Preview text:

Table of Contents INTRODUCTION 3

CONTENT….…………………………………………………………………………….4

I.WHAT INDUSTRY THE COMMODITY IS IN … 4

1.Pure competition definition 4

2. Overview of the Fried Chicken Industry in a Monopolistic Competition .................4

3. Why fried chicken is a monopolistic competition….….………………………..…..5

II.MAIN FACTORS HAVE AFFECTED THE SUPPLY AND DEMAND OF RICE OVER THE LAST YEARS 8

1.Theory of Supply & Demand 8 2.Factors in terms of Supply 11 3.Factors in term of Demand 14

ROLE OF GOVERNMENT ….……...…………………………………………18 CONCLUSION 17 REFERENCES 19 GROUP 6 CLASS EBBA 16.2 2 INTRODUCTION

The fried chicken market in Vietnam has undergone significant transformations in

recent years, driven by a dynamic interplay of economic, social, and cultural

factors. Moreover, the fried chicken industry in Vietnam represents a vibrant and

competitive market shaped by diverse players, ranging from global fast-food

chains to local vendors. As a part of the larger fast-food sector, this industry

operates within a framework best described by the monopolistic competition

model, which balances the competitive forces of multiple firms with the

uniqueness of individual offerings. Firms compete not only with pricing but also

through branding, quality, menu diversity, and marketing strategies, ensuring

consumers have a variety of options to meet their preferences and budgets. This

structure fosters innovation and adaptability, making the industry a compelling

example of how businesses navigate a dynamic and customer-focused market environment.

Vietnam's fried chicken market, dominated by major global brands like KFC,

Lotteria, and Jollibee, alongside a growing number of local competitors, offers a

vibrant example of how these forces operate. The pre-pandemic period witnessed a

steady rise in demand fueled by urbanization, rising incomes, and the growing

influence of fast-food culture. However, this growth trajectory was interrupted by

the unprecedented challenges of the COVID-19 pandemic, which reshaped

consumer behavior and disrupted supply chains.

This analysis explores the factors influencing the supply and demand for fried

chicken in Vietnam, with a particular focus on the market's response to changing

economic conditions, consumer preferences, and policy interventions. By

examining the theoretical concepts of supply and demand and their real-world

application, this discussion sheds light on how the industry navigated challenges

and adapted to recover in a highly competitive environment. Besides that, the

analysis also highlights the role of price and non-price determinants, such as taxes,

subsidies, technological advancements, and shifting consumer expectations, in

shaping market equilibrium and driving growth. This passage delves into the

various stages of demand in Vietnam's fried chicken market—before, during, and

after the pandemic—highlighting key factors that influenced its rise, fall, and

recovery. It also explores the vital roles of government support, evolving

production methods, and consumer-driven innovations in sustaining the industry. GROUP 6 CLASS EBBA 16.2 3 CONTENT

I.WHAT INDUSTRY IS THE COMMODITY IN? EXPLAIN YOUR REASONING.

1.Pure competition definition:

A competitive market is a theoretical market structure in which no single

consumer or producer has the power to influence the market. In a monopolistic

competition model, there is a balance between competitive forces and the unique

offerings of individual firms. Firms have some degree of pricing power due to

product differentiation but still operate in a competitive market where entry and exit are relatively easy.

This kind of structure has several key characteristics, including:

Product Differentiation: Firms sell similar but not identical products.

Differentiation may be based on brand, quality, design, or marketing. For example,

in the fast-food industry, burgers from McDonald's and Burger King serve the

same need but are branded and marketed differently.

Some Price-Setting Ability: Firms have some control over pricing because their

products are differentiated. However, they cannot stray too far from competitors’

prices without risking a loss in demand.

Market Share Influence: Individual firms have varying levels of market share,

but no single firm dominates the market entirely. Consumer loyalty to brands can

influence market share, but competition remains robust.

Imperfect Information: Buyers have incomplete knowledge of all products and

prices in the market. This lack of perfect information allows firms to create

perceived differences through advertising and branding.

Ease of Entry and Exit: Entry into the market is relatively easy, though not cost-

free. New firms can introduce competing products, and existing firms can leave if

profits diminish. For example, opening a local pizza restaurant involves moderate

investment but is feasible compared to entering an oligopoly or monopoly. GROUP 6 CLASS EBBA 16.2 4

Large Number of Buyers and Sellers: There are many firms and consumers in

the market. Each firm has a relatively small share of the total market but enough

presence to attract a loyal customer base.

Non-Price Competition: Firms often compete through marketing, product quality,

or additional services rather than lowering prices. For example, a fast-food chain

might emphasize its healthier options or faster service.

In monopolistic competition, firms aim to strike a balance between attracting

customers through unique offerings and staying competitive in pricing and market positioning.

2. Overview of the Fried Chicken Industry in a Monopolistic Competition

The fried chicken industry represents a quintessential example of a monopolistic

competition market, characterized by numerous competitors who differentiate their

offerings through branding, flavor innovation, and customer service. This

differentiation allows brands to establish loyal customer bases despite the

commoditized nature of the product. The industry's appeal lies in its ability to

blend global fast-food trends with local culinary influences, meeting the diverse

tastes of consumers worldwide. As a result, fried chicken has become a

cornerstone of the fast-food industry, driving significant growth across regions.

