Preview text:

The Market for Gasoline with a Price Ceiling

As we discussed in Chapter 5, in 1973 the Organization of

Petroleum Exporting Countries (OPEC) reduced production of

crude oil, thereby increasing its price in world oil markets.

Production of crude oil was reduced. Price of crude oil increased.

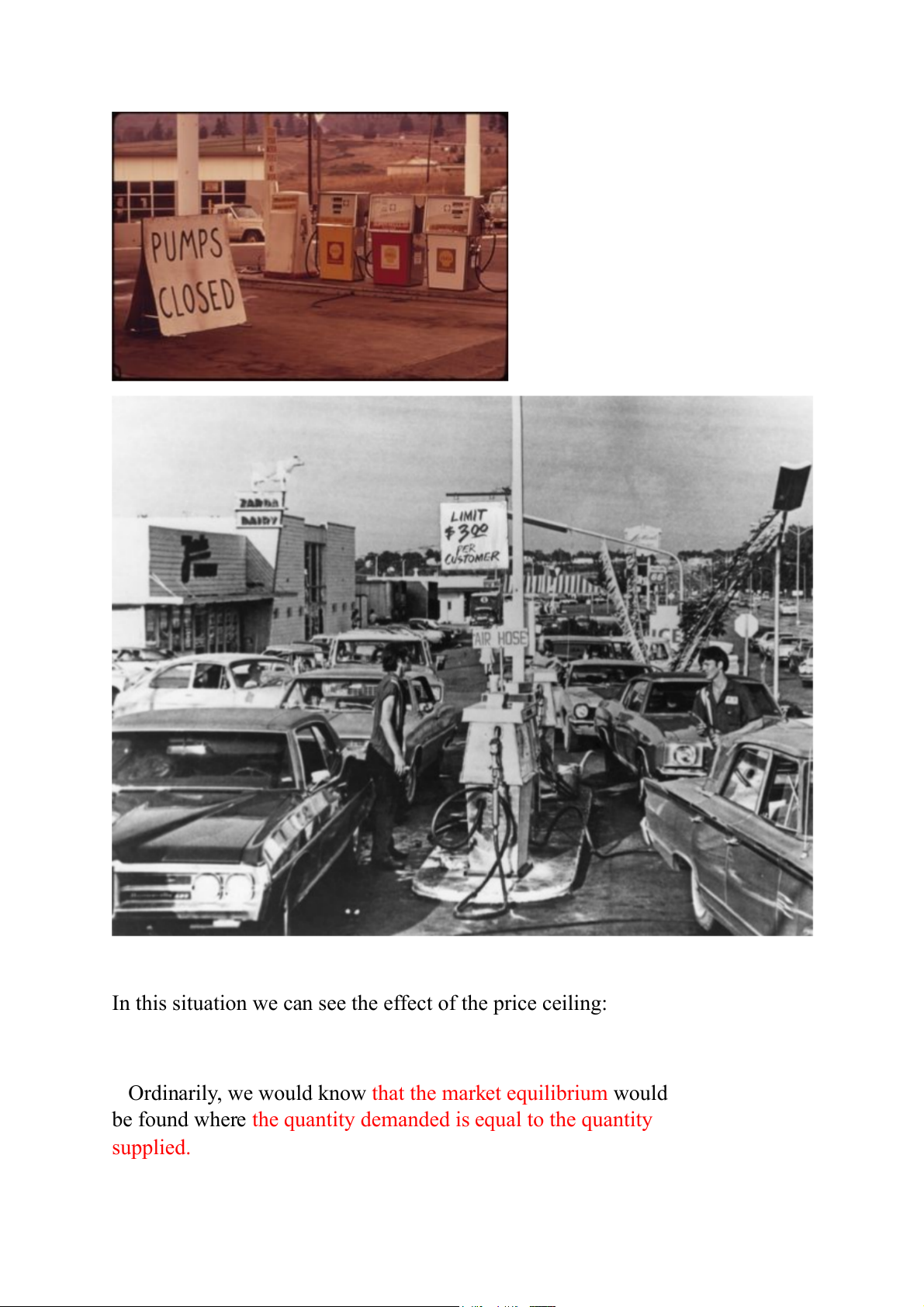

Because crude oil is the major input used to make gasoline, the

higher oil prices reduced the supply of gasoline. Long lines at

gas stations became commonplace, and motorists often had to

wait for hours to buy only a few gallons of gas.

