Preview text:

NATIONAL ECONOMIC UNIVERSITY BUSINESS SCHOOL FINAL GROUP PROJECT SUBJECT: MICROECONOMICS

Topic: Vietnam coffee market structure and

the impact to supply and demand

Name: Duong Minh Nguyet – 11214484 Le Hong Linh - 11213172 Nguyen Van Quynh - 11219345 Le Thu Huong - 11212516 Phan Thi Linh Chi - 11219331 Class: EBDB-3 Hanoi 2022 Table of Contents

INTRODUCTION........................................................................................................... 2 I.

The reason why the Coffee business is closer to pure competition..........................3

1. Characteristics of a pure competition market........................................................3

a. Demand & Marginal revenue curve......................................................................3

b. Profit maximization in the short run.....................................................................5

c. Production decisions. Break-even point and shutdown point................................5

d. In the long run.......................................................................................................6

2. Vietnam coffee industry market structure.............................................................6

a. Numbers of firms:.................................................................................................6

b. Nature of product:.................................................................................................7

c. Barriers of entry....................................................................................................9

d. Market power:.....................................................................................................11

e. Non-price Competition:......................................................................................12

II – Factors that have affected coffee demand and supply the past few years..............13

1. Factors affecting Viet Nam’s coffee supply.........................................................13

1.1. Price factor...................................................................................................... 13

1.2. Non-price factors.............................................................................................. 14

2. Factors affecting Viet Nam’s coffee demand.......................................................19

2.1. Price factors: Price of the product.......................................................................19

2.2. Non-price factors................................................................................................19

2.3. Other factors.......................................................................................................21

CONCLUSION......................................................................................................... 23

REFERENCES........................................................................................................ 24 1 INTRODUCTION

Microeconomics is the study of individuals, households and firms' behavior in

decision making and the allocation of resources. It generally applies to markets of goods

and services and deals with individual and economic issues. Different from

macroeconomics, microeconomics does a smaller research on the issue of what choices

people make, what factors influence their choices and how their decisions affect the

markets by affecting the price, the supply and demand. For example, if there is a rise in

car prices, the demand for a substitute good will also increase. The reason is explained by

the law of supply and demand, which is a part of the study of microeconomics. It might

sound too theoretical and unnecessary for the real-world. However, by understanding the

use of microeconomics, people can clarify the source of industry’s problems and make suitable decisions in time.

Vietnam has been worldwide famous for its strong and impactful flavour of coffee

for many years. To understand how the mutual interaction between market and consumer

can affect the supply and demand for coffee, this essay will explain the market structure

of coffee production firms and how the Vietnamese coffee industry’s demand and supply

has been in the last few years. 2 I.

