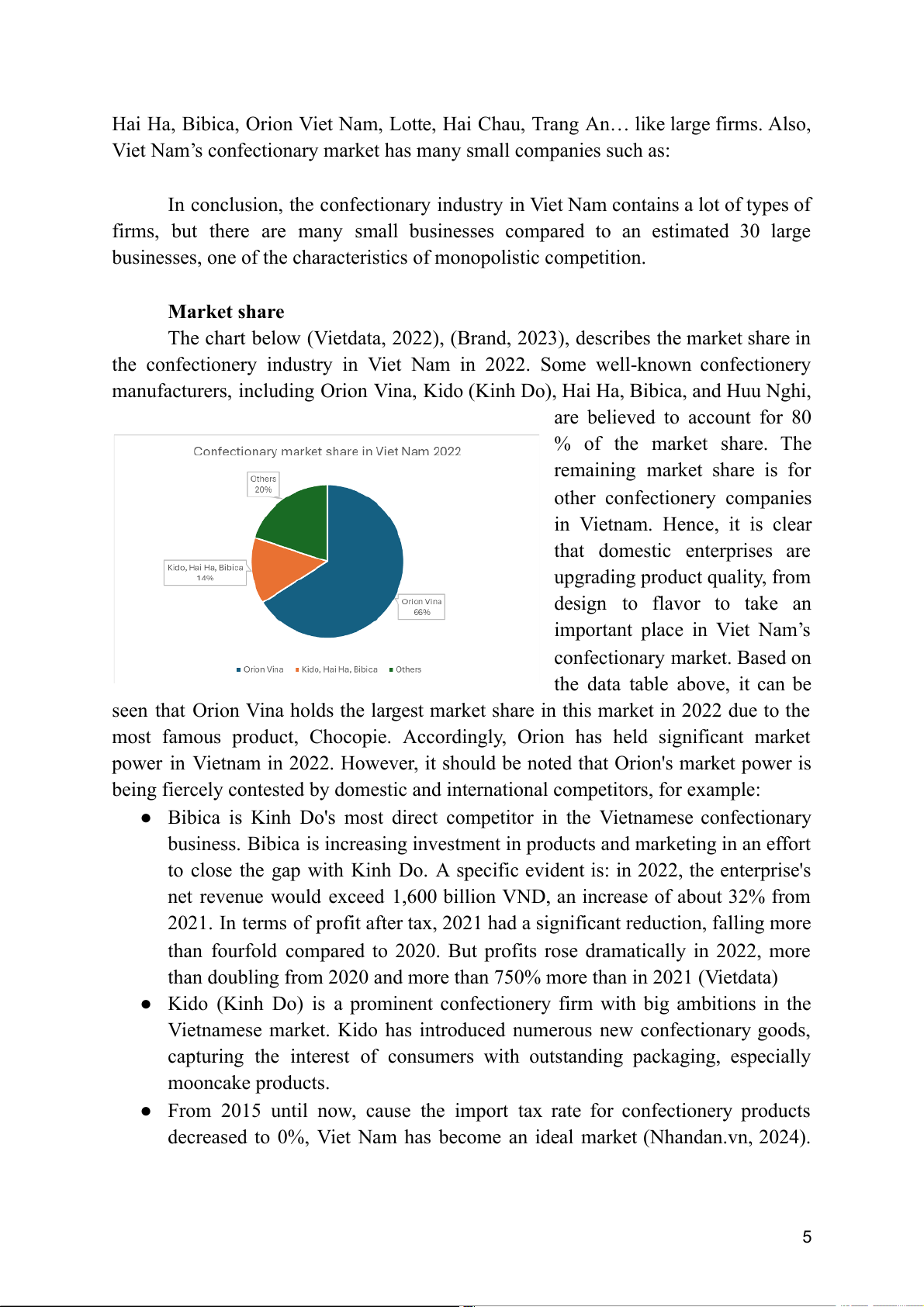

The chart below (Vietdata, 2022), (Brand, 2023), describes the market share in

the confectionery industry in Viet Nam in 2022. Some well-known confectionery

manufacturers, including Orion Vina, Kido (Kinh Do), Hai Ha, Bibica, and Huu Nghi, are believed to account for 80 % of the market share. The remaining market share is for other confectionery companies in Vietnam. Hence, it is clear that domestic enterprises are

upgrading product quality, from design to flavor to take an

important place in Viet Nam’s confectionary market. Based on

the data table above, it can be

seen that Orion Vina holds the largest market share in this market in 2022 due to the

most famous product, Chocopie. Accordingly, Orion has held significant market

power in Vietnam in 2022. However, it should be noted that Orion's market power is

being fiercely contested by domestic and international competitors, for example: ●

Bibica is Kinh Do's most direct competitor in the Vietnamese confectionary

business. Bibica is increasing investment in products and marketing in an effort

to close the gap with Kinh Do. A specific evident is: in 2022, the enterprise's

net revenue would exceed 1,600 billion VND, an increase of about 32% from

2021. In terms of profit after tax, 2021 had a significant reduction, falling more

than fourfold compared to 2020. But profits rose dramatically in 2022, more

than doubling from 2020 and more than 750% more than in 2021 (Vietdata) ●

Kido (Kinh Do) is a prominent confectionery firm with big ambitions in the

Vietnamese market. Kido has introduced numerous new confectionary goods,

capturing the interest of consumers with outstanding packaging, especially mooncake products. ●

From 2015 until now, cause the import tax rate for confectionery products

decreased to 0%, Viet Nam has become an ideal market (Nhandan.vn, 2024). 5

Accordingly, many foreign firms want to enter to take market share in Viet

Nam’s confectionery industry by numerous ways.