In this situation we can see the effect of the price ceiling:

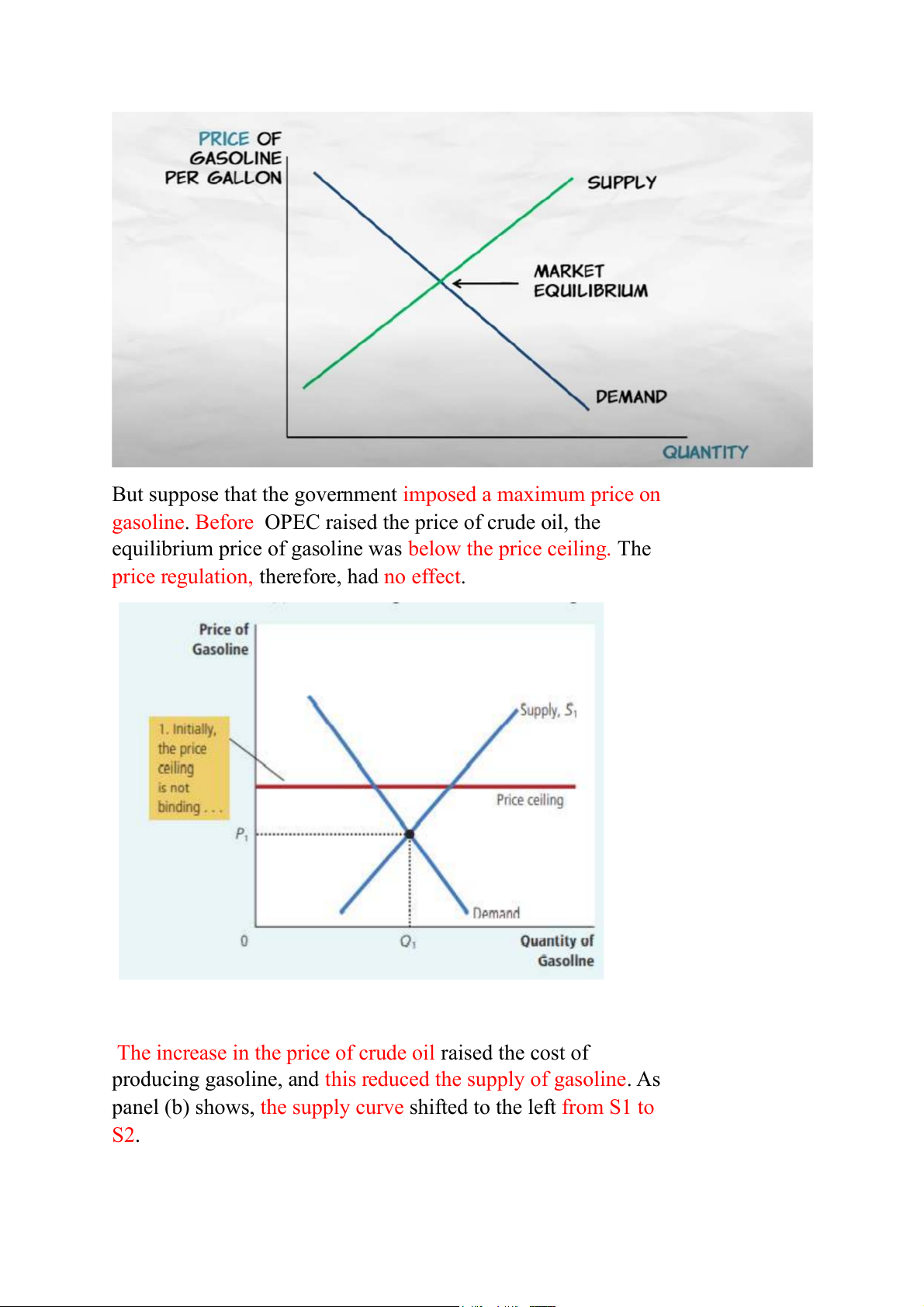

Ordinarily, we would know that the market equilibrium would

be found where the quantity demanded is equal to the quantity supplied.

But suppose that the government imposed a maximum price on

gasoline. Before OPEC raised the price of crude oil, the

equilibrium price of gasoline was below the price ceiling. The

price regulation, therefore, had no effect.

