Preview text:

lOMoAR cPSD| 58583460

VIETNAM NATIONAL UNIVERSITY OF HO CHI MINH CITY

INTERNATIONAL UNIVERSITY

SCHOOL OF ECONOMICS, FINANCE, AND ACCOUNTING FINAL REPORT Lecturer: Nguyen Phuong Anh

Course: ECONOMETRICS WITH FINANCIAL APPLICATION (BA174IU)

Class: Thursday Morning (period 1-3) Group 08 Student Name Student ID Contribution Trần Thị Minh Thuỳ BAFNIU19176 100% Hoàng Kỳ Phương BAFNIU19147 100% Nguyễn Vũ Lan Nhi BAFNIU20200 100% Huỳnh Tiến Đăng Khoa BAFNIU20314 100% June 30th, 2024 Ho Chi Minh City TABLE OF CONTENT lOMoAR cPSD| 58583460

Abstract.............................................................................................................................3 I.

INTRODUCTION.................................................................................................3

1. Background.............................................................................................................3

2. Research Objective..................................................................................................3

3. Research Question...................................................................................................3

4. Practical Implication...............................................................................................4 II.

LITERATURE REVIEW.....................................................................................4 III.

METHODOLOGY................................................................................................4

1. Research Design......................................................................................................4

2. Research Process.....................................................................................................5

3. Data.........................................................................................................................5 IV.

RESULTS AND INTERPRETATION.................................................................6 V.

CONCLUSION......................................................................................................7

1. Conclusion..............................................................................................................7

2. Comparision............................................................................................................7

3. Recommedations.....................................................................................................7

4. Limitations..............................................................................................................7

VI. REFERENCES......................................................................................................8 Abstract

Calendar influences and abnormalities in the market cause fluctuations in the stock market.

There has not been a study done on calendar impacts, though. As a result, it is essential to

investigate how calendar impacts affect the stock market. The purpose of this study is to

investigate how the January impact affects the stock market in Vietnam. The study

examines data from the VN index and closing price for nine years ( from 2015 to 2024).

Using STATA, regression analysis yielded the findings. This study sheds light on whether

or not the January impact affects the Vietnam stock market, which deepens our

understanding of investments. Accordingly, investors in the Ho Chi Minh stock exchange

may find value in the research’s suggestions. I. INTRODUCTION 2 lOMoAR cPSD| 58583460 1. Background

The January effect, first identified by Rozeff and Kinney in 1976, refers to exceptionally

high risk-adjusted returns in January as compared to other months.

This demonstrates a steady trend in stock prices, with January's average raw returns

yielding higher profits than the previous eleven months. However, the efficient market

theory (EMT), which is based on the random walk hypothesis, predicts that stock prices

will fluctuate suddenly in the future. In actuality, prices follow a random walk, negating

the January effect's influence on stock market return.

The Vietnamese securities market, which is relatively tiny in size and has a lower market

capitalization than other Southeast Asian markets, has seen several abnormalities and

fluctuations caused by investors' psychological activity, indicating market inefficiency. 2. Research Objective

Determine the presence of the January effect on the Vietnamese stock exchange using data

from 2015 to 2024. The method we used in this model is OLS regression which is the January effect. 3. Research Question

Does the January impact exist in the Vietnamese stock market?

4. Practical Implication

This article gives a thorough grasp of the calendar component in the stock market,

emphasizing the aspects that impact investment decisions and outcomes, even though not

all investors are knowledgeable in this area. II. LITERATURE REVIEW

This study aims to ascertain whether the January effect is present in the Vietnamese stock

market. Rozeff and Kinney first examined the January impact in 1976. Thirty-one of the

34 nations in the dataset examined by Darrat et al. (2013) showed a January influence,

whereas Denmark, Ireland, and Jordan did not. One of the classic studies found that returns

in January were much higher than those in the other eleven months. Subsequent research

revealed it to be significant in thirteen countries, which might be explained by tax planning.

Investors can sell underperforming stocks in December and repurchase them in January to

cut their tax bills. Another hypothesis is that new information about a company's financial lOMoAR cPSD| 58583460

status, which is widely disseminated, encourages investors to purchase stock (Rozeff and Kinney, 1976). III. METHODOLOGY 1. Research Design

Extensive strategies for data collecting, measurement, and analysis are represented by

research design. According to Marczyk, G. R., DeMatteo, D., and Festinger (2010), it is

also a strategy for choosing the sources and kinds of data required to address the research

question and a framework for putting the correlations between research variables for

process analysis into concrete form. The study design is very important to the research

article since it allows researchers to critically examine the issues and open up new avenues

for creative problem-solving and additional research (Eldabi et al, 2002). As a result,

researchers need to choose the approach that will work best for their investigation.