The reason why the Coffee business is closer to pure competition

1. Characteristics of a pure competition market.

a. Demand & Marginal revenue curve

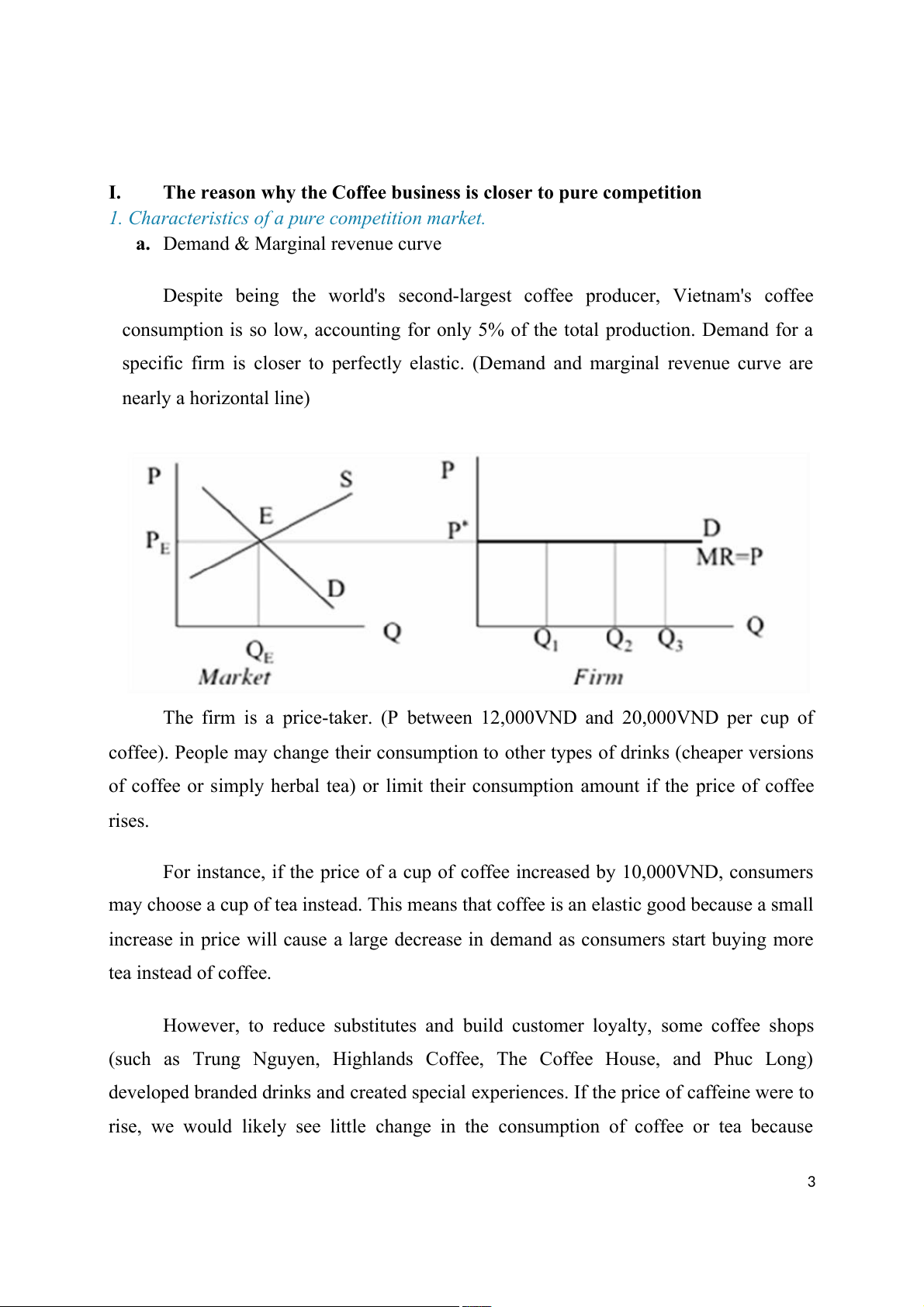

Despite being the world's second-largest coffee producer, Vietnam's coffee

consumption is so low, accounting for only 5% of the total production. Demand for a

specific firm is closer to perfectly elastic. (Demand and marginal revenue curve are nearly a horizontal line)

The firm is a price-taker. (P between 12,000VND and 20,000VND per cup of

coffee). People may change their consumption to other types of drinks (cheaper versions

of coffee or simply herbal tea) or limit their consumption amount if the price of coffee rises.

For instance, if the price of a cup of coffee increased by 10,000VND, consumers

may choose a cup of tea instead. This means that coffee is an elastic good because a small

increase in price will cause a large decrease in demand as consumers start buying more tea instead of coffee.

However, to reduce substitutes and build customer loyalty, some coffee shops

(such as Trung Nguyen, Highlands Coffee, The Coffee House, and Phuc Long)

developed branded drinks and created special experiences. If the price of caffeine were to

rise, we would likely see little change in the consumption of coffee or tea because 3

customers would not willingly give up their morning cup of caffeine regardless of the

price. Coffee is an inelastic product in this case.

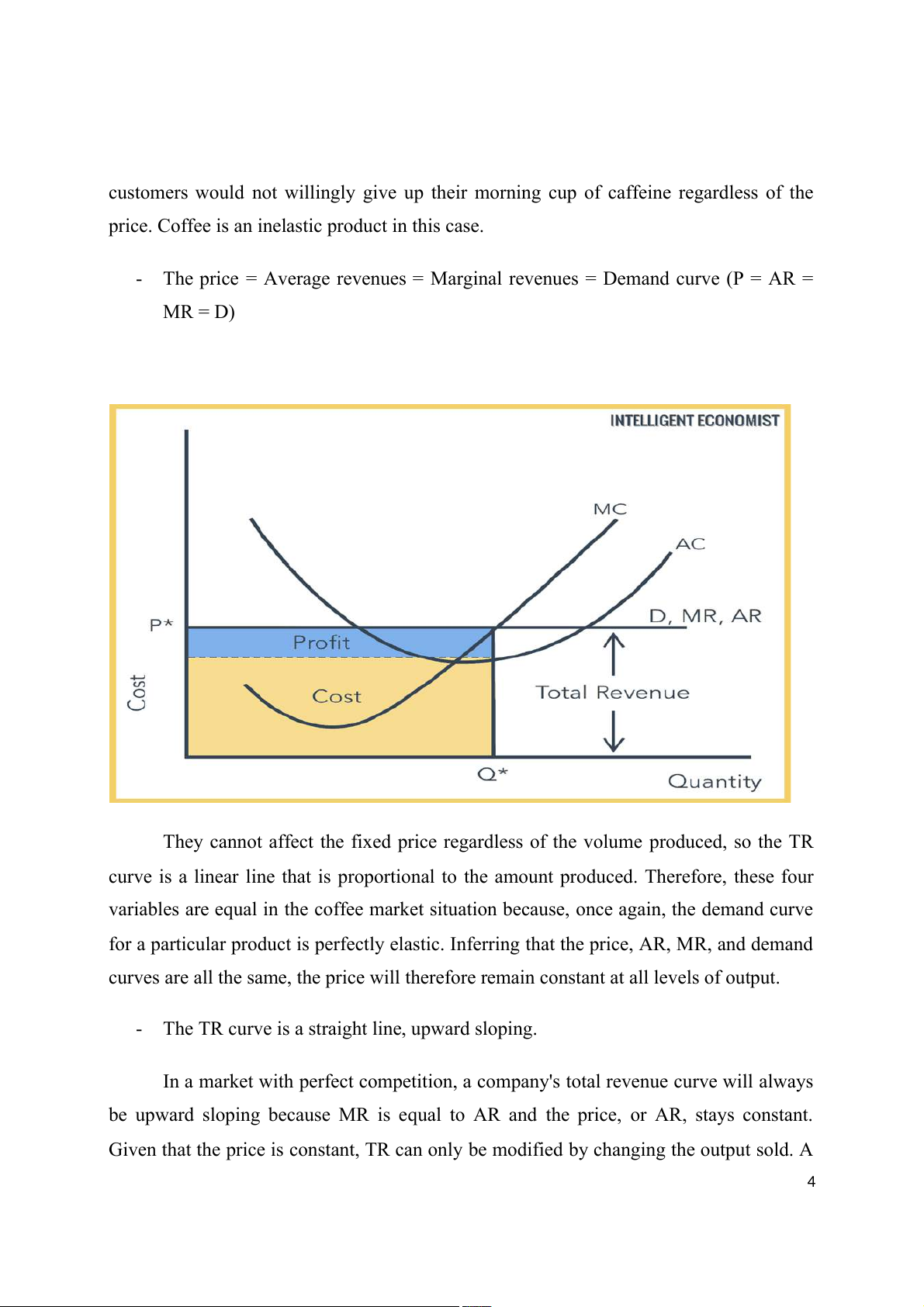

- The price = Average revenues = Marginal revenues = Demand curve (P = AR = MR = D)

They cannot affect the fixed price regardless of the volume produced, so the TR

curve is a linear line that is proportional to the amount produced. Therefore, these four

variables are equal in the coffee market situation because, once again, the demand curve

for a particular product is perfectly elastic. Inferring that the price, AR, MR, and demand

curves are all the same, the price will therefore remain constant at all levels of output.