Hence, it can be seen that the market power of firms in the confectionery

market fluctuates significantly, companies are always innovating to gain more market

share with their own strategies. Accordingly, the confectionery market is closer to monopolistic. Product differentiation

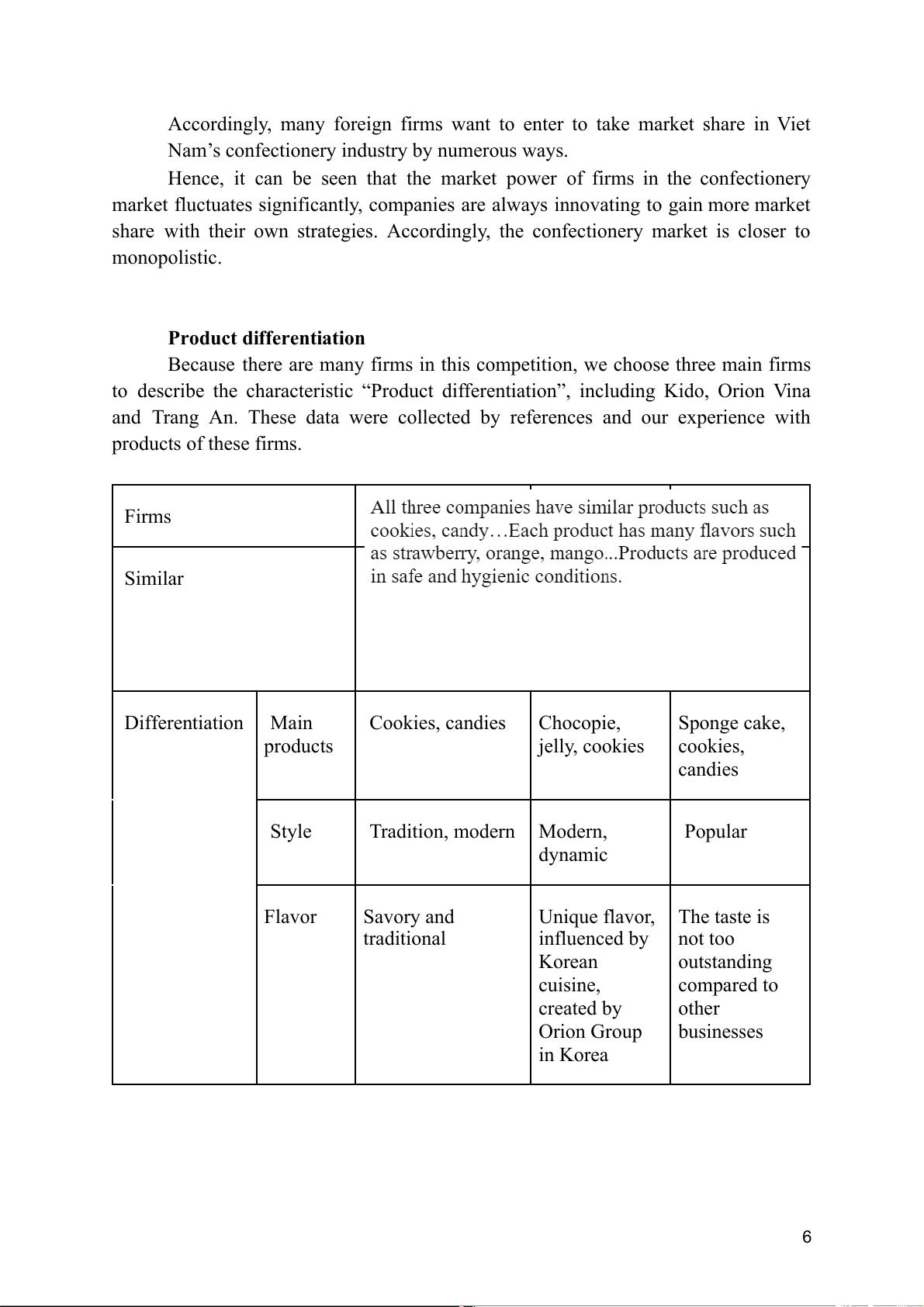

Because there are many firms in this competition, we choose three main firms

to describe the characteristic “Product differentiation”, including Kido, Orion Vina

and Trang An. These data were collected by references and our experience with products of these firms. Firms Similar Differentiation Main Cookies, candies Chocopie, Sponge cake, products jelly, cookies cookies, candies Style Tradition, modern Modern, Popular dynamic Flavor Savory and Unique flavor, The taste is traditional influenced by not too Korean outstanding cuisine, compared to created by other Orion Group businesses in Korea 6 Barrier to entry