The global fried chicken market is a robust segment of the fast-food industry, with

an estimated value of USD 7.2 billion in 2023. It is projected to grow at a

compound annual growth rate (CAGR) of 5.3% from 2023 to 2032, reflecting the

increasing popularity of quick-service restaurants (QSRs) and evolving consumer

preferences. North America remains the dominant region in terms of revenue,

fueled by major brands such as KFC, Chick-fil-A, and Popeyes, which collectively

cater to a culture deeply rooted in fast-food consumption. In the United States

alone, over 50% of consumers consider fried chicken their preferred fast-food

choice, showcasing its integral role in American culinary culture. Meanwhile, the

Asia-Pacific region is emerging as the fastest-growing market, driven by rising

disposable incomes, rapid urbanization, and a growing middle class. With a

projected CAGR of 5.8%, the region is experiencing significant contributions from

both global players like KFC and local chains such as Dicos in China. For

example, the expansion of KFC into rural and urban China has propelled the

brand’s dominance, while localized flavors such as spicy Sichuan chicken cater to GROUP 6 CLASS EBBA 16.2 5

regional tastes. This dual strategy of international scalability and local

customization is critical to the success of fried chicken in the region. Despite its

growth, the fried chicken industry faces challenges, including rising costs of raw

materials and growing consumer concerns over health and environmental

sustainability. The volatility of chicken prices often pressures profit margins, while

shifts in consumer preferences are pushing brands to innovate healthier and more

sustainable options. Many chains have responded by introducing plant-based

alternatives or offering baked chicken to align with health-conscious trends.

Additionally, criticism regarding the environmental impact of fast food—

particularly the carbon footprint associated with packaging and supply chains—has

prompted leading companies to invest in greener practices. Looking forward, the

global fried chicken market is expected to reach a valuation of over USD 10 billion

by 2032, underpinned by demand in emerging markets such as the Middle East,

Africa, and Latin America. These regions offer untapped potential, driven by

increasing urbanization and an expanding consumer base eager for convenient

dining options. The future of the industry will hinge on its ability to innovate while

maintaining affordability and accessibility, ensuring that fried chicken continues to

resonate with a diverse and dynamic global audience.

In Vietnam, the structure of the fried chicken industry consists of several key

elements that define the operational framework and market dynamics. The main

components of the industry include international chains such as KFC, Lotteria, and

Jollibee, which dominate the majority of the market share. The remaining portion

is held by domestic brands like FKT and smaller outlets or independent restaurants,

such as "Tiệm Gà Rán Số 19" and "Tiệm Gà Óng Ánh." These local competitors

emphasize traditional flavors and competitive pricing, making them noteworthy players in the market.

3. Why fried chicken is a monopolistic competition

Based on the characteristics of a monopolistic competitive market, we can conclude that the fried

chicken market is undoubtedly a monopolistic competitive market for several reasons: a. Many Sellers

There are numerous fried chicken chains (e.g., McDonald's, KFC, Lotteria) and

local outlets competing in the market. b. Product Differentiation

While fried chicken products are similar, companies differentiate their offerings

through branding, recipes, pricing, and marketing strategies. GROUP 6 CLASS EBBA 16.2 6

- Example: McDonald's promotes its "Big Mac" as unique, while KFC

emphasizes "Well, it's finger licking good"

Differences in flavors, packaging, or add-ons make consumers perceive them as

distinct, even if they serve similar purposes.

c. Brand Loyalty and Advertising

Companies use extensive marketing to create brand loyalty, making consumers

prefer one brand over another despite similarities. For instance, McDonald’s

golden arches are a strong global brand symbol. d. Ease of Entry and Exit

While starting a global fried chicken chain requires significant resources, smaller

fried chicken outlets can easily enter the market. This contributes to a competitive

yet differentiated market environment. e. Price Setting

Each fried chicken chain has some control over pricing because their products are

differentiated. However, the presence of many competitors limits how much they

can increase prices without losing customers. f. Non-Price Competition

Fried chicken chains compete more through product variety, quality, and

promotional deals (e.g., McDonald's Happy Meal or Wendy's 4 for $4) than by lowering prices.

This makes the fried chicken industry a classic example of a monopolistic

competition rather than perfect competition or a monopoly.

II. MAIN FACTORS HAVE AFFECTED THE SUPPLY

AND DEMAND OF MONEY OVER THE LAST YEARS:

1. Theory of Supply & Demand: a. Concept of Demand: GROUP 6 CLASS EBBA 16.2 7

Demand is the quantity of a product that consumers are willing and able to

purchase at different price levels during a specific time period, assuming all other

factors remain constant (ceteris paribus). This concept is visually represented

through a demand schedule and a demand curve.

Quantity demanded is the amount (number of units) of a product that a household

would buy in a given period if it could buy all it wanted at the current market price.

b. Determinants of Demand:

Price and Quantity Demanded:

