Preview text:

lOMoAR cPSD| 58583460

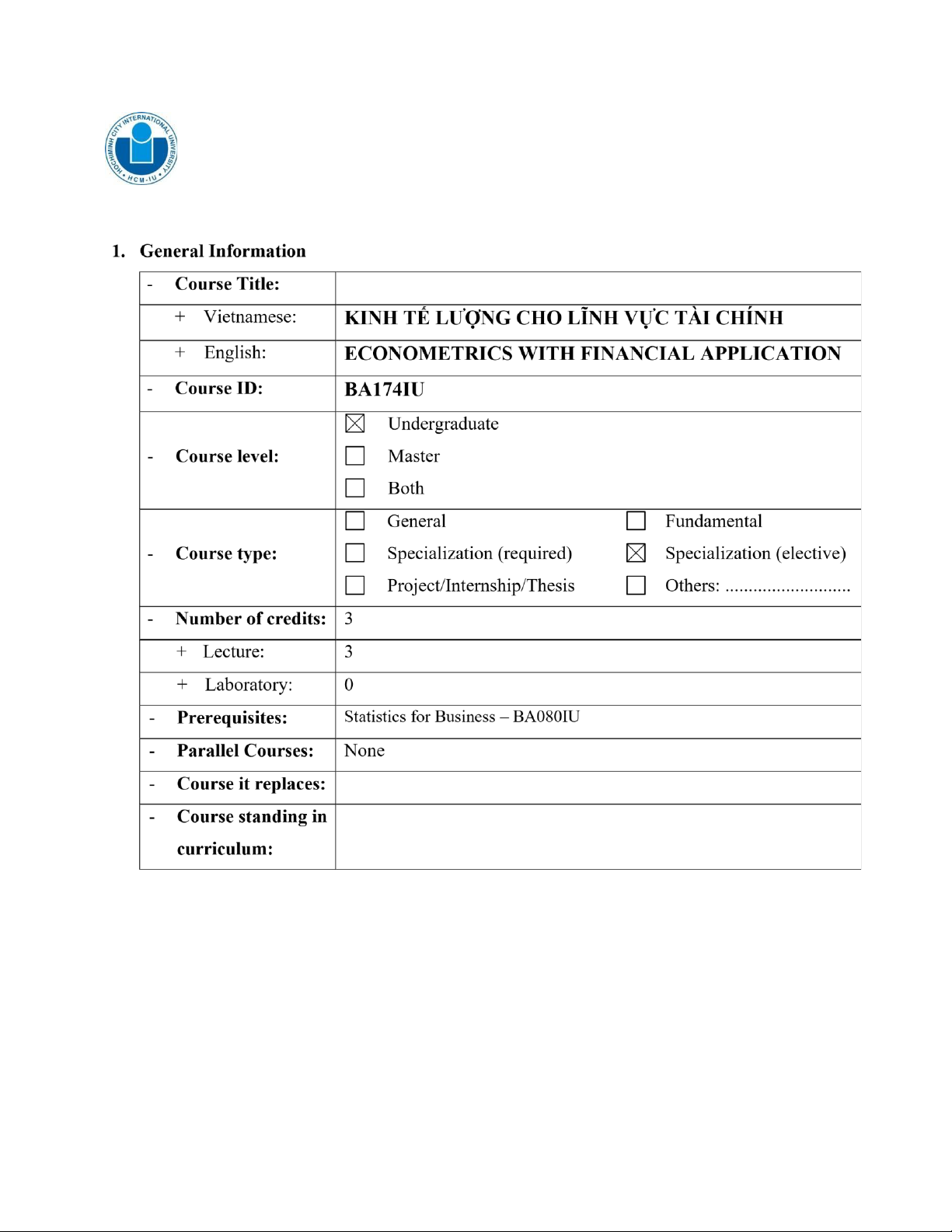

International University School of Economics, Finance and Accounting COURSE SYLLABUS 2. Course Description

The course will provide students with an understanding of the data analysis techniques and

financial applications in the real world. The course will focus on investigating relationships in

finance, modelling and forecasting time series, volatility and correlation among financial

assets such as bonds, stocks and derivatives. lOMoAR cPSD| 58583460

The course will also enable students to answer practical questions, such as the determinants of

stock return, firm performance, impact of risk factors, relationship among financial and

macroeconomic variables, forecasting financial variables… and provide useful information to

managers, investors and policy makers.

3. Textbooks and Other Required Materials Textbooks:

[1] Introductory Econometrics for Finance, Chris Brooks, 4th Edition, Cambridge University Press, 2019. Reference materials:

CFA Program Curriculum, Level I, Volume 1, CFA Institute, 2018.

CFA Program Curriculum, Level II, Volume 1, CFA Institute, 2018.

Basic Econometrics, Damodar N. Gujarati, Mc-Graw Hill.

The Econometrics of Financial Markets by John Y. Campbell, Andrew W. Lo, A. Craig MacKinlay. Recommended Journals

Journal of Applied Econometrics, Wiley SSRN 4. Course Objectives

The course will focus on investigating relationships in finance, modelling and forecasting time

series, volatility and correlation among financial assets. The course will also enable students

to be more familiar with the applied time series modelling and forecasting of financial variables.