Entering the Vietnamese confectionery market presents both promising

opportunities and significant challenges. Here are some of the key barriers that new businesses need to consider: 1. Legal Barriers: ●

Food Safety Regulations: Vietnam has strict food safety regulations for

confectionery products. New businesses must fully obey these regulations to

manufacture and have business licenses. ●

Labeling Regulations: Confectionery product labels must display information

according to Vietnamese law, including ingredients, expiration date, usage instructions, etc. ●

Licensing Procedures: The process of obtaining a license to produce and sell

confectionery in Vietnam can be time-consuming and involve complex

procedures based on the law of Viet Nam 2. Competitive Barriers: ●

Highly Competitive Market: The Vietnamese confectionery industry is highly

competitive with numerous domestic and international firms, such as: Trang

An, Kido, Hai Ha, Orion Vina… Major confectionery companies like Kinh Do,

Bibica, and Orion have established strong brands and hold a significant firm

position in the confectionery market. Moreover, they always change their

actions to fit the need of consumers on Viet Nam. Also, in recent years,

numerous foreign firms have entered this market; hence, the competitive pressure is increasing. ●

Price Barriers: Confectionery product prices in Vietnam are relatively

competitive, making it difficult for new businesses to enter the market if they use a low-price strategy.

3. Consumer Preference Barriers: ●

Consumer Preferences: Vietnamese consumers tend to favor established and

reputable confectionery brands. ●

Behavior: Vietnamese consumers typically purchase confectionery from

grocery stores, supermarkets, and convenience stores. Hence, new firms need

to gain the trust of stores, and supermarkets… to be more accessible to customers Non-price competition

Nowadays, there are many ways to promote products, such as through social

networks, television, newspapers... Companies in the confectionary market are very

aware of trends to be able to make suitable advertisements for their target audience. ● Kido 7

In 2020, Kido posted a TVC to promote the Mooncake product, Kingdom,

“Kingdom - Tết trao Phúc lộc, Thu chúc An Khang”. Kingdom is one of the newly

produced products in 2020, containing many purposes of this firm, opening the new product line of Kido ● Orion Vina

Orion Food Vina frequently appears on major television networks like as

VTV1, VTV3, and VCTV. These programs help to disseminate information

efficiently. Additionally, it has an impact on young individuals, middle-aged people,

and children. Orion Food Vina also hires news websites to generate advertising and

content. At the same time, make contracts with celebrities and KOLs to promote items.

3.2. Factors affecting demand and supply of the market 3.2.1. Demand of the market

Confectionery is one of the food industries recording rapid development in

Vietnam with an estimated domestic production output of about 1.5 million tons/year

and annual revenue of approximately VND 40 trillion.

Recently, many foreign businesses have entered the Vietnamese confectionery

market, due to the high population and demand for this product. Accordingly, this

competitive pressure, domestic confectionery businesses are required to innovate and

find new directions to regain market share. (Nhandan, 2024)

Based on data provided by Data Factory VIRAC, the consumption of

confectionery products in the fourth quarter of 2022 and the first quarter of 2023 both

recorded huge growth despite being negatively affected after the COVID-19 pandemic. Specifically: 8

Despite the economic downturn, people's demand for confectionery products

increased in one month before Tet. The confectionery market has also become more

active. Tet is a huge and significantly important festival for the Vietnamese people, so

people will continue to spend a lot of money on candies, drinks, and necessities during

Tet. Accordingly, the demand of the market is increasing depending on many factors. 3.2.2. Supply of the market