In order to determine the relationship between January's effects and the Vietnam stock

market, this research will employ quantitative methodologies. The quantitative method is

a means of gathering data and using mathematical, statistical, or computer engineering

techniques to these data to determine the correlations in theory and study (Kothari, 2004).

Predictive hypotheses enable quantitative research to be tested (O'Neil, 2005). As a result,

a variety of quantitative techniques can be used by researchers to determine the correlations

between various components. Using statistical analysis tools is one of the most effective methods. 2. Research Process

The research process includes the following steps: Step 1

Begin with an idea/ refine that idea Step 2

State research questions/ statements in 1 sentence Step 3 Specific aim & objectives Step 4 Selected methodology Step 5

Devise data collection methods Step 6 Gathering data Step 7 Analyzing data 4 lOMoAR cPSD| 58583460 Step 8 Draw conclusions Step 9

Complete write-up of the report 3. Data

To test the Empirical January test effect on the Vietnamese stock market, we chose to

collect data from VN-INDEX because VN-INDEX is an index that shows the price

movement trends of all stocks listed and traded on the Ho Chi Minh stock exchange

(HOSE). The index price is the close price and was collected for the period from 2015 to

2024 ( 10 years). Due to testing the January effect, we collect data monthly between

January 1st,2018, and June 1st,2024. Besides, the data of VN-INDEX from the website of

Ho Chi Minh Stock Exchange (http://hsx.vn/) is not possible to get data. Thus, to have the

data to test the model, we use the website: Investing.com - which is a reliable and have the

historical data followed monthly that we need to do the secondary method.

As a result, 1 represents the mean return for January, and 2 represents the difference

between the mean return for January and the mean return for the remaining months of the

year. A statistically significant positive 2 might be indicative of the January effect.