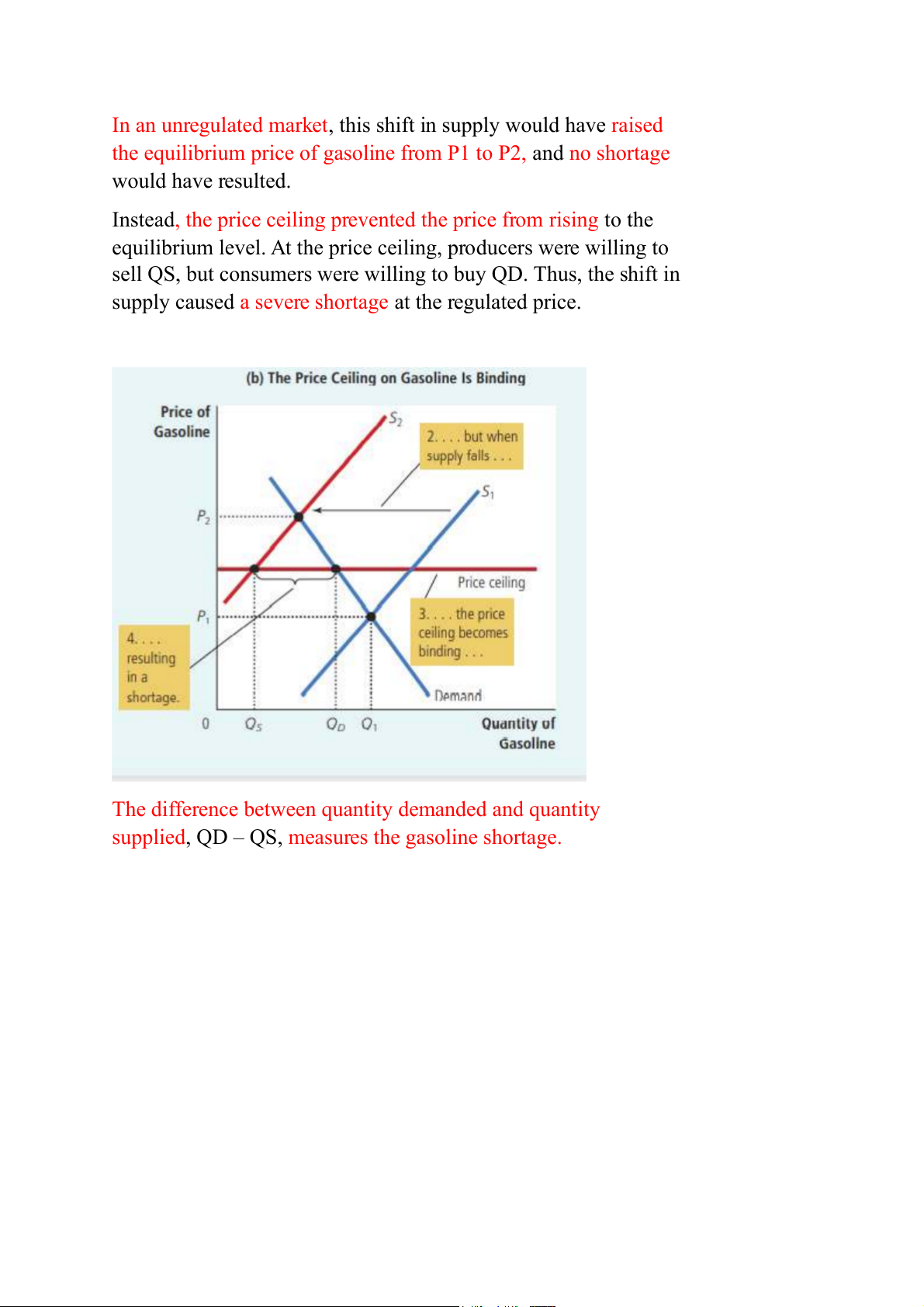

The increase in the price of crude oil raised the cost of

producing gasoline, and this reduced the supply of gasoline. As panel (b) shows, shif the supply curve ted to the left from S1 to S2.

In an unregulated market, this shift in supply would have raised

the equilibrium price of gasoline from P1 to P2, and no shortage would have resulted.

Instead, the price ceiling prevented the price from rising to the

equilibrium level. At the price ceiling, producers were willing to

sell QS, but consumers were willing to buy QD. Thus, the shift in

supply caused a severe shortage at the regulated price.

The difference between quantity demanded and quantity

supplied, QD – QS, measures the gasoline shortage.