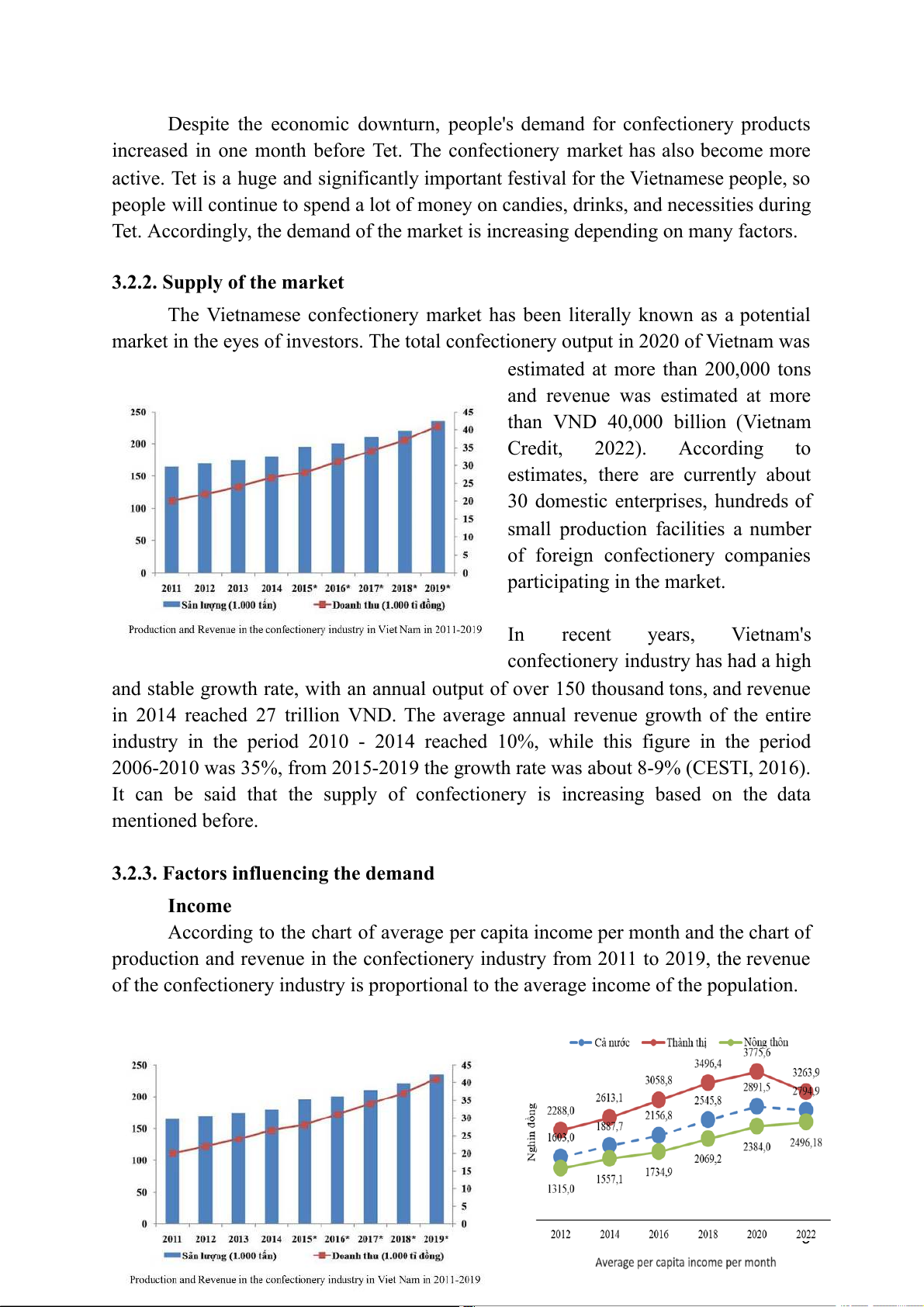

The Vietnamese confectionery market has been literally known as a potential

market in the eyes of investors. The total confectionery output in 2020 of Vietnam was

estimated at more than 200,000 tons

and revenue was estimated at more

than VND 40,000 billion (Vietnam Credit, 2022). According to

estimates, there are currently about

30 domestic enterprises, hundreds of

small production facilities a number

of foreign confectionery companies participating in the market. In recent years, Vietnam's

confectionery industry has had a high

and stable growth rate, with an annual output of over 150 thousand tons, and revenue

in 2014 reached 27 trillion VND. The average annual revenue growth of the entire

industry in the period 2010 - 2014 reached 10%, while this figure in the period

2006-2010 was 35%, from 2015-2019 the growth rate was about 8-9% (CESTI, 2016).

It can be said that the supply of confectionery is increasing based on the data mentioned before.