- The TR curve is a straight line, upward sloping.

In a market with perfect competition, a company's total revenue curve will always

be upward sloping because MR is equal to AR and the price, or AR, stays constant.

Given that the price is constant, TR can only be modified by changing the output sold. A 4

similar proportion exists between the rise in TR and the rise in output sold. The curve

crosses the origin, which suggests that if the output sold is zero TR will also be zero regardless of price level.

b. Profit maximization in the short run

P =MC = MR is the maximum profit point.

Like the points above, we know that in perfect competition- the coffee market, in

this case, P is the same as MR because it is a kind of market that can only take the price

from the supply and demand curve. Therefore, in this type of market, rice providers will

produce at the point when P = MR = MC.

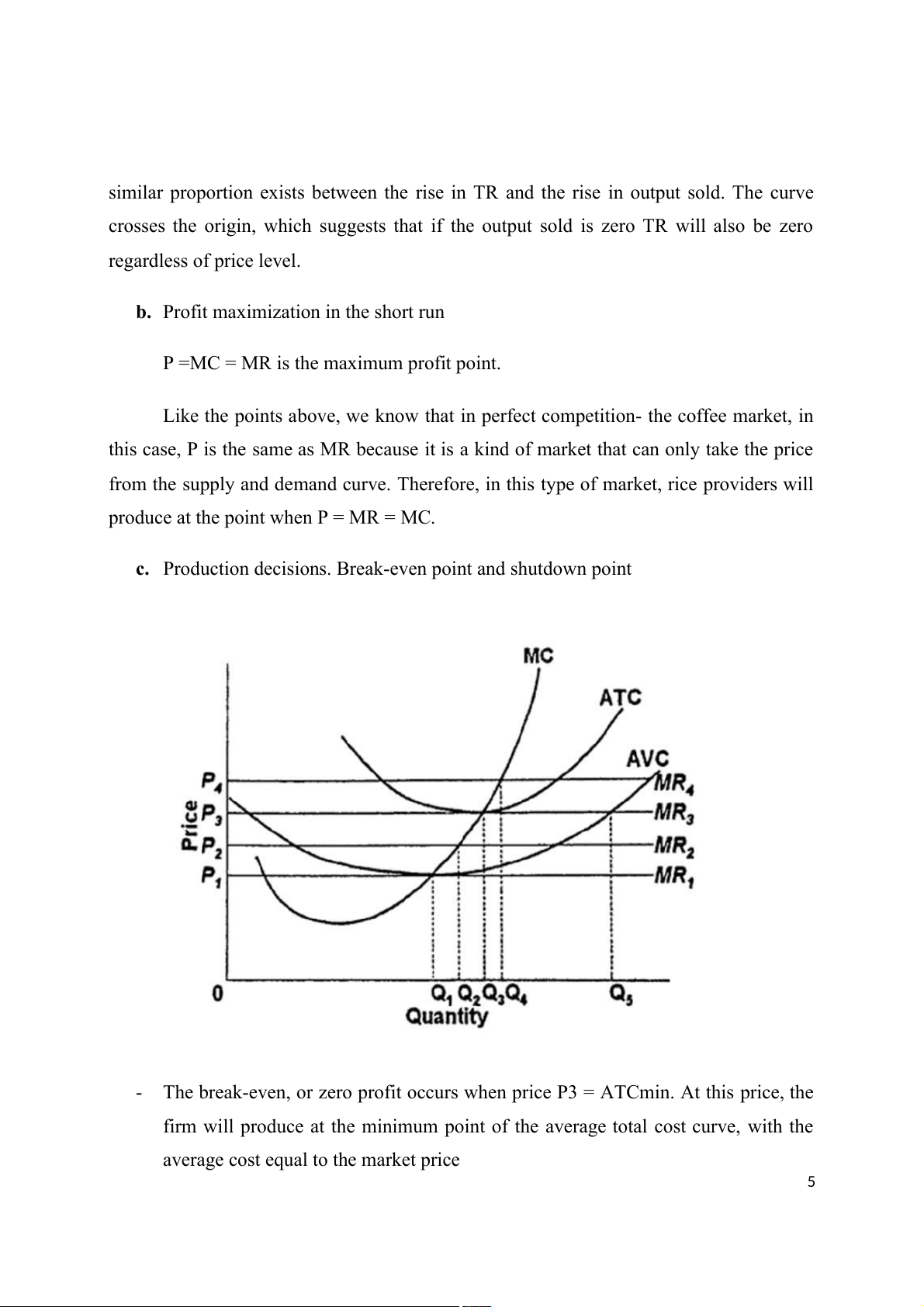

c. Production decisions. Break-even point and shutdown point

- The break-even, or zero profit occurs when price P3 = ATCmin. At this price, the

firm will produce at the minimum point of the average total cost curve, with the

average cost equal to the market price 5

- At a higher price, the firm will make a positive economic profit. (When P4 > ATCmin)

- At a price between the shut-down price and the break-even price (AVCmin < P2 <

ATCmin), the firm will lose money but will continue to operate at a loss because

total revenue will exceed the variable cost of growing coffee.

- The firm’s shut-down price is at P1 = AVCmin d. In the long run

- In long-run competition: the total cost of coffee is equal to the total revenue of

coffee, so the maximum profit equals 0. Coffee production has all allocative

efficiency and productive efficiency

- In a perfect competition market, there is no death weight loss, so the net social benefit of coffee is maximum.