IV. RESULTS AND INTERPRETATION

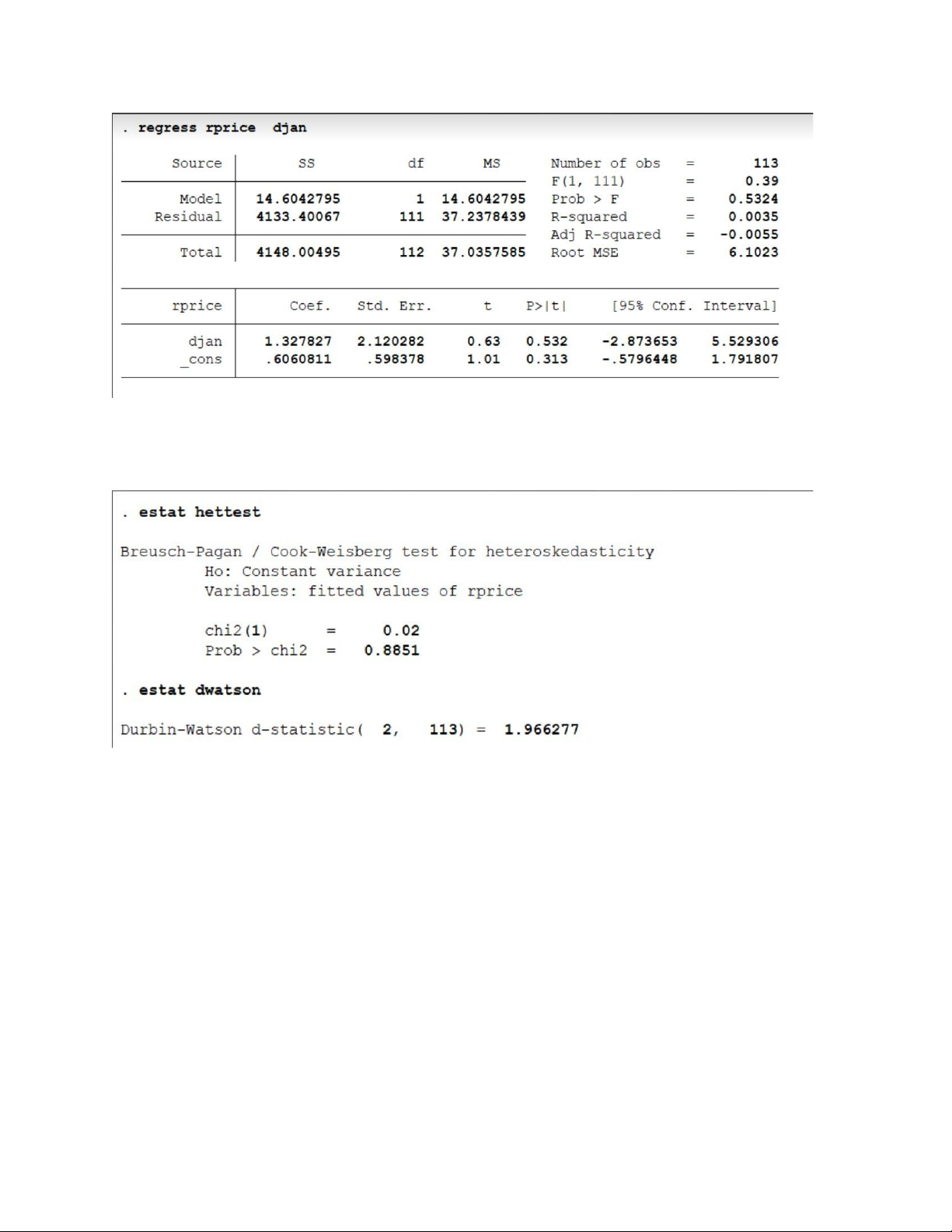

The regression model has one dependent variable (return of VN) and one independent

variable (dummy variable). The number of observations (T)=113

The results of the test show that the P-Value of Jandum = 0.532 > 0.05, which means that

the null hypothesis that these coefficients are zero cannot be rejected at a 95% confidence

level, so they are insignificant lOMoAR cPSD| 58583460

The heteroskedasticity does not happen because the Breausch-Pagen test results that the

P-value = 0.8851 > 0.05. Moreover, the value of the Durbin-Watson d-statistic = 1.9662, approximately equal to 2.

In summary, the regression model shows no significant relationship between the dummy

variable and the return of VN. The model's explanatory power is very low, and there are no

issues with heteroskedasticity or autocorrelation detected. V. CONCLUSION 1. Conclusion

This research studies the link between a range of January effects on stock market returns

over the last five years, from 2015 to 2024. According to the survey, the evidence discussed

did not support the hypothesis that January impacts the Vietnam stock market. There is no

statistically significant relationship between the January effects and market returns. 6 lOMoAR cPSD| 58583460 2. Comparision

Our investigation aligns with the findings of the original paper. We could not establish a

statistically significant correlation between January and stock prices. This outcome

suggests that we lack robust evidence to support the existence of the January effect on the

stock price. In other words, our data doesn't show that January performs consistently

differently from different months. 3. Recommedations

The strategy based on the January effect to investing in the market portfolio is inefficient

because it does not have a sign to forecast where the market return is high or low compared

with the remaining months. Investors seeking an unbiased viewpoint when making

investments should base their decisions on a purchase or sell strategy. 4. Limitations

When doing this research, there are a few unavoidable limitations encountered.

• The purpose of the large sample size was to identify significant correlations from

data that was generated later. The outcomes are tentative and drawn from a relatively

small sample. However, these results contribute to forecasting the relationship

between January's effects and the Vietnam stock market.

• The other limitation of this study is that the survey time is too limited. Additionally,

the researchers are given a set amount of time to work on their research topic and a deadline for finishing it.

• In fact that, the paper takes more weeks to complete and collect data, making it hard

to locate and select the most appropriate data VI. REFERENCES •

VNindex chỉ Số (VNI) - investing.com. Investing.com Việt Nam. (n.d.). Retrieved

June 22, 2022, from https://vn.investing.com/indices/vn •

Le, L. P., & Do, T. D. (2016, 1 10). An Empirical Test of Calendar Effects in the

Vietnam Stock Market. An Empirical Test of Calendar Effects in Vietnam Stock Market, 31-34. •

Caporale, G. M., & Zakirova, V. (2017). Calendar anomalies in the Russian stock market. lOMoAR cPSD| 58583460 •

Russian Journal of Economics, 3(1), 101-108. •

Thaler, R. (1987). Anomalies: The January effect. Journal of Economic Perspectives, 1(1), 197-201. 8