3.2.3. Factors influencing the demand Income

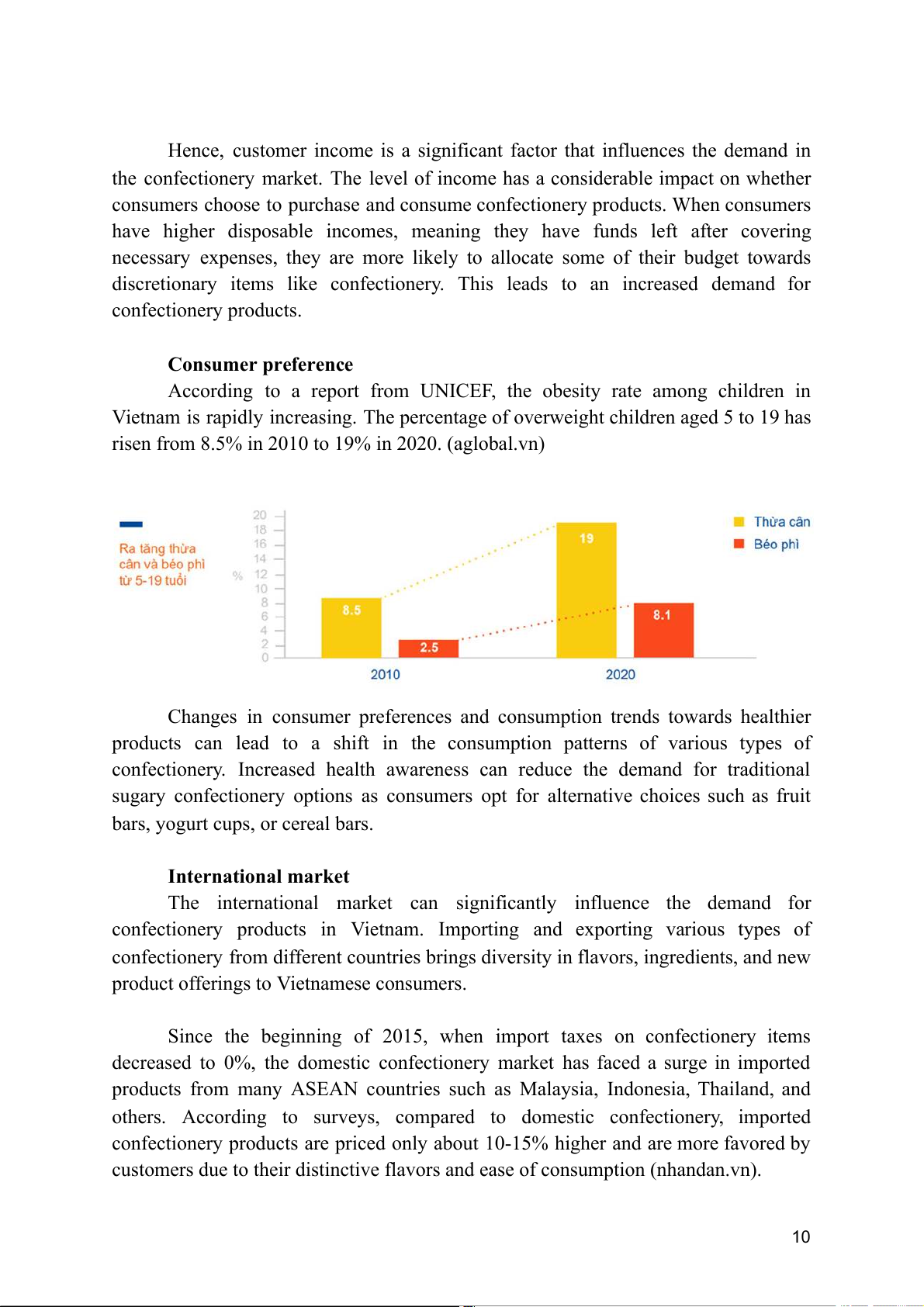

According to the chart of average per capita income per month and the chart of

production and revenue in the confectionery industry from 2011 to 2019, the revenue

of the confectionery industry is proportional to the average income of the population.

Hence, customer income is a significant factor that influences the demand in

the confectionery market. The level of income has a considerable impact on whether

consumers choose to purchase and consume confectionery products. When consumers

have higher disposable incomes, meaning they have funds left after covering

necessary expenses, they are more likely to allocate some of their budget towards

discretionary items like confectionery. This leads to an increased demand for confectionery products. Consumer preference