The Law of Demand

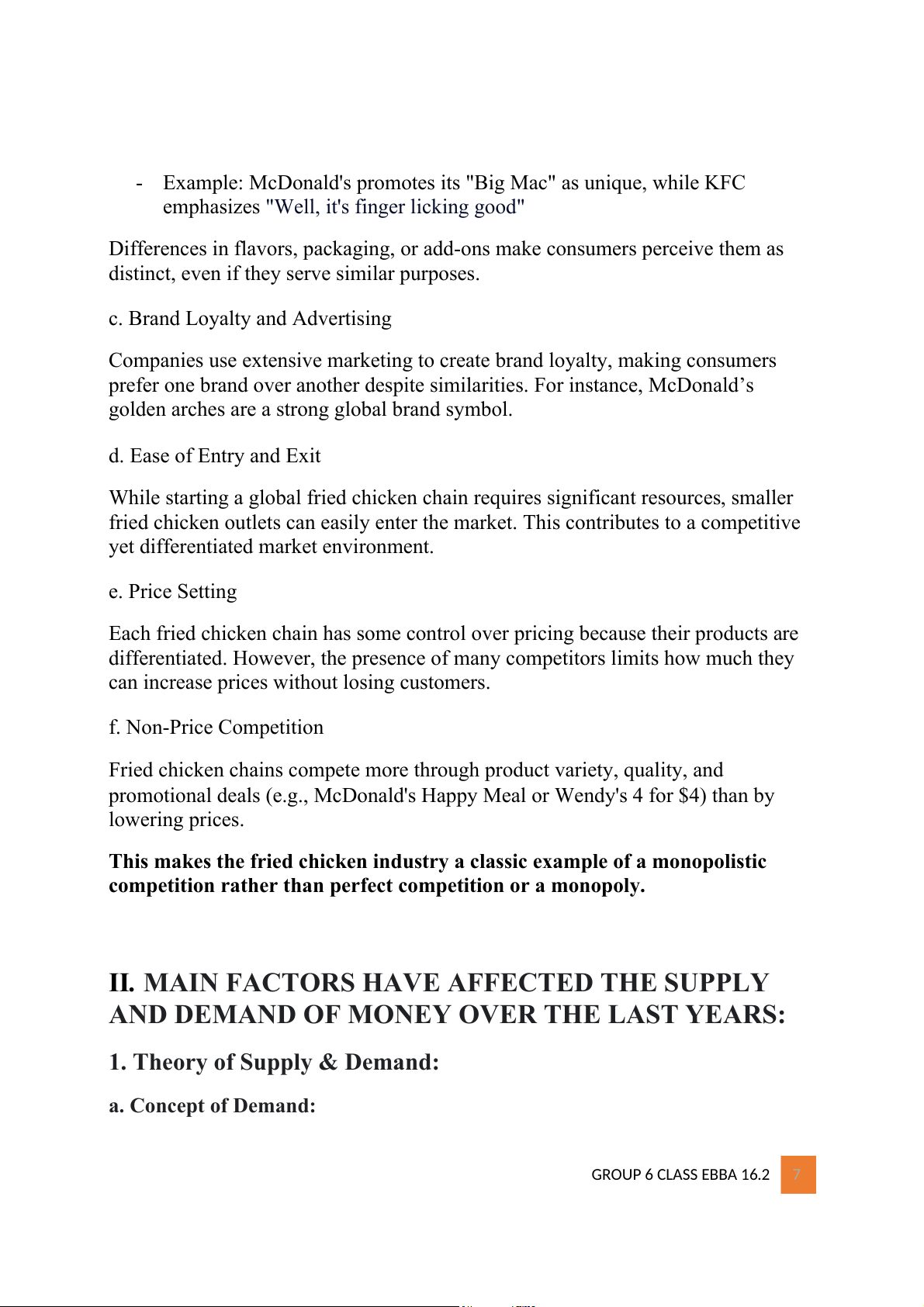

A demand schedule shows how much of a product a person

or household is willing to purchase per time period (each

week or each month) at different prices.

A demand curve is a graphical representation showing the qua

that a household is willing and able to purchase at various

price levels. Demand curves slope downward because of the Law of Demand.

The Law of Demand describes an inverse relationship between price and quantity

demanded: assuming all other factors remain constant (ceteris paribus), as the price

of a good or service increases, the quantity demanded decreases. Conversely, as the

price decreases, the quantity demanded rises, over a specific period of time. GROUP 6 CLASS EBBA 16.2 8

Price factor (other thing’s equal): The effect of price causes movement along the

Demand curve (inverse relationship, change in Quantity Demanded )

Non-price factors (Price is constant): The effect of Non-price factors cause the

shift of the Demand curve to the right /left (change in Demand). - Income of consumers

- Prices of related goods

- Tastes & preferences of consumers

- The number of consumers.

- Expectations about future prices and income. b. Concept of Supply:

The various amounts of a product that producers are willing and able to supply at

various prices during some specific period (ceteris paribus). Demonstrated by the

supply schedule and supply curve.