2. Vietnam coffee industry market structure a. Numbers of firms:

Coffee has become a morning habit of not only Vietnamese consumers but also

many international consumers, whether male or female. Coffee customers are often very

loyal, 65% of Vietnamese coffee users drink coffee 7 times a week, in favor of men

(59%). 21% of consumers use instant coffee 3 to 4 times a week, leaning towards female

consumers (52%). With favorable climate and soil conditions for growing and developing

coffee trees, there are many famous coffee brands in Viet Nam such as Trung Nguyen

Coffee, Highlands Coffee, Nescafe, Classic Coffee, Vinacafe, Cong coffee, and Phuc

Long coffee…. All join hands to bring Vietnamese coffee brands to the world.

The whole country has 97 bean coffee processing establishments, 160 roasting

coffee processing establishments, 8 instant coffee processing facilities, and 11 blended

coffee processing establishments.

Nescafe of Nestle, G7 of Trung Nguyen, Vinacafe and Wake up of Vinacafé Bien

Hoa, Cafe Pho of Food Empire Singapore are the top 5 instant coffee brands with the 6

highest level of awareness. Nestle leads this list with 35% of the total consumption,

followed by Vinacafe, Trung Nguyen and Food Empire at 20.3%, 18.7% and 3.6%

respectively. The remaining 21% belongs to other brands and small local coffee shops.

This shows that the coffee market has been shaped very well, there are hardly any opportunities for new players.

Since 2013, the Vietnamese coffee market has really heated up when Starbucks

began to increase its presence and followed by the Korean coffee chain Coffee Bene, the

American brand PJ's Coffee and the domestic chain such as PJ's Coffee. The Coffee

House, Trung Nguyen, Highlands, Phuc Long, Passio…

Up to now, the Highlands system owns the largest number of shops with nearly

150 stores in many provinces and cities. Starbucks has about 30 stores, Trung Nguyen

has more than 60 stores and The Coffee House has 80 stores, .... No chain has expressed

its intention to stop at a certain number but continue to plan to invest to expand and develop. b. Nature of product:

The coffee market is usually divided into two major segments: roasted and ground

coffee and instant coffee. Roasted coffee accounted for 1/3 of the market, the rest was

instant coffee. In the instant coffee segment, it is also divided into two sub-segments is

pure instant coffee and mixed instant coffee: - Roasted coffee:

Roasted coffee is a general term for only high quality coffee, ground on the spot –

at the point of sale to distinguish it from poor quality coffee with impurities.

The roasting process is the process of creating the characteristic flavor of coffee by

causing the green coffee beans to change flavor. Unroasted coffee beans contain higher if

not higher levels of acids, proteins, sugars and caffeine than roasted beans, but do not 7

have the flavor of roasted coffee beans due to other chemical reactions that take place during roasting.

Coffee is selected from the best coffee beans, through the roasting and grinding

process, to produce coffee products without impurities such as beans, corn, starch or

other additives and flavors. During the roasting process, butter and alcohol can be added

and aged under certain temperature conditions. - Instant coffee:

Instant coffee is a beverage derived from coffee in the form of coffee powder and

has been pre-seasoned to taste and processed by dry roasting method. Instant coffee can

be used immediately by making it with boiling water and stirring well. This type of

coffee is very convenient to use, can be stored for a long time and is easy to use.

Instant coffee appeared on the market in the 1950s and has grown rapidly to

become one of the most popular types of coffee. Globally, instant coffee always

generates a stable revenue of over 20 billion USD, which is equivalent to the revenue of

coffee shop chains. Currently, the instant coffee market share for more than half a century is dominated by Nescafe.

According to a survey, VinaCafe is still the leading brand in the instant coffee

market, accounting for about 45% of the market share, followed by NesCafe with 38%

and G7 with about 10%... the rest are brands. other. The three leading instant coffee

brands in Vietnam today are Vinacafé of Bien Hoa Coffee Joint Stock Company, Nescafé

of the world's No. 1 food group Nestlé and G7 of Trung Nguyen Co., Ltd. Retailer of AC

Nielsen in 2011, Trung Nguyen's G7 instant coffee led the Vietnamese instant coffee

market with 38% market share, followed by VinaCafe of Bien Hoa Coffee Joint Stock

Company with 31% and Nescafe of the Joint Stock Company of the world's No. 1 food

group Nestlé about 27%...the rest are other brands.

- Is instant coffee or ground coffee better? 8

In general, the debate about whether ground coffee is better than instant coffee

depends on personal preference. In terms of health levels, instant coffee is likely to be

considered healthier due to its lower caffeine levels.

Instant coffee, on the other hand, is simpler to prepare. Just add hot water, we are

basically ready to use. It can be finished in minutes and if you are a busy person instant

coffee is a perfect choice. However, you can't do that with ground coffee, it takes at least

3-5 minutes to finish, not to mention the washing and cleaning stage.

In terms of taste, the general consensus is that ground coffee offers more flavor

than instant coffee. Ground coffee keeps all the essential oils and other chemicals intact,

providing a fuller, richer and more subtle flavor than most instant coffees. In terms of

cost, instant coffee is cheaper and doesn't need any specialized equipment to make them. c. Barriers of entry

In general, for the Vietnamese coffee industry, the barriers to entry are quite low

and there is freedom to enter the market. It is relatively easy for new businesses to enter

the coffee market as agricultural products are already available in the country and there

are few legal constraints. In addition, businesses can easily exit the market if their coffee

products are not profitable, but there are still high barriers to entry for specialty or "big

man" in the coffee industry get high:

Economics of scale: Potential competitors wishing to enter the industry will face a

number of barriers. The first is the fact that companies like Vinacafe, Netcafe and G7

have built many Asian-class coffee processing factories across the country to meet the

needs of domestic consumption as well as export. Such a factory in terms of construction

costs alone is about 80 million-90 million USD.

Product differentiation: standing in front of many big names in the Vietnamese

coffee market such as Trung Nguyen, G7, and Nescafé is a big challenge for new

businesses. Although Trung Nguyen has recently had many fluctuations, this is still a big 9

problem when it has a variety of designs and is the first name of coffee that Vietnamese

people mention. Besides, Vinacafe with sweet taste is mostly for the elderly in Vietnam.