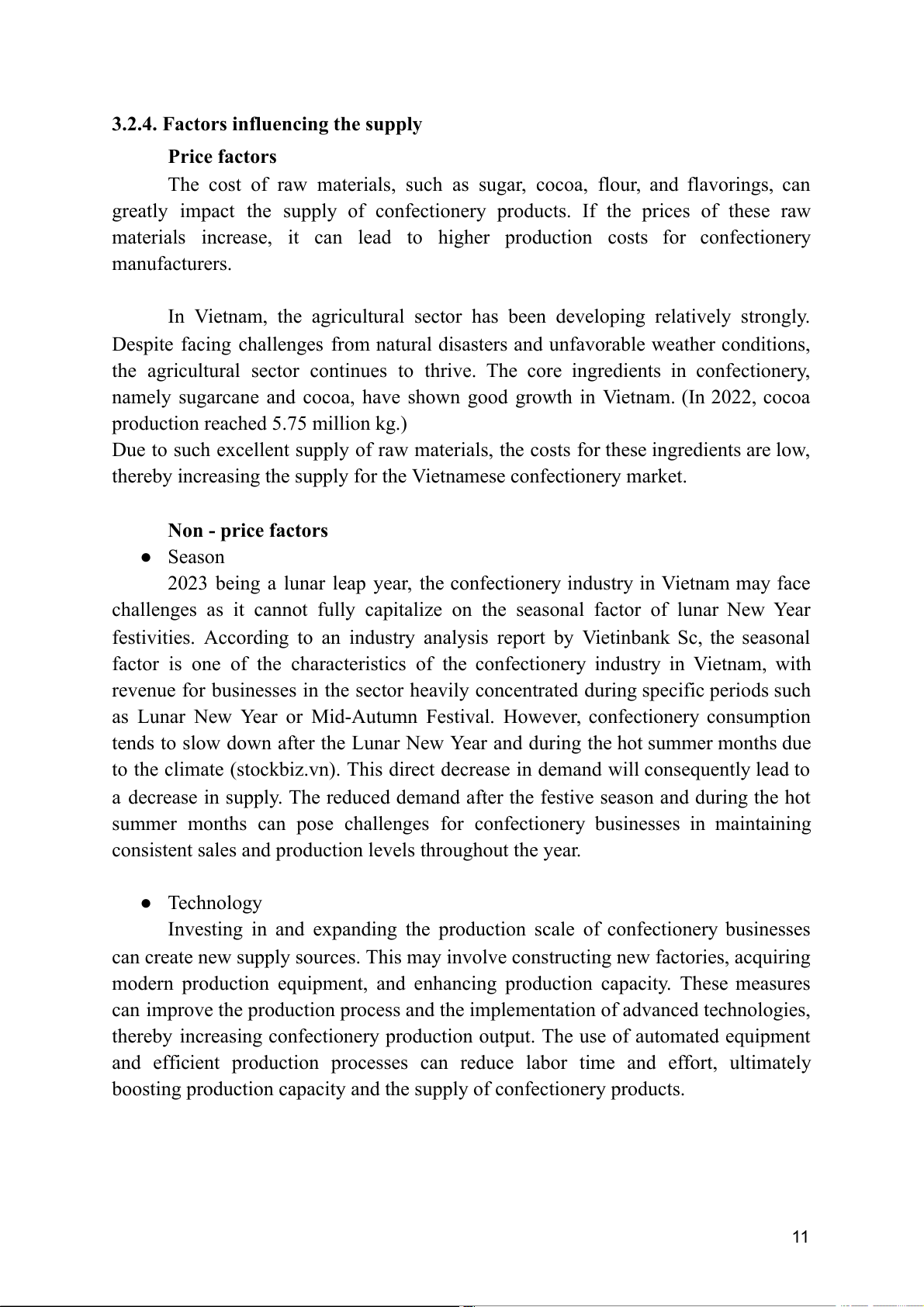

According to a report from UNICEF, the obesity rate among children in

Vietnam is rapidly increasing. The percentage of overweight children aged 5 to 19 has

risen from 8.5% in 2010 to 19% in 2020. (aglobal.vn)

Changes in consumer preferences and consumption trends towards healthier

products can lead to a shift in the consumption patterns of various types of

confectionery. Increased health awareness can reduce the demand for traditional

sugary confectionery options as consumers opt for alternative choices such as fruit

bars, yogurt cups, or cereal bars. International market

The international market can significantly influence the demand for

confectionery products in Vietnam. Importing and exporting various types of

confectionery from different countries brings diversity in flavors, ingredients, and new

product offerings to Vietnamese consumers.

Since the beginning of 2015, when import taxes on confectionery items

decreased to 0%, the domestic confectionery market has faced a surge in imported

products from many ASEAN countries such as Malaysia, Indonesia, Thailand, and

others. According to surveys, compared to domestic confectionery, imported

confectionery products are priced only about 10-15% higher and are more favored by

customers due to their distinctive flavors and ease of consumption (nhandan.vn). 10

3.2.4. Factors influencing the supply Price factors

The cost of raw materials, such as sugar, cocoa, flour, and flavorings, can

greatly impact the supply of confectionery products. If the prices of these raw

materials increase, it can lead to higher production costs for confectionery manufacturers.

In Vietnam, the agricultural sector has been developing relatively strongly.

Despite facing challenges from natural disasters and unfavorable weather conditions,

the agricultural sector continues to thrive. The core ingredients in confectionery,

namely sugarcane and cocoa, have shown good growth in Vietnam. (In 2022, cocoa

production reached 5.75 million kg.)

Due to such excellent supply of raw materials, the costs for these ingredients are low,

thereby increasing the supply for the Vietnamese confectionery market. Non - price factors ● Season

2023 being a lunar leap year, the confectionery industry in Vietnam may face

challenges as it cannot fully capitalize on the seasonal factor of lunar New Year

festivities. According to an industry analysis report by Vietinbank Sc, the seasonal

factor is one of the characteristics of the confectionery industry in Vietnam, with

revenue for businesses in the sector heavily concentrated during specific periods such

as Lunar New Year or Mid-Autumn Festival. However, confectionery consumption

tends to slow down after the Lunar New Year and during the hot summer months due

to the climate (stockbiz.vn). This direct decrease in demand will consequently lead to

a decrease in supply. The reduced demand after the festive season and during the hot

summer months can pose challenges for confectionery businesses in maintaining

consistent sales and production levels throughout the year. ● Technology

Investing in and expanding the production scale of confectionery businesses

can create new supply sources. This may involve constructing new factories, acquiring

modern production equipment, and enhancing production capacity. These measures

can improve the production process and the implementation of advanced technologies,

thereby increasing confectionery production output. The use of automated equipment

and efficient production processes can reduce labor time and effort, ultimately

boosting production capacity and the supply of confectionery products. 11 ● International markets

Expanding export markets can create opportunities for increasing the supply of

confectionery products. Exporting confectionery to international markets can help

boost the revenue and production capacity of confectionery businesses. According to

the Ministry of Industry and Trade, Free Trade Agreements (FTAs) can reduce import

duties by 85-90% for Vietnamese confectionery products. This presents a significant

opportunity for Vietnamese confectionery businesses to expand their markets and

enhance competitiveness. Furthermore, with the connectivity of the internet,

Vietnamese confectionery businesses can reach new audiences and promote brand

awareness on an international scale (aglobal.vn).