Price and Quantity Supplied: The Law of Supply

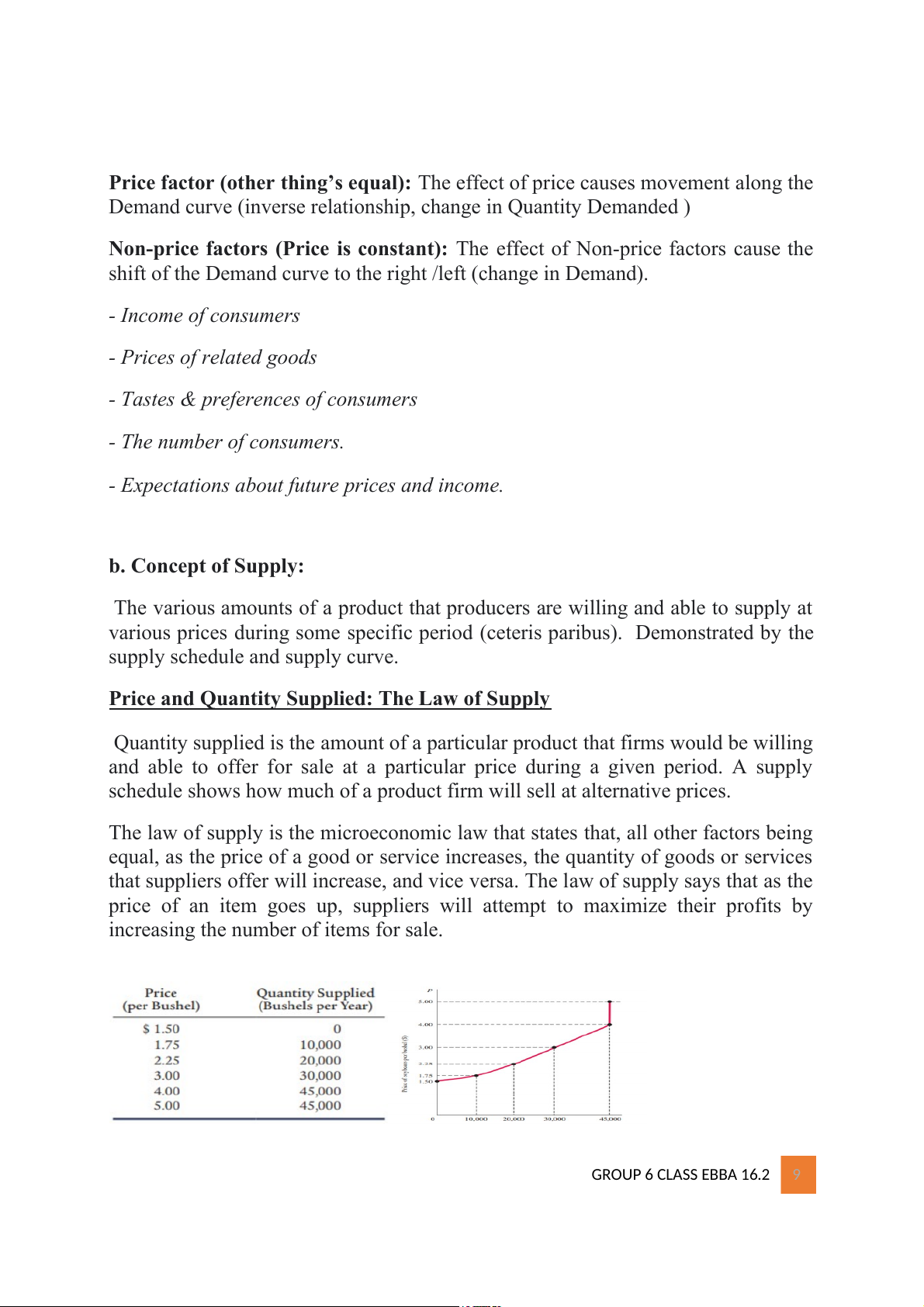

Quantity supplied is the amount of a particular product that firms would be willing

and able to offer for sale at a particular price during a given period. A supply

schedule shows how much of a product firm will sell at alternative prices.

The law of supply is the microeconomic law that states that, all other factors being

equal, as the price of a good or service increases, the quantity of goods or services

that suppliers offer will increase, and vice versa. The law of supply says that as the

price of an item goes up, suppliers will attempt to maximize their profits by

increasing the number of items for sale. GROUP 6 CLASS EBBA 16.2 9

Price factor and Non-price factors:

Price factor (other thing’s equal): Effect of Price causes movement along the

Supply curve (direct relationship, change in Quantity Supplied).

Non- Price factors (Price is constant): Effect of Non-price factors cause the shift

of the Supply curve to the right /left (change in Supply).

- Input prices: P input increase, supply decrease. - Technology.

- Government policies – Taxes.

- The number of producers. - Expectations.

2. Factors in term of Supply:

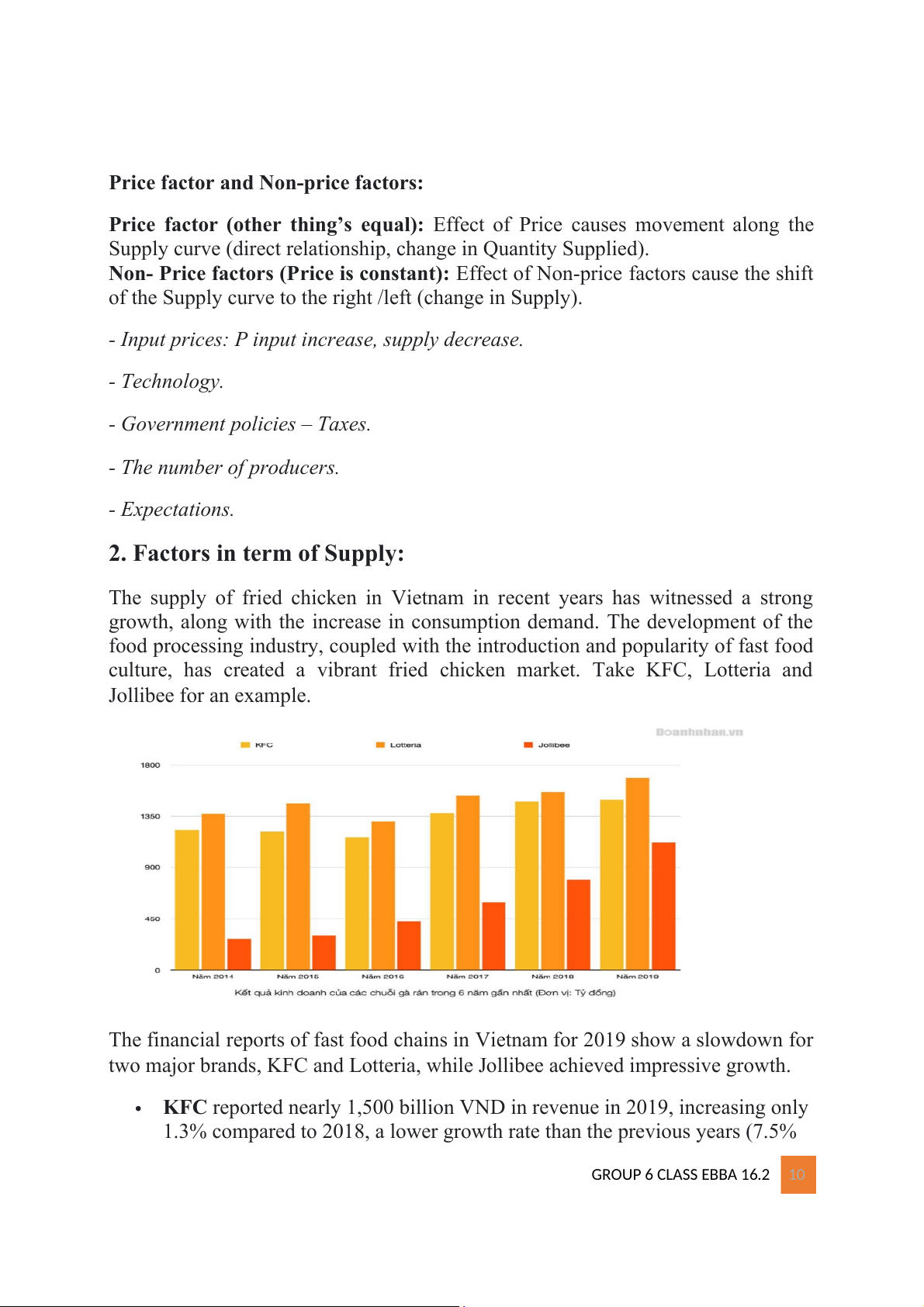

The supply of fried chicken in Vietnam in recent years has witnessed a strong

growth, along with the increase in consumption demand. The development of the

food processing industry, coupled with the introduction and popularity of fast food

culture, has created a vibrant fried chicken market. Take KFC, Lotteria and Jollibee for an example.