Nescafe when taken has a charismatic aroma. G7 with rich flavor in every cup of coffee.

This is because their R&D units operate very efficiently throughout the country.

Accompanying those are the statistical units that are always looking for information and

changing the tastes of customers every day so that the company can come up with

development strategies in the future. Therefore, it is difficult for new companies to win

the trust of customers in a short time

Capital requirements: this is a very important issue for beginners. Companies

advertise massively in recent times with huge advertising costs. The second is the

investment cost for research activities from roasting and roasting activities right from the

selection stage to the procurement of modern machinery and equipment into the

production stage to ensure the full flavor of traditional coffee is preserved.

Access to distribution channels: as a latecomer, when the market is covered by

large distributors, the problem of bringing products to customers is more difficult than

ever. Nescafe is a world leader with a worldwide production and sales network. And

companies like Vinacafe, Trung Nguyen have also established distribution systems

covering the whole country. Most large companies have integrated later, causing many

difficulties for companies who want to enter the industry.

In short, there is a huge barrier to entry for businesses that want to build a big

brand because they are dominated by existing businesses. For small businesses, the

barriers are quite low, but in return, the growth rate is quite slow. d. Market power:

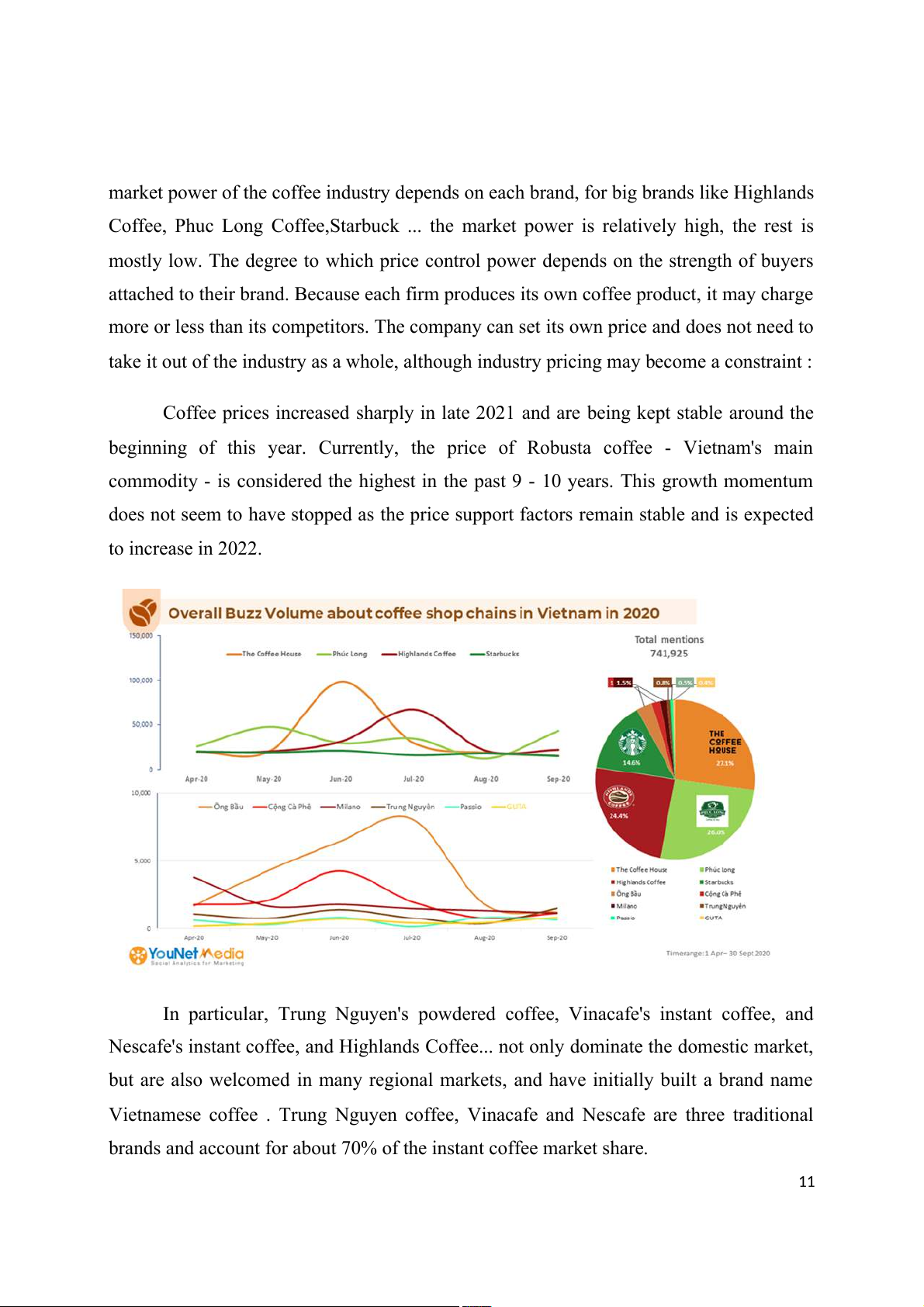

Enterprises in the Vietnamese coffee industry are not the ones who decide or

accept the price. Each brand has its own standout product, so in each coffee there is a

business that affects the price. It's not entirely, but it's a pretty big part. Therefore, the 10

market power of the coffee industry depends on each brand, for big brands like Highlands

Coffee, Phuc Long Coffee,Starbuck ... the market power is relatively high, the rest is

mostly low. The degree to which price control power depends on the strength of buyers

attached to their brand. Because each firm produces its own coffee product, it may charge

more or less than its competitors. The company can set its own price and does not need to

take it out of the industry as a whole, although industry pricing may become a constraint :

Coffee prices increased sharply in late 2021 and are being kept stable around the

beginning of this year. Currently, the price of Robusta coffee - Vietnam's main

commodity - is considered the highest in the past 9 - 10 years. This growth momentum

does not seem to have stopped as the price support factors remain stable and is expected to increase in 2022.