Moreover, the presence of international confectionery brands in Vietnam has

created competition in the market (mentioned in 3.2.3). This encourages domestic

confectionery manufacturers to improve their products and enhance their quality to

compete with international brands. This competition brings about a variety of

confectionery choices, improves product quality, and benefits consumers.

4. Potential, challenging and market trend 4.1 Potential

Vietnamese confections have an emphasis on quality in addition to offering a

wide variety of tastes and processing techniques. Because of this, there are now many

attractive export prospects due to a significant competitive advantage. Vietnam has

signed some Free Trade Agreements (FTAs), greatly lowering trade barriers in this

industry. For example, because of practically 0% tariffs under the free trade agreement

between Vietnam and South Korea, Vietnamese confectionery items are very

competitive in the Korean market (To Quoc, 2023). China, the US, Cambodia, Japan,

South Korea, Taiwan, and Middle Eastern nations are the top export destinations for

Vietnamese candies. Moreover, Vietnamese candies may be found in more than 100

nations and territories globally.

Additionally, Vietnam ranks as the third most populous country in Southeast

Asia (after Indonesia and the Philippines) and 15th globally, making it an attractive

market for imported goods due to its large and expanding consumer base. 4.2. Challenging Domestic firms

The economic disadvantages also partly affect the development of the

confectionery industry in Vietnam. The confectionery business faces challenges from

inflation as the COVID-19 epidemic gradually disappears. Representatives from

Bibica, a significant Vietnamese candy producer, stated that input costs started to grow 12

near the end of l2022 and that as of right now, raw material costs had increased by

20–25% when compared to the same period in 2022 (thesaigontimes, 2022). Foreign firms

Manufacturing raw materials for the confectionery production process poses a

significant challenge in Vietnam, primarily due to the seasonal nature of many raw

materials, coupled with natural disasters and adverse weather conditions.

In the context of deepening international economic integration, the export of

Vietnamese confectionery also faces numerous opportunities and challenges. There

are strict laws covering quality, food safety, labeling, inspection, and other factors to

each export market. To export to these markets, businesses need to follow certain

laws. This necessitates thorough documentation preparation, ongoing oversight, and

updating of these regulations, in addition to meticulous document preparation. Failure

to comply with these regulations puts businesses at risk of export rejection or product

recall, resulting in financial loss and damage to reputation.

The Vietnamese confectionery market also faces fierce competition from

imported products, especially from ASEAN countries and Europe. Import duties on

confectionery from ASEAN countries in Vietnam have been reduced to 0%, leading to

a large influx of imported confectionery products into the Vietnamese market. 4.3. Consumption trend

According to a 2023 Coc Coc study, 63% of participants preferred snacks, with

those aged 13–19 favoring them more (70%) than those aged 20 and older (57%).

Chocolate, ice cream, and cakes were products that appealed to people of every

generation. Price, region of origin, and flavor were the main variables that influenced

purchase decisions, with flavor having the most influence. The older group favored

nutritive materials, whereas the younger group was more interested in taste and

novelty. Two-thirds of respondents were willing to try new products, while the

youngers showed greater interest in premium brands and older people gravitated

toward limited edition products. The list of the most well-known confectionery brands

makes it clear that "imported" names dominate the market. The top 4 most familiar

brands with Vietnamese consumers include Oishi, Orion, Kinh Đô, and Lay’s. While

the market is full of potential, it is also a fierce competition for domestic enterprises to

assert their position on their home turf.

Not only does the Vietnamese confectionery market have a large consumer

base, but it also sees frequent purchases, with nearly half of respondents buying these

products weekly. Direct shopping channels like convenience stores and supermarkets 13

are preferred by 75% of consumers. About 35% of consumers make faster purchasing

decisions when encountering appealing promotions, and feel stimulated by unique

packaging or new product launches from their favorite brands. Overall, Vietnamese

consumers tend to buy snacks for themselves, with average spending ranging from

20,000 to 50,000 VND per product (Coccoc, 2023). 5. Recommendation

Put Quality and Food Safety First

To earn the confidence and loyalty of customers, make sure that all output

items adhere to quality and safety requirements. Diversify Product Offerings

Expand the range of confectionery products to cater to diverse consumer

preferences. Introduce innovative flavors, textures, and packaging designs to captivate

the market and stay ahead of competitors. Adjust to consumer trends

Constantly monitor trends and customer preferences to modify product offers.

Promote natural, healthful items and eco-friendly packaging to draw in customers who care about the environment.