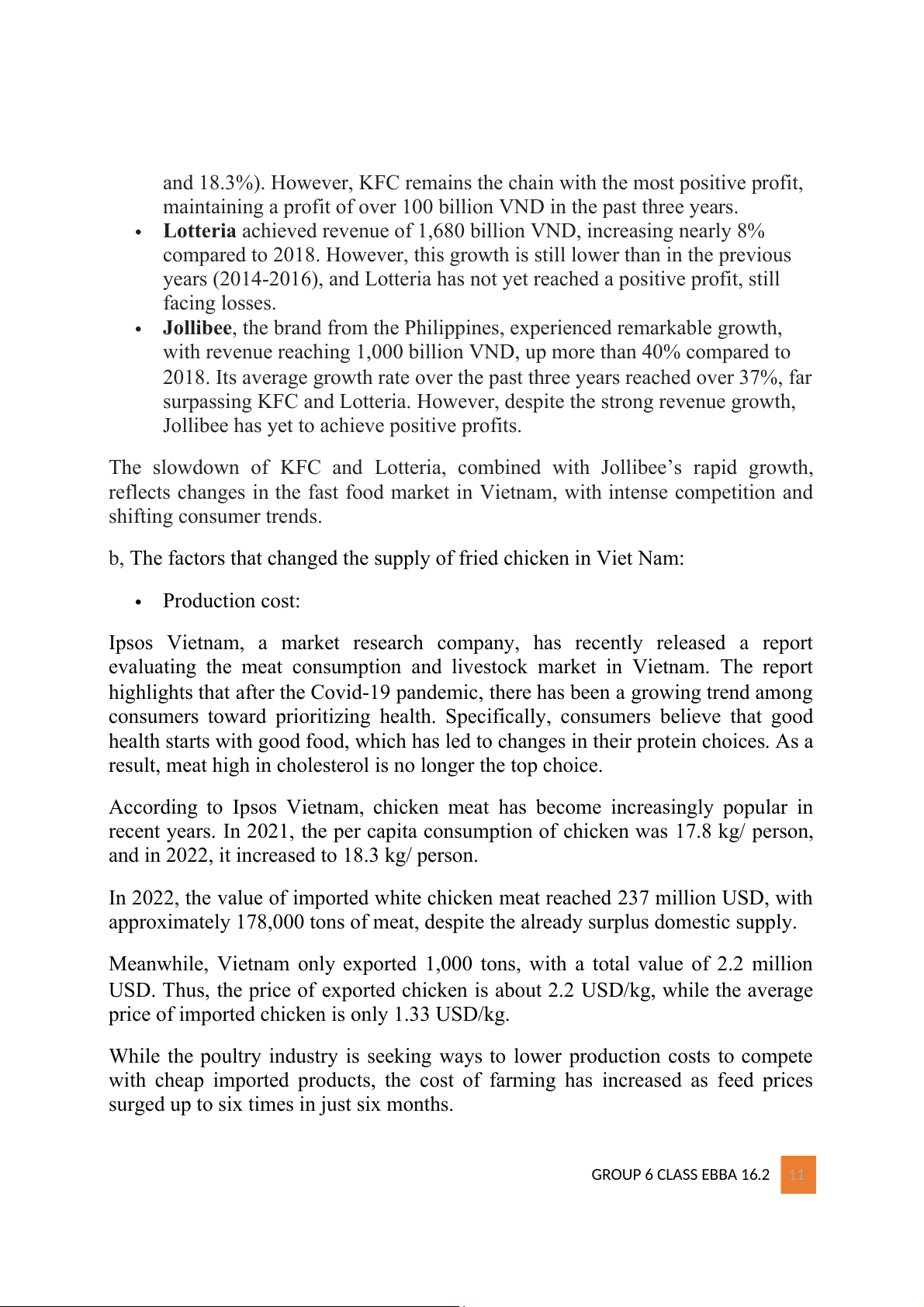

The financial reports of fast food chains in Vietnam for 2019 show a slowdown for

two major brands, KFC and Lotteria, while Jollibee achieved impressive growth.

KFC reported nearly 1,500 billion VND in revenue in 2019, increasing only

1.3% compared to 2018, a lower growth rate than the previous years (7.5% GROUP 6 CLASS EBBA 16.2 10

and 18.3%). However, KFC remains the chain with the most positive profit,

maintaining a profit of over 100 billion VND in the past three years.

Lotteria achieved revenue of 1,680 billion VND, increasing nearly 8%

compared to 2018. However, this growth is still lower than in the previous

years (2014-2016), and Lotteria has not yet reached a positive profit, still facing losses.

Jollibee, the brand from the Philippines, experienced remarkable growth,

with revenue reaching 1,000 billion VND, up more than 40% compared to

2018. Its average growth rate over the past three years reached over 37%, far

surpassing KFC and Lotteria. However, despite the strong revenue growth,

Jollibee has yet to achieve positive profits.

The slowdown of KFC and Lotteria, combined with Jollibee’s rapid growth,

reflects changes in the fast food market in Vietnam, with intense competition and shifting consumer trends.

b, The factors that changed the supply of fried chicken in Viet Nam: Production cost:

Ipsos Vietnam, a market research company, has recently released a report

evaluating the meat consumption and livestock market in Vietnam. The report

highlights that after the Covid-19 pandemic, there has been a growing trend among

consumers toward prioritizing health. Specifically, consumers believe that good

health starts with good food, which has led to changes in their protein choices. As a

result, meat high in cholesterol is no longer the top choice.

According to Ipsos Vietnam, chicken meat has become increasingly popular in

recent years. In 2021, the per capita consumption of chicken was 17.8 kg/ person,

and in 2022, it increased to 18.3 kg/ person.