In particular, Trung Nguyen's powdered coffee, Vinacafe's instant coffee, and

Nescafe's instant coffee, and Highlands Coffee... not only dominate the domestic market,

but are also welcomed in many regional markets, and have initially built a brand name

Vietnamese coffee . Trung Nguyen coffee, Vinacafe and Nescafe are three traditional

brands and account for about 70% of the instant coffee market share. 11

e. Non-price Competition:

In the competitive coffee market, prices are negligible, so most businesses

compete on brand, quality and creativity (bold and different ideas). Therefore, businesses

focus on advertising to attract customers, promote sales and product research and development.

Currently, Starbucks, Highlands Coffee and Phuc Long are the 3 most popular

coffee shop chains in the coffee market. In order to increase brand awareness, companies

have had extremely successful advertising strategies to attract customers.

Phuc Long is a Vietnamese brand, so with the home field advantage, Phuc Long is

ready to confront any foreign brand, including Starbucks. Phuc Long has set up stores in

prime locations in big cities such as Hanoi and Ho Chi Minh City. Ho Chi Minh.

Moreover, Phuc Long is not afraid to set up shop next to big competitors such as

Starbucks, Highlands, etc. In the first year, Phuc Long expanded its area to Hanoi with

the first store in the IPH trade center, even though this is not the case. not the best option

but it is also close to many office districts and universities.Currently, Phuc Long has

nearly 100 stores across the country, the stores are concentrated in big cities with

locations that are golden lands and extremely potential. Phuc Long's products are not only

displayed and sold at stores, but also in many supermarkets and commercial centers, convenience stores, etc.

II – Factors that have affected coffee demand and supply the past few years. 1.

Factors affecting Viet Nam’s coffee supply

Coffee was first introduced to Vietnam around 1850 by the French. Despite the

late appearance in Vietnam, after a few decades, during the 90s, Vietnam’s coffee

production increased rapidly, becoming the world’s second largest producer and exporter

of coffee green beans in 1999 (Source: ICO historical data). During recent years, the

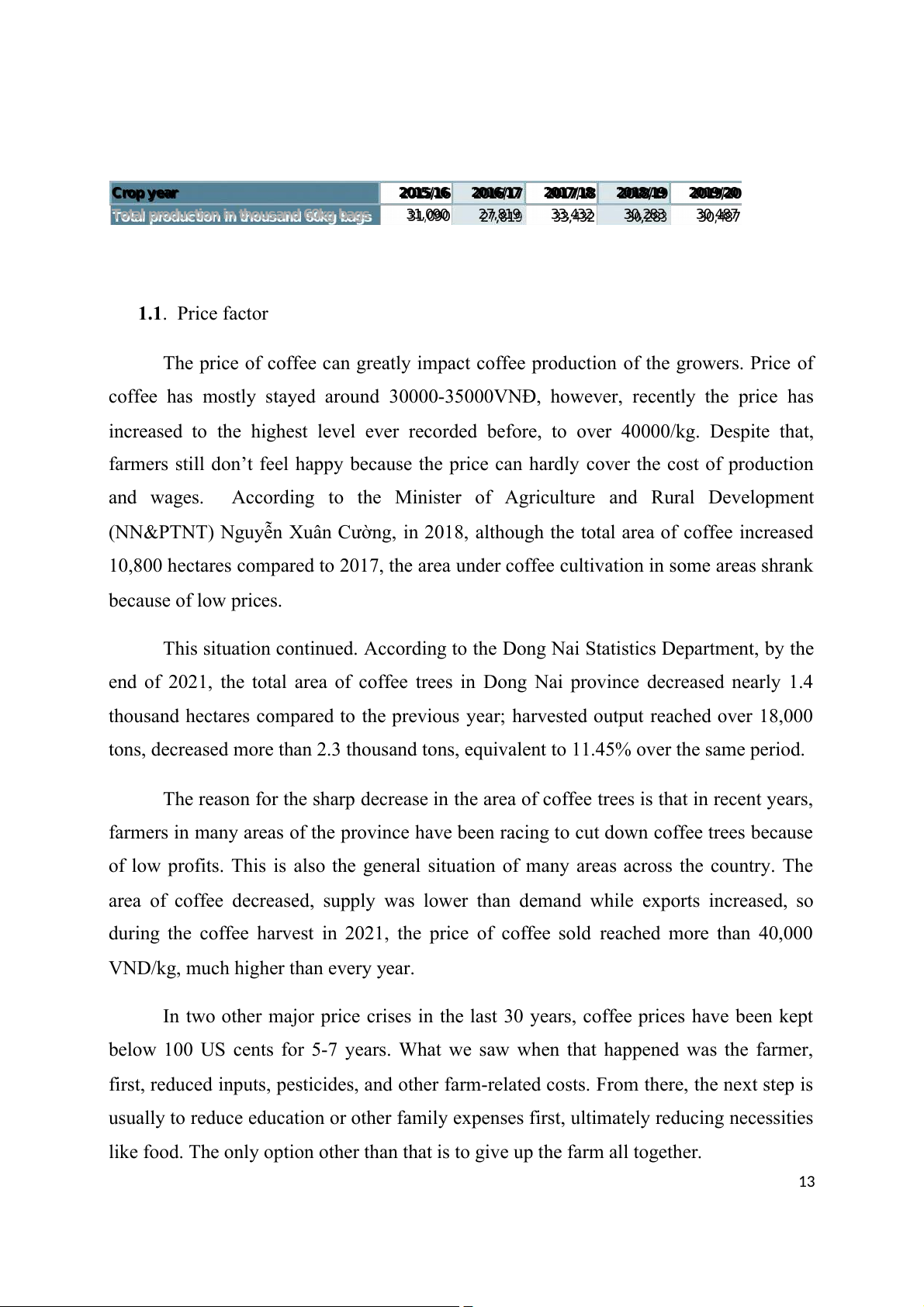

production of coffee in Vietnam has changed constantly, this is resulting from many factors. 12 Crop year 2015/16 2016/17 2017/18 2018/19 2019/20