Invest in research and development

Set aside funds for projects aimed at innovating and setting products apart from

the competition. To stand out from the competition and satisfy rising customer needs,

we're testing novel recipes and production methods. 6. Conclusion

After reviewing and analyzing, we describe the characteristics to prove the

confectionery industry is closer to monopolistic competition, with a relatively large

number of small firms and some main large firms in Vietnam’s confectionary market.

Until 2022, Kido took the largest market share in this industry. Products in firms are

similar but not identical, including main products, styles, and flavors. Barriers to entry

into the market are quite high causing new firms to need to meet conditions if they

want to have a significant position.

Moreover, this project shows the demand, and supply of the market and the

factors affecting them. But, in general, both the demand and supply of confectionary

products increase and are expected to increase soon due to the data we mentioned above. 14

In addition, due to identify the potential, challenges, and trends in the industry,

we make some recommendations for firms in this sector. Over the years, human needs

have changed, and the factors affecting supply and demand have also gradually

changed, so businesses need to grasp that to develop and gain more market share in

the market. In addition, Vietnam's confectionery market is an ideal place to attract

foreign businesses with many opportunities to enhance profits. REFERENCE

Aglobal THỊ TRƯỜNG BÁNH KẸO VIỆT NAM: TỪ NỘI ĐỊA ĐẾN VỊ THẾ

QUỐC TẾ [Online] Retrieved from:

https://aglobal.vn/blog/thi-truong-banh-keo-viet-nam-tu-noi-dia-den-vi-the-quoc-te-13 30272020

Brands Vietnam (2023) ORION TĂNG TRƯỞNG DOANH THU 2 CHỮ SỐ,

CHIẾM THÊM THỊ PHẦN NHỜ KHÔNG TĂNG GIÁ [Online] Retrived from:

https://www.brandsvietnam.com/23721-Orion-tang-truong-doanh-thu-2-chu-so-chiem

-them-thi-phan-nho-khong-tang-gia

CESTI (2016) HẤP DẪN THỊ TRƯỜNG BÁNH KẸO VIỆT NAM [Online] Retrieved from:

https://cesti.gov.vn/bai-viet/TGDL/hap-dan-thi-truong-banh-keo-viet-nam-01002491- 0000-0000-0000-000000000000

Nhandan (2024) GIAN NAN TÌM THỊ PHẦN CHO BÁNH KẸO VIỆT NAM [Online] Retrieved from:

https://nhandan.vn/gian-nan-tim-thi-phan-cho-banh-keo-viet-nam-post242278.html Retrieved from:

https://stockbiz.vn/tin-tuc/nguyen-nhan-bat-ngo-khien-cac-doanh-nghiep-banh-keo-ga

p-kho-khan-hon-trong-nam-2023-nam-nhuan/17437709

Stockbiz (2023) NGUYÊN NHÂN BẤT NGỜ KHIẾN CÁC DOANH NGHIỆP

BÁNH KẸO GẶP KHÓ KHĂN HƠN TRONG NĂM 2023: NĂM NHUẬN [Online]

To Quoc (2023) NGÀNH BÁNH KẸO TẠI VIỆT NAM ĐANG BÙNG NỔ [Online] Retrieved from:

https://toquoc.vn/nganh-banh-keo-tai-viet-nam-dang-bung-no-20230802084635445.ht m

Tong cuc thong ke (2022) THÔNG CÁO BÁO CHÍ KẾT QUẢ KHẢO SÁT MỨC

SỐNG DÂN CƯ 2022 [Online]. Retrieved from:

https://www.gso.gov.vn/du-lieu-va-so-lieu-thong-ke/2023/05/thong-cao-bao-chi-ket-q

ua-khao-sat-muc-song-dan-cu-2022/ 15

Vietdata (2023) KIDO - THAM VỌNG GIÀNH LẠI VỊ TRÍ DẪN ĐẦU TRONG

THỊ TRƯỜNG BÁNH KẸO VIỆT [Online] Retrieved from:

https://www.vietdata.vn/vi/post/kido-tham-v%E1%BB%8Dng-gi%C3%A0nh-l%E1%

BA%A1i-v%E1%BB%8B-tr%C3%AD-ng%C3%A0nh-b%C3%A1nh-k%E1%BA%B 9o

VietinBankSc (2015) BÁO CÁO NGÀNH BÁNH KẸO[Online]. Retrieved from:

https://www.cts.vn/wp-content/uploads/migrate/2015/09/30/cts-bao-cao-nganh-banh-k eo-092015-vnsshort.pdf

Vietnam Credit (2022) OVERVIEW OF VIETNAM’S CONFECTIONERY

INDUSTRY [Online] Retrieved from:

https://vietnamcredit.com.vn/news/overview-of-vietnams-confectionery-industry_147 78

Virac Research (2023) THỊ TRƯỜNG BÁNH KẸO TẾT 2024: DOANH NGHIỆP

TĂNG SẢN LƯỢNG – NGƯỜI TIÊU DÙNG ƯU TIÊN SẢN PHẨM LÀNH MẠNH [Online] Retrived from:

https://viracresearch.com/thi-truong-banh-keo-tet-2024-san-luong-hang-tang/ 16