In 2022, the value of imported white chicken meat reached 237 million USD, with

approximately 178,000 tons of meat, despite the already surplus domestic supply.

Meanwhile, Vietnam only exported 1,000 tons, with a total value of 2.2 million

USD. Thus, the price of exported chicken is about 2.2 USD/kg, while the average

price of imported chicken is only 1.33 USD/kg.

While the poultry industry is seeking ways to lower production costs to compete

with cheap imported products, the cost of farming has increased as feed prices

surged up to six times in just six months. GROUP 6 CLASS EBBA 16.2 11 Franchisees:

Franchising significantly impacts the supply curve by increasing the quantity of

goods or services and reducing production costs. concise analysis include

Increased Supply; Economies of Scale; Standardized Operations; Lower Market Entry Costs; Constraints

Increased Supply: Franchising enables rapid expansion through new locations and

geographic coverage, shifting the supply curve to the right. Economies of Scale:

Bulk purchasing lowers production costs, allowing franchisees to supply more at

the same price. Standardized Operations: Consistent pricing and quality reduce

inefficiencies, stabilizing supply growth. However, franchisees have less

flexibility, making the supply curve less elastic. Lower Market Entry Costs:

Franchising reduces barriers to entry, encouraging more suppliers and further

shifting the supply curve to the right. Constraints: Franchisors may impose quotas

or restrict output, limiting further shifts in the supply curve. Long-Term Impacts:

Competition among franchisees and innovations by franchisors can stabilize or increase supply over time.

For that reason, Franchising shifts the supply curve to the right by expanding

supply and lowering costs but can make it less elastic due to operational constraints. Indirect way: Taxes:

Since fried chicken is an elastic product in the monopolistic market, taxes can

have a profound impact on elastic products in monopolistic markets, primarily by

reducing demand, shifting consumers to substitutes, and increasing inefficiencies.

Firms in such markets must adapt their strategies to minimize these effects

To explore the effects of government policy on taxes, the government was to

impose a 10% tax (VAT/GST). Although this particular exercise is arbitrary, its

results point to the direction and magnitude of other potential changes (such as a

subsidy, or a smaller tax). The tax would push the domestic price down by 10%

relative to the world price. This in turn would reduce the quantity supplied by 0.7%

(= 10% times the own-price elasticity of supply of 0.07). Subsidy:

When subsidizing, the government implements preferential policies or transfers a

sum of money to the producer or consumer. In other words, the subsidy is a

negative task. Because fried chicken is in the monopolistic market, the subsidy GROUP 6 CLASS EBBA 16.2 12

mostly does not benefit it. However, the customer still can enjoy the subsidy via

policies which provide financial support for poultry farming such as chicken. Direct way: Price ceiling measure:

When realizing the price of rice products is higher than the normal level, the

equilibrium price of rice is very high, the government sets a ceiling price, and the

maximum price is lower than the equilibrium price in order to stabilize the price to protect consumers.

When the price ceiling is imposed by the government above the market

equilibrium price, the price ceiling has no impact on the economy. It neither

restricts supply nor encourages demand. People can't pay or have to pay more than some amount paid.

The positive effect of the price ceiling measure is that it increases purchasing

power and stabilizes prices for fried chicken.

The negative effect of the price ceiling measure is that sellers suffer a lot

because they have to sell fried chicken at a price lower than the equilibrium price. Price floor measure:

When finding that the price of rice products is lower than normal (the

equilibrium price of the product is very low) or there is a shortage of food, the

government will stabilize the floor price (the lowest price) below the equilibrium

price. To stabilize prices, protect consumers.

The positive effect of the price floor measure is that it stimulates production,

increases supply and increases income.

The negative effect of the price floor measure is that consumers have to buy

fried chicken at a high price, reducing demand, and causing unemployment or crime.

It can be assessed that this is a measure to stimulate supply, causing oversupply

and excess of most products on the market.

3. Factors in term of Demand:

The supply and demand for fried chicken in Vietnam have experienced significant

fluctuations over the past few years, particularly influenced by the four waves of

the COVID-19 pandemic - as a non-price factor. These changes were driven by

shifts in consumer behavior, disruptions in supply chains, and the adoption of new

business models. This analysis focuses on demand-side factors and their evolution

across three distinct periods: before, during, and after the COVID-19 pandemic.

a. Demand Before COVID-19: A Period of Growth and Stability GROUP 6 CLASS EBBA 16.2 13

Before the pandemic, the demand for the fried chicken industry in Vietnam

steadily increased. Urbanization and rising disposable incomes contributed to a

growing preference for fast food, especially among younger generations and

working professionals. Additionally, dine-in services played a significant role,

attracting families and groups for social gatherings due to their convenience and

welcoming atmosphere. These settings provided a mix of affordable pricing and

convenience, driving consistent customer footfall.

This trend was further bolstered by the expansion of international chains which

capitalized on their established brand recognition and widespread outlets.

According to VN Express, KFC, Lotteria, and Jollibee are the dominant players in

this market segment. In 2019, the combined revenue of these three chains reached

nearly 4.3 trillion VND, reflecting an increase of over 11% compared to 2018.

Beside Western fried chicken chains, Korean brands have also gained significant

popularity among Vietnamese consumers such as Bonchon, Nollowa Chicken, and Don Chicken.

The emergence of local brands such as Tiệm Gà Rán Số 19, Tiệm Gà Óng Ánh

along with numerous independent local vendors offering competitively priced fried

chicken products also contributed to market diversity and accessibility for

consumers with varying income levels.

b. Demand During COVID-19: Shifts in Behavior and Priorities

The COVID-19 pandemic has brought unprecedented challenges, leading to a

sharp decline in consumer demand for fried chicken products.

Consumers have tightened their spending due to economic pressure from the

pandemic, people tend to prioritize more basic needs, reducing spending on fast food such as fried chicken. GROUP 6 CLASS EBBA 16.2 14

In addition, the demand for in-store dining has also decreased, instead, consumers

increasingly rely on digital platforms and delivery services such as GrabFood,

Baemin, and ShopeeFood to access fried chicken. In result,

an external environmental factor like Covid-19 has

shifted the demand curve to the left.