Total production in thousand 60kg bags 31,090 27,819 33,432 30,283 30,487 . Price factor 1.1

The price of coffee can greatly impact coffee production of the growers. Price of

coffee has mostly stayed around 30000-35000VNĐ, however, recently the price has

increased to the highest level ever recorded before, to over 40000/kg. Despite that,

farmers still don’t feel happy because the price can hardly cover the cost of production

and wages. According to the Minister of Agriculture and Rural Development

(NN&PTNT) Nguyễn Xuân Cường, in 2018, although the total area of coffee increased

10,800 hectares compared to 2017, the area under coffee cultivation in some areas shrank because of low prices.

This situation continued. According to the Dong Nai Statistics Department, by the

end of 2021, the total area of coffee trees in Dong Nai province decreased nearly 1.4

thousand hectares compared to the previous year; harvested output reached over 18,000

tons, decreased more than 2.3 thousand tons, equivalent to 11.45% over the same period.

The reason for the sharp decrease in the area of coffee trees is that in recent years,

farmers in many areas of the province have been racing to cut down coffee trees because

of low profits. This is also the general situation of many areas across the country. The

area of coffee decreased, supply was lower than demand while exports increased, so

during the coffee harvest in 2021, the price of coffee sold reached more than 40,000

VND/kg, much higher than every year.

In two other major price crises in the last 30 years, coffee prices have been kept

below 100 US cents for 5-7 years. What we saw when that happened was the farmer,

first, reduced inputs, pesticides, and other farm-related costs. From there, the next step is

usually to reduce education or other family expenses first, ultimately reducing necessities

like food. The only option other than that is to give up the farm all together. 13 1.2. Non-price factors a. Input prices

According to the 2018 coffee market report by Vietnambiz, at one point, the price

of coffee hit a 50-year low while costs such as gasoline and services, fertilizers, and

pesticides increased. The selling price sometimes falls below the production cost, causing

farmers not to pay attention to fertilization, affecting the yield of the crop. As a result,

some of the replanted areas have switched to growing durian, avocado, passion fruit and

other trees of higher value, leading to a decrease in coffee area. According to the

Department of Crop Production, the area of avocado and durian has increased to 102,000

hectares. In addition, with more than 93,000 hectares of coffee, of which about 80,000

hectares are in business, Gia Lai province has faced a shortage of workers for many

years. In the harvest season, in some places, the harvesting worker’s wages increased by

nearly 20% to 1 million VND per ton.

Experts emphasized that the impact of the Covid-19 pandemic is still affecting the

domestic and foreign coffee market. Logistics crises such as lack of empty containers and

space on ships have limited coffee production in 2021. In the same year, the price of

coffee increased to more than 40,000 VND/kg, the highest level in the past 10 years, but

coffee was still not profitable, farmers become labor on their own land because 1 kg of

coffee has to carry nearly 10 kinds of costs, especially fertilizer and labor costs increased.

The COVID-19 epidemic has turned global and domestic supply chains upside down,

fertilizer prices have increased by 30-50%, plant protection drugs have increased by 10-

20%, and labor costs have increased by 25% on average compared to 2020, putting great

pressure on farmers. According to the Department of Agriculture and Rural Development

(NN&PTNT) of Dak Nong province, normally, the cost of fertilizer accounts for 45-50%

of the cost, the hiring of harvesting workers accounts for 25-30% of the production cost. 14

On the other hand, the war between Russia and Ukraine is breaking the market

circuit in Eastern Europe in general, Russia and some neighboring countries with Ukraine

in particular. For the Russian market alone, in 2021, it imported 75,000 tons of coffee

from Vietnam, however, this year it is uncertain how many tons of coffee Russia will import.

In terms of production, the war has increased the price of inputs such as fertilizer,

gasoline, and labor costs, making it more difficult for coffee growers if they are not

active in the export market. In particular, fertilizer sources such as potassium, SA are

mostly imported from Russia, Ukraine and Belarus, now they have temporarily stopped

exporting and coffee production in the 2022-2023 crop year may decrease if it rains

erratically. With the increase in price of most goods like this, the burden that the farmers

need to bear will be even heavier than ever before. b. Technology

Vietnam is the second largest producer and exporter of coffee. However, the

cultivation of coffee is facing many difficulties, which is the decline in coffee production.

The coffee cultivation of farmers is currently only based on experience and lack of

science such as: unbalanced fertilization, abuse of pesticides leading to imbalance of

nutrients in the soil, hardening and acidification of the soil. The result is yellow leaves,

dry branches, root rot, fruit drop, reduced yield, rapid aging, while the life cycle of coffee

trees is over 30 years. To solve this problem, science and technology have been applied to cultivation.

Thuan An (Dak Mil) is gradually forming a high-tech coffee production area with

a scale of 500 hectares. People here have applied coffee production processes according

to VietGAP, GlobalGAP, 4C, RainForest, UTZ, Fair trade, organic standards. Thanks to

the application of high technology, the average yield of coffee is 10% - 30% higher than

that of ordinary coffee. The high-tech coffee production environment is always hygienic,

bio-safe, and the coffee pods are reused... 15

Mr. Nguyen Hong Phong - General Director of Tien Nong Agriculture Industry

Joint Stock Company introduced the solution of using Tien Nong nutrition

synchronously, applying scientific and technical advances to the fertilizer production

process for farmers. Before using Tien Nong's fertilizer, they had to spray pesticides 3

times a year, now they only need to spray once, rust disease is prevented, fruits develop

evenly, costs are reduced by 1/3 , and productivity increases by 20%”.