5. Course Learning Outcomes

After successful completion of this course, students should be able to:

L01. Effectively use a software package (STATA) for modelling and forecasting financial data

L02. Understand classical linear regression models

L03. Model and forecast time series, long-term relationship in finance, volatility using econometric software lOMoAR cPSD| 58583460

L04. Do a project or dissertation, or conduct empirical research in banking and finance

L05. Understand and recognize the global and local context of business

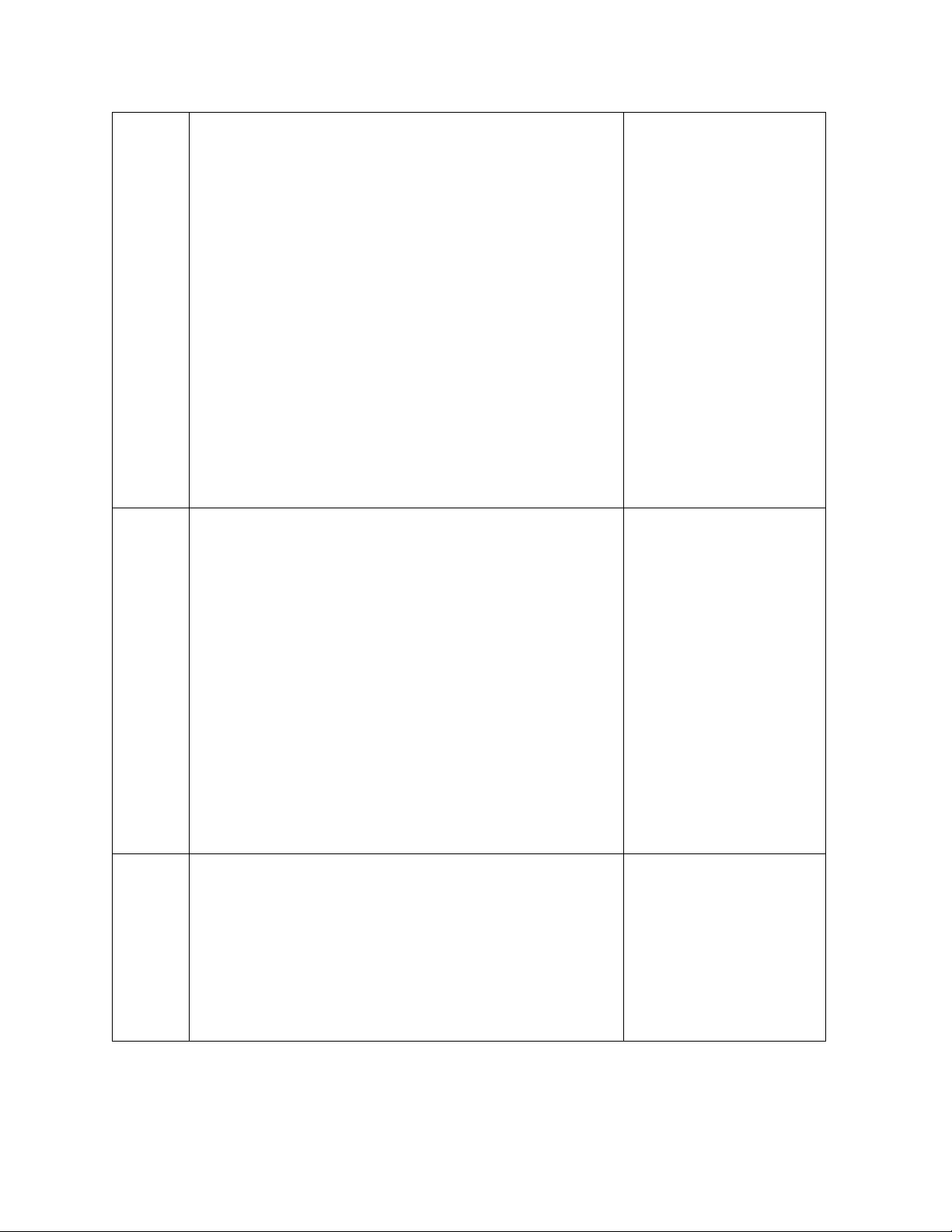

L06. Know how to work within a team lOMoAR cPSD| 58583460 6. Course Assessment Assessment component Assessment form Percentage %