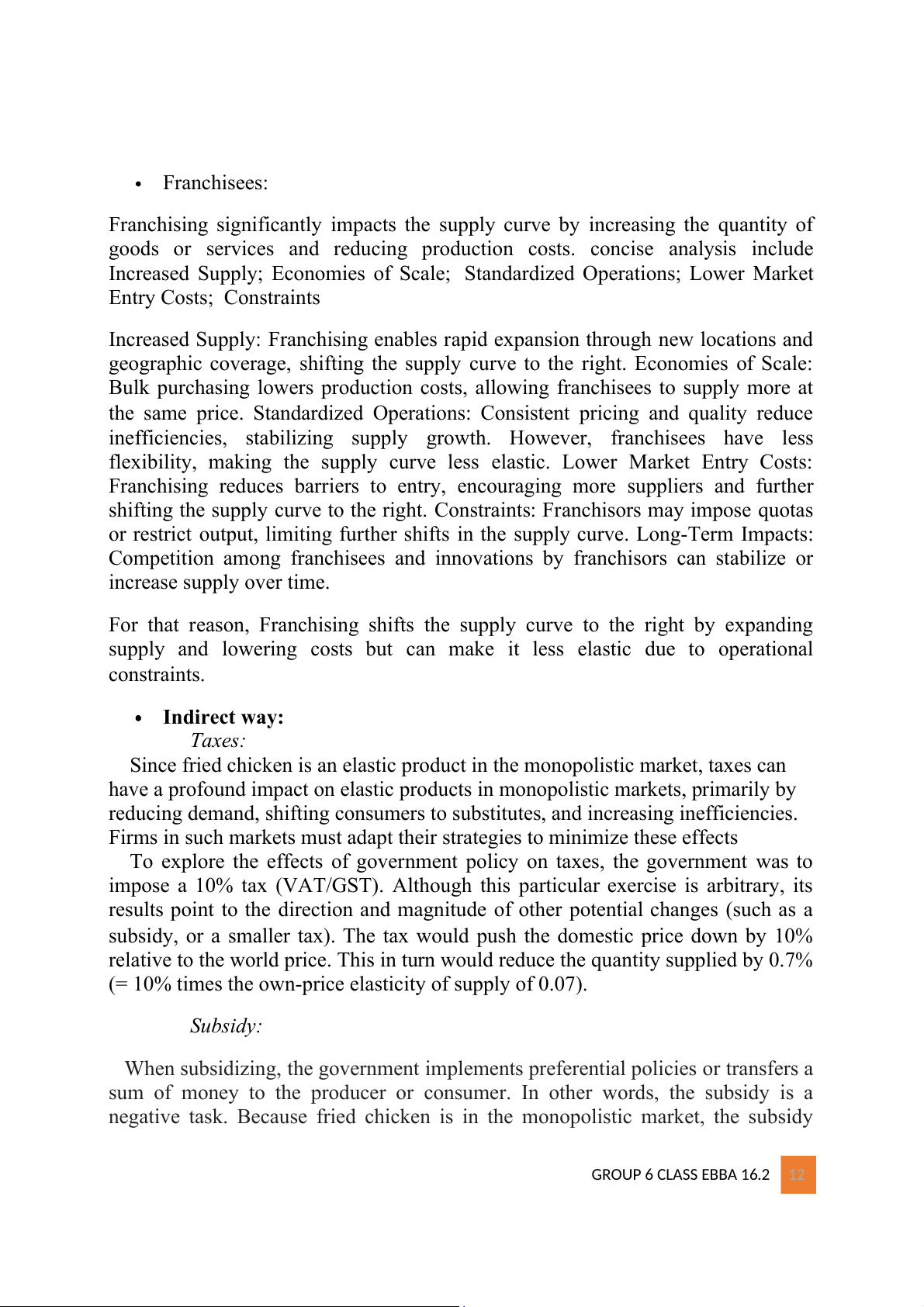

The Vietnam Report Survey (August 2021) highlighted a

sharp decline in consumer demand, revealing significant

challenges for the F&B sector, especially the fried

chicken industry. The pandemic's prolonged effects

became critical by July, with over 91% of businesses

severely impacted. For instance, Jollibee faced a net loss

of $208 million in 2020, compared to a $131.1 million

profit on $3.2 billion revenue in 2019. Similarly, KFC

Vietnam's 2019 revenue grew by nearly 1.3% to VND

1,500 billion, a slower pace than the 7.5% and 18.3% growth in the prior two years.

c. Demand After COVID-19: Recovery

The recovery of the fried chicken industry in Vietnam is closely linked to the

restoration of customer demand after the pandemic. There are several factors have

contributed to the increased demand for fried chicken and fast food.

As restrictions eased and the pandemic was brought under control, consumers

began returning to normal life, including dining out. The reopening of restaurants

and lifting of travel bans significantly boosted demand for fast food, particularly

for convenient, comfort foods like fried chicken. This trend was reflected in the

growth of major brands like Jollibee and KFC, as well as smaller, local fried

chicken shops. In 2022, Jollibee recorded an impressive revenue of nearly VND

1,900 billion, nearly double that of the previous year, according to zee news.vn.

After the pandemic, many customers were more price-conscious but still sought

convenience. Fried chicken shops responded with affordable combo meals, family

deals, and promotions, which attracted both budget-conscious and convenience- GROUP 6 CLASS EBBA 16.2 15

seeking customers. This trend helped fuel the revival of customer demand for fried

chicken, as consumers looked for quick and affordable meal options.

KFC Vietnam embraced innovation by becoming the first quick-service restaurant

to host TikTok livestream sales on June 13, allowing users to order food, interact,

and enjoy 1-hour delivery for a 10,000 VND fee. To cater to healthier eating

trends, brands like Jollibee and KFC introduced local, health-conscious options

such as the Chicken Rice Bowl and Seaweed Soup. Smaller local shops also

thrived thanks to loyal neighborhood customers, aiding the recovery of fried chicken demand in Vietnam.