Recently, Master Tran Thi Hoang Anh has cooperated with colleagues at the Tay

Nguyen Agro-Forestry Science and Technology Institute to research and implement the

solution: “Application of bioreactor in coffee seed production by culture technology.

tissue". Compared with the bud grafting method, this method increases the multiplication

speed by 1,000-2,000 times, creating better coffee varieties with higher survival rate

while shortening the time of 2-3 months.

According to the Ministry of Agriculture and Rural Development, scientific and

technological solutions are prioritized to improve research capacity, transfer technology

of replanting and grafting to improve coffee for scientific and technological units under

the Ministry of Agriculture and Rural Development. and localities. Specifically, the

industry will research, select and create new coffee varieties suitable for each ecological

region in the direction of productivity, high quality, resistance to pests and diseases,

adaptation to climate change conditions, and good mechanical properties.

Since applying science and technology in cultivating, our coffee production has

increased significantly. It is clear that science and technology should be given special

focus in order to enhance the production level of coffee. c. Government policies

Although Vietnam entered the coffee market late compared to other countries,

after just a short period, Vietnam has become the second largest producer and exporter of

coffee. The reason for these achievements is the government's policies on encouraging

export development and export coffee production. The system of policies on export, 16

trade, credit, agricultural extension, etc. has created momentum and force for Vietnamese

coffee towards sustainable development.

Policy of integration and expansion of export markets. Vietnam is a member of the

International Coffee Organization (ICO) and the Vietnamese government also signed the

International Coffee Agreement (ICA) in 2008, making our country's coffee market a part

of the global coffee chain. Besides, joining the World Trade Organization (WTO) and

other international and regional organizations has also created a large market for our

country's coffee industry. The policy of free circulation and market development in recent

years has brought into play the strength of all economic sectors in coffee production and

trading. The connection between domestic and foreign markets also creates favorable

conditions for the coffee industry to expand the consumption market at home and abroad.

In addition, the government also introduced financial support policies, preferential

policies on land and land rent to create favorable conditions for coffee producers to

participate in large-scale and to enhance production. productivity and quality of exported

coffee products. There are a number of other policies of the government which support,

encourage and regulate coffee exports such as export subsidy policy, input and output

product subsidy policy, exchange rate policy, etc.

So, the government has recognized the importance of the coffee market to the

country, a market which is second only to rice, and has implemented appropriate policies

to promote and support production and coffee exports, creating favorable conditions for

our country's coffee exports to increase in quantity and export turnover, enhancing

product brands name around the world. d. Expectation

Statistics and data have a significant impact on the producer’s decision to continue

to grow coffee. Producers depend on the news and data from some source like

International Coffee Organization (ICO) and United States Department of Agriculture

(USDA)’s reports, newspaper and television to predict the trend of the coffee market. 17

Currently, due to the lack of arabica coffee supply, some roasters are looking for the

option of mixing arabica and robusta coffee to lower the selling price. This in the long

run can help change consumer tastes and become more accustomed to drinking roasted

and ground robusta coffee and will help Vietnam's Robusta coffee exports more smoothly

and production for robusta may increase. e. Weather

Weather will decide whether a year has a good or bad harvest. According to the

United States Department of Agriculture (USDA), Vietnam's total coffee production in

the year 2016/17 is estimated at 26 million bags, slightly down from the previous forecast

of 26.7 million bags, which was because of the unusual rains that caused the production

of Robusta coffee to drop unexpectedly. However, in the next MY 2017/18, coffee

production was forecast at around 28.6 million bags, up 10% from 2016/17 due to

favorable weather conditions in the first half of 2017/18. From January to March 2018,

moderate rainfall helped coffee trees branch more and have earlier flowering.

According to the Vietnam Meteorological and Hydrological Administration's

observations and forecasts, temperatures in Tay Nguyen in the first months of 2022 were

slightly lower than average, which was favorable for coffee flowering and

cherry setting stages. Temperatures will be at the average level in May-September, and

slightly higher in October. Rainfall will be at the average level in May-September, and

slightly lower in October. These weather forecasts may be favorable for MY 2022/23

coffee harvests. Generally, the production of coffee can be predicted by the weather of

that year, whether it is dry or rainy.

2. Factors affecting Viet Nam’s coffee demand

2.1. Price factors: Price of the product

There is an inverse (negative) relationship between the price of a product and the

amount of that product consumers are willing and able to buy. Consumers want to buy 18

more of a product at a low price and less of a product at a high price. This inverse

relationship between price and the amount consumers are willing and able to buy is often

referred to as The Law of Demand. It is said by Vicofa ( Viet Nam’s Coffee and Cocoa

Association) that there has been a continuous decrease in coffee prices from 2016 to the

end of 2020. Along with that, the association also claimed that in recent years, the

amount of coffee consumed by the domestic market has increased to about 10 percent of

the country's total coffee production. 2.2. Non-price factors

a. The income of consumers

The amount of money available to customers to purchase goods is known as their

buyer's income, which is correlated with their socioeconomic level. Coffee is considered

normal goods. Therefore, when the income of a person increases, so does the quantity

demanded. According to Ceicdata, the average household income of Vietnamese people

has risen over the years. In addition, the consumption of coffee in Vietnam's market also

experienced a slight increase during a 7 years period from 2015 to 2021.

b. Price of related goods

Substitute goods: Substitute goods are goods which can be used in place of one

another for satisfaction of a particular want. There are several substitutions for coffee

ranging from hot cocoa, matcha to green tea. Take green tea as an example, green tea is a

common substitute for coffee since it has an affordable price and same uses as coffee. In

Viet Nam’s market, packaged dry tea is sold with the price of 60 or 90 thousand dongs

per 250g. To specify the effect of the price of substitute goods, the decreasing price of

green tea will lead to a reduction in demand for coffee in the local market since people

will turn to buy green tea more.

Complementary goods: A complementary good is a product or service that adds

value to another. In other words, they are two goods that the consumer uses together. On 19