A1. Process assessment Attendance, Quiz, Assignment 15%

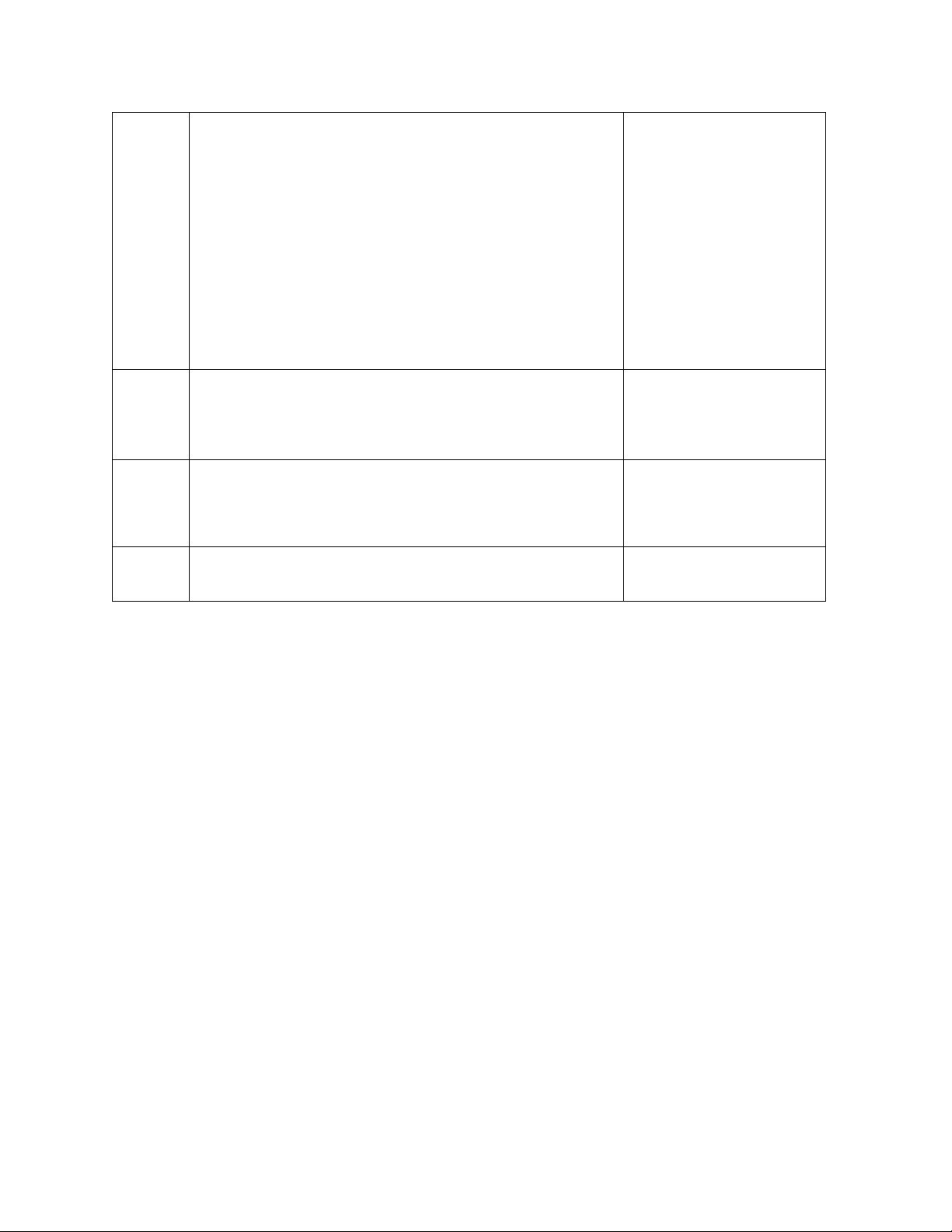

A2. Midterm assessment A2.1 Mid-term Exam 30% A3. Final assessment A3.1 Project 15% A3.2 Final exam 40% 7. Course Outline Week/ Teaching and Class Content learning activities 1

Basic Statistical Concepts Descriptive statistics

Probability and Random Variables Probability Density Function Probability Distributions

Some important probability distributions: [1] Chapter 1 & 2 - Normal Distribution - Chi-square Distribution - Student’s t Distribution - F Distribution

Statistical Inference: Estimation

Statistical Inference: Hypothesis Testing lOMoAR cPSD| 58583460 2-3

Introduction to Econometrics Basic concepts Types of data Simple Return and Log Return

Process to formulate an econometric model

Classical linear regression model Basic concepts

Comparing regression and correlation [1] Chapter 1 & 3 Simple regression Assumptions Properties of OLS estimator Precision and standard errors Statistical inference Lab session

4-5-6-7 Multiple Linear Regression Introduction

Testing multiple hypotheses: the F-test Goodness of fit statistics

Classical linear regression model assumptions and [1] Chapter 4 & 5

diagnostic tests Multicollinearity Heteroskedasticity Autocorrelation Robust regression Lab session Review 8-9

Regression model with Panel data [1] Chapter 11 Pooled Regression Fixed Effect Model Random Effect Model Hausman test and others Lab session lOMoAR cPSD| 58583460

10-1112 Time series: modelling and forecasting Basic concepts MA processes [1] Chapters 6 AR processes ACF and PACF ARMA processes Constructing ARMA models Forecasting Lab session 13

Stationarity and unit root testing Volatility [1] Chapter 8 part 1 modelling and forecasting [1] Chapter 9 part 1 with ARCH-GARCH 14

How to conduct empirical research in finance [1] Chapter 15 Review 15 Project presentation