After the pandemic, Demand Curve shifted to the right. ROLE OF GOVERNMENT

Government policies, such as tax regulations, subsidies, and price control

measures, have significantly influenced the supply of fried chicken in Vietnam,

playing a pivotal role in shaping the market. Taxation, for instance, affects

production costs and pricing strategies, as producers must balance their desire to

maintain profitability with the need to remain competitive. In cases where taxes are

levied on products like fried chicken, producers may transfer a portion of the tax

burden to consumers by increasing prices. However, given that fried chicken is

considered an elastic product in the fast-food market, excessive price hikes risk

reducing demand, pushing consumers toward more affordable substitutes.

Subsidies, on the other hand, have the potential to alleviate some of the cost

pressures on producers. By offering financial support to poultry farming or the GROUP 6 CLASS EBBA 16.2 16

broader food processing industry, the government can indirectly support fried

chicken producers, enabling them to maintain or increase supply levels without significant price increases.

Additionally, advancements in technology have had a transformative effect on the

production and supply of fried chicken. Innovations in food processing, logistics,

and supply chain management have allowed producers to increase efficiency,

reduce costs, and ensure consistent quality. Automation in cooking processes,

enhanced storage facilities, and optimized distribution networks have enabled

businesses to meet growing demand while maintaining product standards. For

instance, the use of digital platforms for inventory tracking and order management

has streamlined operations, reducing wastage and ensuring timely delivery to consumers.

The ability of businesses to adapt to evolving consumer behaviors has been another

critical factor in the market's recovery and growth. In response to changing

preferences, major brands have diversified their menus to include more locally

inspired dishes, healthier options, and innovative meal combinations. They have

also embraced digital sales channels, including mobile apps and social media

platforms, to reach tech-savvy consumers. For instance, KFC Vietnam’s innovative

approach of using TikTok livestreams for sales not only enhances customer

engagement but also sets a precedent for other brands to follow.

In combination, government policies, technological advancements, and strategic

business adaptations have enabled the fried chicken market in Vietnam to recover

from past disruptions and thrive in a highly competitive landscape. By addressing

both supply-side and demand-side challenges, the industry has demonstrated

resilience and the ability to capitalize on emerging opportunities, positioning itself

for sustained growth in the future. GROUP 6 CLASS EBBA 16.2 17 CONCLUSION

The story of the fried chicken market in Vietnam illustrates the intricate interplay

between theoretical economic concepts and real-world dynamics. Initially marked

by steady growth due to urbanization, increased disposable incomes, and the

popularity of fast-food culture, the market encountered significant disruptions

during the COVID-19 pandemic. Consumer demand declined sharply as economic

uncertainty, lockdowns, and shifting priorities led to reduced spending on non-

essential goods like fast food. Businesses were forced to pivot, relying heavily on

delivery services and online platforms to sustain operations.

Despite these challenges, the market demonstrated remarkable resilience and

adaptability. As Vietnam emerged from the pandemic, demand for fried chicken

rebounded, fueled by innovations such as digital ordering, livestream sales, and

affordable promotional combos that catered to price-conscious consumers. Leading

brands like Jollibee and KFC invested in enhancing customer experiences and

expanding their menus to meet changing preferences, while smaller local vendors

leveraged community loyalty to maintain their foothold.

Looking ahead, the fried chicken industry in Vietnam will likely continue evolving

as businesses adapt to new challenges and opportunities. The market's ability to

embrace innovation, respond to external shocks, and cater to diverse consumer

needs will be pivotal for sustained growth. Ultimately, Vietnam's fried chicken

market exemplifies how economic principles can provide insights into market

dynamics, showcasing the resilience and creativity of businesses in navigating a rapidly changing environment. GROUP 6 CLASS EBBA 16.2 18 References

1. Principles of microeconomics, Karl E Case; Ray C Fair, Sharon M Oster

2.https://www.businessresearchinsights.com/

3. https://analyticsmarketresearch.com/

4.https://vnexpress.net/chuoi-ga-ran-kfc-lotteria-jollibee-kinh-doanh-ra-sao- 4163173.html

5.https://mekongasean.vn/doanh-thu-chuoi-thuc-an-nhanh-jollibee-phuc-hoi-ngang- muc-truoc-dai-dich-7861.html

6.https://www.congluan.vn/khong-rut-khoi-viet-nam-lotteria-va-cac-chuoi-ga-ran-

da-kinh-doanh-the-nao-post128944.html

7.https://kinhtevadubao.vn/nganh-thuc-pham-do-uong-2021-buc-tranh-nhuom- mau-covid-19-19833.html

8.https://znews.vn/mcdonald-s-kfc-burger-king-dang-lam-an-ra-sao-o-viet-nam- post1504007.html

9.https://genk.vn/kfc-viet-nam-mang-ga-len-tiktok-ban-livestream-khach-nhan-

hang-trong-1-gio-phi-ship-chi-10000-dong-mot-ky-nguyen-moi-sap-bat-dau- 20240801161801977.chn

10.https://www.facebook.com/JollibeeVietnam/posts/-c%C6%A1m-g%C3%A0-m

%E1%BA%AFm-t%E1%BB%8Fi-m%C3%B3n-m%E1%BB%9Bi-th%C6%A1m-

ngon-ch%C3%ADnh-th%E1%BB%A9c-ra-m%E1%BA%AFt-ch%E1%BB%89- GROUP 6 CLASS EBBA 16.2 19

35000%C4%91-m%E1%BB%99t-su%E1%BA%A5t-no-n%C3%AA-

%C4%91%E1%BB%91/898091345676922/

11.https://www.facebook.com/photo.php?

fbid=3174344575931100&id=104569802908608&set=a.108634262502162 GROUP 6 CLASS EBBA 16.2 20